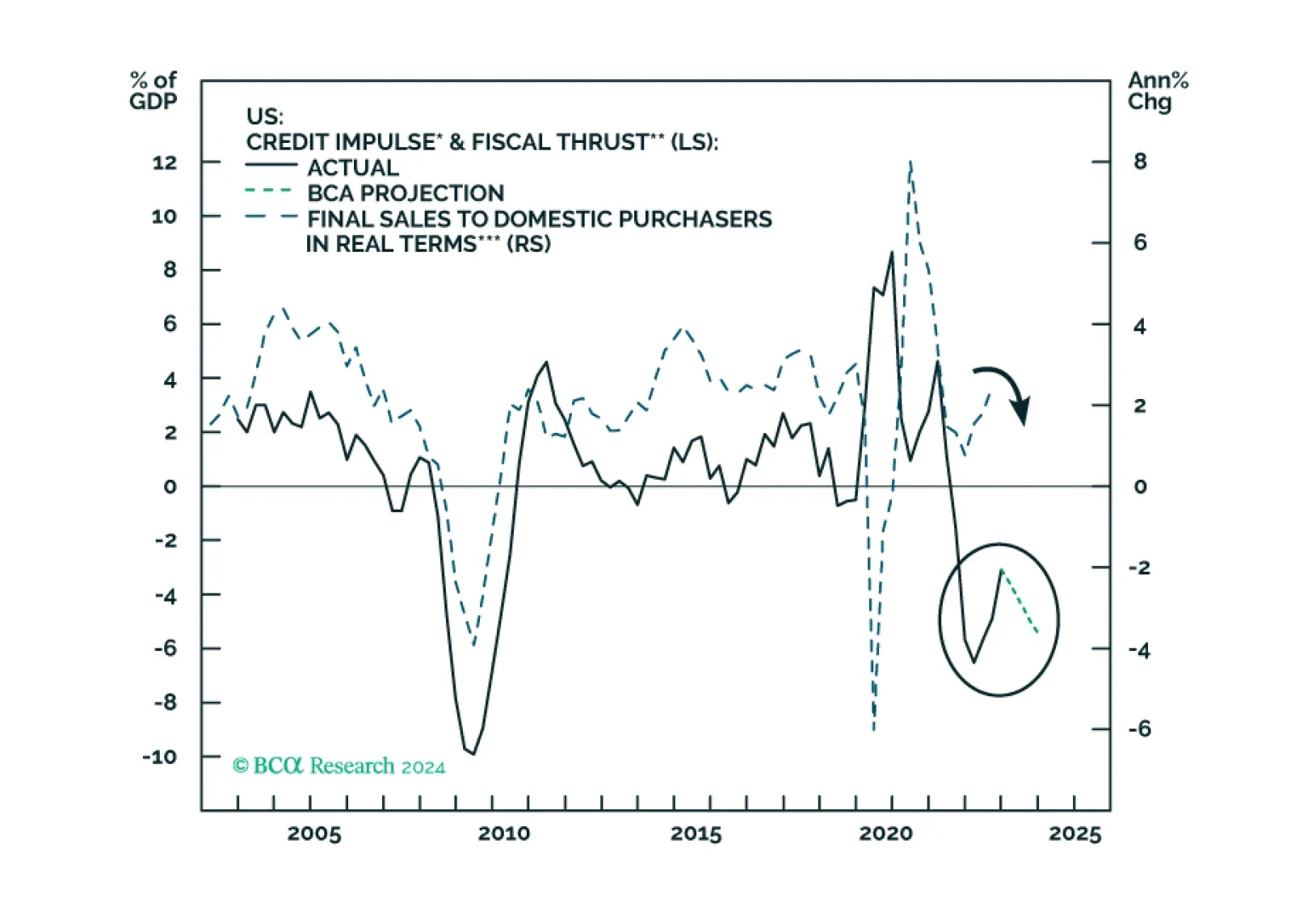

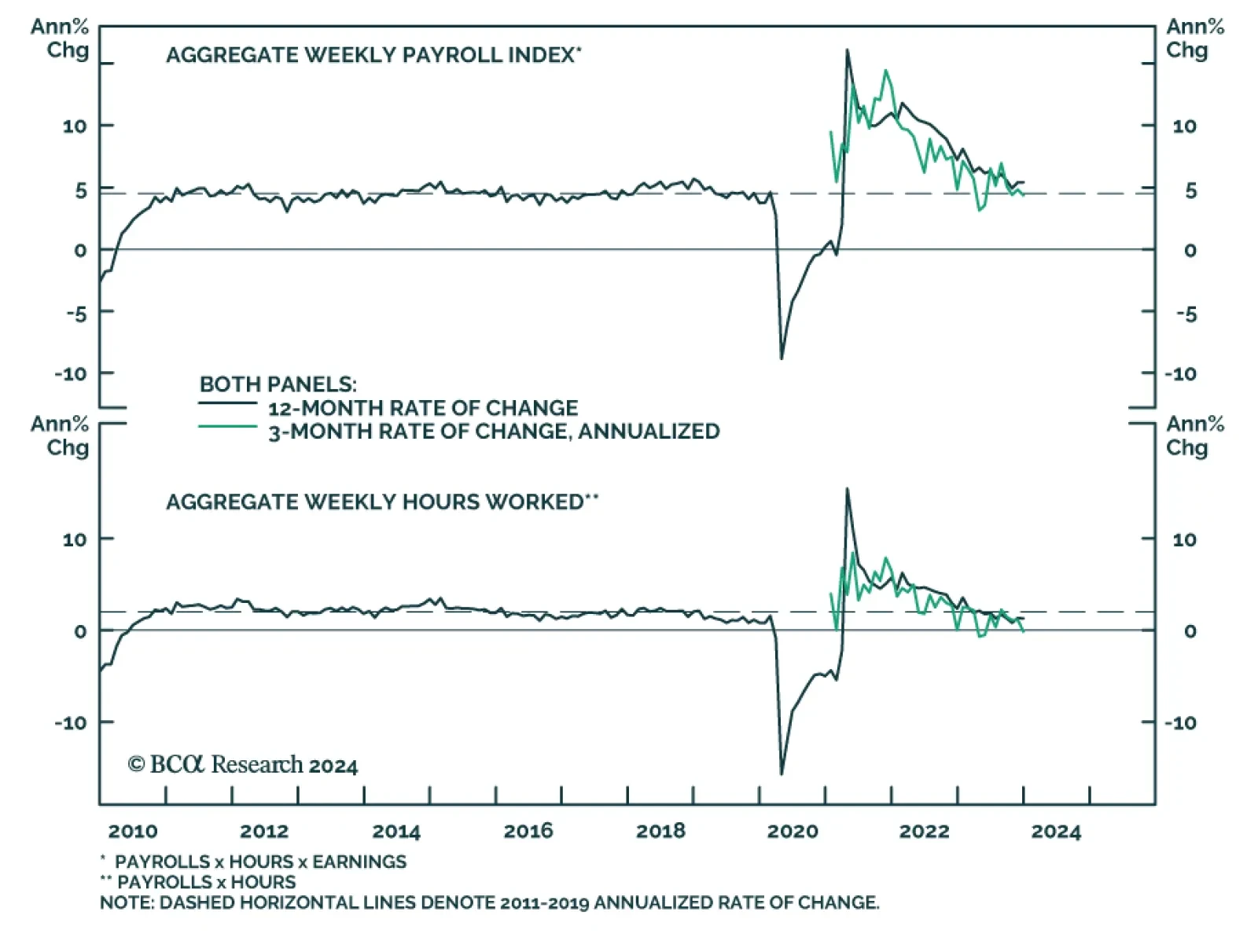

The combined US credit impulse and fiscal thrust indicator will likely relapse in 2024, heralding growth weakness. Stalling US sales volume and falling inflation, combined with sticky labor costs, will herald a non-trivial profit…

