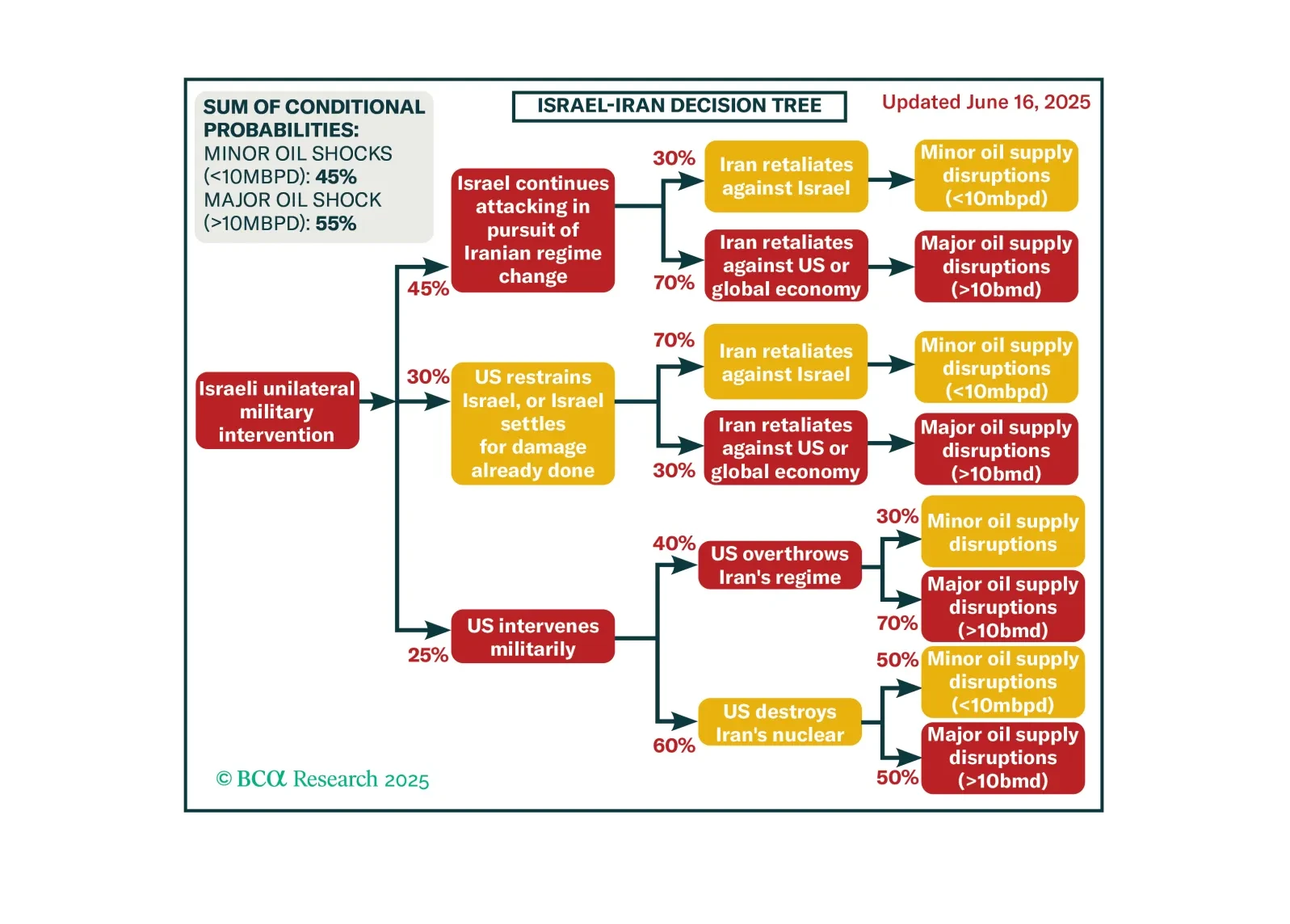

Israel’s attacks on Iran will continue until Iran is forced to strike regional oil supply to get the US to restrain Israel. That may not work. Investors should prepare for a broader economic impact of the conflict.

