Insights

Access expert research, timely insights, and exclusive webcasts to help you make confident, data-driven decisions.

Insight

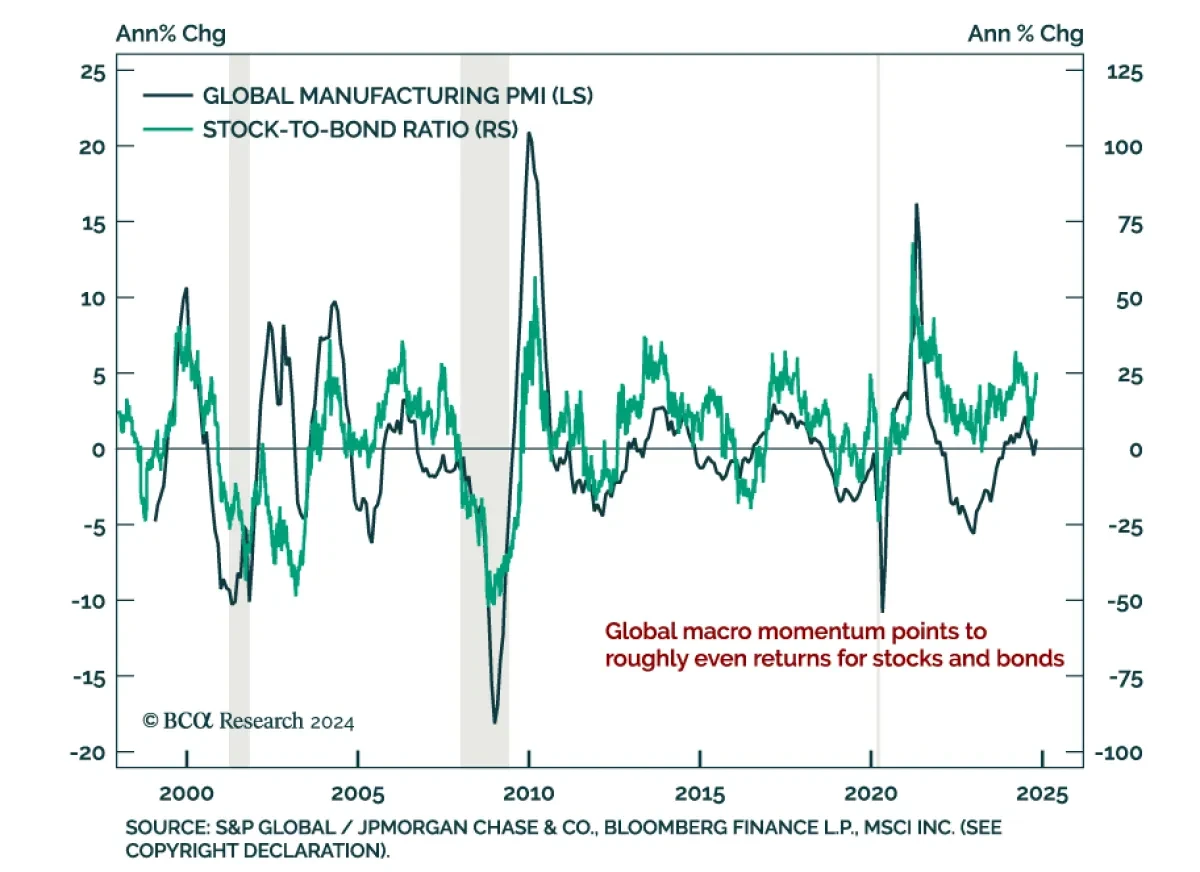

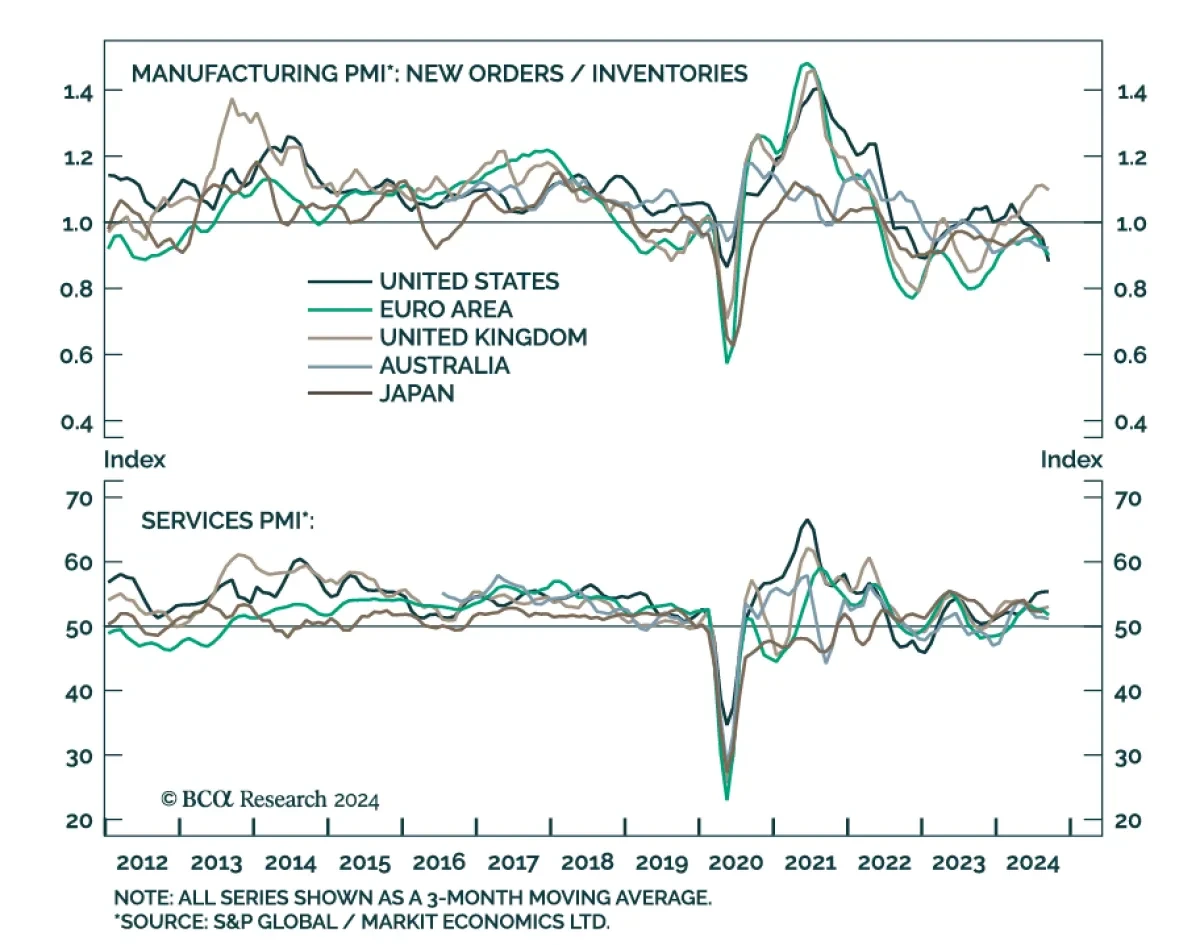

The October global manufacturing PMI printed at 49.4, up from 48.7 in September but still in contractionary territory. While output stabilized at 50.1, new orders (48.8) and new export orders (48.3) remain in contraction, as is the case for the new orders-to-inventories spread. This rebound is ...

