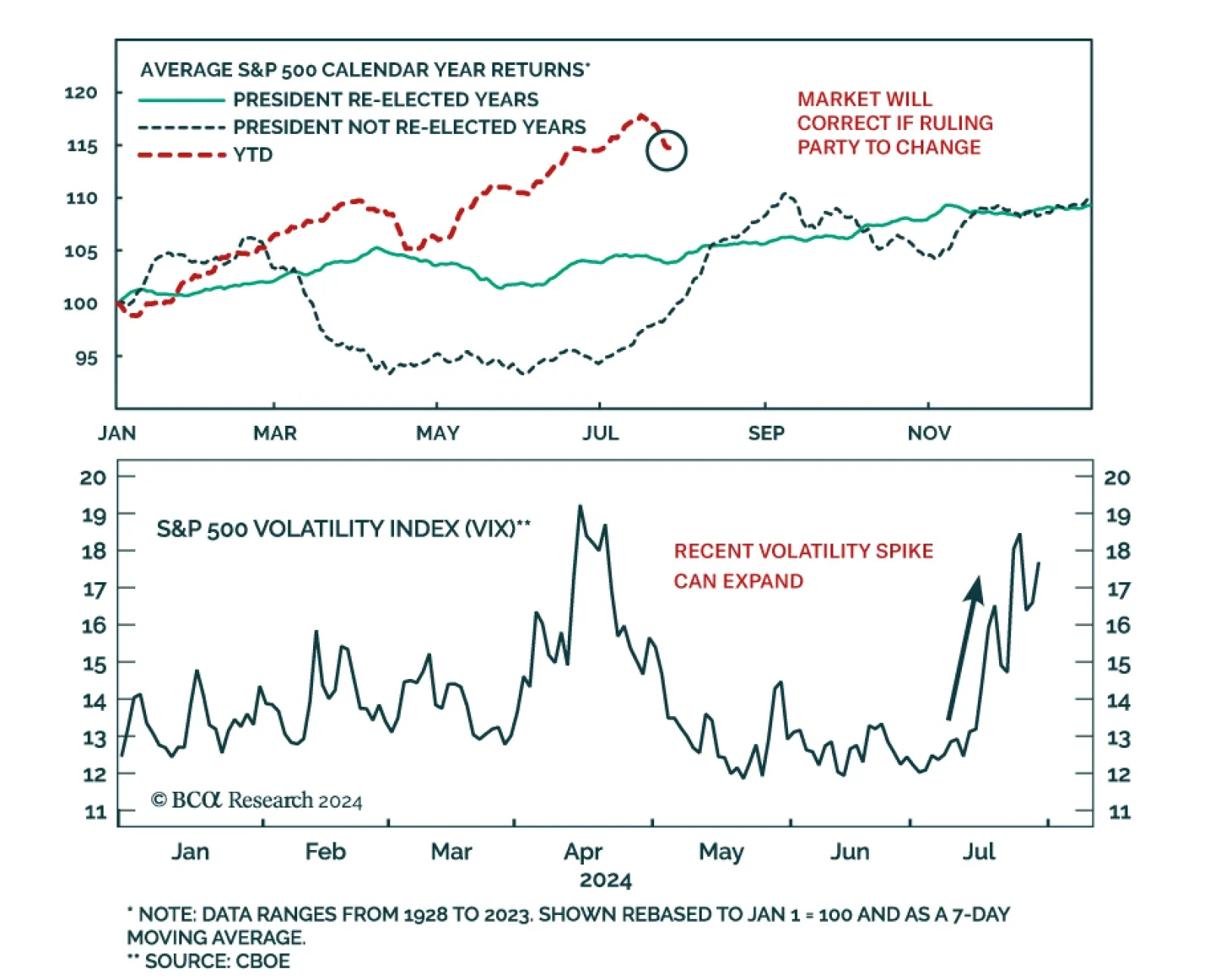

According to BCA Research’s US Equity Strategy service, the stock market outperformance in 2024 thus far is an unusual pattern in election years. The historical data imply that the market will suffer a spill if investors…

