The implications of this morning’s CPI report for Fed policy, Treasuries and TIPS.

In this report, we review our European fixed income strategy recommendations ahead of tomorrow’s critical ECB meeting

Magnificent Seven leadership is neither a new nor an unnatural phenomenon. There is no shortage of reasons why equities might have already made a top, but investors should not be tricked into thinking that the rally was somehow…

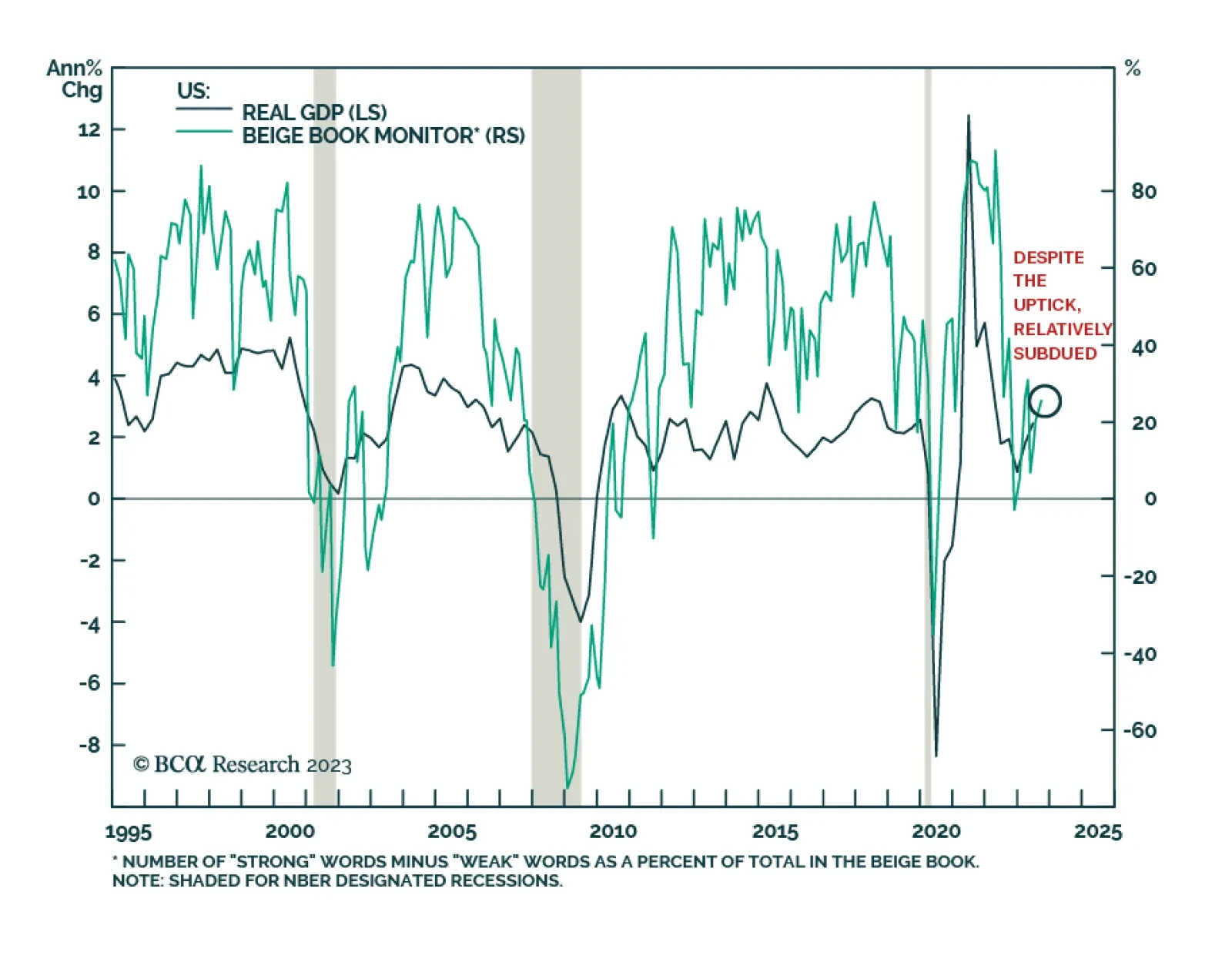

Overall, the Fed’s latest Beige Book provided a pessimistic assessment of the US economy. Although the report characterized tourism spending as “stronger than expected,” it also noted that pent-up demand for…