The US economy has held up better so far this year than we had expected. For the time being, investors should remain modestly underweight equities. A more aggressive underweight would be justified only once the “whites of the…

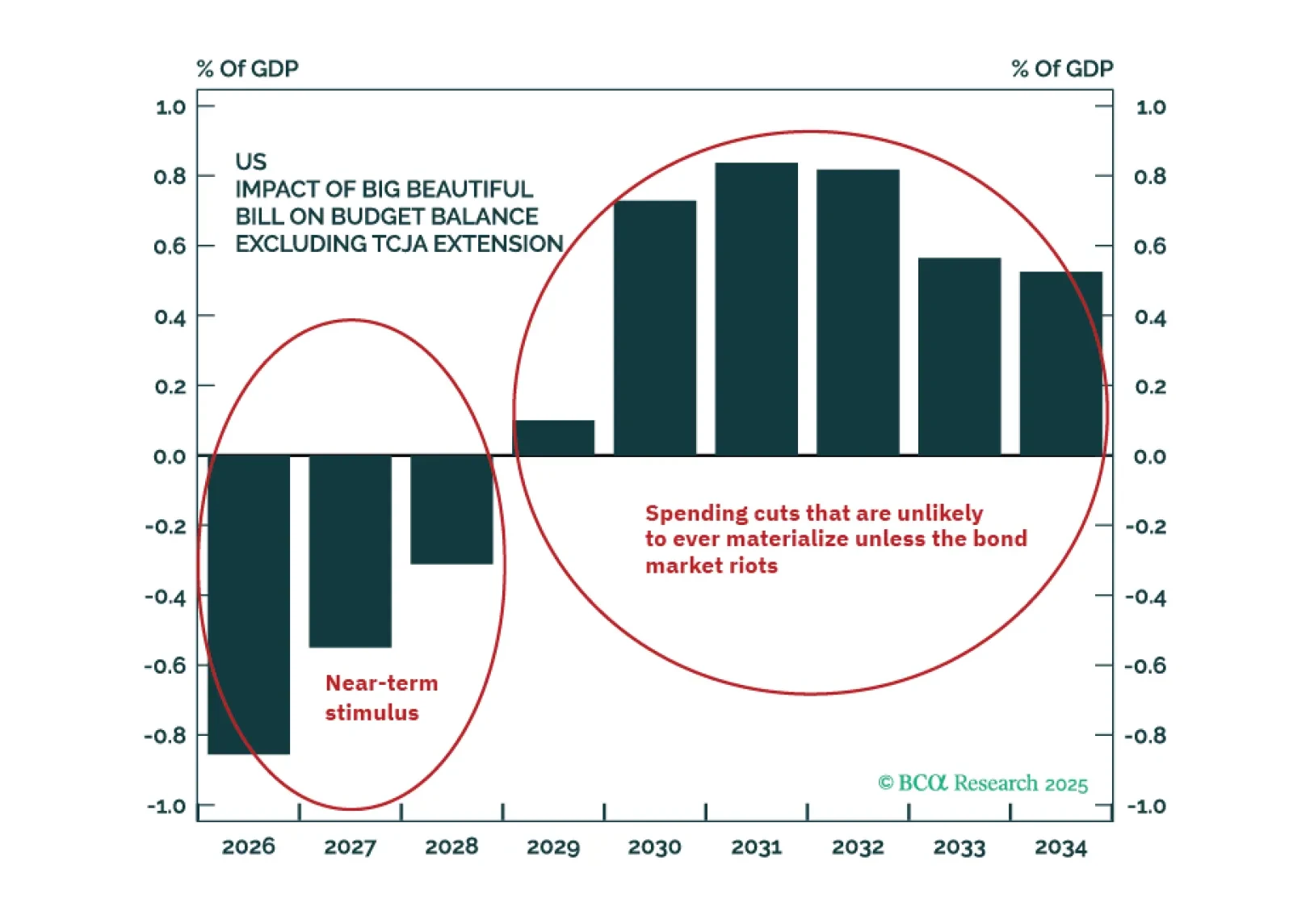

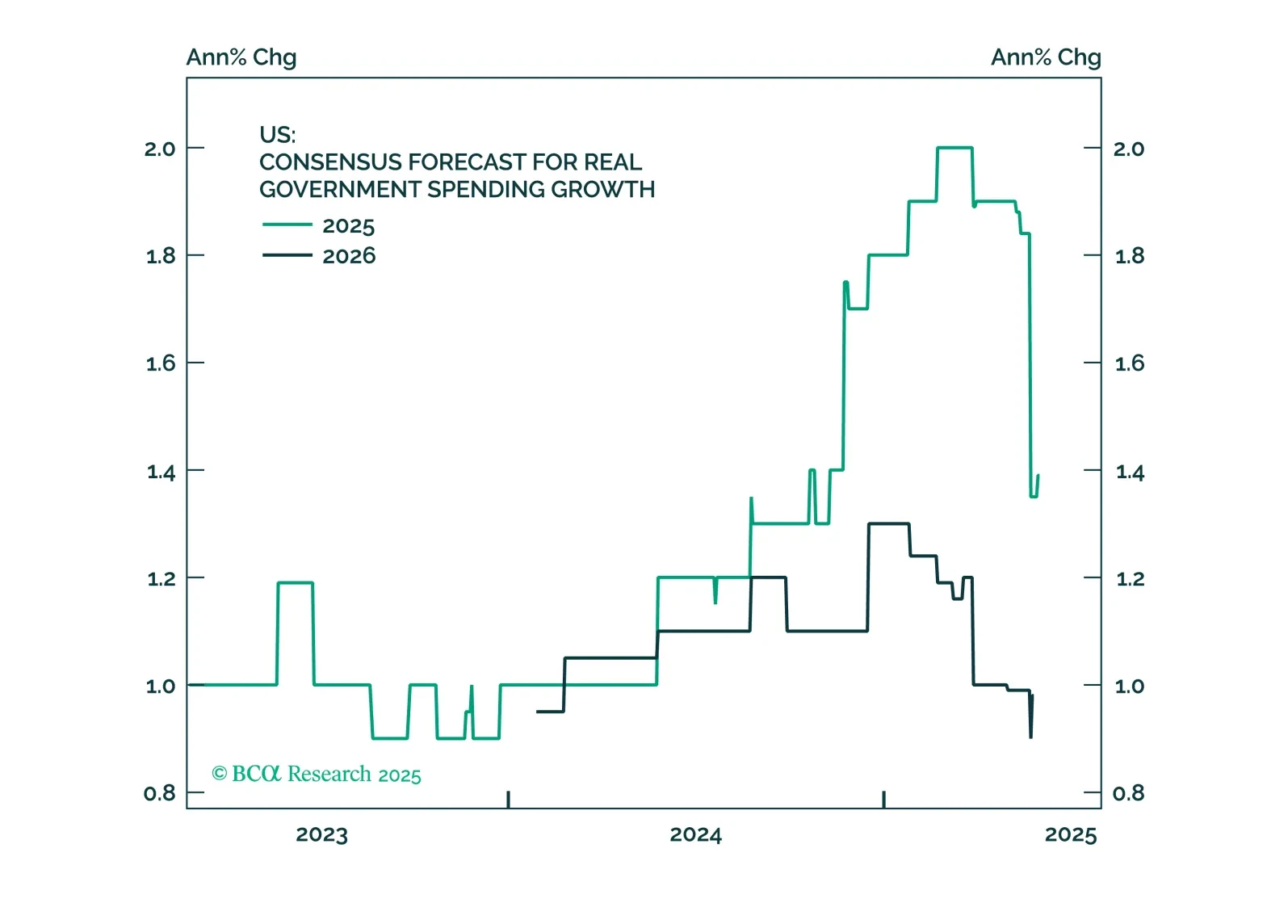

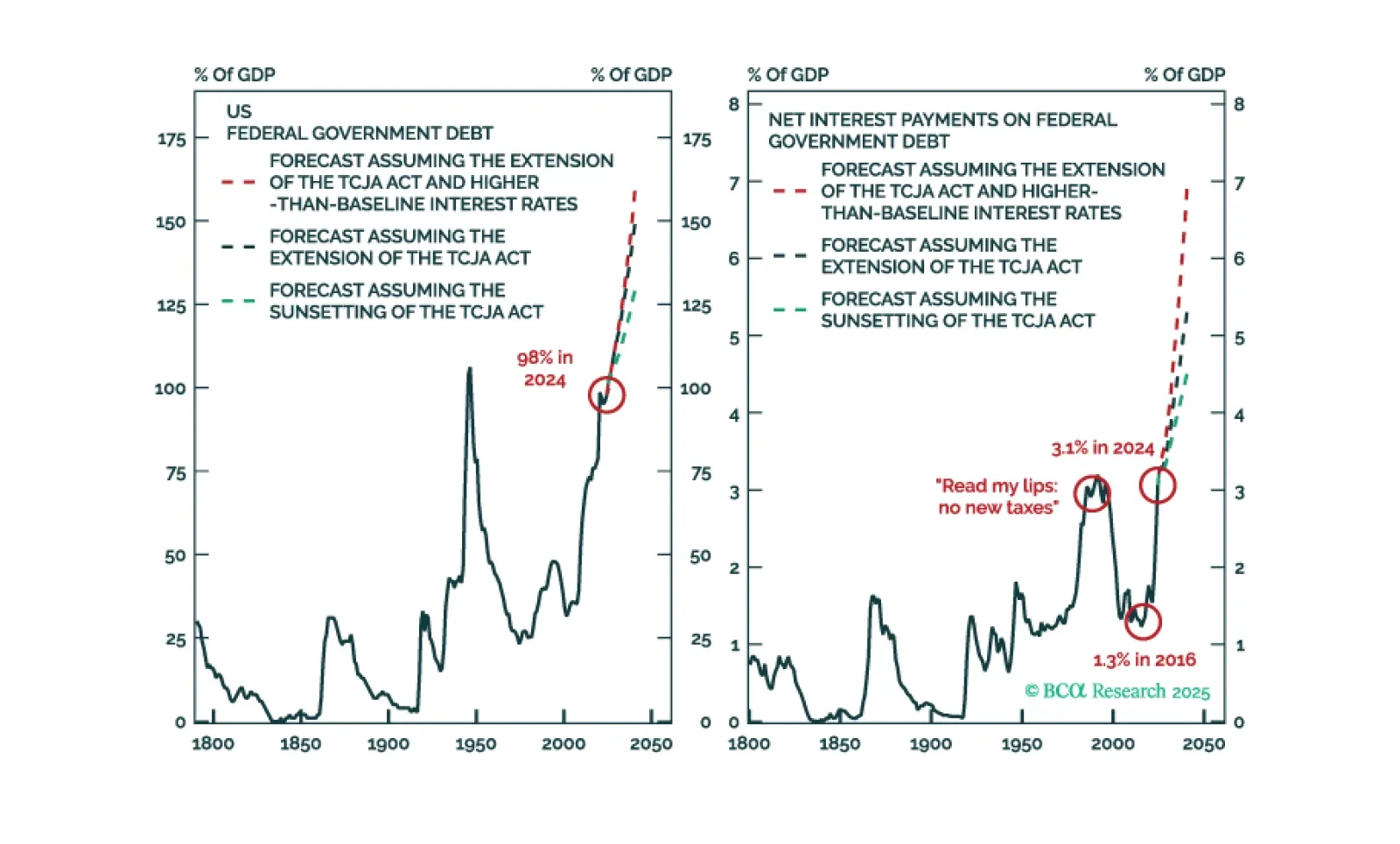

This month, we focus on the One Big Beautiful Bill Act (OBBBA). Our assessment in the Alpha report is that there won’t be any remaining alpha to harvest by shorting duration. The team that coined the “Human Steepener” moniker for…

After considering some of the most common bullish arguments, we stand by our recession view and reiterate our defensive asset allocation recommendations.

