Sell America Pt. II?

Favor curve steepeners and gold as recent price action highlights rising term premia and diversification away from US assets. With markets closed on Monday for the MLK holiday, Tuesday’s session saw price action reminiscent of last year’s “Sell America” trade amid escalating tensions between the US and Europe over Greenland. US assets sold off across the board: Equities and the dollar declined, while Treasury yields rose. The move in rates was driven by the long end of the curve, indicating a higher Treasuries term premium. While this episode could reverse if tensions ease, it is the type of stress where markets show their hand.

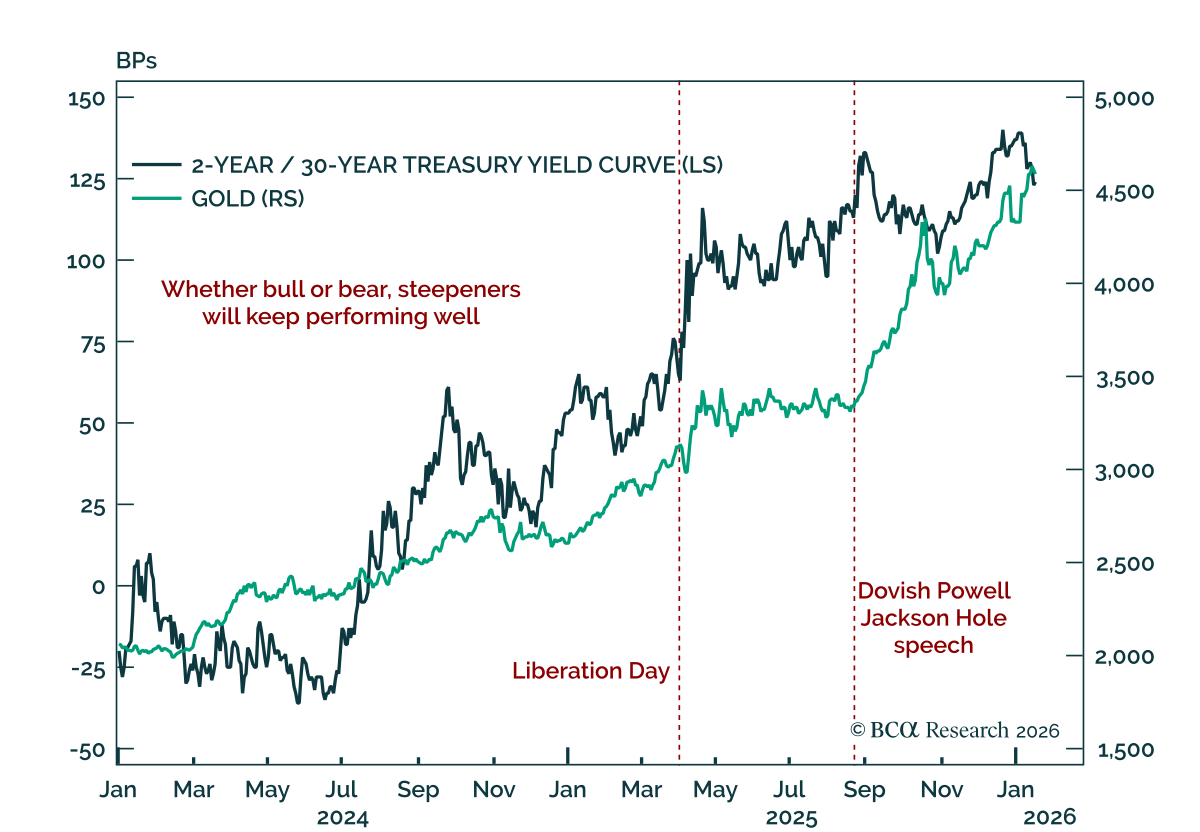

The episode points to two investment conclusions. First, curve steepeners remain in a win-win position. In a growth slowdown, the curve would likely bull steepen, while US-driven geopolitical chaos would tend to bear steepen the curve via higher term premia. Improved odds for Kevin Warsh as a potential Fed Chair reinforce steepeners. Warsh has been a consistent hawk, and has emphasized reducing the Fed’s balance sheet. Cutting the balance sheet while shortening its maturity would add duration back to the market, increasing term premia and steepening the curve.

Second, gold remains an attractive allocation. It continues to benefit from investor and foreign central bank diversification away from US assets. Gold broke out of its post–Liberation Day range late last year and has since moved to new highs. More broadly, metals should remain supported as countries seek to stock strategic resources, implying limited downside even during macro-driven selloffs.