Investors should modestly underweight equities in their portfolios and look to turn more aggressively defensive once the whites of the recession’s eyes are visible. We think that will happen within the next few months.

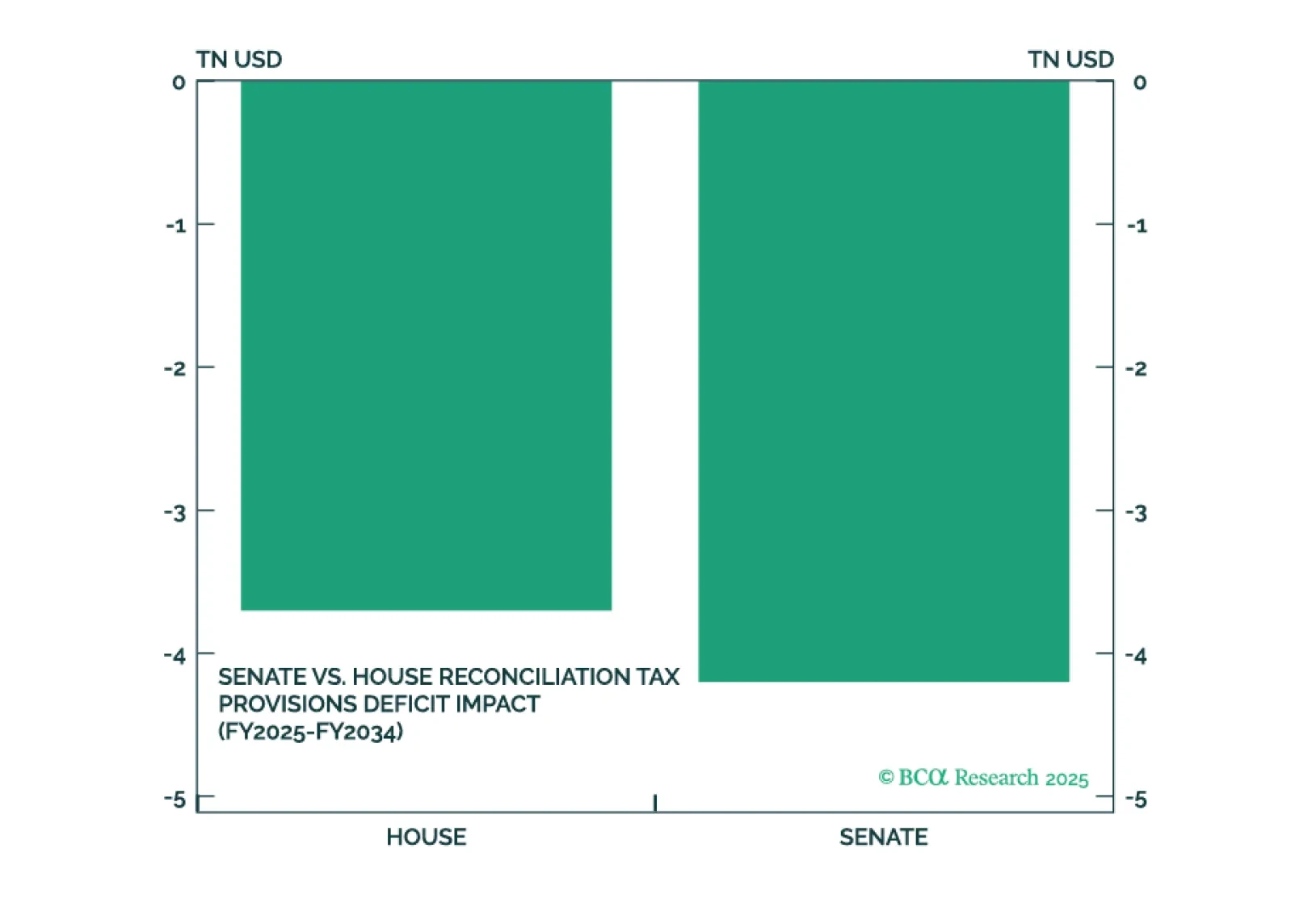

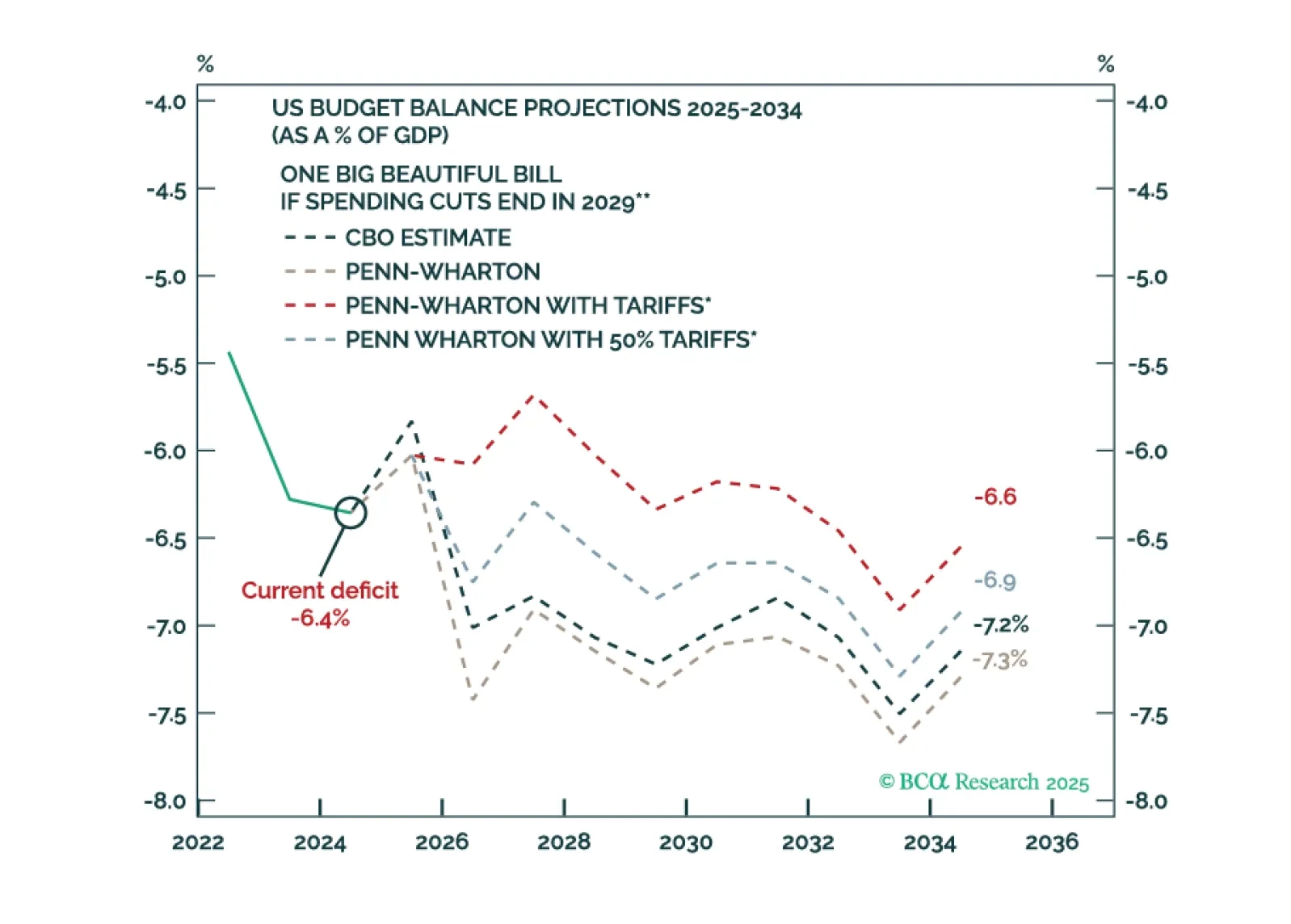

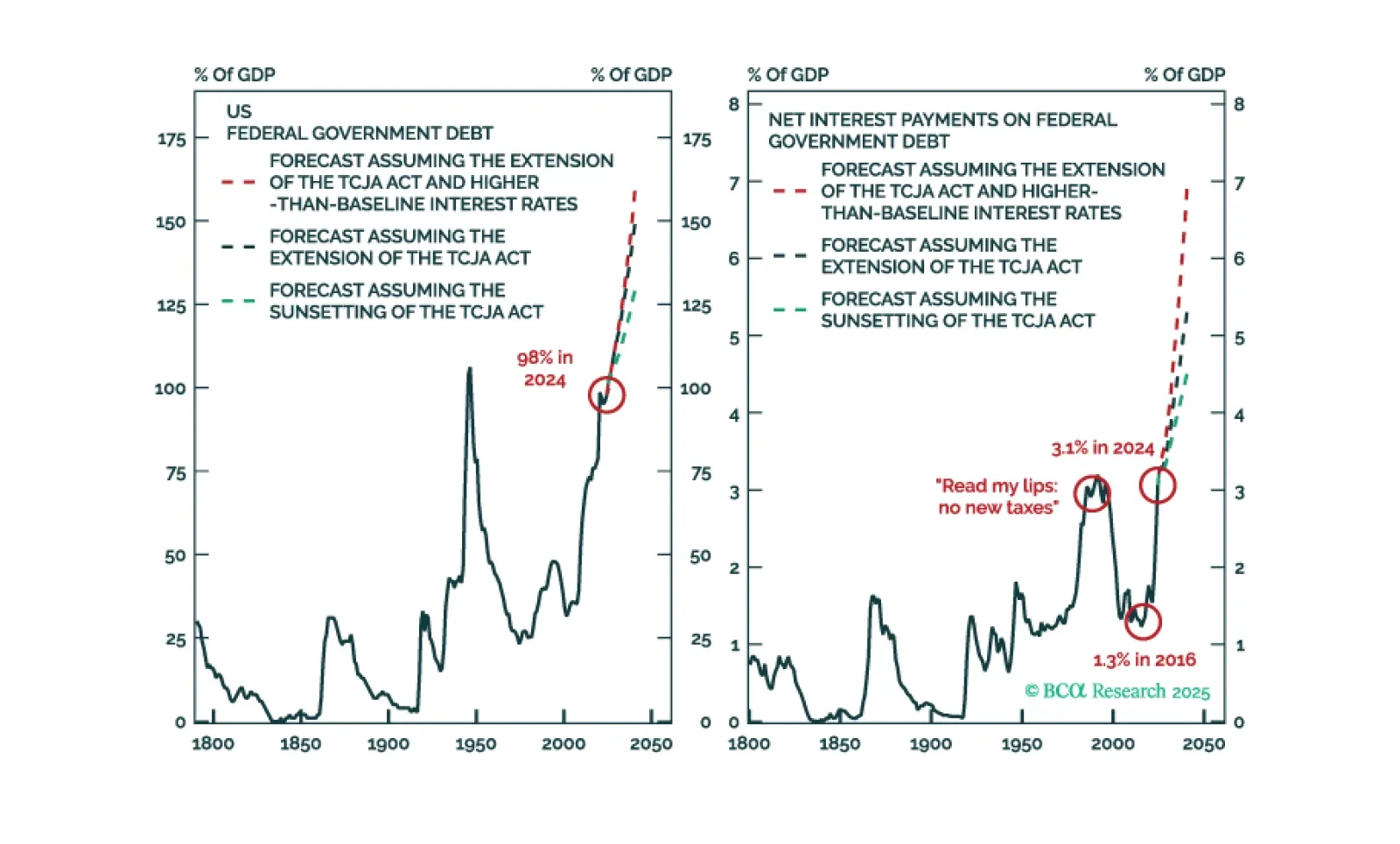

President Trump’s big beautiful bill will pass but faces near-term hurdles and will not tighten the government’s belt. It will combine with renewed tariff implementation to generate near-term risk for both the bond and stock market.…

