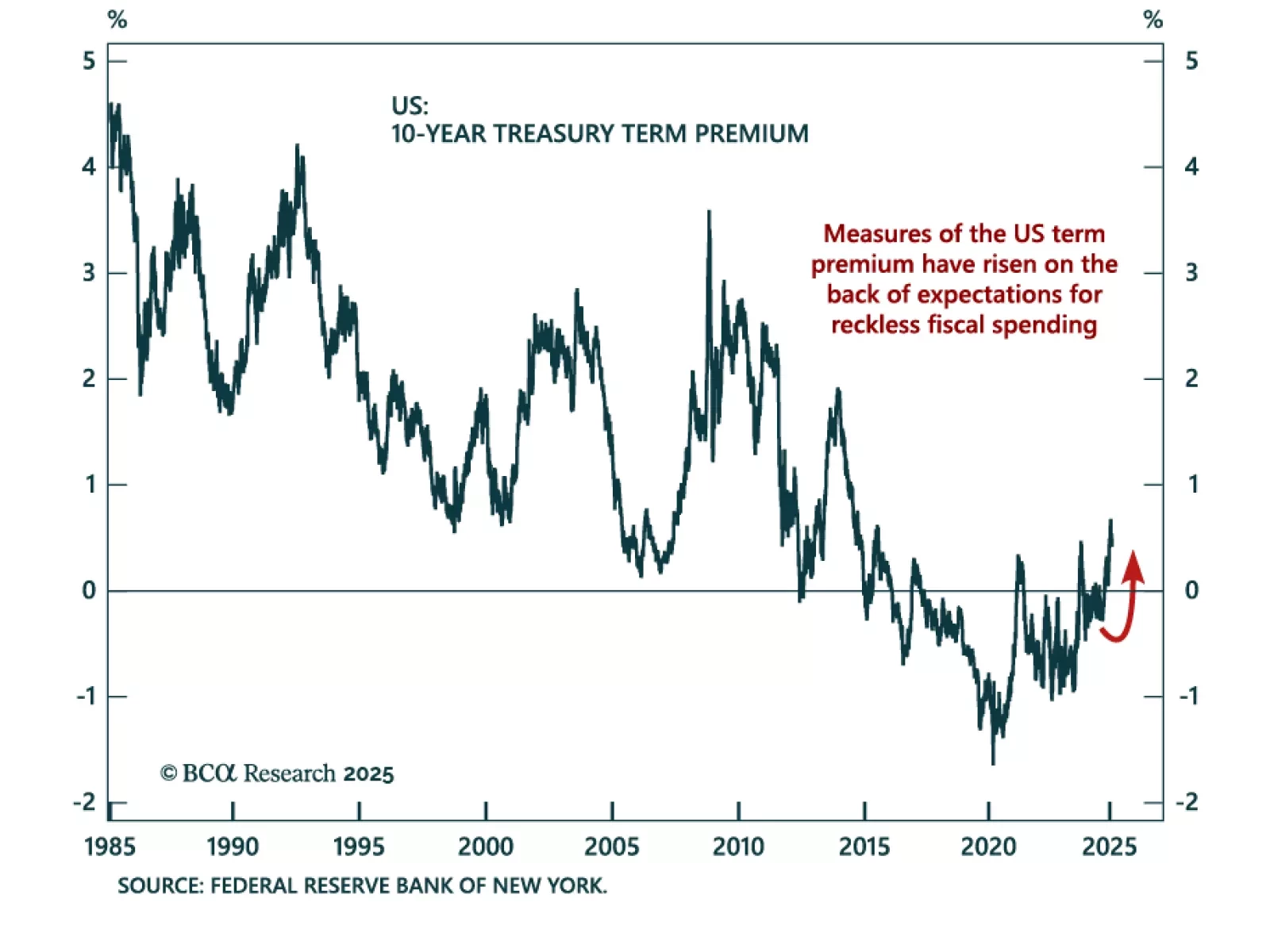

Treasury Secretary Scott Bessent commented that one of the Trump administration’s priority was lowering 10-year bond yields. Bessent’s 3/3/3 plan, boosting growth to 3% from deregulation, increasing US oil production by 3 mmb/d, and…

