Insights

Access expert research, timely insights, and exclusive webcasts to help you make confident, data-driven decisions.

Insight

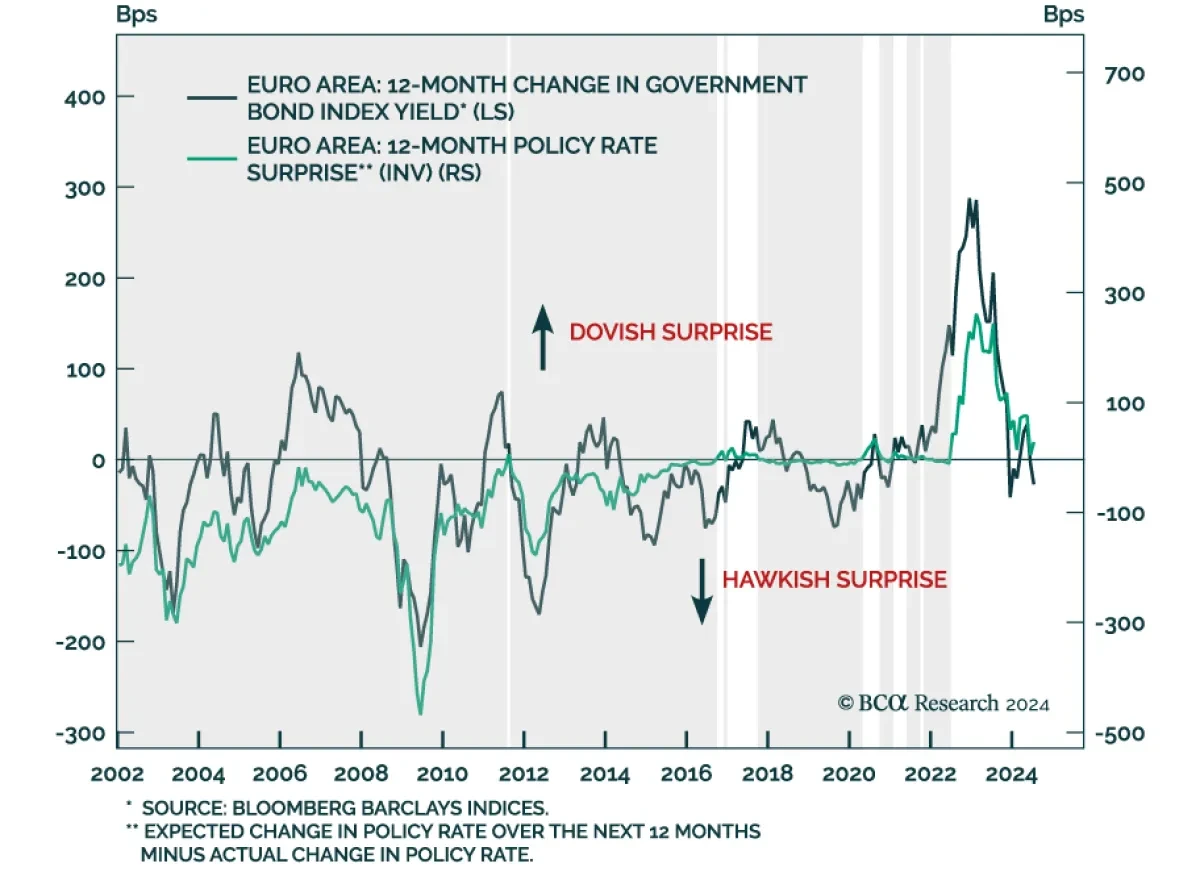

After surprising to the upside in July on higher energy costs, Eurozone CPI resumed its deceleration in August. Headline and core CPI declined from 2.6% y/y to 2.2% and from 2.9% to 2.8%, respectively.Energy prices contracted 0.3% y/y from July’s 1.2% increase, however services inflation, which is m...