Read more

Insight

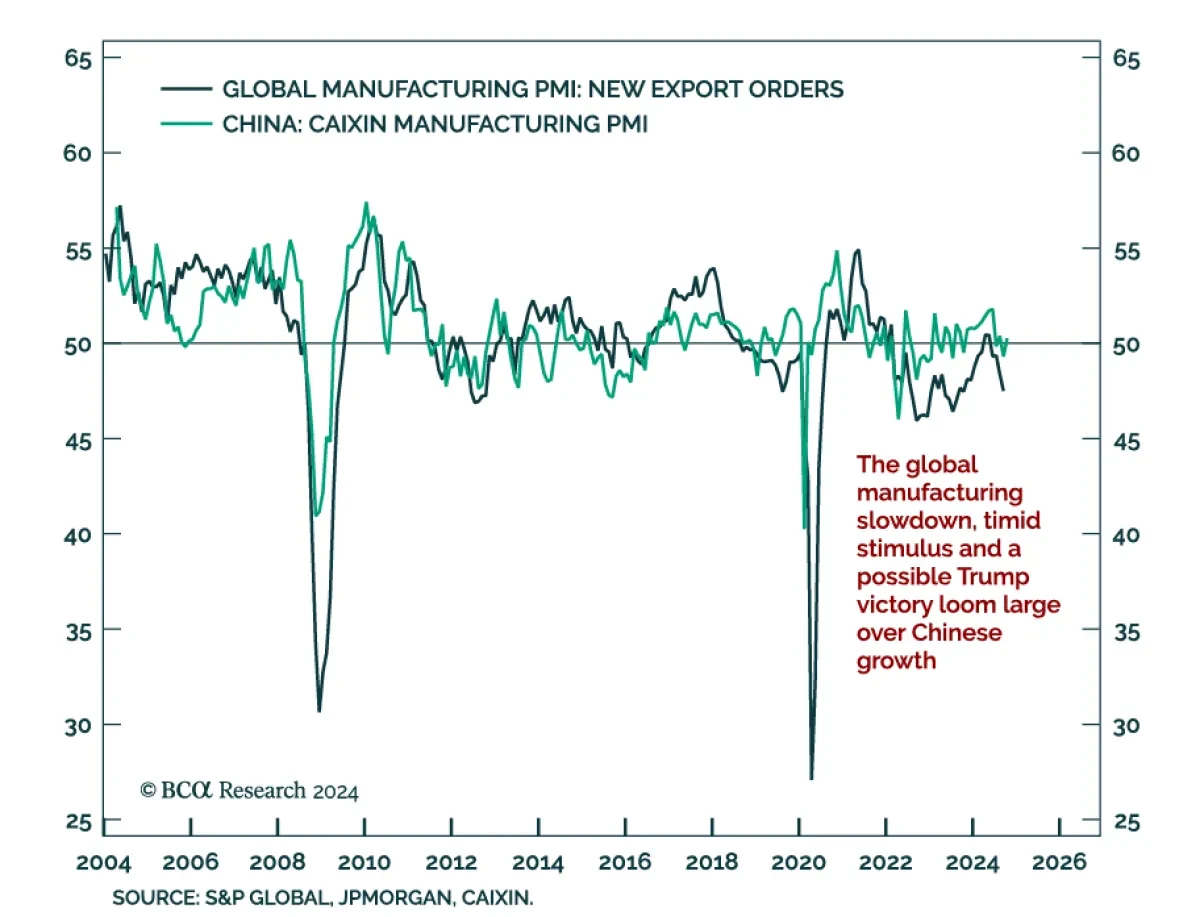

China’s Caixin Manufacturing PMI rebounded one point in October to 50.3. This was in line with the NBS PMIs from earlier this week, which also showed a modest rebound. We are looking for a turning point in China as the government unrolls stimulus measures. This Caixin rebound is not that turnin...