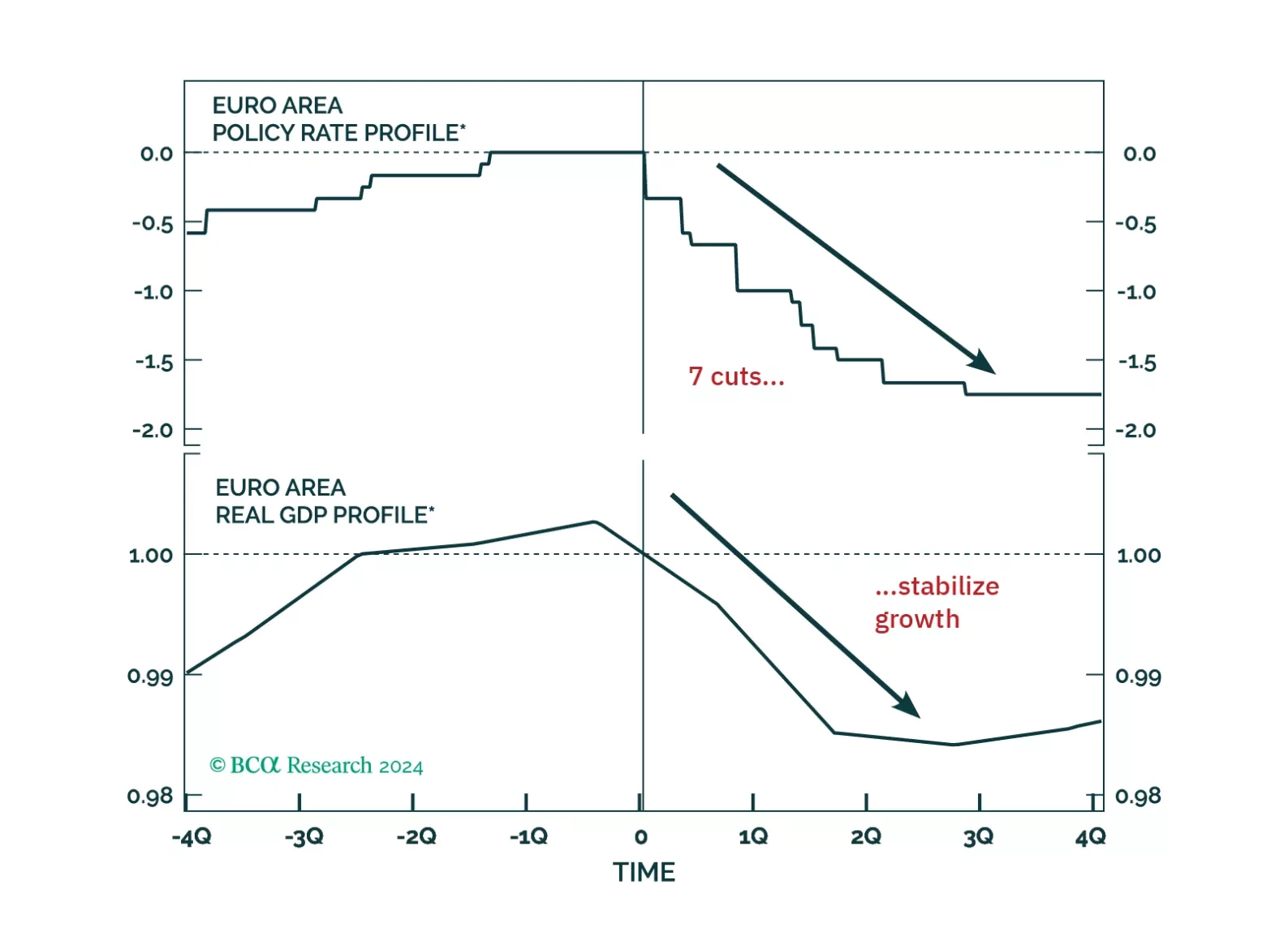

Bond market volatility will spike again in the near term. The Fed is committed to an easing cycle yet the Trump administration’s signature fiscal policy action will stimulate the economy. Tariffs are supposed to keep the budget…

Rising bond yields may present an even greater danger to the global economy than the trade war. With equity valuations no longer discounting much economic risk, investors should position themselves defensively.

