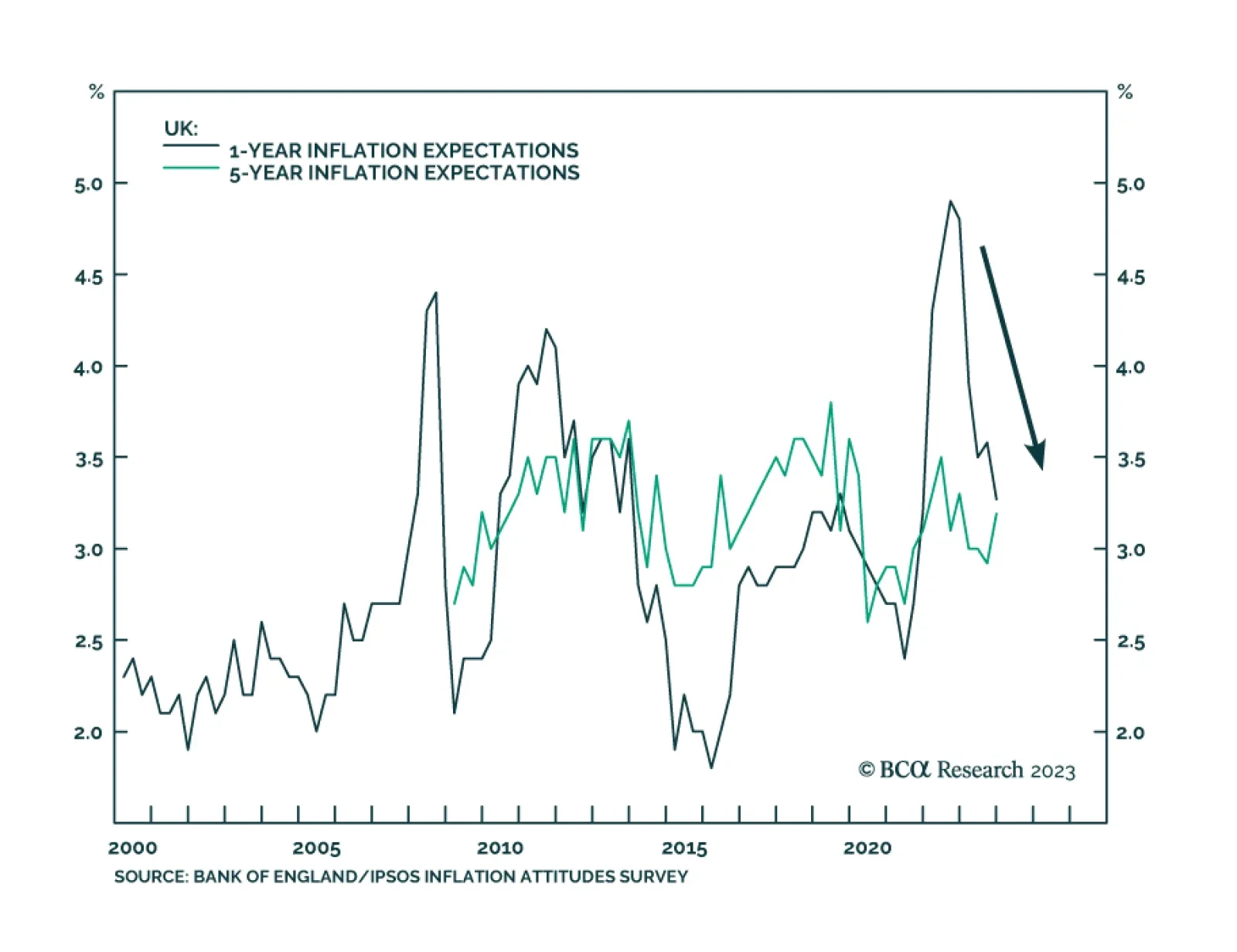

The latest Bank of England/Ipsos quarterly Inflation Attitudes Survey shows the public revised down its near-term inflation outlook. Respondents now believe inflation will fall to 3.3% in the year ahead – down from 3.6% in…