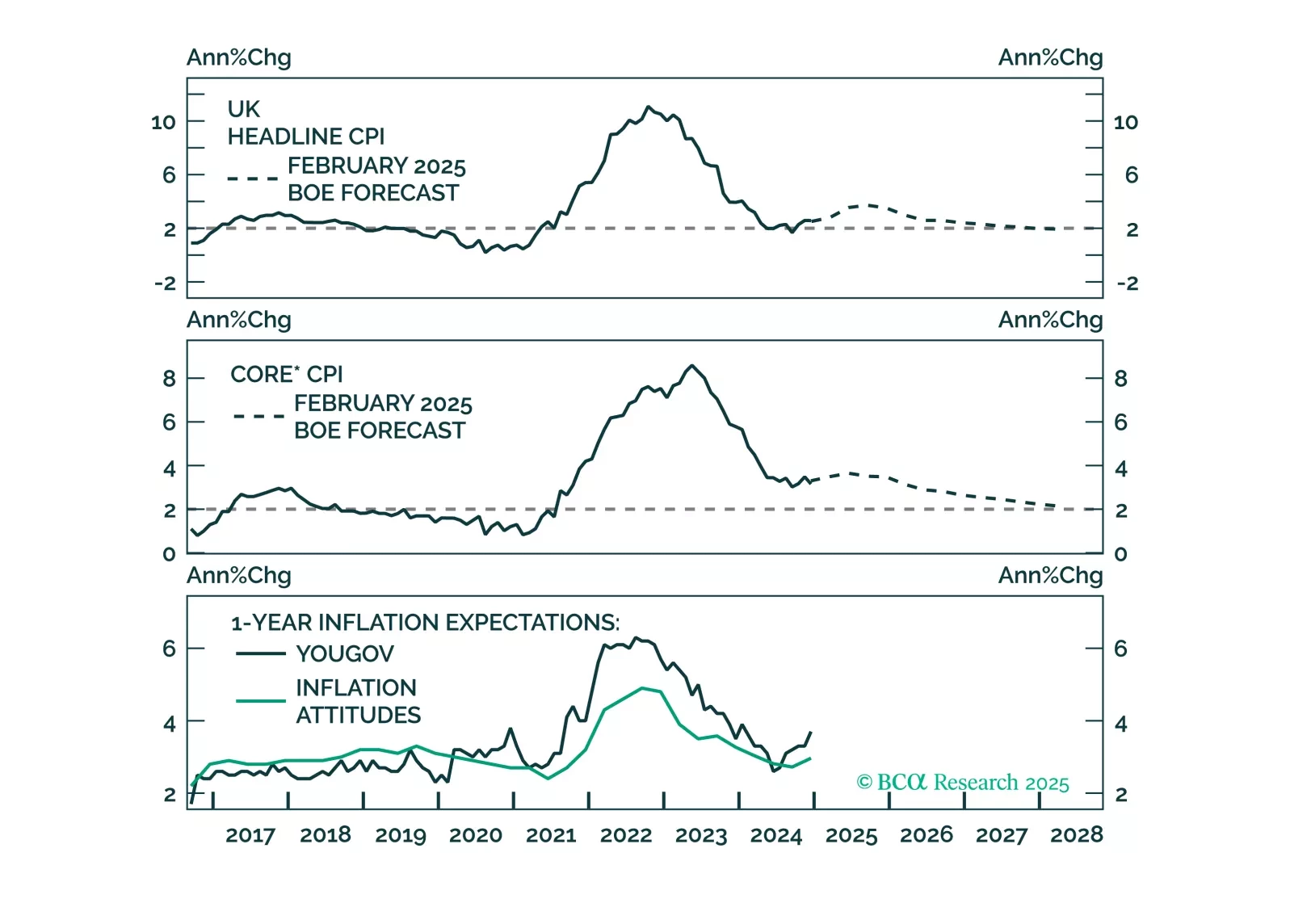

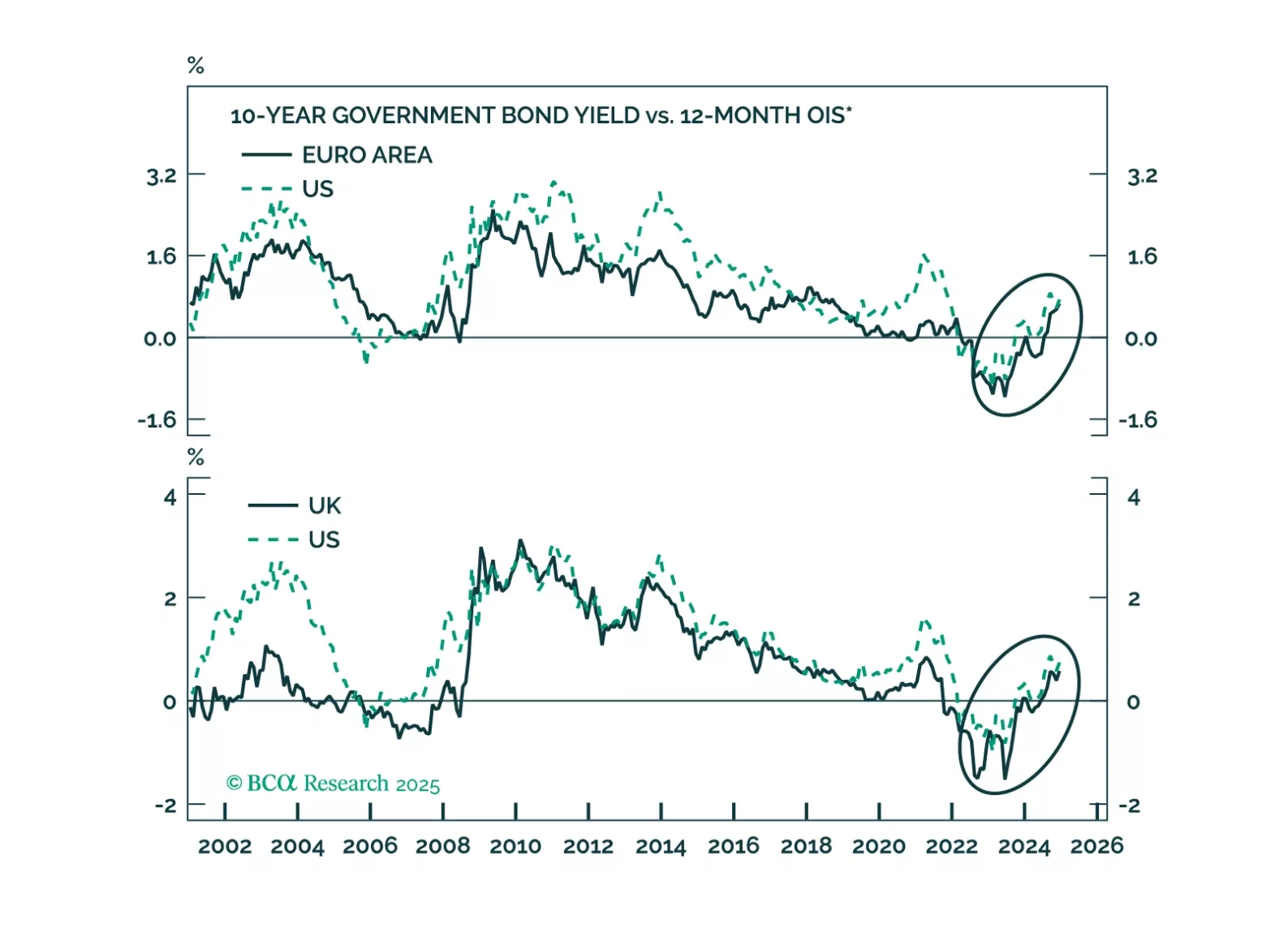

Following today’s Bank of England’s policy meeting, at which the policy rate was cut by 25 bps, we discuss our outlook for monetary policy in the UK. We expect the gradual easing to continue and discuss the investment implications…

