DM Growth Slows Further In September

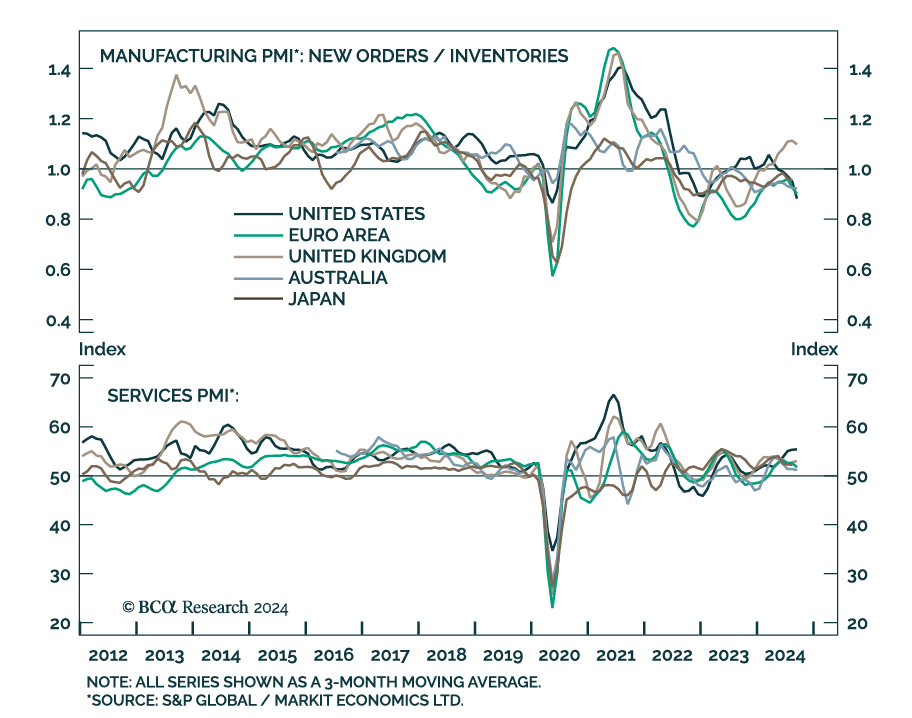

Preliminary estimates suggest that activity continued to slow across DM economies in September.

Manufacturing PMIs contracted at a faster pace in the US, Eurozone, Germany, France and Australia, and grew at a slower pace in the UK. Services PMIs continued to expand in most regions, though the pace of growth slowed. Notably, the Olympic Games’ one-off boost to France’s services PMI in August completely wore off in September, with the country’s services PMI unexpectedly shedding a whopping 6.7 points to 48.3.

A holiday is delaying the release of Japan’s preliminary PMIs for September. In August, the country’s manufacturing PMI extended a second month of decline (after a couple of brief stabilization episodes broke a nearly two-year contraction streak).

Details of the US flash PMIs highlight a sharp worsening in domestic and foreign demand conditions in the pro-cyclical manufacturing sector, as well as a deterioration in the employment components of both sectors.

The US has been a large source of global demand this cycle and a US recession morphing into a global downturn remains our base case. Last week’s outsized rate cuts will work with a lag and are thus unlikely to alter the course of the ongoing labor market softening over the next 6-to-12 months. Meanwhile, Chinese demand is unlikely to fill the void given the stimulus is timid in scope and inadequate in nature.

Cyclical investors should underweight equities and overweight bonds, avoiding pro-cyclical Eurozone and EM equities in favor of US equities.