Insights

Access expert research, timely insights, and exclusive webcasts to help you make confident, data-driven decisions.

Insight

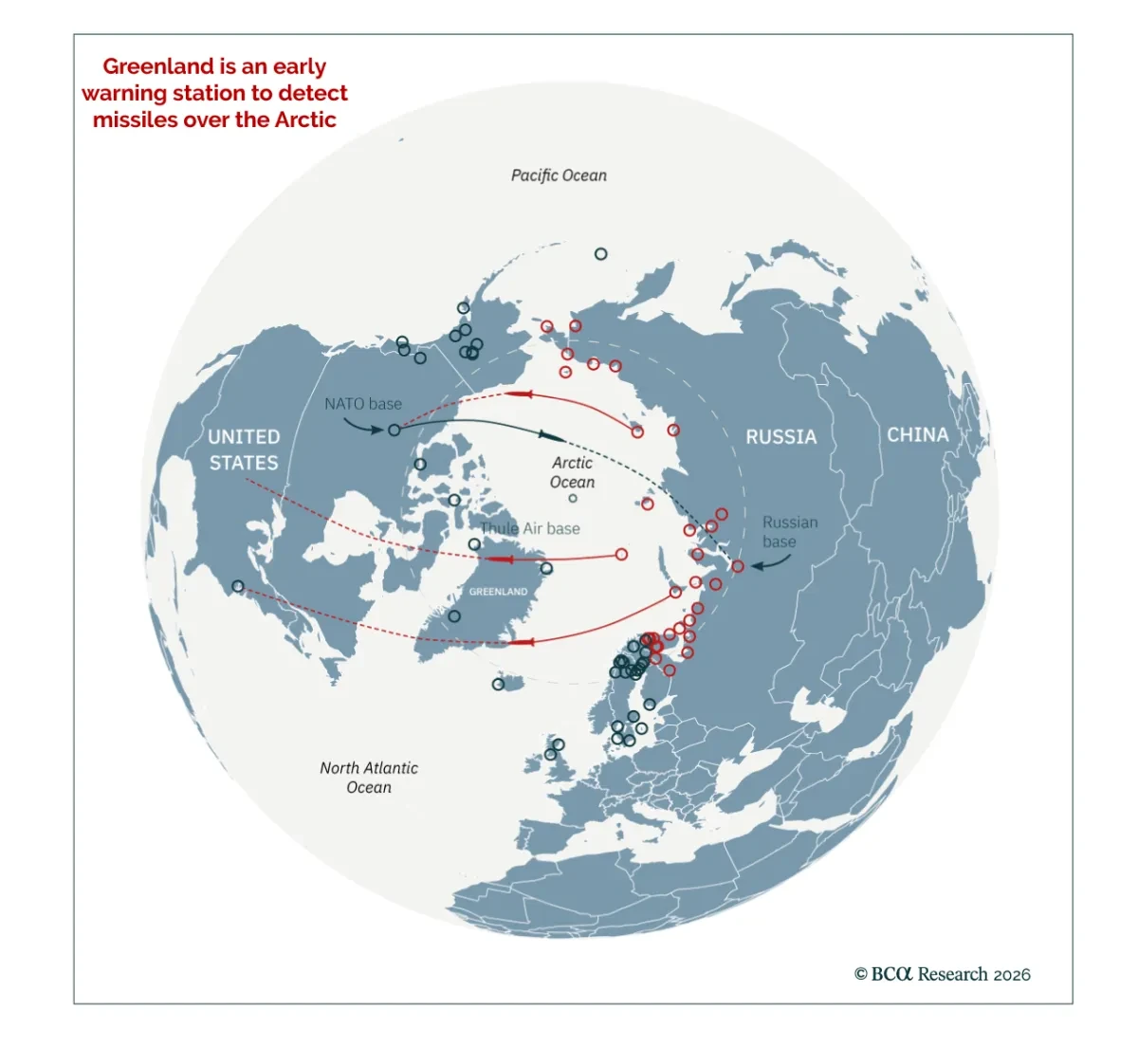

Stay constructive on European defense stocks and increase strategic exposure to industrial metals as geopolitical priorities reassert themselves. Following the capture of Venezuelan President Maduro, top US officials seem to confirm that President Trump is exploring ways to buy Greenland. While the ...

