While 2024 will see various election risks, global geopolitical uncertainty is driven by the US election and its struggle with Russia, China, and Iran. The stock market can manage local domestic political risk. But it will correct…

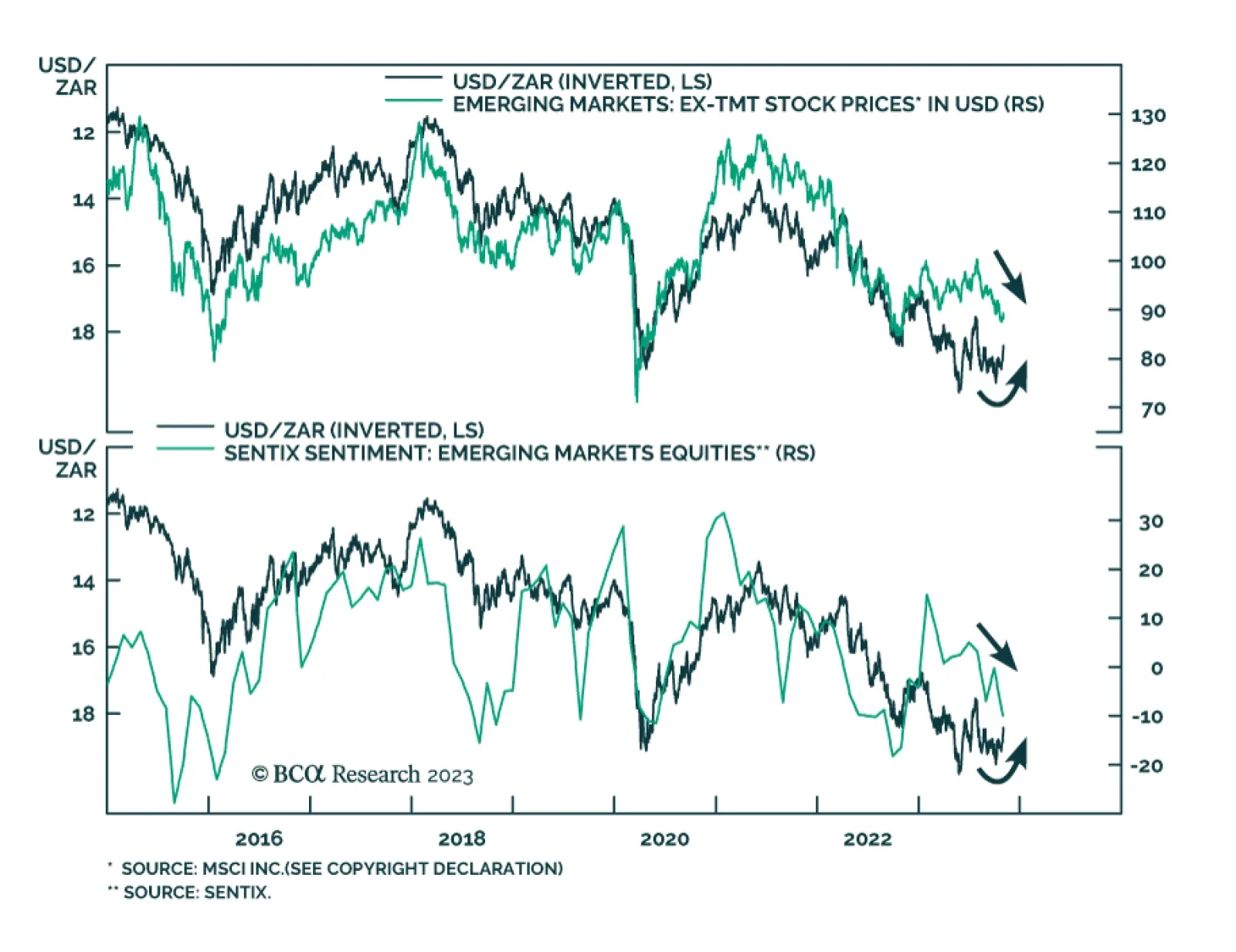

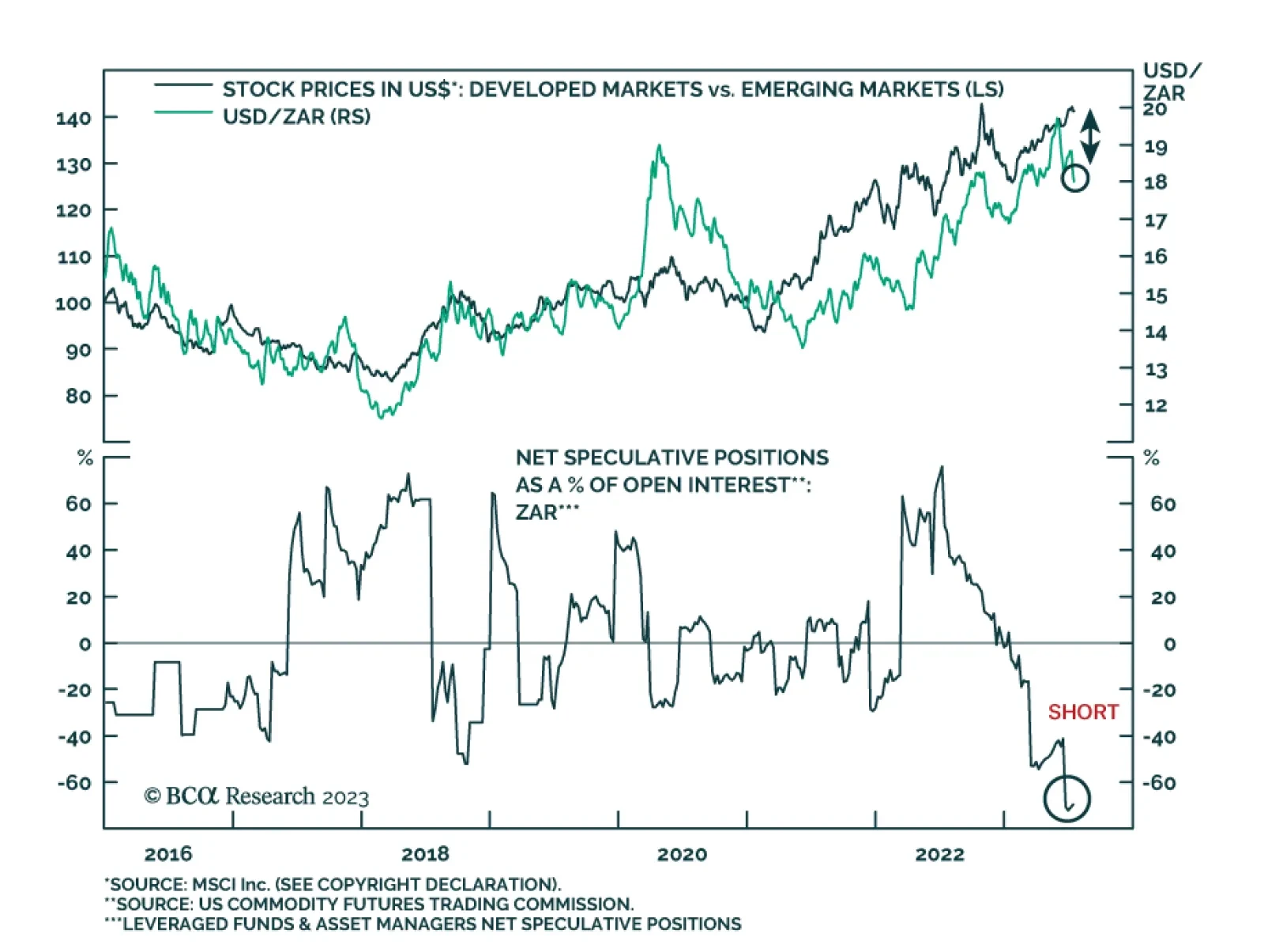

The South African rand is the best performing major currency since the DXY peaked on October 3. Considering that the rand acts as a proxy for global sentiment towards emerging markets, its recent strength raises the question…

The South African rand has been a key winner amid the recent improvement in risk sentiment. Notably, the ZAR's 10.9% appreciation versus the US dollar since May 25 has made it the best performing major currency over this…

The South African rand is among the worst performing major global currencies since the DXY peaked on September 27 (behind only the Argentine peso, Russian ruble, and Turkish lira). Given that the ZAR is a high-beta currency,…

