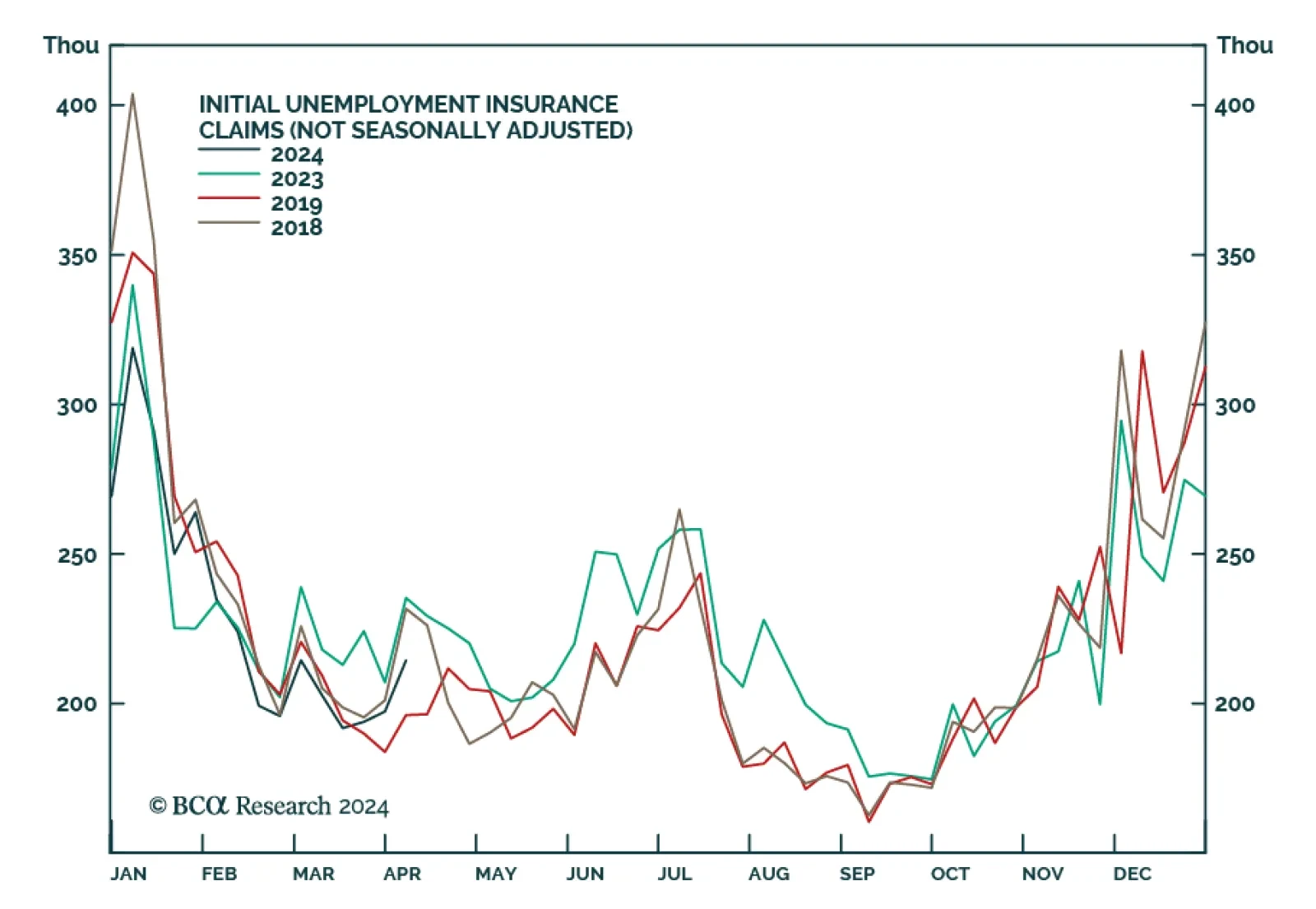

US Initial jobless claims declined from 222 thousand to 211 thousand in the week ending April 5, below expectations of a less pronounced decrease to 215 thousand. On a seasonally unadjusted basis, the number increased to 214…

