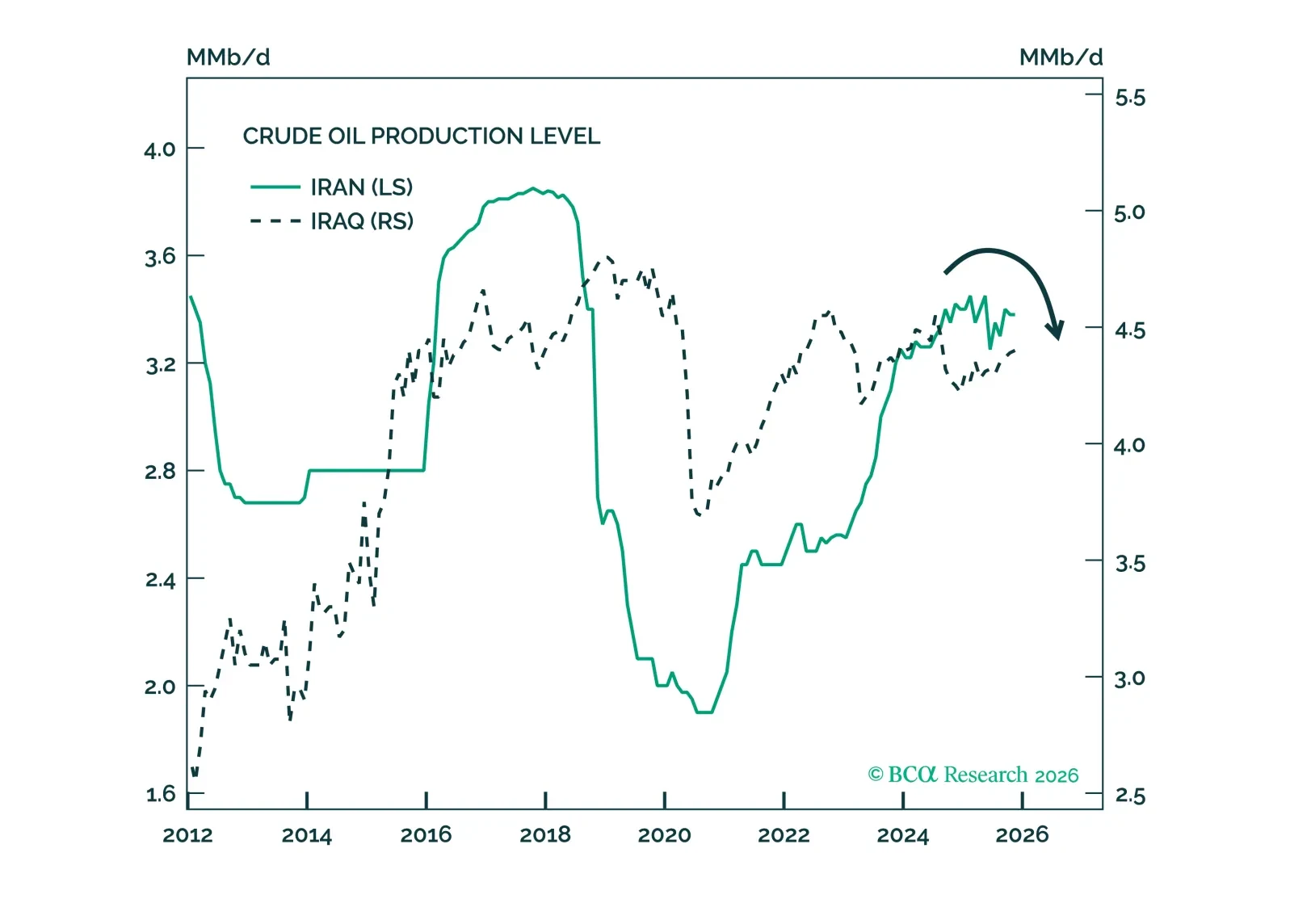

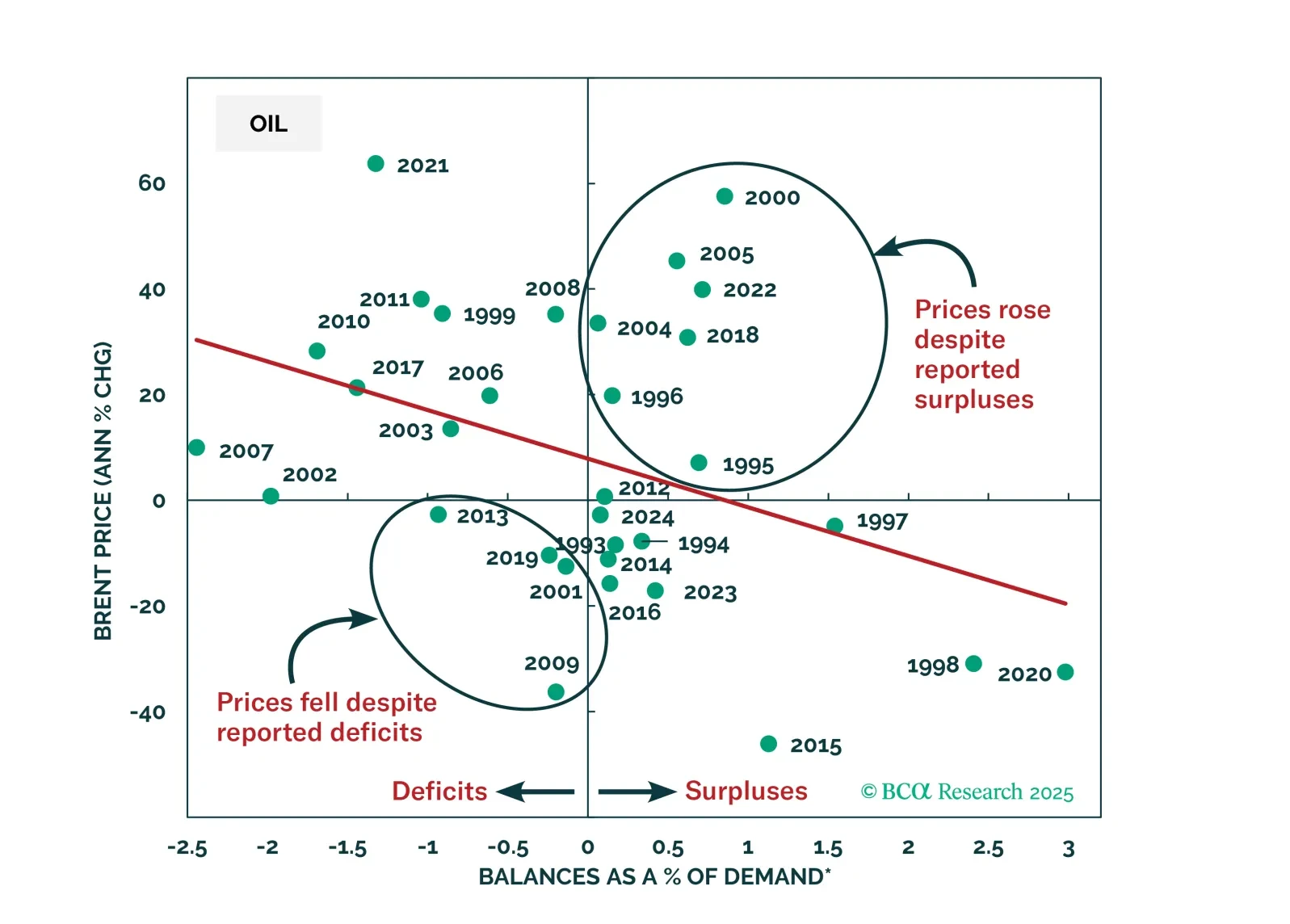

The risk to Iran's regime survival raises the probability of a massive global oil supply shock back to around 40%, where we put it last year.