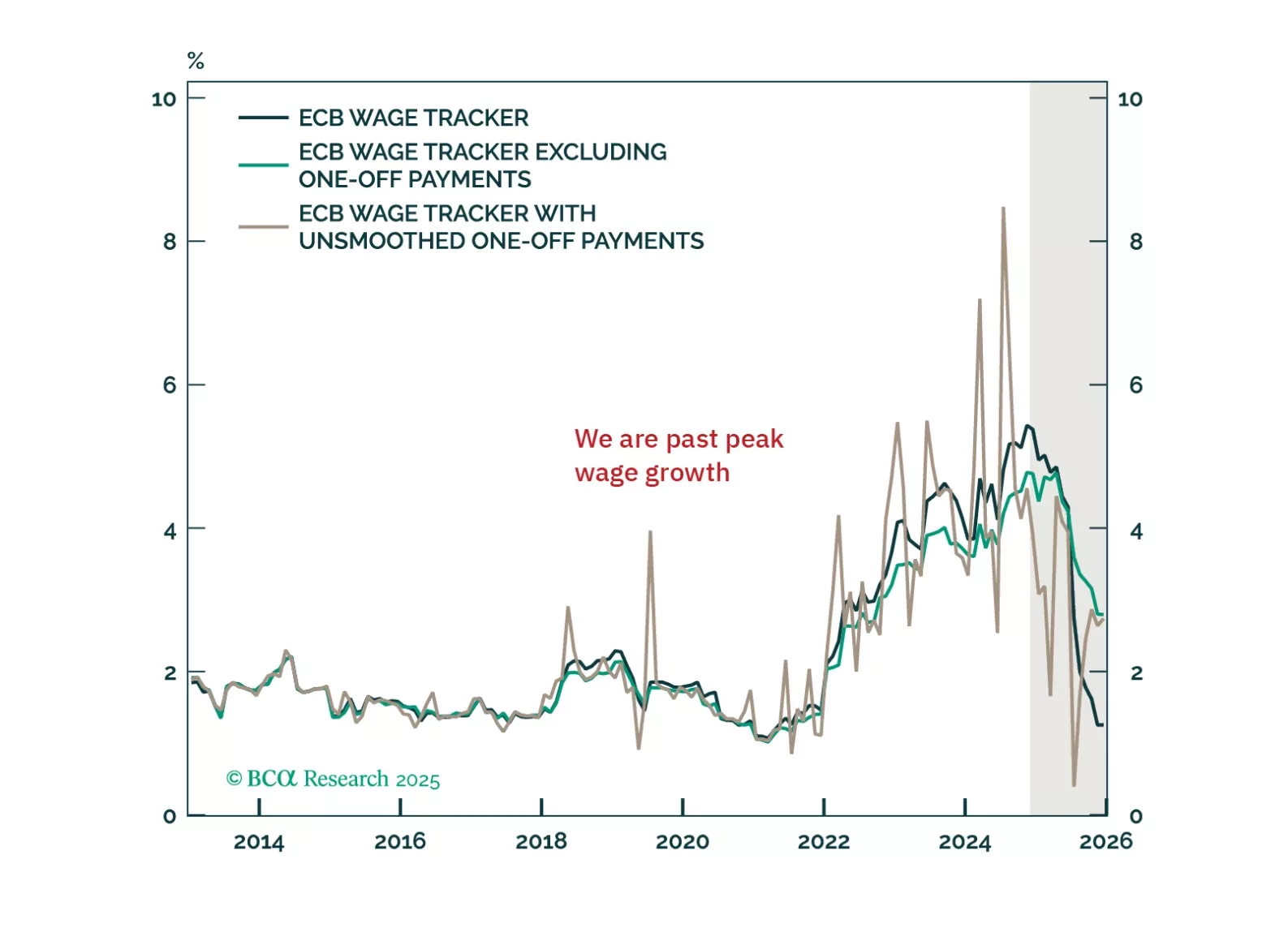

The ECB cut its deposit rate to 2.75%, as was widely anticipated. President Christine Lagarde did not provide any fireworks, but the Governing Council’s message was clear: Policy is restrictive, and inflation will fall further. As a…