Read more

Insight

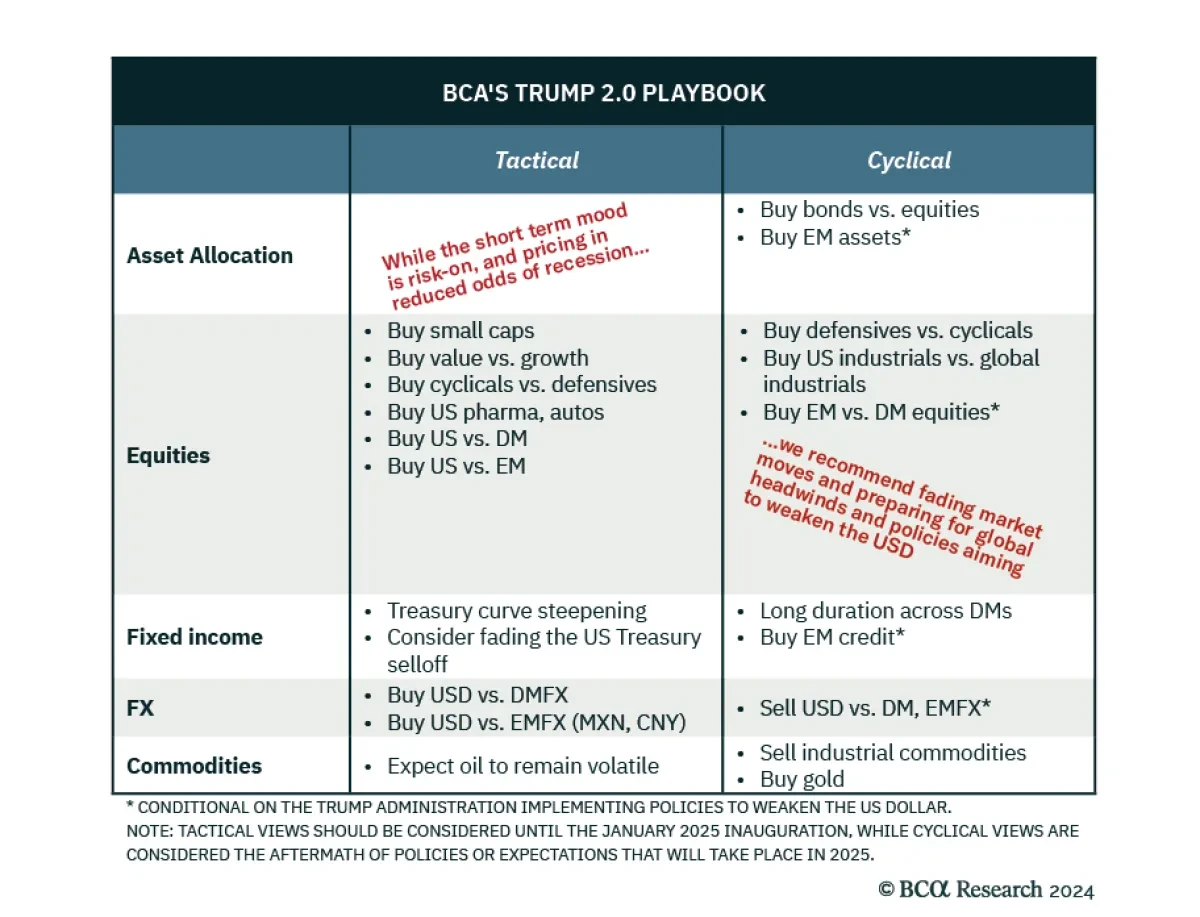

Although foreseen by our US & Geopolitical strategists, a “Red Sweep” now makes the macro environment more volatile. After convening for our BCA Live & Unfiltered meeting, we offer three main takeaways. First, 2024 is not 2016. To begin with, a Trump victory is less of a surprise....

