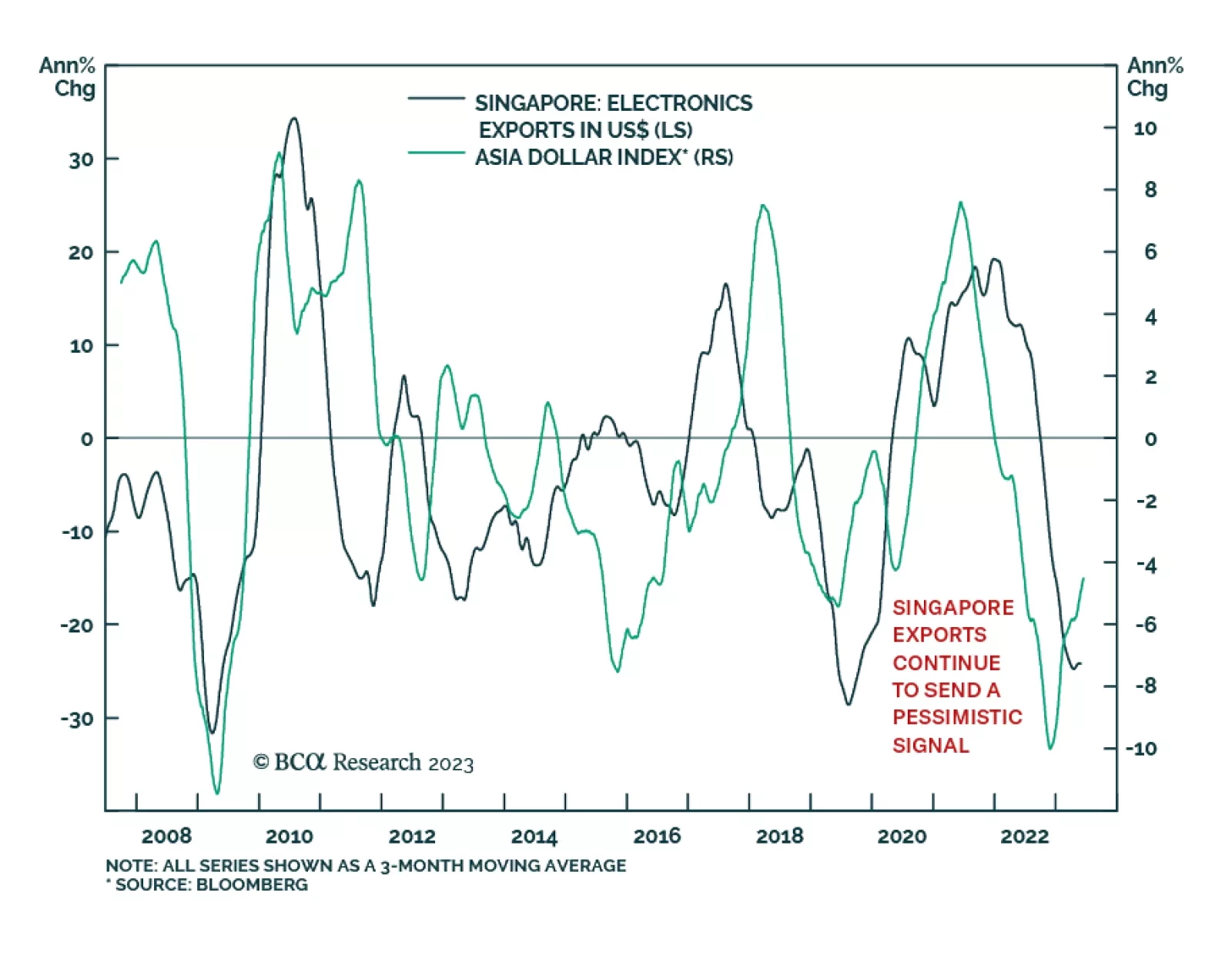

Singapore’s exports have historically acted as a good gauge for the health of the global economy. As a small open economy that is extremely exposed to fluctuations in the Asian and global manufacturing cycles, Singapore…

