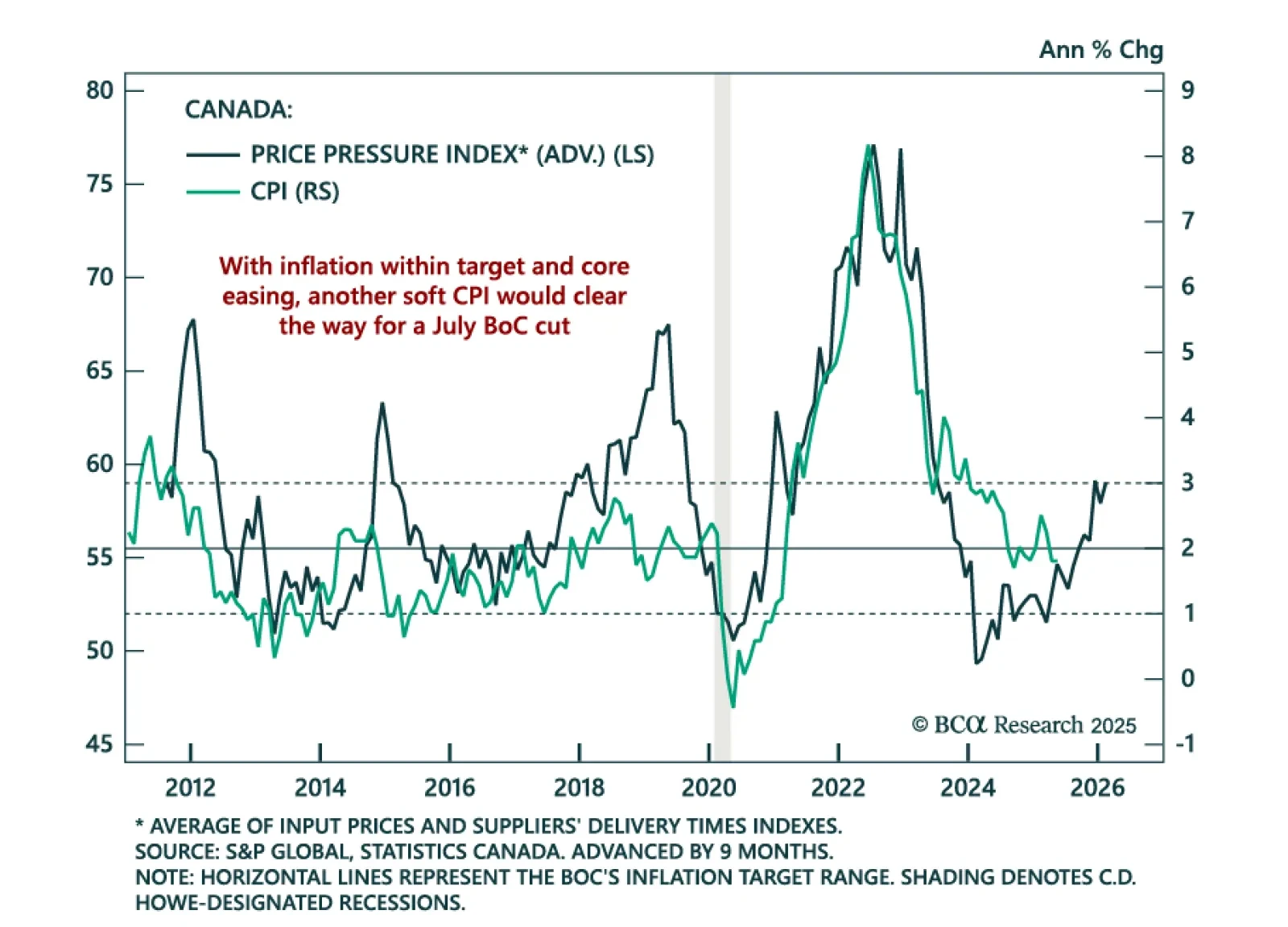

Contained Canadian inflation and soft macro conditions support our overweight on Canadian government bonds. May CPI was in line with expectations, with headline inflation holding at 1.7% y/y and core measures slowing to 3.0%, the…

