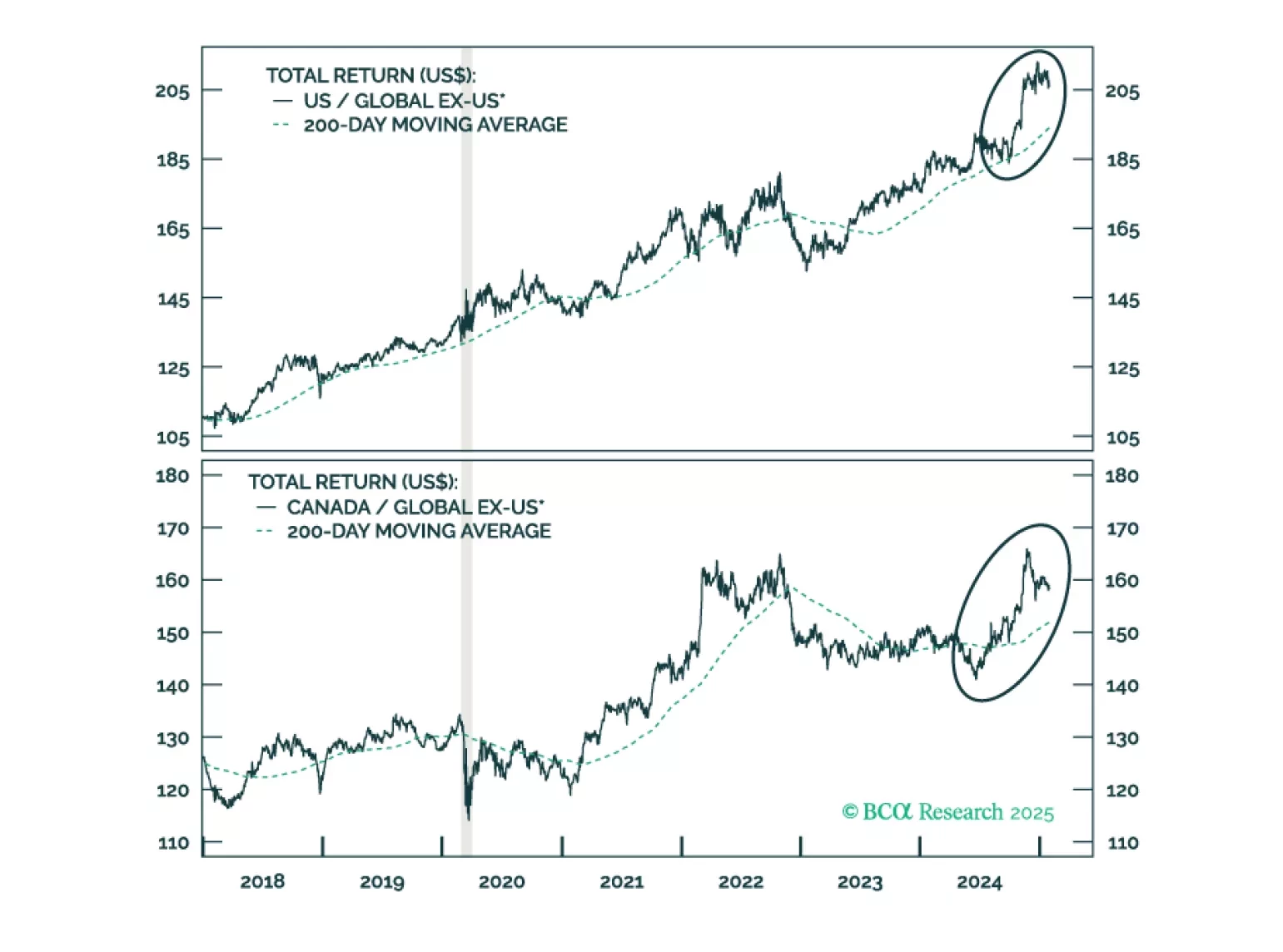

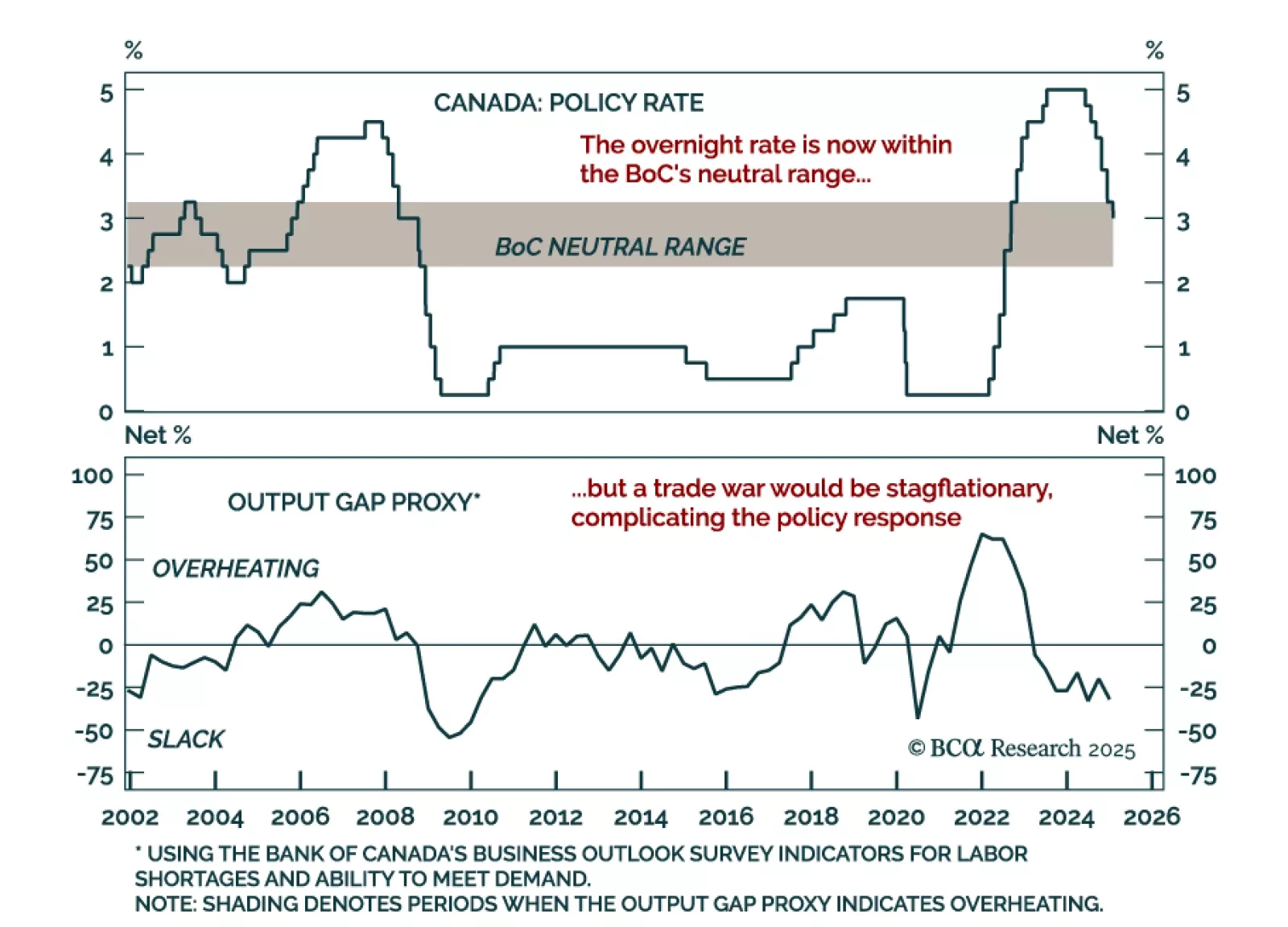

The Bank of Canada cut by 25 bps to 3% as expected, and announced the end of quantitative tightening. This sixth consecutive cut brings the policy rate further into neutral territory, estimated to be in the 2.25%-to-3.25% range.…