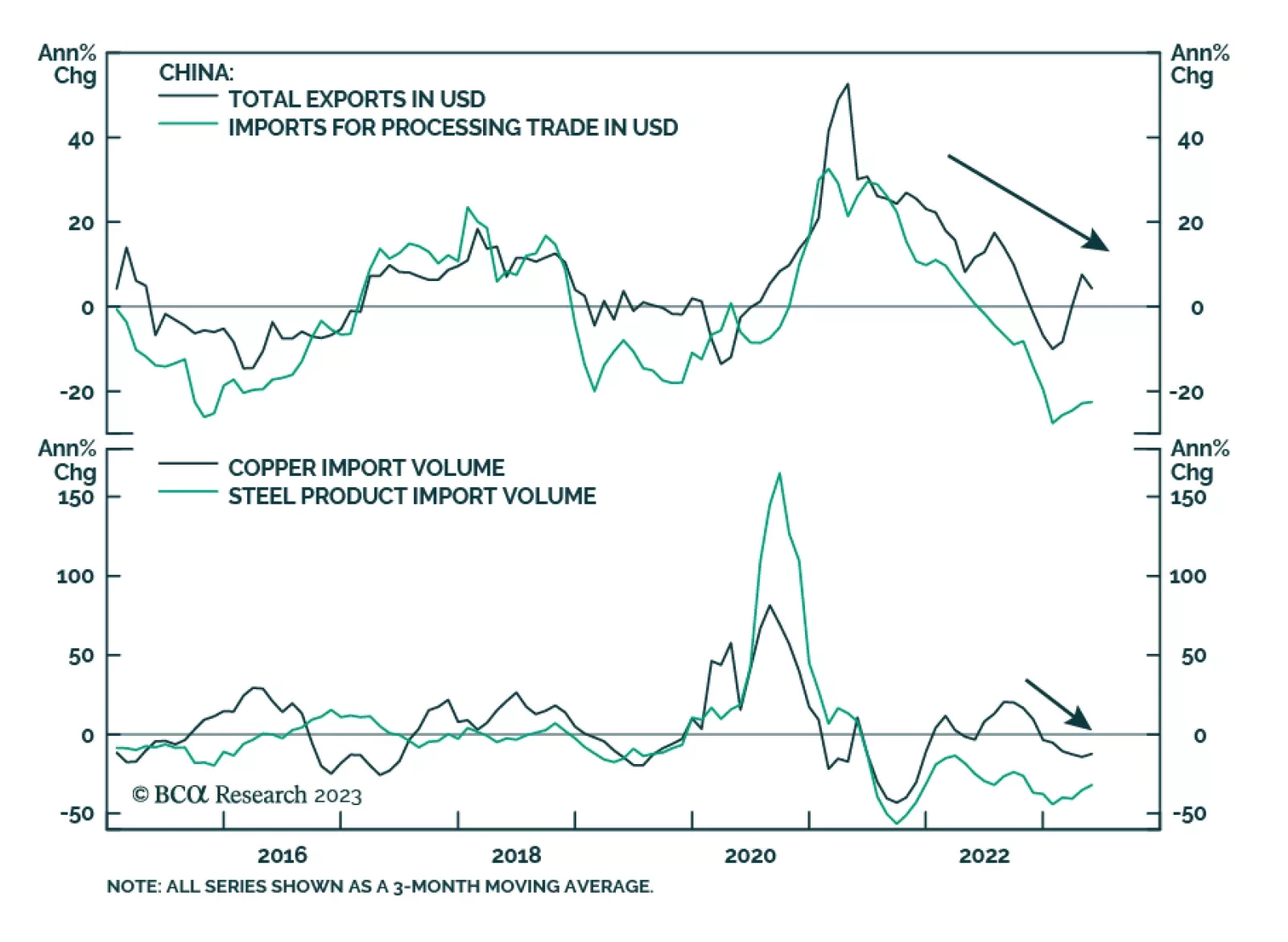

Chinese trade data delivered a disappointing signal about the global manufacturing cycle. After a brief rebound in March and April, exports dropped by 7.5% y/y in USD terms last month – below consensus estimates of a 1.8% y…