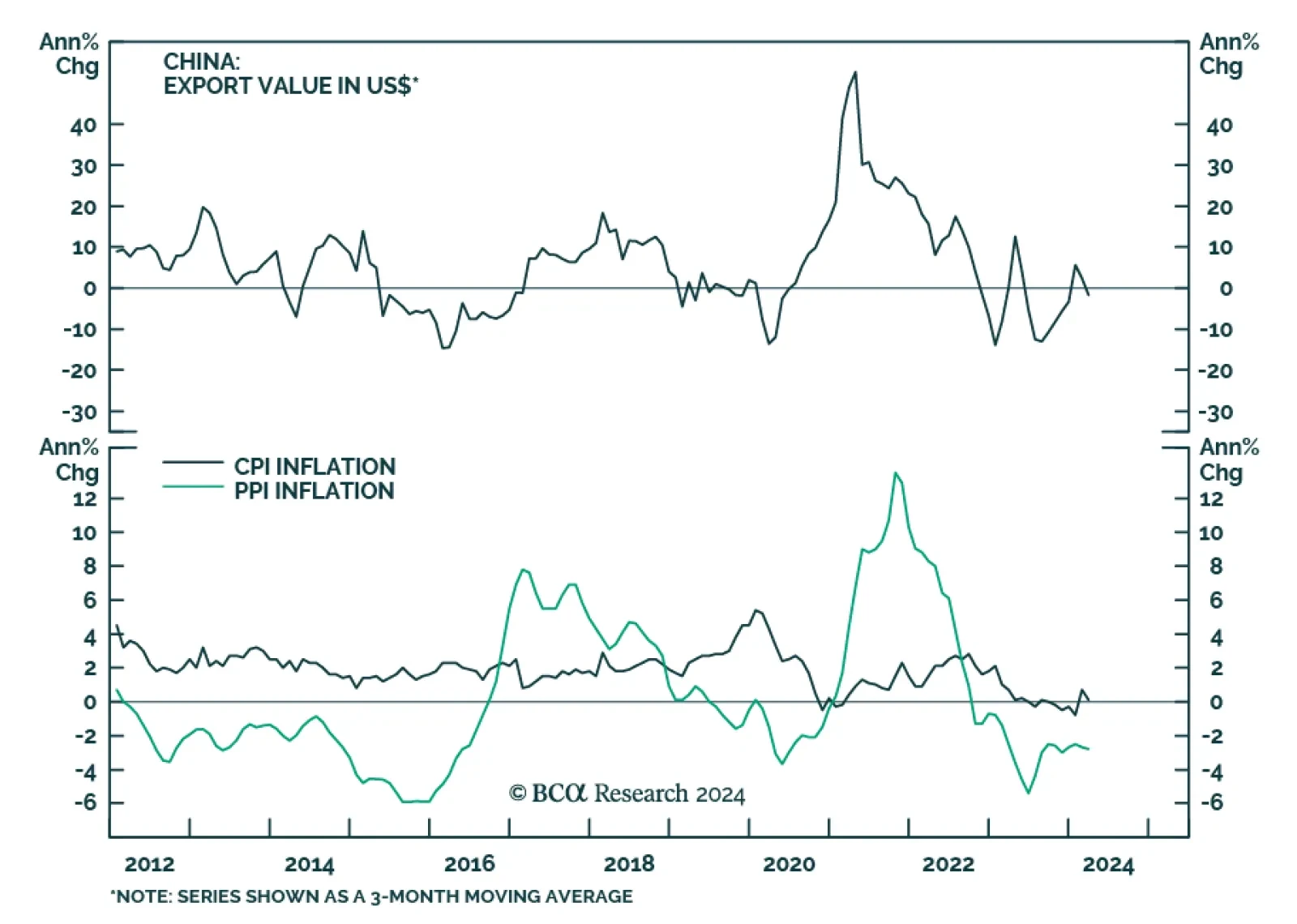

Chinese trade and credit data delivered a negative surprise for March. On the trade front, the 7.5% y/y drop in exports came in below expectations of a 1.9% y/y decline following four consecutive months of growth. While the jump…