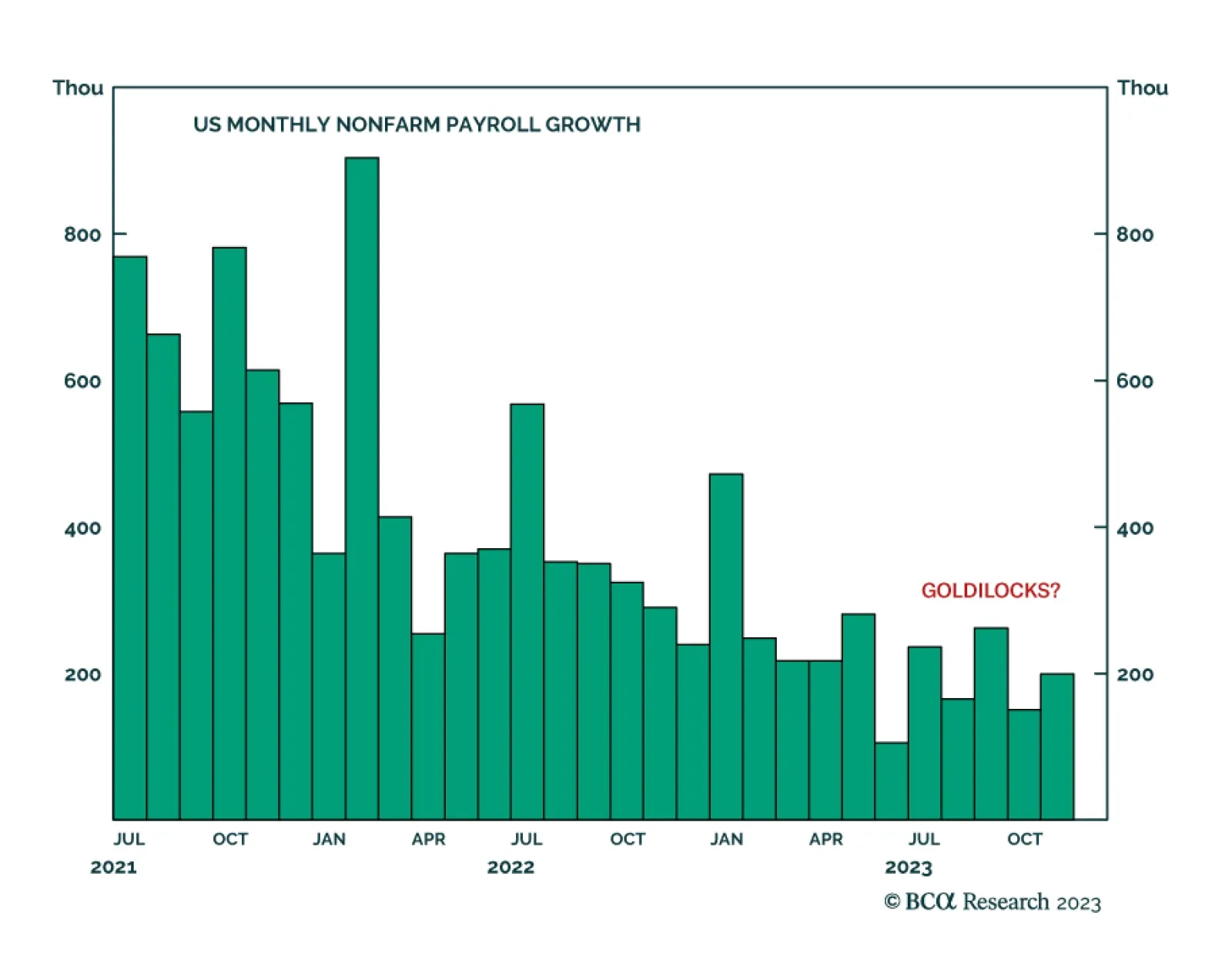

The US employment report delivered a positive surprise on Friday. Nonfarm payroll growth accelerated from 150 thousand to 199 thousand in November, beating expectations of 185 thousand. Importantly, the favorable result was…

