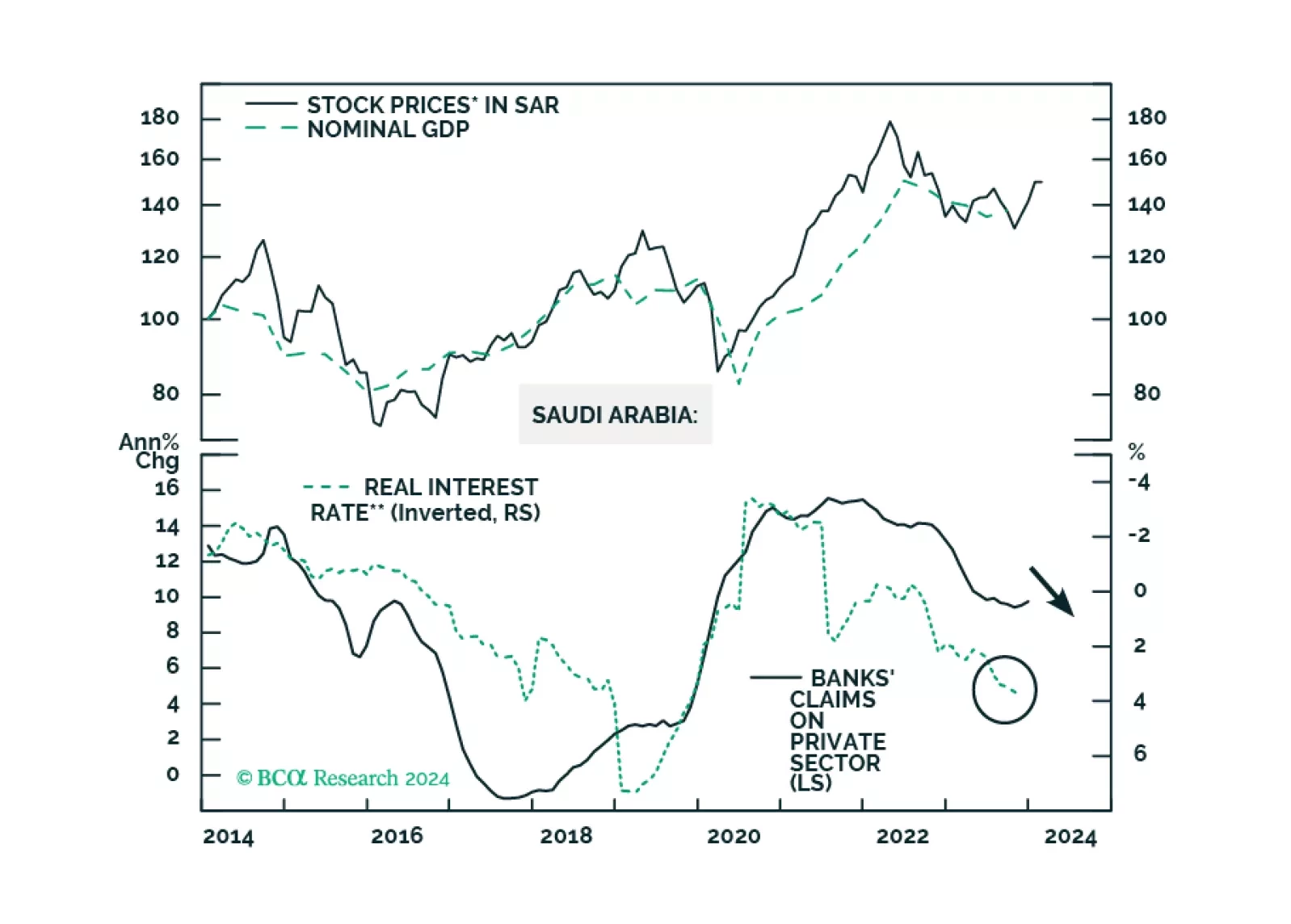

The Saudi economy is facing internal and external headwinds. The geopolitical conflict is also escalating in the Middle East. EM equity portfolios should stay neutral on Saudi stocks. EM sovereign credit portfolios should upgrade…