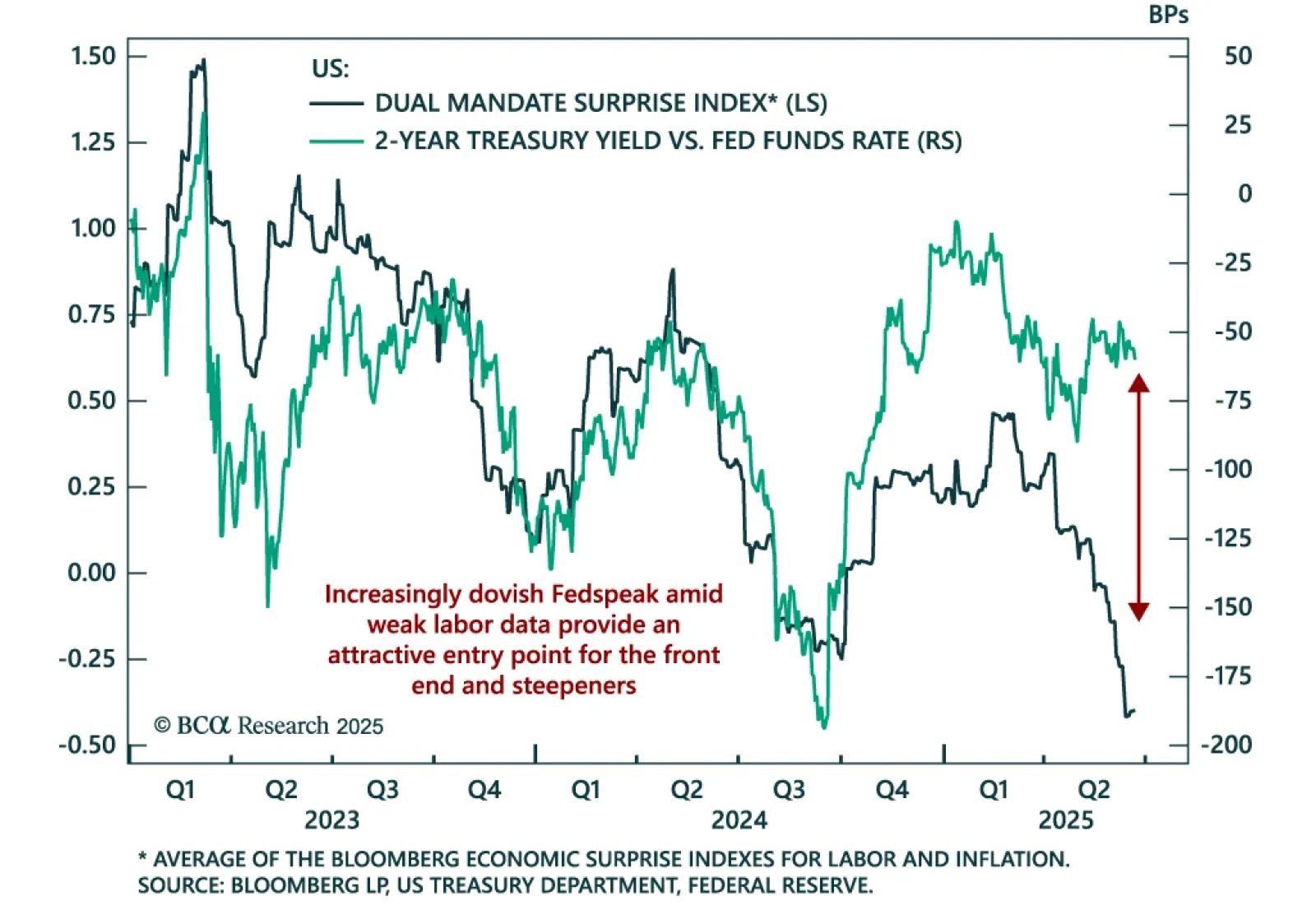

Dovish signals from Fed Governors Waller and Bowman increase the likelihood of a rate cut as early as July, supporting long front-end positions and steepeners. Last week’s FOMC meeting revealed a split between hawkish participants…

