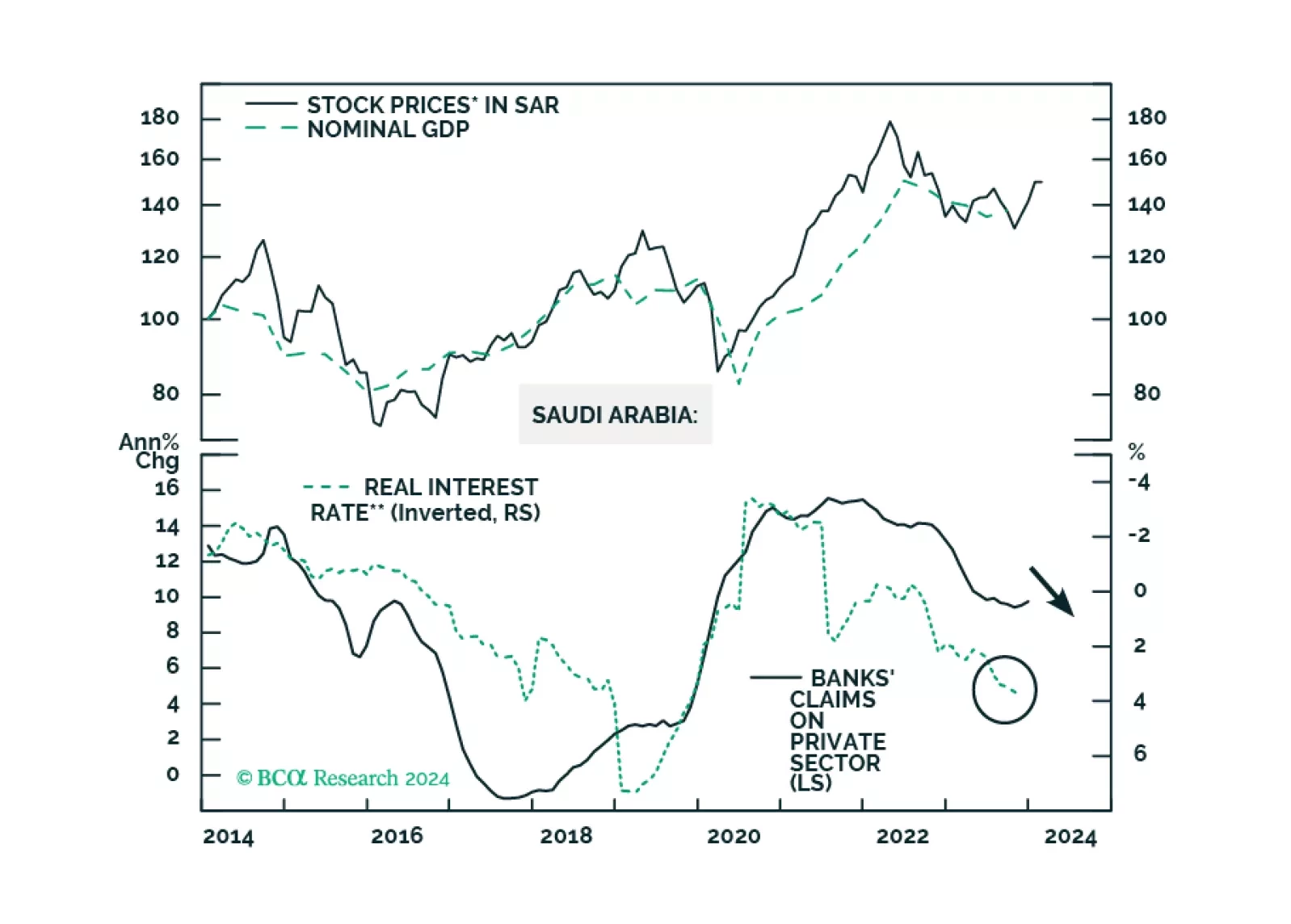

The Saudi economy is facing internal and external headwinds. The geopolitical conflict is also escalating in the Middle East. EM equity portfolios should stay neutral on Saudi stocks. EM sovereign credit portfolios should upgrade…