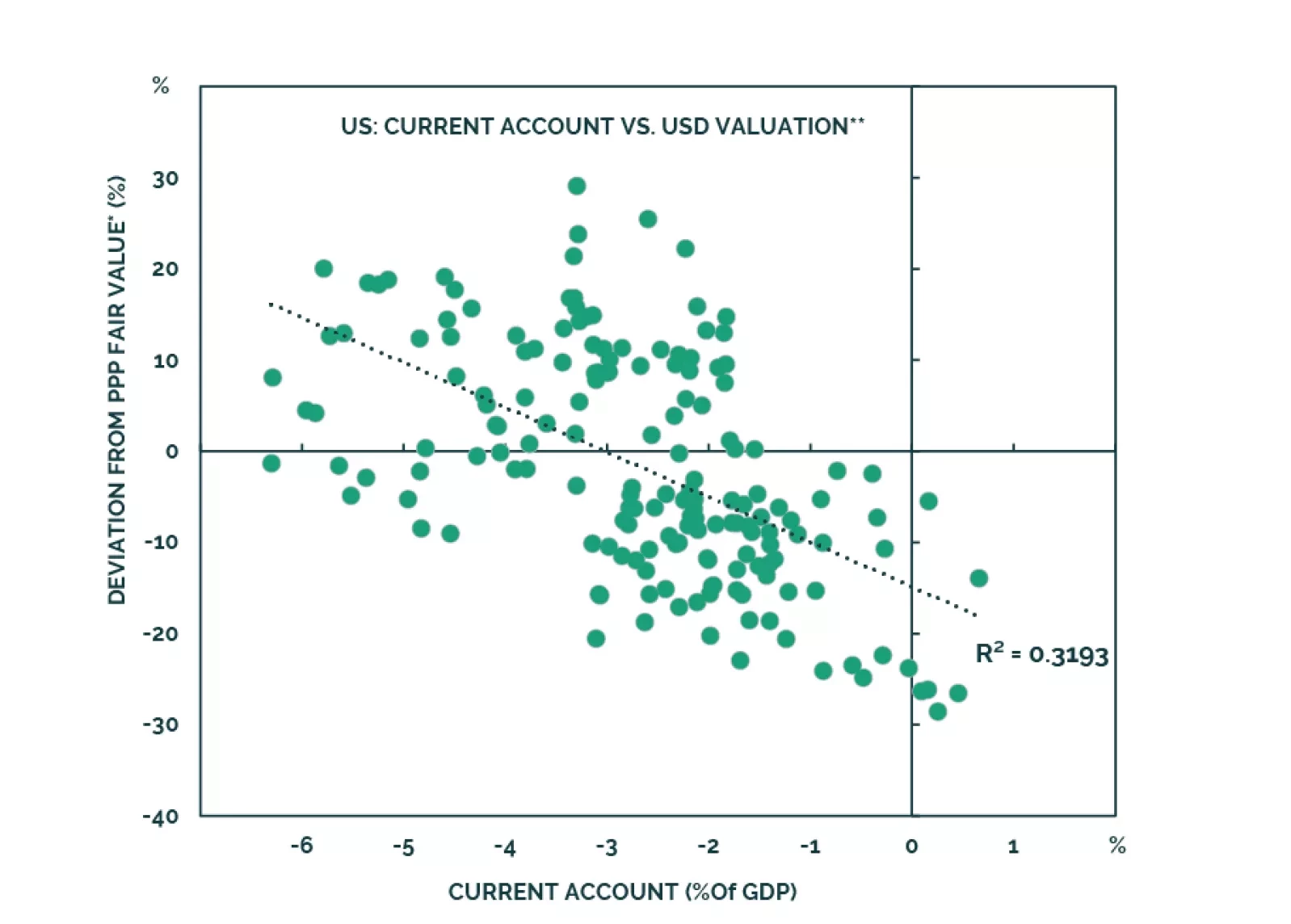

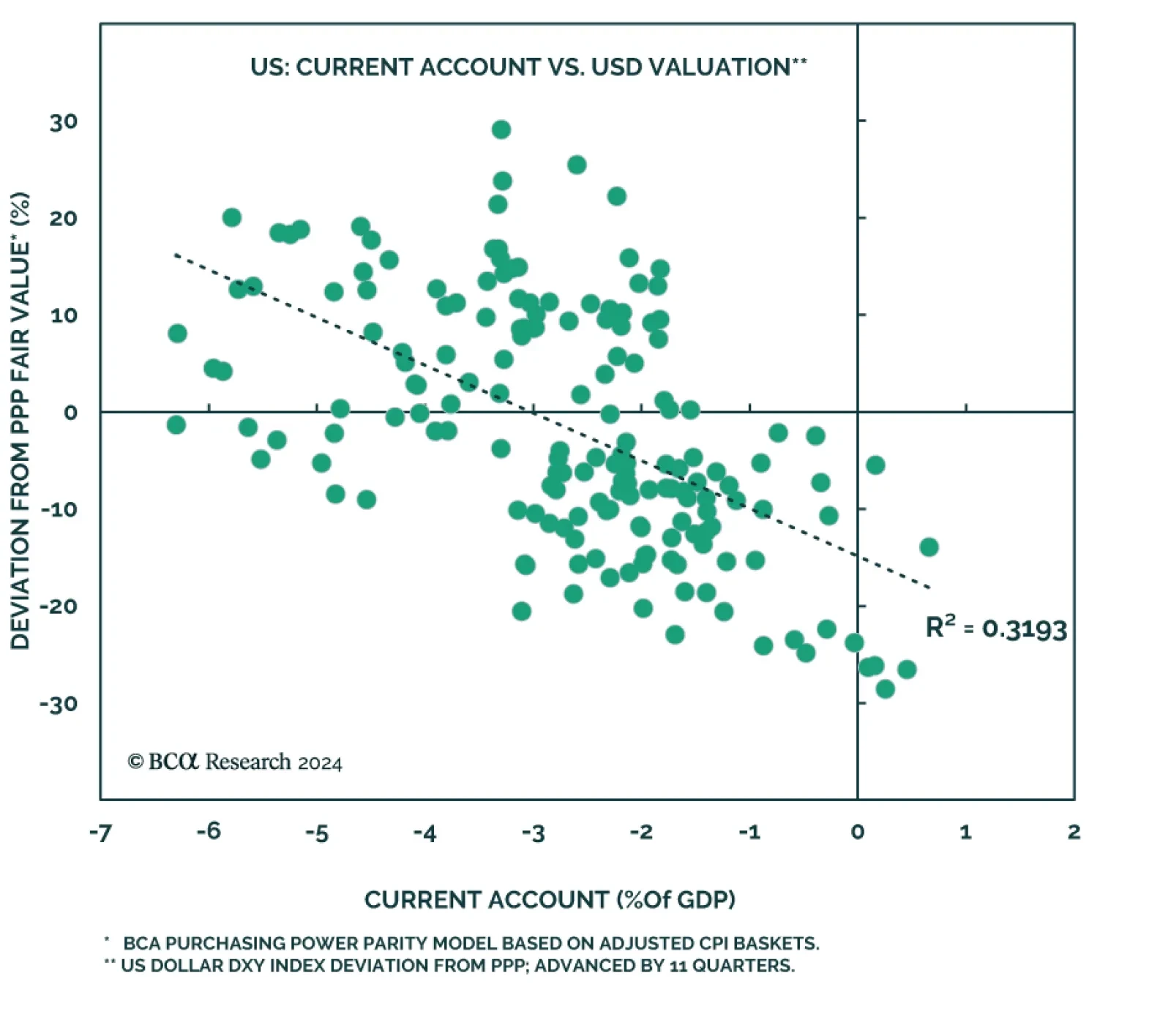

While balance of payments (BoP) do not really matter for day-to-day FX considerations, they do matter over the long term. According to BCA’s Foreign Exchange Strategists, at high levels of US dollar valuation like today,…