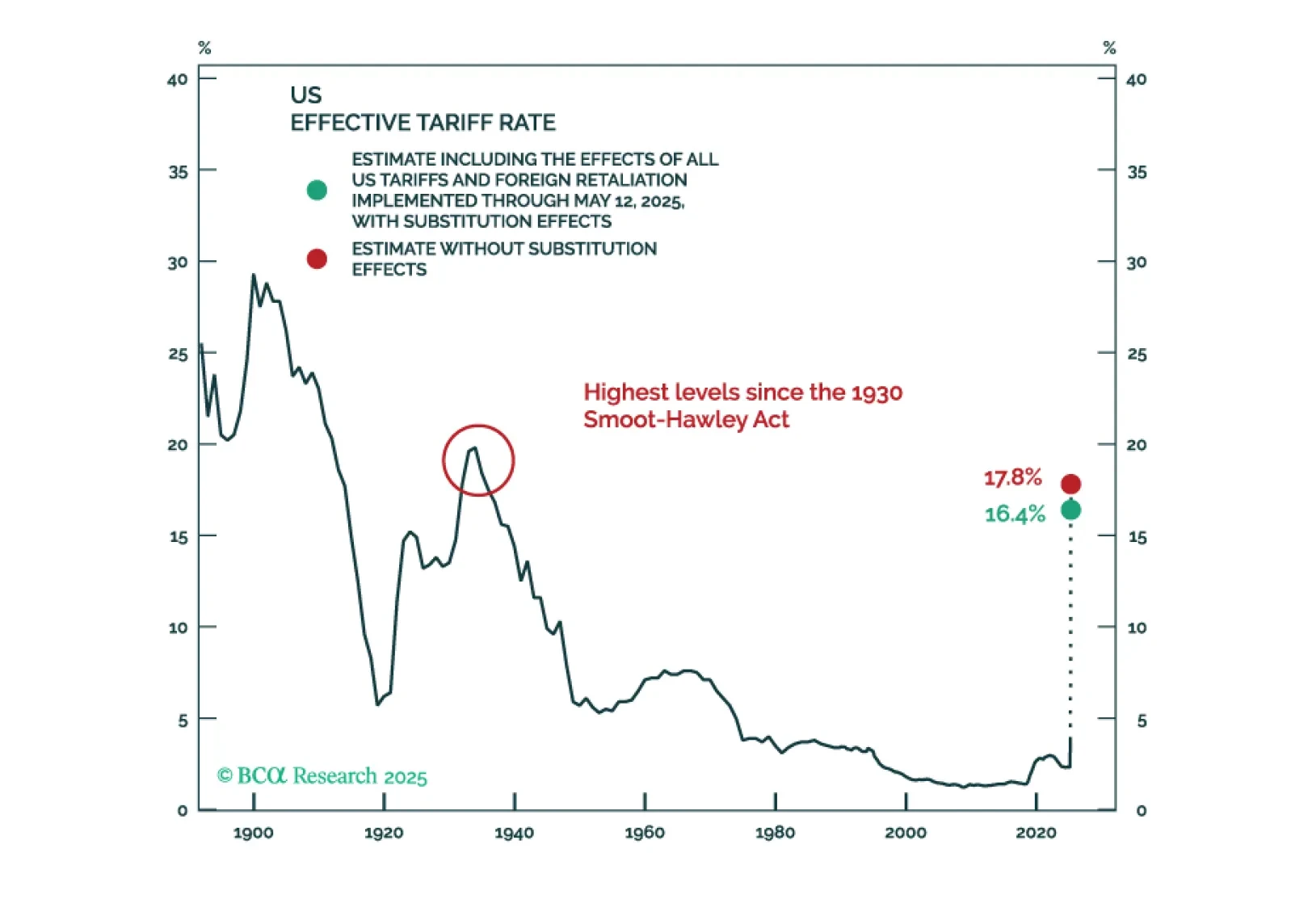

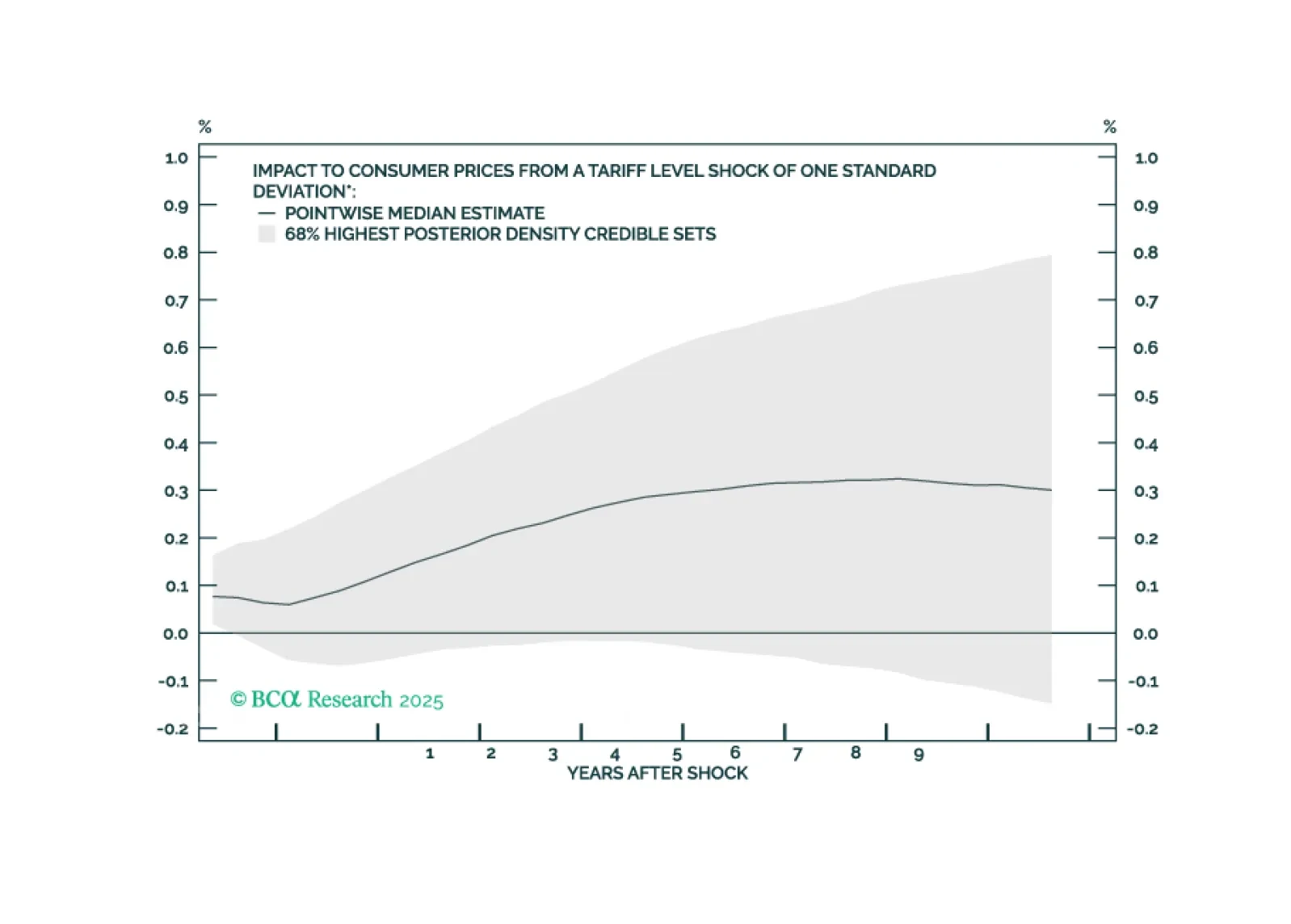

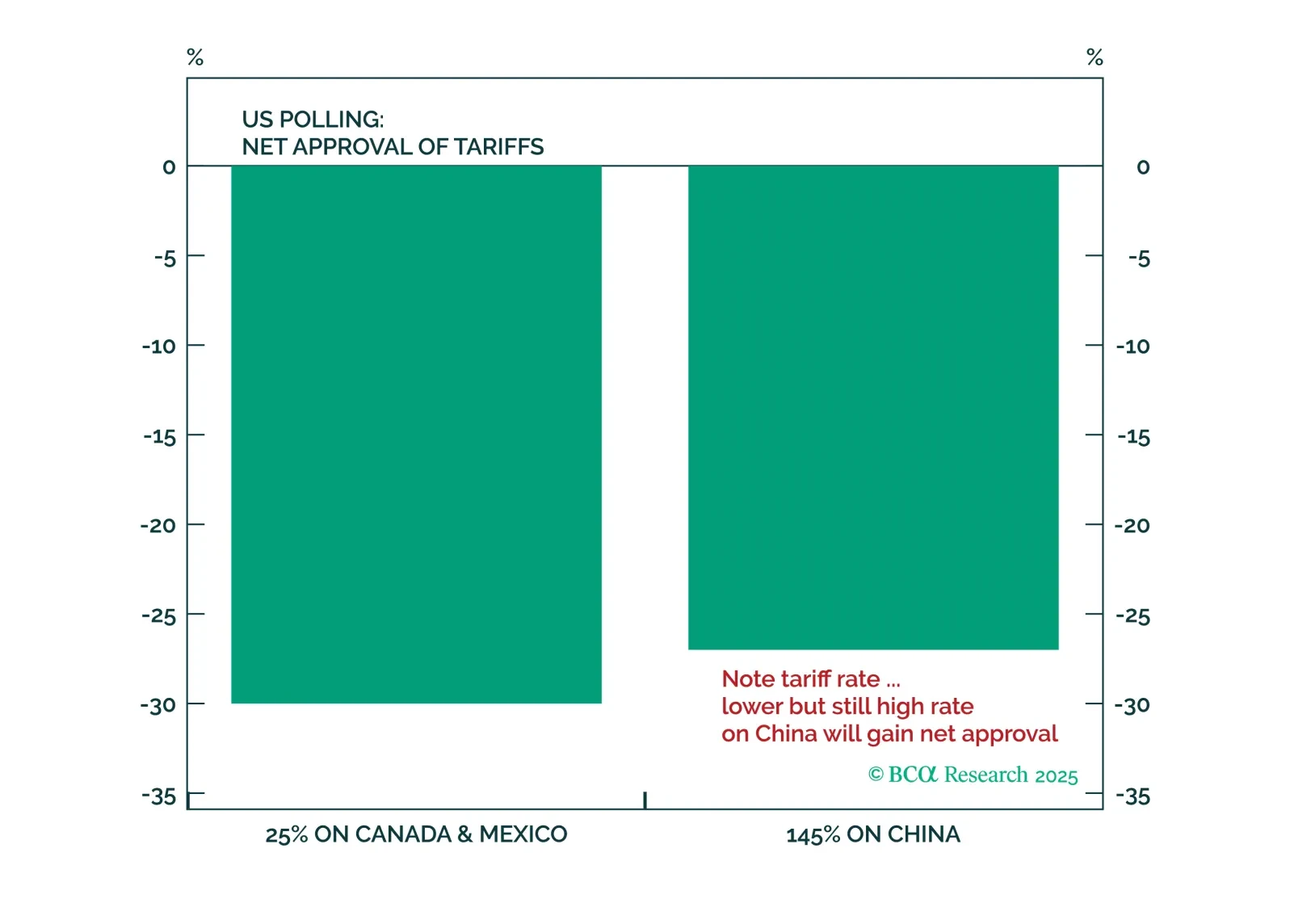