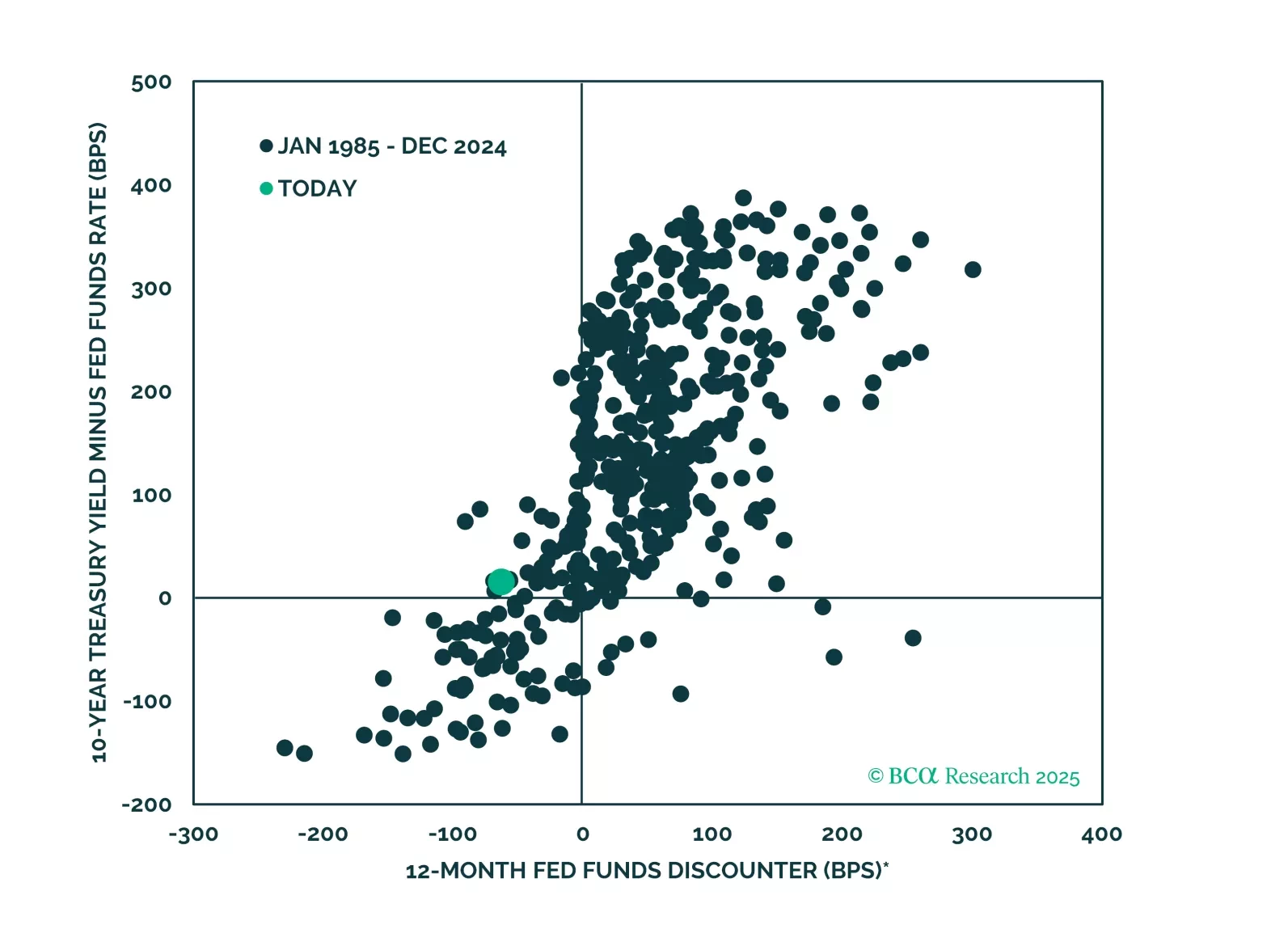

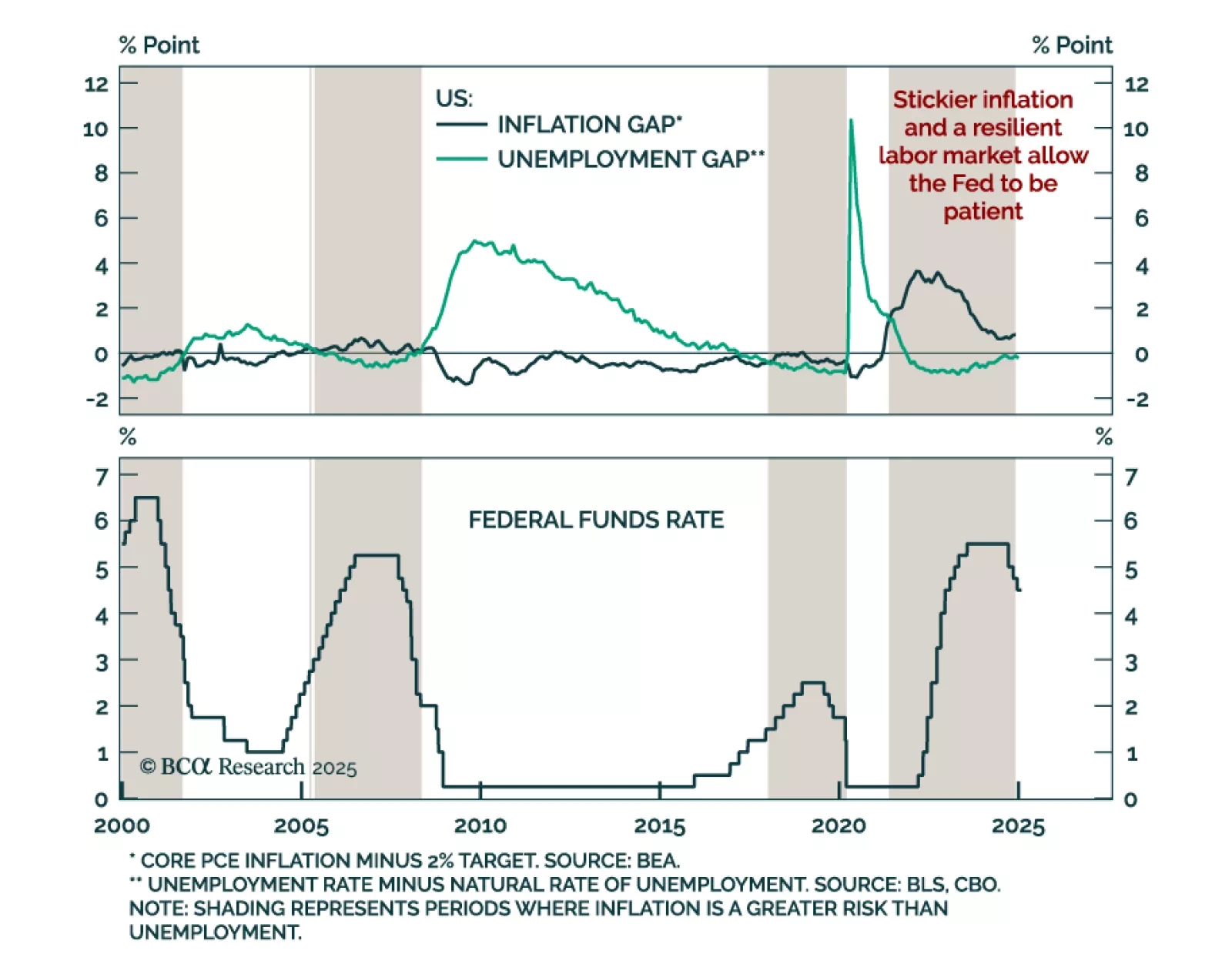

The Federal Reserve kept rates on hold in its 4.25%-to-4.5% range, as expected. The main change in the statement was the removal of the reference to progress towards the Fed’s 2% target, leaving instead a simple mention that…

Jay Powell didn’t say much at this afternoon’s FOMC press conference, and monetary policy will continue to take a back seat to fiscal for the next few months.