Advanced Q4 US GDP missed estimates, slowing down to 2.3% quarterly annualized growth from 3.1%. The weakness was however driven by inventories. Consumer spending beat estimates and accelerated to 4.2% from 3.7% in Q3. Growth is…

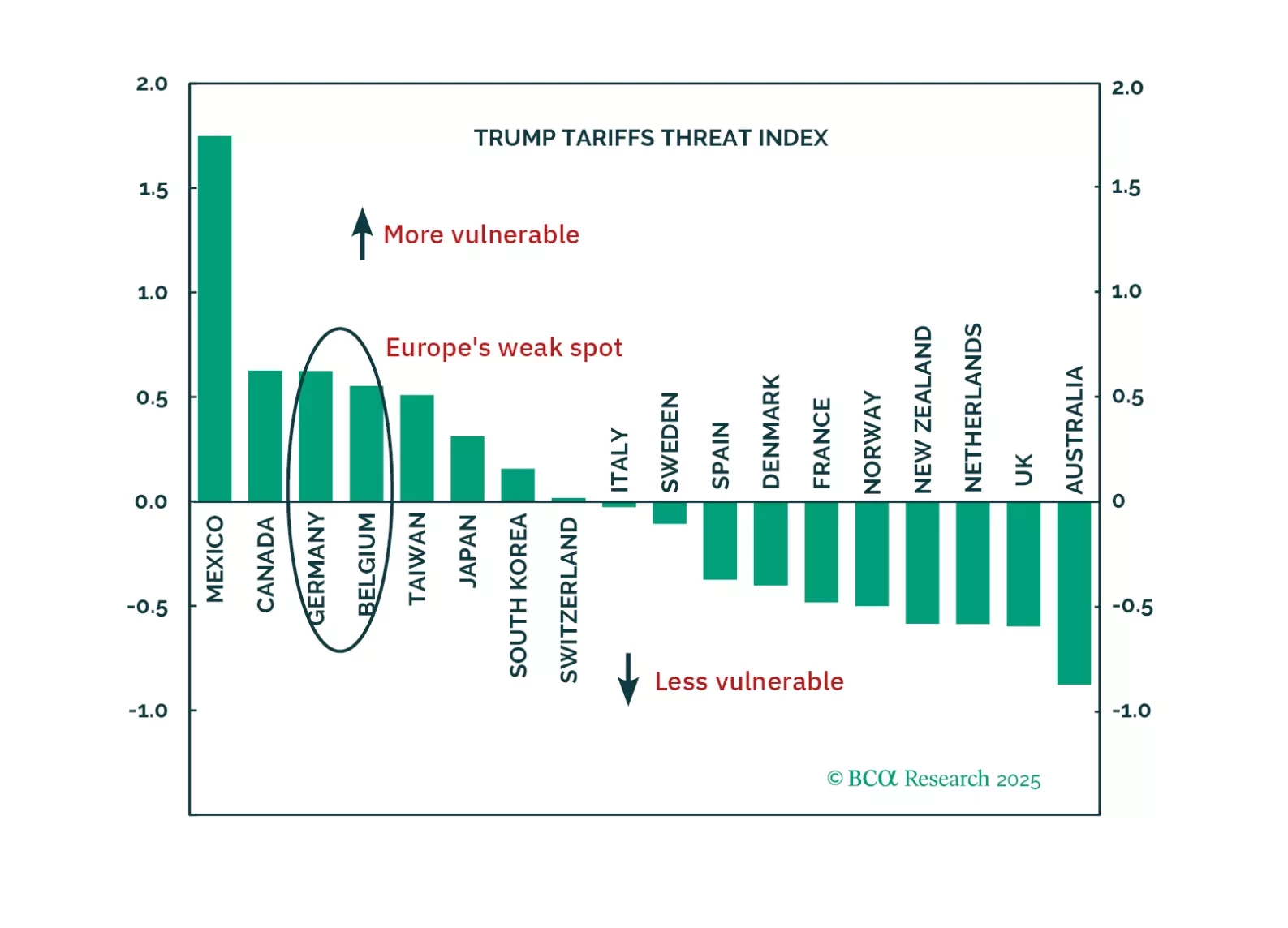

President Trump is about to be inaugurated. Investors often assume all his policies will hurt Europe, but the reality is more nuanced.