Read more

Insight

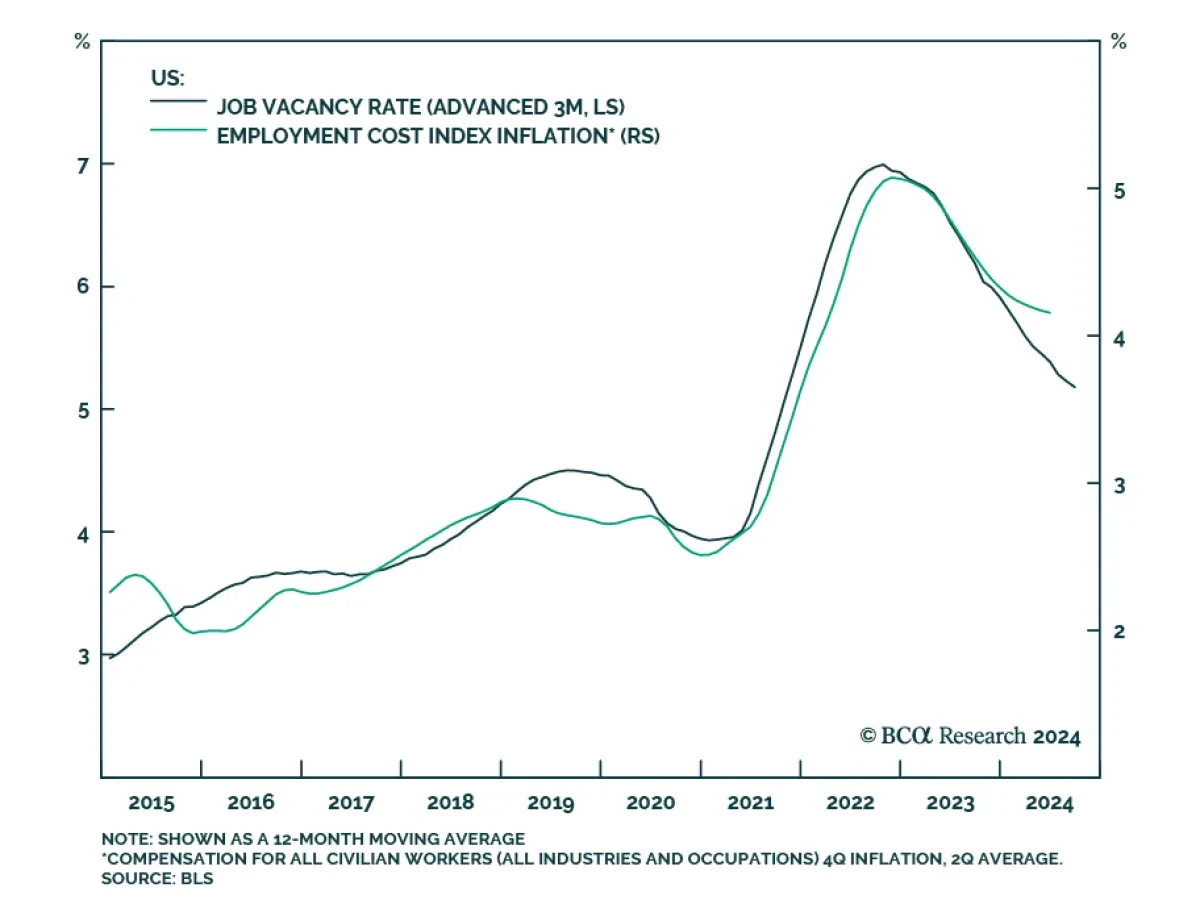

According to BCA Research’s Counterpoint Strategy service, the post-pandemic US economy has inverted from its usual ‘demand-constrained’ state to a highly unusual ‘supply-constrained’ state. This inversion is still a ways from normalizing, with labor demand still exceeding supply by 2.2 million jobs...