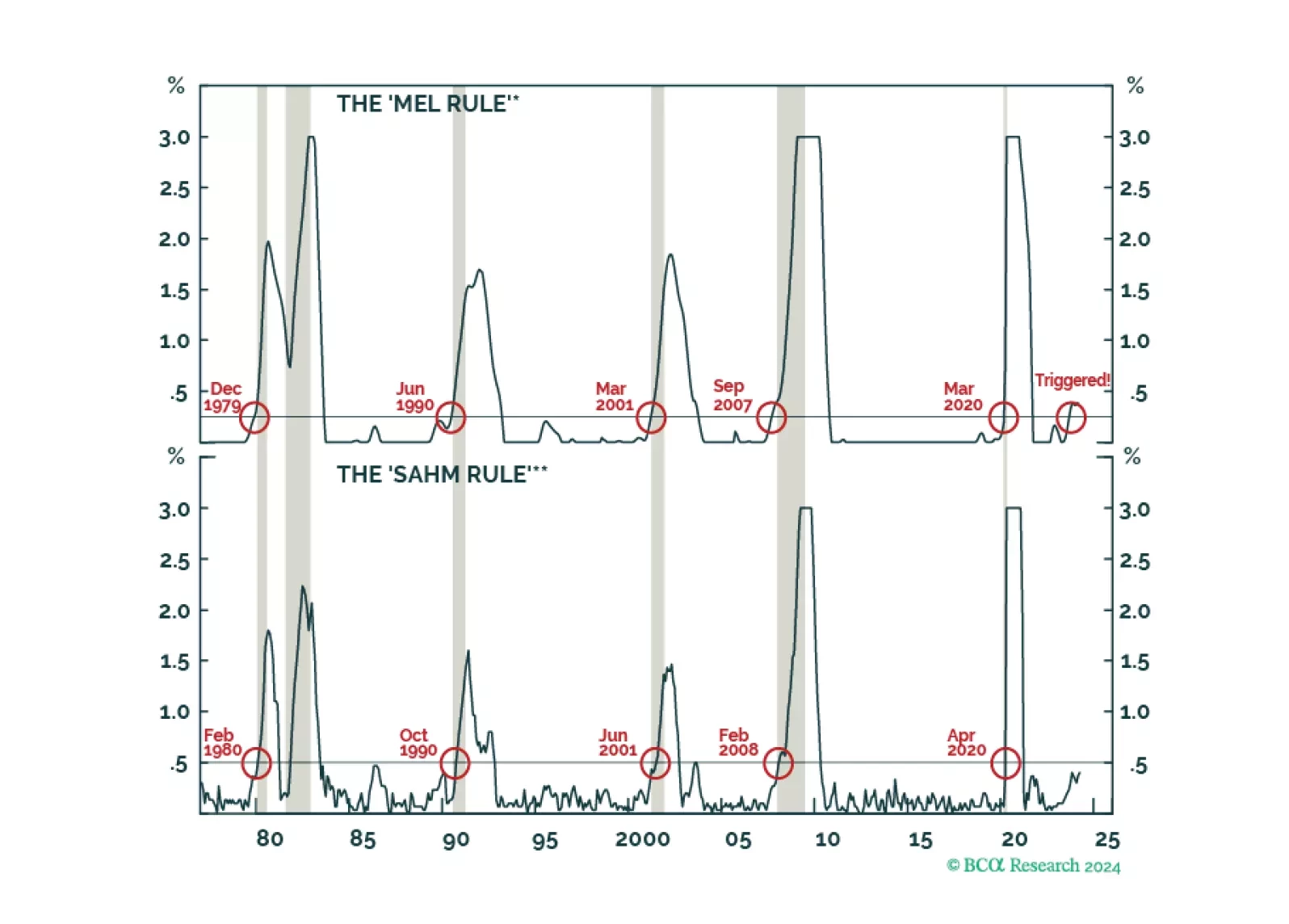

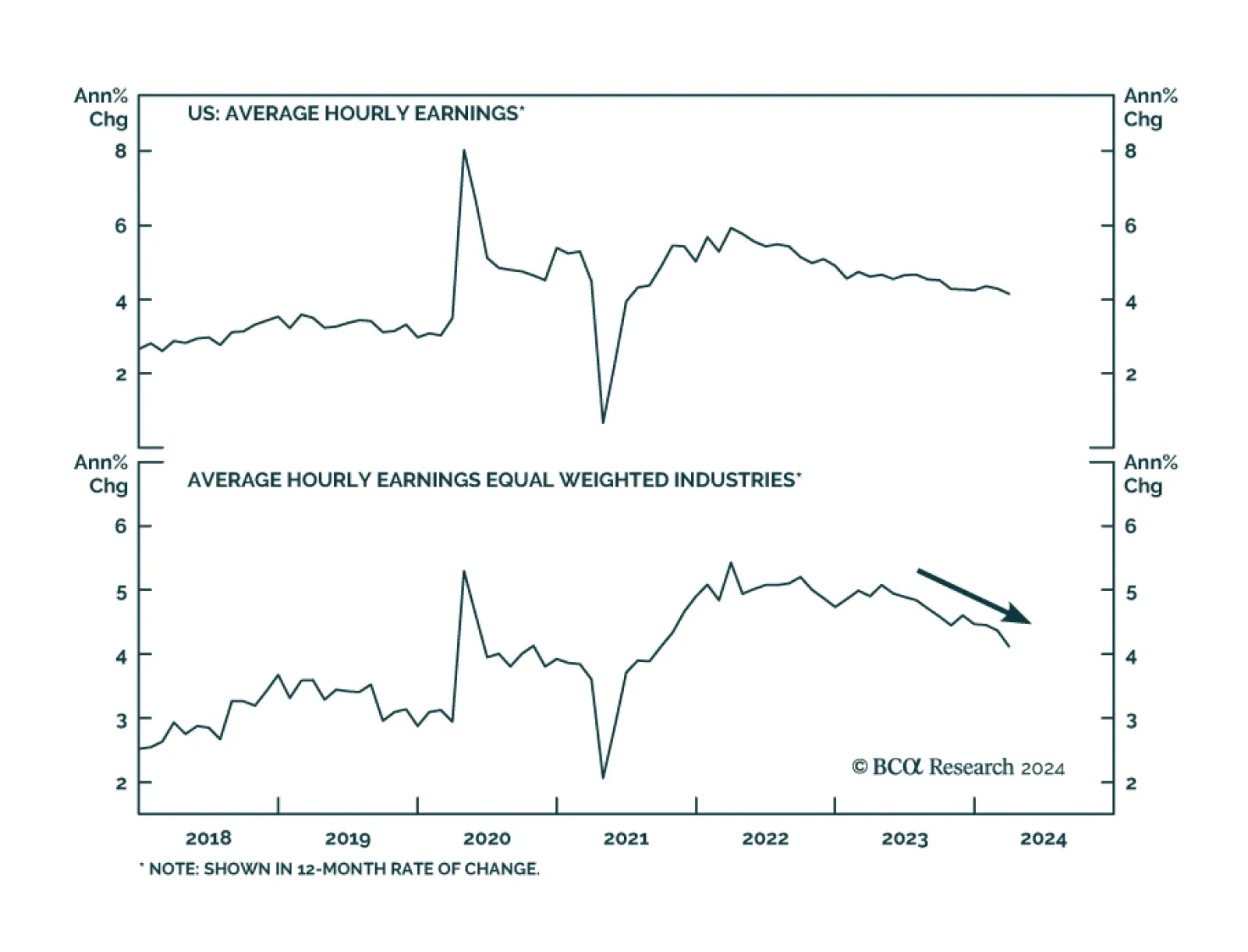

Contrary to conventional wisdom, most leading indicators suggest that the US labor market is weakening, including our very own “Mel rule.” After being overweight stocks last year, we moved to neutral at the start of 2024, and are now…