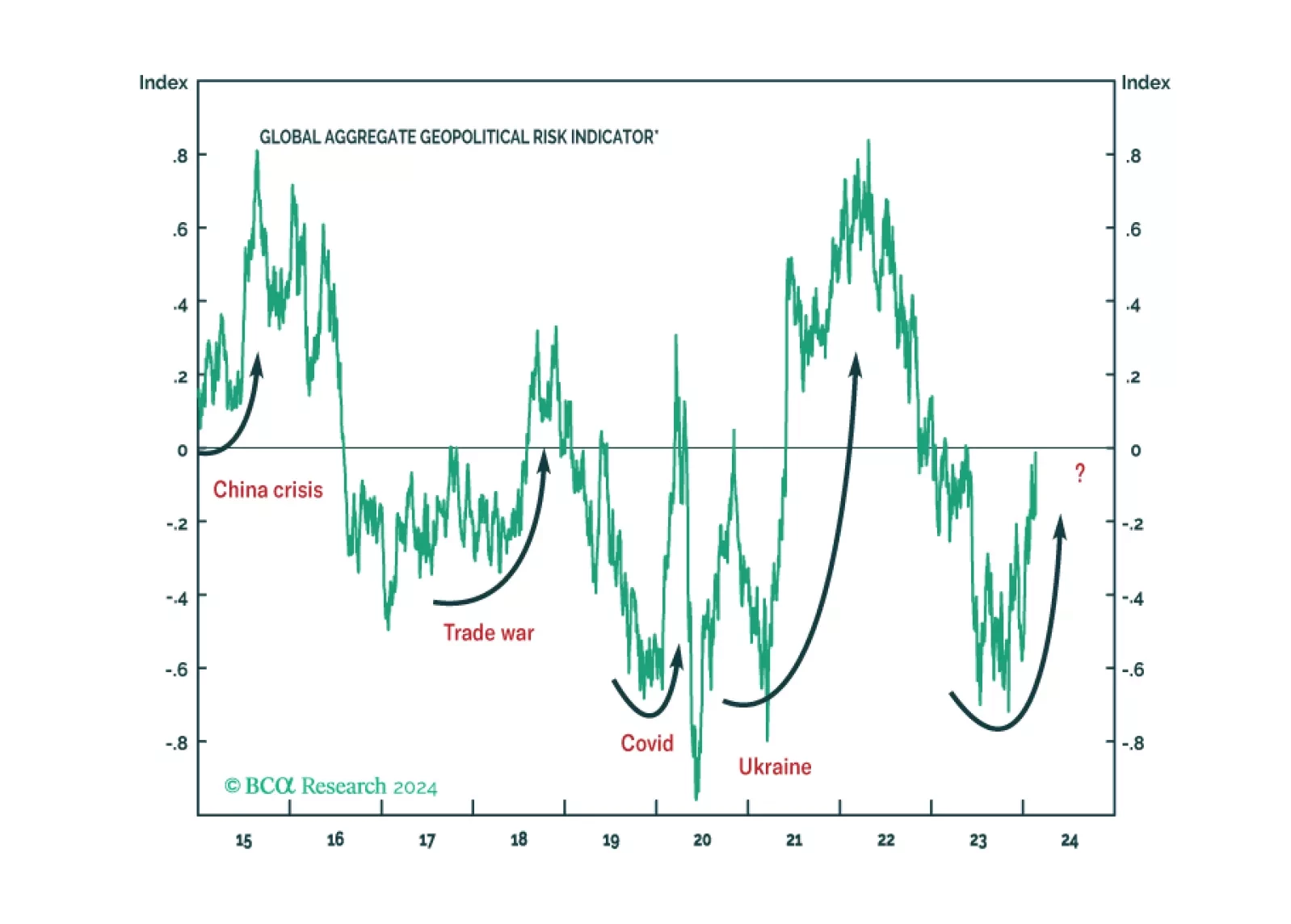

No, the secular rise in geopolitical risk has not peaked. EU-China trade ties underscore the multipolar context, but this multipolarity is unbalanced, as the US has not reached a new equilibrium with its rivals. While the second…