Read more

Insight

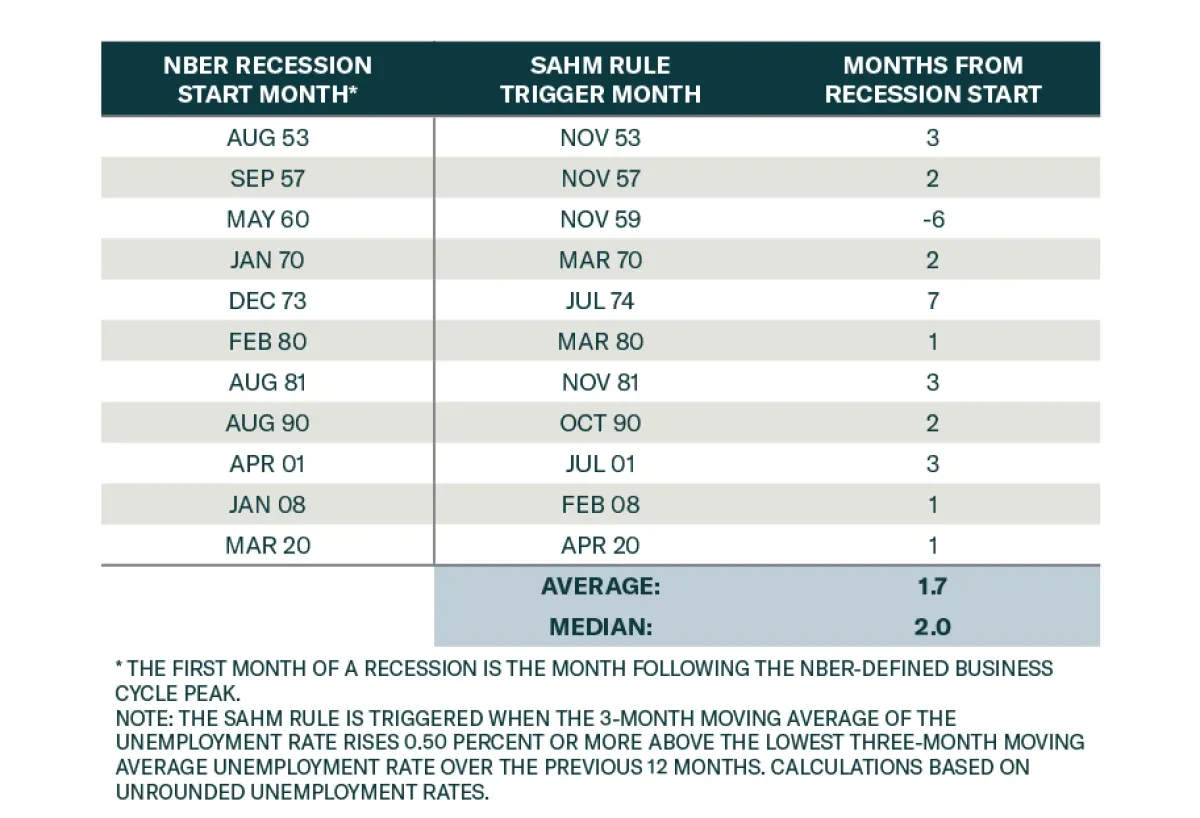

Market and economic observers have devoted a lot of attention to the Sahm Rule following July’s employment report, and whether or not it has been triggered. BCA’s analysis has highlighted that the overall direction of the labor market is far more important than the rounding conventions one applies t...