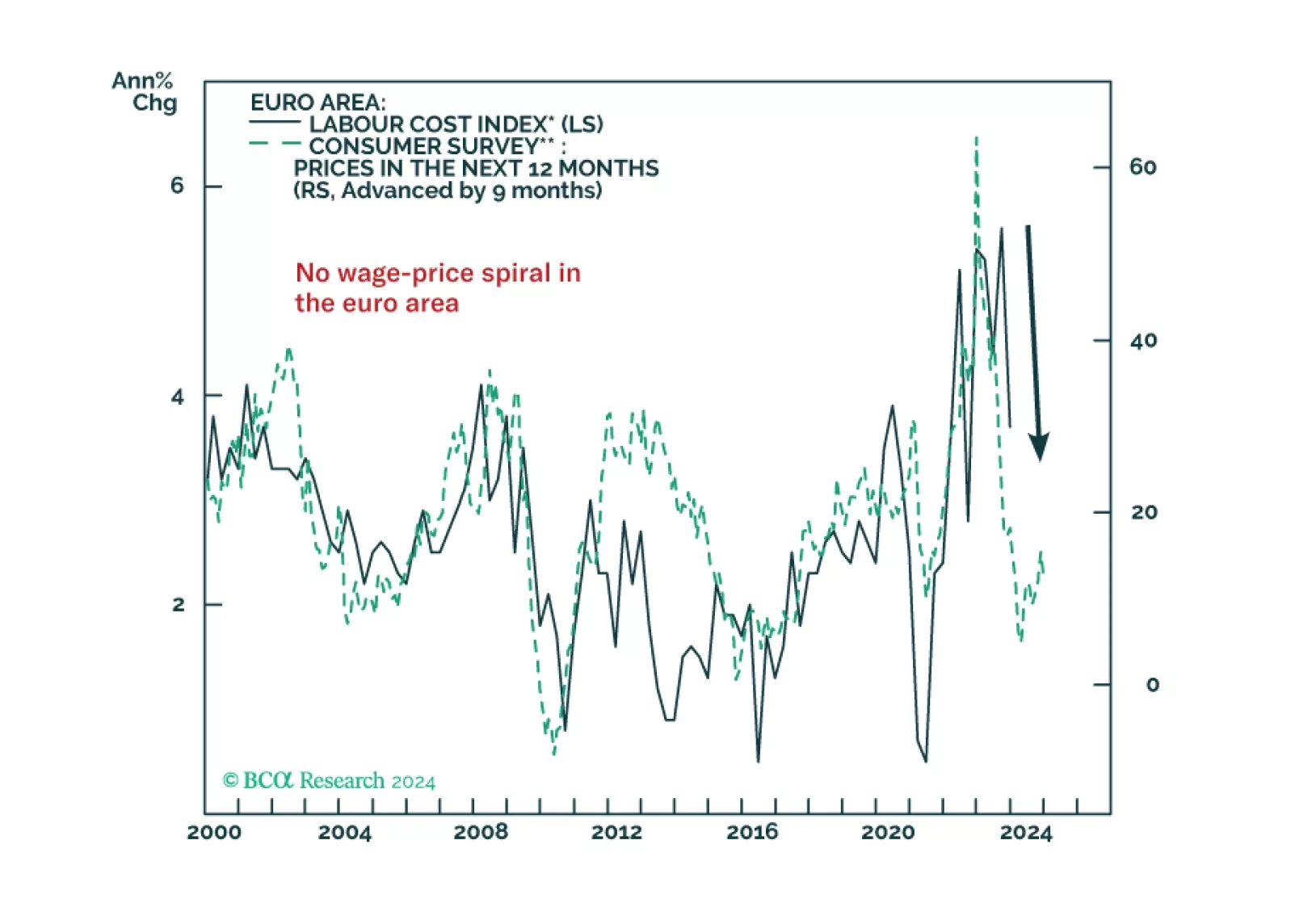

At today’s monetary policy meeting, the ECB gave strong hints that rate cuts will begin as soon as the next meeting in June. In this Insight, we share our thoughts on today’s meeting and discuss the implications for European bond…

