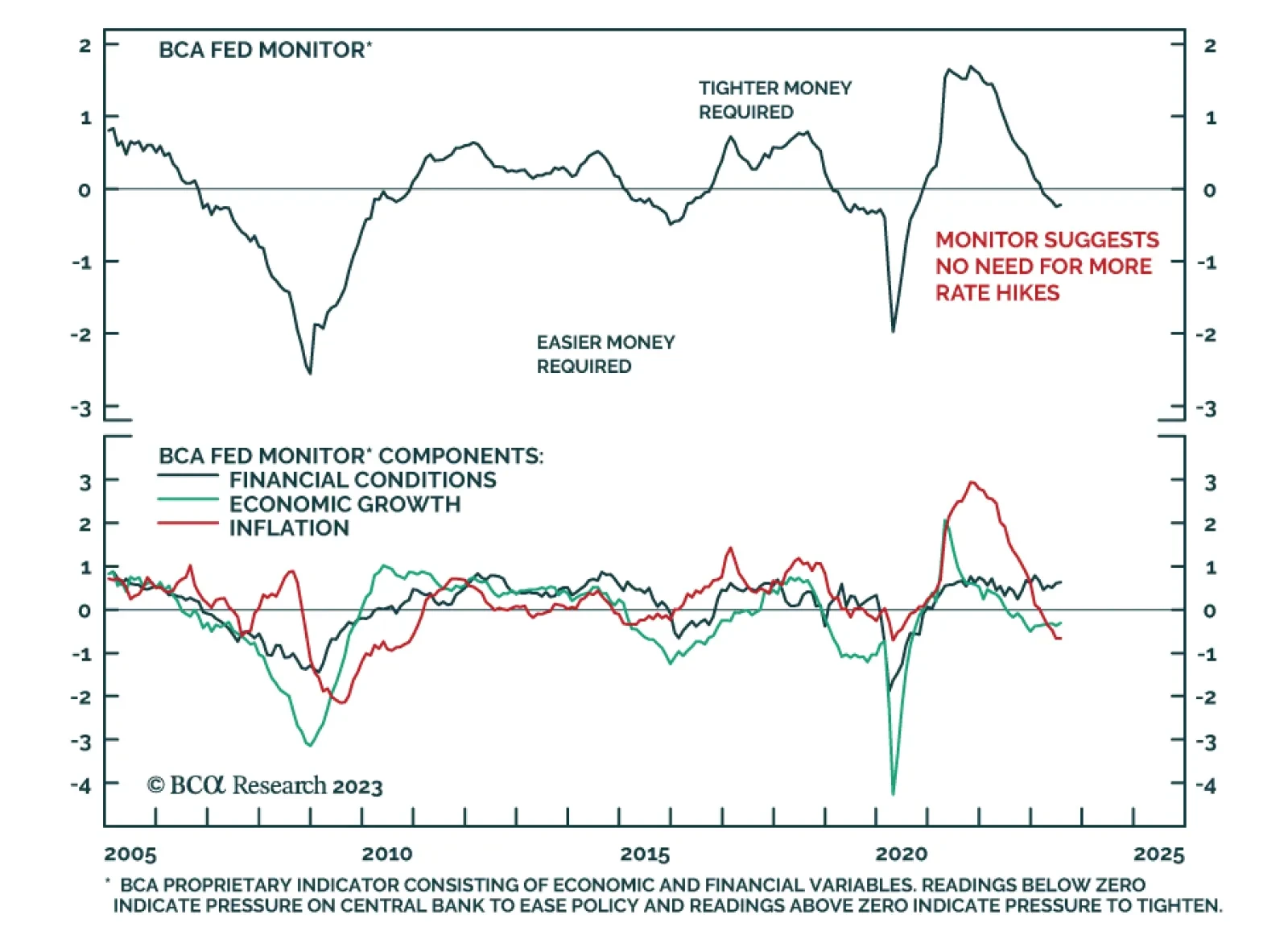

In Section I, we respond to the ongoing challenge to our view that the US economy is on a recessionary path. The available evidence overwhelmingly supports the notion that US monetary policy is tight, which argues against the “no…

The Fed and ECB talked a good game as they redoubled their commitments to returning core inflation to 2% p.a. at Jackson Hole. However, their outmoded inflation-fighting playbooks do not address supply tightness in commodity and…