Read more

Insight

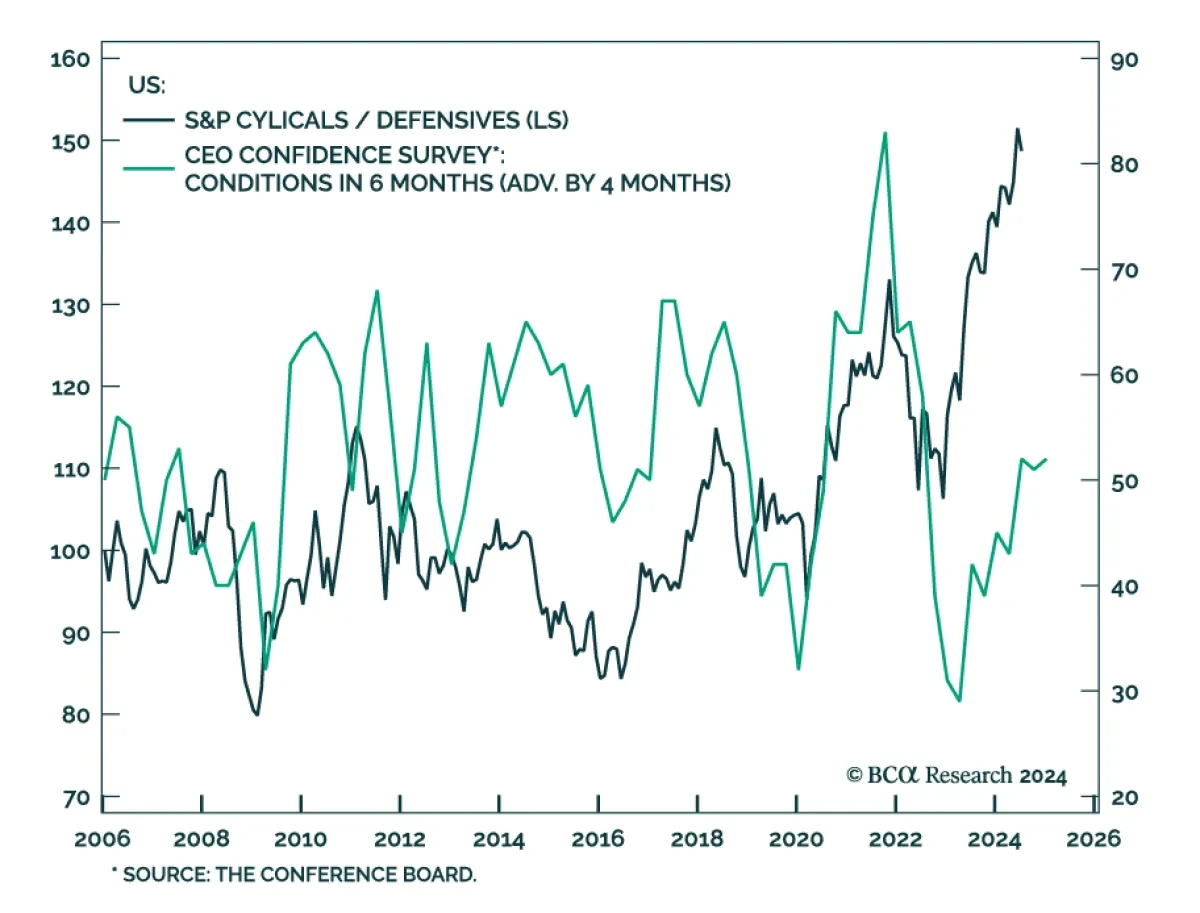

The Conference Board measure of CEO Confidence declined in Q3, from 54 to 52, its lowest level so far this year. Still, a reading above 50 indicates that optimistic perceptions of business conditions outweigh pessimistic assessments. The Q3 survey marks a decline in CEO optimism, which ha...

Read more

Insight

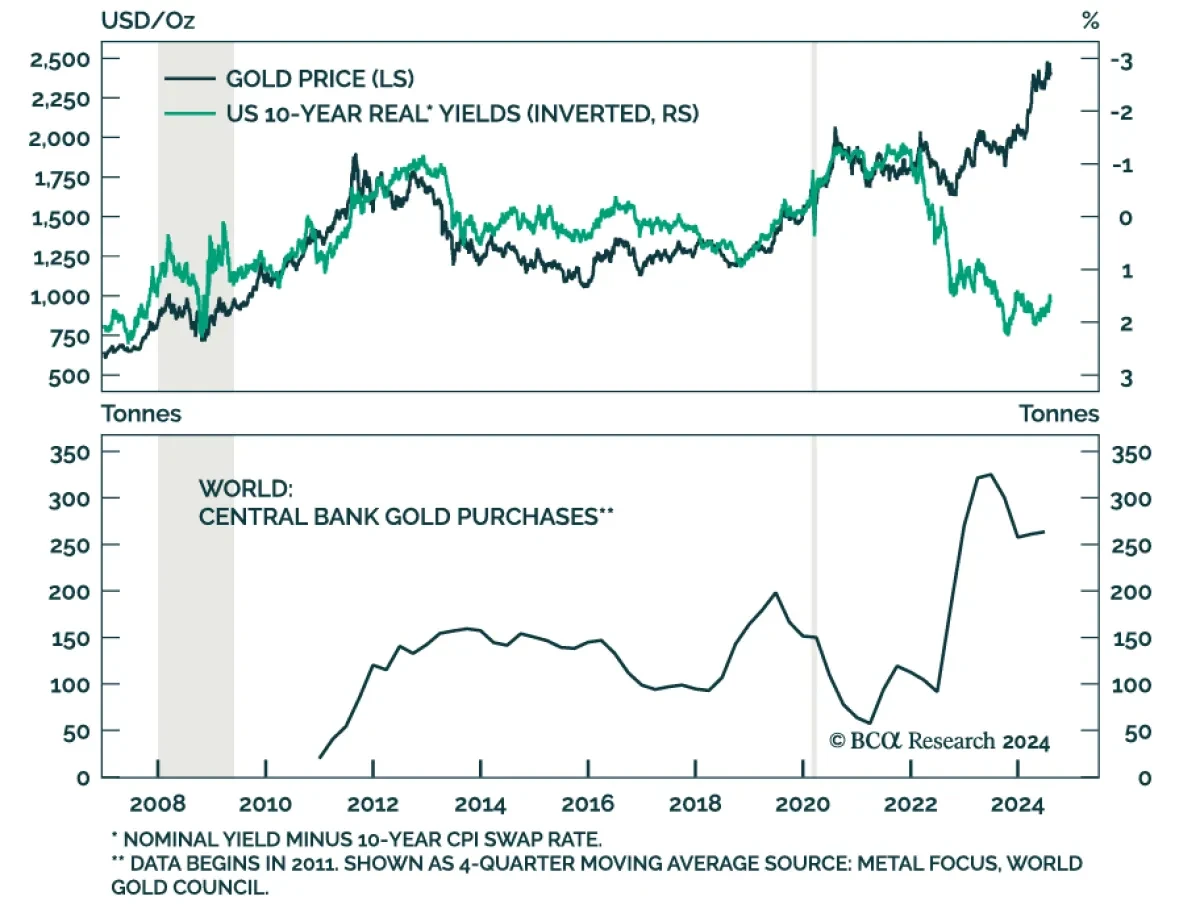

Despite the recent market rout, gold’s performance has maintained its leadership position. Global equities are up 7.5% in 2024YTD, global bonds are up 2.6% over the same period while gold prices have rallied by a solid 17%. Given our high conviction that the US economy will tip into recession by ear...

