Insights

Access expert research, timely insights, and exclusive webcasts to help you make confident, data-driven decisions.

Insight

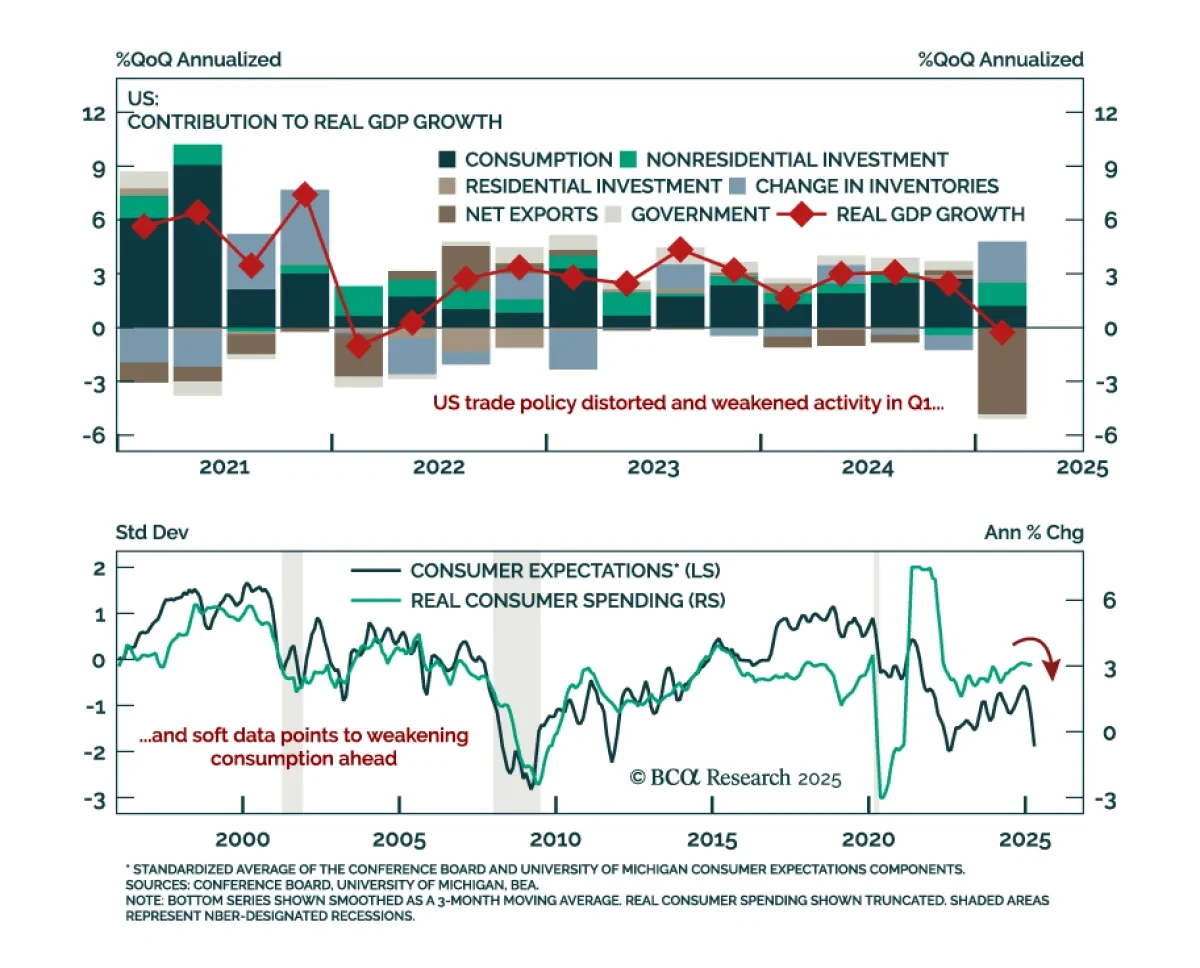

The Q1 US GDP contraction and inflation dynamics reinforce our defensive asset allocation. GDP missed estimates and contracted -0.3% annualized, led by a sharp slowdown in net exports. Consumption slid to 1.8% from 4.0%, reflecting falling consumer confidence. Business investment rose modestly, like...