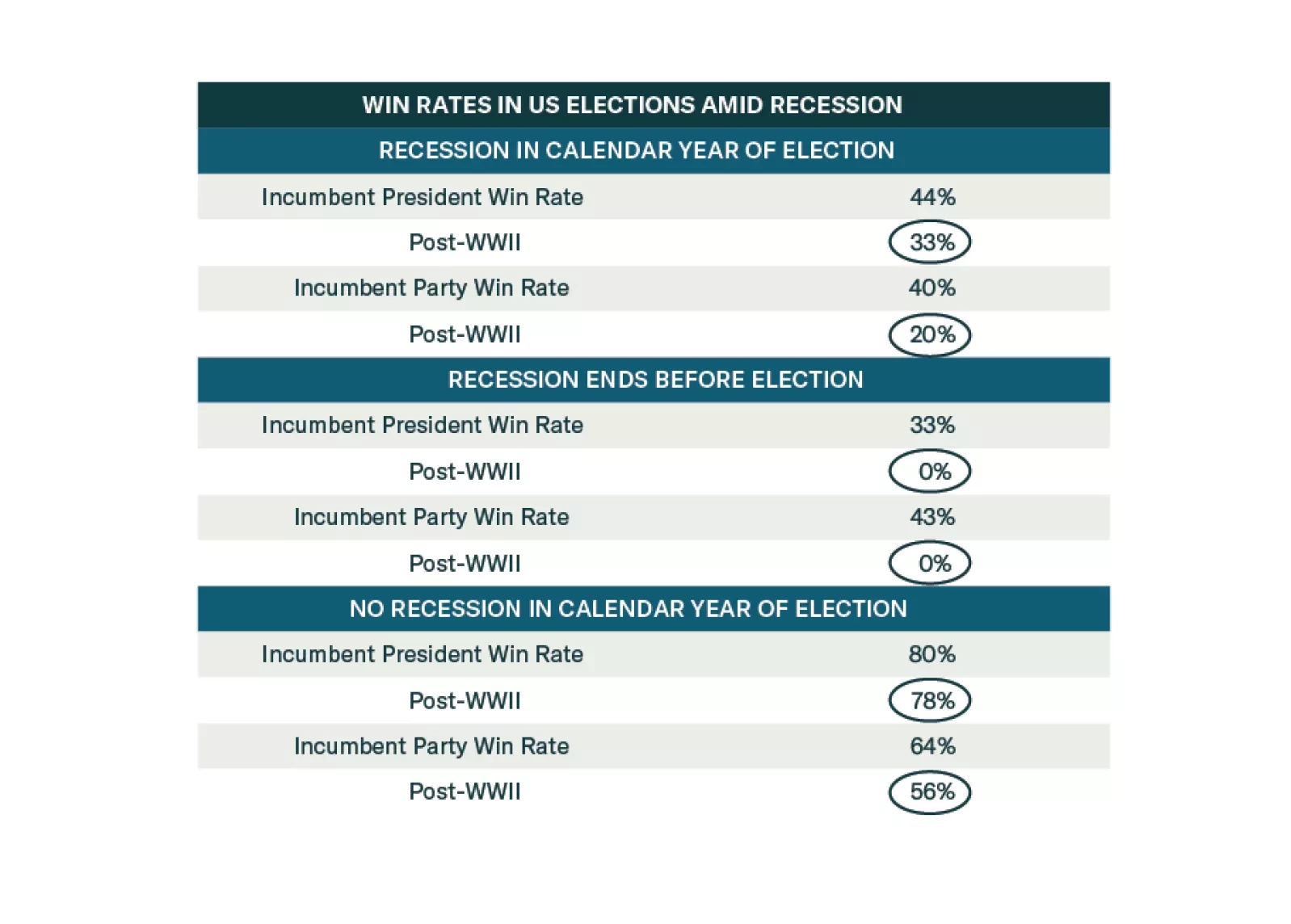

Democrats are favored to win the election until recession materializes. But recession risks are high. Investors should adopt a defensive and conservative strategy in 2024 amid extreme US policy uncertainty.