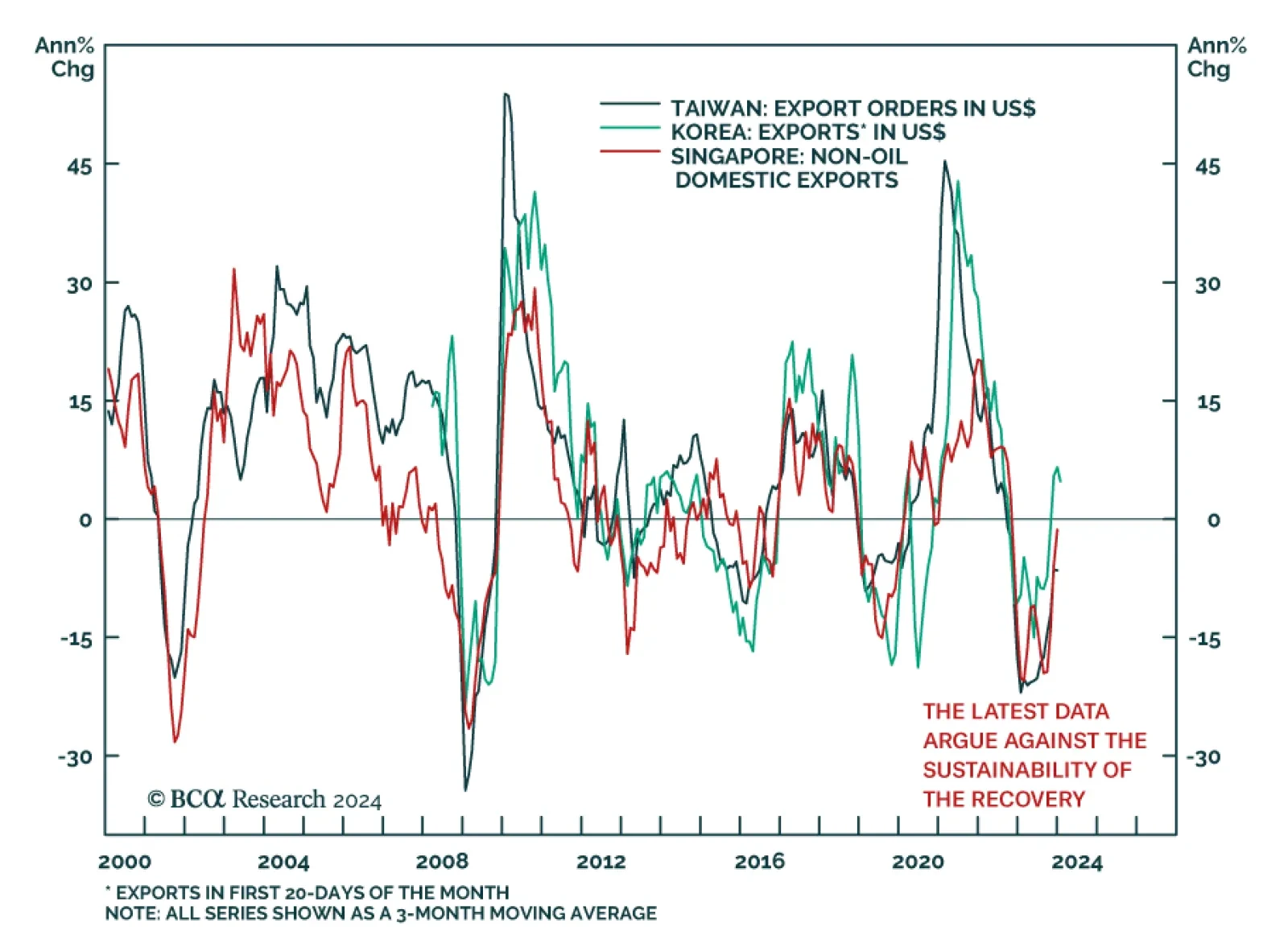

Some key Asian trade indicators are warning against betting on a sustained rebound in global trade activity. In particular, Taiwanese export orders collapsed by 16% y/y in December – significantly below expectations of a…

This report examines if investors should worry about a balance of payments crisis in the next 3-to-6 months.

