Will 2026 Provide Investors With A Breadth Of Fresh Air?

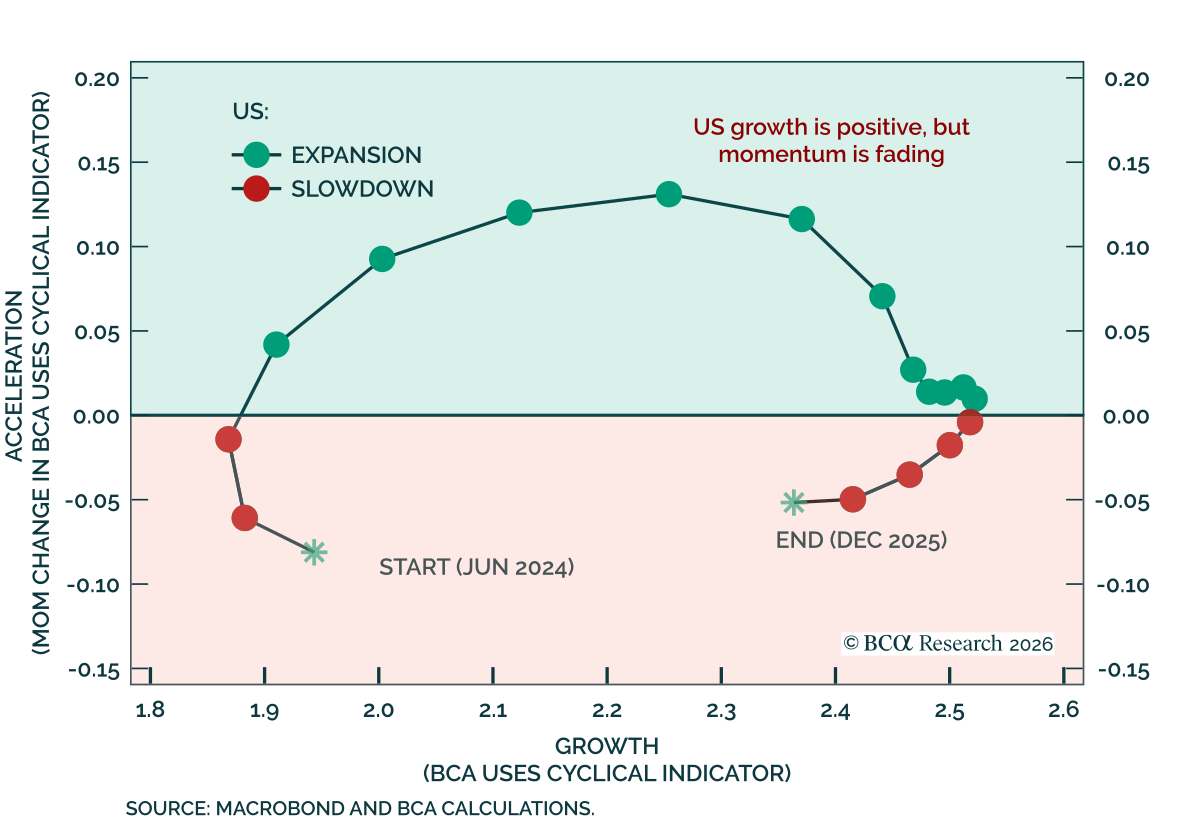

Our US equity strategists expect another year of gains for the S&P 500 in 2026, with returns capped by revenue growth as the bull market matures. The US economy is slowing but not contracting, pointing to positive but more modest equity returns. Equity performance should be increasingly driven by topline growth rather than multiple expansion. Technology can outperform, but overall market leadership should broaden and performance gaps should narrow.

Technology leadership is likely to persist, but our colleagues expect earnings growth to converge across sectors. Market breadth should improve both across and within sectors, favoring rotation toward laggards and cheaper expressions of core investment themes rather than a narrow leadership structure.

AI remains a powerful long-term driver of productivity and profits. AI-related capex has ramped up sharply, but our colleagues note that the stock of tech-related capital, which may be a better indicator of overinvestment than investment flows, does not appear excessive by historical standards. Still, they expect near-term ROE pressure, with cash conversion acting as a key swing factor. Valuations does not cap the market’s upside in 2026, but theyit should increasingly shape relative returns, playing a larger role in identifying rotation opportunities across and within sectors.