Read more

Insight

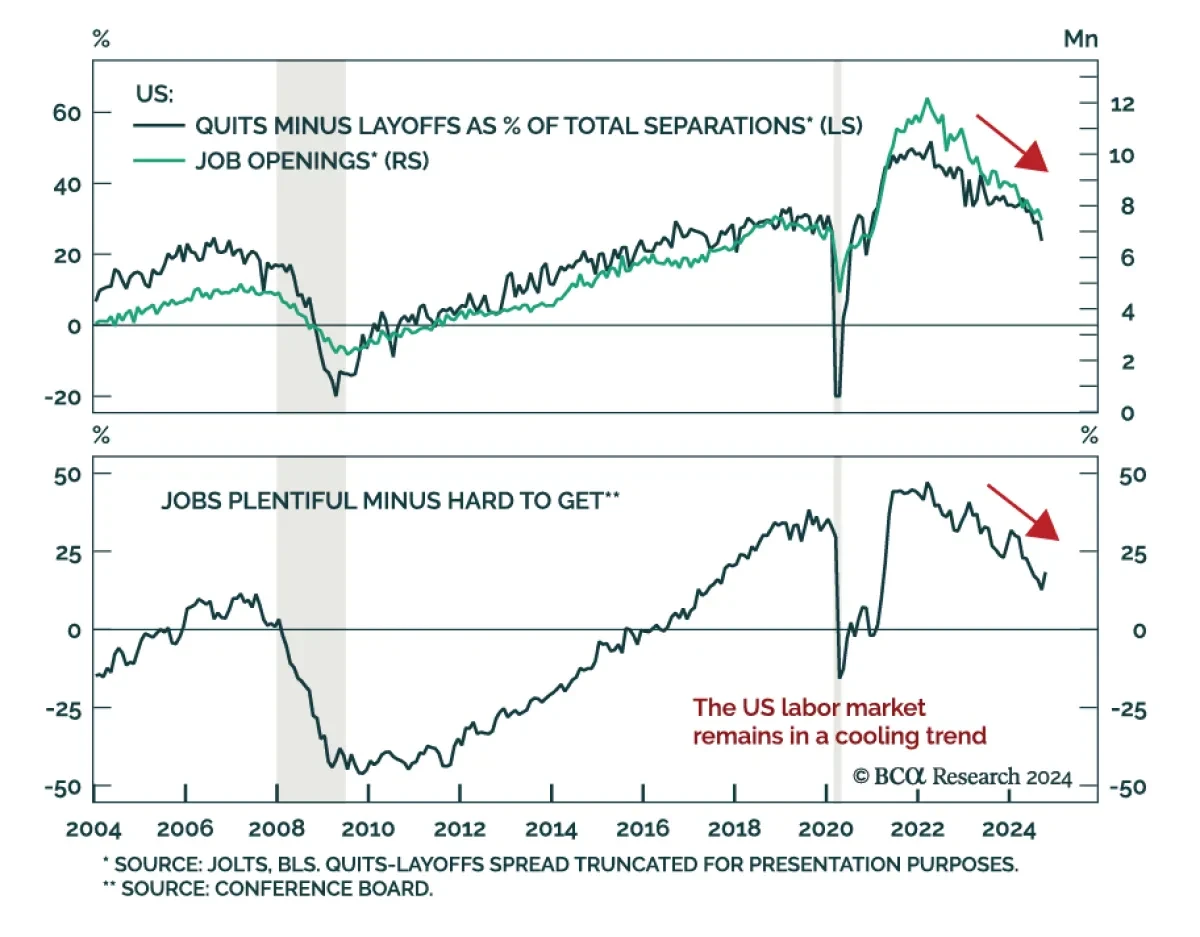

Job openings missed expectations at 7.44 million in September, a mild slowdown from August. The details of the JOLTS report were also negative, except for hirings which continue their June rebound. Meanwhile, consumer confidence for October data beat expectations. The Conference Board’s labor differ...