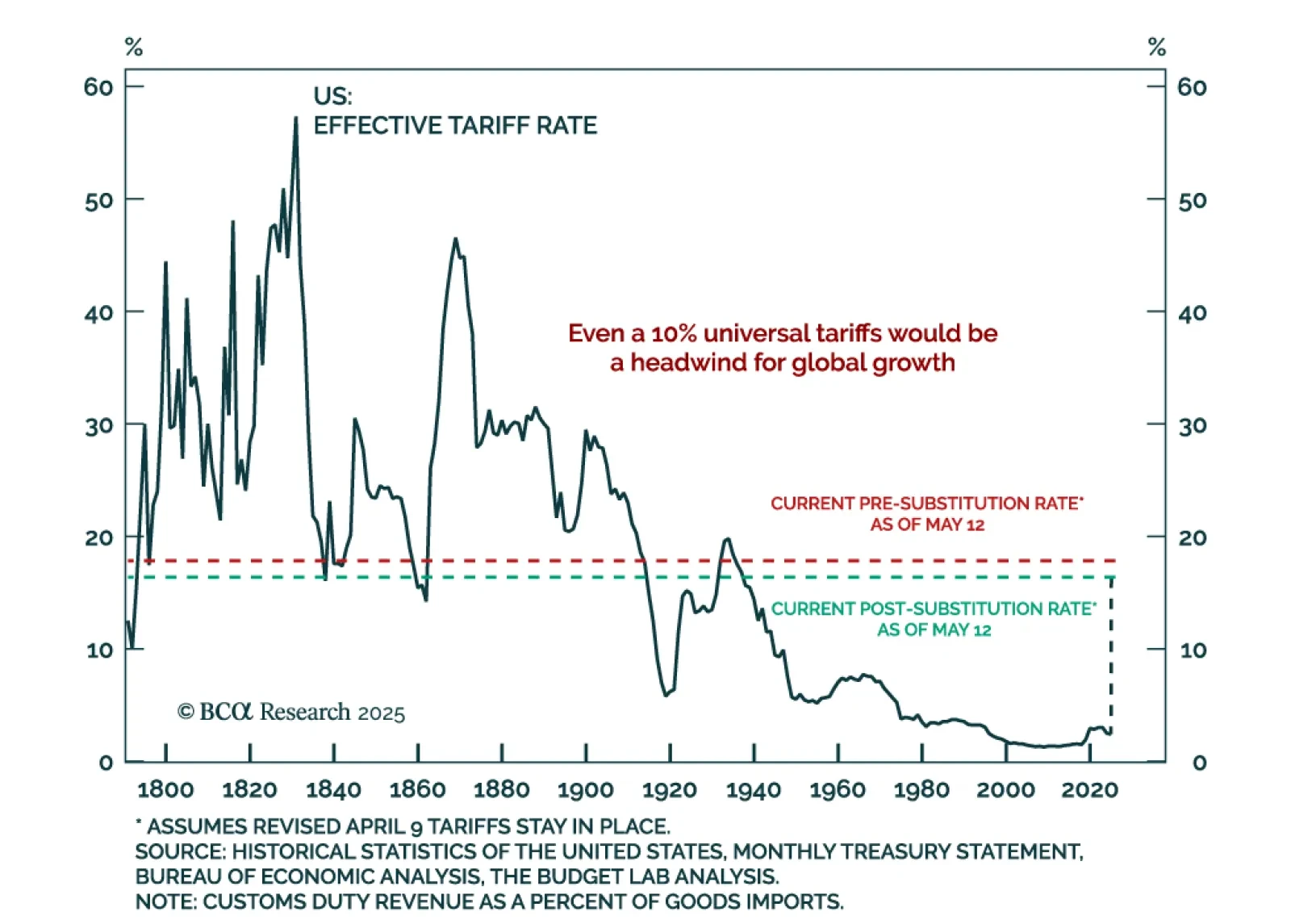

In Section I, Doug warns that US trade policy may produce a considerably worse outcome than investors currently expect. The administration’s apparent 10% tariff baseline is likely to be negative for the US economy and particularly…

