From Venezuela to Greenland: Hard Power Returns

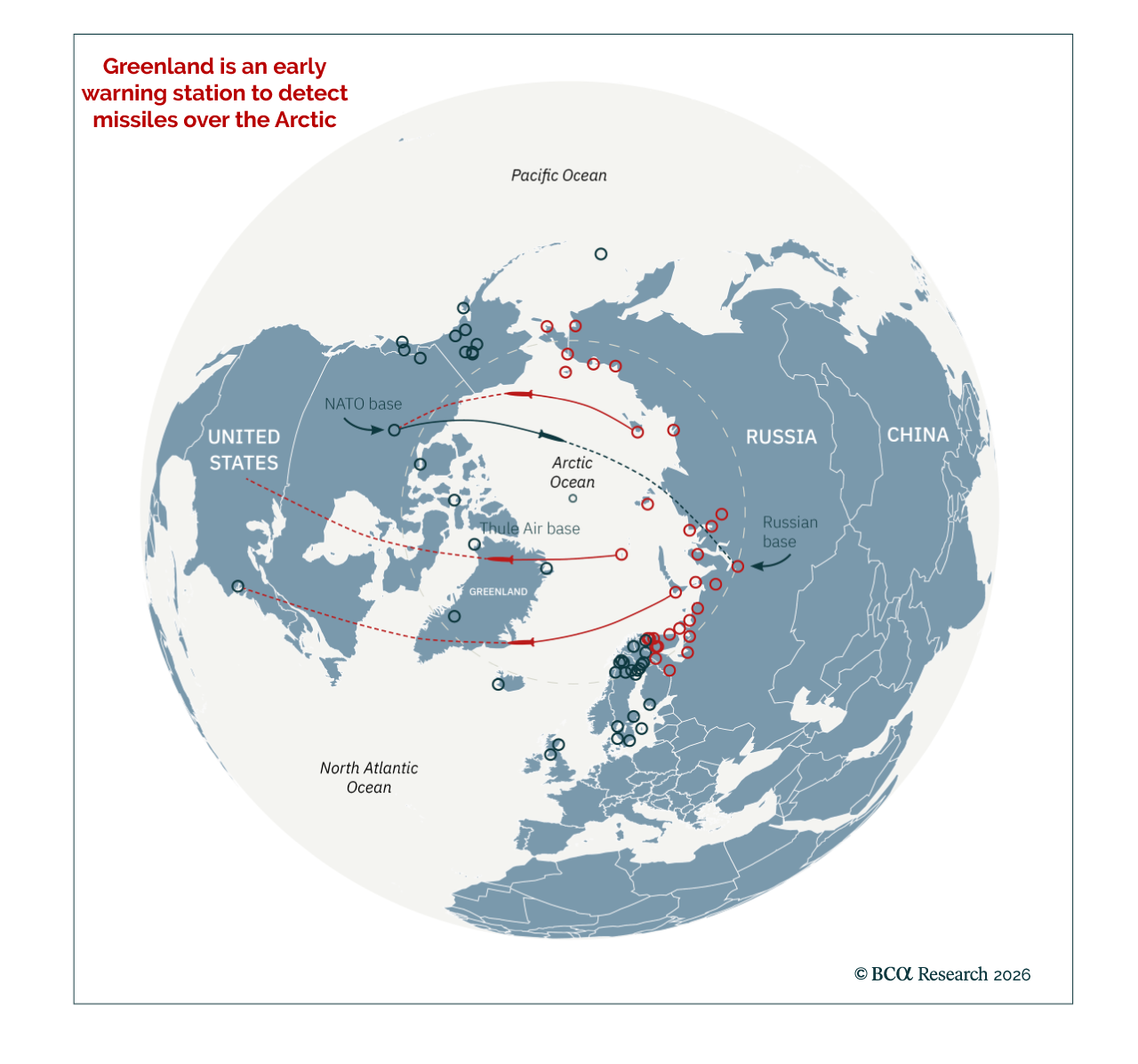

Stay constructive on European defense stocks and increase strategic exposure to industrial metals as geopolitical priorities reassert themselves. Following the capture of Venezuelan President Maduro, top US officials seem to confirm that President Trump is exploring ways to buy Greenland. While the belligerent tone toward a NATO ally is suboptimal, the Greenland question reflects concerns any US administration would raise when focused on securing the Western Hemisphere. The Russia-Ukraine war has underscored Europe’s difficulty to protect its periphery.

Trump’s negotiating style often begins with an extreme demand before converging on the actual objective. In this case, the underlying aim is for Denmark (and Europe more broadly) to substantially increase defense commitments. Buying Greenland itself makes little financial sense, as the US already exercises effective military control, enjoying the strategic benefits without bearing social spending costs. However, global warming and the Russia-Ukraine war have altered the strategic environment, reinforcing the need for higher European defense spending in the Arctic.

There are two key investment implications. First, European defense stocks still have upside after consolidating on Ukraine ceasefire news. Second, investors should increase strategic allocations to industrial metals, as the evolving geopolitical backdrop requires the hoarding of critical resources, a theme our GeoMacro colleagues describe as an “Age of Empires Premium.”