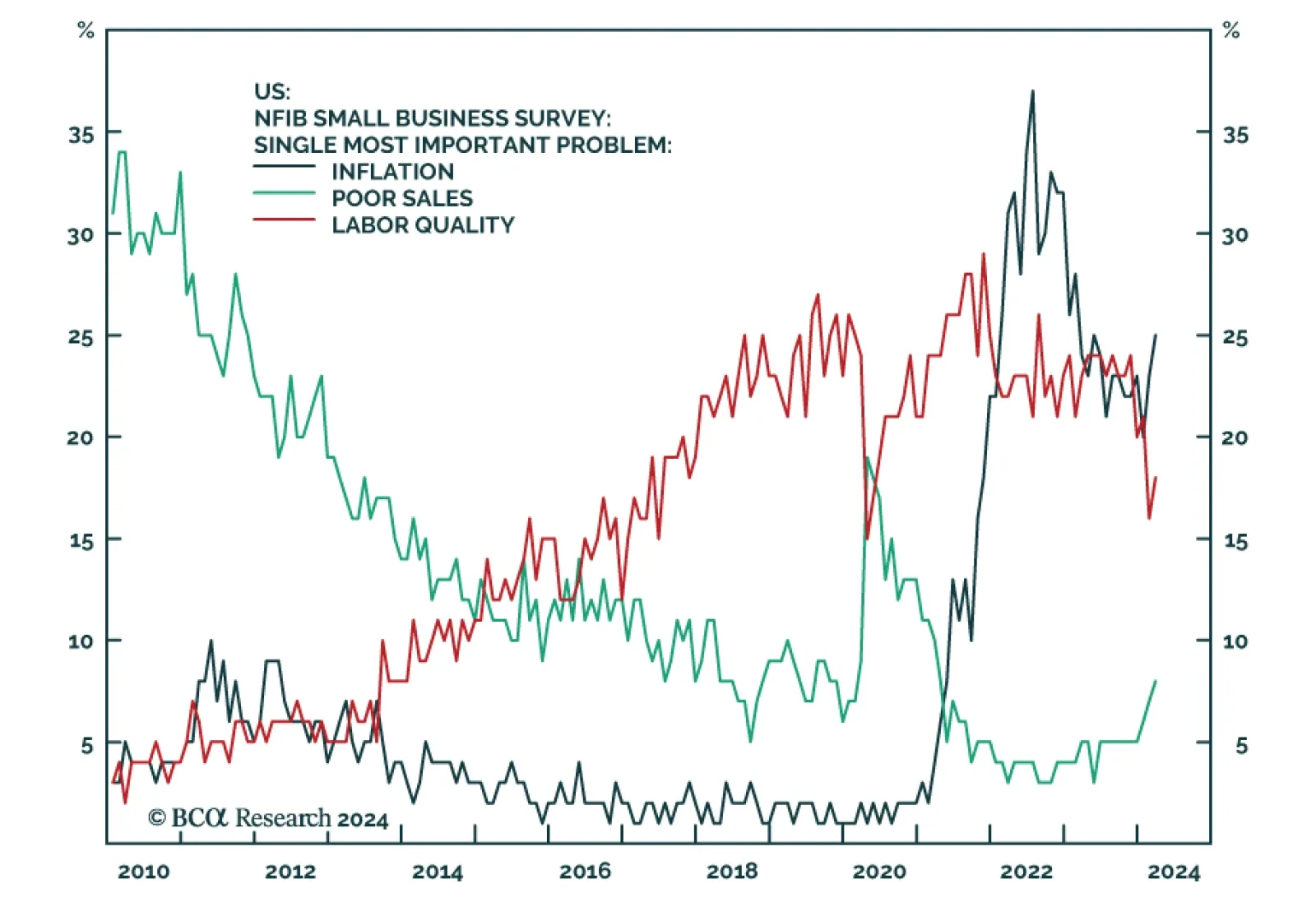

The NFIB’s small business optimism index decreased by 0.9 points to 88.5 in March, missing expectations of 89.9, and reaching its lowest level since 2012. A few things stood out from the report: Labor market…