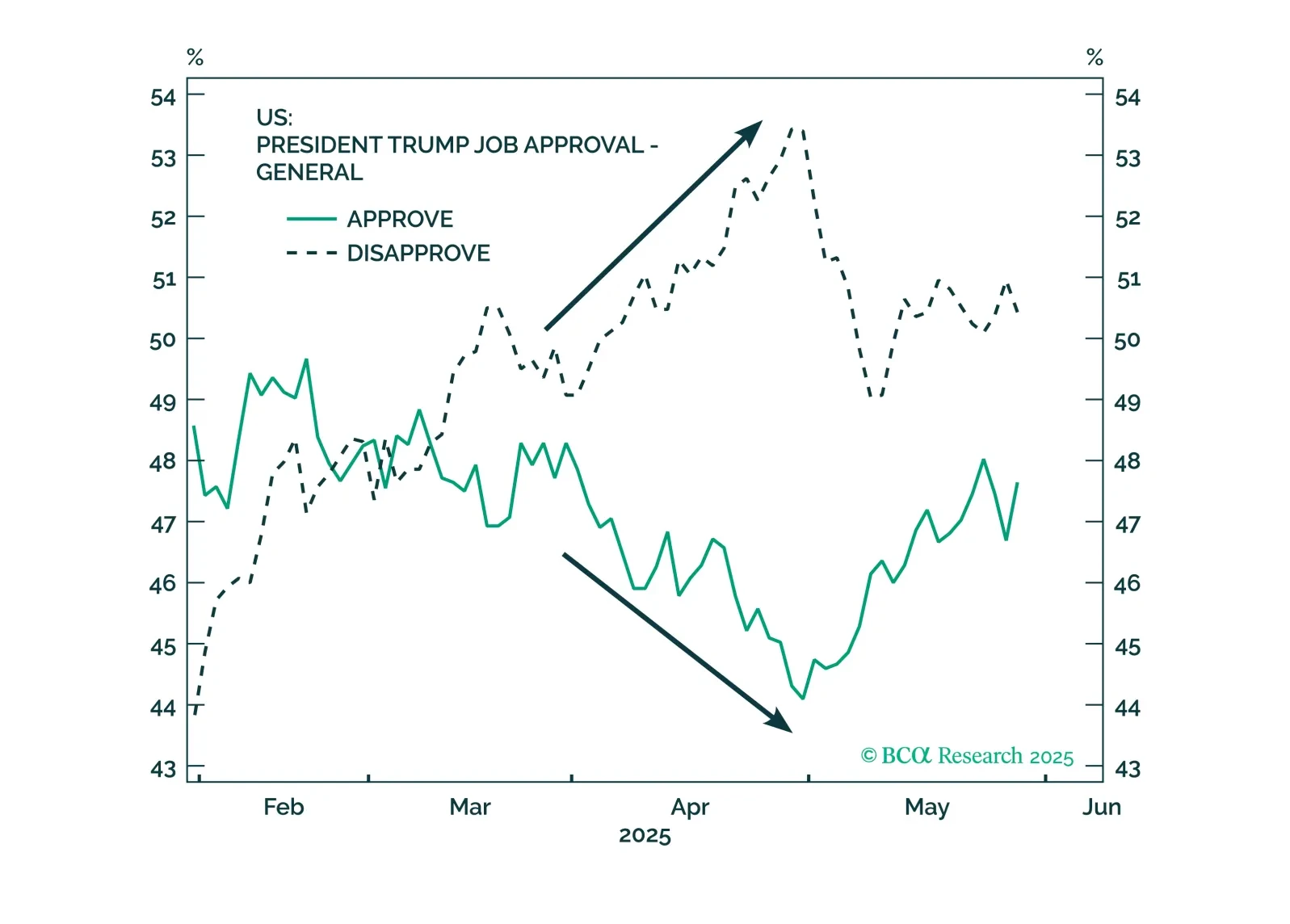

President Trump faces new restrictions on his trade powers coming from the US judicial branch, but they will not prevent him from continuing to restrict trade and investment with China. Rather, they will establish some curbs against…

Rising bond yields may present an even greater danger to the global economy than the trade war. With equity valuations no longer discounting much economic risk, investors should position themselves defensively.

The US-China trade truce triggered a market rally, but tight policy, lingering inflation risks, and tariff-related drag still support a defensive stance. Risk assets and the USD surged on Monday following the de-escalation…