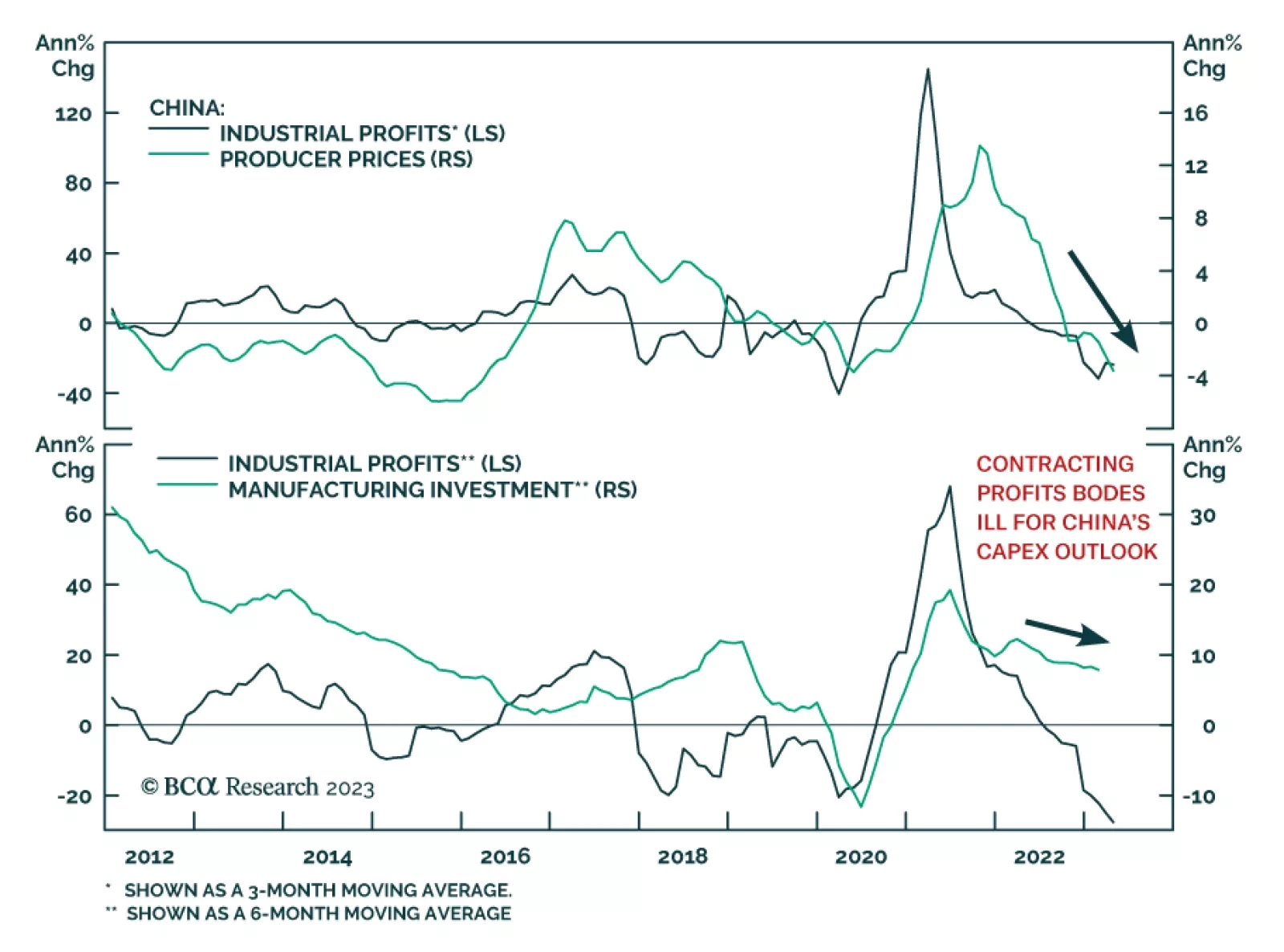

Profits of Chinese industrial firms dropped by 20.6% y/y in the first four months of 2023, extending the contraction that began in the second half of last year. Notably, the weakness remains particularly pronounced across the…

Global growth will weaken in the coming months, yet monetary authorities worldwide will be reluctant to ease policy. This state of affairs foreshadows a clash between markets and policymakers in the months ahead. China’s recovery is…

Indian EPS growth is set for major disappointments vis-à-vis the lofty expectations. Weak domestic demand amid tight fiscal and monetary policy entails more downside in stock prices. Stay underweight.

The risk-reward of the US dollar is currently positive. If a US recession is not imminent, then US bond yields will move higher, thus supporting the greenback. If the US enters a recession soon, the US dollar will benefit because it…

In this week’s report, we look at the current de-dollarization discussion within the context of the USD’s near-term cyclical outlook, and whether it warrants a bullish or bearish stance.

China's recovery will be driven by consumer spending in general and on services in particular, while industrial sectors will disappoint.