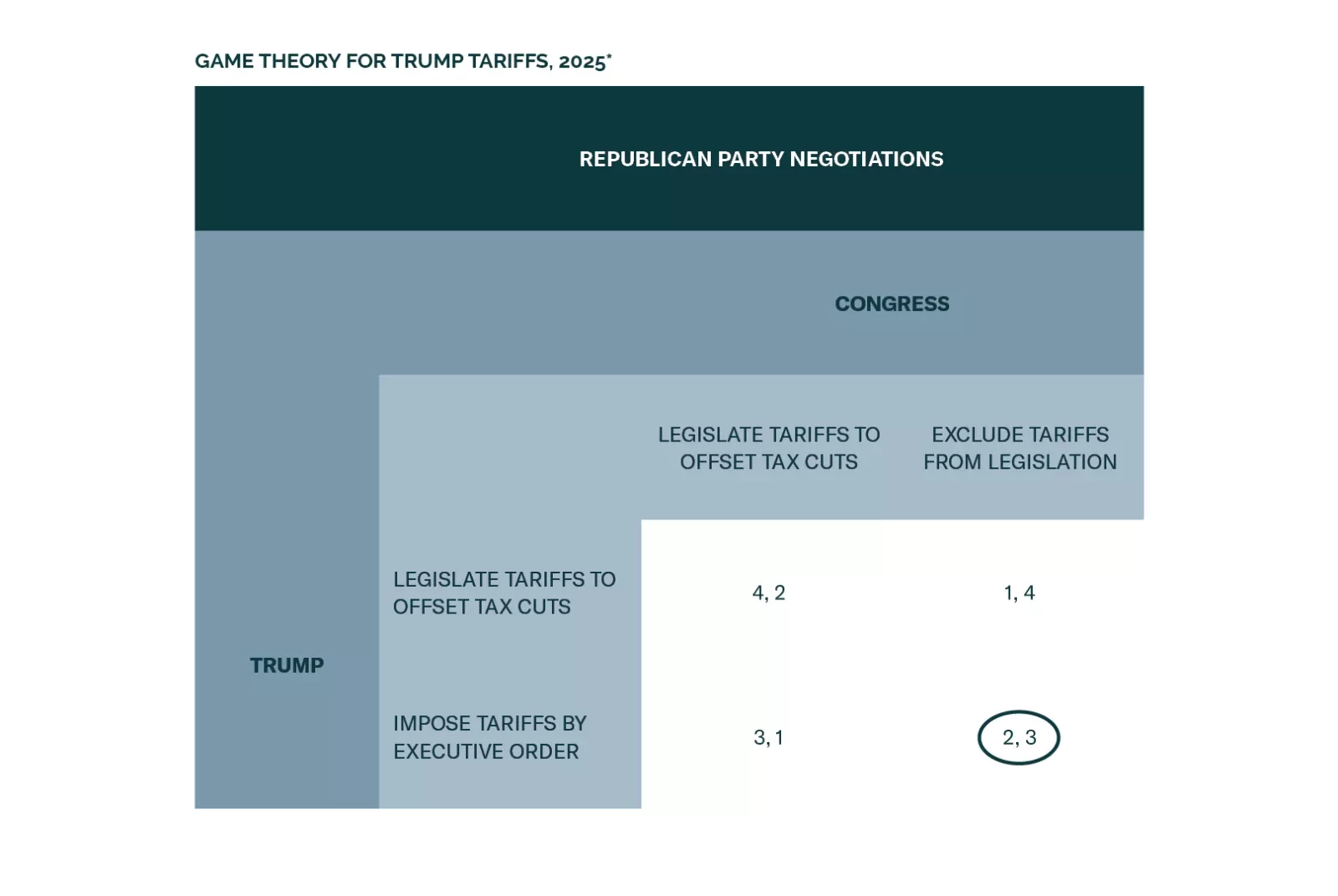

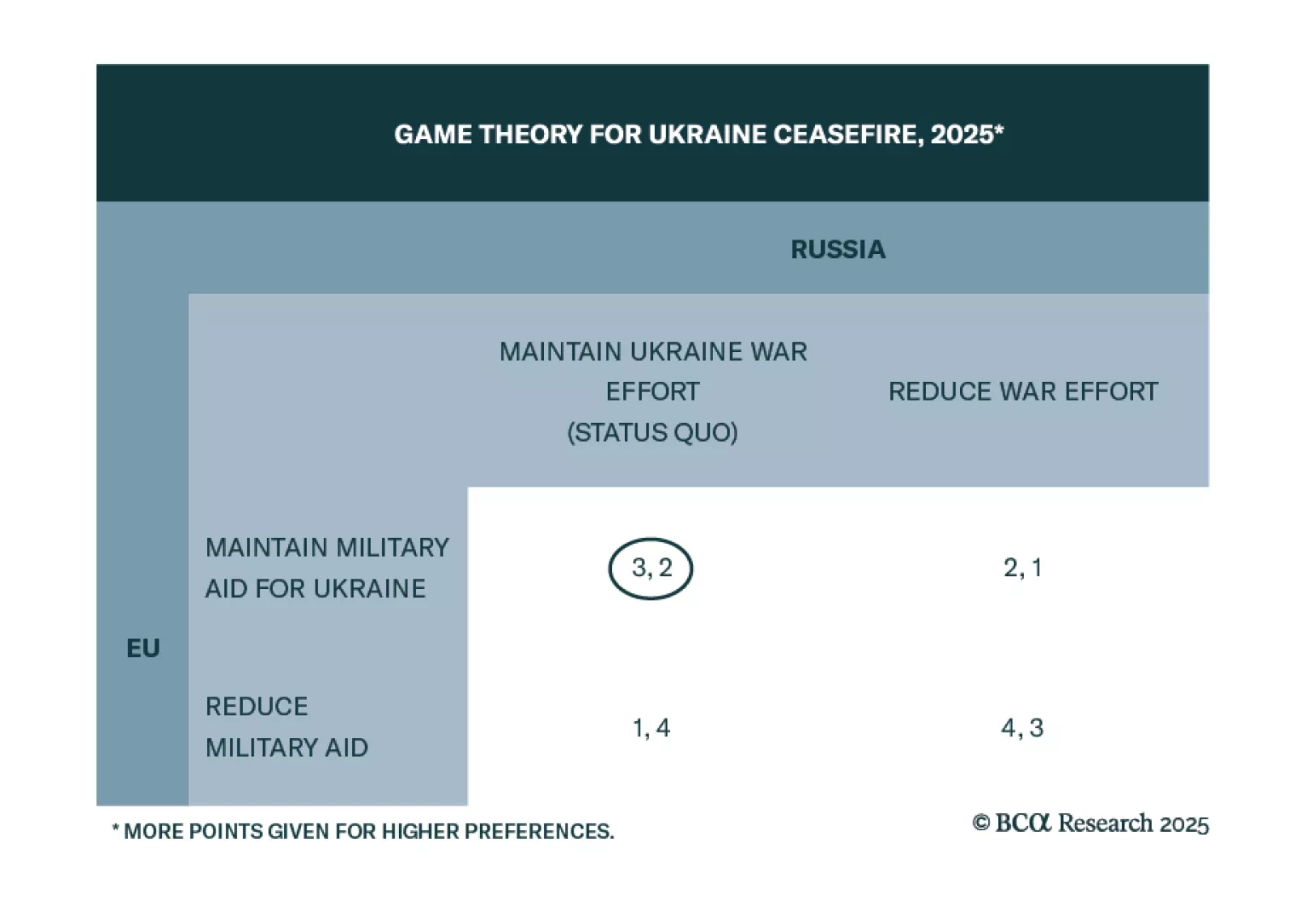

Our Geopolitical Strategy team modeled several of the Trump administration’s most disruptive policies in a simple game theory framework. The Trump administration’s policies have created a complex web of trade and foreign…