Read more

Insight

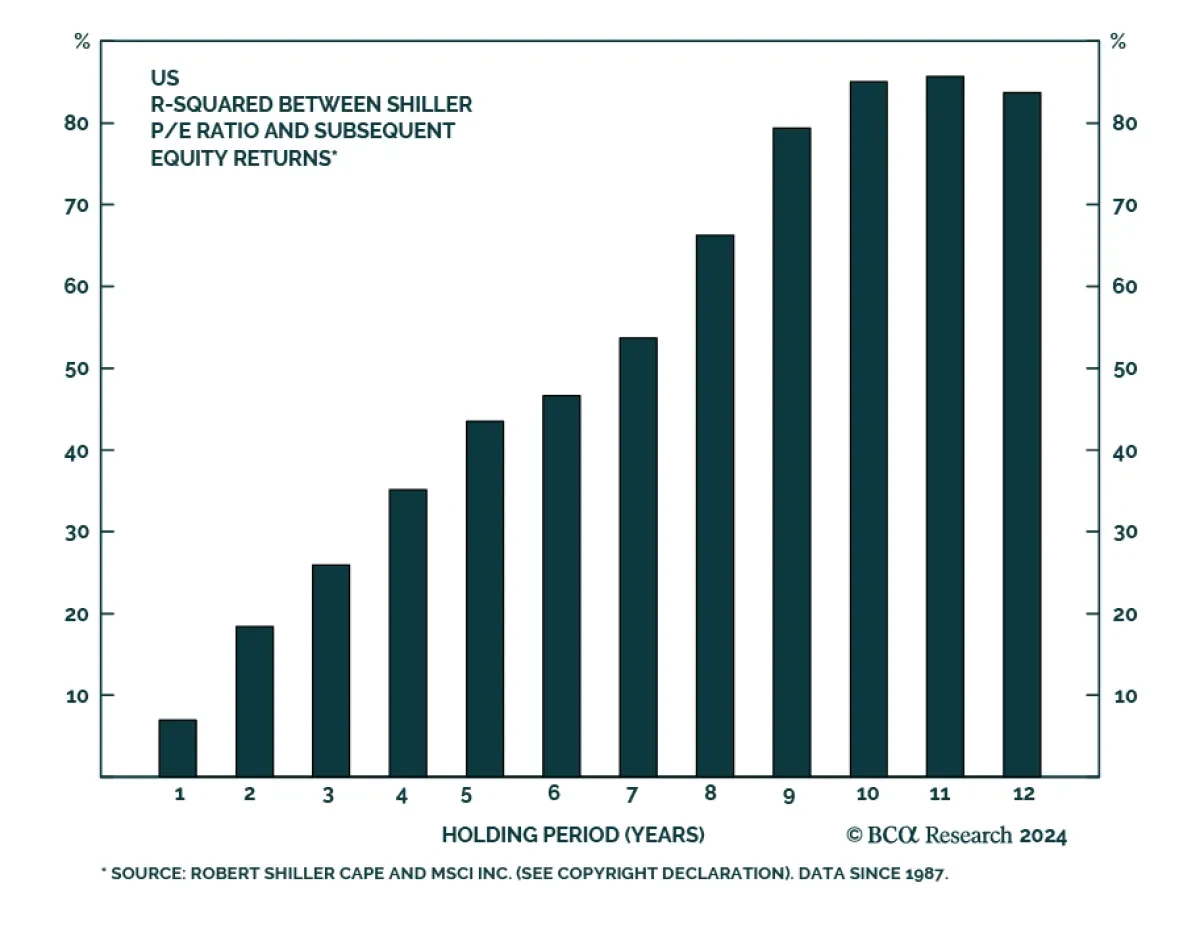

Elevated US equities valuations and their impact on returns are a hot topic right now. Valuations are not a tactical or cyclical timing tool, but they help predict long-term returns. Our Global Asset Allocation Strategy team publishes their multi-asset 10-to-15 years return assumptions annually, and...

