US Labor Market Near Balance As Hiring Stays Weak

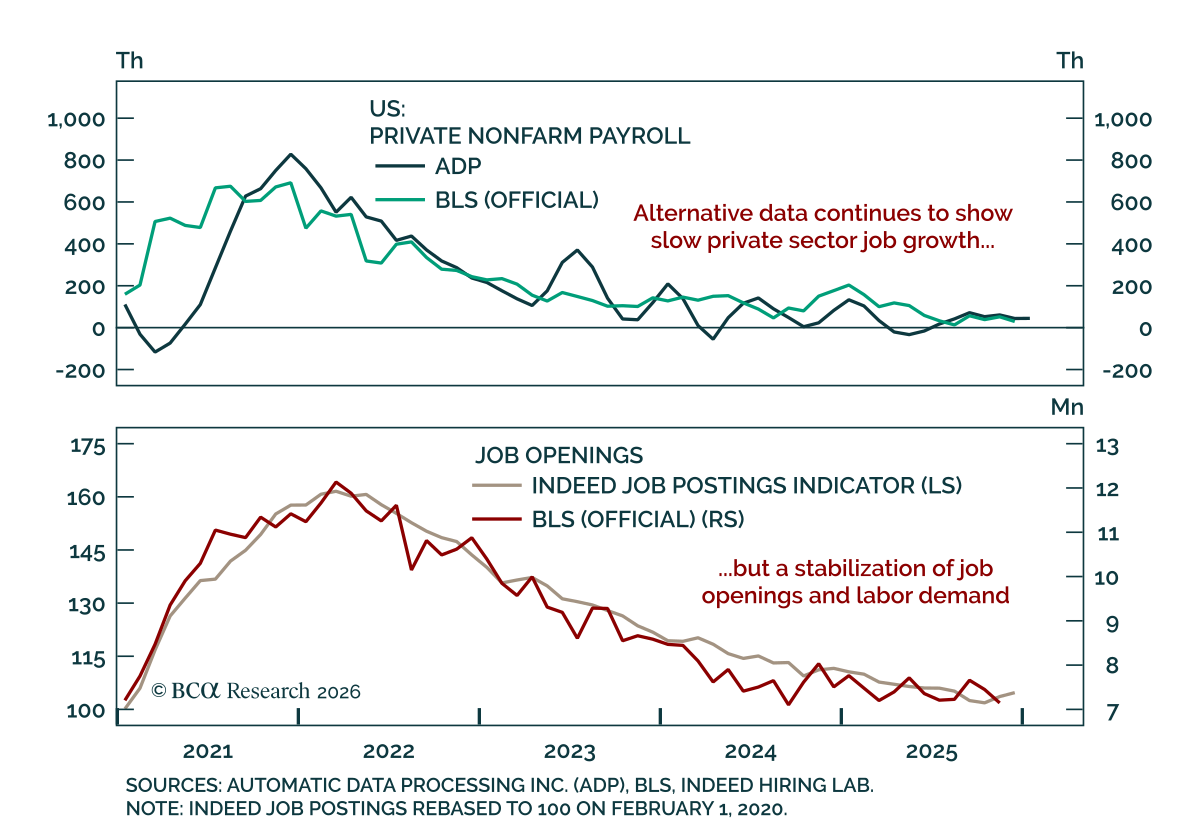

The US labor market remains weak but stable, leaving both labor conditions and US rates at a pivotal point. Given the partial government shutdown, Friday’s January employment report has been postponed to February 11. Alternative data show the US labor market remains in a “low hiring, low firing” mode. The January ADP report missed estimates, with 22k new private-sector jobs, slowing from a downwardly revised 37k in December and well below the 133k jobs created in January 2025.

While job growth is low, employment is not contracting. Initial and continuing jobless claims actually fell in Q4. The January ISM Manufacturing and Services reports showed weak employment but no collapse, with steady-but-sluggish activity not weak enough for employers to trim headcount. The November JOLTS report was also postponed due to the shutdown, but higher-frequency job postings data imply a stabilization of labor demand at a weak level.

The labor market sits at a pivotal point, having weakened and roughly showing balance. The US Treasury market is also at a pivotal point, having traded in a range for a few months and seeing a collapse of both implied and realized volatility. Signs of re-acceleration would likely take rate cuts off the table and weaken risk assets, while signs of growing slack would warrant more aggressive cuts than currently priced in. We lean toward the latter scenario and reiterate our long-duration stance and tactical curve steepeners in bond portfolios.