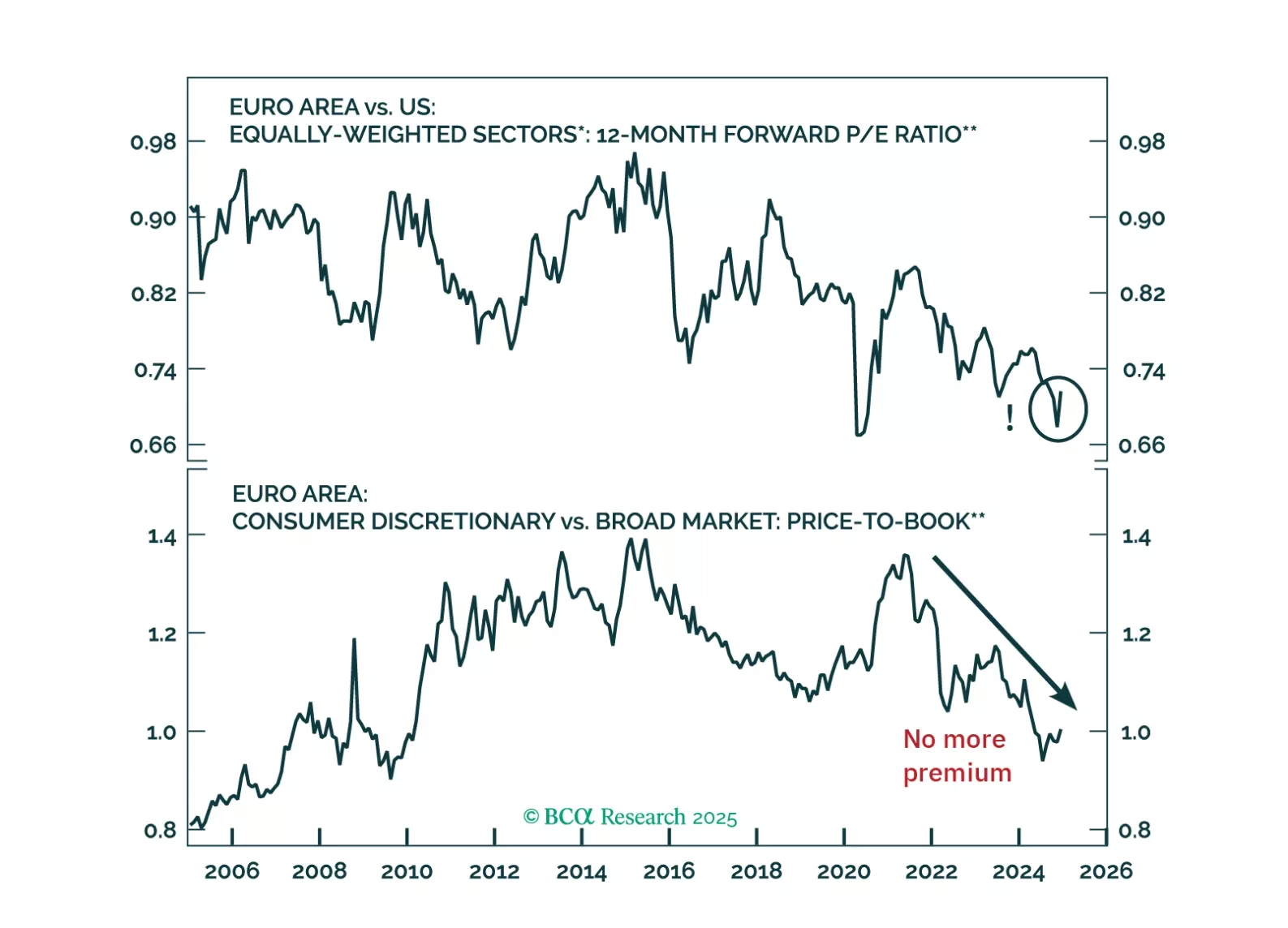

The January Ifo Business Climate index for Germany beat estimates, increasing to 85.1 vs. 84.7 in December. The increase came from the survey’s current assessment component, which increased a full point, as the expectations component…

Global risk assets are engulfed in a wave of euphoria, which is pulling Europe higher along the way. However, risks