Read more

Insight

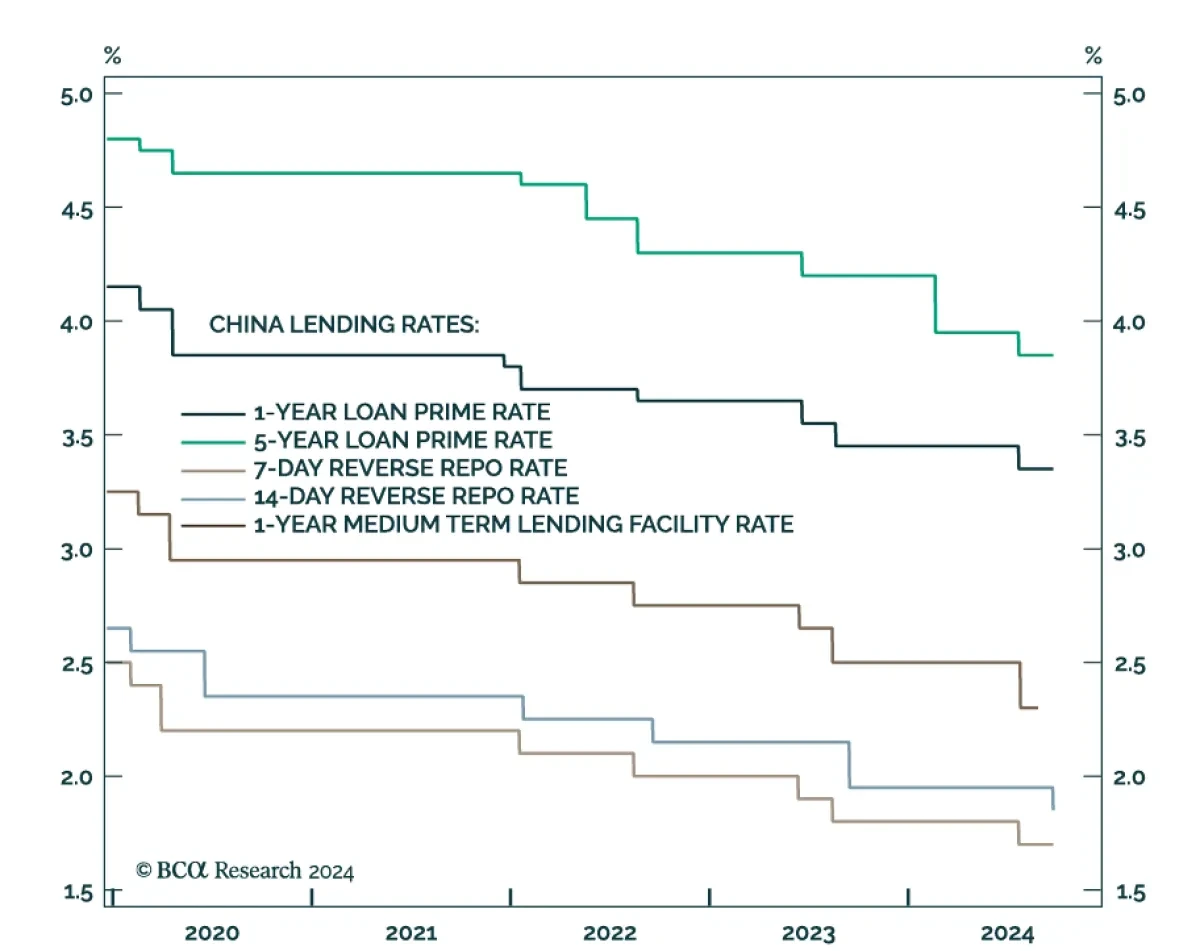

The PBoC lowered the 14-day reverse repo rate by 10 bps on Monday, a move that follows a string of easing measures in late July when the central bank lowered the 7-day reverse repo rate, several maturities of the loan prime rate and the 1-year medium-term lending facility rate.Our China Investment s...

Read more

Insight

Preliminary estimates suggest that activity continued to slow across DM economies in September.Manufacturing PMIs contracted at a faster pace in the US, Eurozone, Germany, France and Australia, and grew at a slower pace in the UK. Services PMIs continued to expand in most regions, though the pace of...