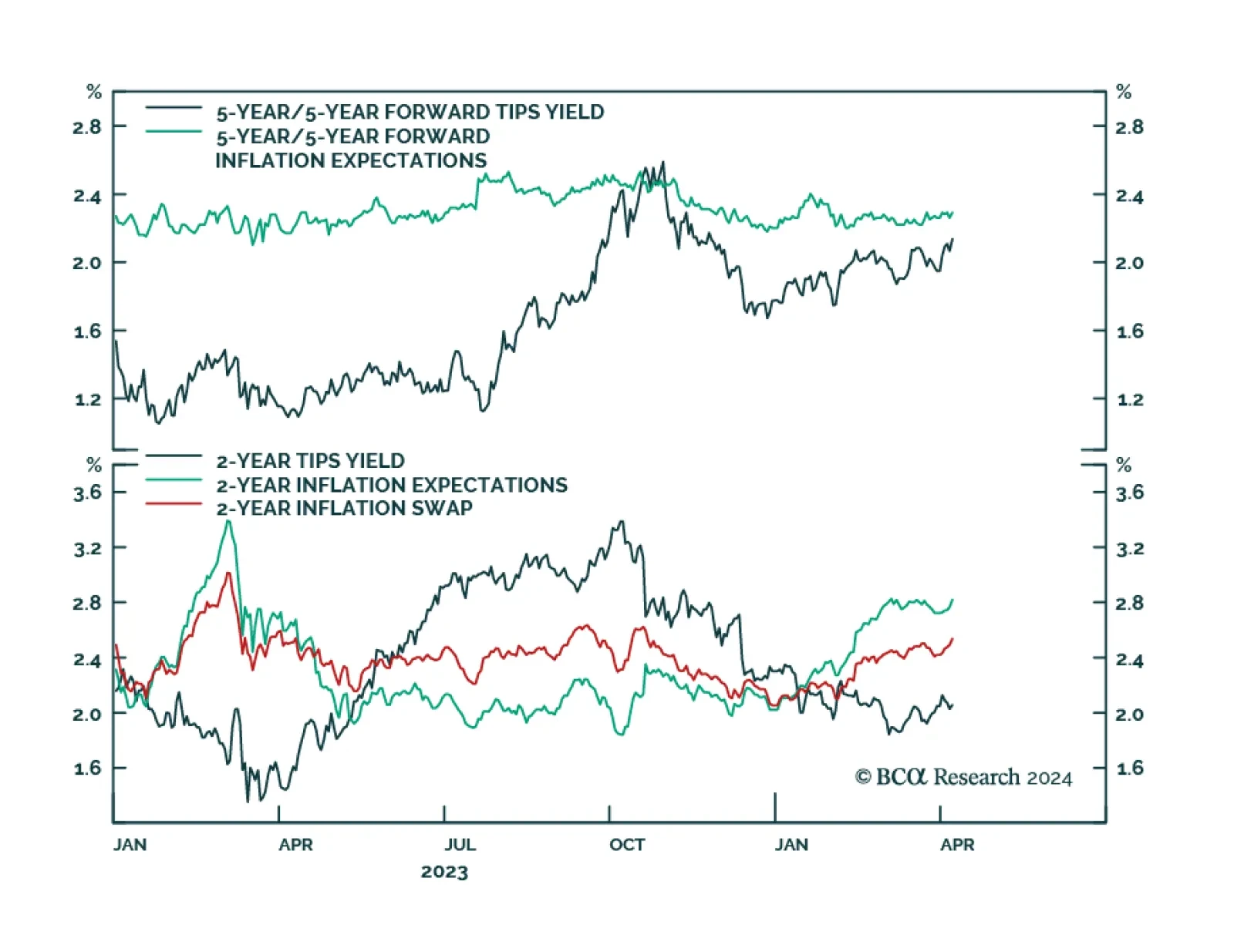

The recent rise in market-based inflation expectations has caught the attention of market participants. Some investors have begun to worry that the Federal Reserve might be losing control of its inflation mandate by cutting rates…