Read more

Insight

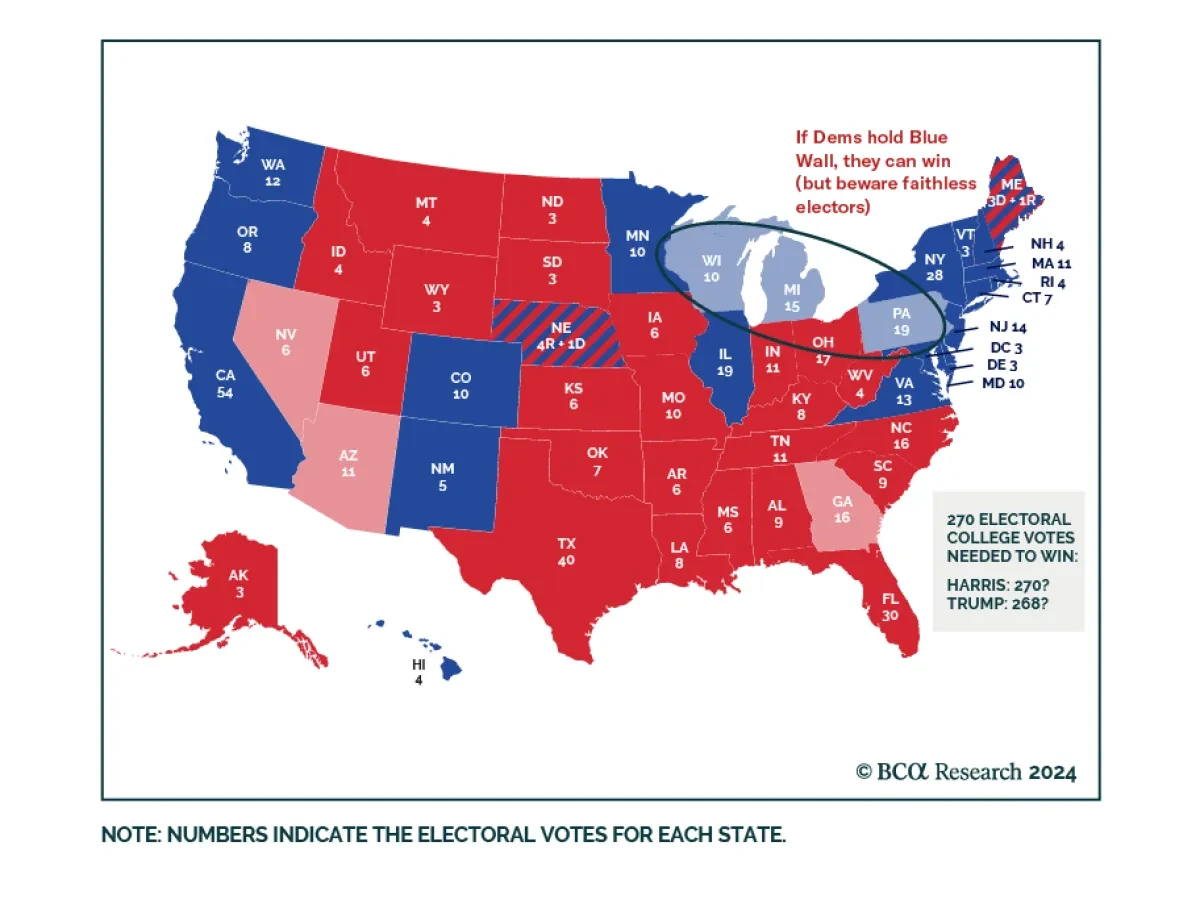

According to BCA Research’s Geopolitical Strategy service, seven surprises with non-negligible odds could tip the scale in favor of Republicans for the White House by November 5. One of them is a war between Israel and Iran.Iran is still highly likely to retaliate against Israel. The Biden administr...