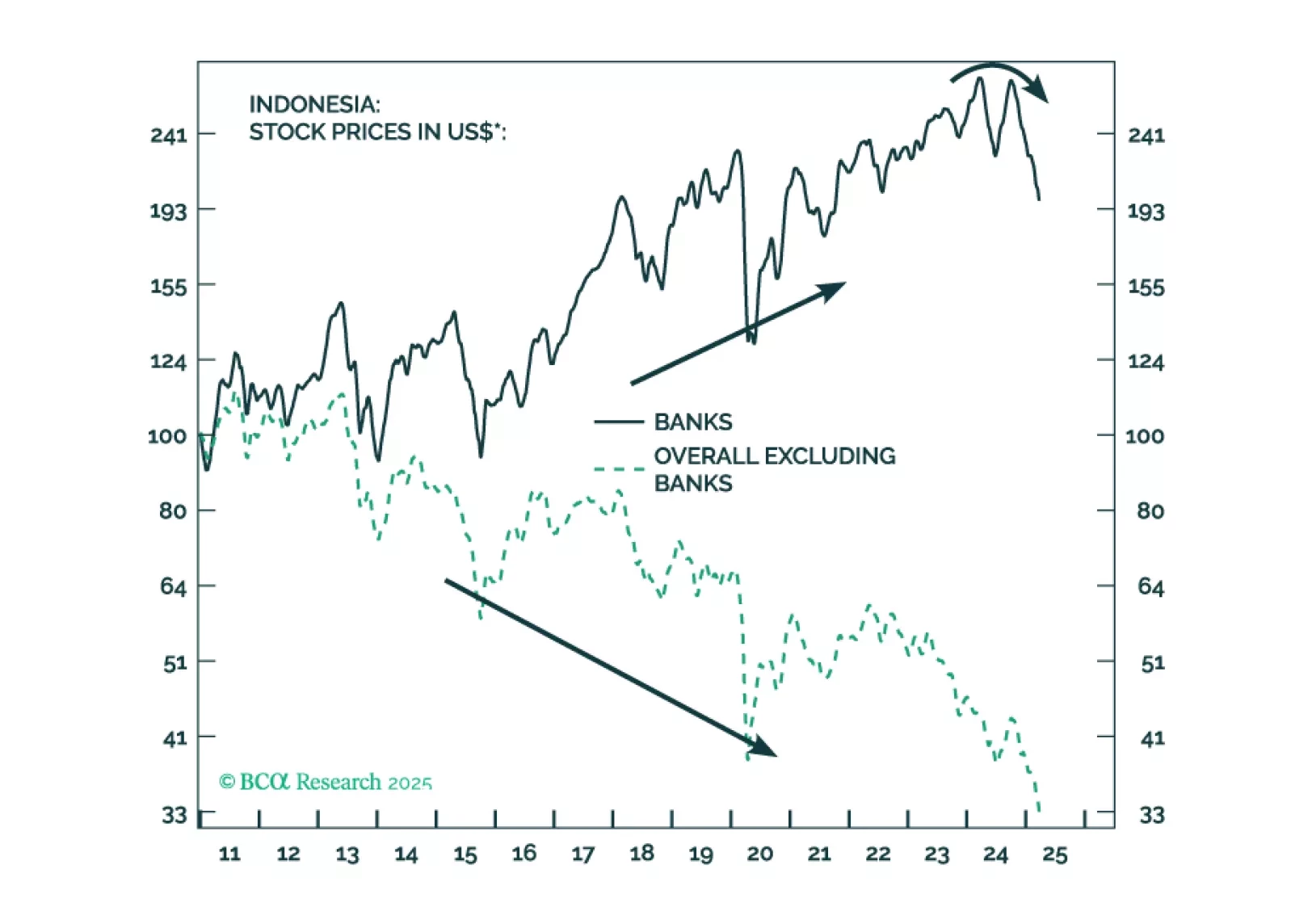

There is an ongoing regime shift in Indonesia: SOEs will be used to drive economic growth. Bank loans will accelerate, but their profit margins will shrink. Despite higher nominal growth, Indonesian equity prices in US dollar terms…

