Insights

Access expert research, timely insights, and exclusive webcasts to help you make confident, data-driven decisions.

Insight

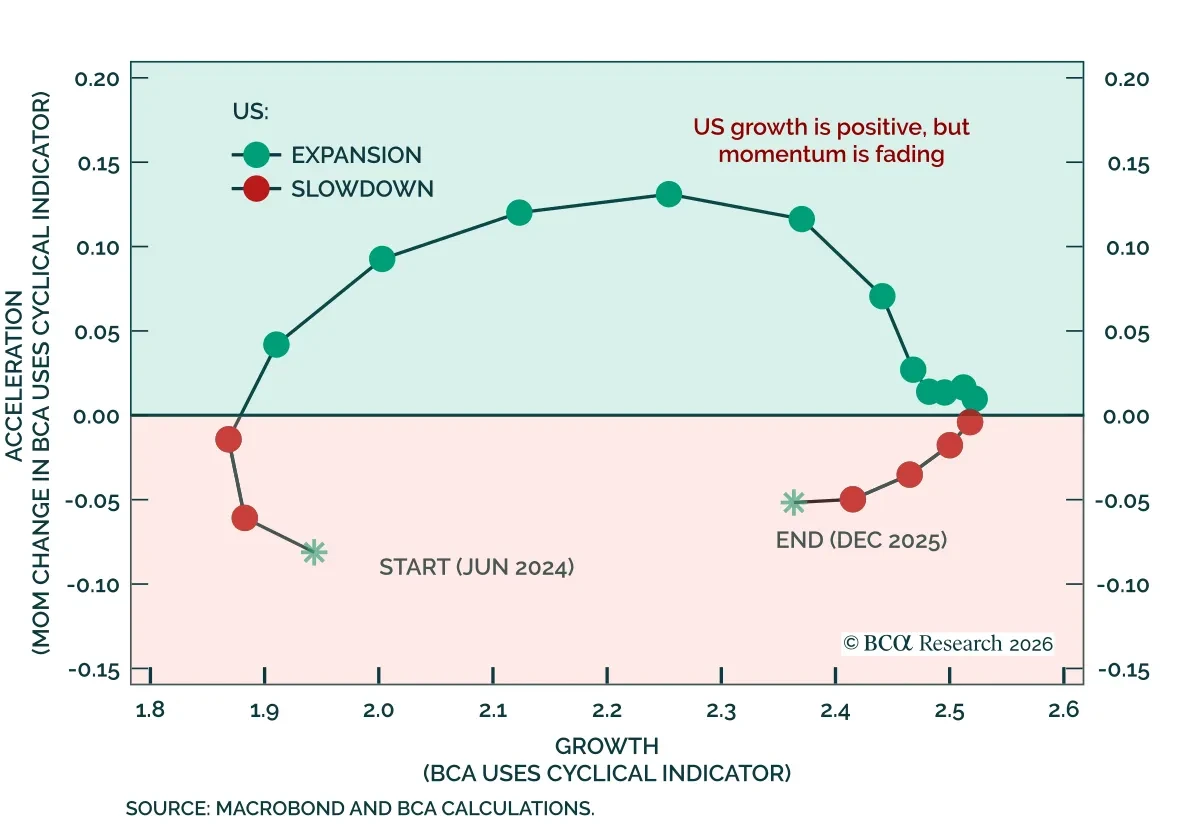

Our US equity strategists expect another year of gains for the S&P 500 in 2026, with returns capped by revenue growth as the bull market matures. The US economy is slowing but not contracting, pointing to positive but more modest equity returns. Equity performance should be increasingly driven b...