Read more

Insight

According to BCA Research’s US Political Strategy service, there is a strange quirk about Walz and the state of Nebraska that could have national consequences in the black swan scenario of an electoral college tie.Walz was born in Nebraska, even though he has lived in, represented and governed Minne...

Read more

Insight

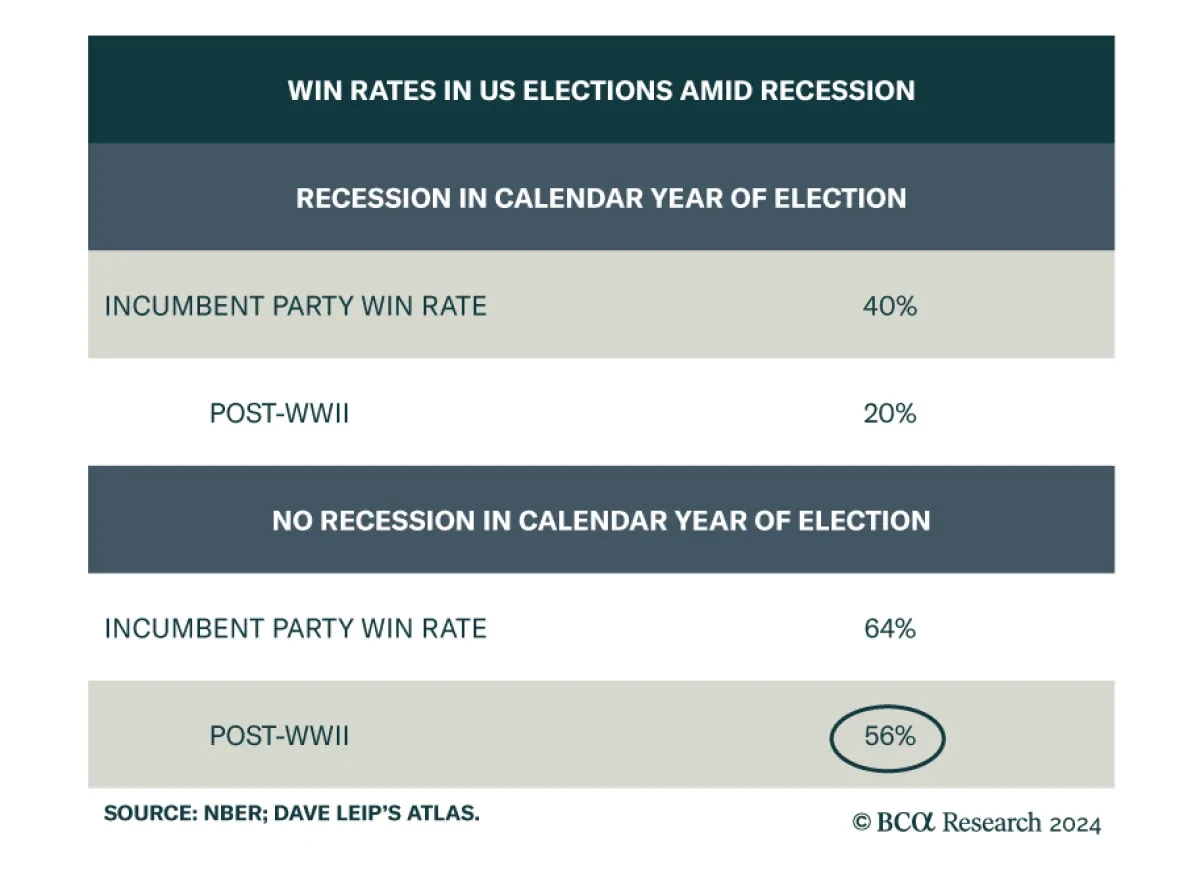

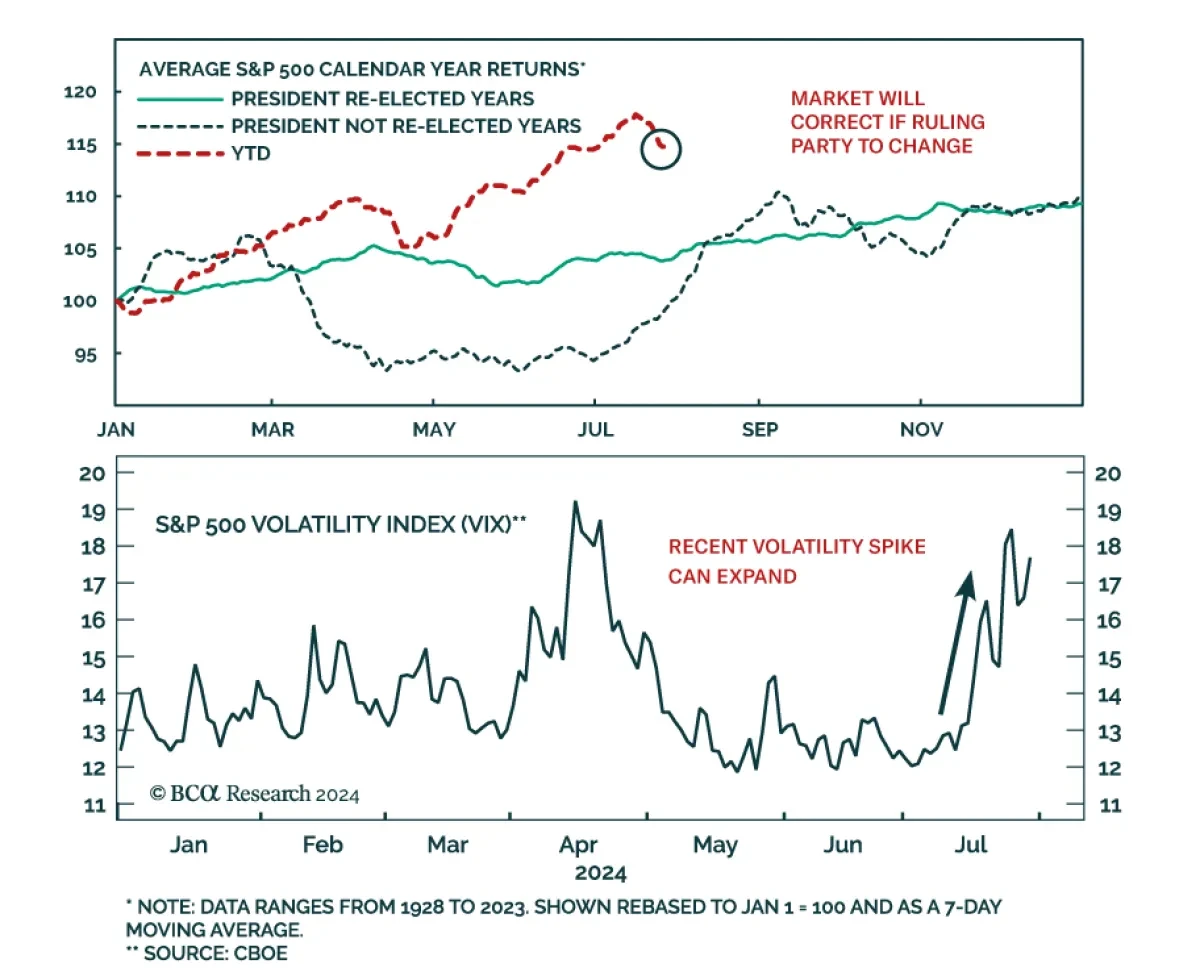

According to BCA Research’s US Equity Strategy service, the stock market outperformance in 2024 thus far is an unusual pattern in election years. The historical data imply that the market will suffer a spill if investors come to believe the incumbent party will change. The spike in volatility i...