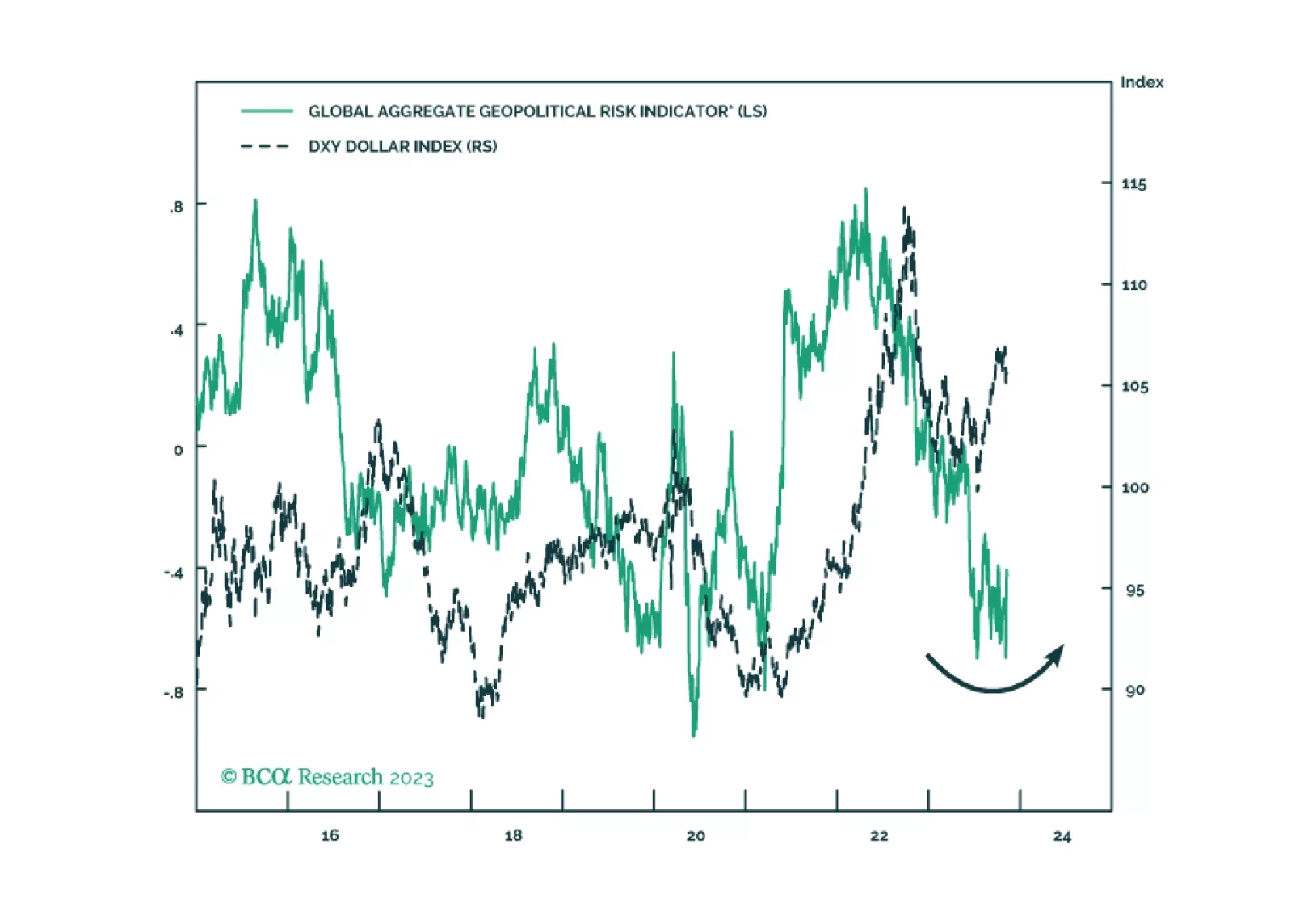

Amid a range of geopolitical narratives, what matters is that the US strategy of economic engagement with its rivals is failing, giving rise to a new strategy of containment that will reinforce the secular rise in geopolitical risk.…