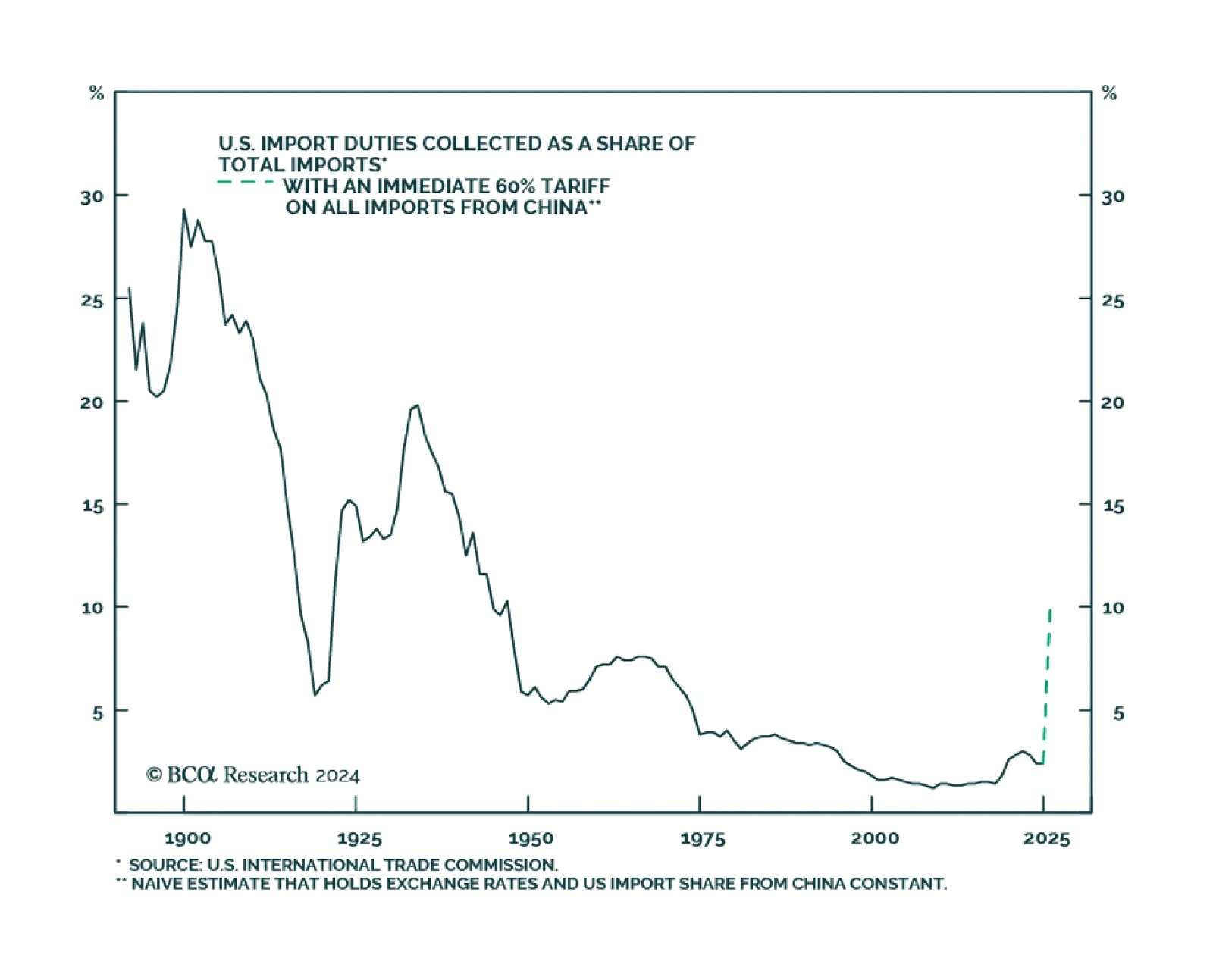

According to BCA Research’s Bank Credit Analyst service, trade policy under a second Trump presidency represents one of the greatest cyclical risks to investors. A key question for investors is whether tariffs are…