still abound. How should investors adjust their allocation to Europe under these highly uncertain conditions?

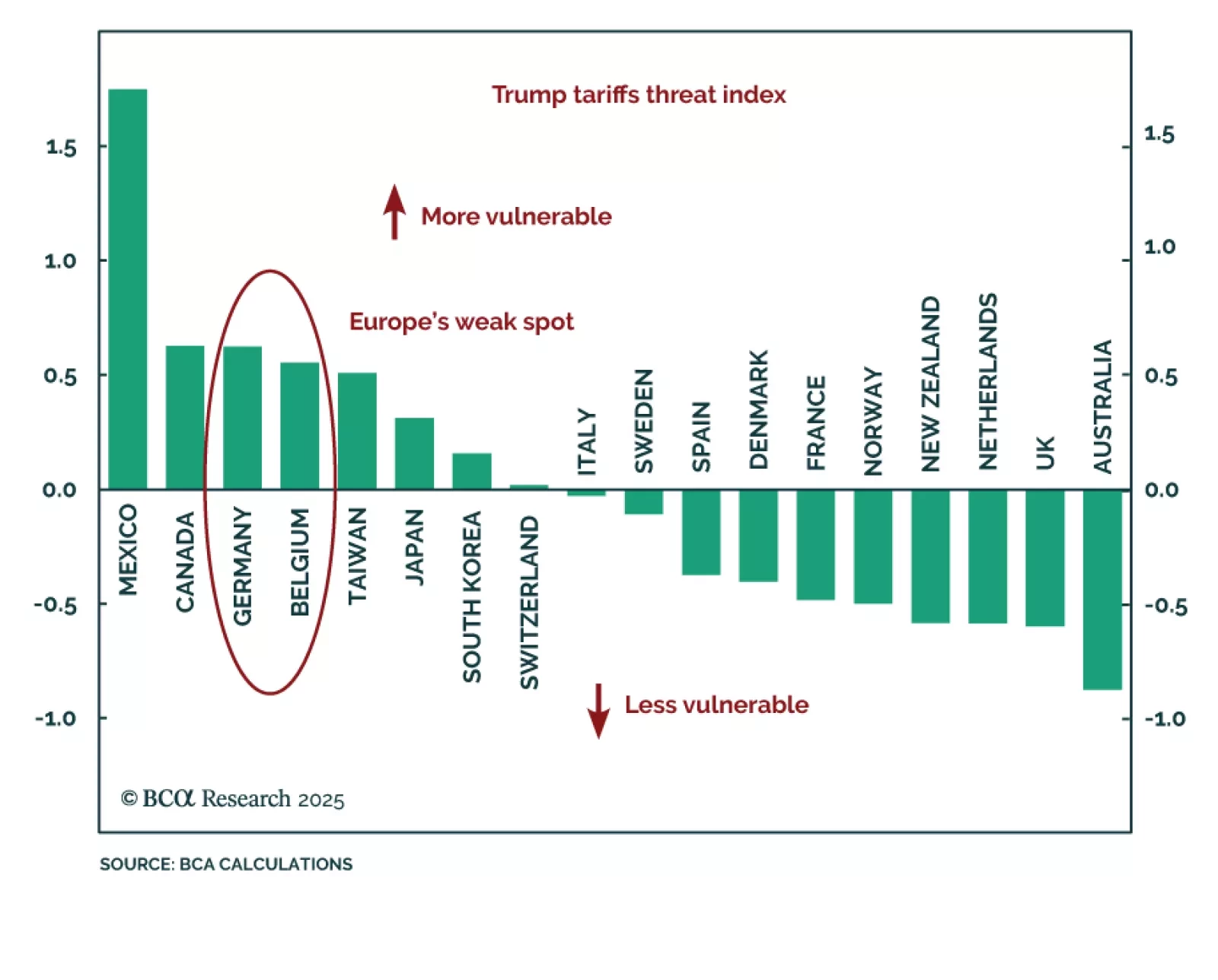

Our Chart Of The Week comes from Mathieu Savary, Chief Strategist of our European Investment Strategy service. Mathieu investigates why President Trump started his global trade offensive with an attack on Canada and Mexico, the US’…