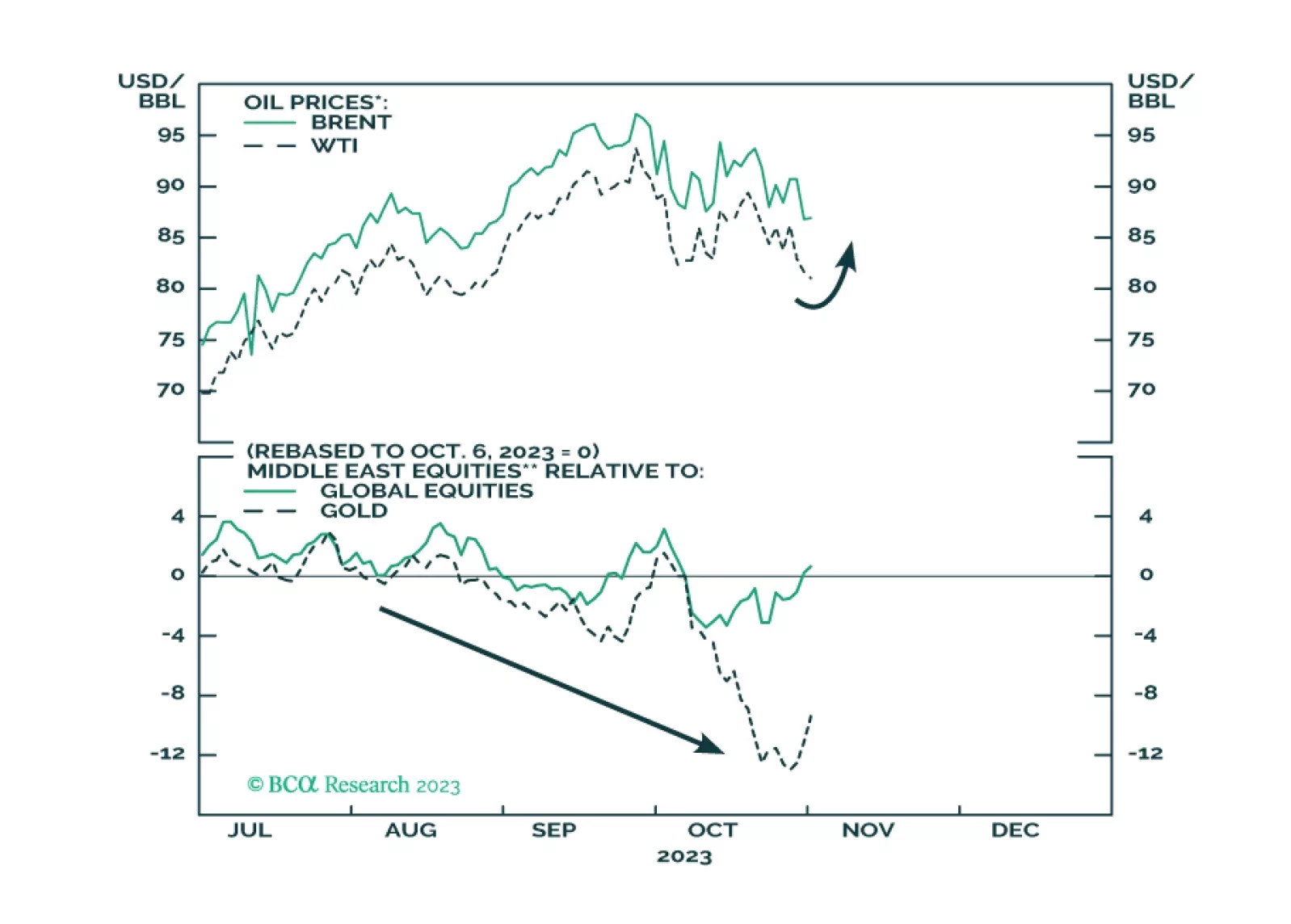

Investors should reduce risk, increase allocation to safe havens, and brace for oil price volatility and supply disruptions stemming from the Middle East over the next zero-to-12 months.