UK and German bonds are victims of the global bond market riots. Will European yields continue to move higher and will the euro and the pound find a floor anytime soon?

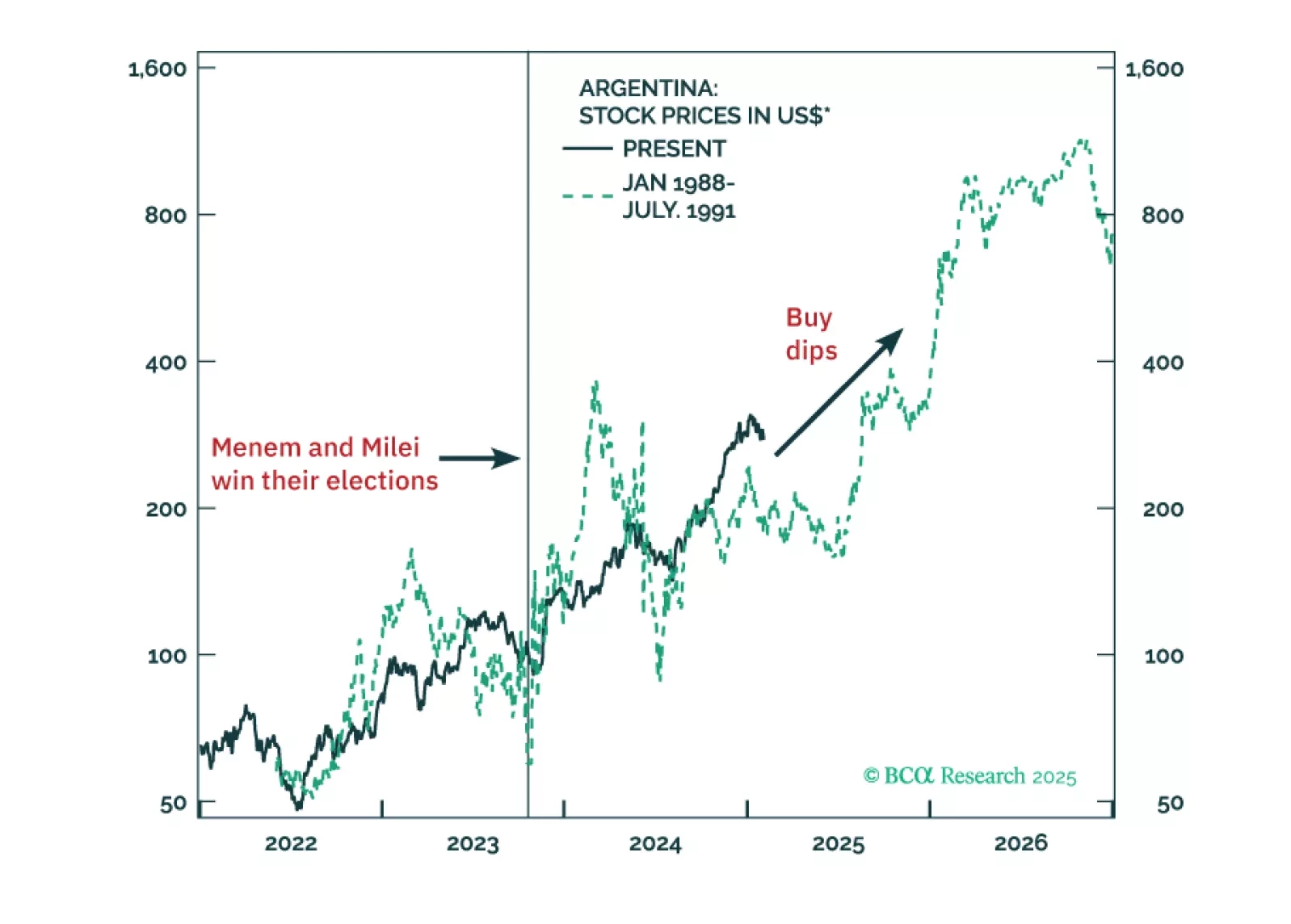

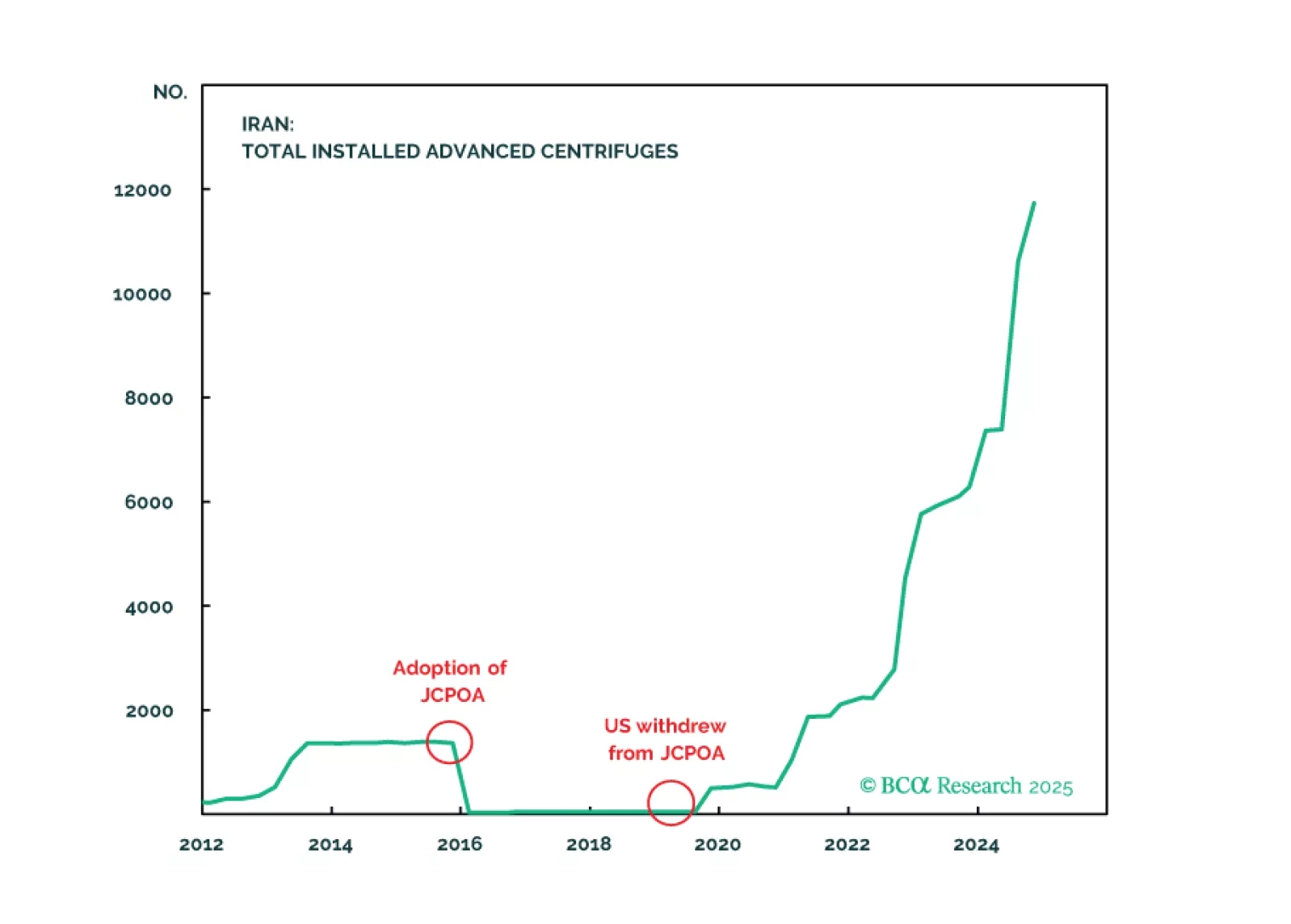

Every year we highlight five low-odds scenarios that would have a major impact on global financial markets if they happened. This year we contemplate a total reversal of Chinese policy, a US-Iran nuclear deal, a breakdown of NATO, US…