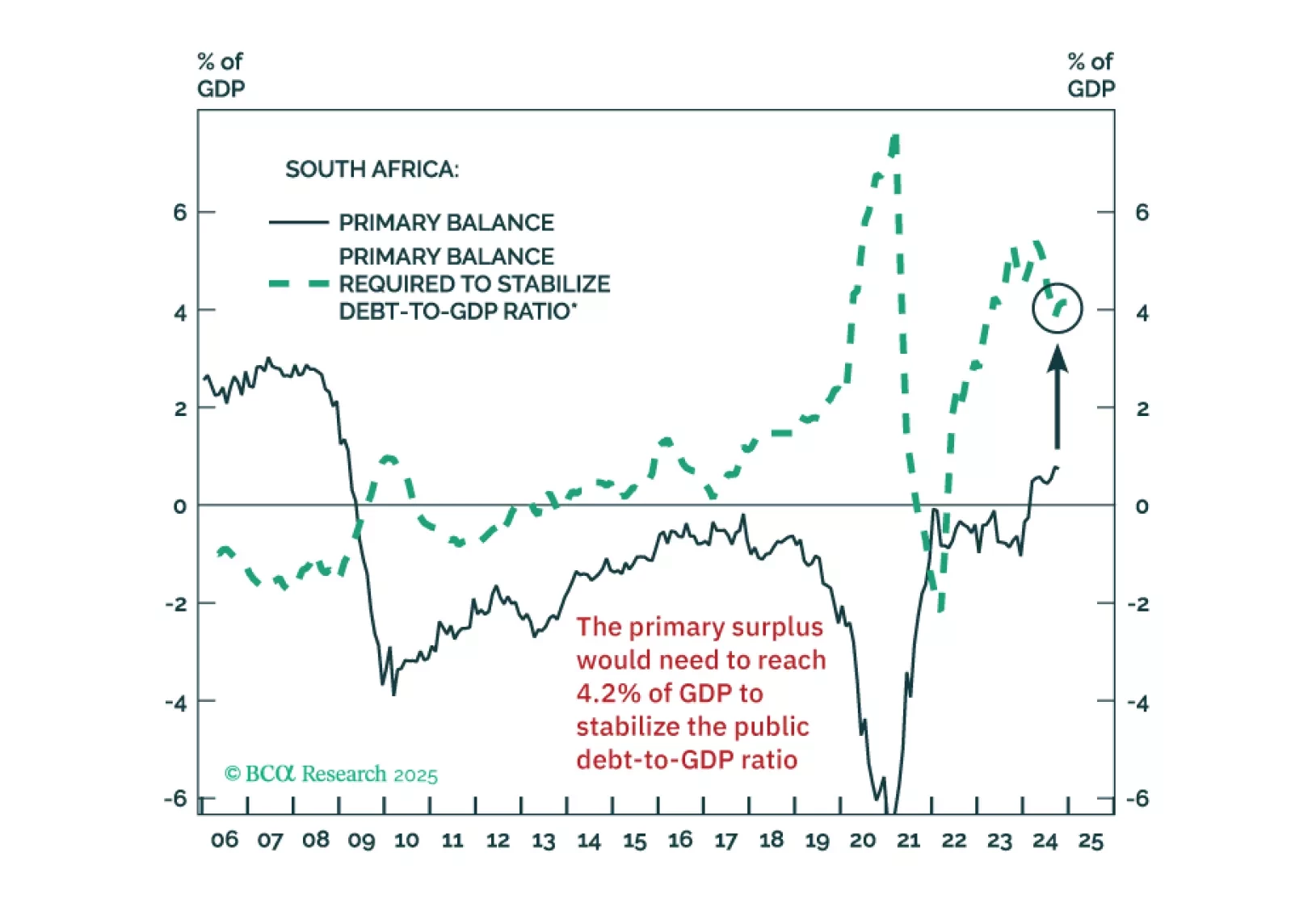

The South African government seems to believe that some fiscal retrenchment can stabilize the public debt-to-GDP ratio. But that’s a misconception. The country will need draconian spending cuts to achieve this.