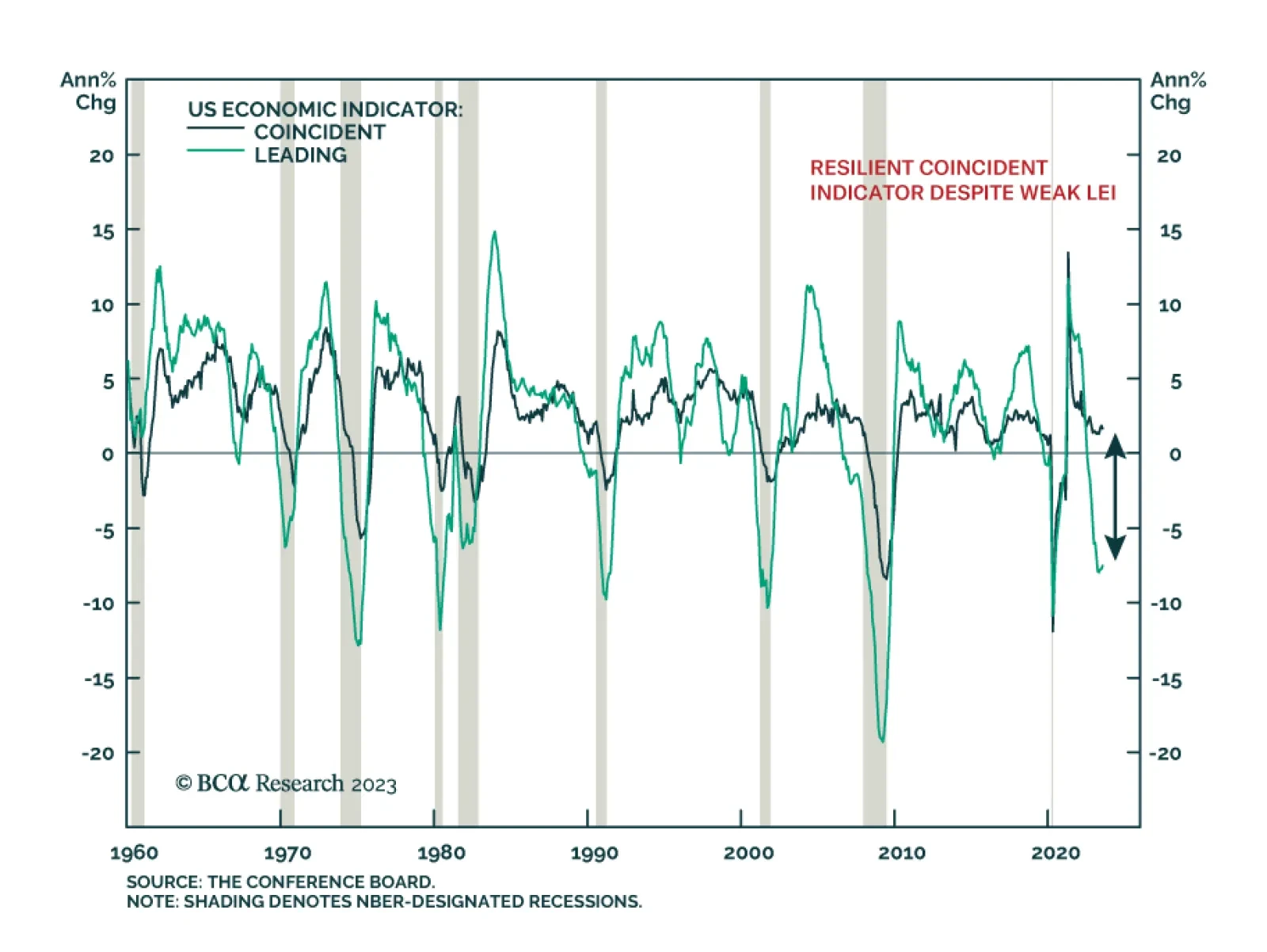

Consensus expectations for the US economy were bleak at the start of the year. In hindsight, this pessimism was excessive: real GDP expanded in the first two quarters of the year (see Country Focus). Similarly, the US Conference…

