Negotiations on trade, Iran, and Ukraine will prove critical this month. Markets will remain volatile because positive data surprises enable the White House to press its hawkish tariff hikes, while negative surprises force the White…

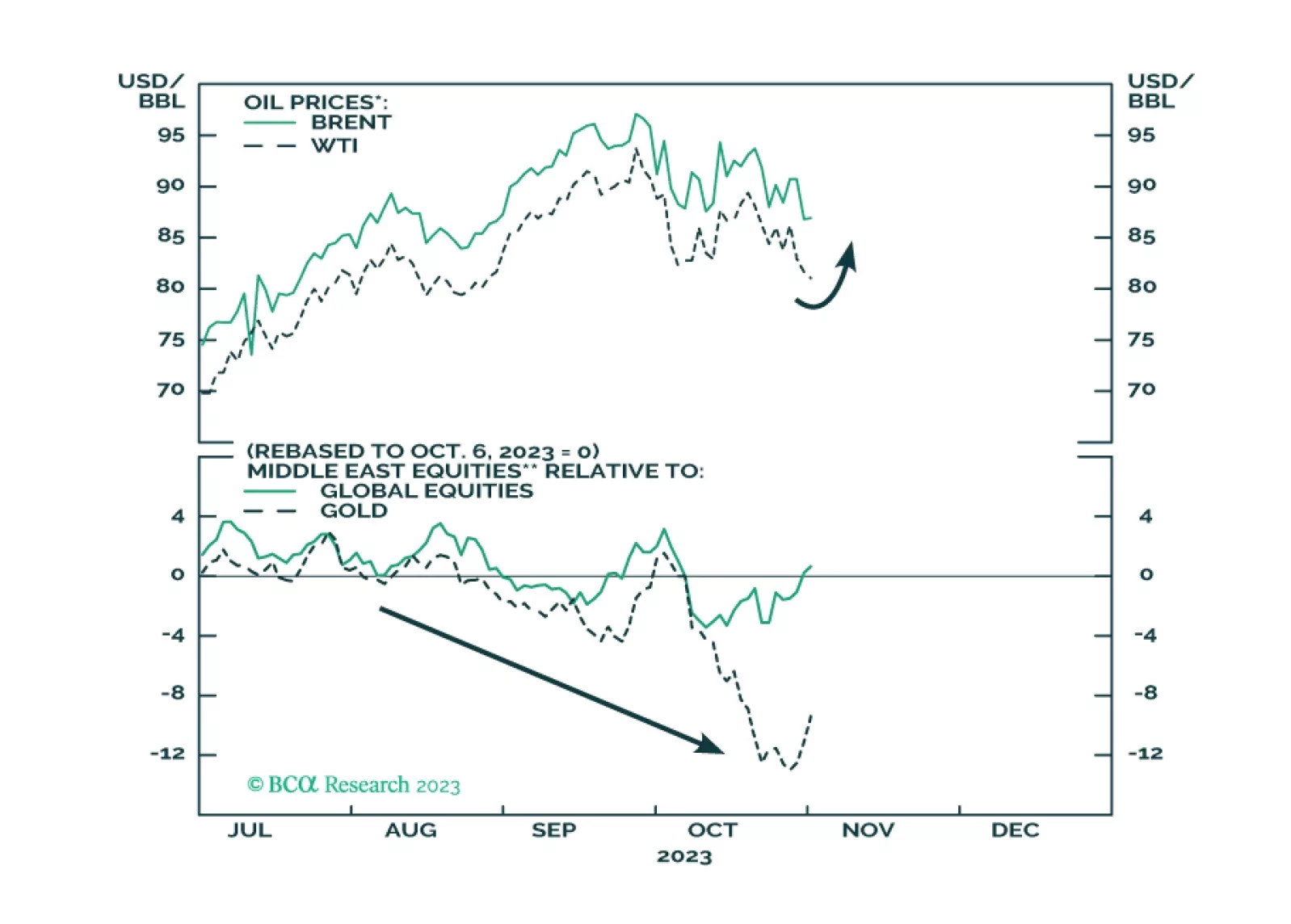

Stocks will continue to struggle in the second quarter as President Trump tries to implement tariffs. Tax cuts will only temporarily dispel growth fears, if at all. Middle Eastern instability will add oil price surprises to an…