Read more

Insight

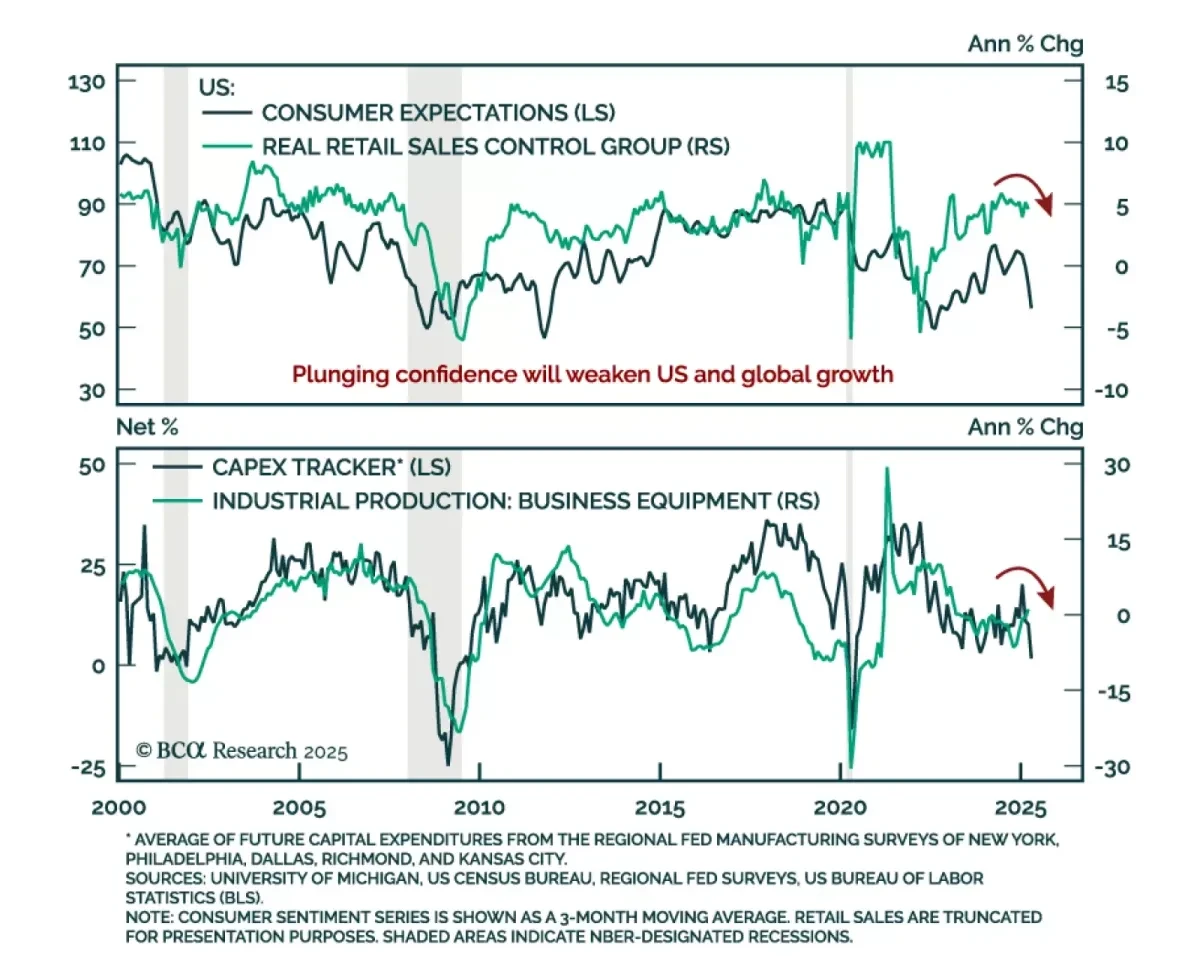

Soft data continues to deteriorate and hard data will soon follow, reinforcing our defensive asset allocation. Consumer and business confidence have plunged as policy uncertainty and inflation expectations rise, with spending, hiring and capex plans softening.March retail sales were decent but mixed...