Read more

Insight

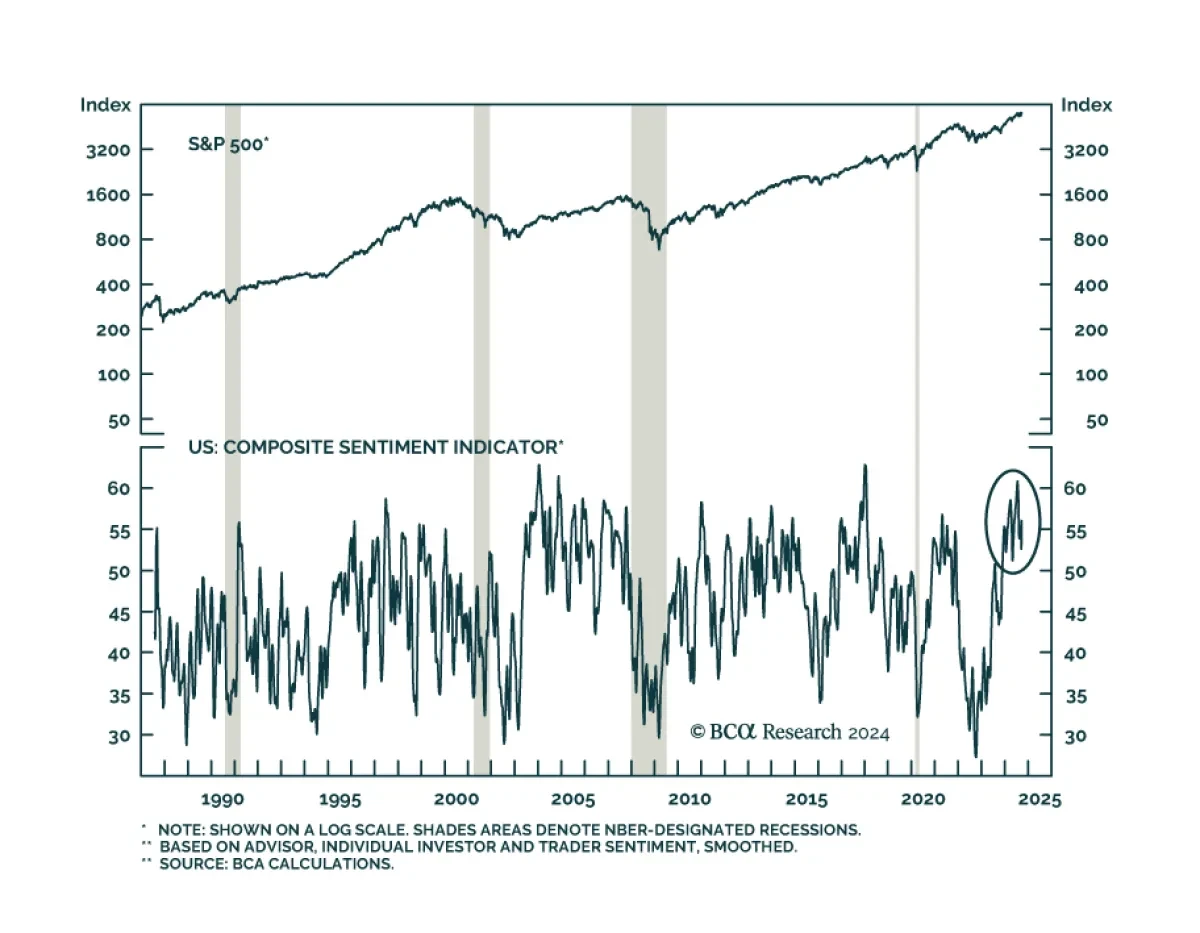

One key takeaway from Wednesday’s post-FOMC press conference is the Fed’s unshaken conviction that it can avoid a recession. A risk-on mood dominated markets on Thursday, with the S&P 500 breaching new all-time highs while the 10-year Treasury yield rose 3.5 basis points (see Indicator Spotlight...