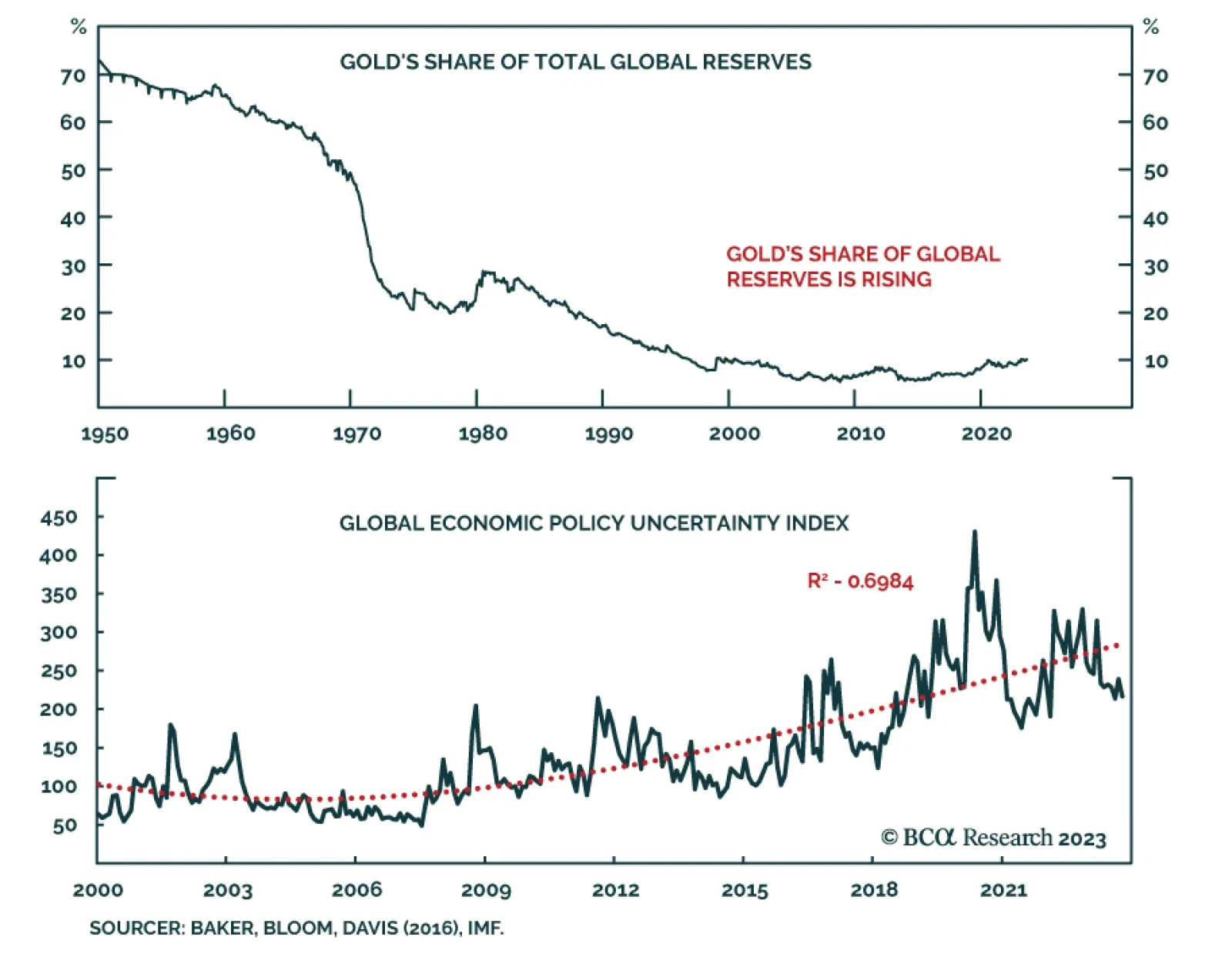

According to BCA Research’s Commodity & Energy Strategy service, as the world splits into East-West trading blocs, the continuing trend of trade fragmentation will challenge the need for a USD-centric monetary system,…