Read more

Insight

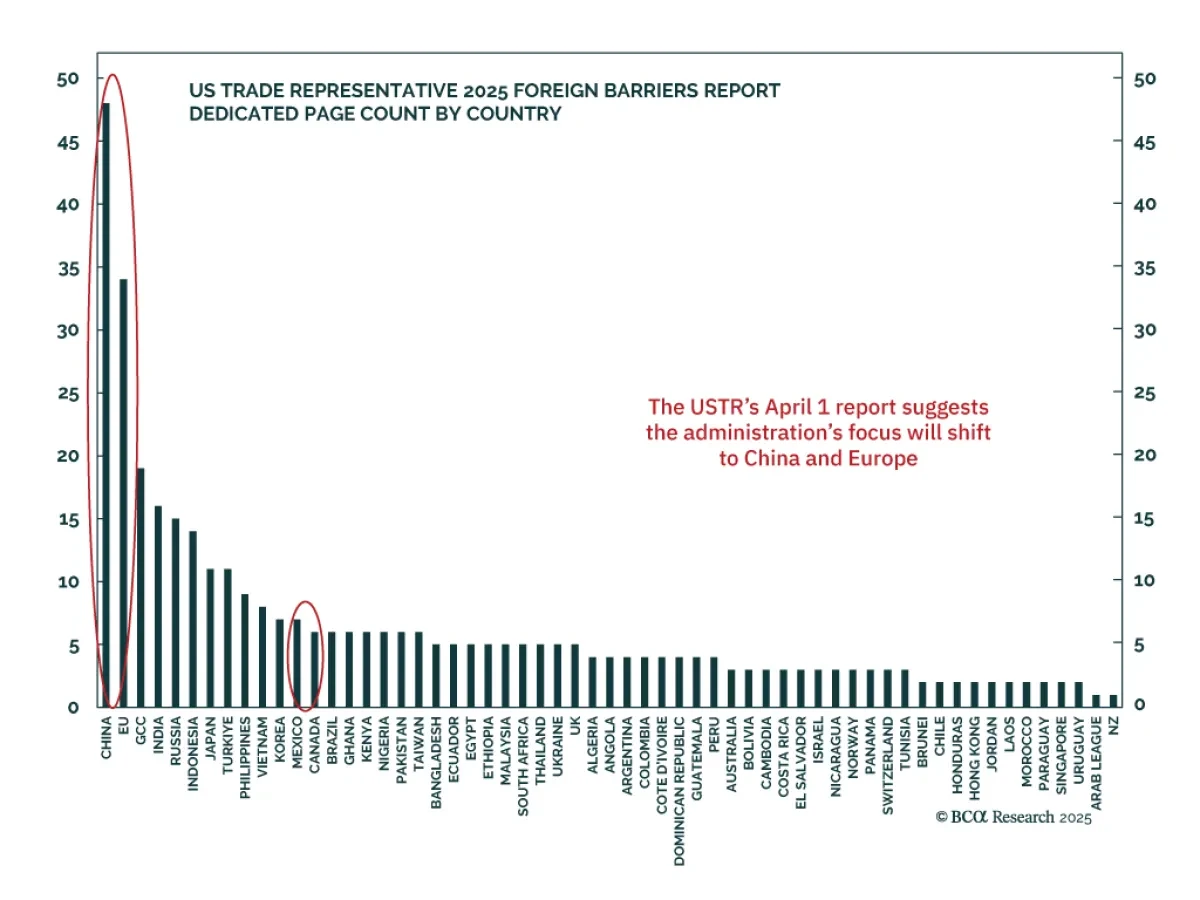

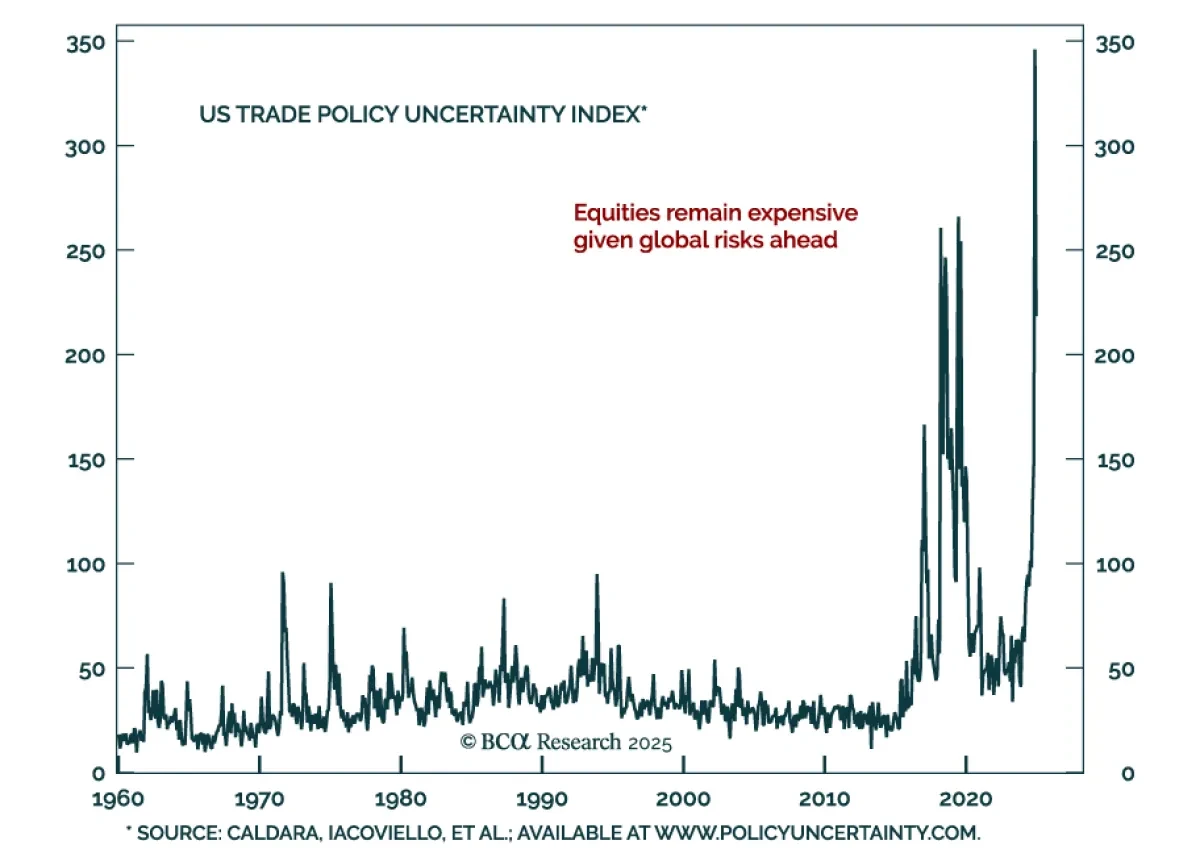

April 2 may mark peak trade tensions, but the path forward remains highly uncertain, supporting our underweight on risk assets and industrial commodities. The USTR’s long-awaited report on trade barriers will guide the next phase of US trade policy. While the report only contains a total of 13 pages...

Read more

Insight

Our tactical framework highlights how financial conditions and economic surprises interact, where growth often sows the seeds of its own demise. Markets price expectations efficiently but lack perfect foresight, making data surprises key to price action. Growth surprises tighten financial conditions...