Read more

Insight

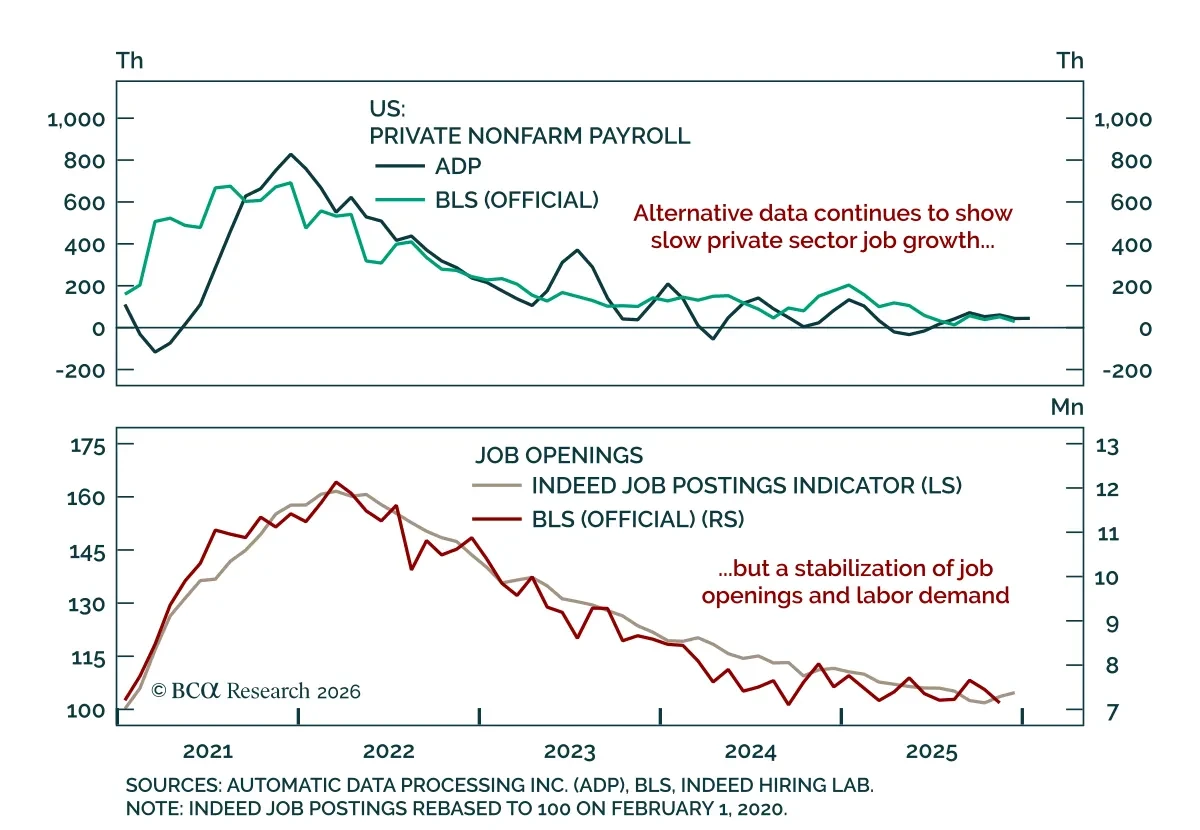

The US labor market remains weak but stable, leaving both labor conditions and US rates at a pivotal point. Given the partial government shutdown, Friday’s January employment report has been postponed to February 11. Alternative data show the US labor market remains in a “low hiring, low firing” mod...

Read more

Webcast Replay

Please join BCA Research Chief Strategist of the Counterpoint service, Dhaval Joshi for a Webcast on Thursday, January 29 at 10:30 EST | 15:30 GMT | 16:30 CET in which he will discuss three contrarian takes for 2026:

- Tech stocks are more likely to follow the benign unwind of 2021 than the malign unwind of 2000.

- The risk of US economic overheating is greatly underestimated.

- Gold and bitcoin are perfect soulmates for each other.

Dhaval will also go through the major asset allocation signals that his proprietary complexity indicators are giving right now.