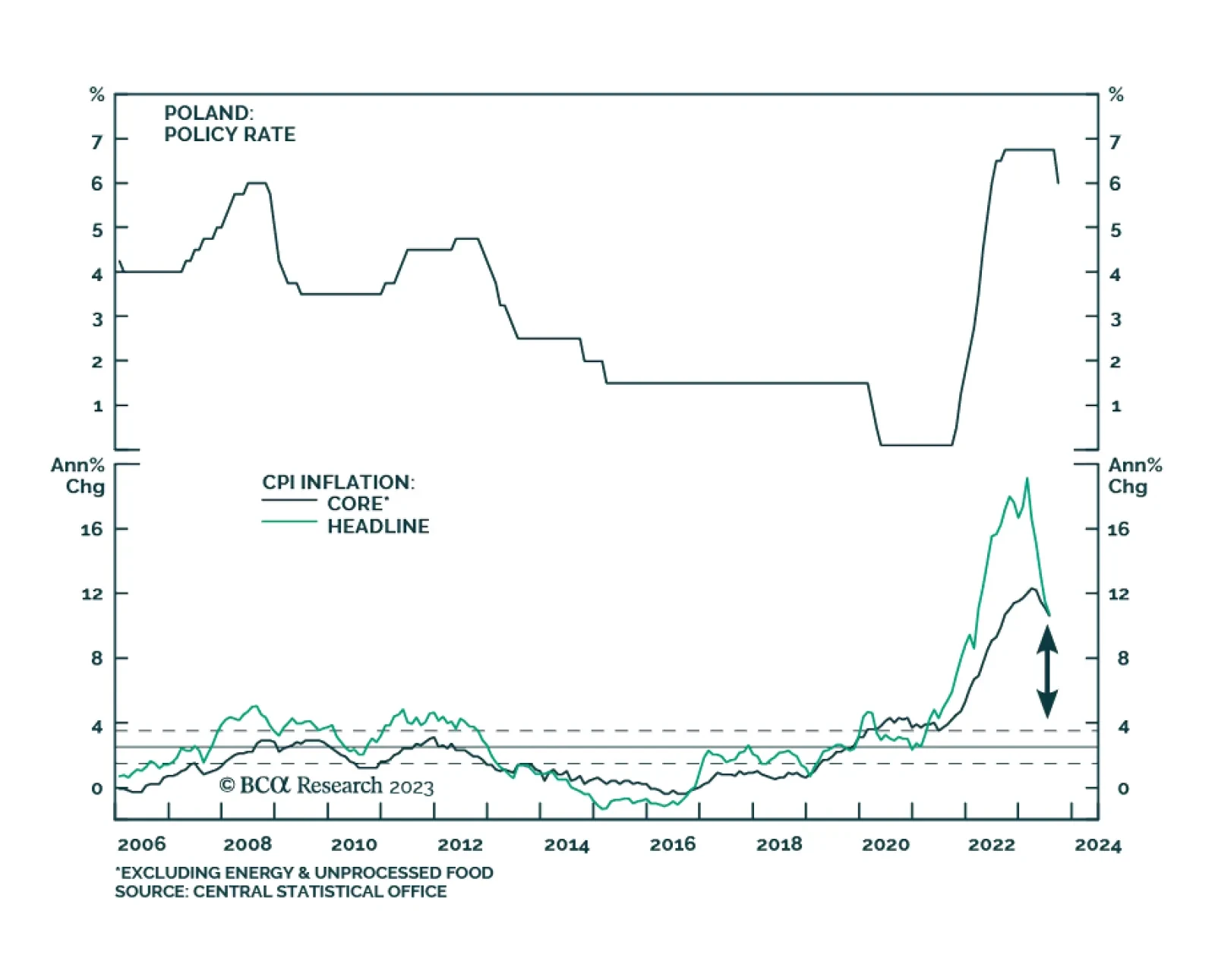

The Polish central bank delivered a larger-than-anticipated 75 basis point rate cut on Wednesday – slashing the policy rate to 6%, versus expectations of 6.5%. The aggressive move marks the first rate cut following a 11-…