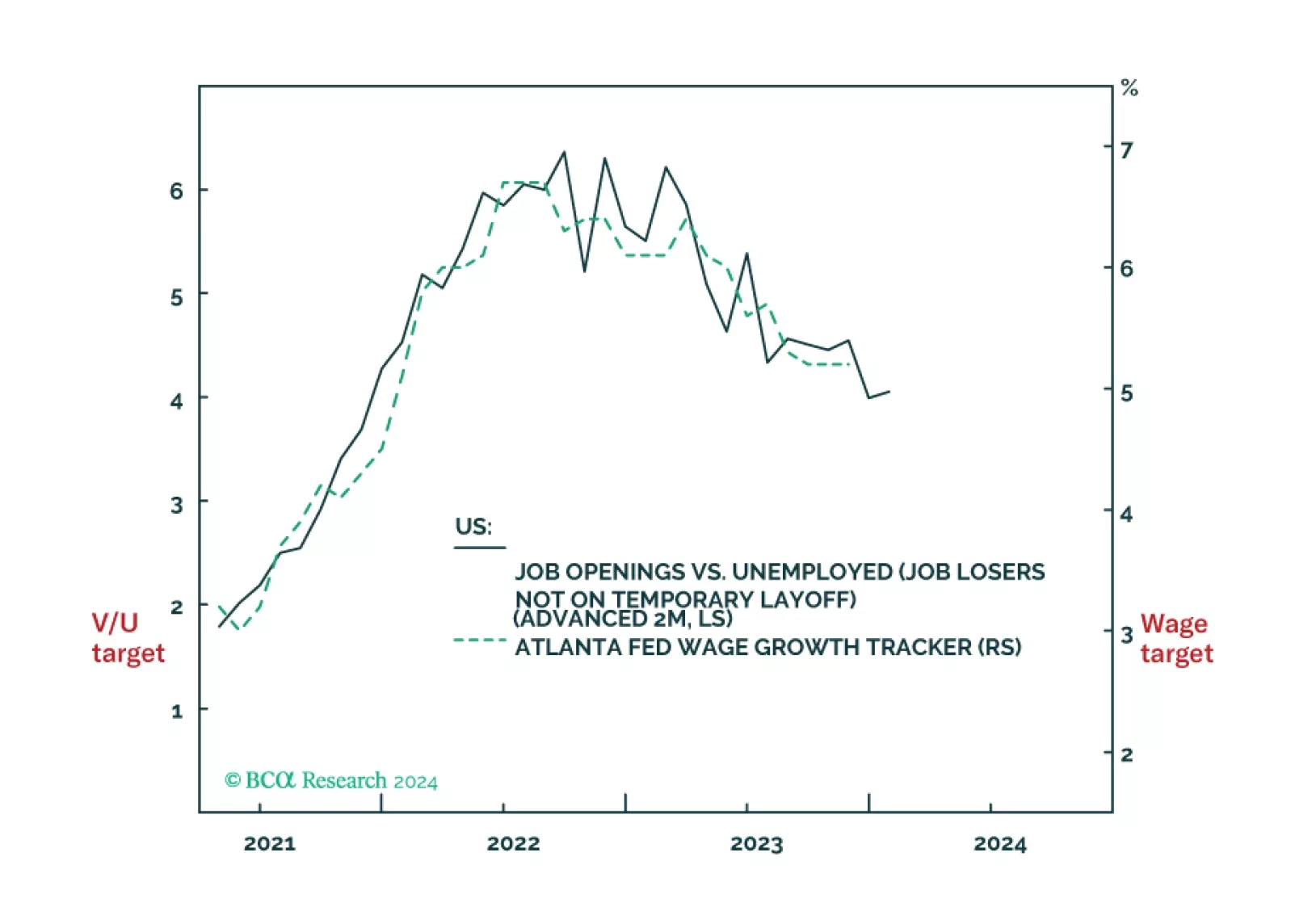

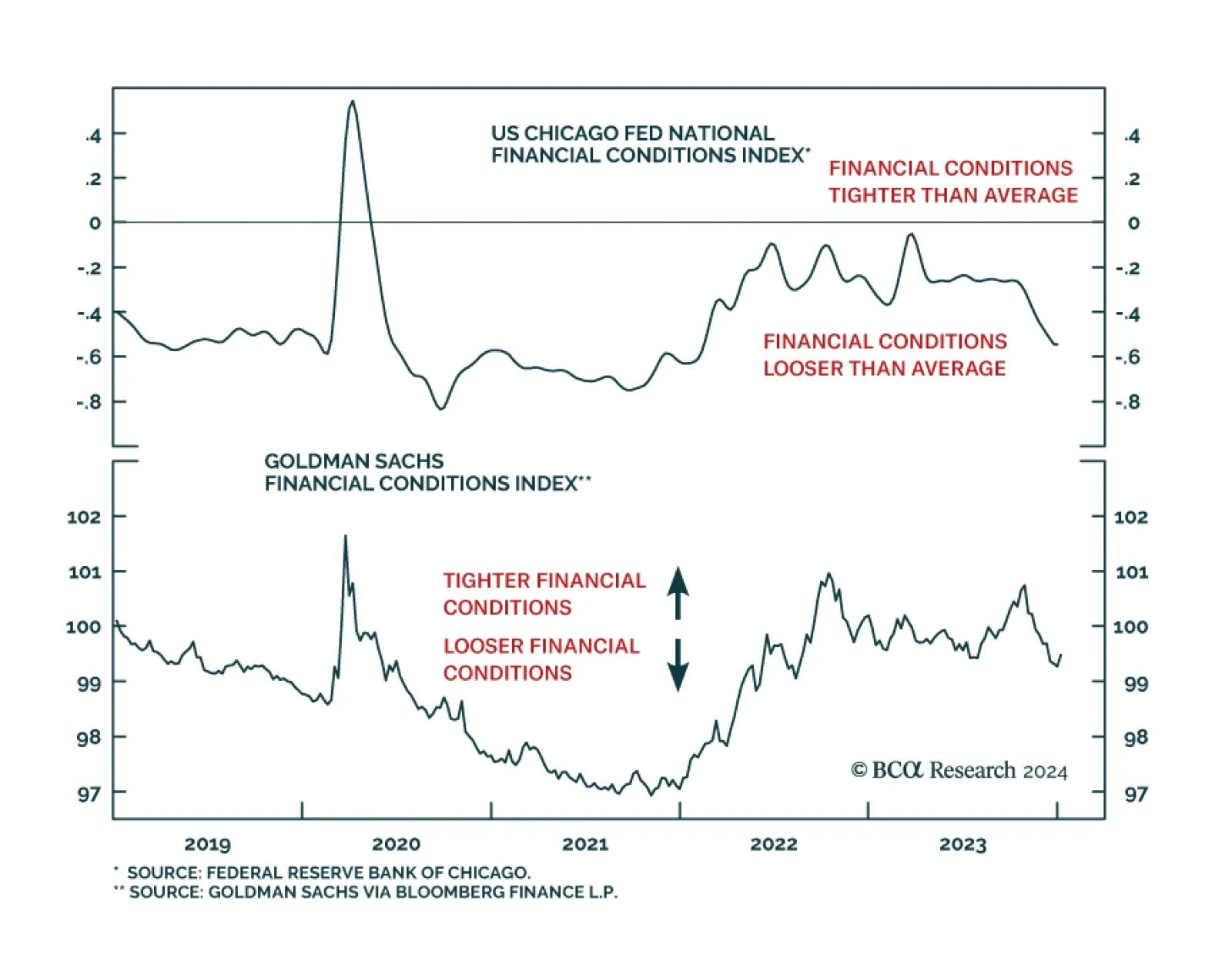

The Fed faces a dilemma. Cut rates early to avoid a recession, but at the risk of not slaying wage inflation. Or, not cut rates early to ensure that wage inflation is slayed, but at the risk of a downturn. Faced with such a dilemma,…

BCA Research’s US Bond Strategy service recommends investors keep portfolio duration close to benchmark for now. They will increase rate exposure as the labor market downturn worsens. Treasury yields are up slightly to…