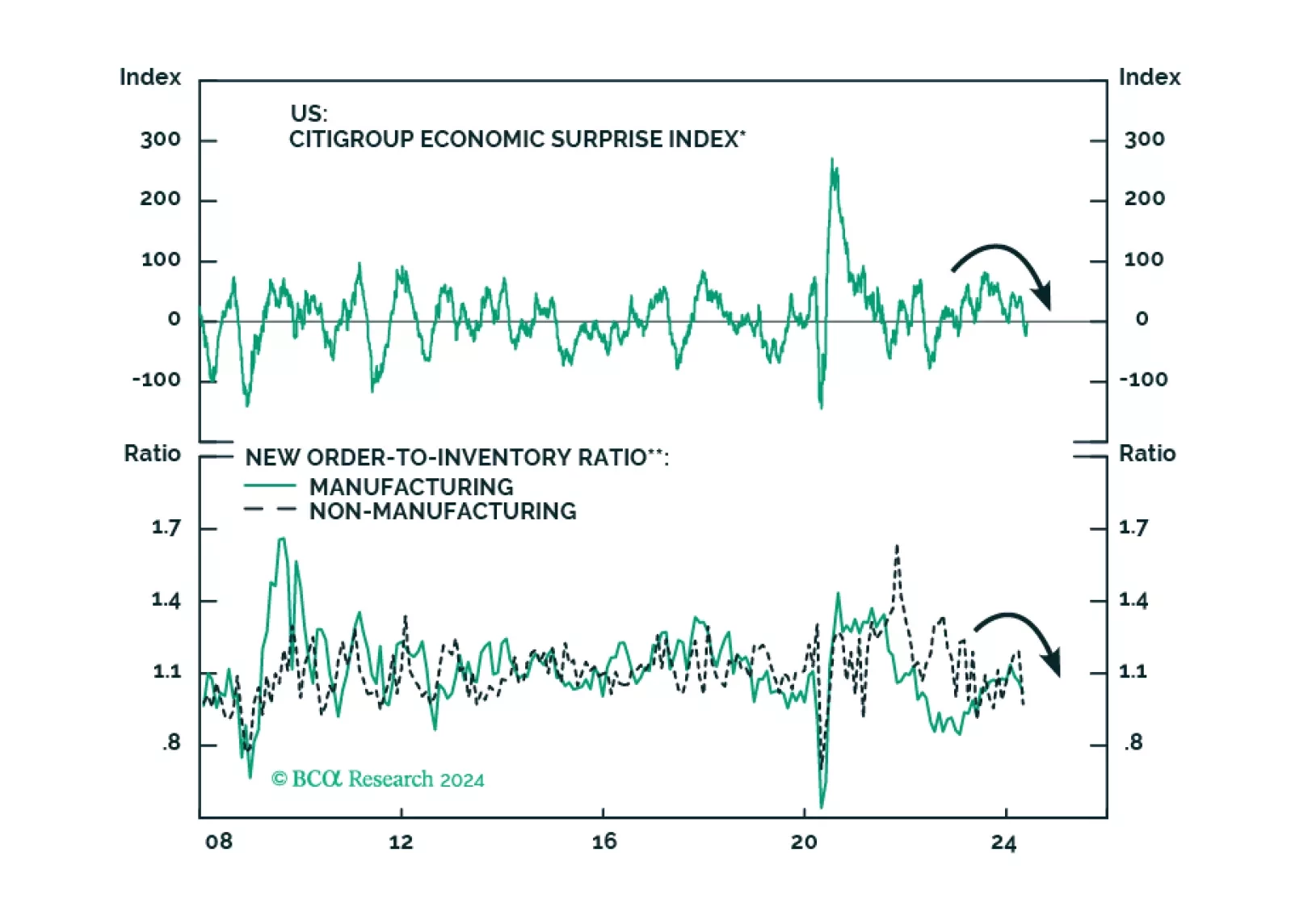

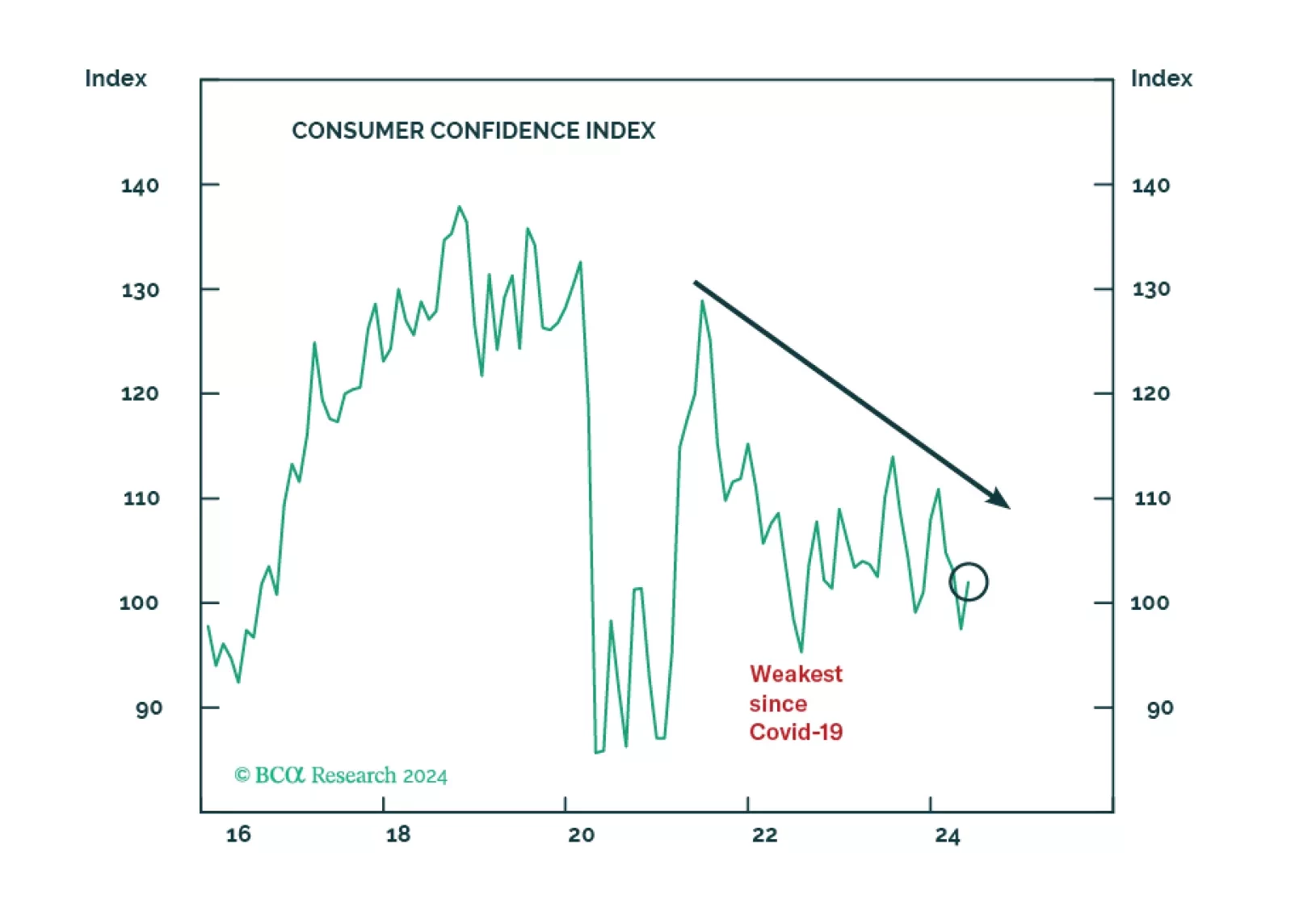

Investors should focus on growth concerns rather than the “Trump trade.” Bond yields will fall in the short run due to cyclically disinflationary economic slowdown, rather than rise in anticipation of a Republican full sweep and…

Investors should overweight US assets and de-risk their portfolios in anticipation of a major increase in policy uncertainty and geopolitical risk surrounding the US election and its global ramifications.