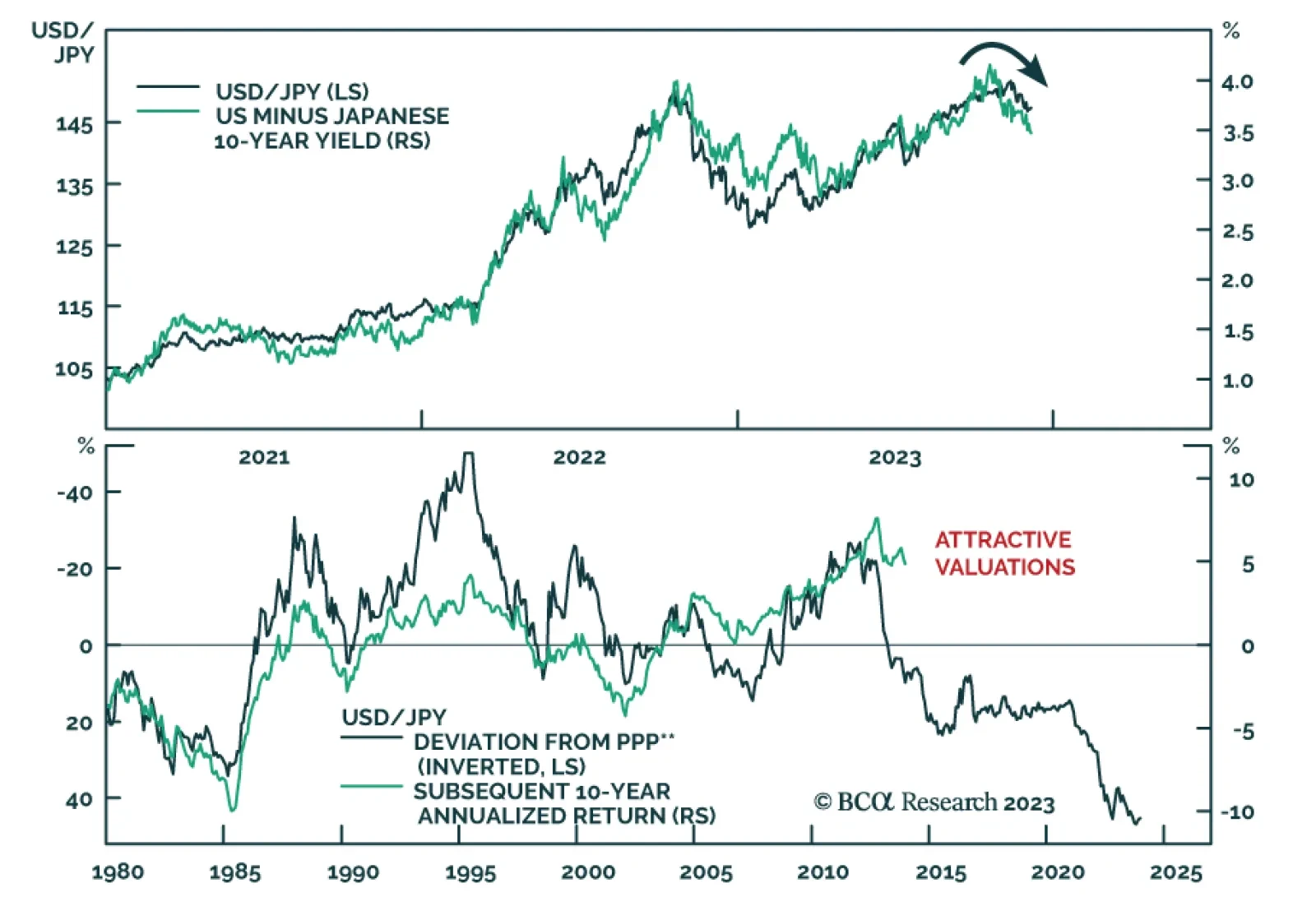

The Japanese yen strengthened considerably on Thursday after comments by Bank of Japan (BoJ) Governor Kazuo Ueda caused investors to bring forward their expectation of the timing of the end of negative rates. In particular, Ueda…

