The 2000 Template

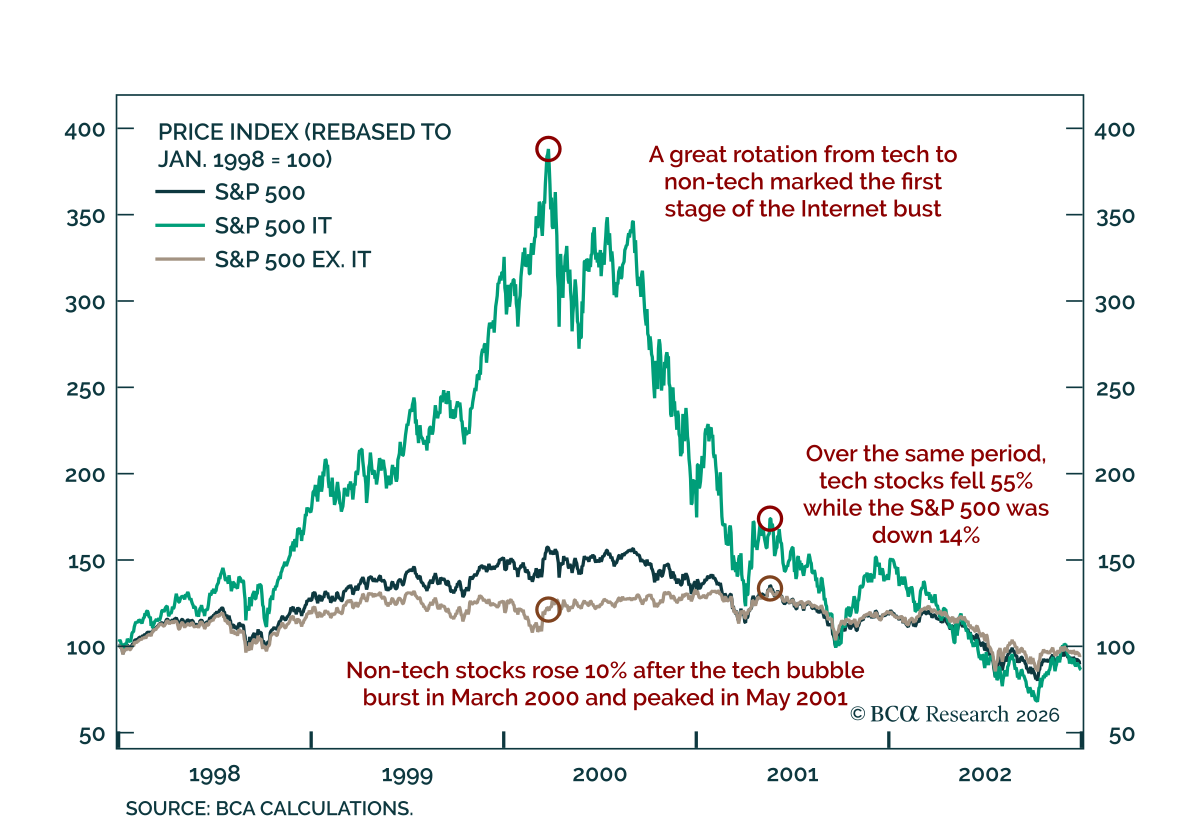

Our Global Investment strategists expect 2026 to follow a two-stage pattern: a “Great Rotation” from tech to non-tech equities in H1, followed by a broader market selloff in H2 as US economic momentum fades. Much like the 2000 cycle, the initial phase of sector rotation may mask deeper fragilities in the underlying growth outlook.

Multiple indicators such AI adoption rates, GPU rental prices, and weakening free cash flow point to an aging AI boom. A bust would likely weigh on investment and valuations, potentially tipping the US into recession by year-end.

While monetary and fiscal policy are turning more supportive, and a Supreme Court ruling could lower tariffs, higher deficits pose a risk. If yields climb, the stimulus impulse could be blunted. Our colleagues remain tactically neutral on equities for now and are watching their MacroQuant model for signals to shift more defensive. In commodities, they note a typical late-cycle rally in metals and are taking partial profits on their long copper/short oil trade.

If you found this insight useful, you can explore more from Global Investment Strategy here.