Insight

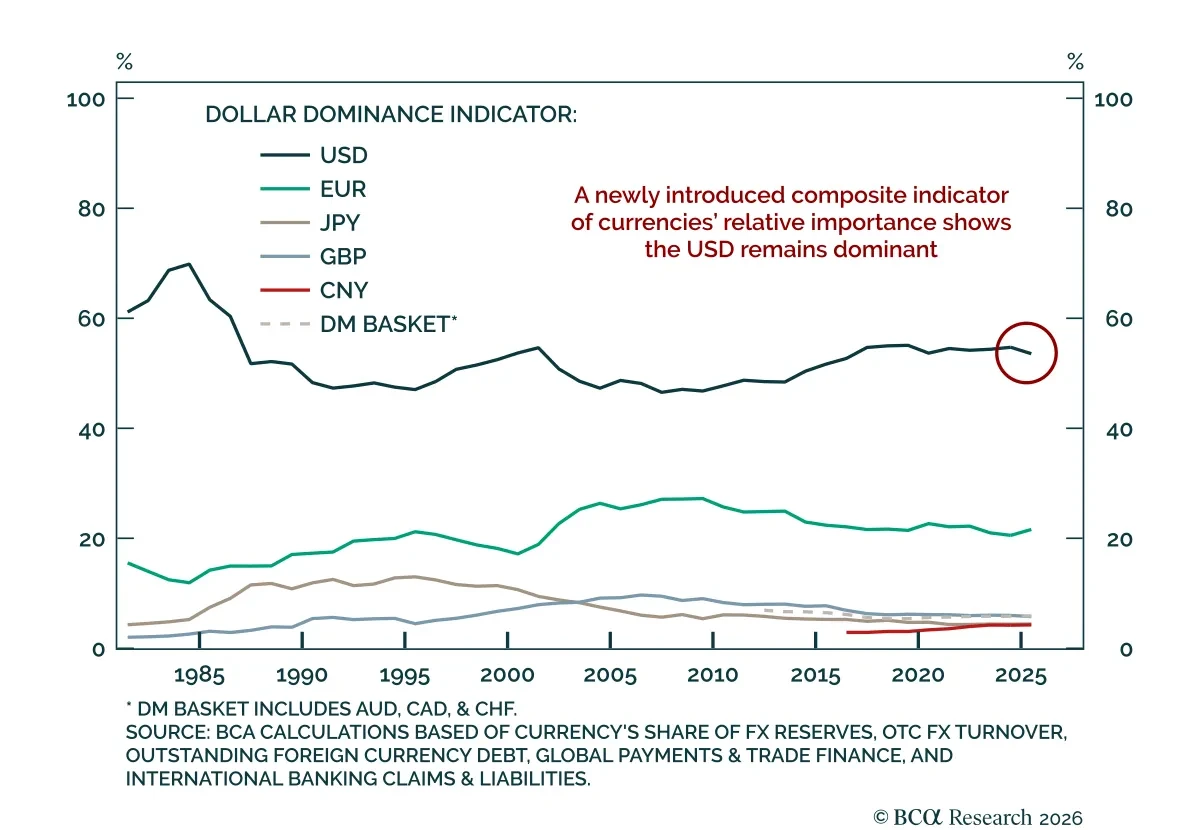

Our FX strategists expect the US dollar to remain the backbone of the global financial system, even as its reserve-currency premium gradually erodes. The dollar’s entrenched role in global markets argues against abrupt regime breaks. However, the decline in demand for USD reserve assets is expected ...