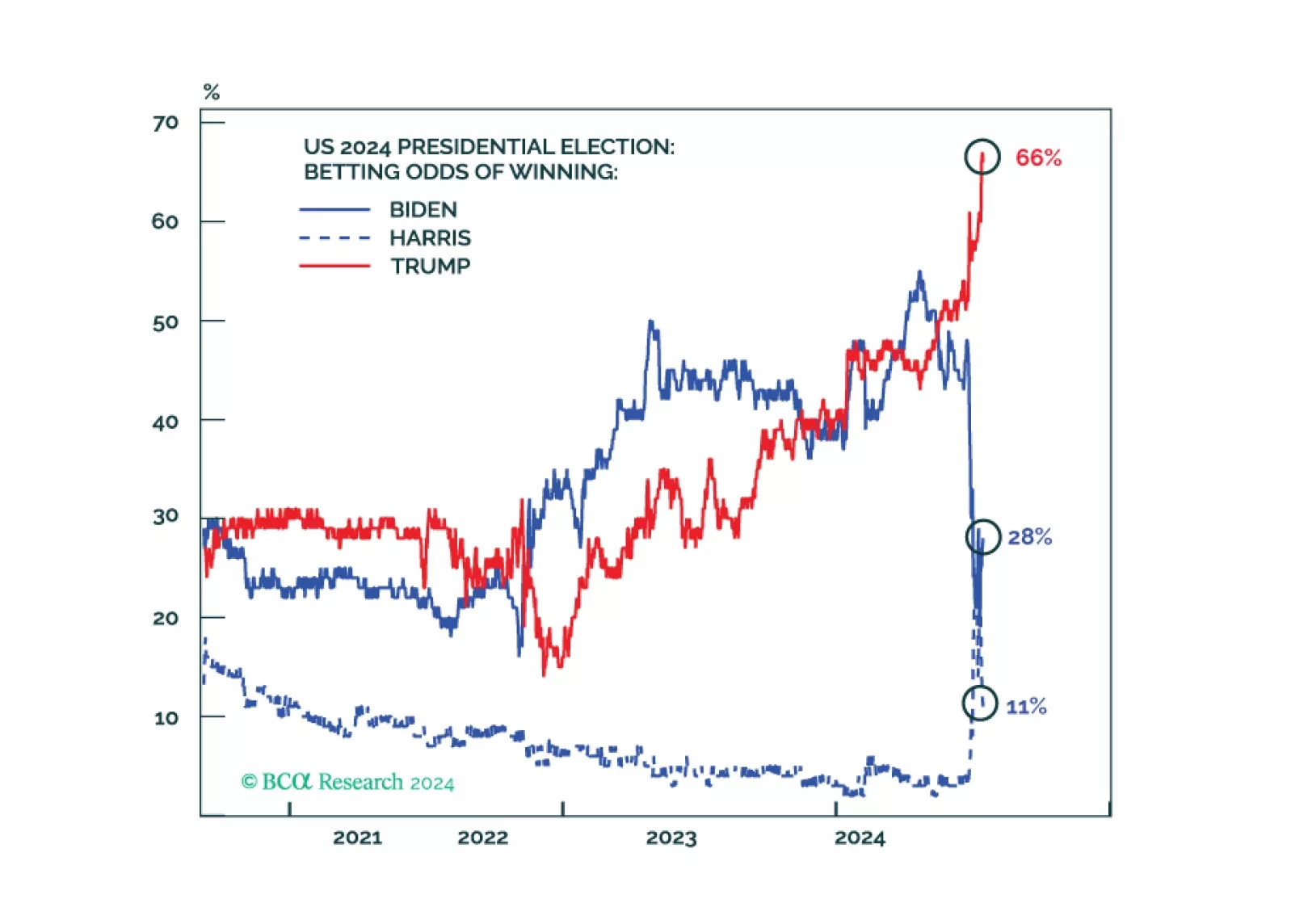

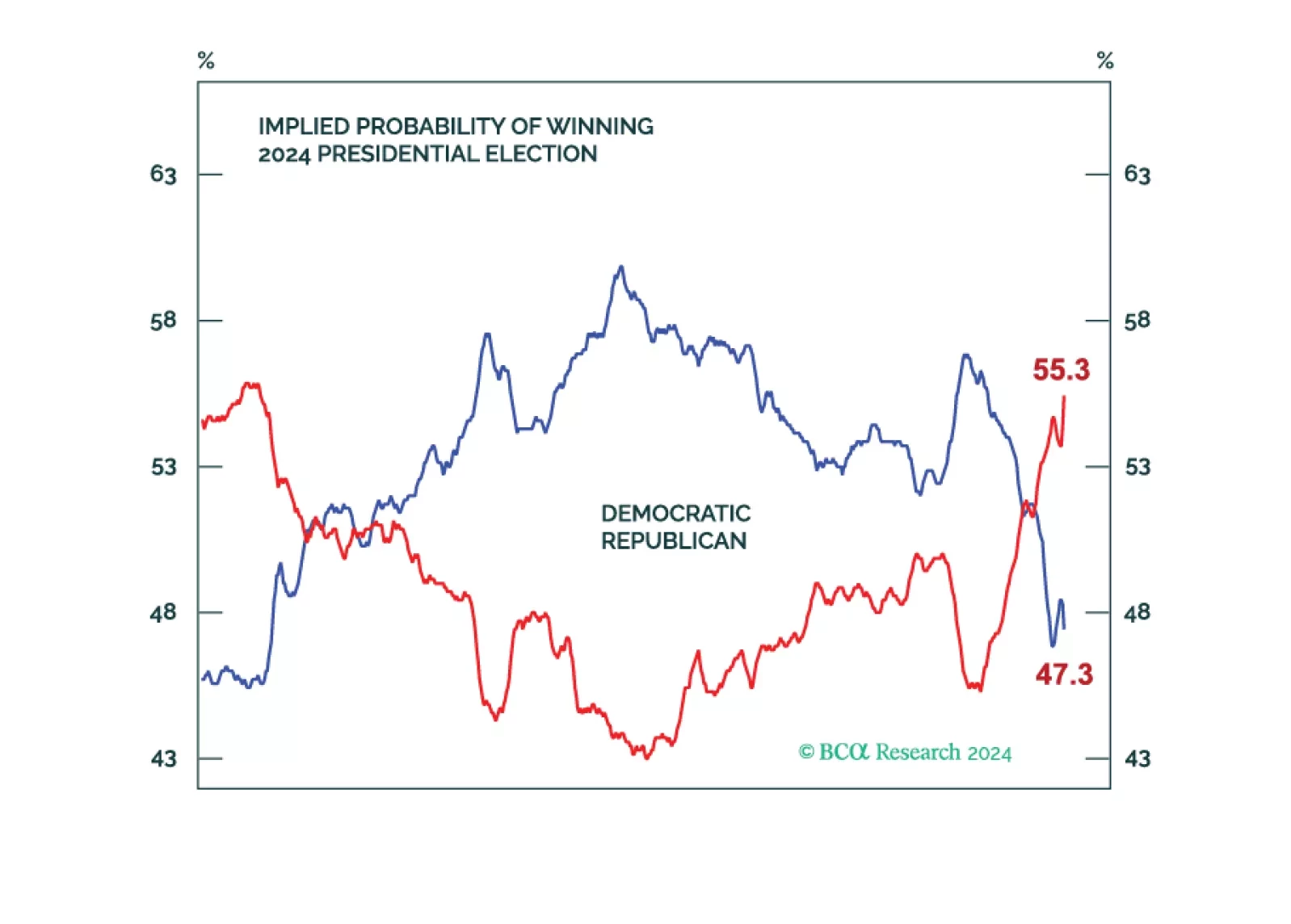

The cyclical economy is slowing today. Republicans are now more likely to win a full sweep, crack down on immigration and trade, and at least modestly stimulate the economy. Uncertainty and volatility will rise.

The bond market should sell off and drag stocks down on higher odds of a single-party sweep, policy uncertainty, unorthodox Trump presidency, aggressive tariffs, large tax cuts, large budget deficits, labor shortages, a fired Fed…

