JGBs: Can Volatility Be… A Good Thing?

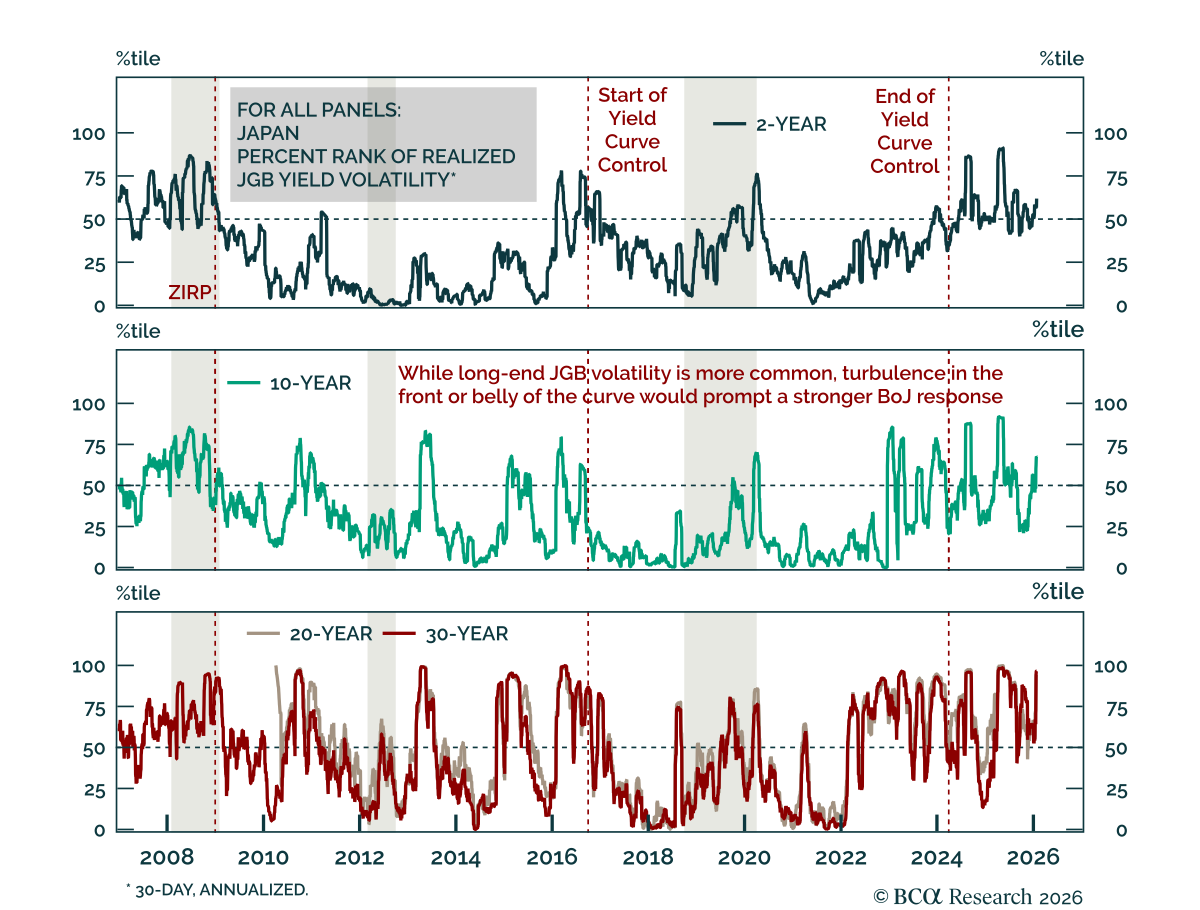

Japanese yields are heading higher as Japan exits its deflationary regime. Japan is exiting decades of deflation and ultra-accommodative policy, and markets are trying to find their footing. While attention has been focused on policy at the front end of the JGB curve, long-end volatility has increased markedly. Not all volatility is problematic. Under yield curve control (YCC), volatility was suppressed by design, as right-tail risks for yields were effectively removed. With the exit from the effective lower bound, price discovery is necessary for markets to price the appropriate terminal rate, making higher volatility inevitable.

Higher rates volatility also tightens financial conditions, which is consistent with the BoJ’s current hawkish policy stance. Two dimensions will matter for policymakers. First, inflation expectations must remain anchored around target. Second, volatility must not reflect impaired JGB market functioning. If dysfunction emerges, the BoJ has tools to respond through open market operations and guidance (or “open mouth operations”). Balance-sheet runoff could be adjusted, and officials could signal more aggressive hikes. Elevated volatility at the long end is not unusual in this context, but sharp volatility at the front end or belly of the curve would be more concerning and likely trigger a stronger response.

Fiscal concerns remain secondary for now. Yields are still below nominal growth, keeping Japan’s large debt burden sustainable. We nevertheless see further upside for yields. JGBs remain negatively convex: They would get hurt by more hikes if global growth reaccelerates, yet underperform higher-yielding DM peers if global growth slows further. As of now, more hikes are needed to increase real yields.