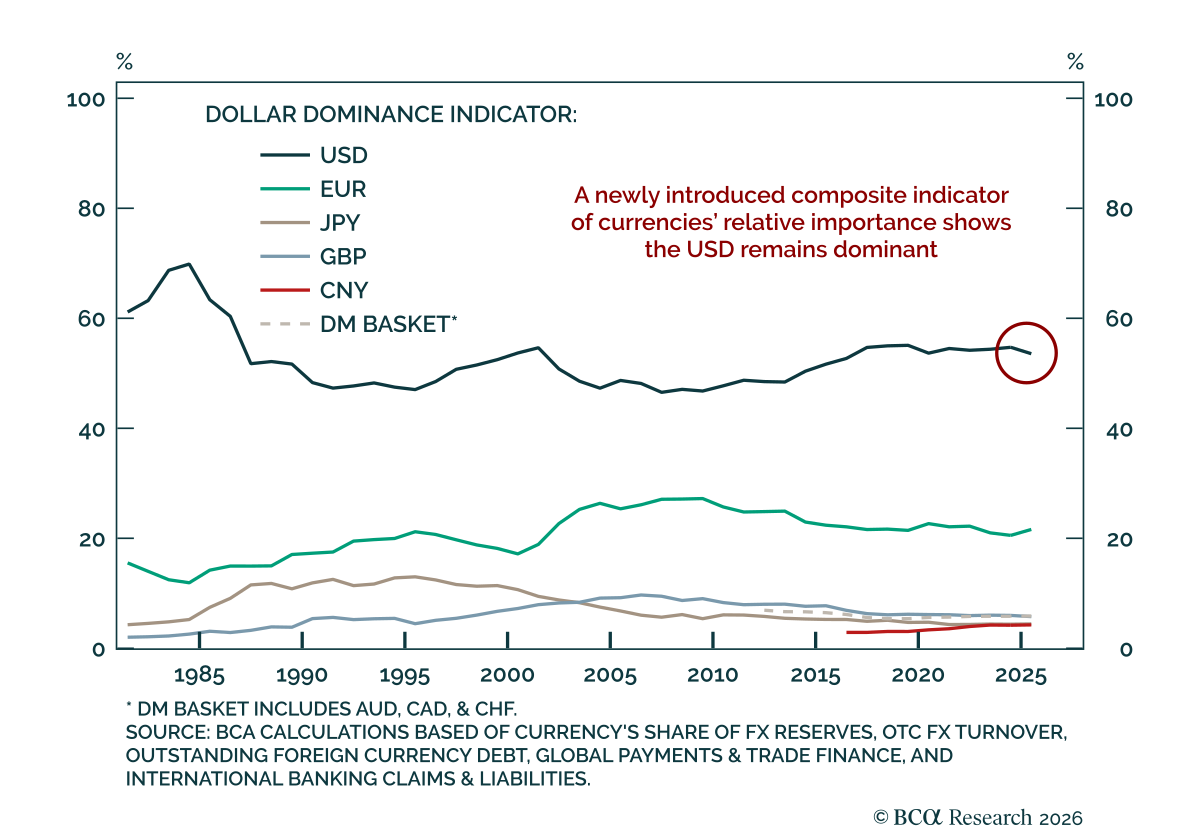

Tracking Dollar Dominance

Our FX strategists expect the US dollar to remain the backbone of the global financial system, even as its reserve-currency premium gradually erodes. The dollar’s entrenched role in global markets argues against abrupt regime breaks. However, the decline in demand for USD reserve  assets is expected to accelerate, and unlike in the past, the current geopolitical environment makes a rebound in the dollar’s share of global FX reserves unlikely.

assets is expected to accelerate, and unlike in the past, the current geopolitical environment makes a rebound in the dollar’s share of global FX reserves unlikely.

This creates a structural headwind over the medium-to-long term and a prolonged transition phase in which dollar usage remains high even as official demand weakens. Gold and alternative reserve assets are still strategic beneficiaries of this transition. Continued diversification of reserve assets supports sustained official-sector demand for gold, particularly among emerging markets and non-aligned economies.

USD assets could remain attractive based on returns rather than safety. Capital inflows into the United States are increasingly driven by equity returns rather than safe-haven demand, implying greater sensitivity to US growth, valuations, and risk sentiment. Our colleagues expect currency diversification to be asymmetric, favoring a basket of non-traditional currencies with stable fiscal outlooks and reliable institutions, rather than a single USD challenger.

To read this report in full: please click here.