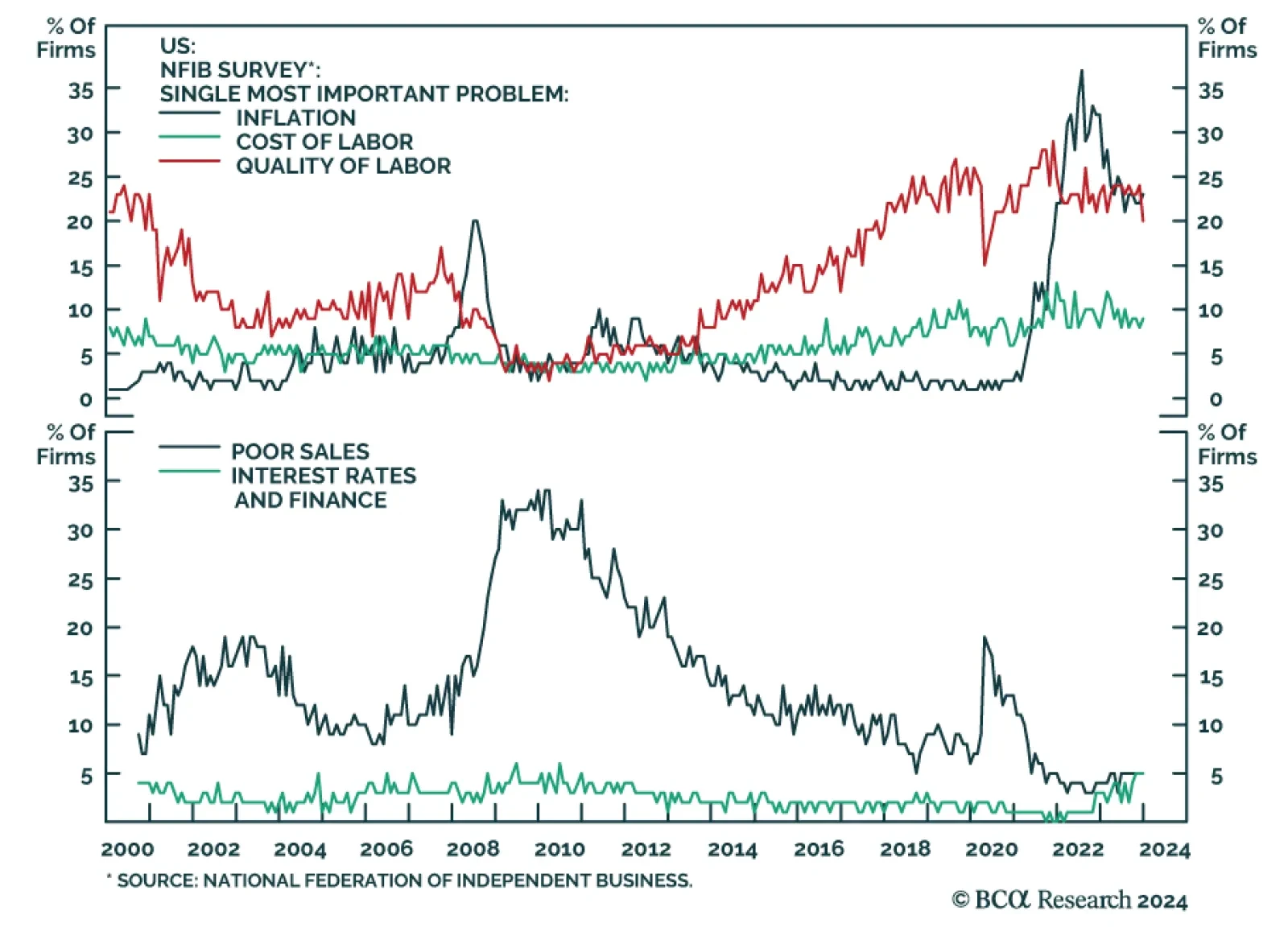

The NFIB Small Business Optimism Index delivered a slight positive surprise on Tuesday. The index rose 1.3 points to a five-month high of 91.9 in December and beat consensus expectations of 91.0. However, the contents of the…

The market’s pricing of a soft landing means that geopolitical risks are becoming more, not less, relevant in 2024. US domestic divisions will invite challenges as foreign powers rightly fear that US policy will turn more hawkish…

The S&P 500 has started off the new year on a weak footing, dropping by 1.5% in the first week of January. Indeed, by the end of 2023, several indicators were warning that conditions were becoming bearish. In…