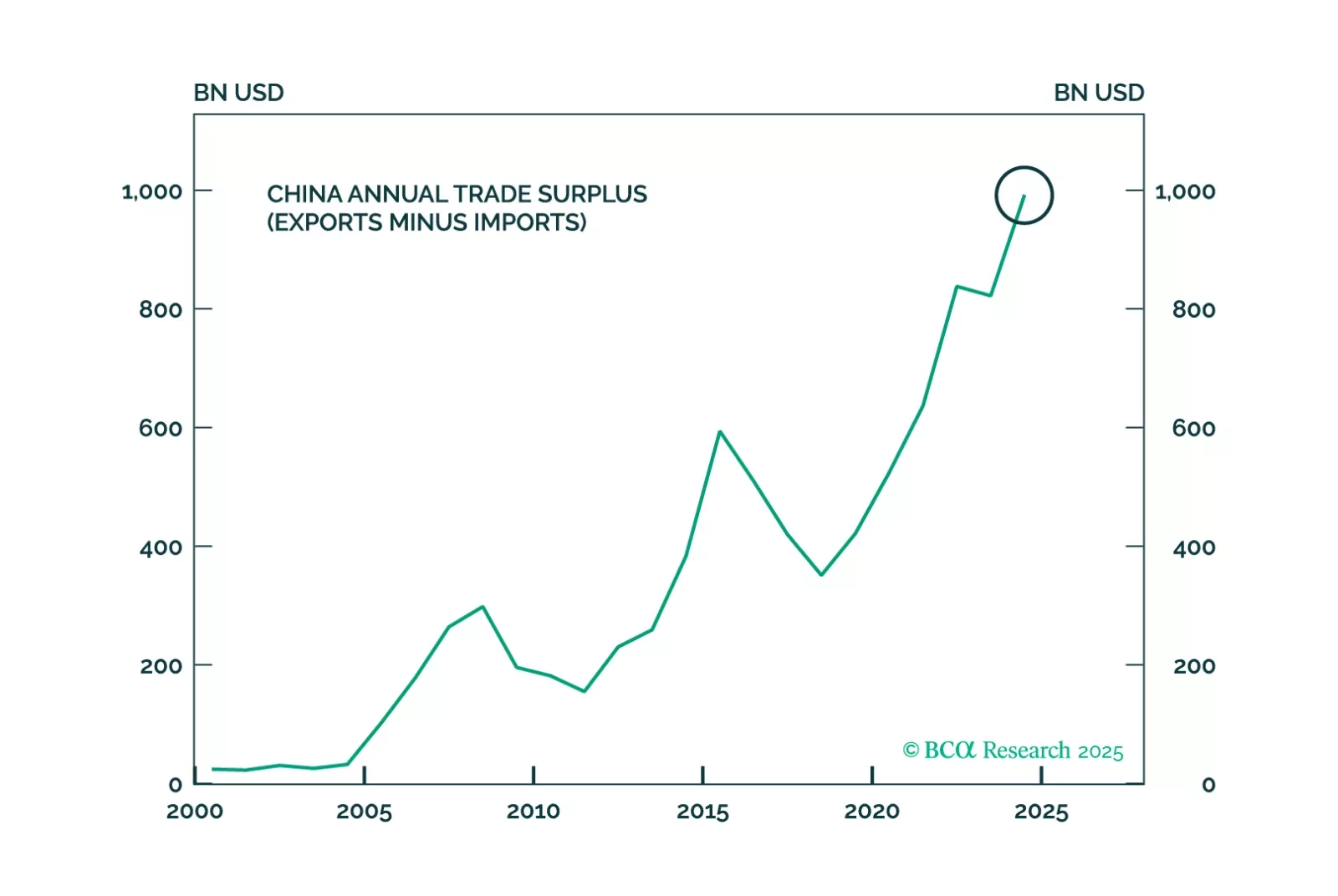

Congress will pass tax cuts by end of 2025 producing a fiscal thrust of about 0.9% of GDP in 2026. Trump will count on that stimulus as a basis for slapping tariffs on leading trade partners.China will retaliate against Trump…