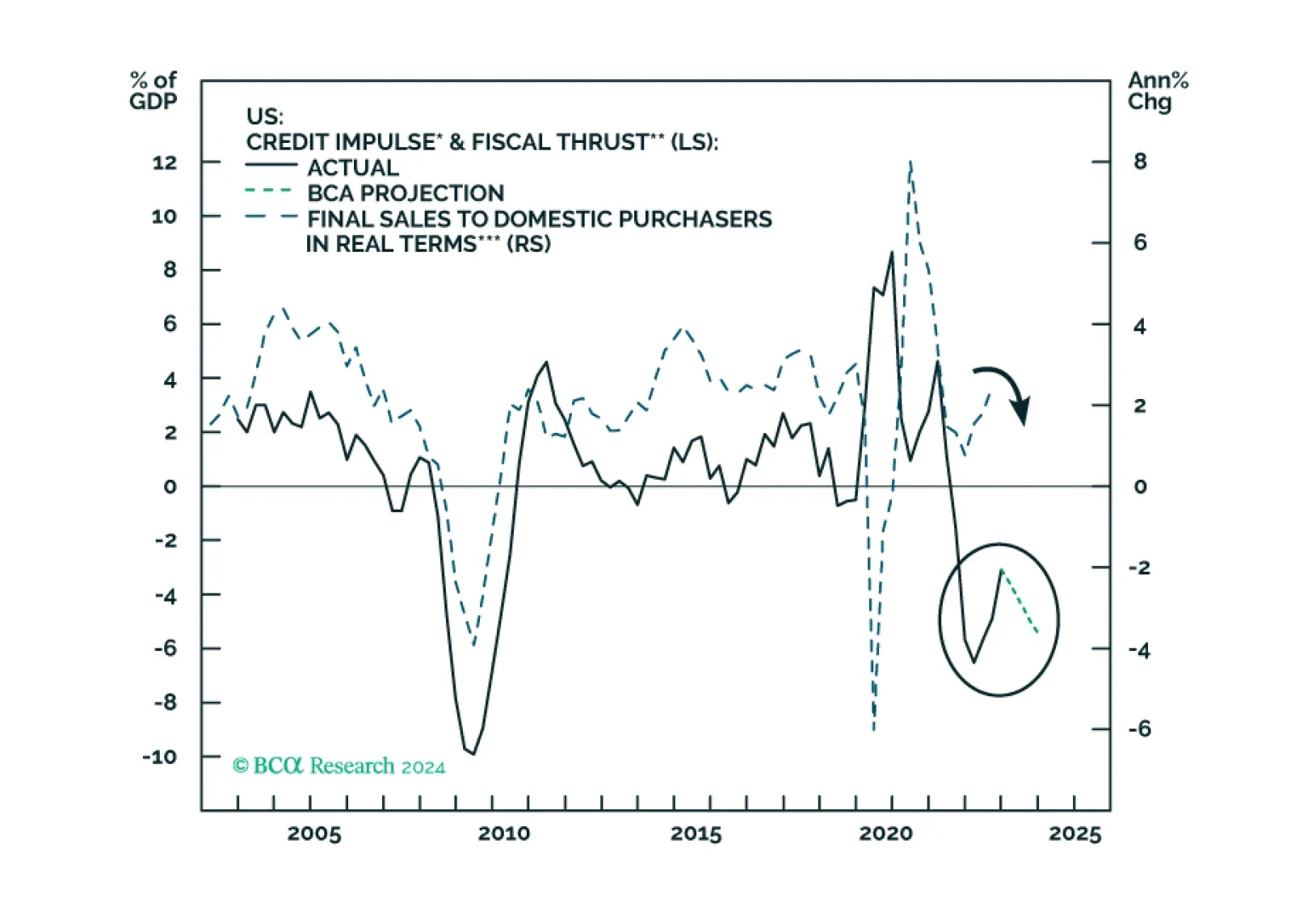

The combined US credit impulse and fiscal thrust indicator will likely relapse in 2024, heralding growth weakness. Stalling US sales volume and falling inflation, combined with sticky labor costs, will herald a non-trivial profit…