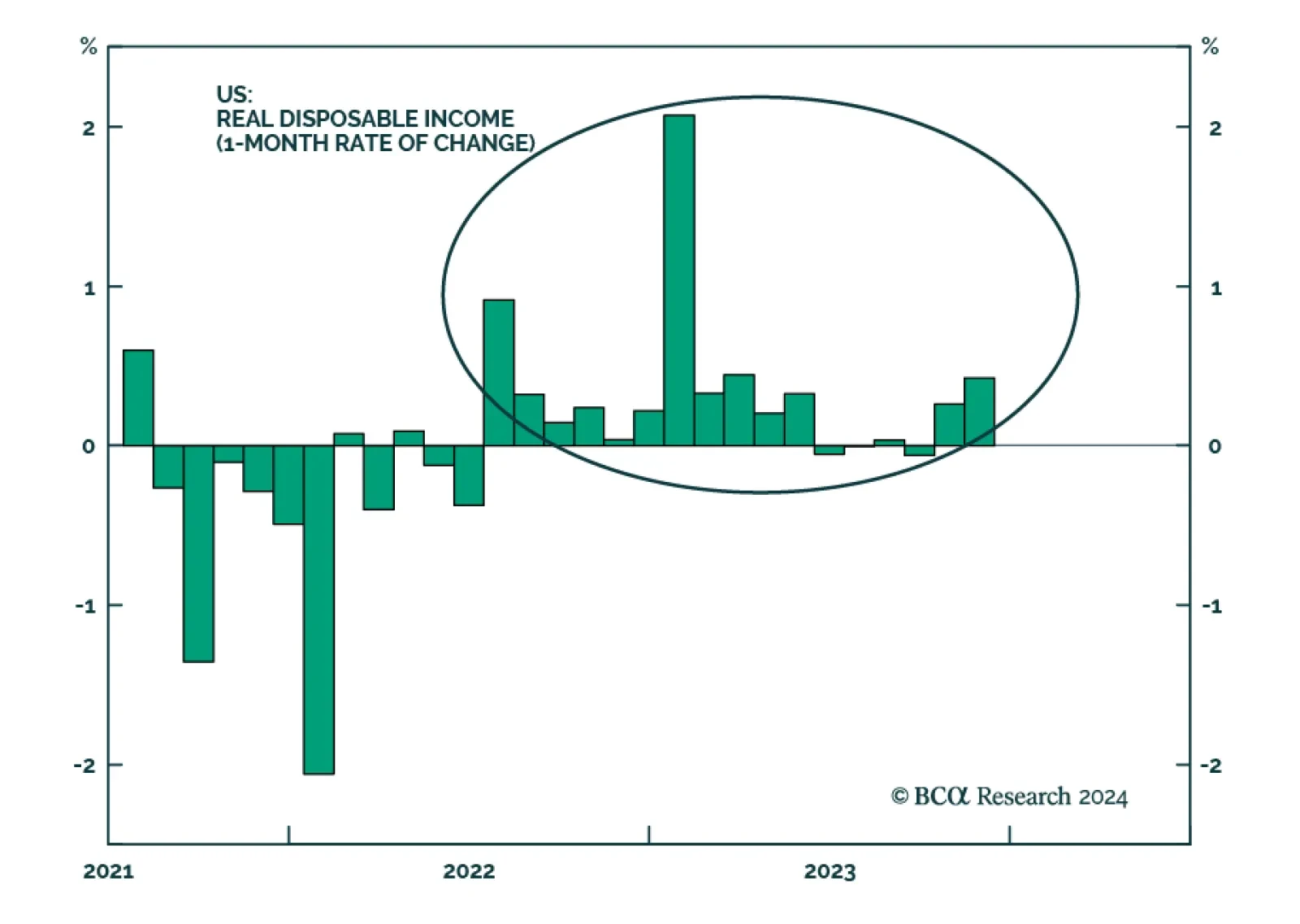

Growth in US disposable income has outpaced inflation nearly every month since mid-2022. Consumption is principally driven by income, but in the US it has gotten a meaningful assist the last two years from the drawdown of excess…