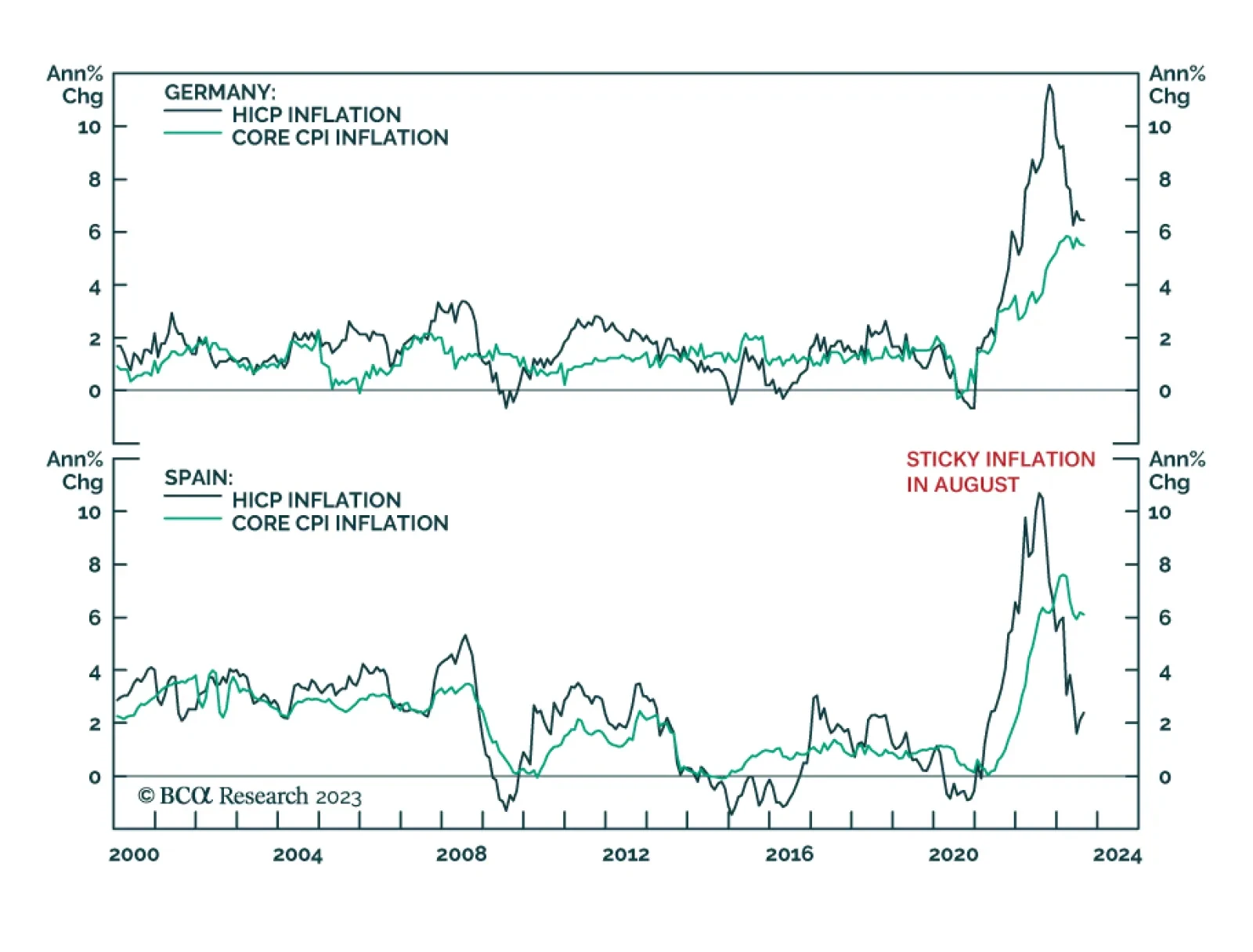

Euro Area inflation data surprised to the upside on Wednesday. According to preliminary data, although Germany’s harmonized headline CPI inflation rate fell from 6.5% y/y to 6.4% y/y in August, it nevertheless came in…

We comment on Jay Powell’s Jackson Hole speech and recommend shifting to a barbelled allocation along the Treasury curve.

The US and China agreed to hold trade talks more regularly on August 28, even as they fell short of establishing a strategic détente or general reduction of tensions. US Commerce Secretary Gina Raimondo visited Beijing…

Investors should underweight global equities and risk assets; overweight US stocks relative to global; and overweight defensive sectors versus cyclicals.