Read more

Insight

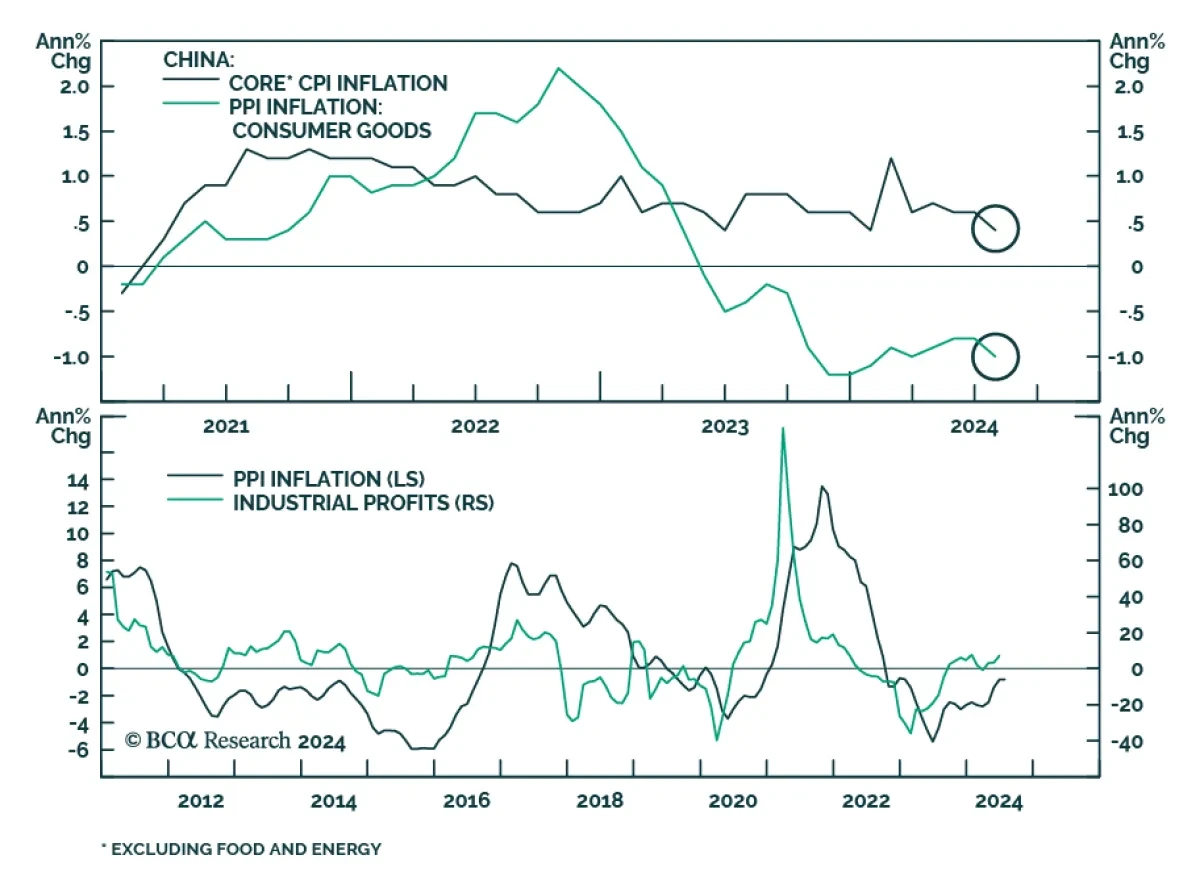

China’s CPI and PPI prints surprised to the upside on Friday. Producer prices contracted -0.8%y/y, unchanged from June, compared to expectations of a -0.9% contraction. Consumer prices increased 0.5%y/y, above 0.3% expectations.The consumer price index hit its highest rate of change since February, ...