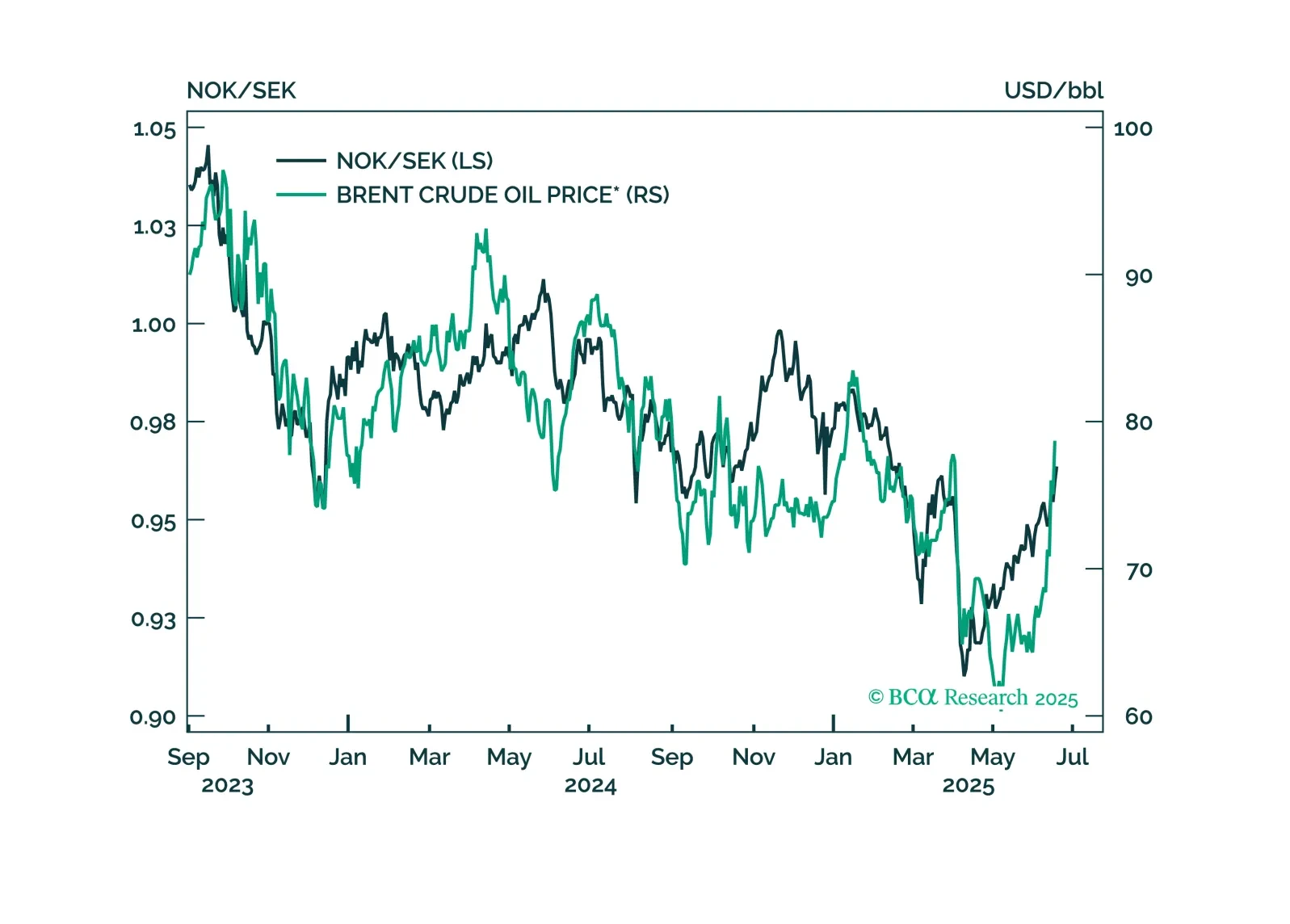

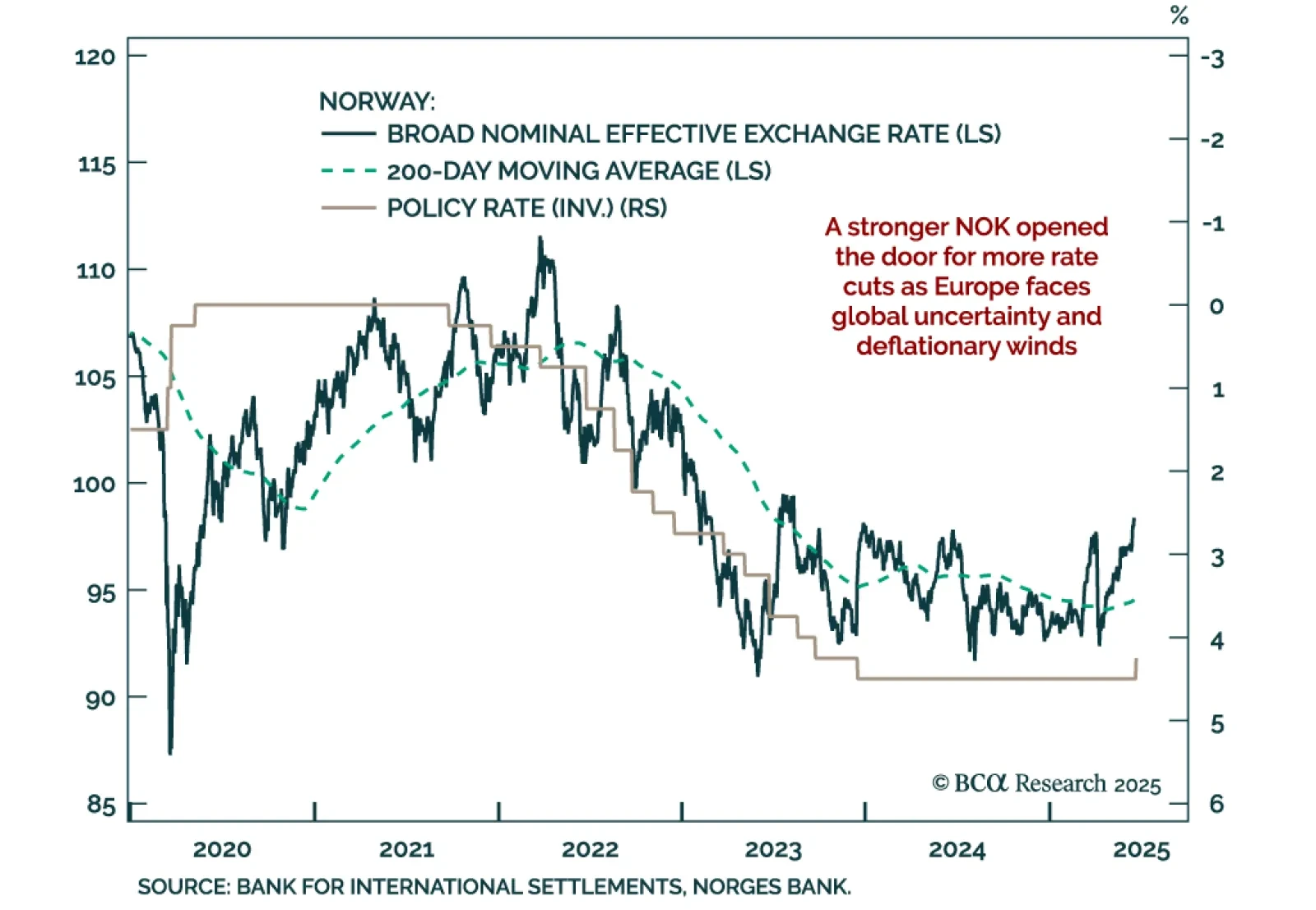

A stronger Norwegian krone has opened the door to more rate cuts, making Norwegian government bonds more attractive. Our Chart Of The Week comes from Jeremie Peloso, European Strategist. With its surprise 25 basis point cut, the…

In this Insight, we highlight our strong conviction trades based on the