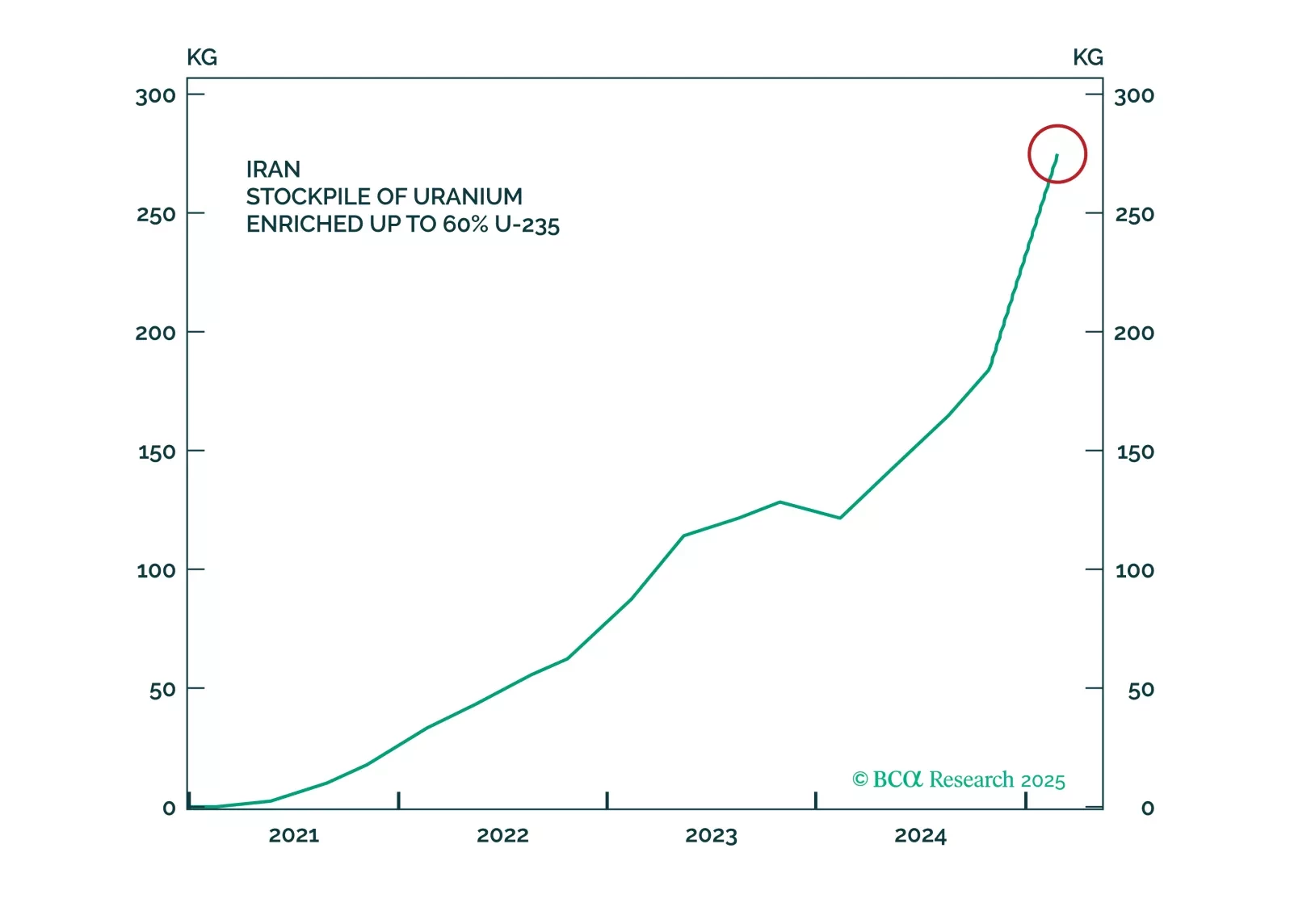

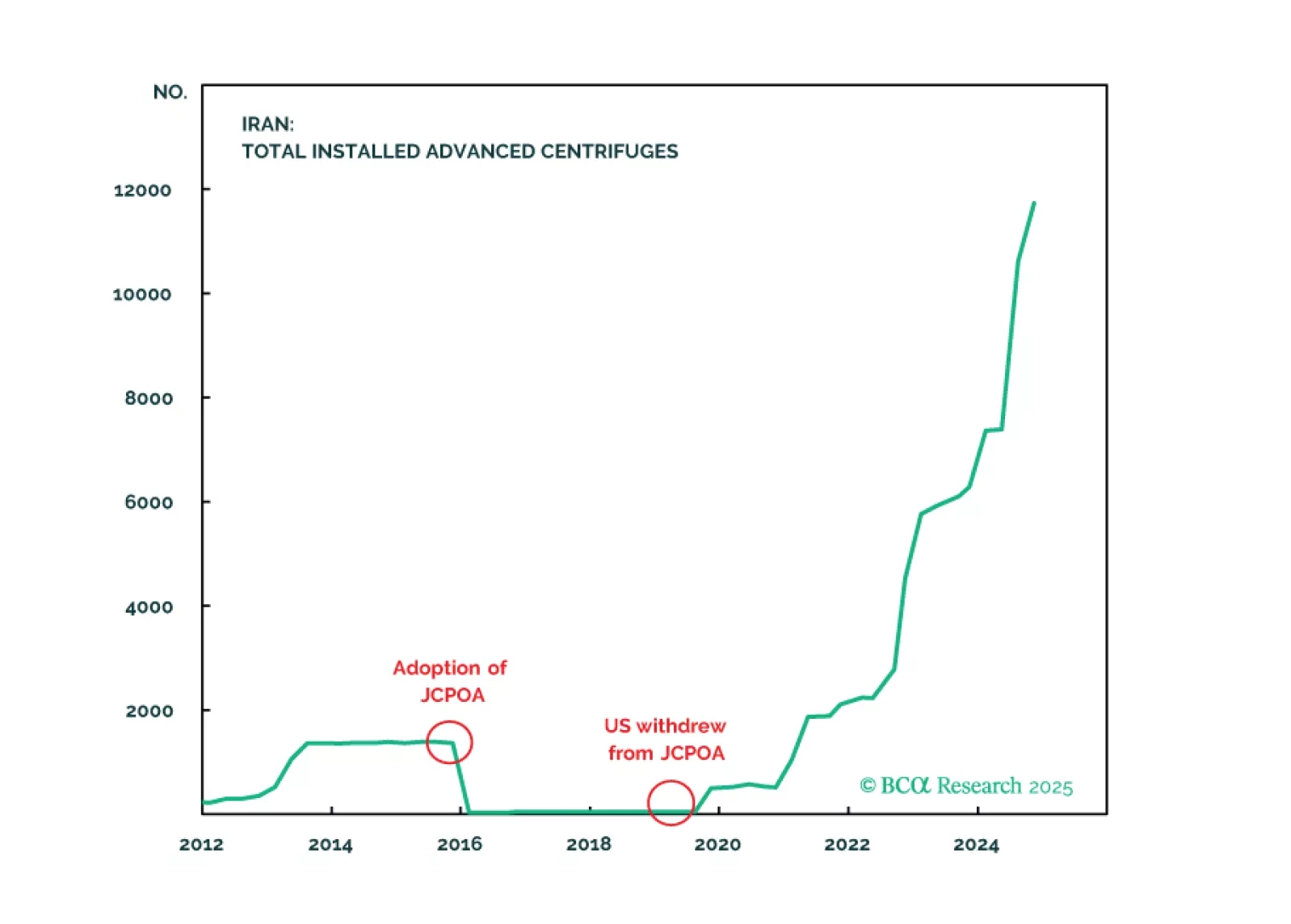

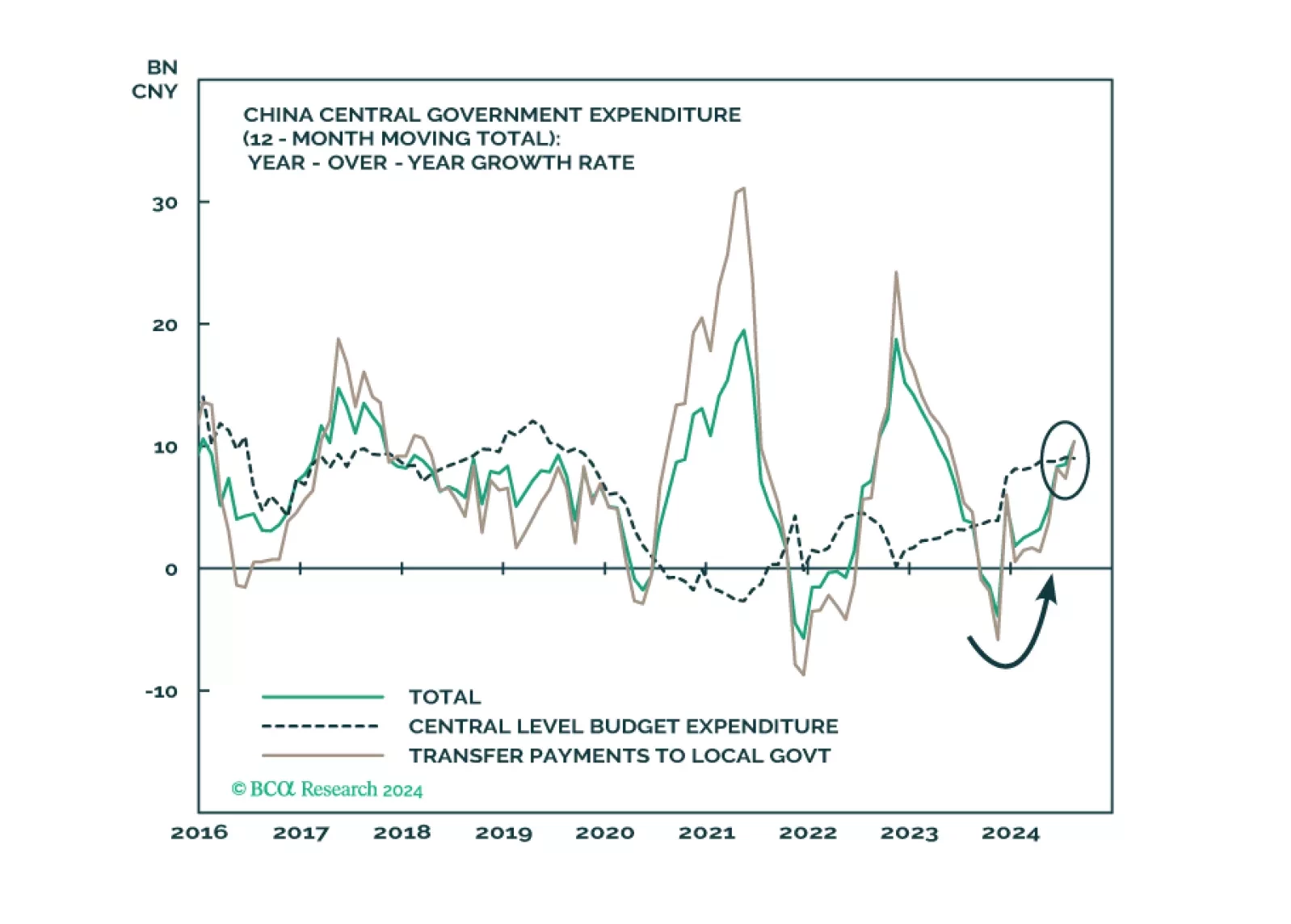

The tariffs on Canada and Mexico will come into effect as scheduled while the tariffs on China will be doubled. In the Middle East, Iranian response to any attack will threaten Middle Eastern oil supply. Meanwhile, Chinese fiscal…

Every year we highlight five low-odds scenarios that would have a major impact on global financial markets if they happened. This year we contemplate a total reversal of Chinese policy, a US-Iran nuclear deal, a breakdown of NATO, US…

Congress will pass tax cuts by end of 2025 producing a fiscal thrust of about 0.9% of GDP in 2026. Trump will count on that stimulus as a basis for slapping tariffs on leading trade partners.China will retaliate against Trump…