Read more

Insight

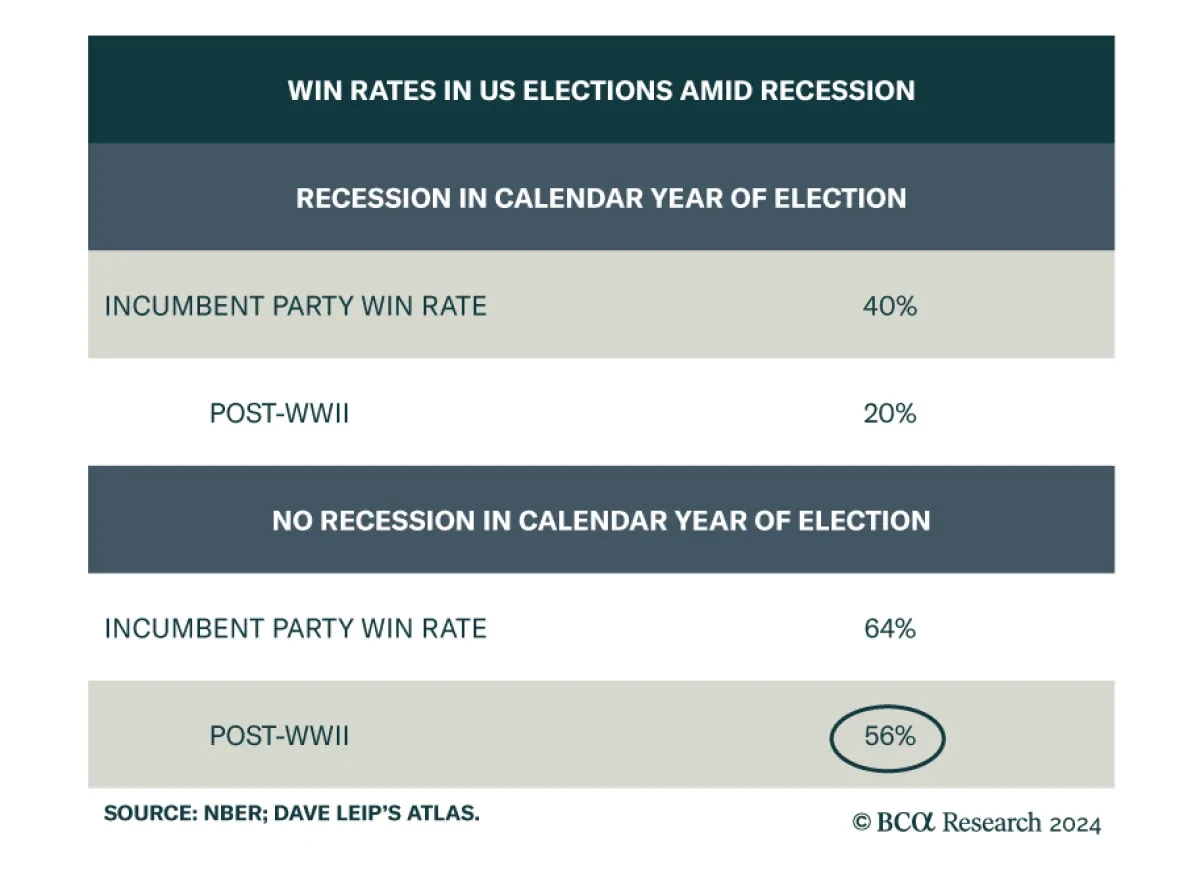

According to BCA Research’s Geopolitical Strategy service, seven surprises with non-negligible odds could tip the scale in favor of Republicans for the White House by November 5. One of them is a war between Israel and Iran.Iran is still highly likely to retaliate against Israel. The Biden administr...