Read more

Insight

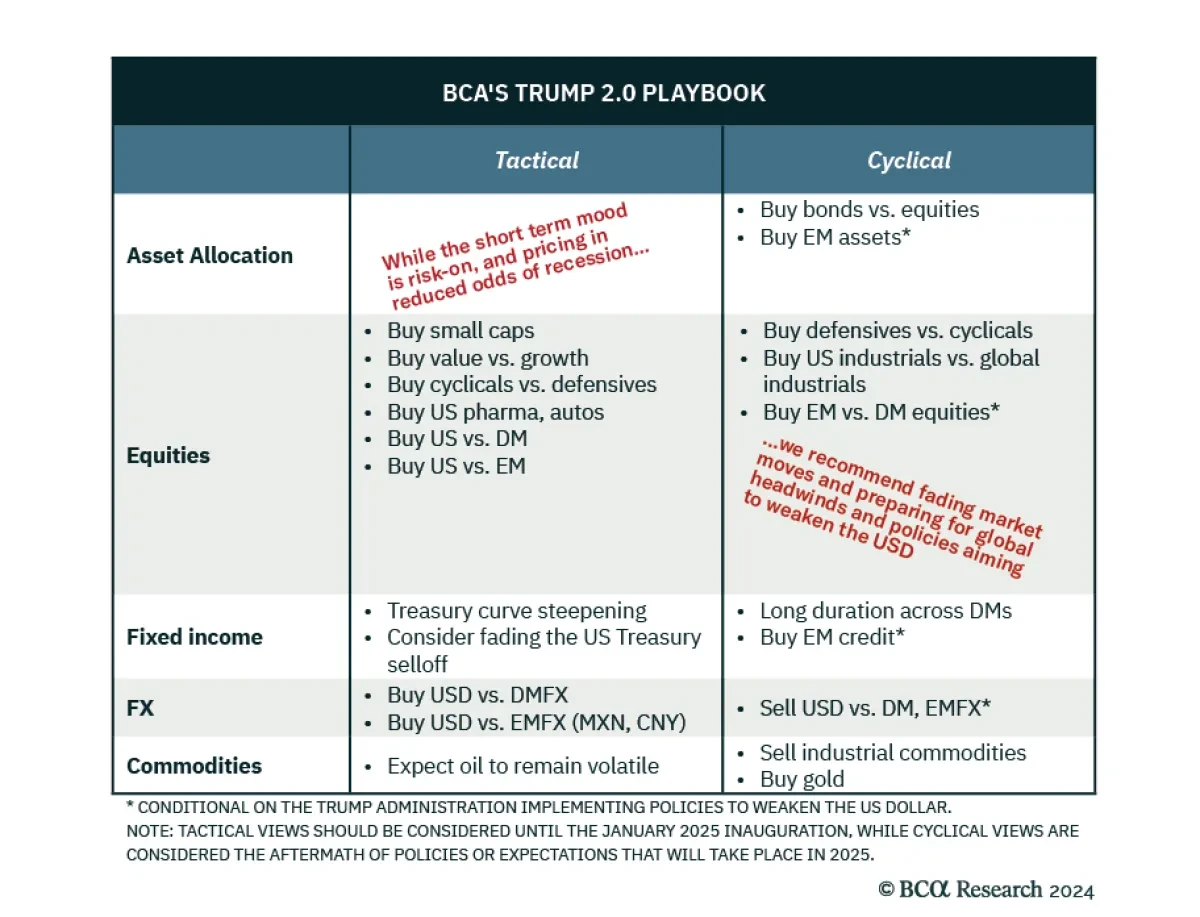

President Trump’s inaugural speech outlined his second term agenda. The theme was that the US will become “far more exceptional” than it already is. Trump pledged to reverse America’s decline, rebalance the justice system, streamline government, protect borders, pare back inflation, restore manufact...