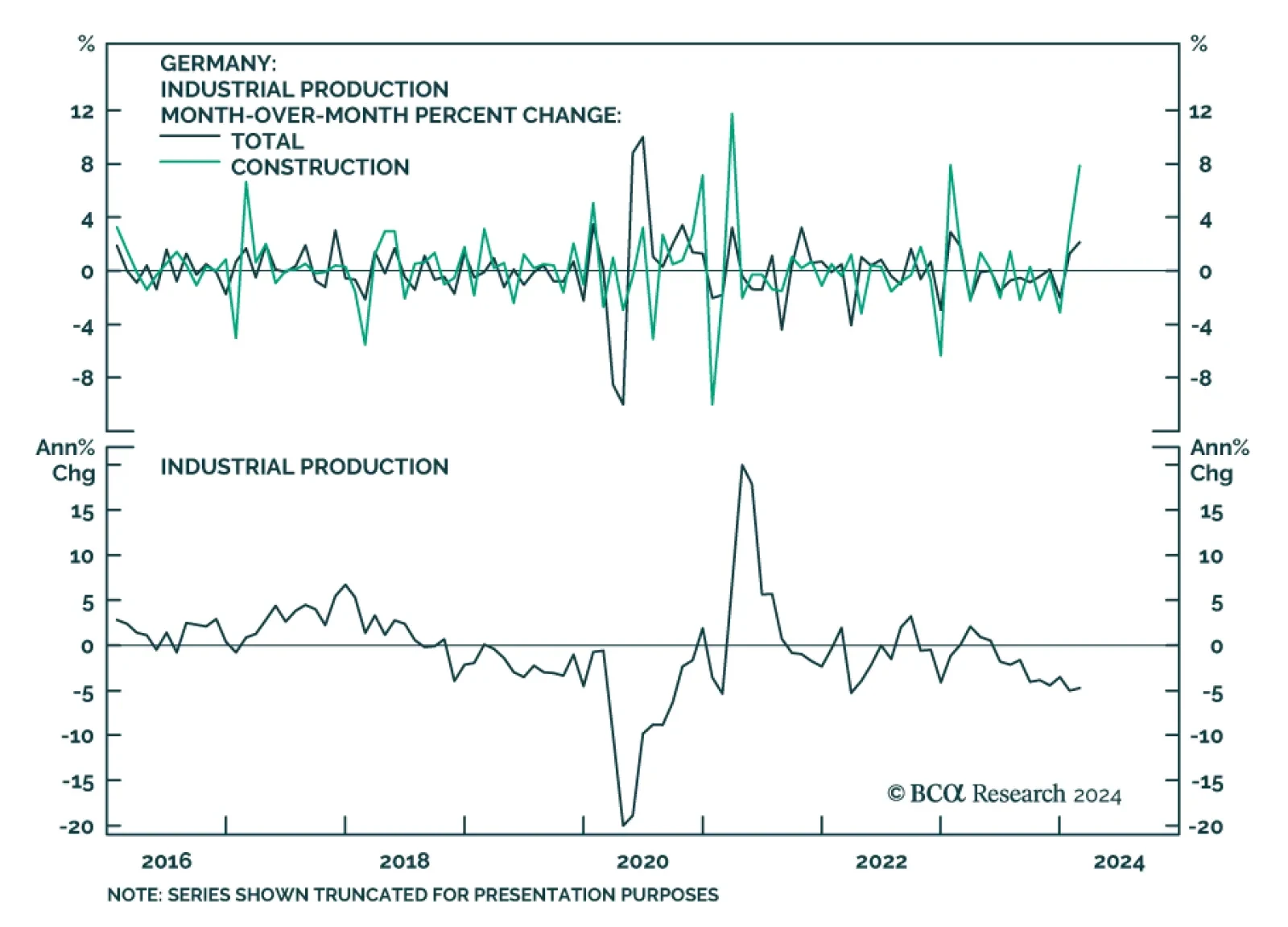

German industrial production growth accelerated from an upwardly revised 1.3% m/m to 2.1% m/m in February, registering the fastest pace in 13 months and largely beating expectations of a slowdown. A 7.9% m/m increase in the…

The 303-thousand increase in nonfarm payrolls in March came in well above consensus expectations of a moderation from 270 thousand to 214 thousand. Healthcare, the public sector and construction were the top contributors to…

