FOMC Minutes: More Details On The Hawks-Doves Divide

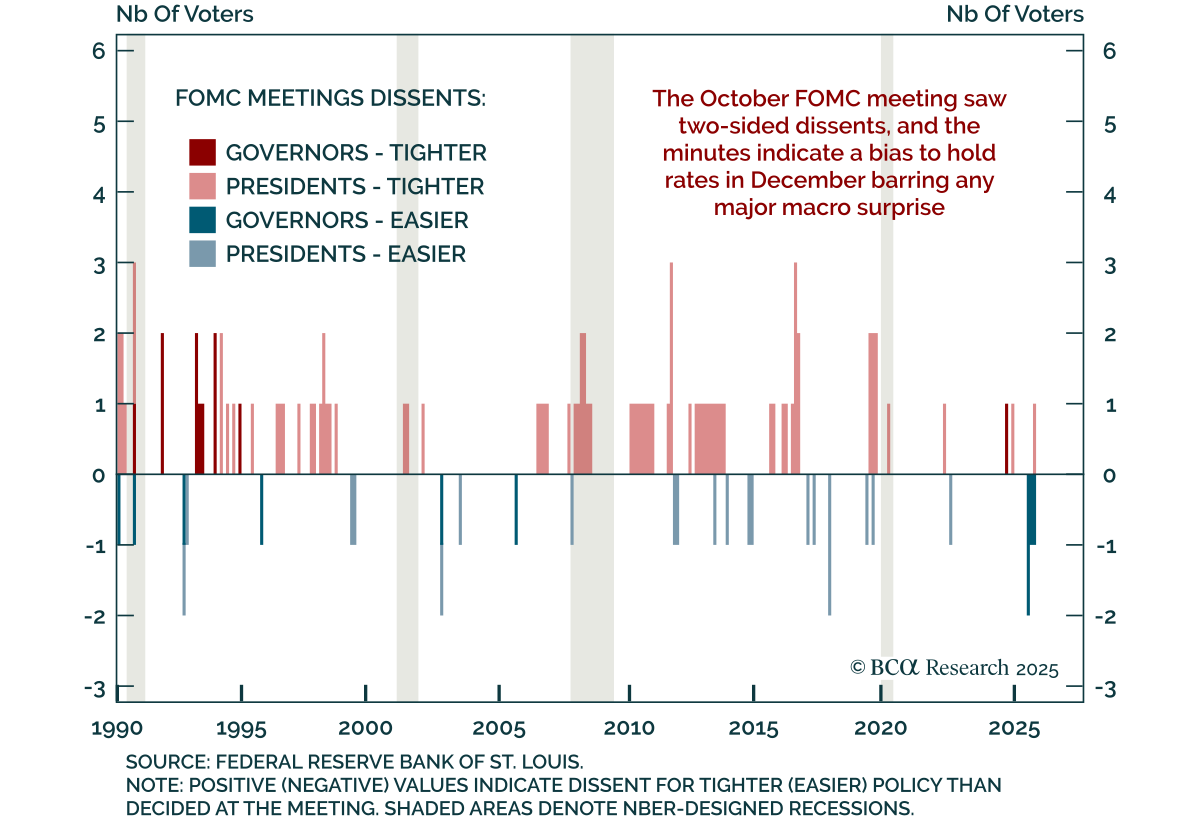

The October FOMC minutes underscored deep divisions over the Fed’s next move, reinforcing expectations for a December hold but keeping the easing bias intact. The 10–2 vote for a 25 bps cut included dissents on both sides (Governor Miran for a 50 bps move and Kansas City Fed President Schmid for no change), reflecting “strongly different views” on the current policy stance and next steps. While most participants judged that more cuts would eventually be needed, many saw no case for easing in December. Additionally, some voters were indifferent between an October hold or cut.

Subsequent Fedspeak points to a likely pause next month. Schmid, representing the hawkish camp, argued that inflation remains broad-based and above target, with decent growth momentum, and a largely balanced labor market. He views the employment slowdown as structural and warned against de-anchoring inflation expectations. In contrast, Governor Waller, a leading dove, sees tariff-driven inflation and cyclical labor weakness, with slower wage growth and falling job openings signaling a demand-driven slowdown.

With growth momentum and sentiment subdued, further “risk management” cuts will likely be needed unless labor conditions improve. We recommend maintaining a long duration stance in US bond portfolios and favoring steepeners, as slowing growth and inflation still point to additional easing ahead. While a bit stale, Thursday’s employment report could help the FOMC consensus move to a December cut if the details show a markedly deteriorating labor market.