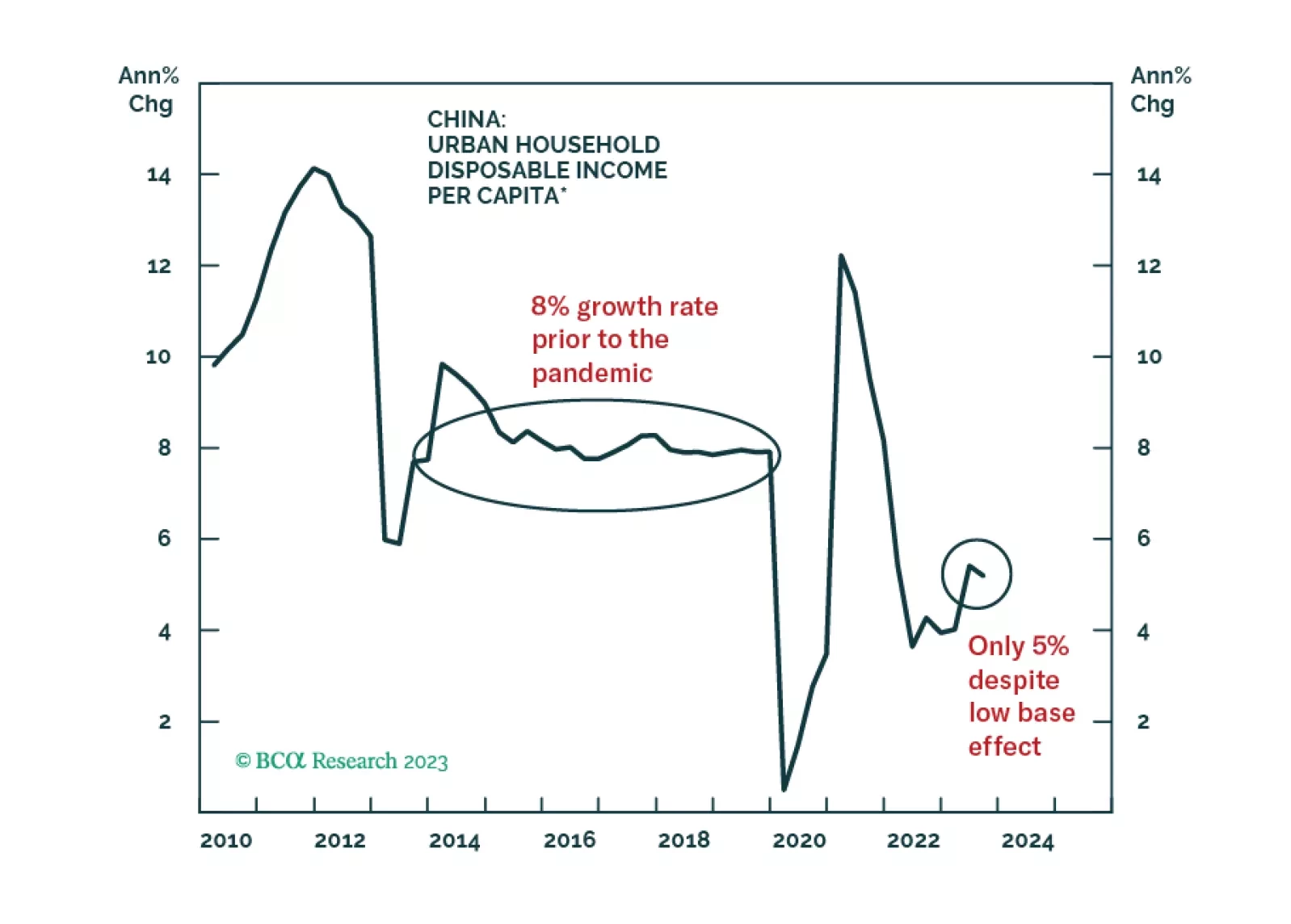

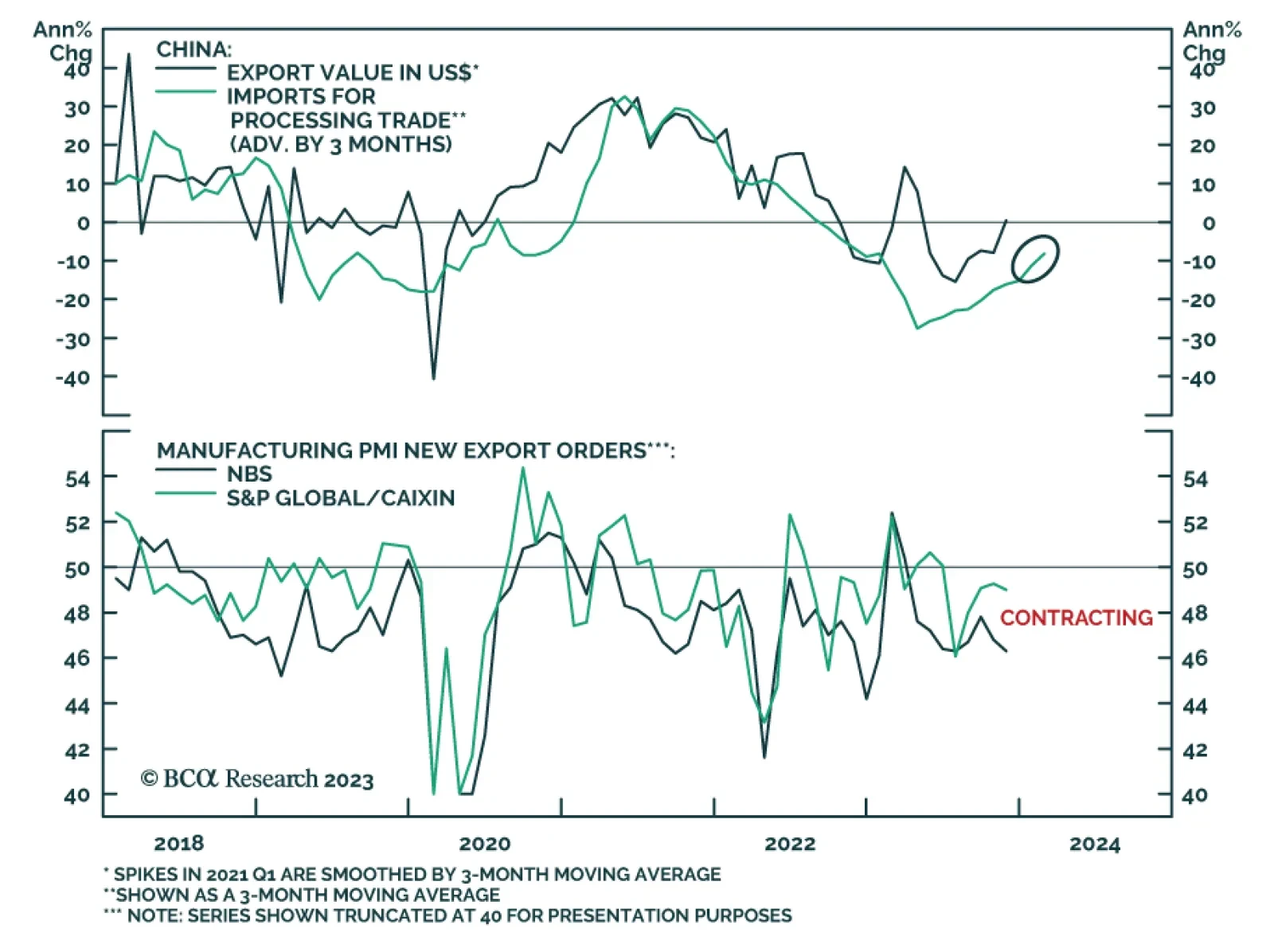

On the surface, Chinese export data delivered a positive surprise on Thursday, painting a favorable picture of the global manufacturing cycle. Exports unexpectedly grew on a year-over-year basis in November for the first time…

