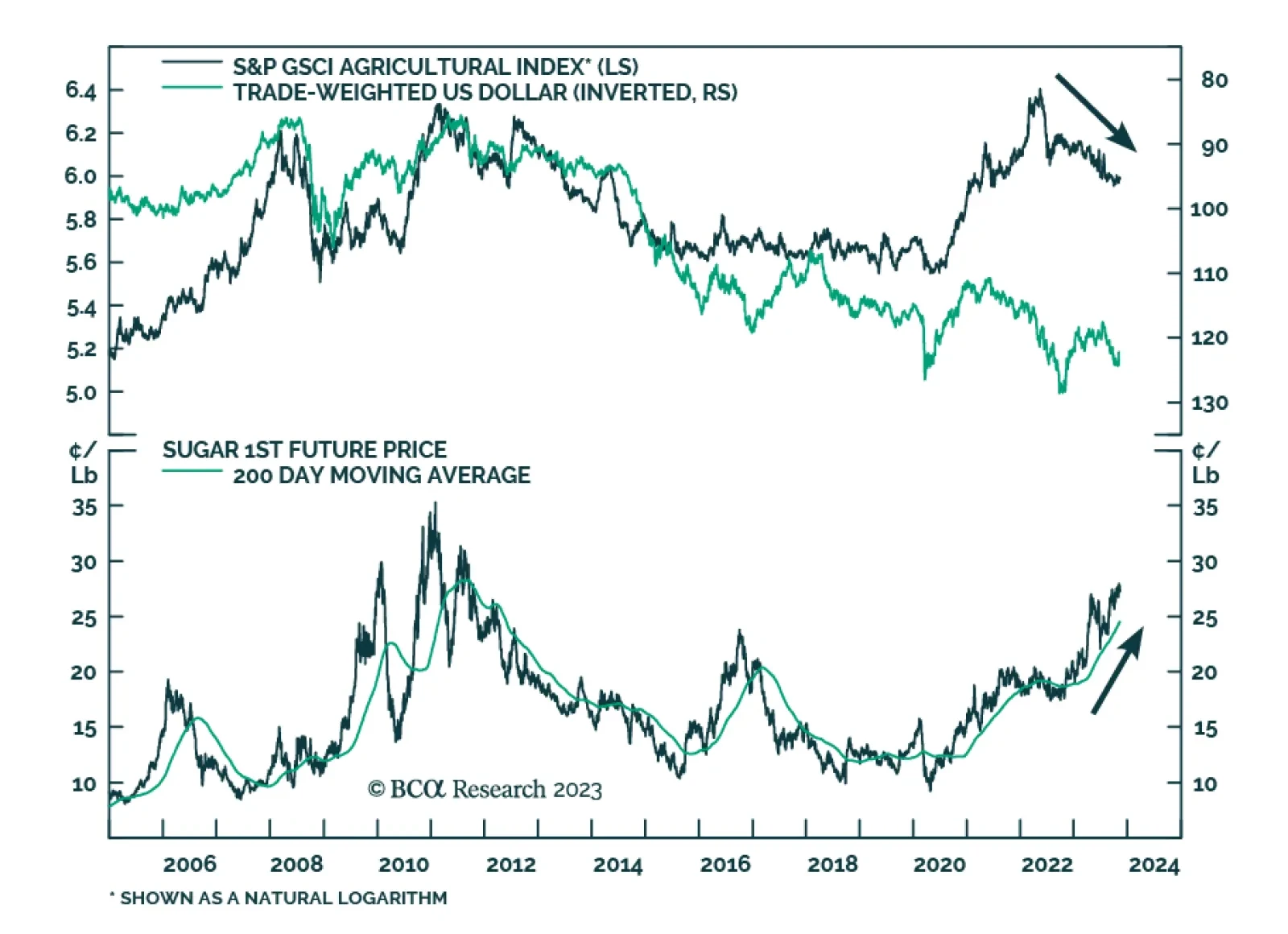

Agriculture commodity prices have been on a steady decline for over a year. Since peaking in mid-May 2022, the GSCI Agriculture index has dropped by 34% -- nearly half of which occurred in 2023. The weakness is generally broad-…