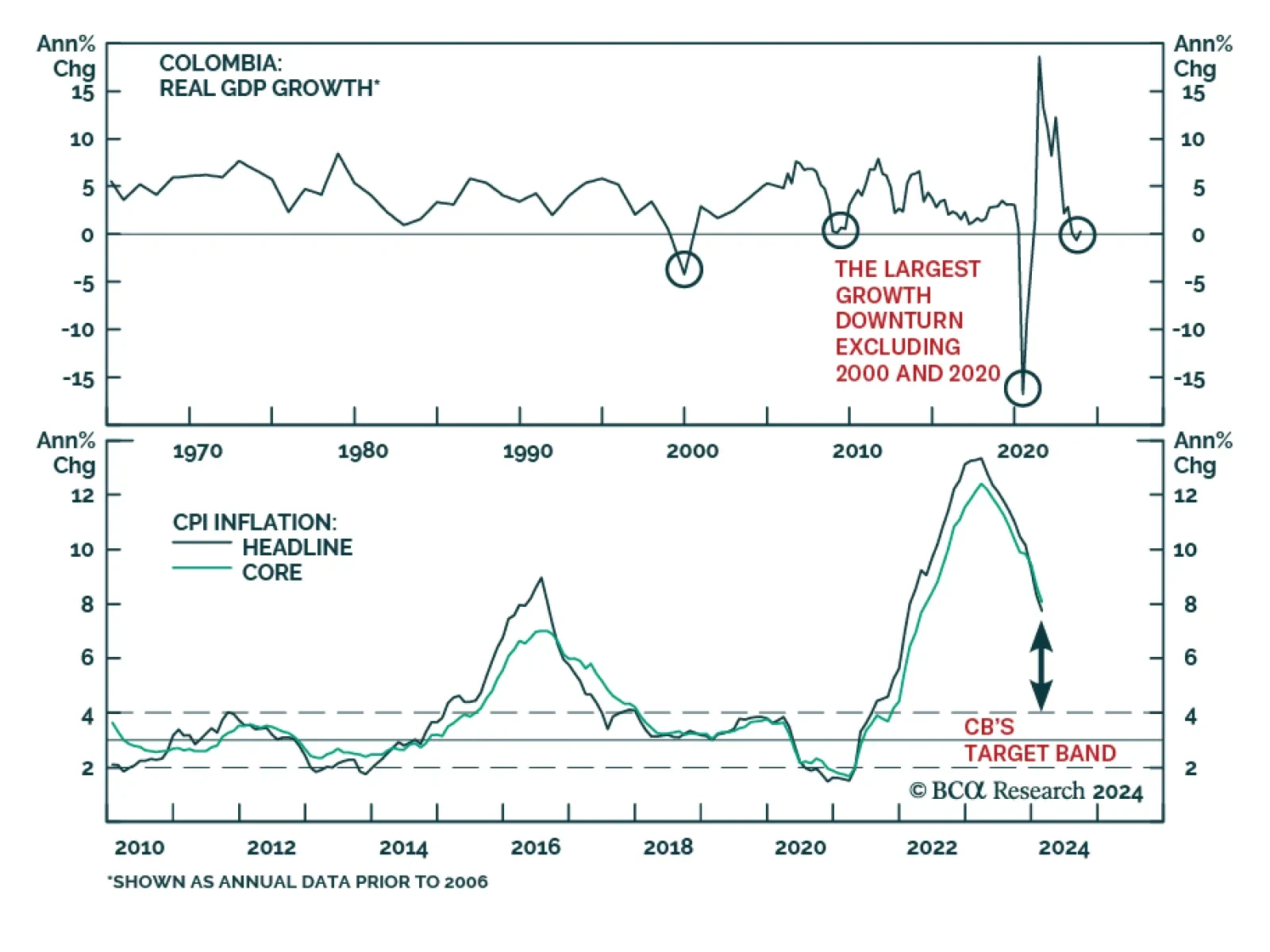

Colombia: Macroeconomic Fundamentals, Public Finances, And Political Uncertainty Warrant Underweight

BCA Research’s Emerging Markets Strategy service argues that Colombia has fallen from grace in terms of its healthy macroeconomic fundamentals, business-friendly government policies, and conservative fiscal stances.…

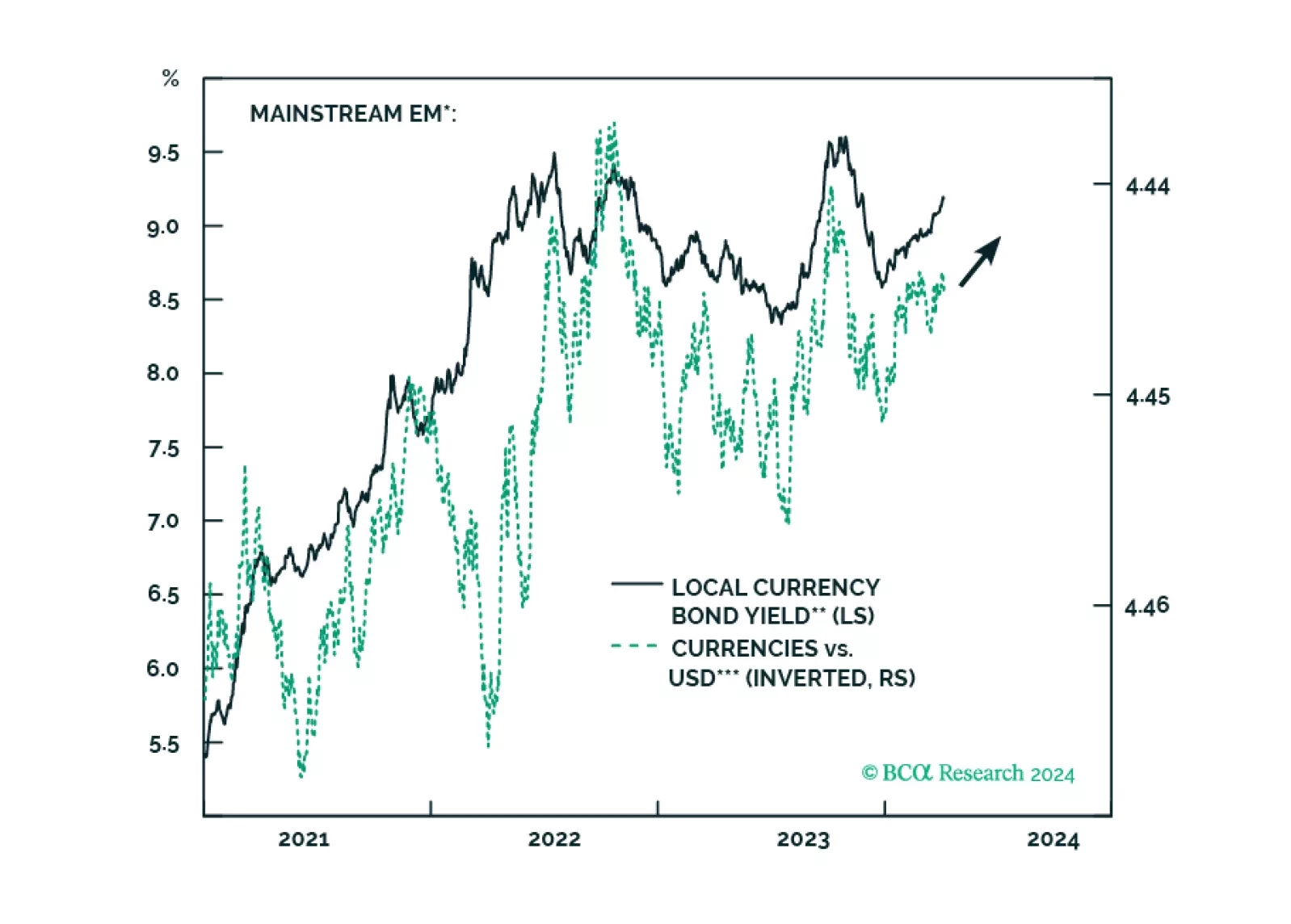

Climbing US bond yields, alongside higher oil prices, might spoil the party for global risk assets. There are budding cracks in EM domestic bonds, and even though we like this asset class in the long run, investors exposed to it…