Venezuelan crude output is unlikely to alter the global oil market outlook for this year. However, US control of Venezuelan crude is a risk to Canadian oil sands producers and Canadian oil prices. Go long US oil refiners/short…

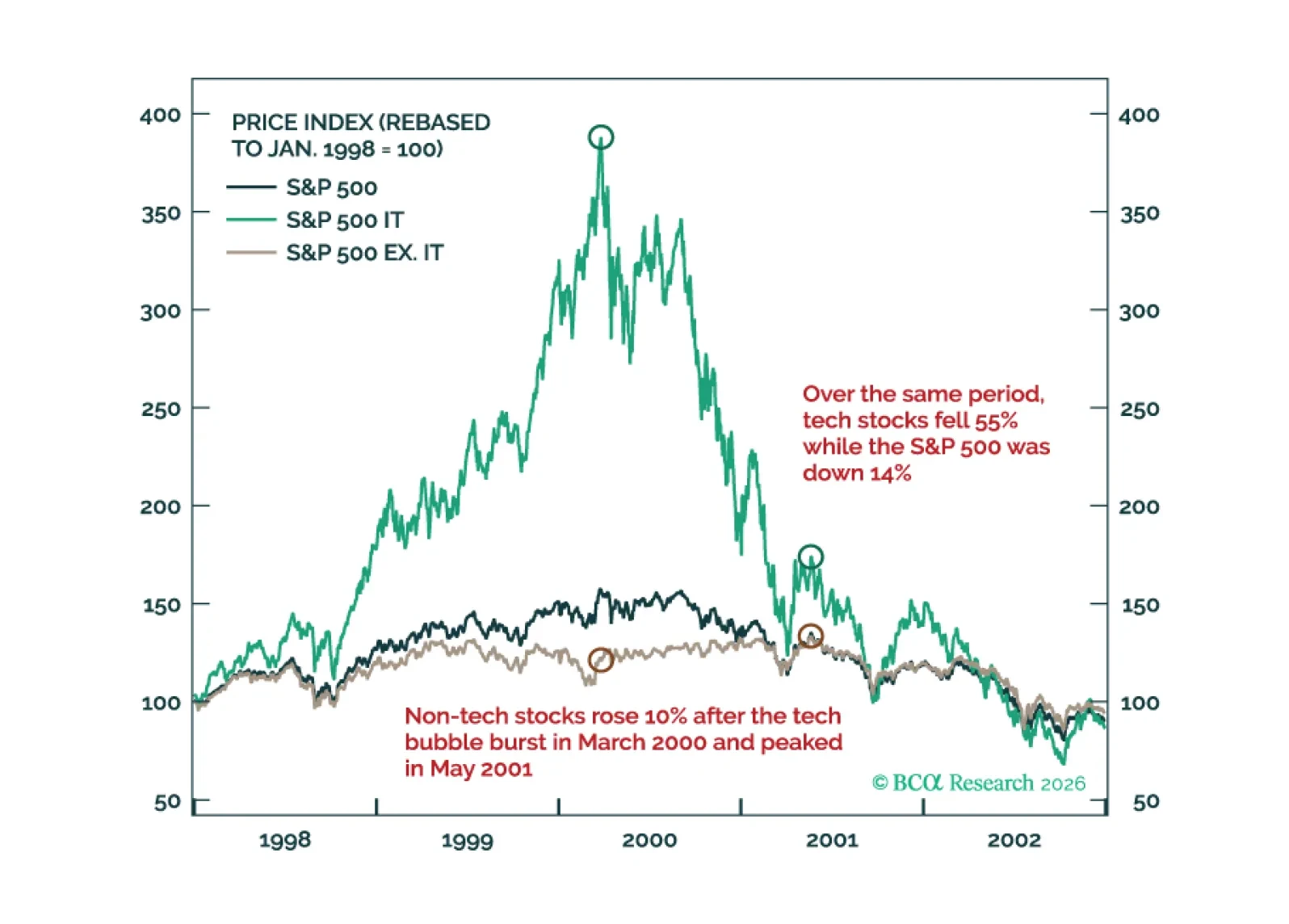

Much like the 2000 episode, we expect this year to unfold in two stages: A “Great Rotation” from tech stocks to non-tech names in the first half of 2026 followed by a broad-based selloff in stocks in the second half on the back of a…

The first week of January is always the most difficult for investment strategists. The annual outlook is usually penned in early December. Ours went to your inbox on December 2, perhaps too early to get a read on the next 12 (really 13!)…