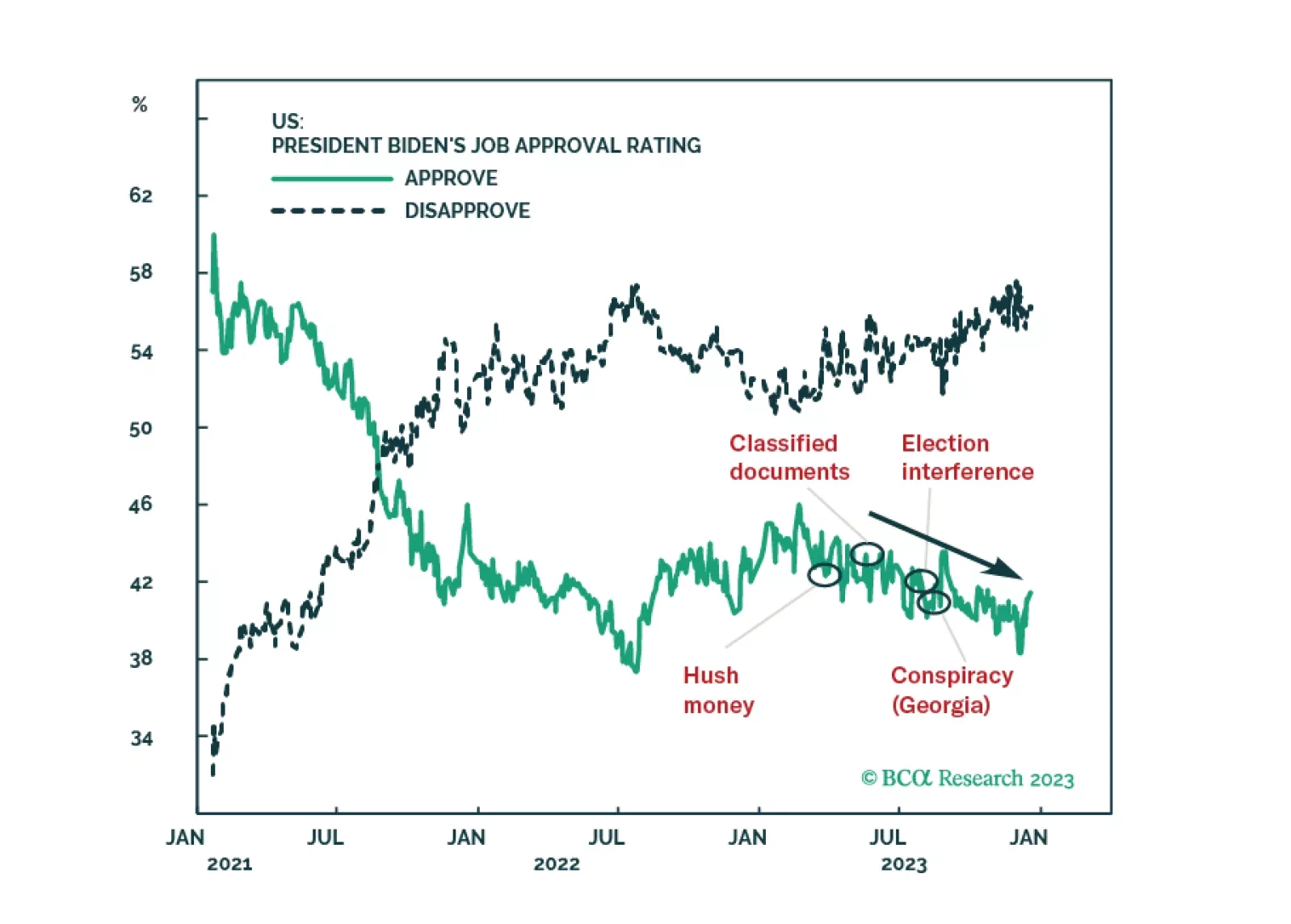

The market’s pricing of a soft landing means that geopolitical risks are becoming more, not less, relevant in 2024. US domestic divisions will invite challenges as foreign powers rightly fear that US policy will turn more hawkish…