Read more

Insight

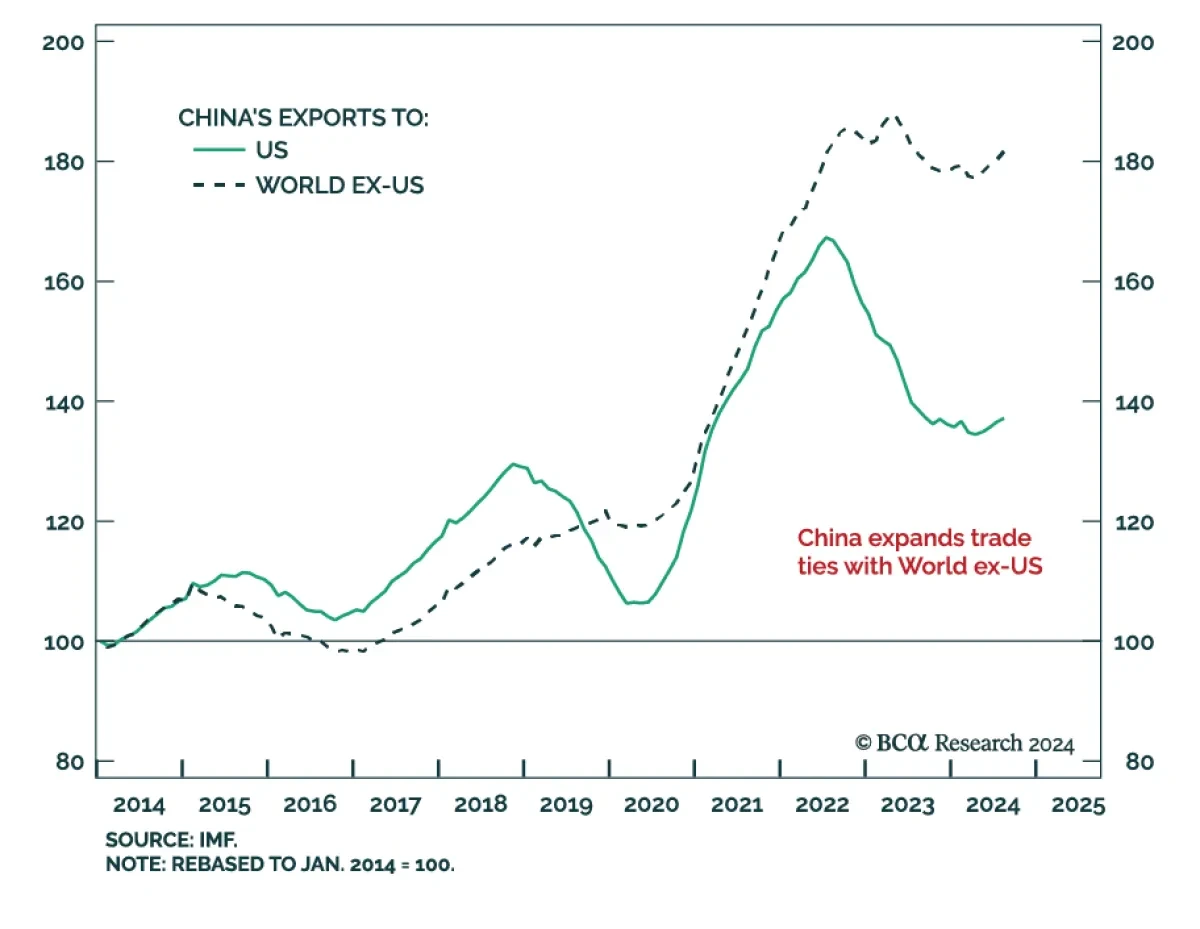

Our Geopolitical Strategy team published their annual outlook, and see three trends shaping 2025. First, Congress is expected to pass tax cuts by the end of 2025, providing a fiscal thrust of 0.9% of GDP in 2026. This stimulus will likely embolden Trump to impose tariffs on ma...

Read more