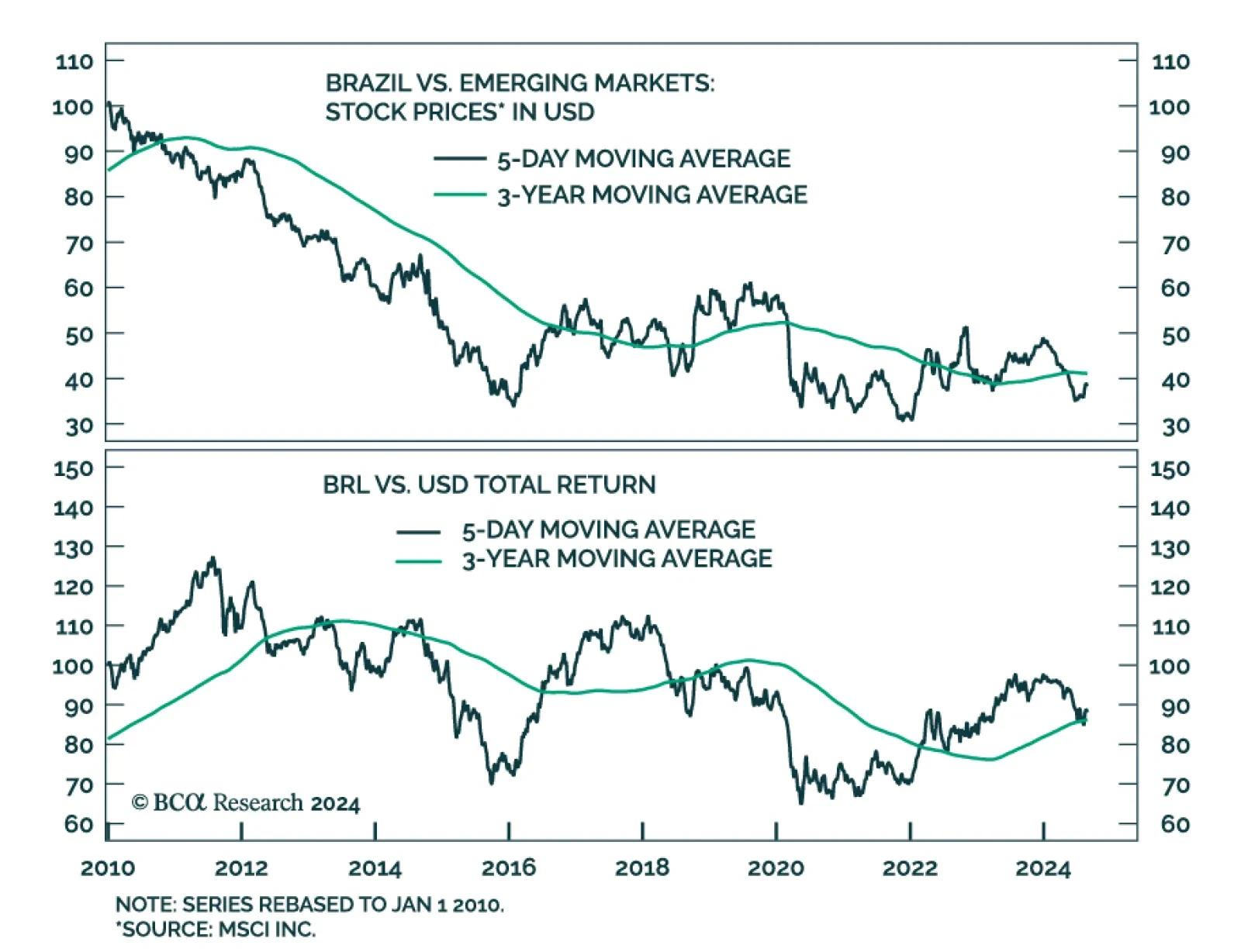

Brazilian equities have largely underperformed their EM peers in USD terms since the beginning of the year. Rising public debt and inflation are the two main forces weighing on the Brazilian bourse. Our Emerging Market…