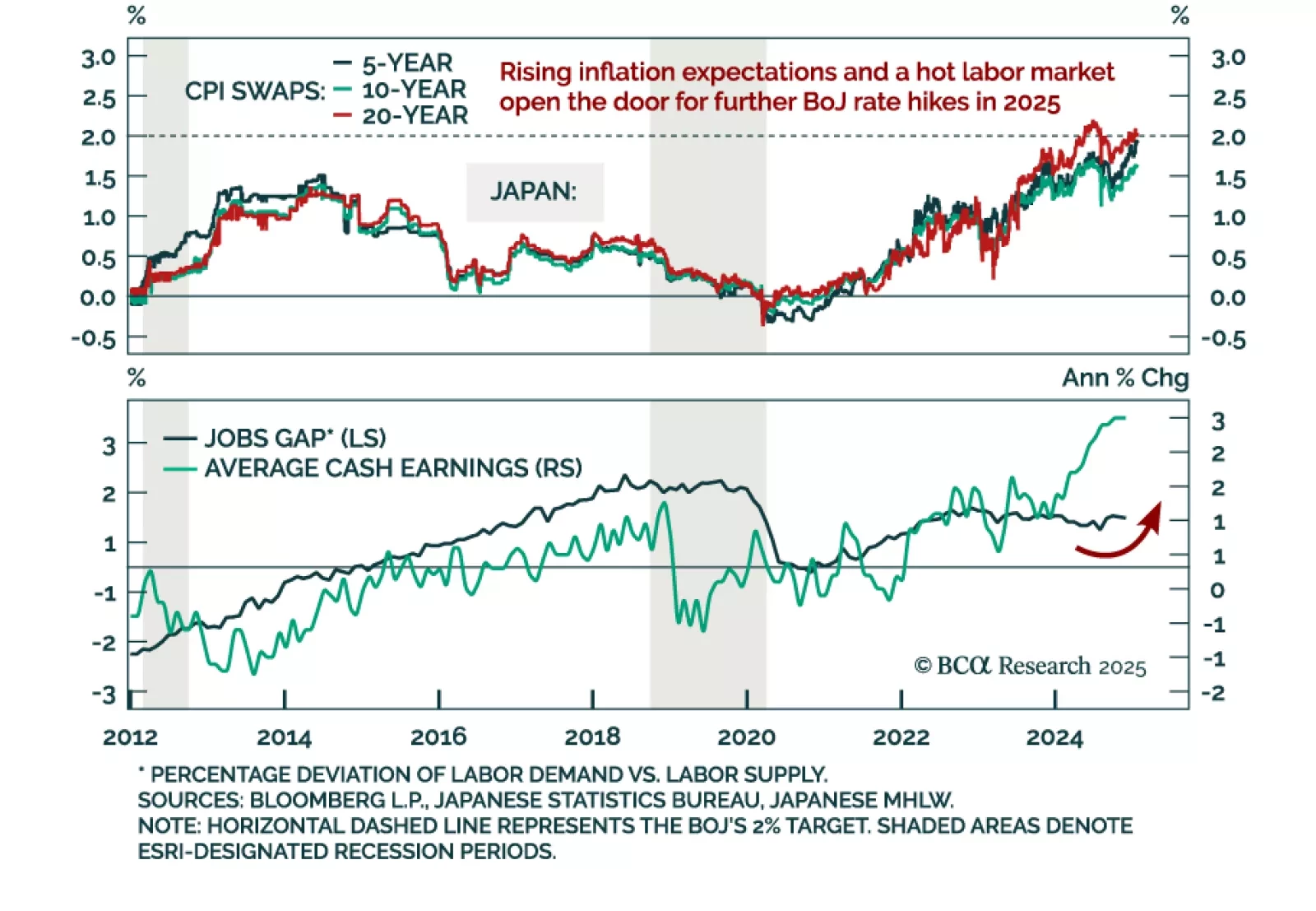

The Bank of Japan hiked rates by 25 bps as expected to 0.50%, or a 17-year high. The BoJ is currently the only G10 central bank in a hiking cycle, as the hot labor market creates sustained domestic price pressures. …