How The US Could Cheat A GDP Recession

According to BCA Research’s Counterpoint Strategy service, the post-pandemic US economy has inverted from its usual ‘demand-constrained’ state to a highly unusual ‘supply-constrained’ state. This inversion is still a ways from normalizing, with labor demand still exceeding supply by 2.2 million jobs, or 1.3 percent.

In the supply-constrained state, it is the evolution of supply, not demand, that drives output. Even as labour demand has gone into recession, the growth in labour supply has driven GDP. In a supply-constrained economy, output will go into recession only if supply goes into recession. Or if the economy ‘un-inverts’ back to demand-constrained and demand stays in recession.

If the current recession in labor demand is mild, as in 1990 or 2001, it is almost halfway complete. By the time the economy un-inverts back to demand-constrained, most of the recession in labor demand will be over, leading to a fascinating possibility:

The highly unusual inversion of the US economy means that despite suffering a typical labor demand recession, the US could cheat a GDP recession.

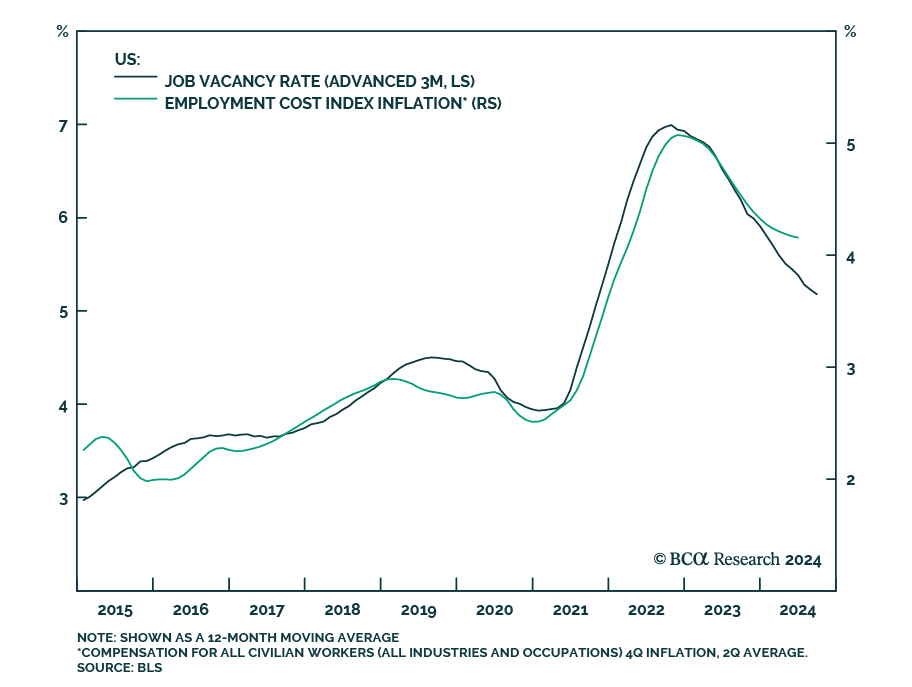

Many contend that the inversion of the US economy is overstated because the jobs and job openings that make up labor demand are overstated. However, our colleagues argue that the jobs data is based on the generally reliable Household Survey rather than the heavily (and recently) revised Establishment Survey. Meanwhile, the JOLTS job openings data are buttressed by their excellent explanatory power for wage inflation, which suggests that they are currently more likely to be understating demand.

One other possibility is that the supply-constrained US economy goes into recession because labor supply goes into recession. It could happen if labor participation fell sharply and/or net immigration turned into net emigration. This would be a major risk in a Trump administration, though that outcome is not a central case.