Read more

Insight

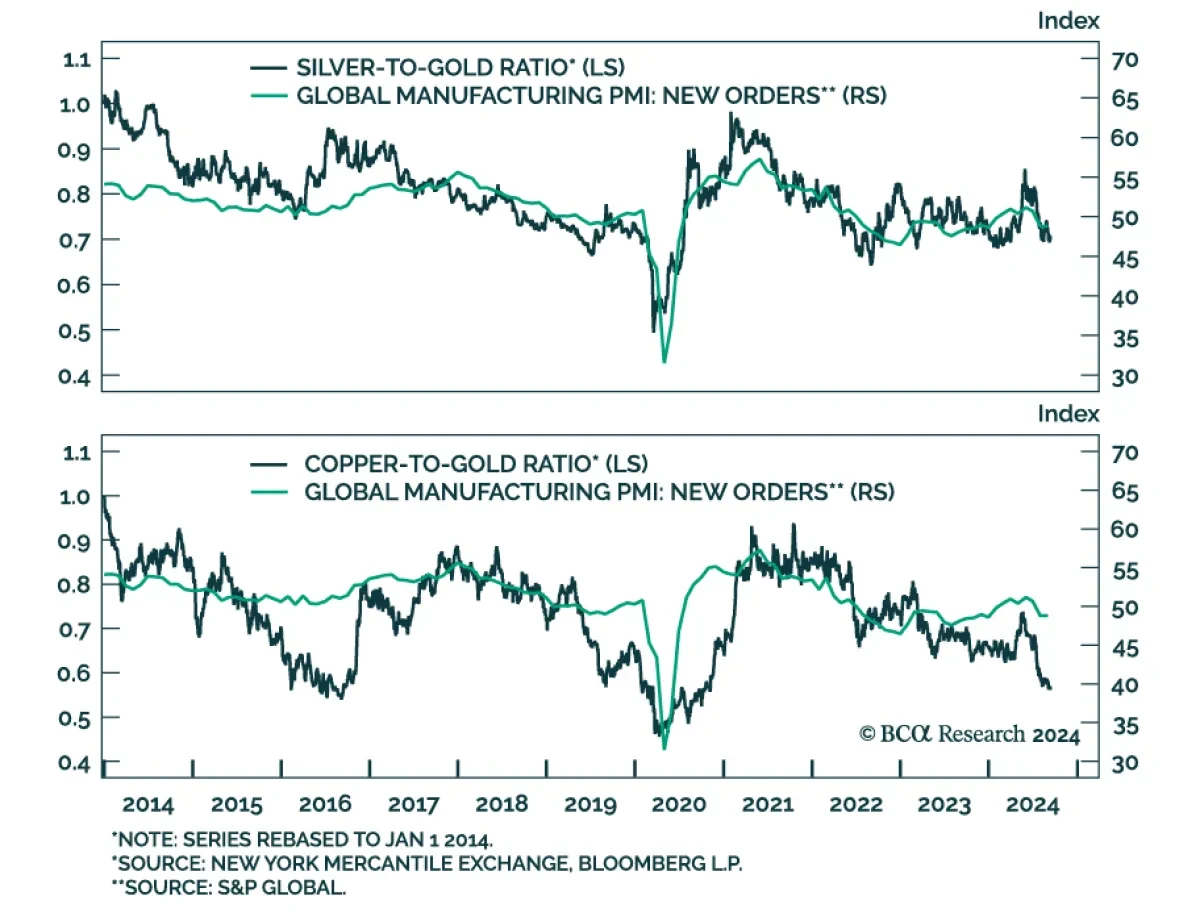

As an industrial metal, copper acts as a barometer of economic activity. Silver and gold are safe-haven assets with inflation-hedging properties, though silver is relatively more sensitive to global growth developments given that industrial applications account for roughly half of silver demand.The ...

Read more

Insight

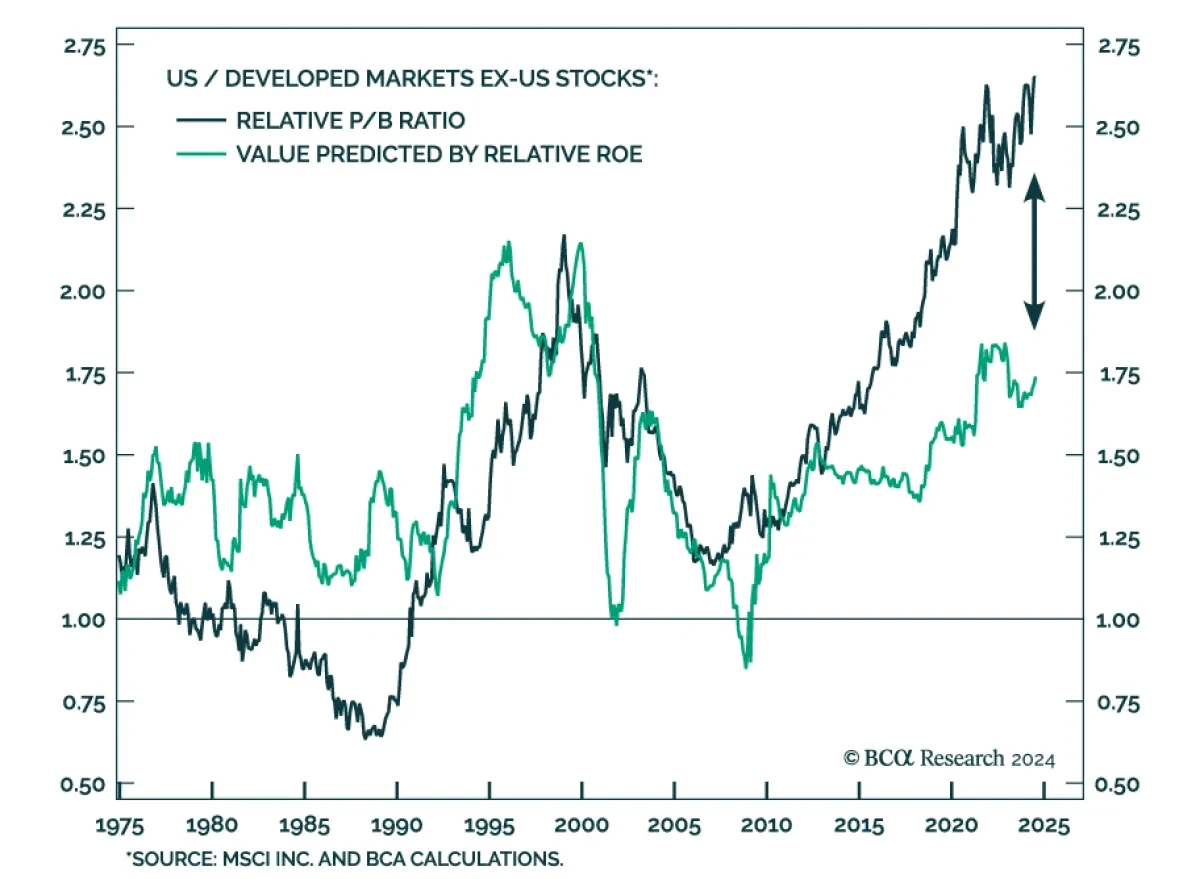

According to our Bank Credit Analyst service, an inflection point in the relative performance of US stocks is not likely to occur over the coming 6-12 months. A recession favors US equities in common currency terms barring substantially less global ex-US earnings weakness than has historically occur...

Read more