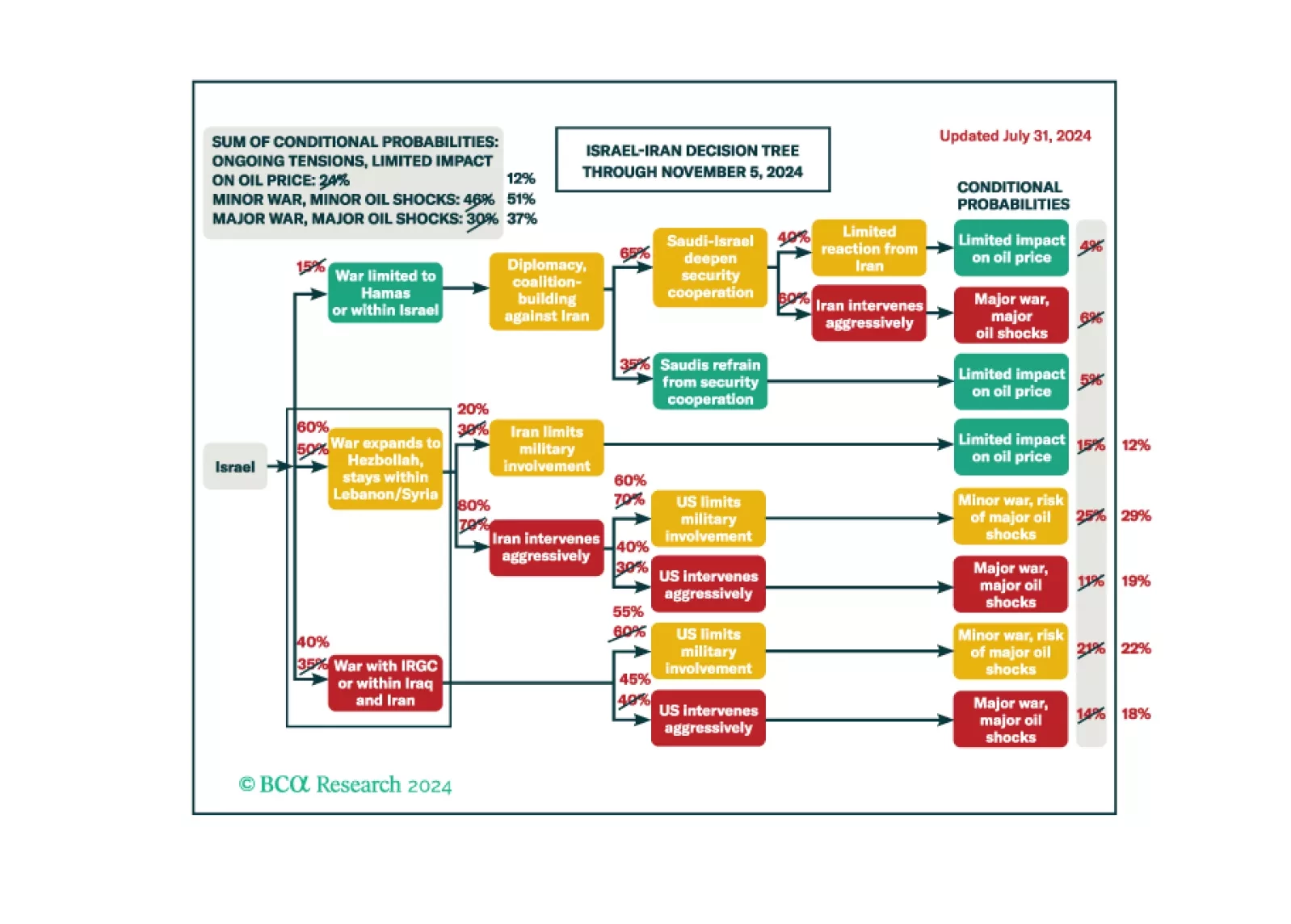

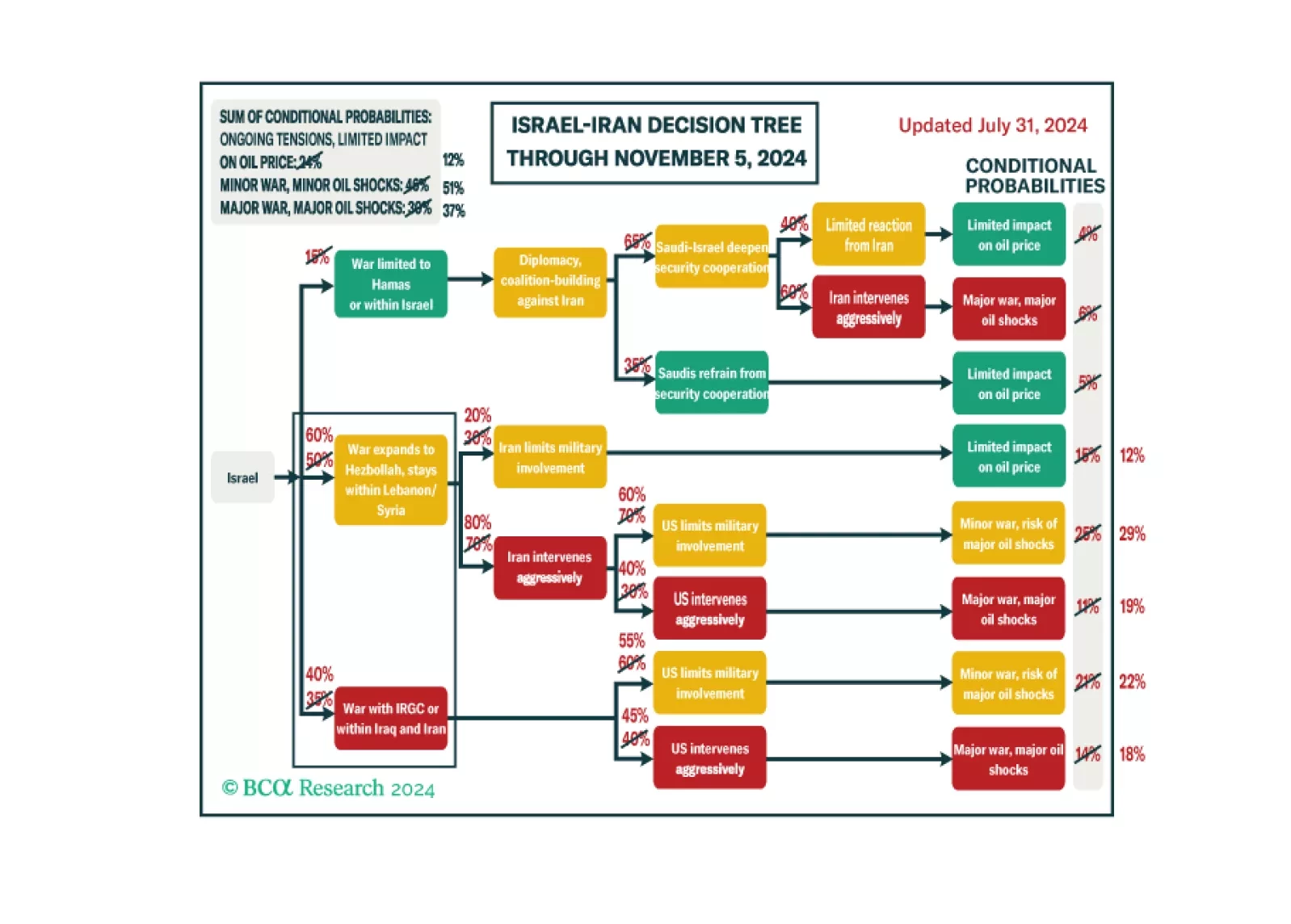

We maintain 37% odds of a major recessionary oil shock, 51% odds of minor shocks, and 12% odds of no shocks.

Markets are rallying on Fed rate cuts and China stimulus but there will also be October surprises ahead of the US election, which Trump could still win. Russia’s conflict with the West is escalating and the Middle East is…

The war in the Middle East is expanding, upgrading our subjective odds of a major oil supply shock to 37% and underscoring our 60% odds of Republican victory in November. Volatility should spike again as investors contemplate the…

Investors should reduce risk, increase allocation to safe havens, and brace for oil price volatility and supply disruptions stemming from the Middle East over the next zero-to-12 months.