Insight

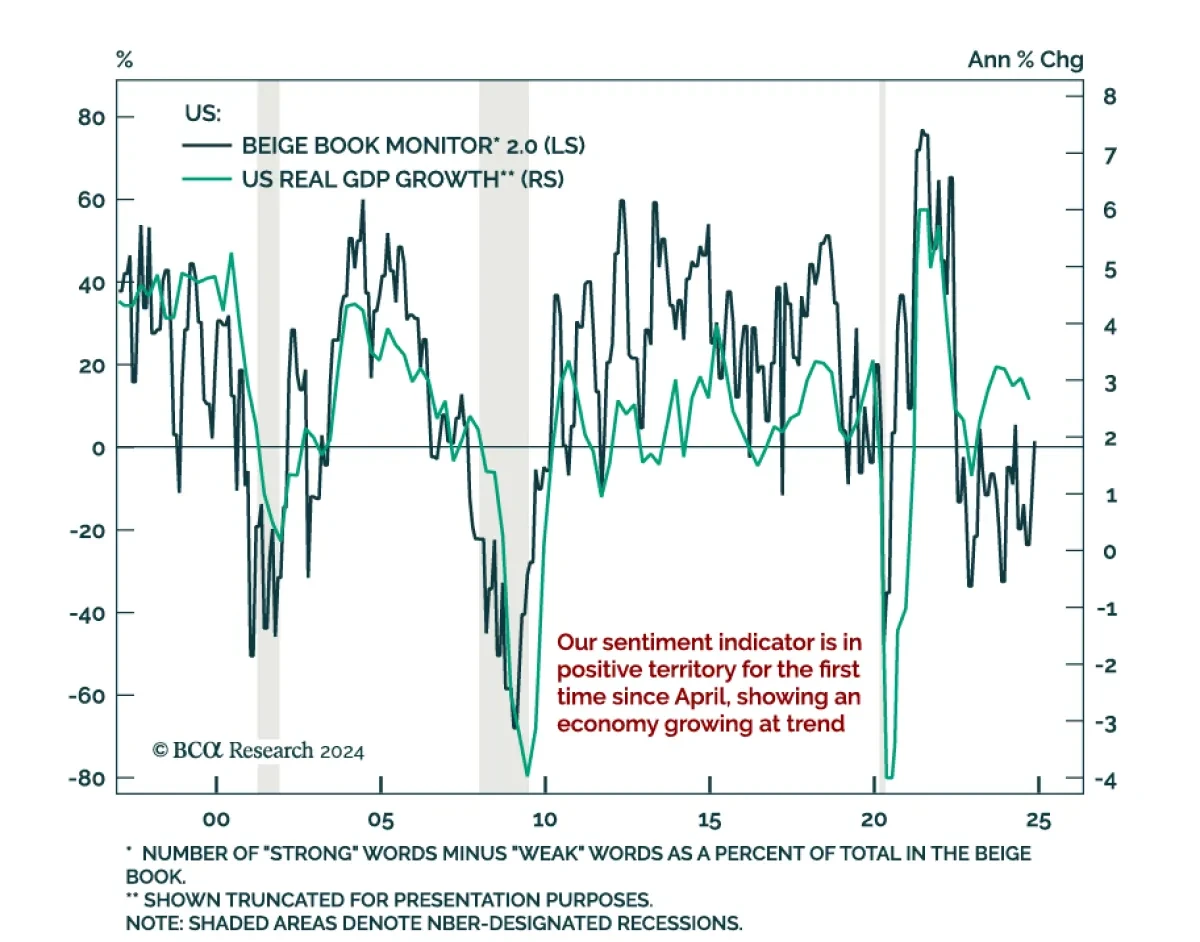

The Federal Reserve’s Beige Book shows a modestly growing economy imbued with post-election optimism, while highlighting some caution about employment. The latest Beige Book is in line with other sentiment indicators showing modest growth but increased post-election expectations. The pict...