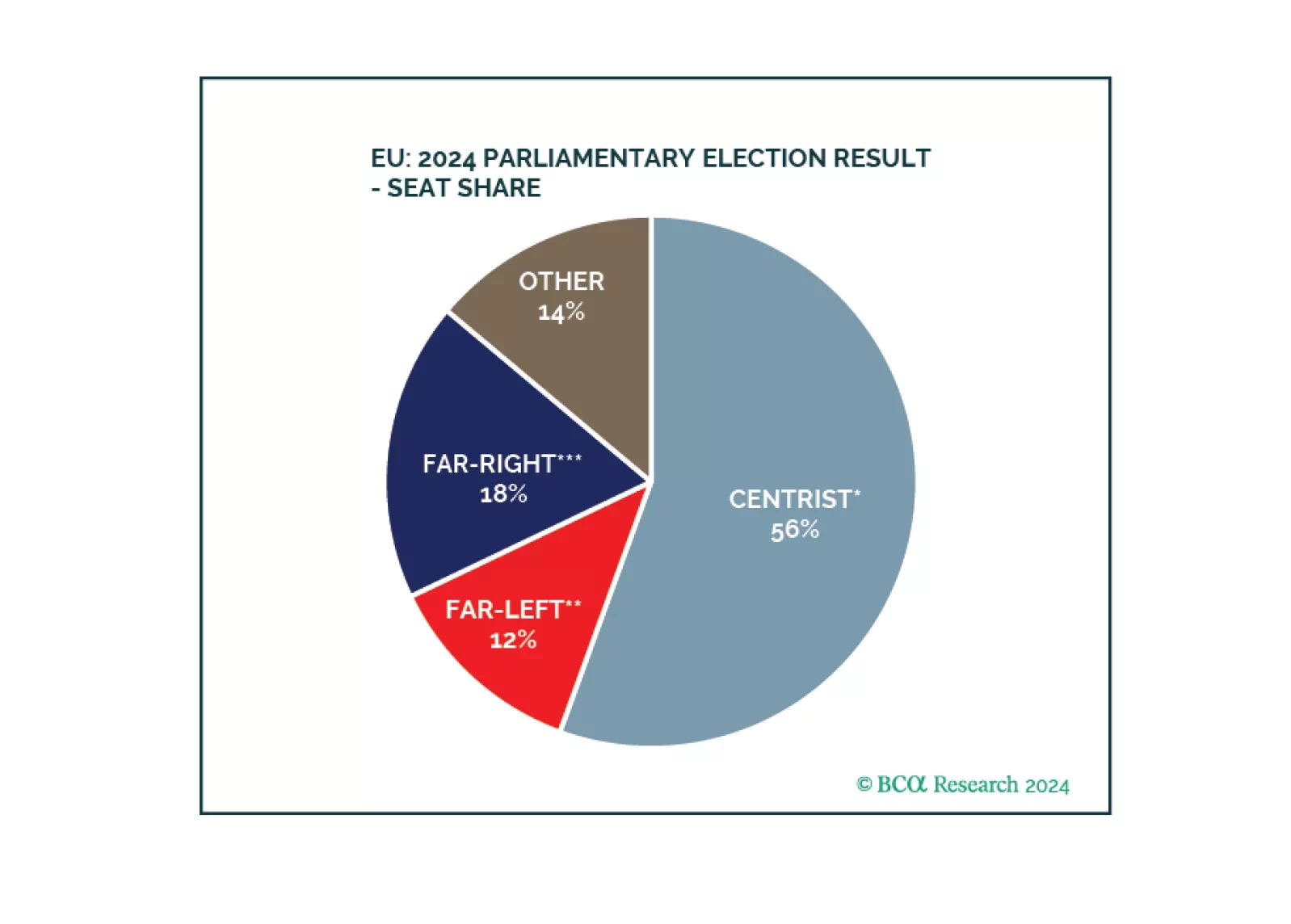

Europe did not witness a major policy reversal. Inflationary pressures are coming down, enabling the ECB to cut rates and European states to maintain soft budgets. Geopolitical challenges ensure that European parties continue to…