Read more

Insight

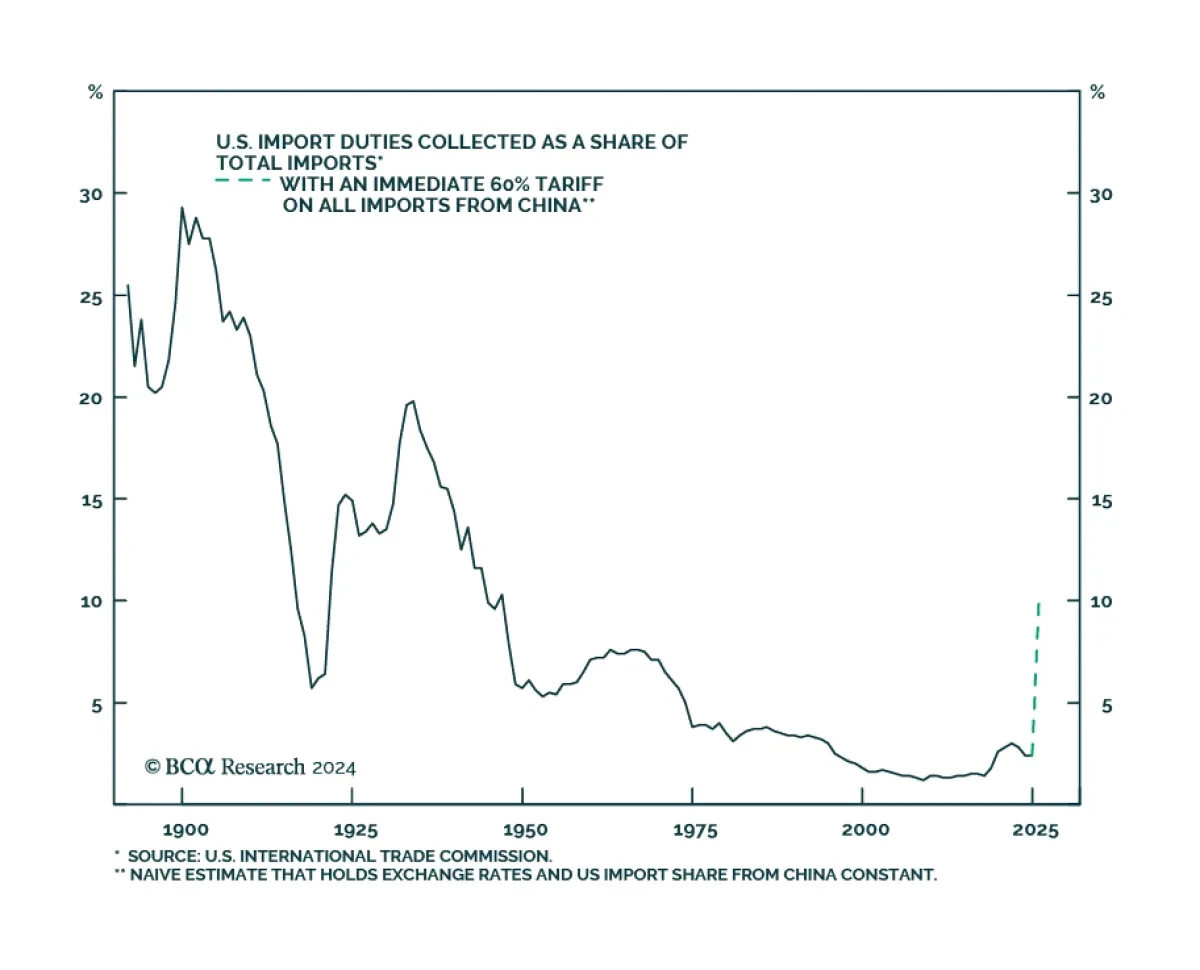

According to BCA Research’s Bank Credit Analyst service, trade policy under a second Trump presidency represents one of the greatest cyclical risks to investors. A key question for investors is whether tariffs are prioritized early in the administration or saved for later. Our colleagues expect...