Read more

Insight

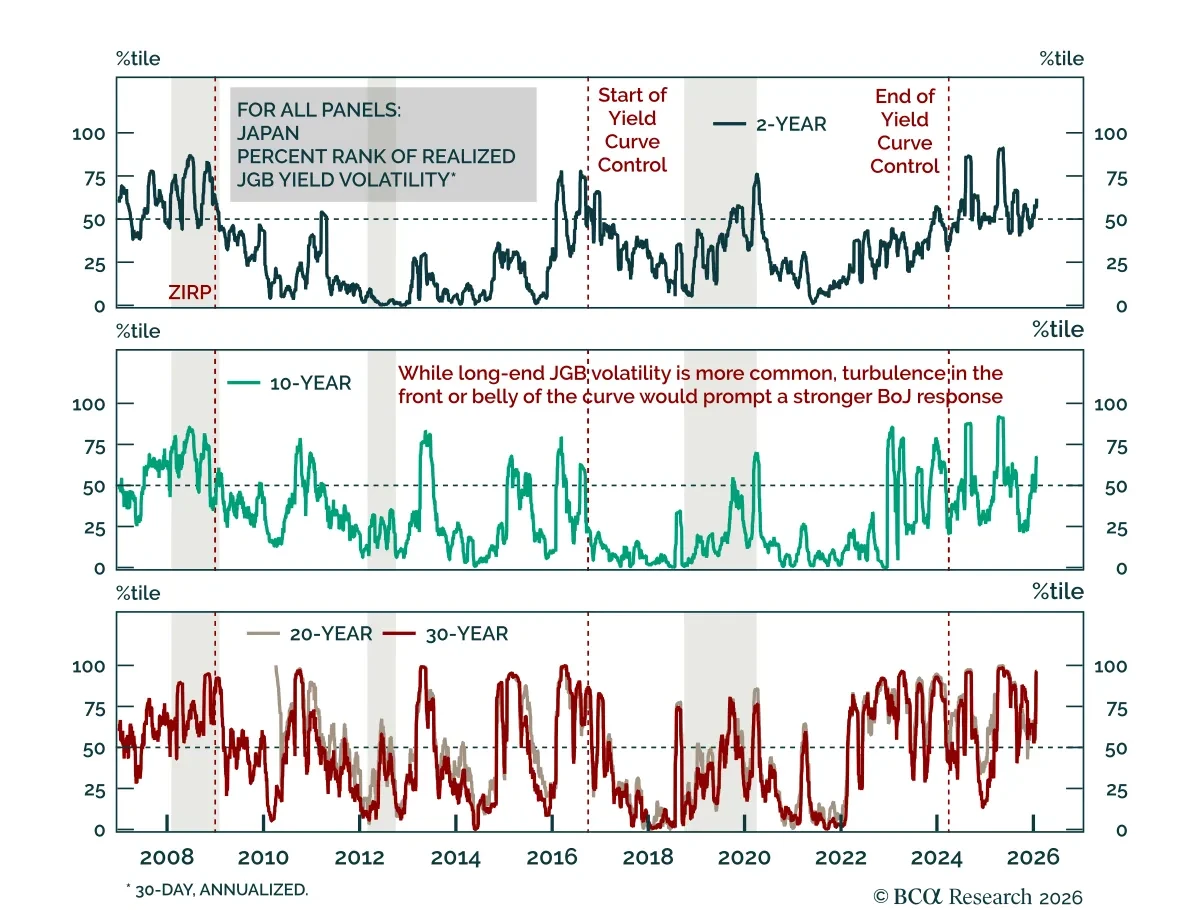

Japanese yields are heading higher as Japan exits its deflationary regime. Japan is exiting decades of deflation and ultra-accommodative policy, and markets are trying to find their footing. While attention has been focused on policy at the front end of the JGB curve, long-end volatility has increas...