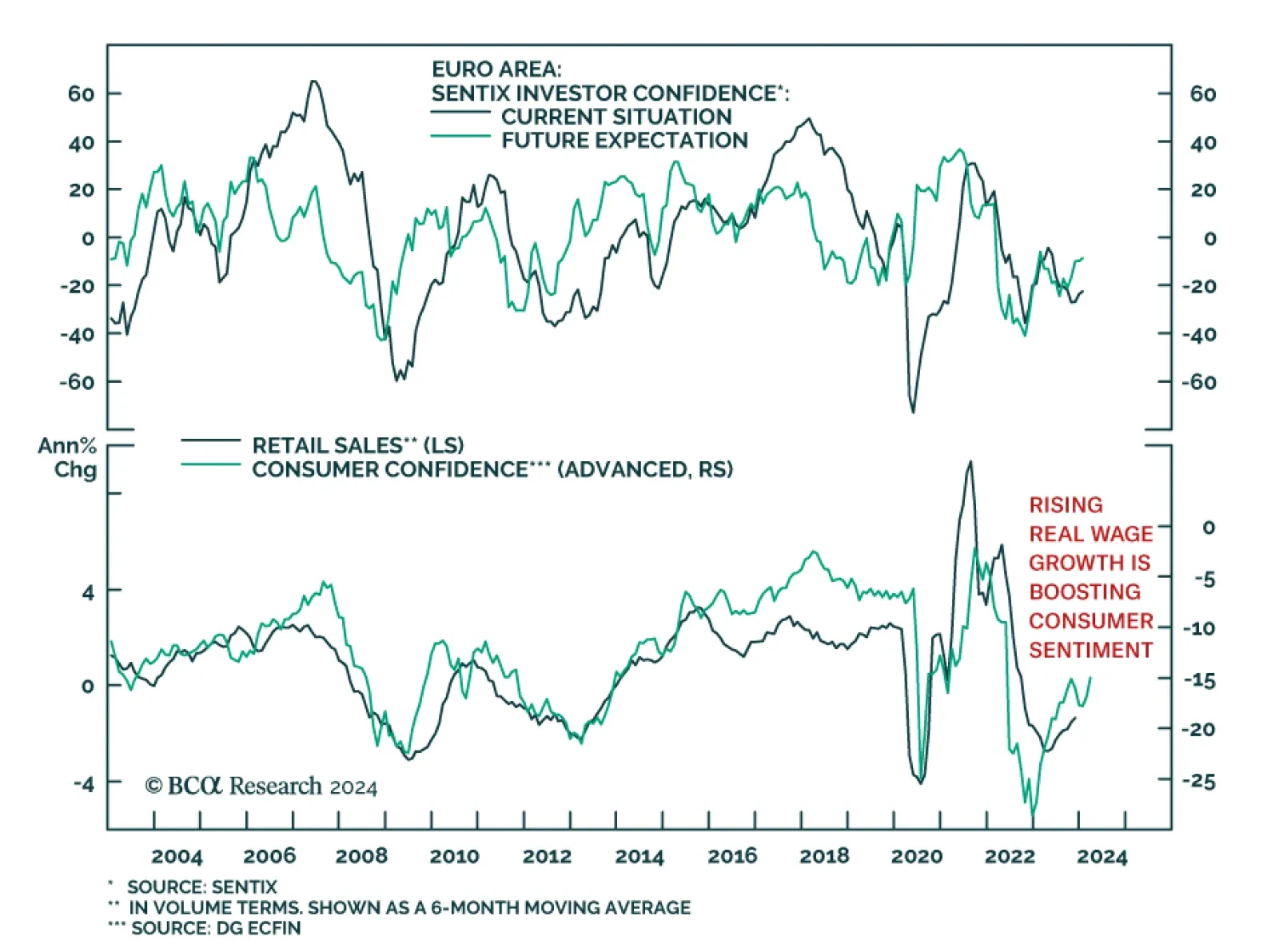

Optimism among investors and economic agents continues to improve in the Eurozone. The Sentix Economic Index for the Eurozone rose from -16.8 to -15.8 in January – in line with consensus expectations and marking the third…

According to BCA Research’s Global Investment Strategy service, the risk of a second inflation wave has gone up. Until last December’s FOMC meeting, the team’s bias was to think that the Fed would cut rates…

