Trade Policy Under A Second Trump Presidency

According to BCA Research’s Bank Credit Analyst service, trade policy under a second Trump presidency represents one of the greatest cyclical risks to investors.

A key question for investors is whether tariffs are prioritized early in the administration or saved for later. Our colleagues expect the former. An early legislative priority on immigration over tax cuts, alongside the rapid imposition of new tariffs, would be the worst alignment for risky assets.

Being barred from a third term, Trump would lack electoral constraints in his second term. In 2019, the Trump administration escalated the trade war with China, which weighed heavily on the global manufacturing sector. Then, when the 2020 election began to loom, Trump pivoted and started negotiating the Phase One trade deal with China.

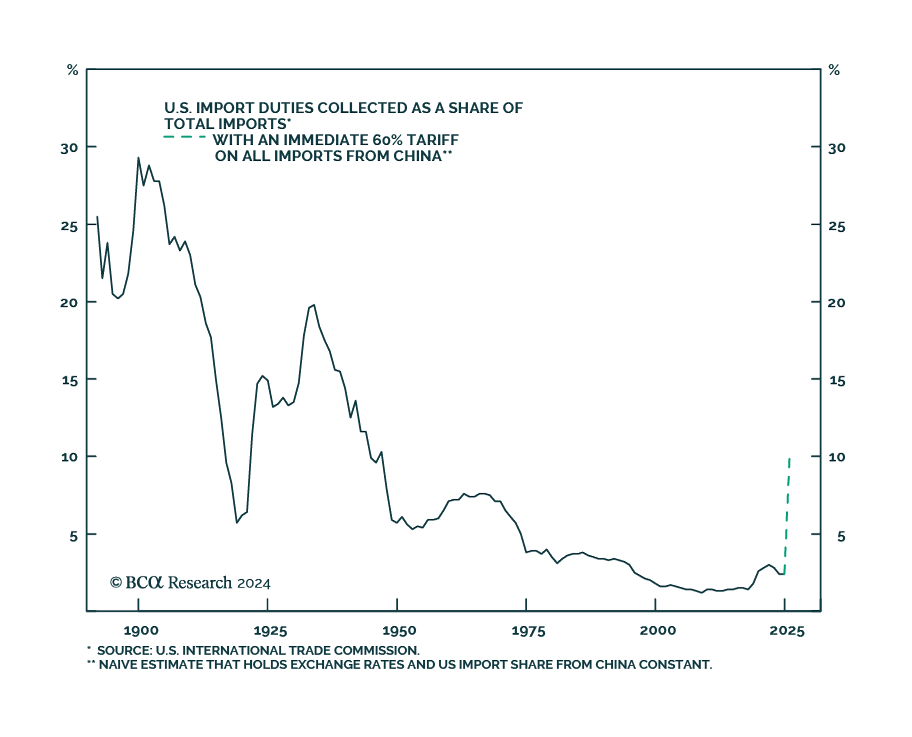

During a second term, if China does not offer structural concessions, Trump will not be forced to conclude a Phase Two deal. Thus, his campaign threats of tariffs “more than” 60% on Chinese imports could materialize – and they may not be watered down in 2028. The impact of a true 60% flat tariff on all imports from China would bring the overall US import tariff rate to 10%, back to 1940s levels. They would dwarf the total increase in tariffs that occurred during the first Trump administration.

One optimistic take about Trump’s trade policy is that he views tariffs as a negotiation tool, and not as something that will stand permanently. The first counterpoint to that view is that China and other countries may not offer structural concessions. The second counterpoint is that tariffs can have a very significant impact on economic growth even if they are only in effect temporarily. That is because large and damaging trade actions are typically met with retaliation, which is theoretically rational, even if it constrains economic activity.