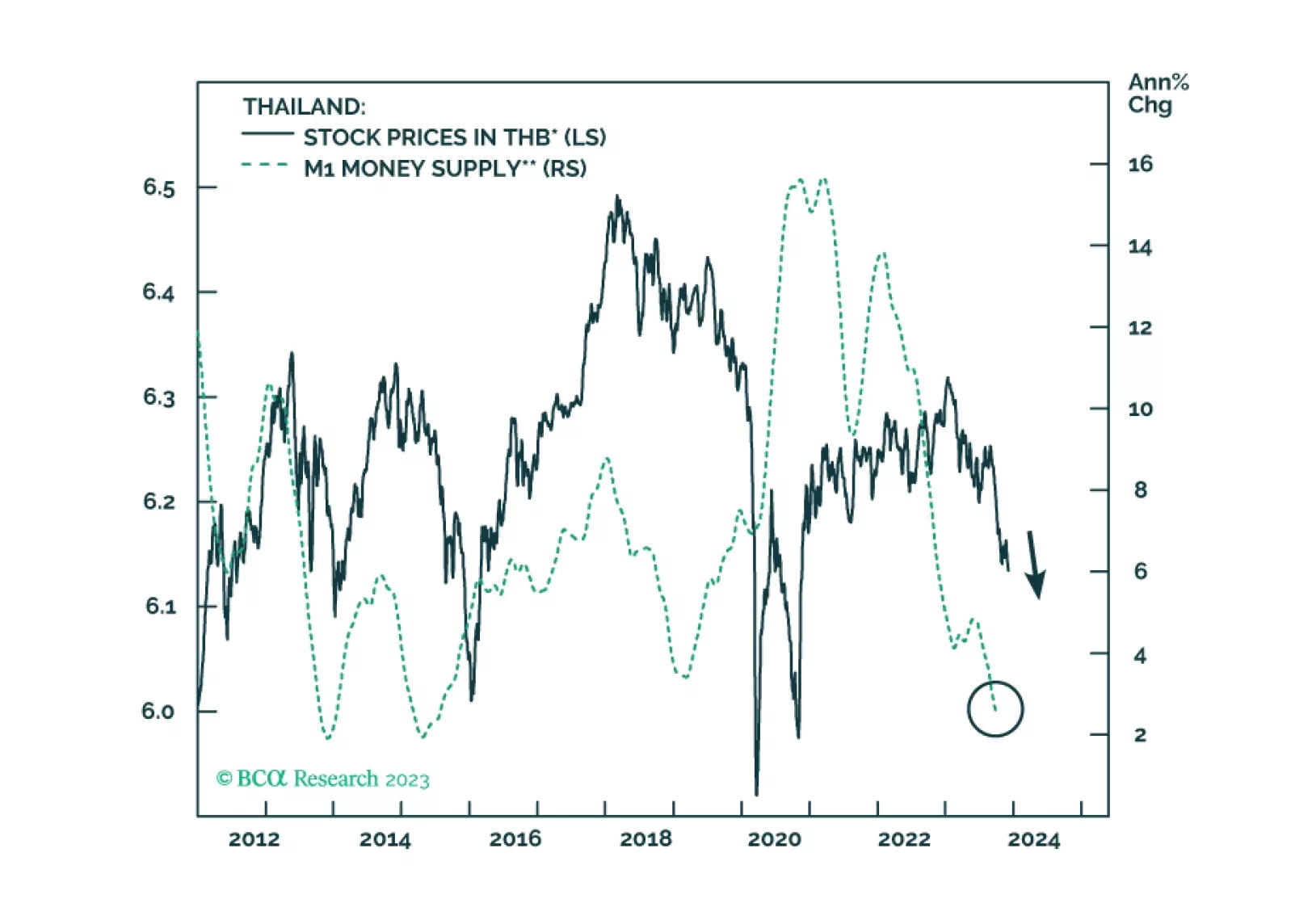

Meager credit growth and shrinking real wages will keep Thai inflation very low in the coming months. The currency will get support from an improving current account surplus. Fixed-income investors should upgrade Thailand from…