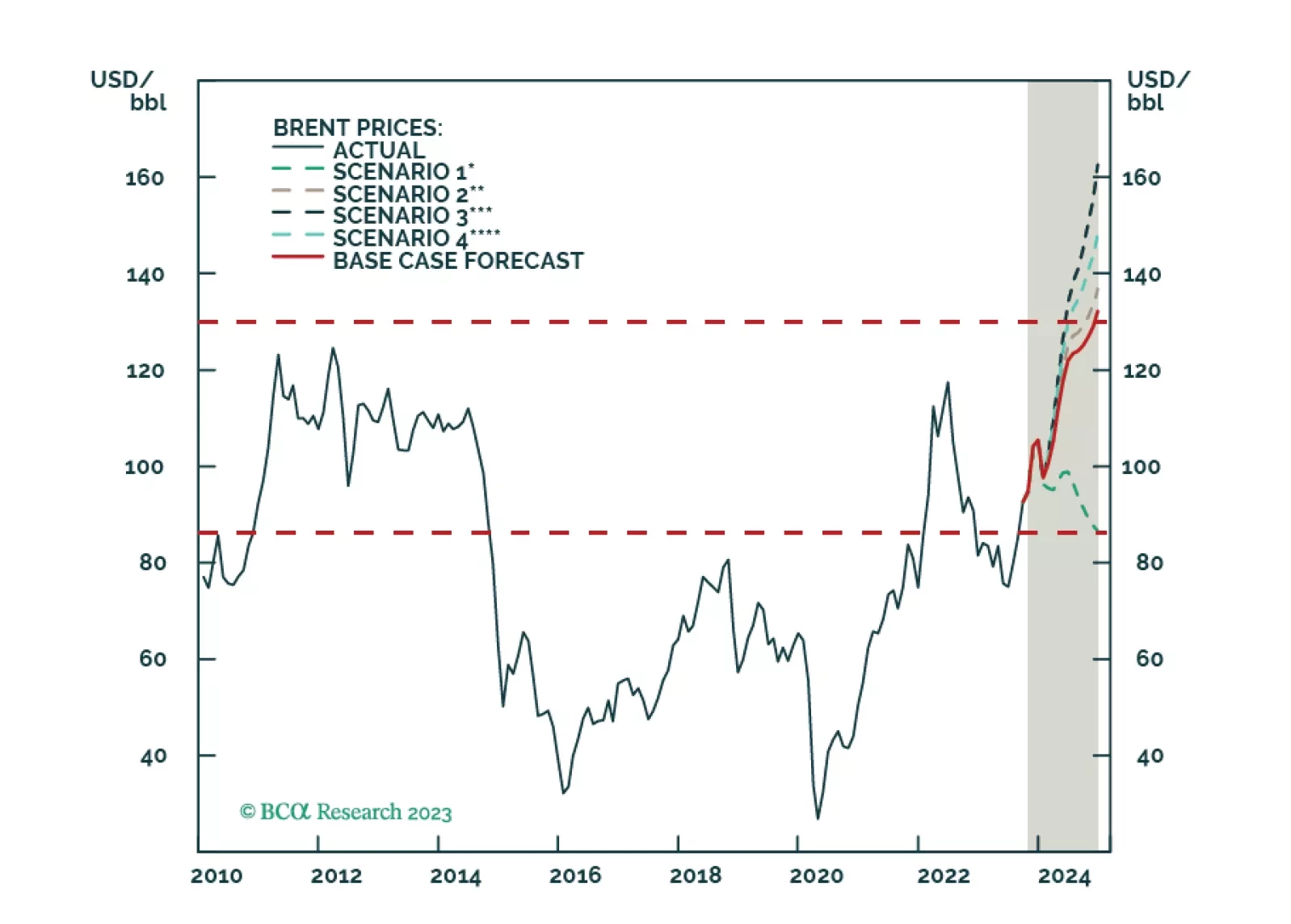

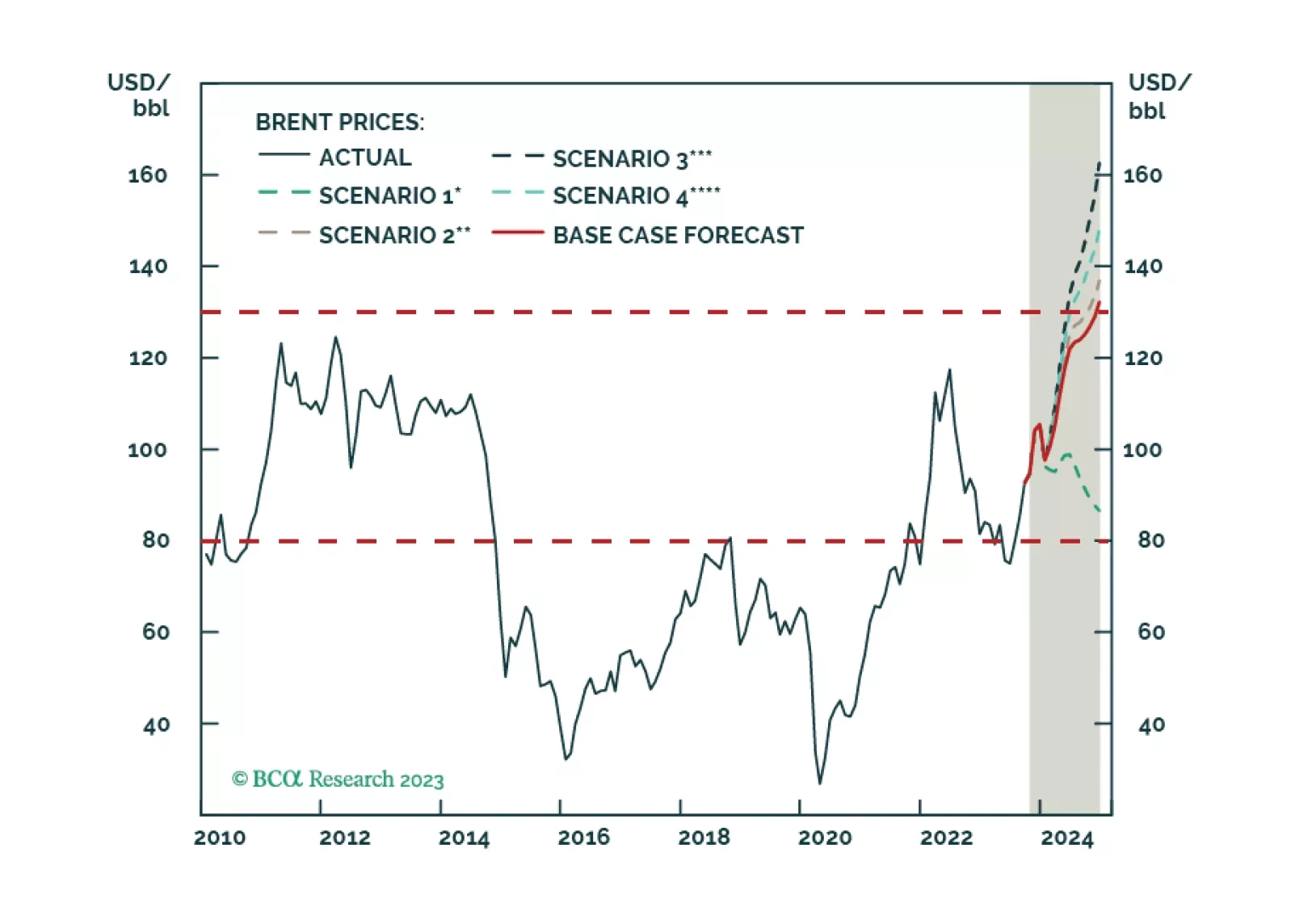

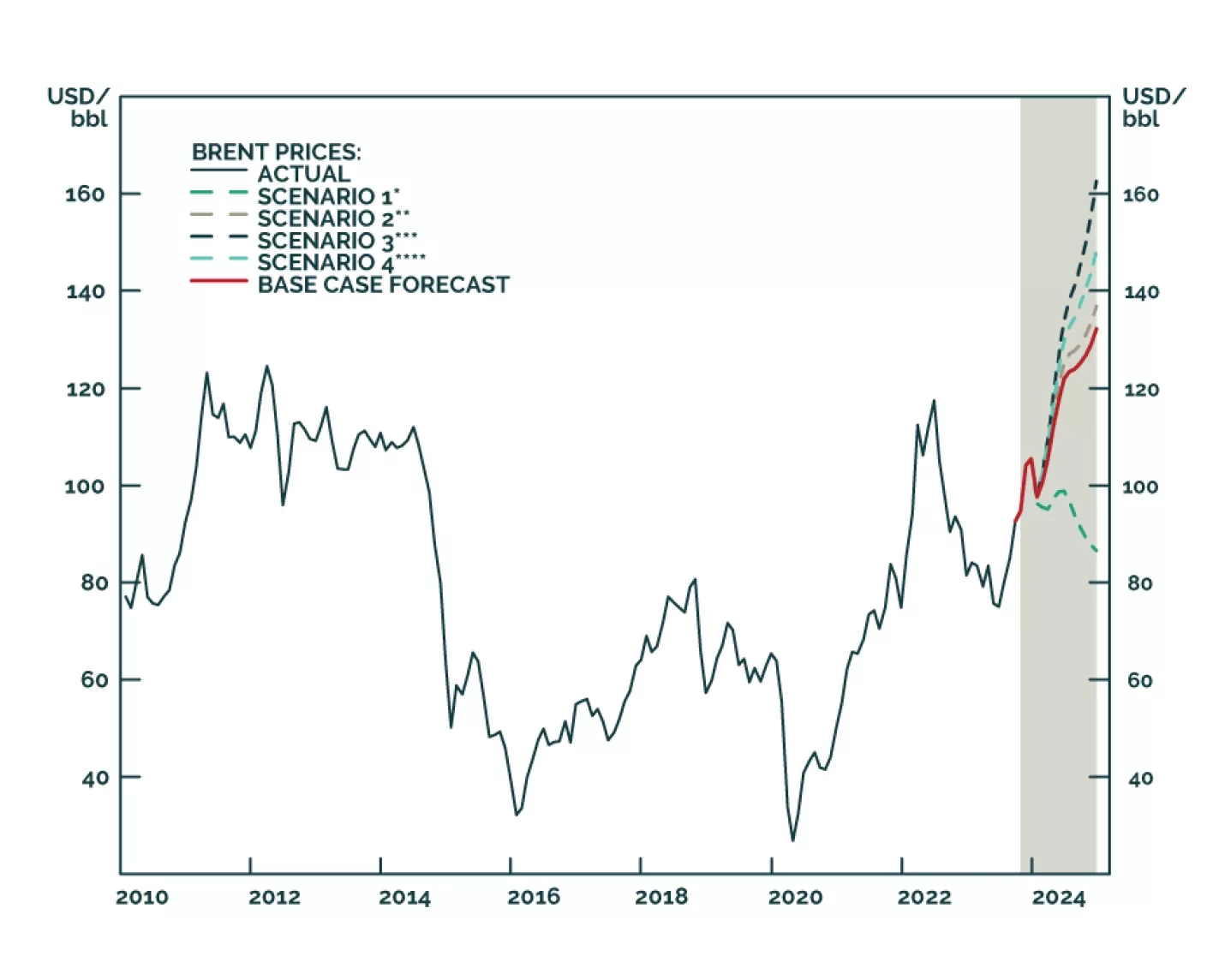

The US and core OPEC 2.0 are – wittingly or not – laying the groundwork for a price band with a floor and cap on oil prices – at $79/bbl and $130/bbl, respectively – “at least” to May 2024. This accommodates multiple goals for both…

Despite higher uncertainty, our Brent price forecasts remain unchanged at just over $101/bbl for 4Q23 and $118/bbl for next year. We remain long equity exposure to oil and gas producers via the XOP ETF, and commodity exposure via the…

Volatility will remain the key dynamic in oil markets in the aftermath of the surprise Hamas attacks against Israel on October 7. The risk of a major oil supply shock has gone up, but meanwhile supply constraints will remain at…

Investors should underweight global equities and risk assets; overweight US stocks relative to global; and overweight defensive sectors versus cyclicals.