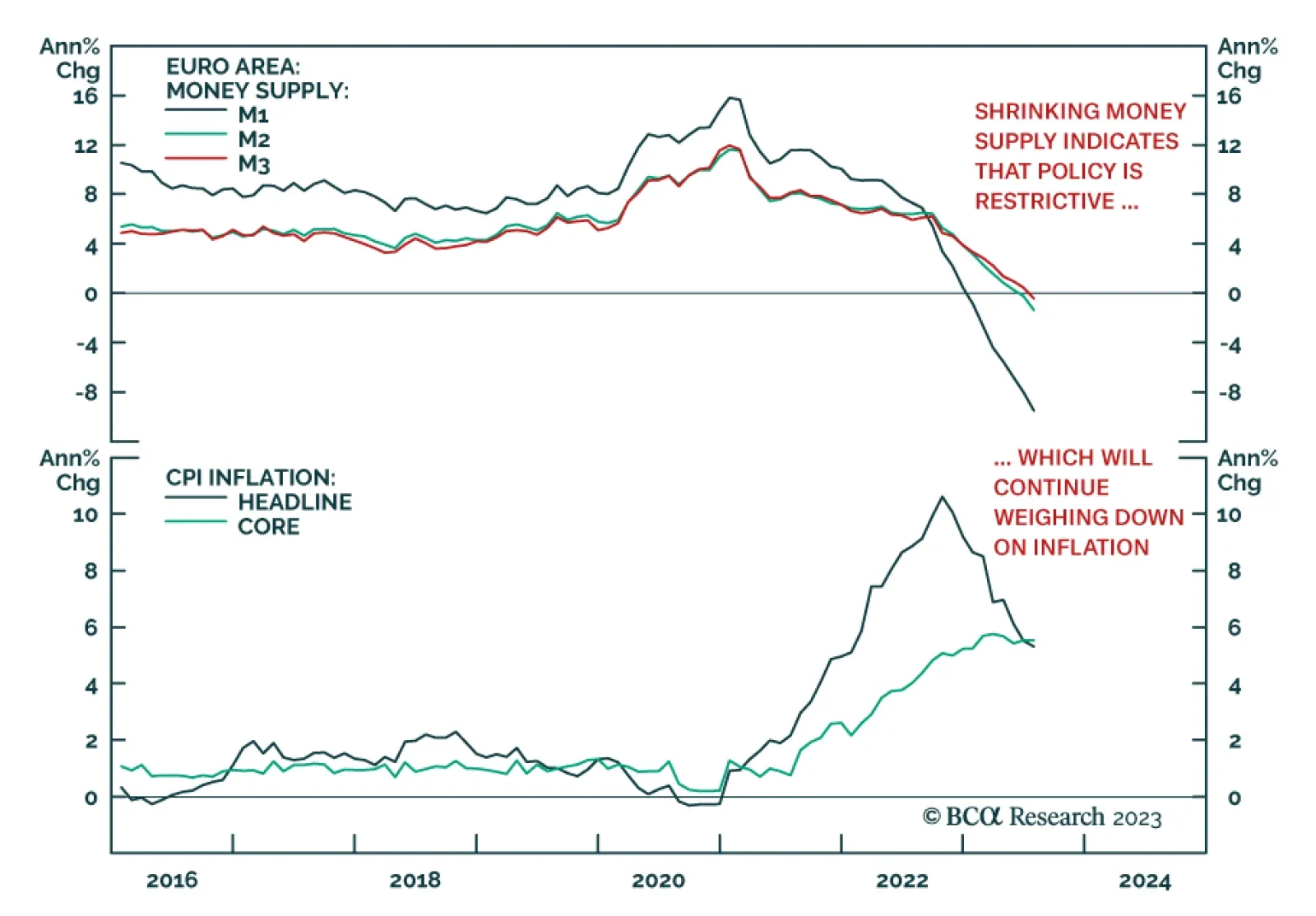

Eurozone money supply data reflect the impact of the ECB’s aggressive tightening campaign on the region’s economy. Data released on Monday showed the July M3 measure of broad money (the sum of M2, repurchase…

Today’s Strategy Report chartbook presents the data underpinning our view that both inflation and growth are slowing, likely pointing to a recession beginning sometime in the first half of next year. We are tactically equal weight…

The Treasury market’s reaction to Fed Chair Jermone Powell’s Jackson Hole speech was relatively tame on Friday. Although there was some volatility during the speech, the 10-year yield ended the day broadly unchanged.…