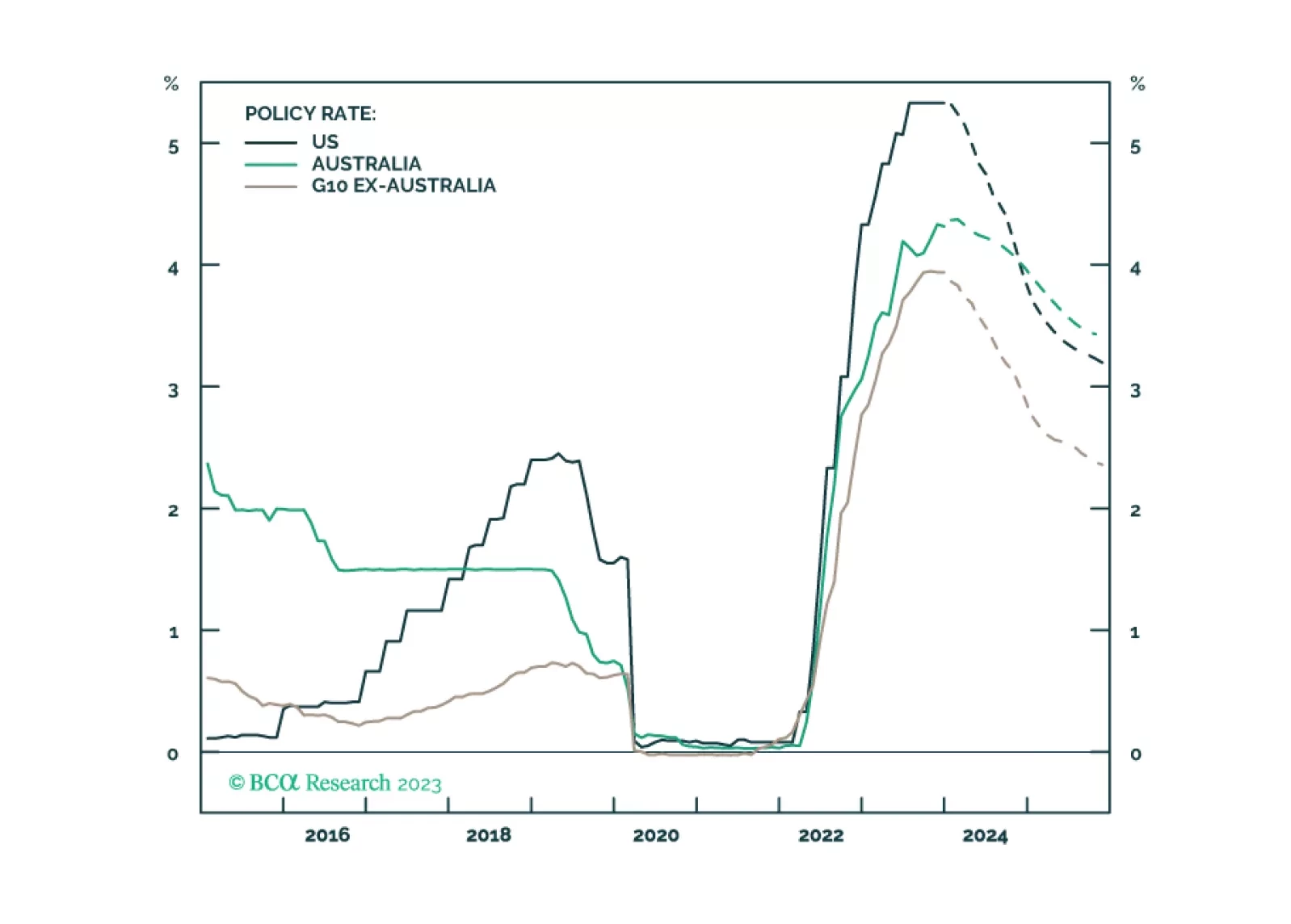

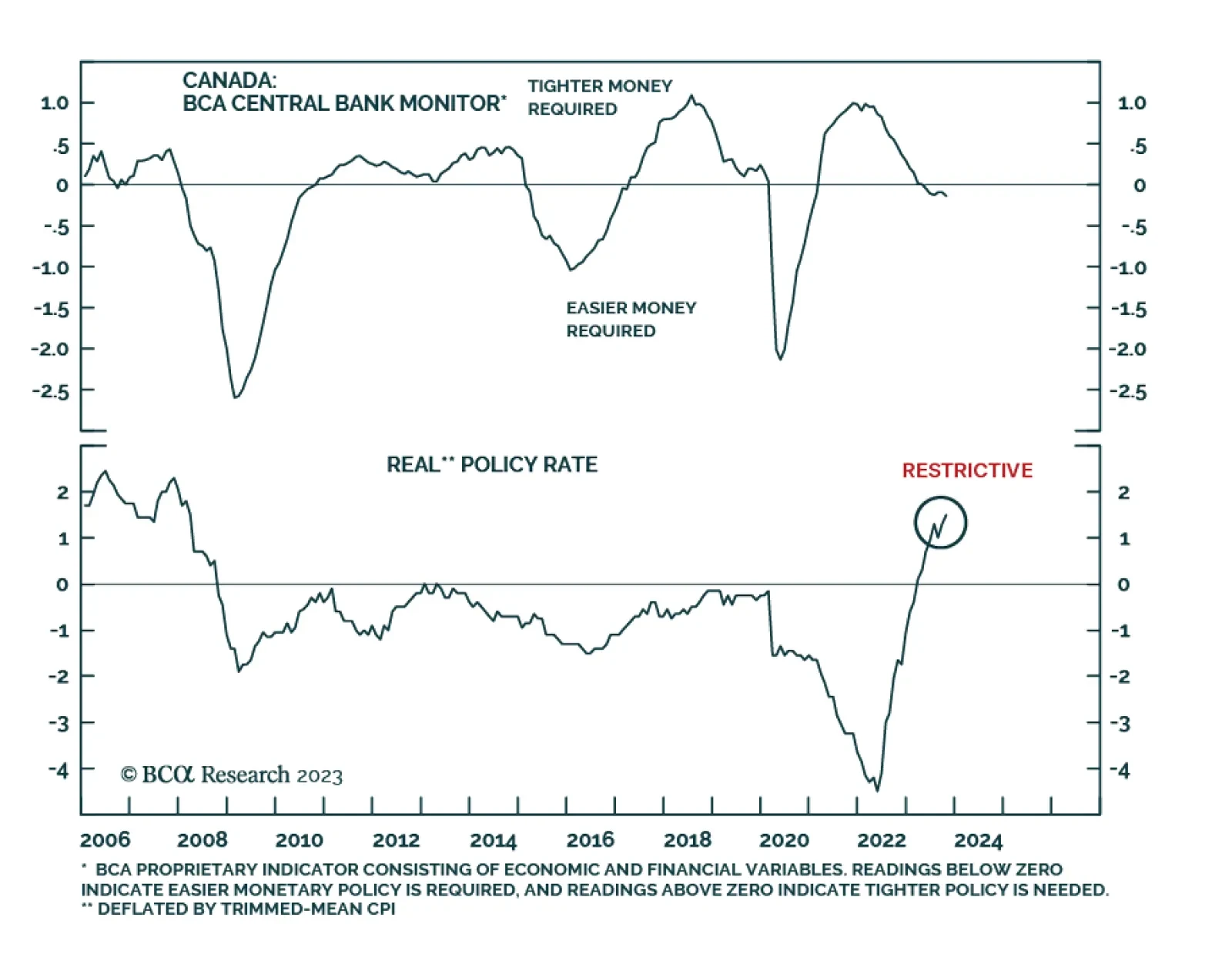

The BoC kept its policy rate steady at 5% for the fourth consecutive meeting on Wednesday, in line with expectations. In its press release, the BoC maintained that it is ready to keep hiking if deemed necessary. That said, the…