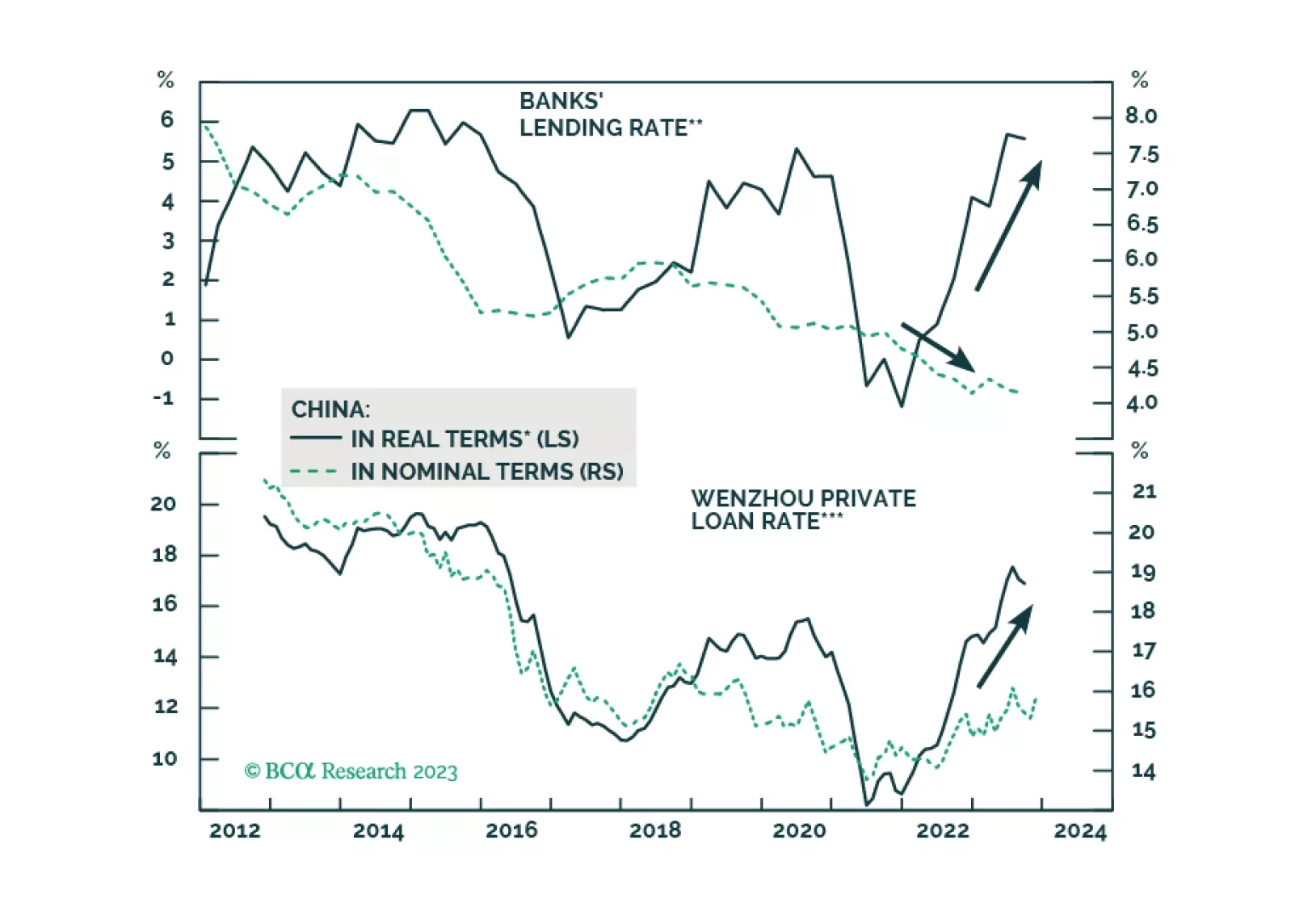

The statement from last week’s Central Economic Work Conference indicates that Chinese authorities are still not considering large-scale stimulus in 2024. Odds are that a full-fledged business cycle recovery in 2024 is unlikely.…

The Republican Party’s odds of winning the 2024 election will benefit, if anything, from state courts’ attempts to exclude President Trump from primary or general election ballots. Higher odds of a change of ruling party will…