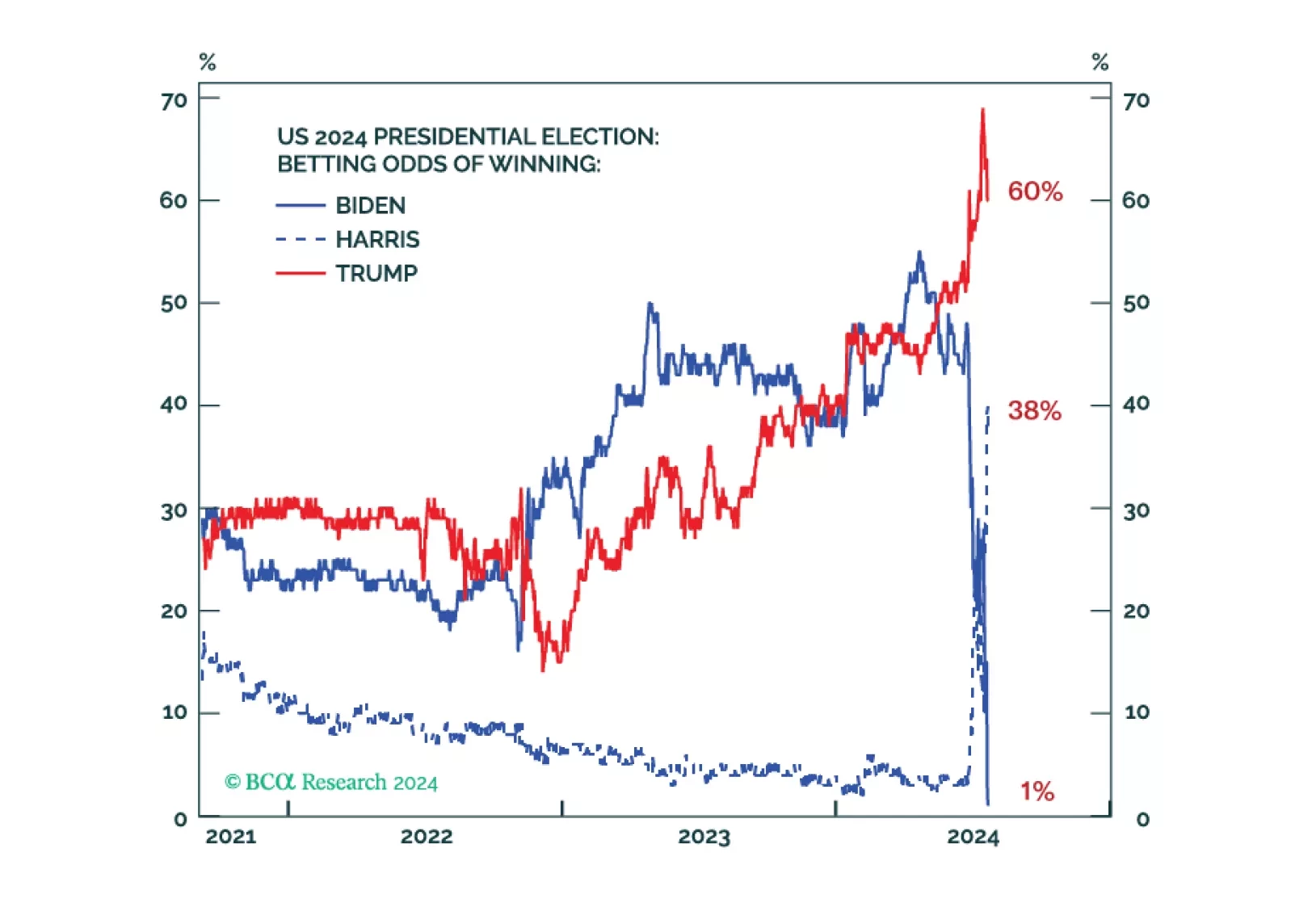

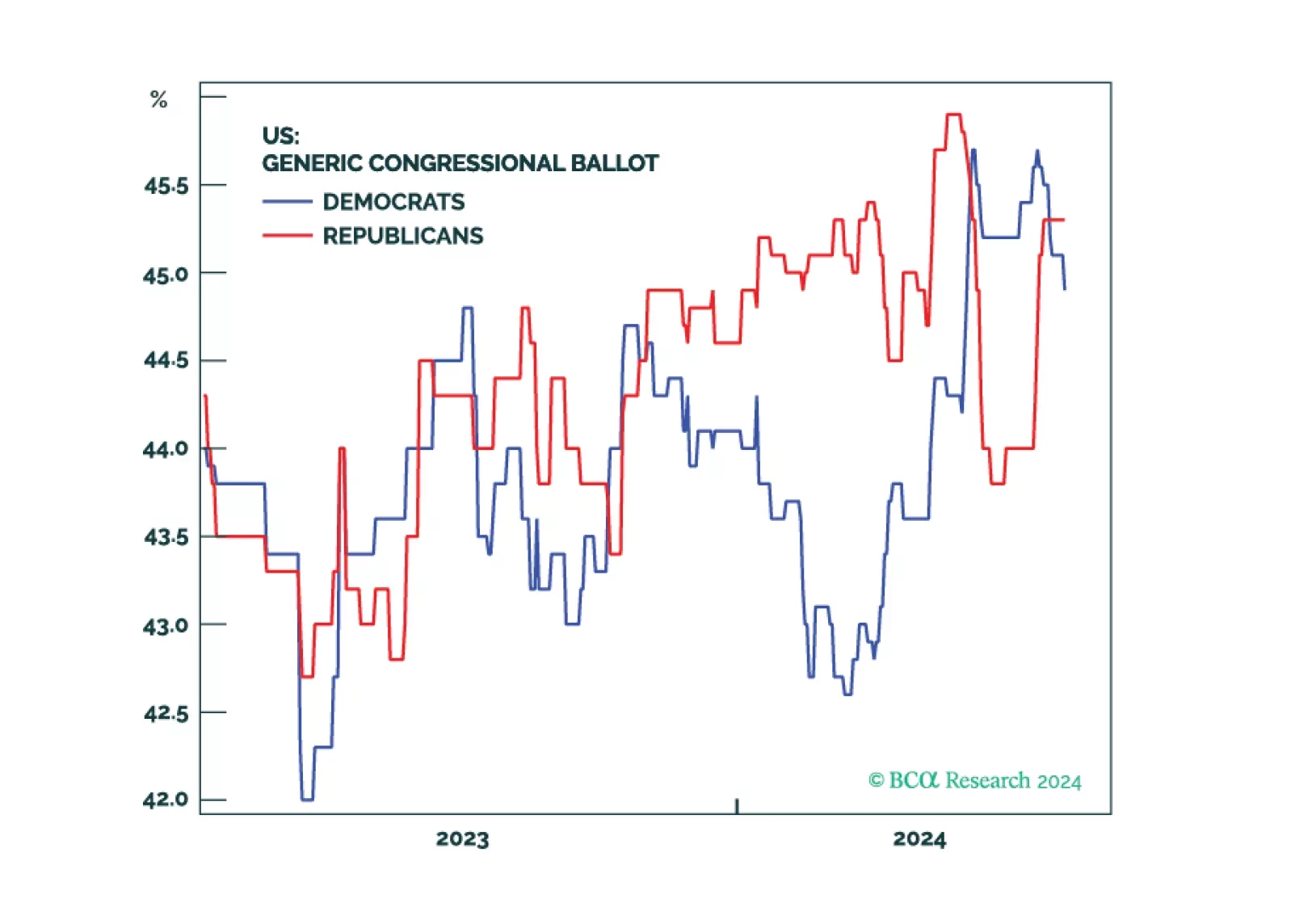

Republicans are favored in the House and Senate even if they do not win the White House. A Democratic sweep is a 20% risk. The policy implication would be inflationary, but not so much as under a Republican sweep. Election…

Democrats remain slightly favored for the White House because they are the four-year incumbent presidential party and the economy is not in recession. But if the unemployment rate rises in the lead up to November, then Biden and…

Favor defensive sectors, low-beta assets, and long-duration bonds until the election uncertainty is lifted one way or another over the next five months.