Insights

Access expert research, timely insights, and exclusive webcasts to help you make confident, data-driven decisions.

Tariffs, geopolitics, inflation… there are plenty of reasons to worry that the US economy and markets are going down the wrong path. Marko Papic, BCA’s Chief Strategist of the GeoMacro Strategy argues that all of this misses the Big Picture: the US economy and assets have been pump-primed by an orgy of fiscal profligacy since 2017. And that fiscal dominance – the most important global macro trend of this decade – is coming to an end. Silently and largely in the background of most dominant narratives capturing the attention of clients.

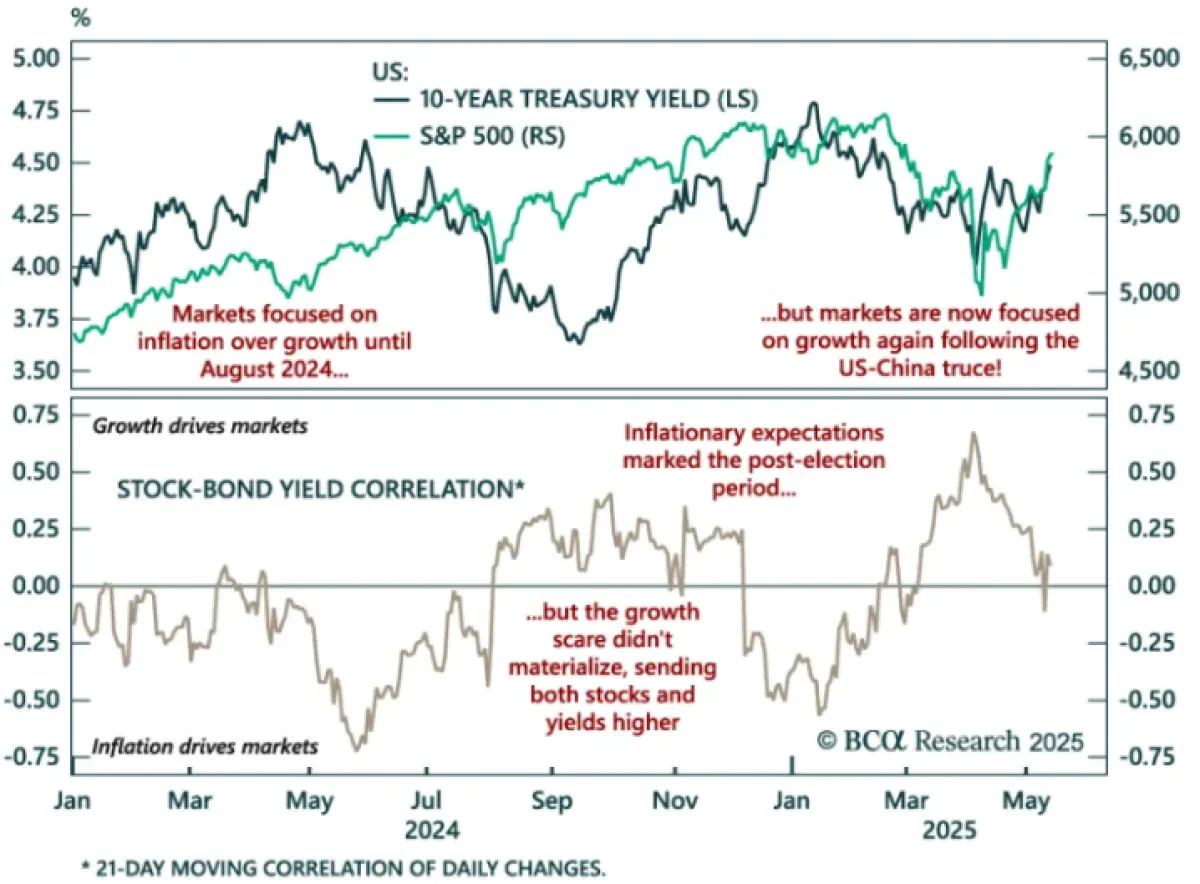

While it may seem bearish at first, Marko has been the only BCA Strategist that has remained in the bullish camp throughout 2025. Why? Because a slowdown in fiscal policy is the only hope that the US has to avoid a bond market riot, see yields settle down, and allow for a transition from cash-fueled cycle to evolve into a leverage-driven one. An important caveat here is that President Trump must land the plane on his various trade wars, which Marko expects him to do.

From a global asset allocation perspective, however, the era of US asset outperformance is over. This is as much a geopolitical shift as it is a macro one.

Marko will focus on his differentiated views, including that:

- A “melt-up” in risk assets is underway and politics has a lot to do with it.

- Investors should remember President Trump’s Seven Steps of Maximum Pressure and trade accordingly.

- President Trump will be a boon for both globalization and world peace…

- …But will, ironically, not be positive – from a relative perspective – for US assets.

- Europe – and other non-US assets – are likely to benefit from the rotation.