central bank meetings held by the Bank of England, the Norges Bank, the Swiss National Bank and the Riksbank.

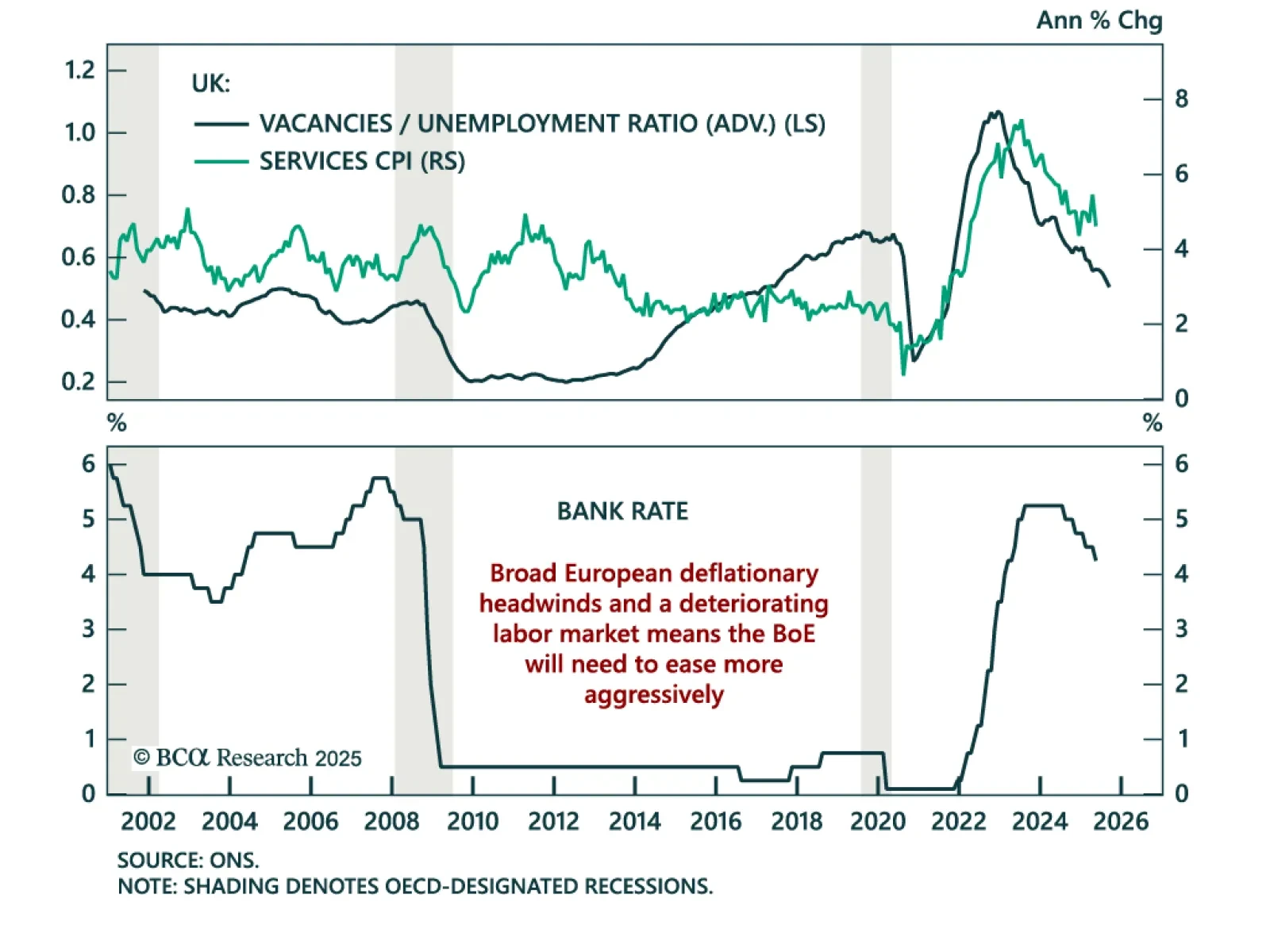

European central banks are pivoting quickly amid deflationary pressure, reinforcing our long UK Gilts and short GBP trades. The Norges Bank surprised with a 25 bps cut to 4.25%, abandoning its hawkish stance. The Swiss National Bank…