Read more

Insight

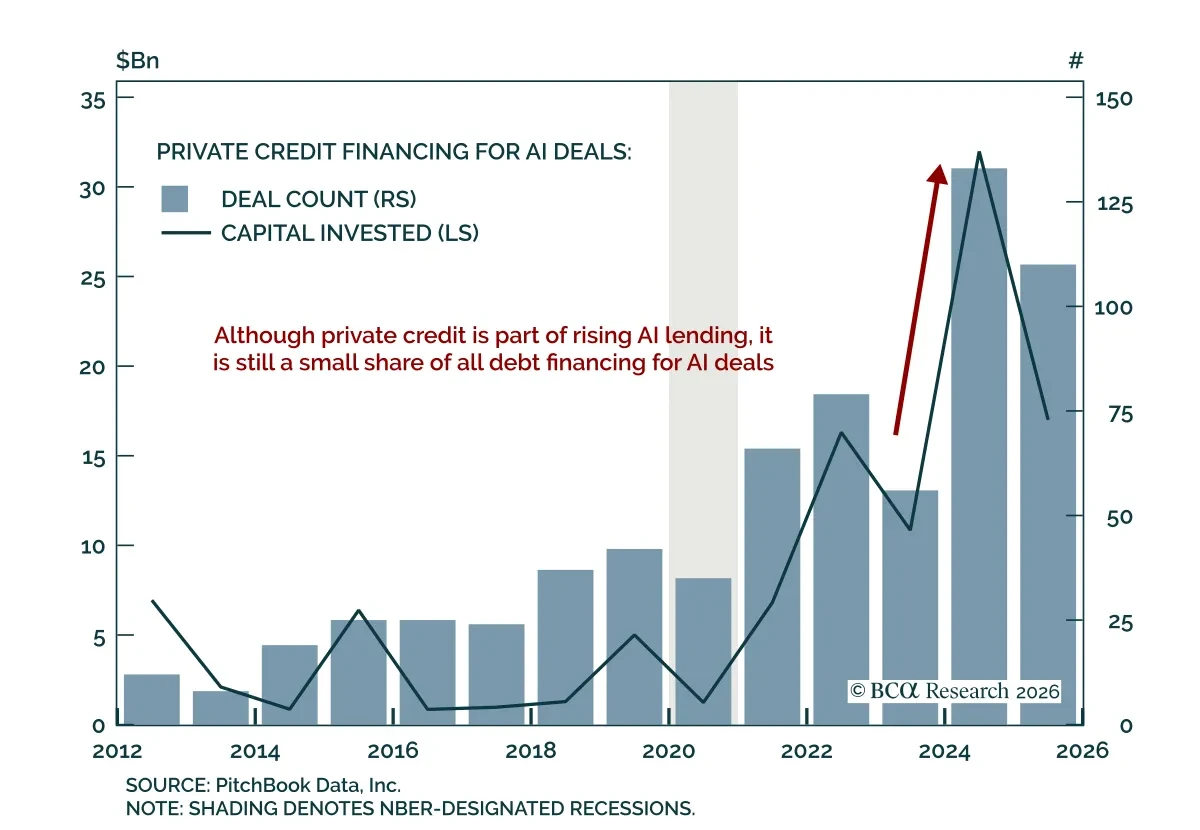

Private Credit’s role in financing AI is growing, but remains small and concentrated. Our Chart Of The Week comes from Brian Payne, Chief Strategist for our Private Markets & Alternatives (PMA) service. Both private and public market investors are asking how much AI exposure is embedded in ...

Read more

Insight

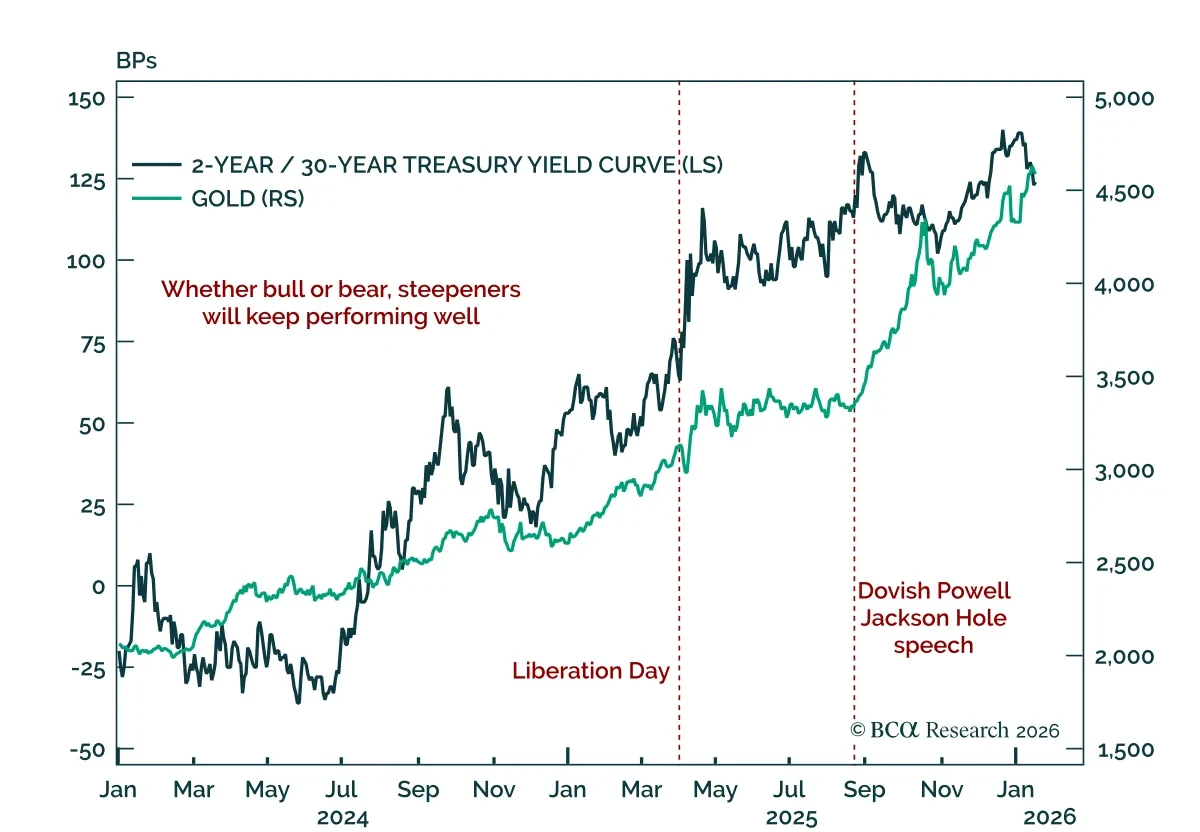

Favor curve steepeners and gold as recent price action highlights rising term premia and diversification away from US assets. With markets closed on Monday for the MLK holiday, Tuesday’s session saw price action reminiscent of last year’s “Sell America” trade amid escalating tensions between the US ...