Read more

Insight

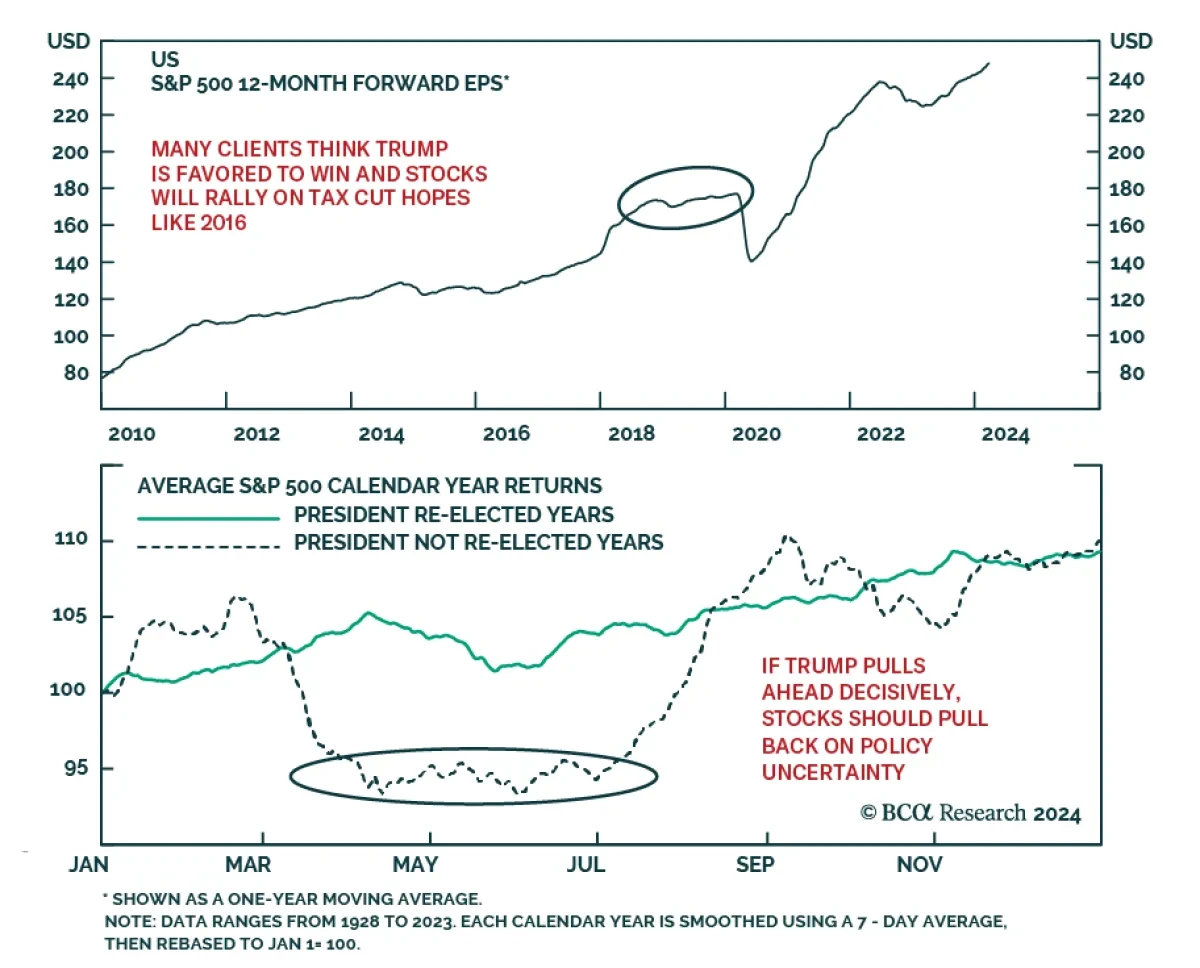

According to BCA Research’s Geopolitical Strategy service, Trump’s agenda is structurally inflationary and would eventually be needed to be discounted by markets, if he wins. Most retail investors – and many clients – seem to believe that Trump will win and the stock market will boom. Opinion p...

Read more