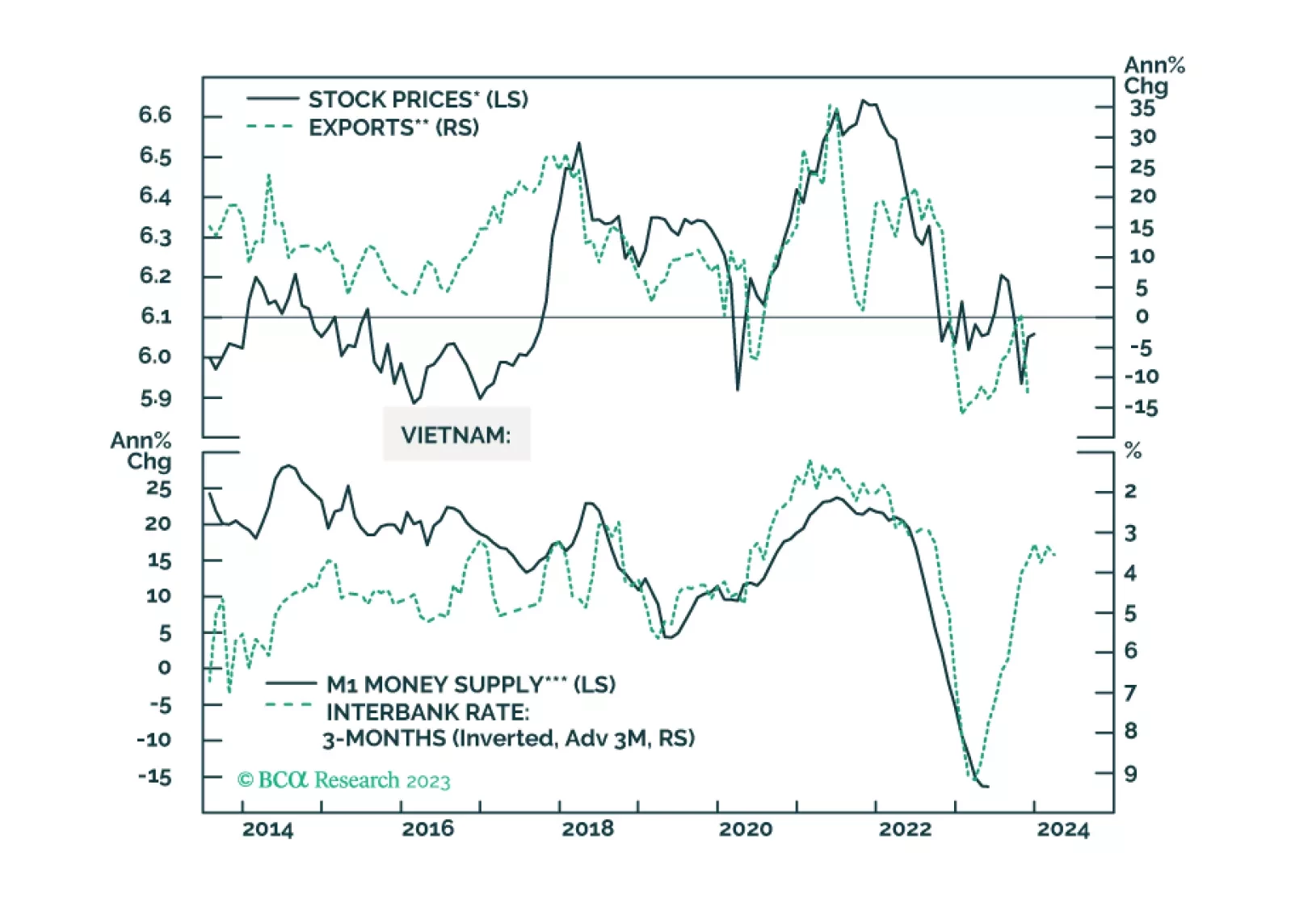

Vietnamese stocks may not see an immediate rally as global manufacturing and exports remain weak. But investors with longer-term horizons should stay overweight this market.