Read more

Insight

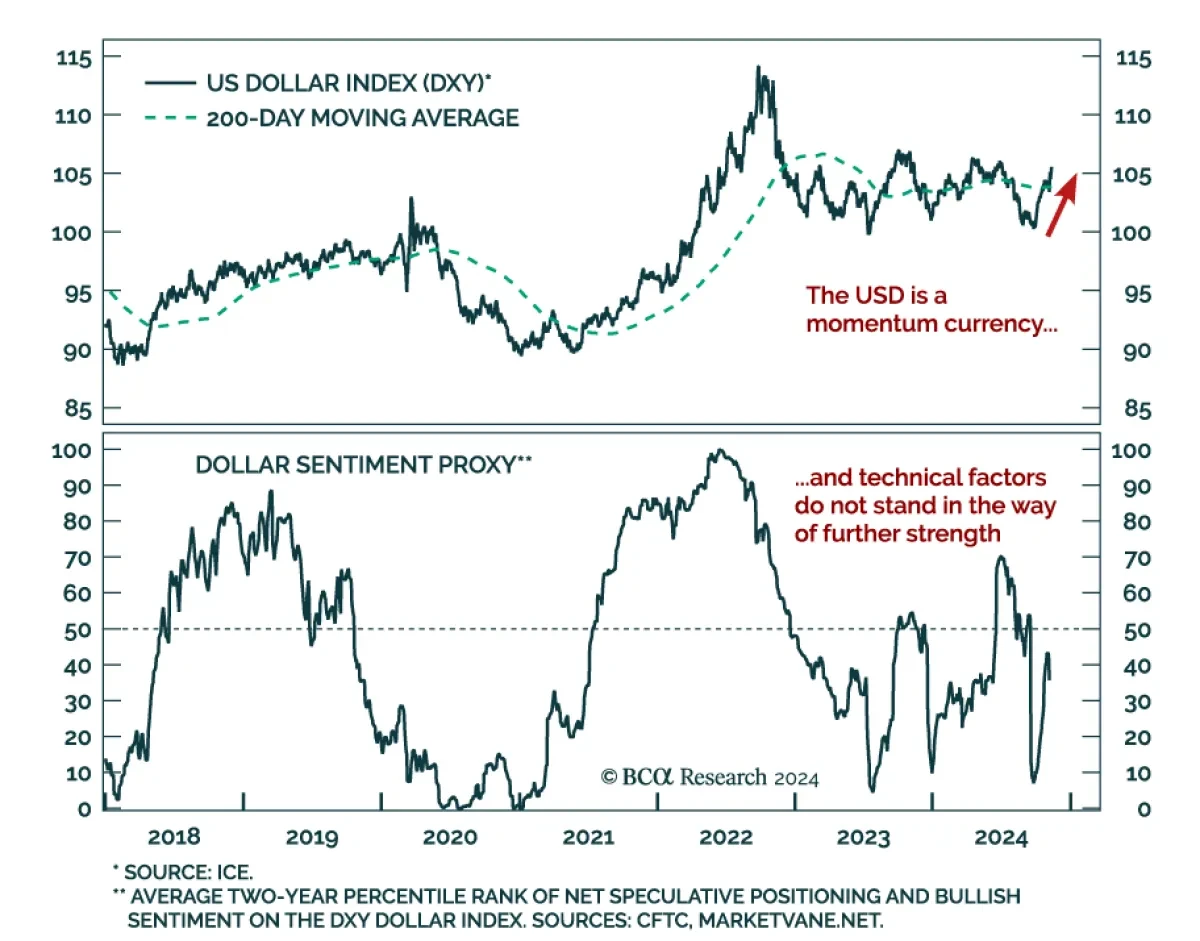

The US dollar steamrolled its peers since early October. After breaking out above its 200-day moving average, it is now fast approaching recent highs. Multiple factors drove this rally, among them are the stronger-than-expected US economic data, weaker data overseas, and Trump’s victory. ...