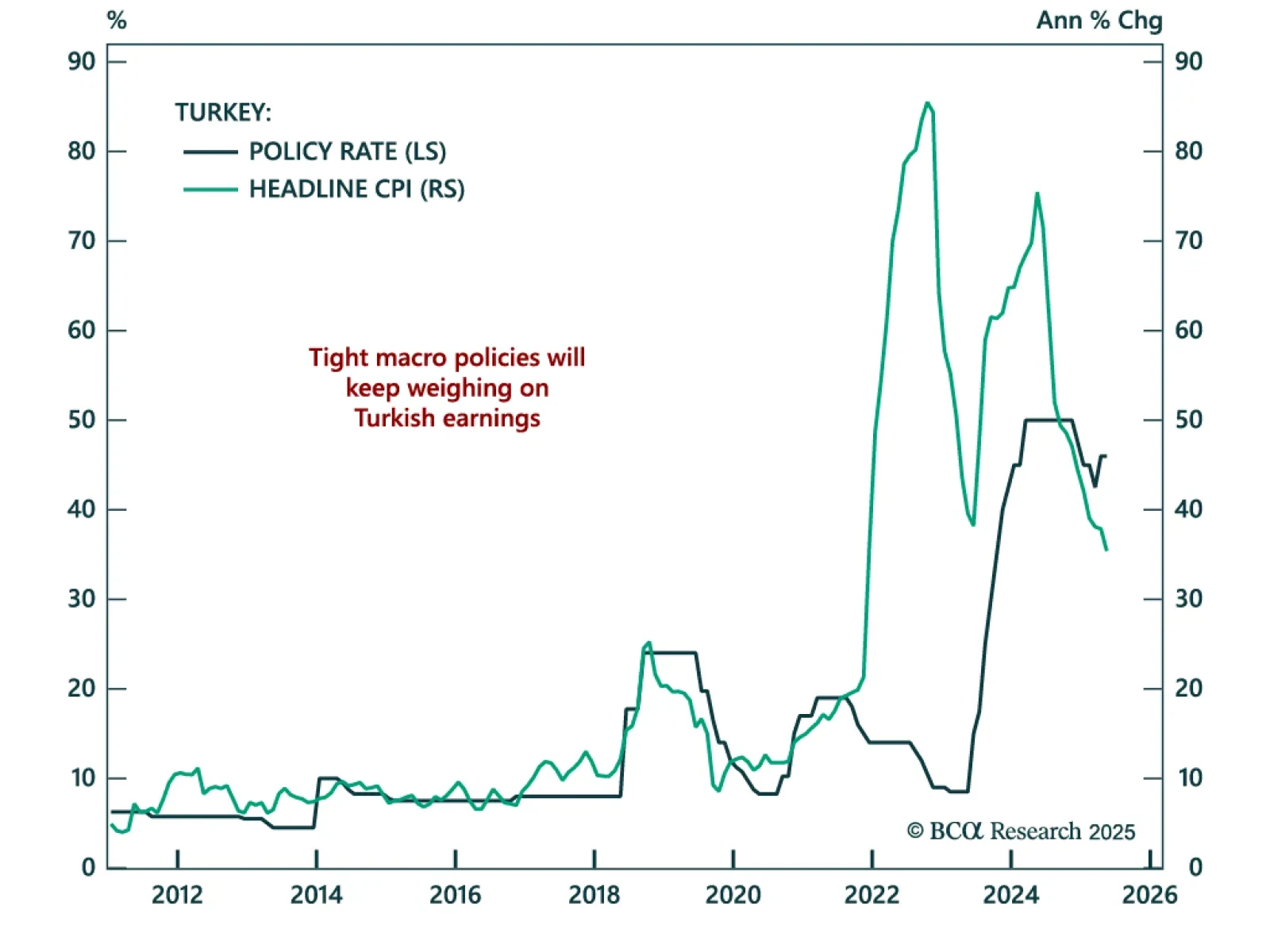

Turkey’s tight policy stance will weigh on growth and earnings, reinforcing our bearish view on Turkish equities. The central bank held rates at 46% and maintained a hawkish bias, consistent with efforts to bring inflation down from…

In this Insight, we look at the best trade idea from the recent rate cut by the Riksbank.