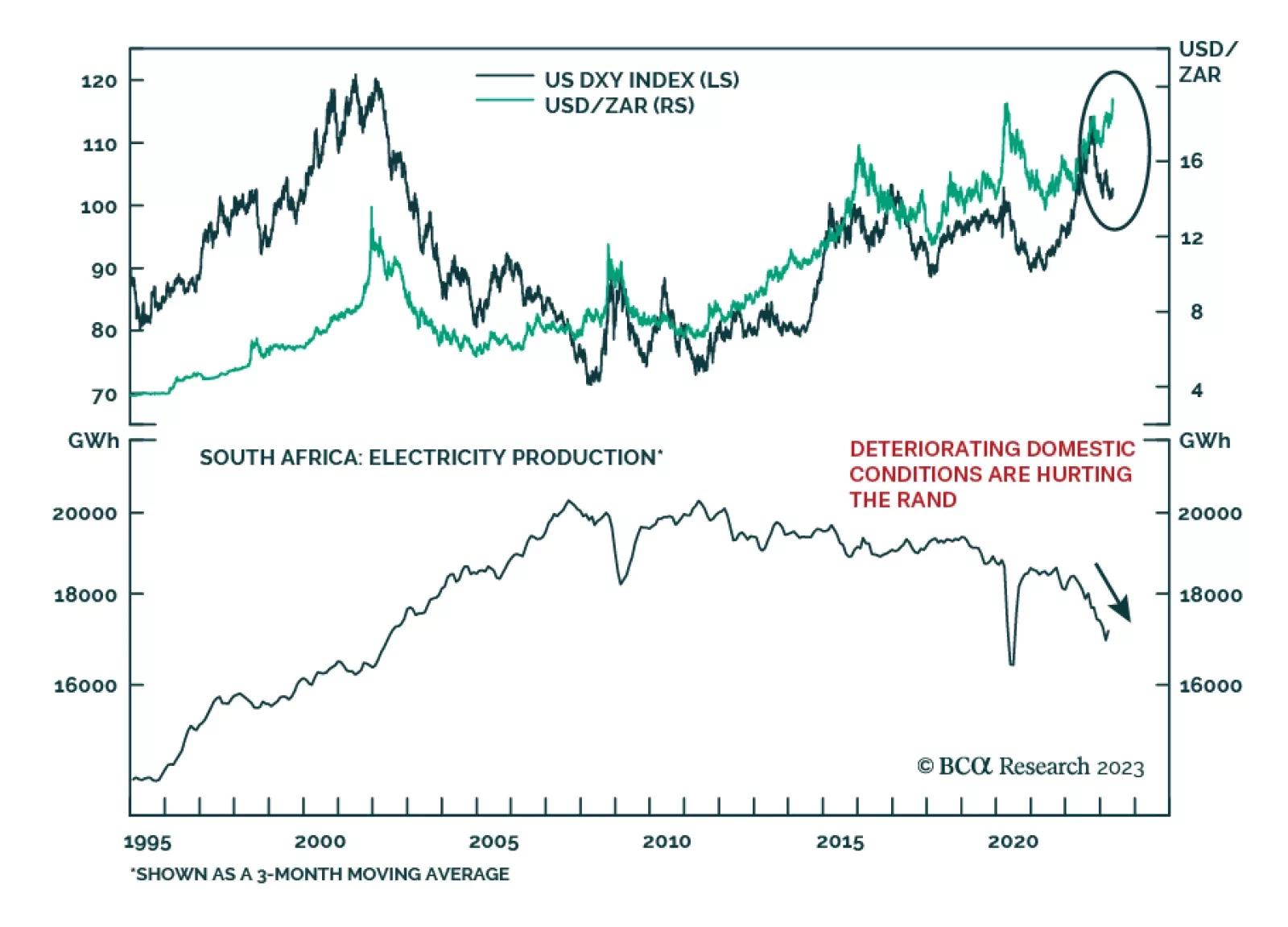

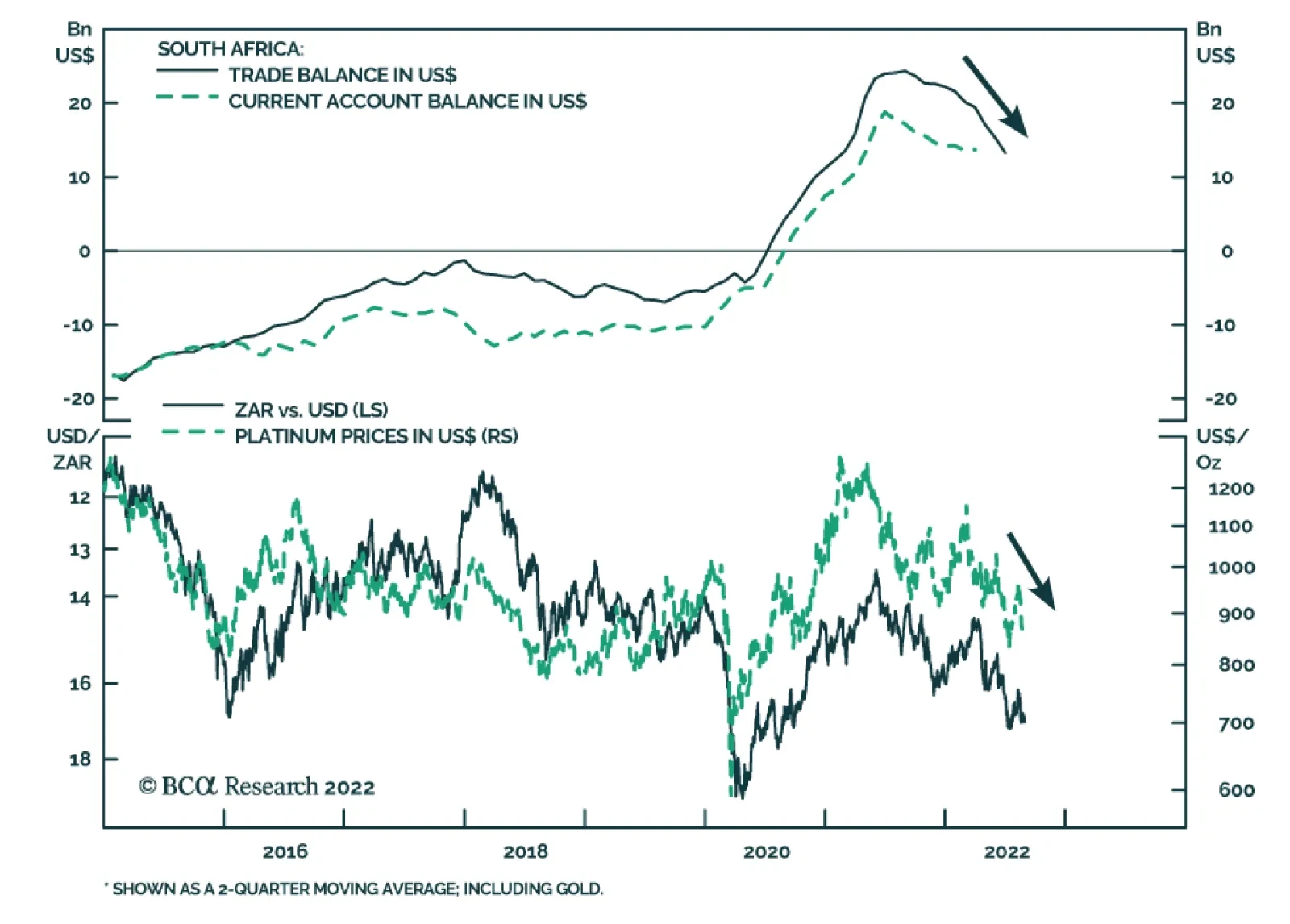

Eventually South Africa will do its macro rebalancing the least painful way: via adjustments in nominal variables such as prices and currency, rather than in real variables such as jobs and incomes. That entails a much weaker rand in…

Remain cautious and defensive overall. Stay long DM Europe over EM Europe. Look for EM opportunities in Southeast Asia and Latin America over Greater China.

Following a brief reprieve earlier in the month, the South African rand is once again depreciating against the US dollar. Indeed, domestic headwinds are gathering and pointing to further weakness for the South African currency…

Executive Summary China: GeoRisk Indicator A new equilibrium between NATO, which now includes Sweden and Finland, and Russia needs to be reestablished before geopolitical risks in Europe subside. Russia aims to inflict a…