Read more

Insight

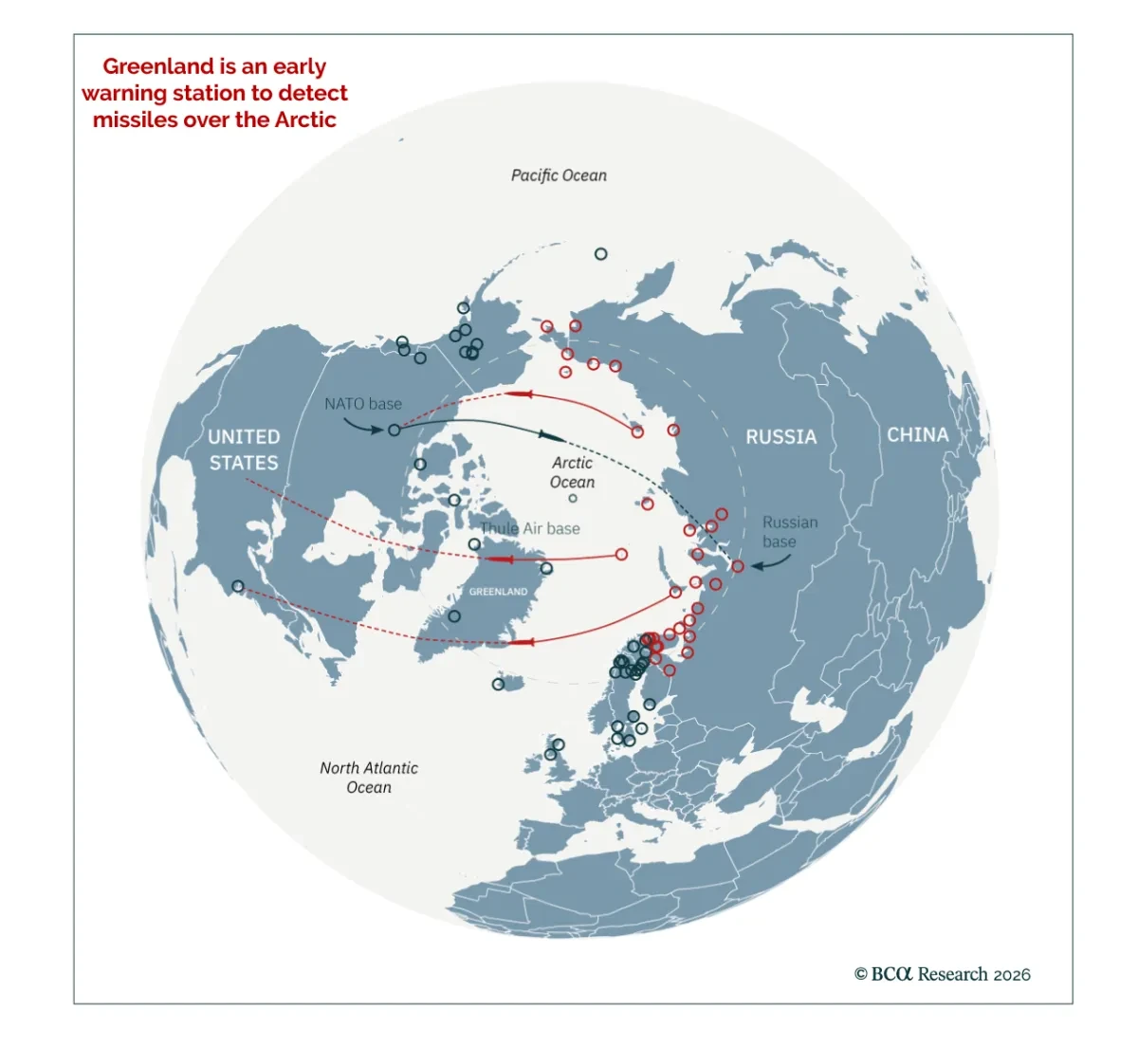

Stay constructive on European defense stocks and increase strategic exposure to industrial metals as geopolitical priorities reassert themselves. Following the capture of Venezuelan President Maduro, top US officials seem to confirm that President Trump is exploring ways to buy Greenland. While the ...