Read more

Insight

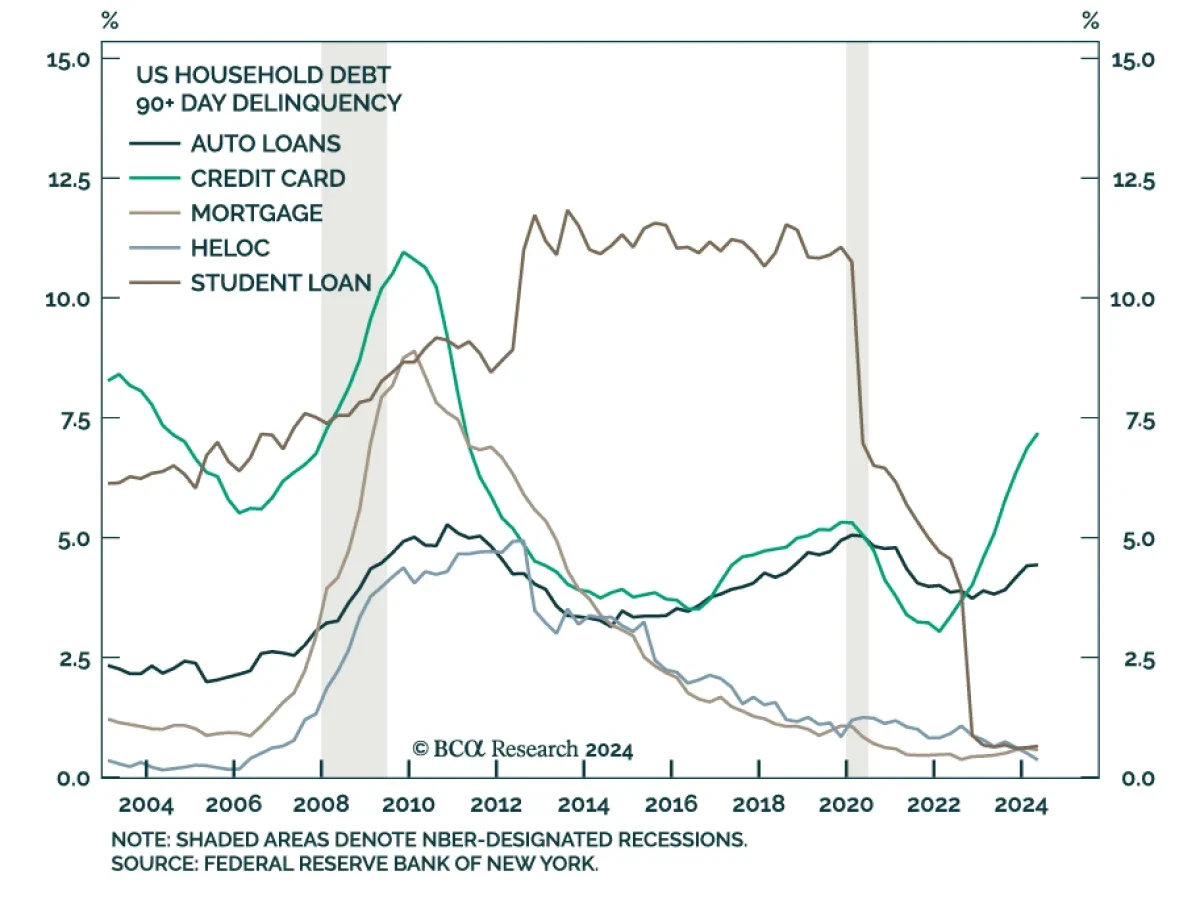

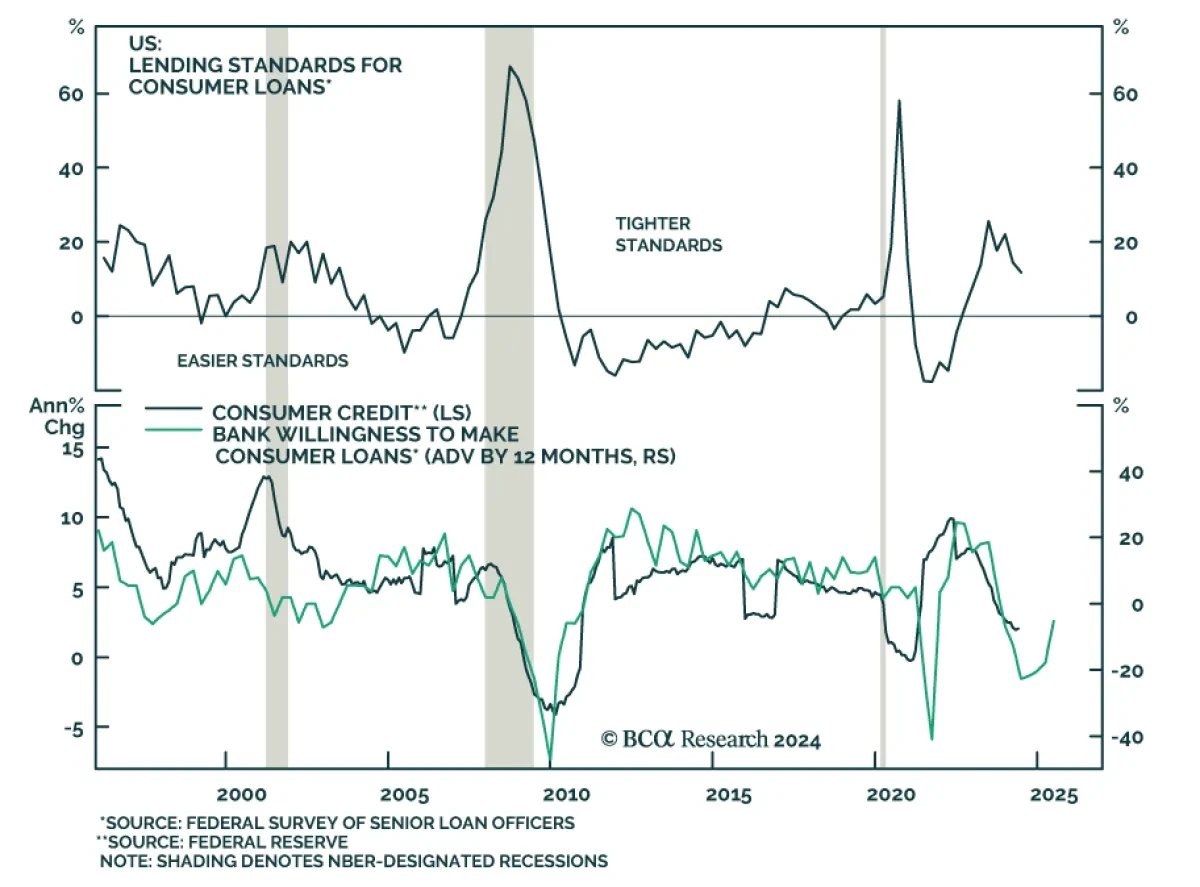

Consumer credit growth disappointed in June. Total credit outstanding rose by USD 8.9 billion, in June, lower than May's USD 13.9 billion, and shy of expectations of USD 10 billion. Revolving credit (which includes credit cards) declined USD 1.7 billion in June but accounted for the lion’s share of ...