Read more

Insight

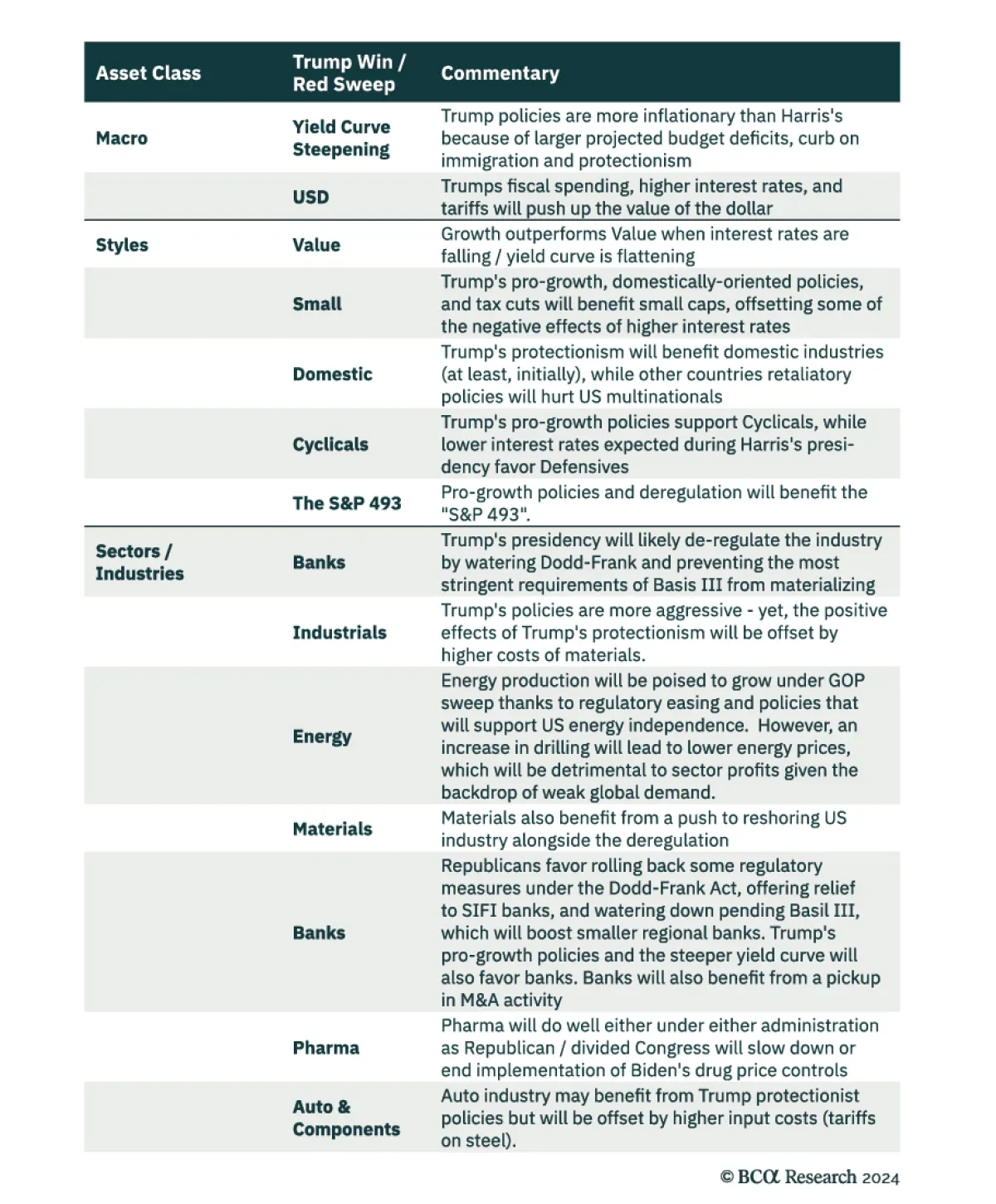

Our US Equity strategists prepared a Post-Election US Equity Cheat Sheet. Here are highlights of their recommended positioning for a US equity portfolio in a Red Sweep scenario. Our US Equity strategists prepared a Post-Election US Equity Cheat Sheet. Here are highlights of their recommen...

Read more

Insight

Although foreseen by our US & Geopolitical strategists, a “Red Sweep” now makes the macro environment more volatile. After convening for our BCA Live & Unfiltered meeting, we offer three main takeaways. First, 2024 is not 2016. To begin with, a Trump victory is less of a surprise....

Read more