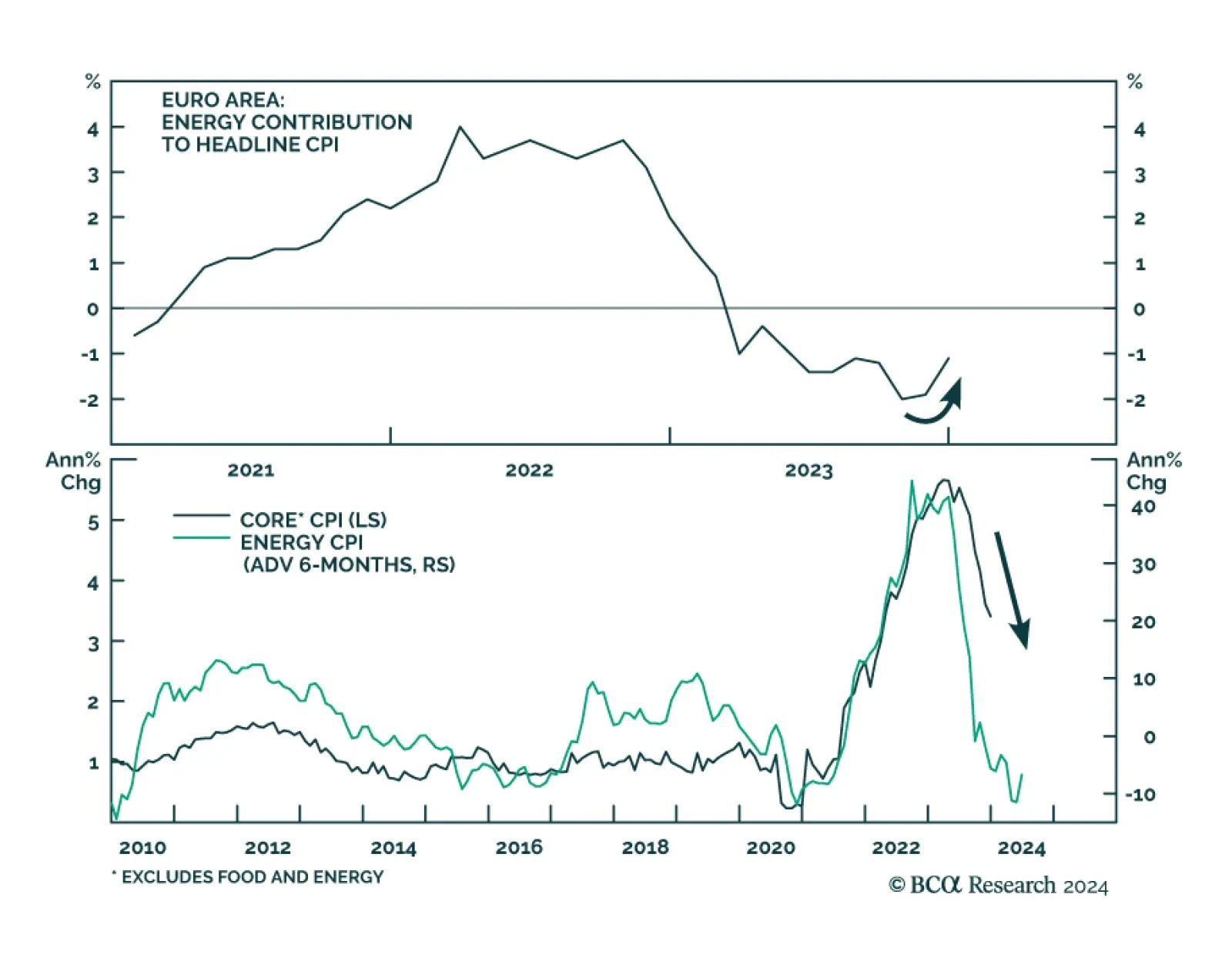

Friday’s Eurozone CPI inflation report was in line with consensus estimates. Headline inflation reaccelerated from 2.4%y/y to 2.9%y/y in December, in part reflecting the impact of the end of energy subsidies in Germany and…