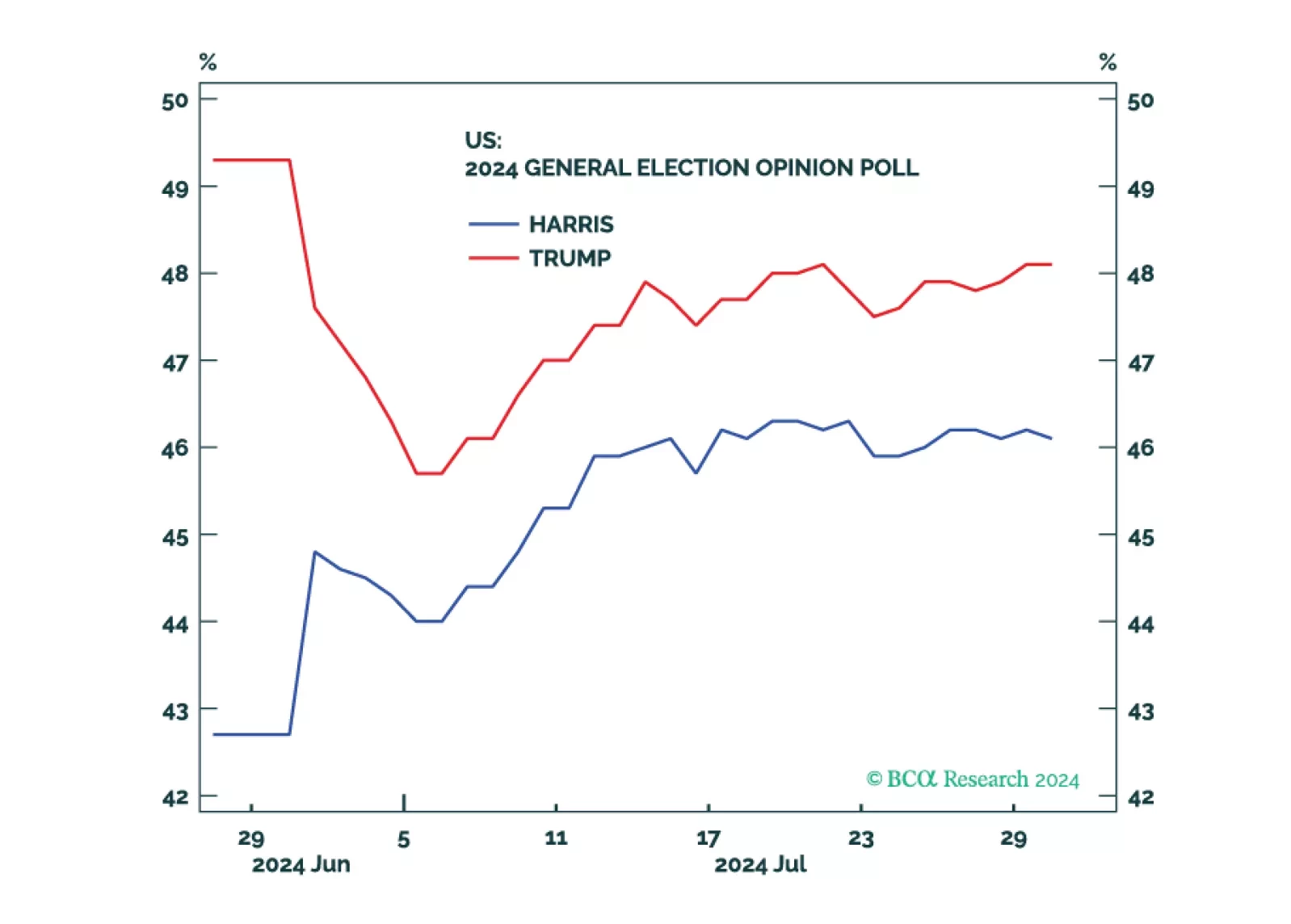

Republicans are favored but the election is still competitive. Equities, corporate credit, and cyclical sectors will fall until policy uncertainty is reduced.