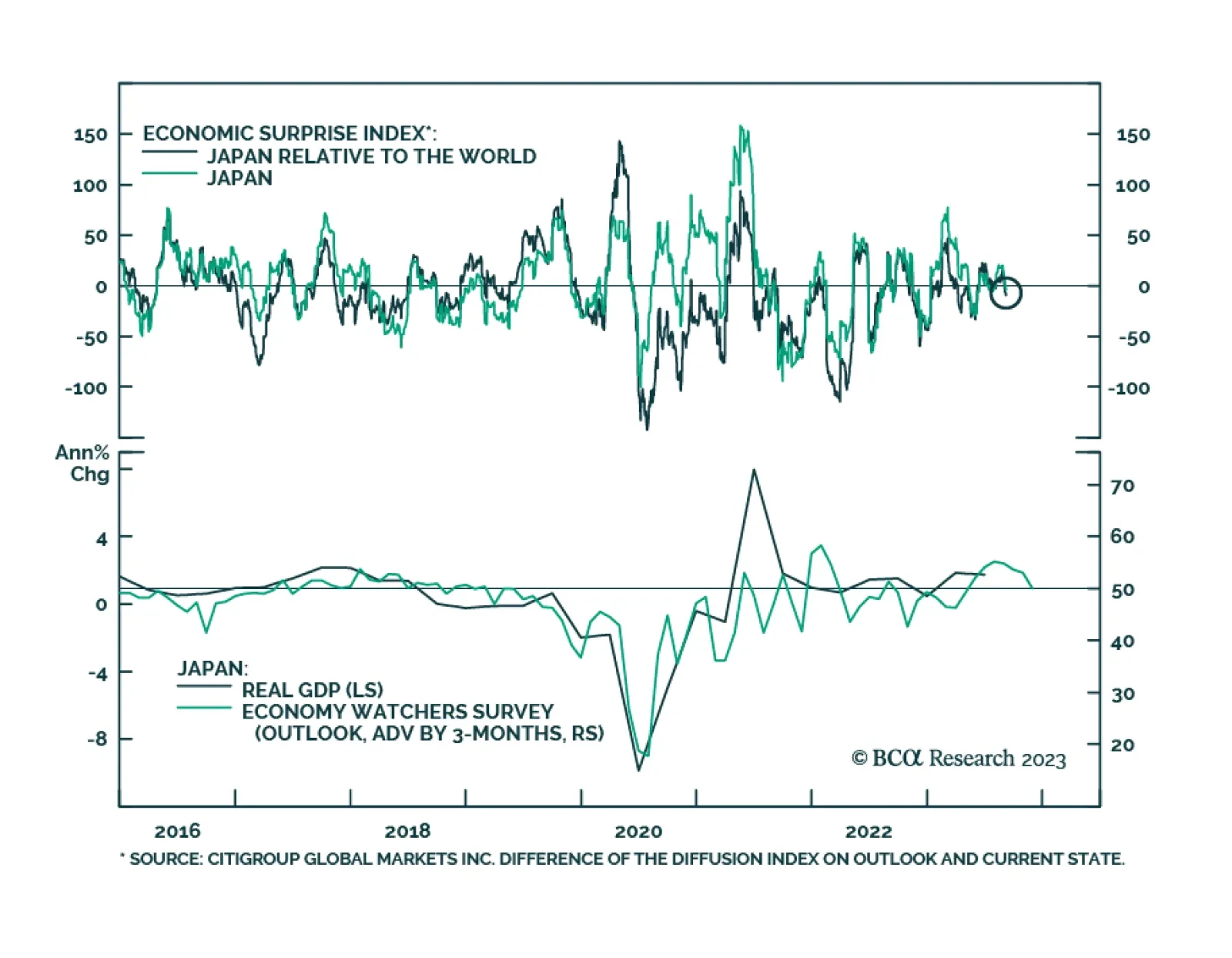

Japanese economic data delivered a negative surprise on Friday. Q2 GDP growth was revised down from 1.5% q/q to 1.2% q/q, below expectations of 1.4% q/q. The downwards revision reflects a 1% q/q decline in business spending (…

Our Portfolio Allocation Summary for September 2023.

If we look at global growth as an aircraft, the plane is experiencing failing engines and will lose more altitude in the coming months. Yet, neither Chinese authorities, nor the Fed or the ECB will be quick to come to the rescue as…