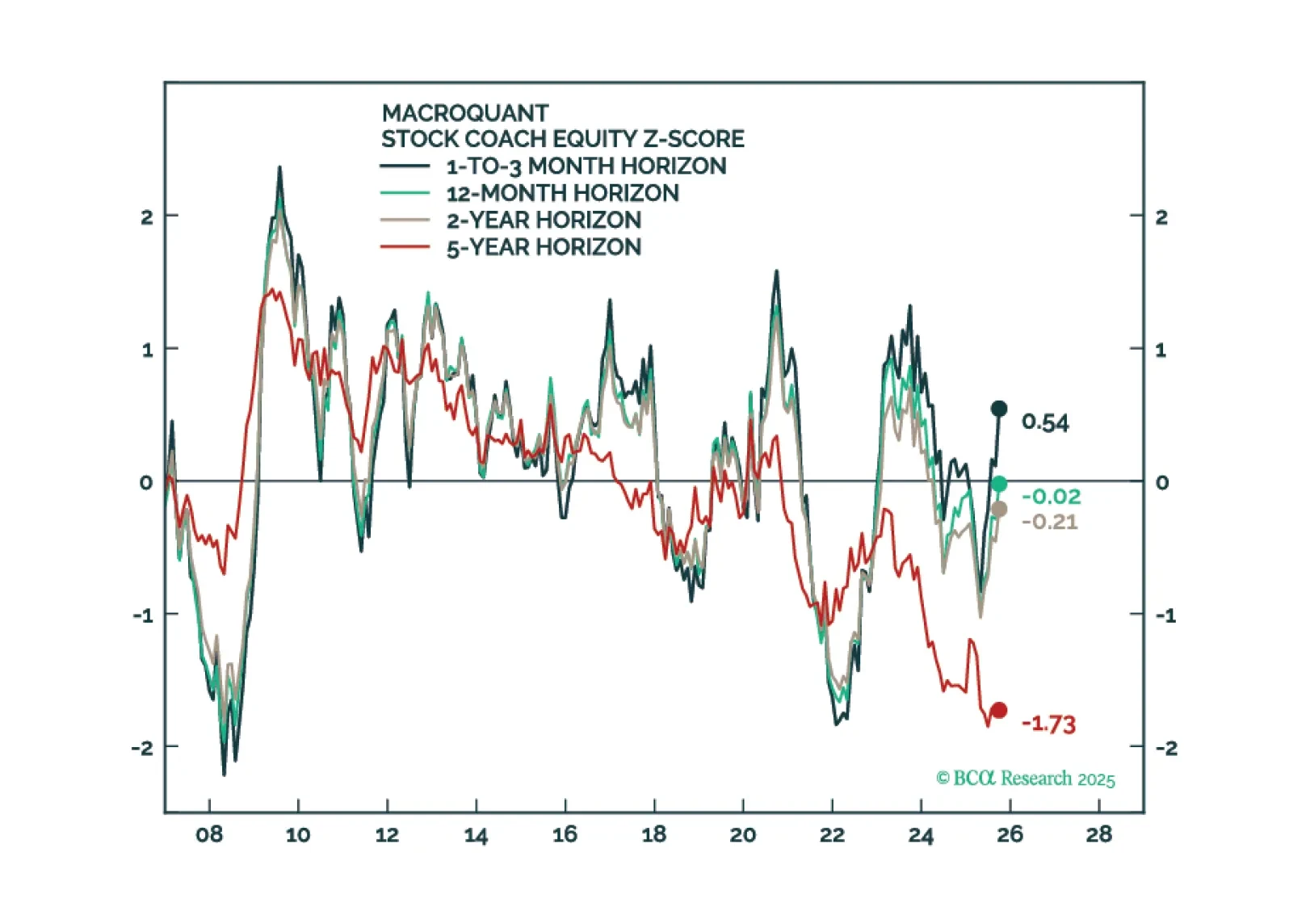

MacroQuant has downgraded equities to underweight, favors a below-benchmark duration stance in fixed-income portfolios, remains bearish on the US dollar, and is still bullish on gold.