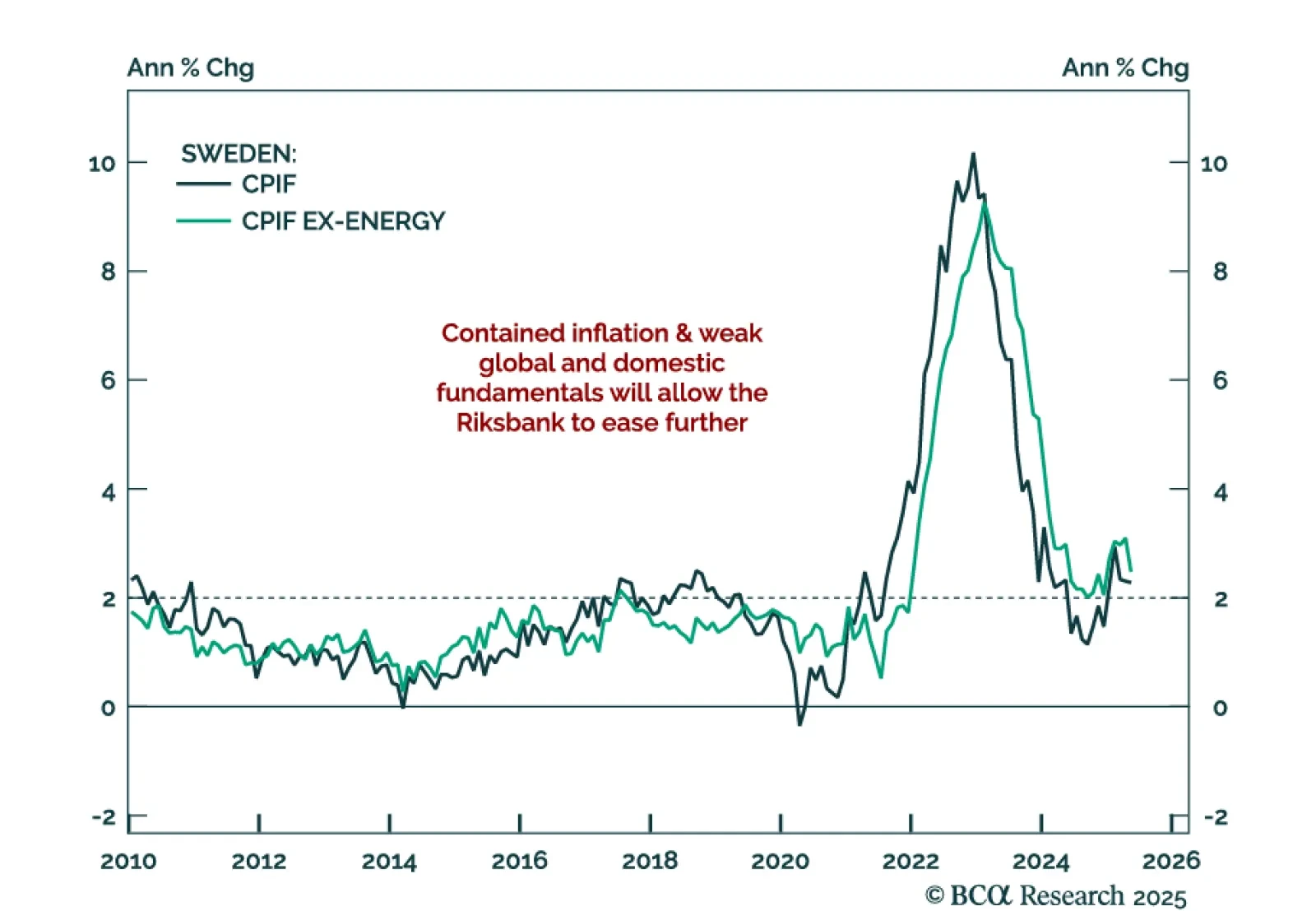

Sweden’s economic fragility and disinflation support further easing, reinforcing our long SEK rates and NOK/SEK trades. The Riksbank cut rates by 25 bps to 2.0% and projected an additional cut, consistent with prior OIS pricing.…