Read more

Insight

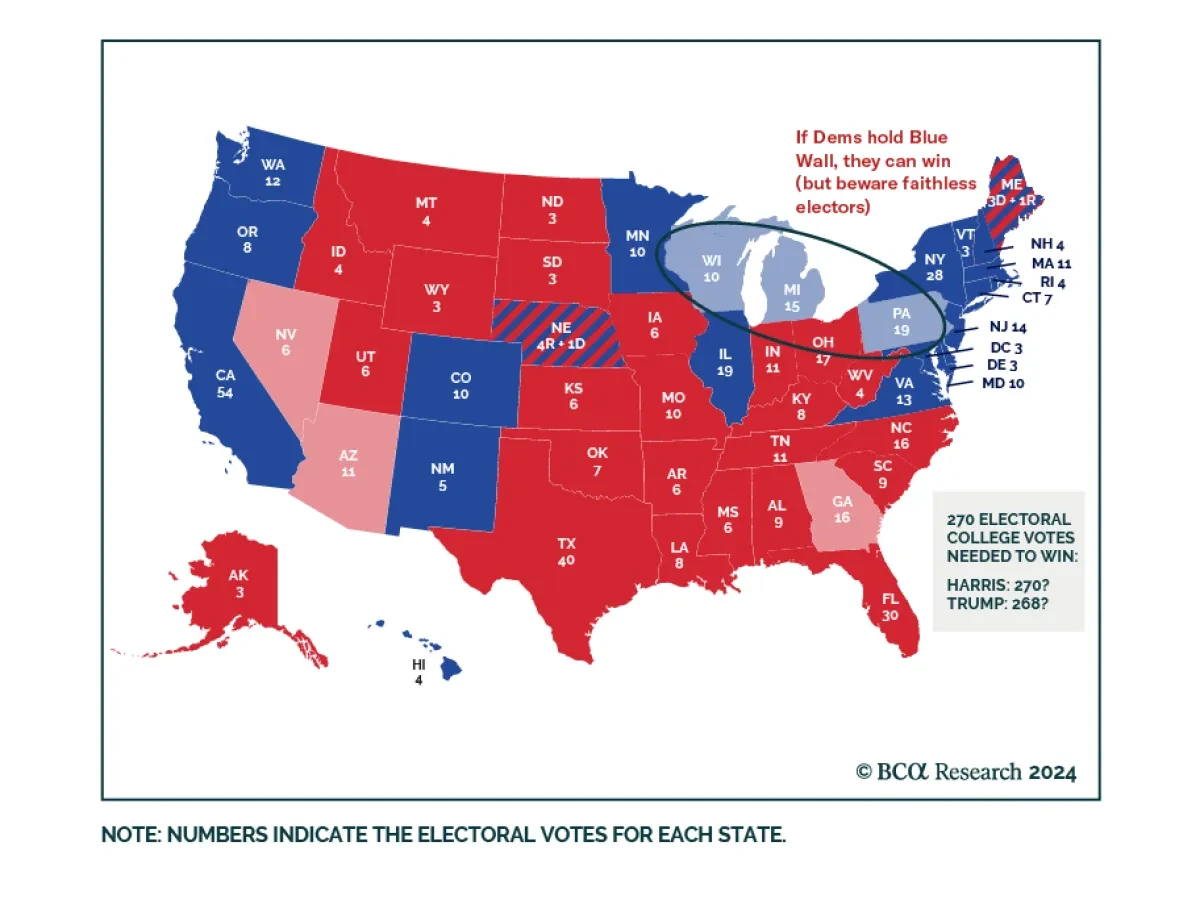

According to BCA Research’s US Political Strategy service, there is a strange quirk about Walz and the state of Nebraska that could have national consequences in the black swan scenario of an electoral college tie.Walz was born in Nebraska, even though he has lived in, represented and governed Minne...