This year, we once again present our 2026 outlook as a retrospective from the future – a future in which the AI boom turned to bust.Next week, please join me for a Webcast on Wednesday, December 17 at 10:30 AM EST (3:30 PM GMT, 4:30…

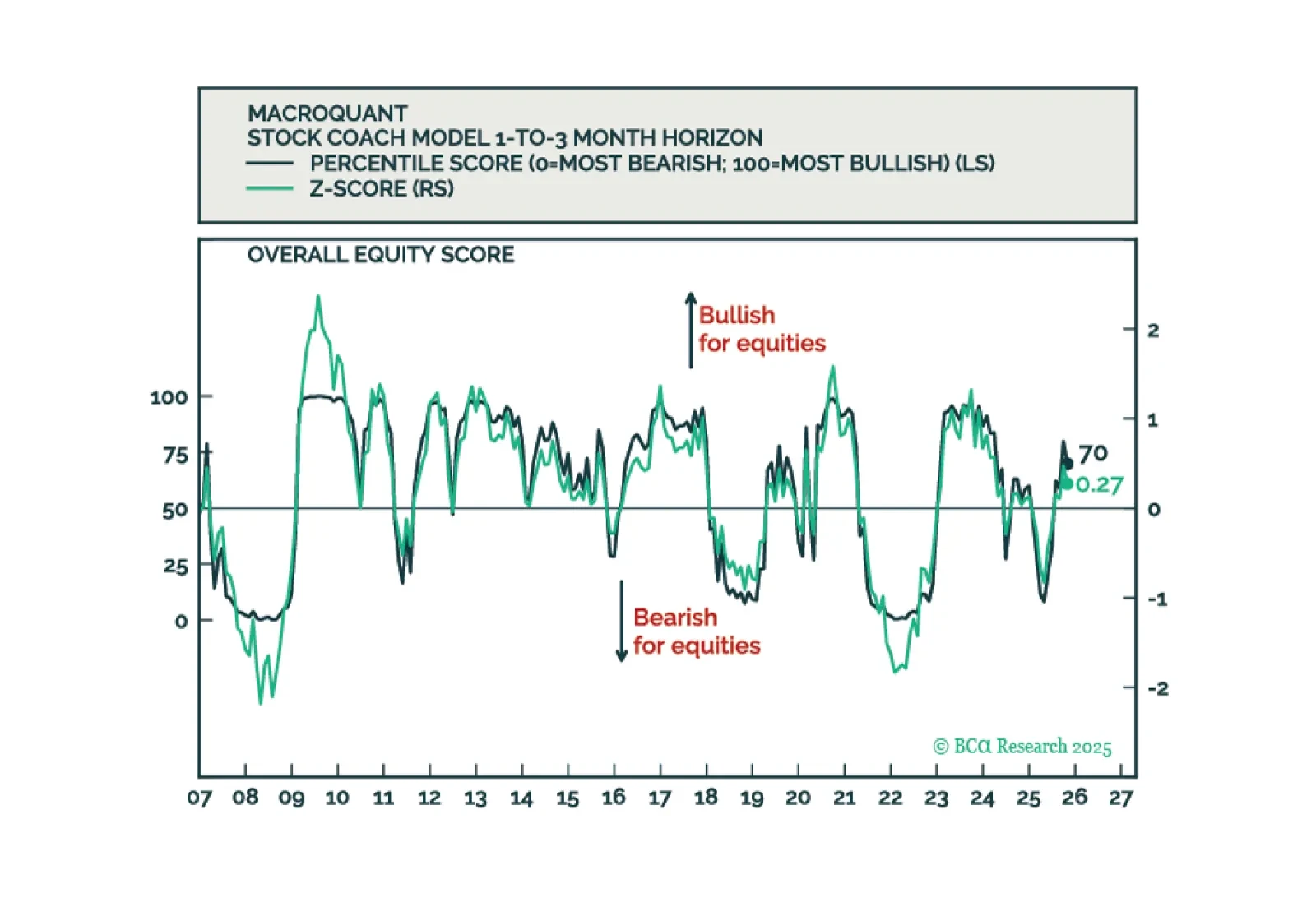

MacroQuant remains tactically overweight equities, favors an above-benchmark duration stance in fixed-income portfolios, remains bearish on the US dollar, and is bullish on gold.

MacroQuant is tactically overweight equities, favors an above-benchmark duration stance in fixed-income portfolios, remains bearish on the US dollar, and is bullish on gold and copper.