How Much AI Exposure Do You Really Have?

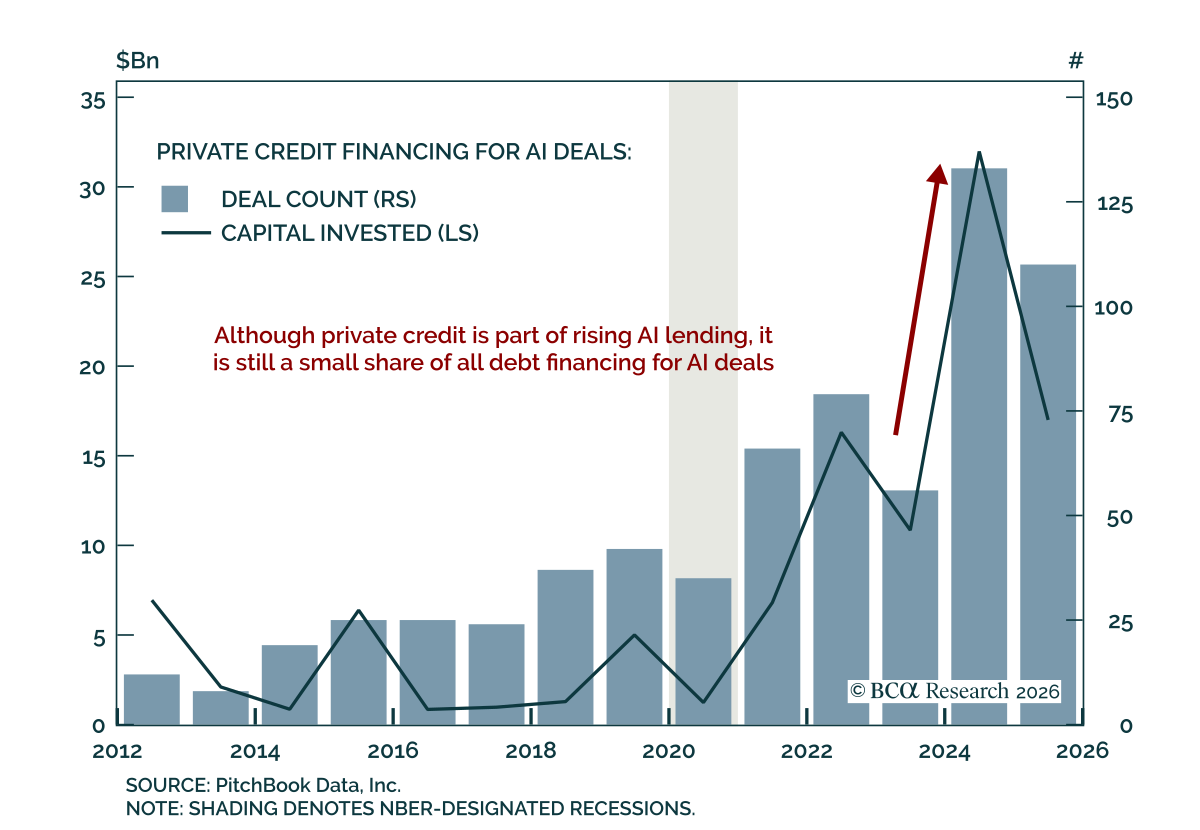

Private Credit’s role in financing AI is growing, but remains small and concentrated. Our Chart Of The Week comes from Brian Payne, Chief Strategist for our Private Markets & Alternatives (PMA) service.

Both private and public market investors are asking how much AI exposure is embedded in their credit portfolios. The answer, for now, is limited. While AI companies are increasingly accessing debt markets and Private Credit deal activity has picked up, AI-related lending still represents less than 5% of post-2023 Private Credit transactions and a similarly small share of the $2 trillion asset class.

That said, activity accelerated meaningfully in 2024, with a rising number and share of AI-related loans. As capital becomes more concentrated in the AI trade, investors need to assess effective exposure across credit portfolios, especially where it overlaps with positions in public equities, venture capital, and data centers.