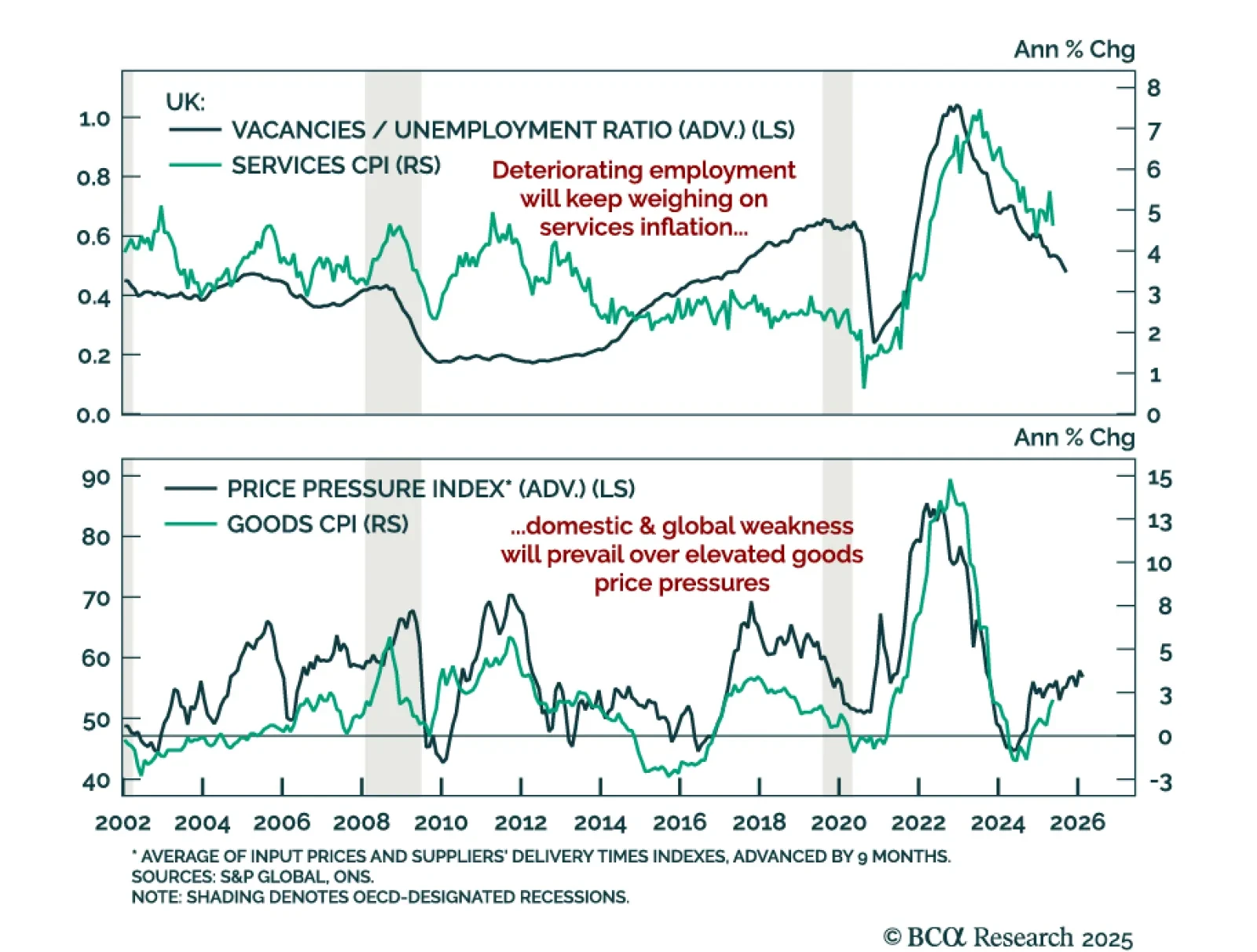

UK disinflation and labor market softening support our overweight in Gilts and short GBP trade. UK CPI came in slightly hotter than expected in May, with headline inflation at 3.4% y/y (vs. 3.5% in April) and core CPI meeting…