Read more

Insight

Total consumer credit rose by USD 11.4 billion in May (to USD 5,065 billion outstanding) from a slightly upwardly revised USD 6.5 billion increase in April, surpassing expectations of a smaller increase. Notably, revolving credit (which includes credit cards) accounted for nearly two-thirds of the r...

Read more

Insight

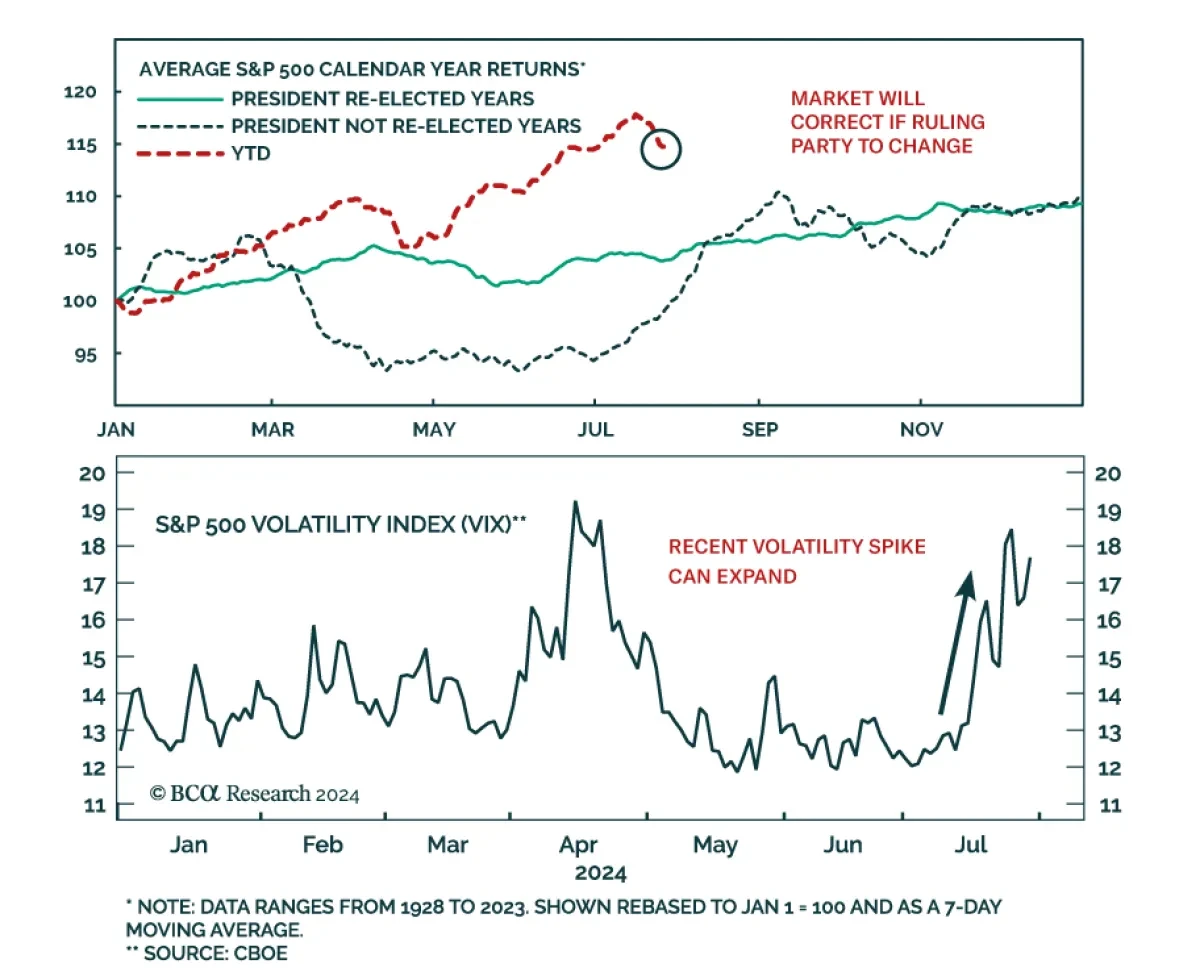

According to BCA Research’s US Equity Strategy service, the stock market outperformance in 2024 thus far is an unusual pattern in election years. The historical data imply that the market will suffer a spill if investors come to believe the incumbent party will change. The spike in volatility i...

Read more