Read more

Insight

Our Global Investment strategists expect 2026 to follow a two-stage pattern: a “Great Rotation” from tech to non-tech equities in H1, followed by a broader market selloff in H2 as US economic momentum fades. Much like the 2000 cycle, the initial phase of sector rotation may mask deeper fragilities i...

Read more

Insight

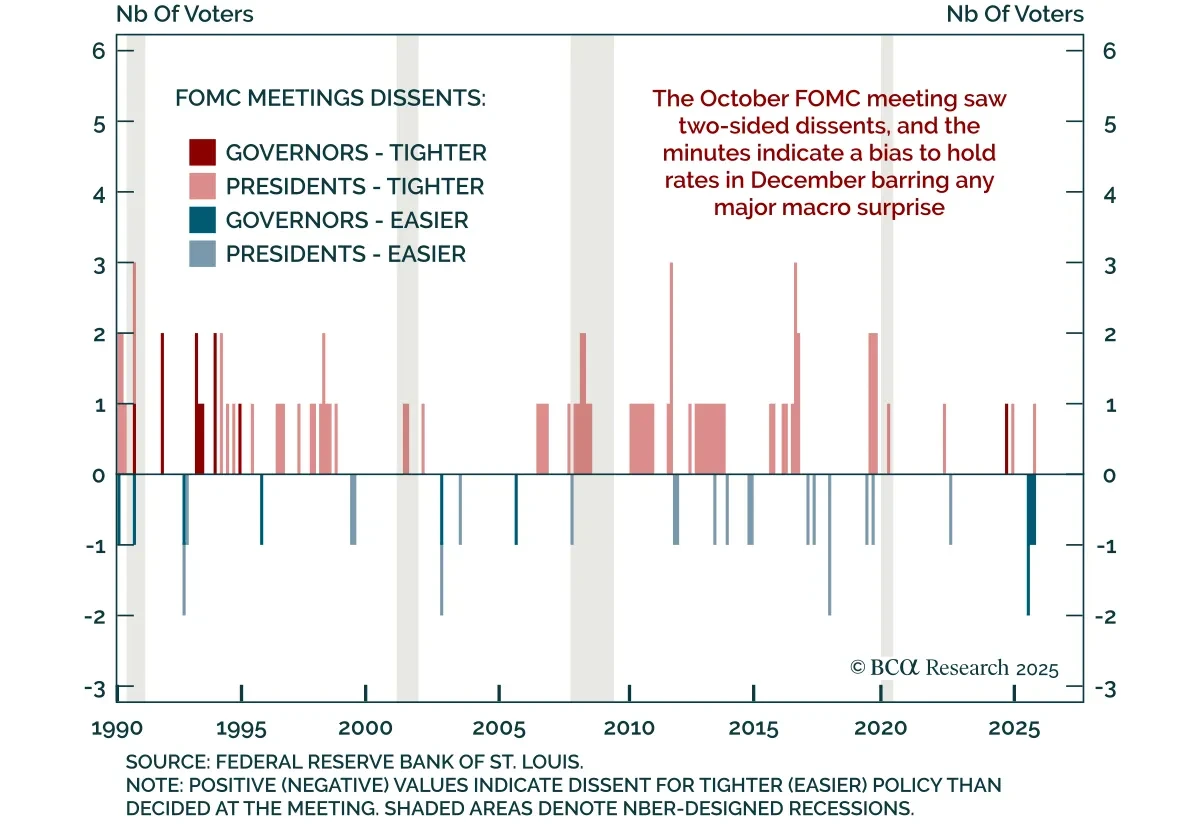

The October FOMC minutes underscored deep divisions over the Fed’s next move, reinforcing expectations for a December hold but keeping the easing bias intact. The 10–2 vote for a 25 bps cut included dissents on both sides (Governor Miran for a 50 bps move and Kansas City Fed President Schmid for no ...

Read more