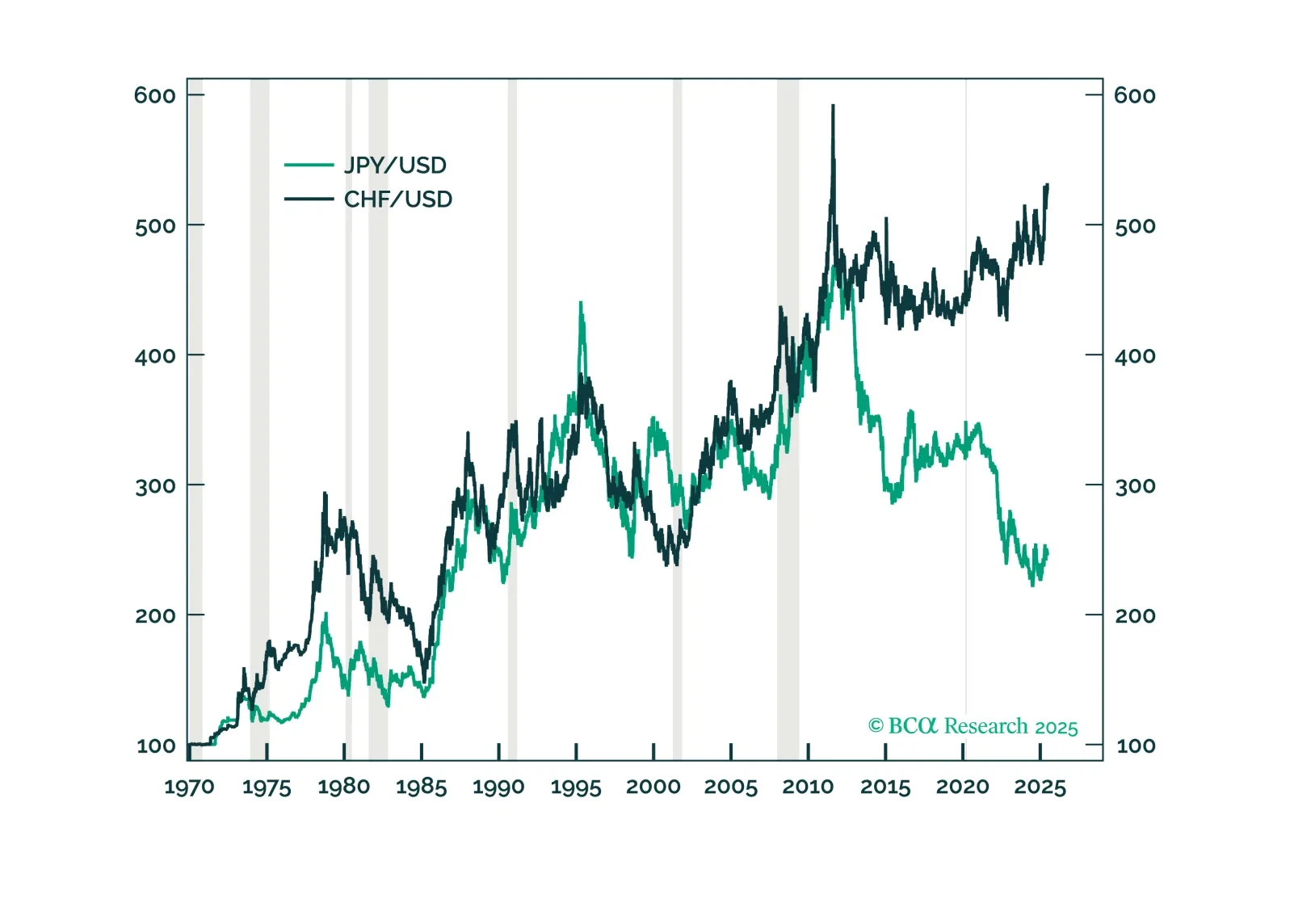

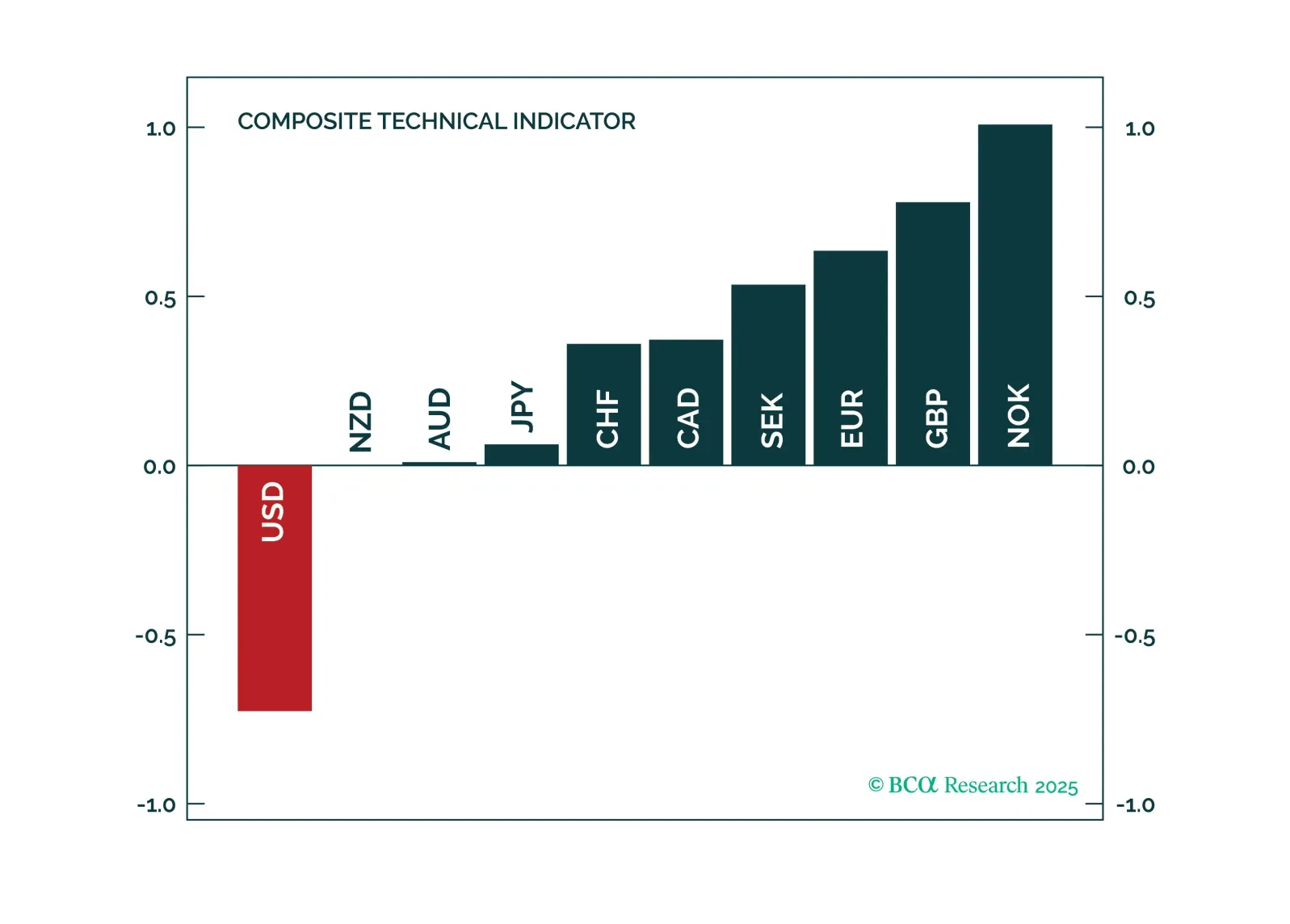

In this FX note, we provide a rationale for why it is important to pay attention to technical indicators, while still keeping your eyeball on the structural factors that drive currencies. This report answers the following questions:…