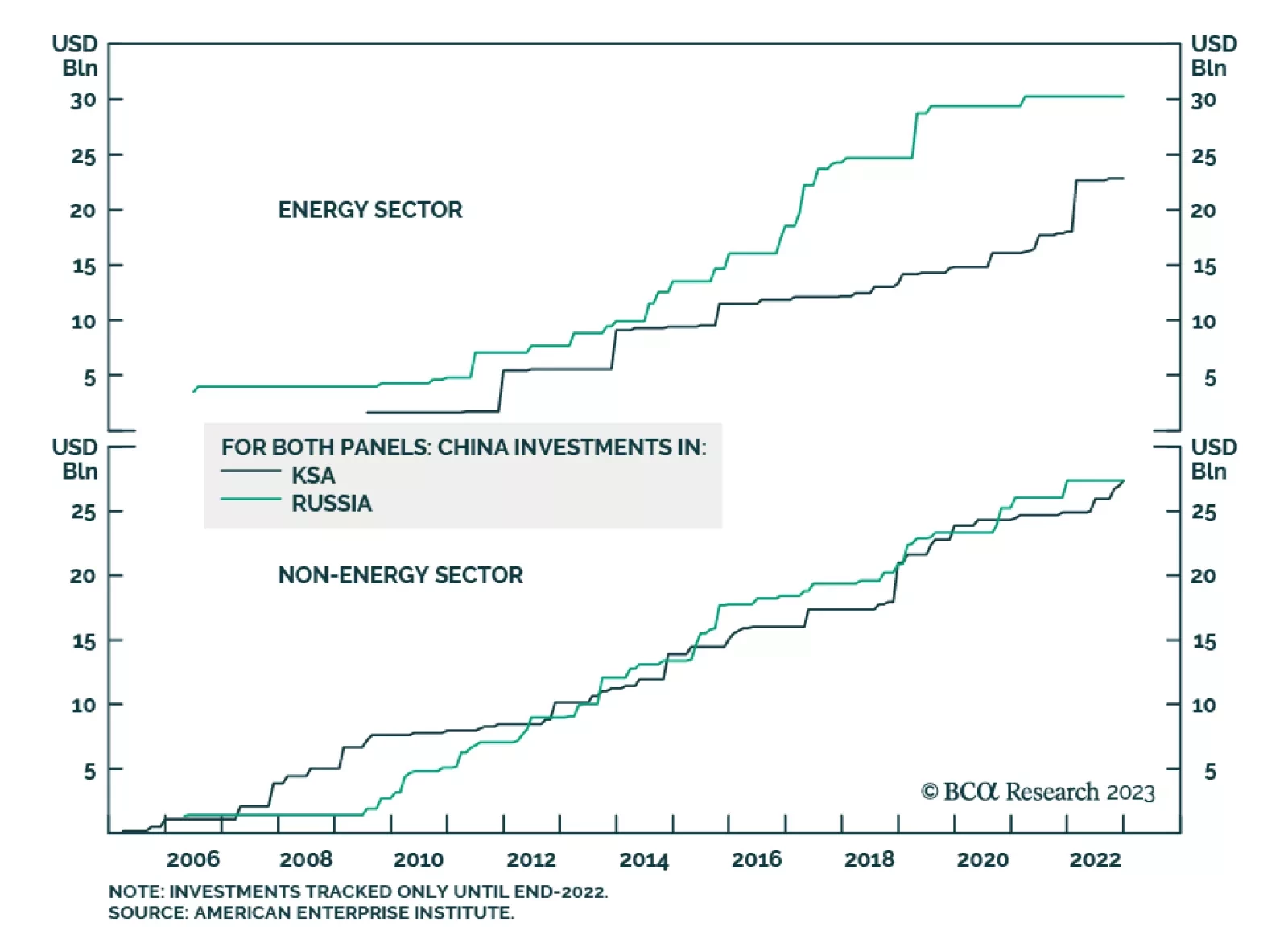

Gulf Cooperation Council (GCC) oil producers stand the most to gain following the failed coup against the administration of Russian President Vladimir Putin. The biggest beneficiaries will be the Kingdom of Saudi Arabia (KSA…

China’s economic and diplomatic interests in the GCC region will expand, as will its military presence. Whether or not this stabilizes the region is yet to be determined, particularly if tensions in the South China Sea and other…