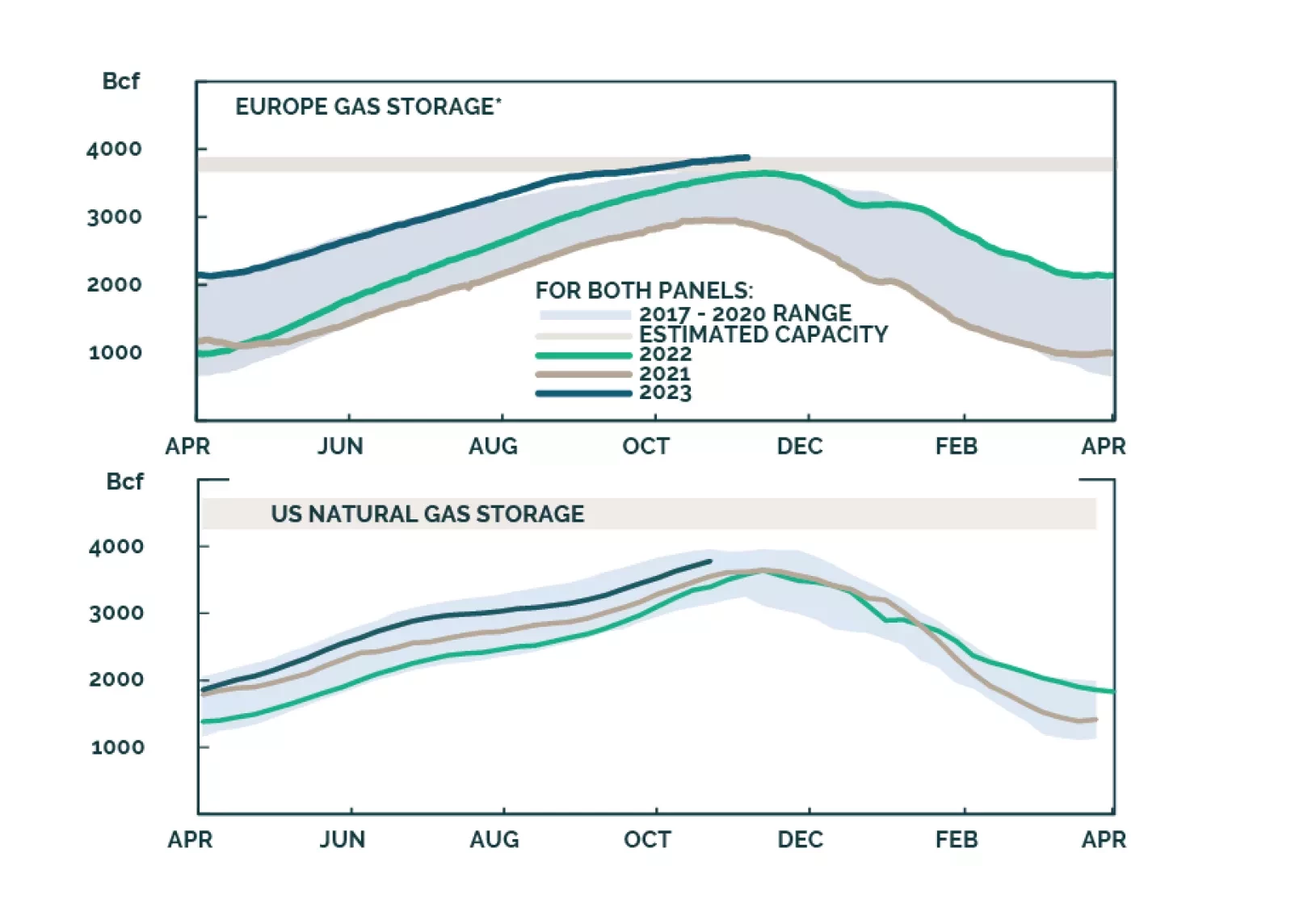

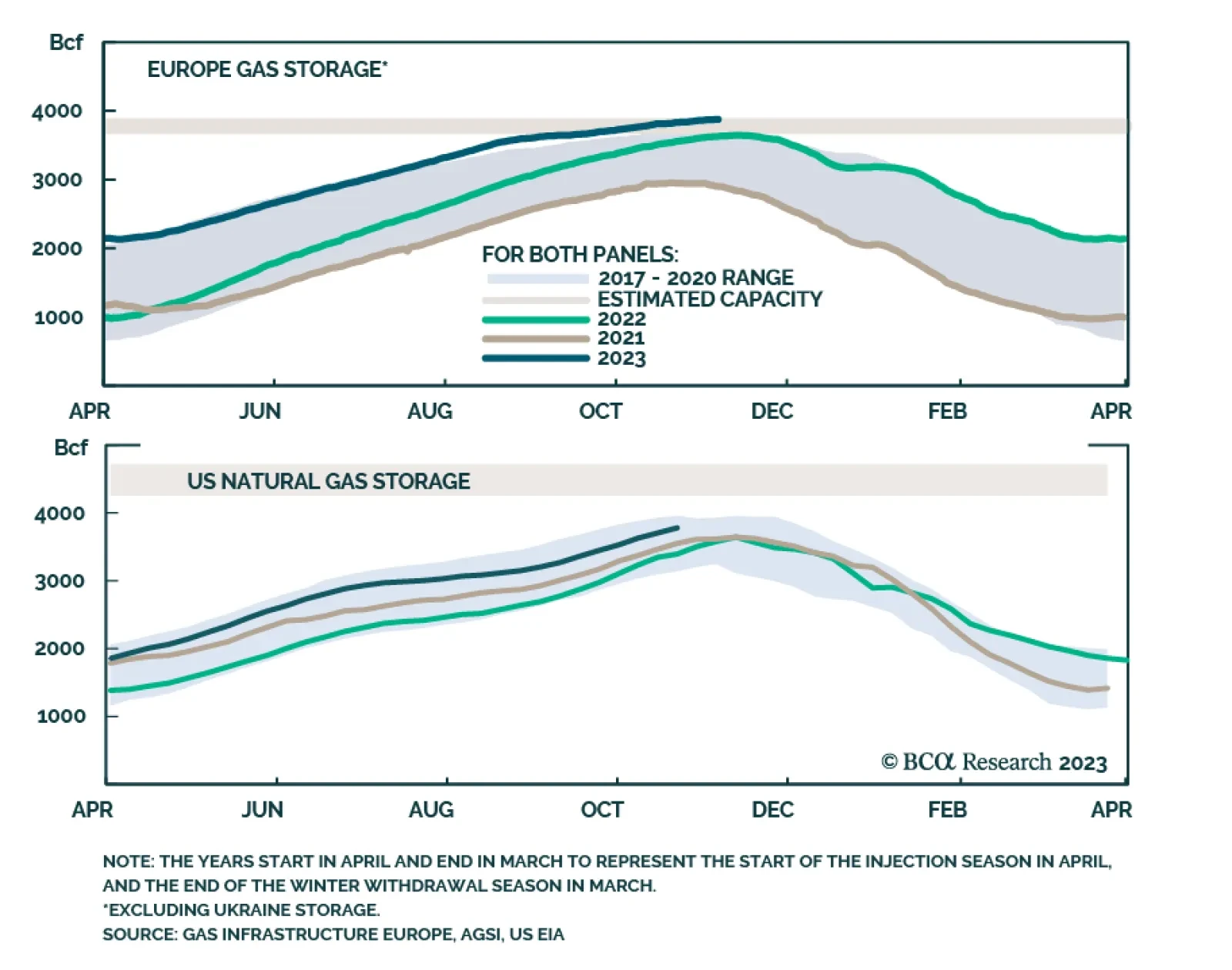

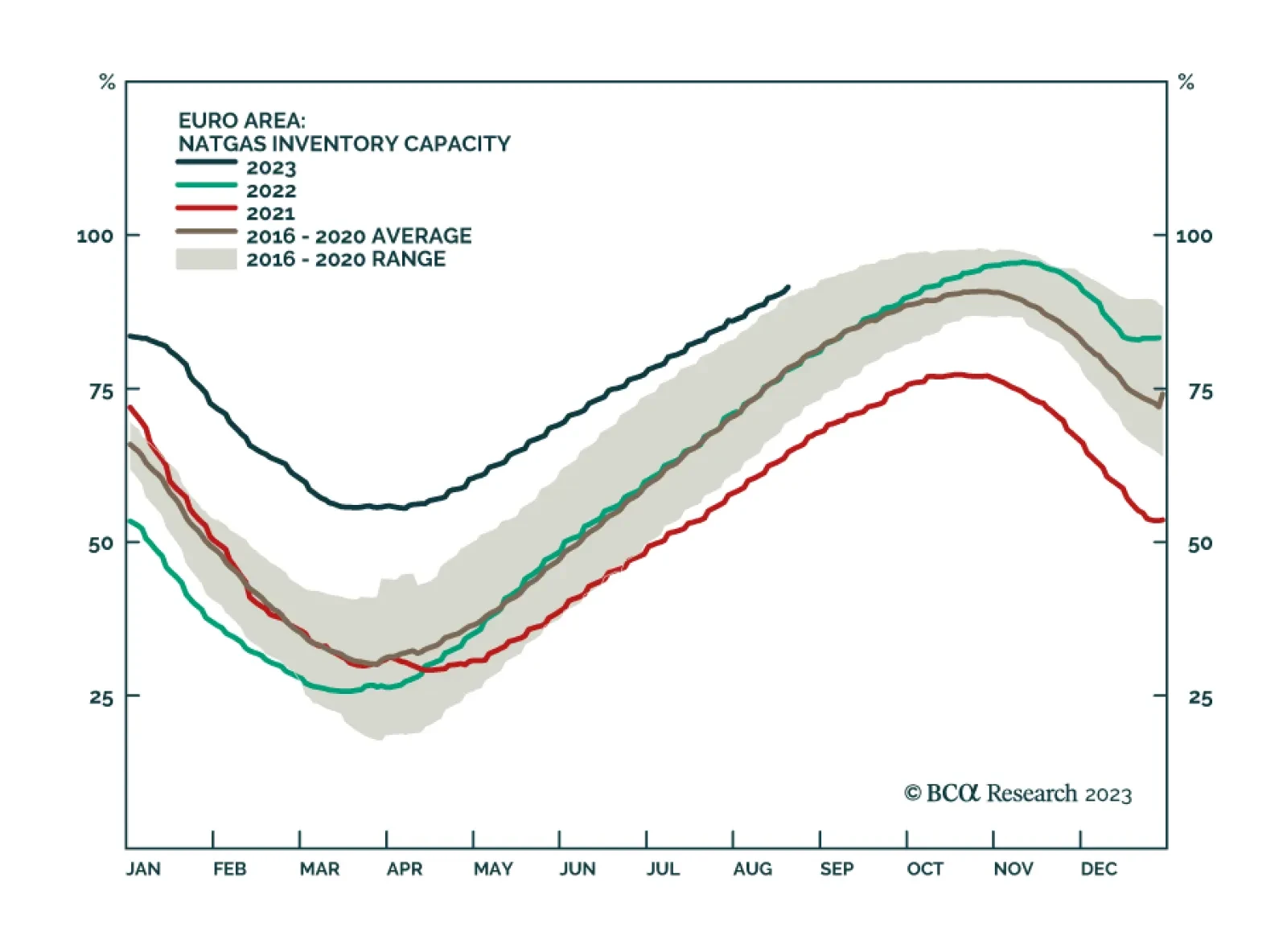

In the short run – i.e., over the current Northern Hemisphere winter – natural gas storage levels will be sufficient to balance heating and industrial demand with flowing supplies, assuming a normal winter in the EU…

Natural gas storage levels in the US and EU are sufficient to balance flowing supply and demand this winter, assuming normal weather. China continues to invest in domestic production, and to diversify supply sources to compensate…

Volatility will remain the key dynamic in oil markets in the aftermath of the surprise Hamas attacks against Israel on October 7. The risk of a major oil supply shock has gone up, but meanwhile supply constraints will remain at…

The global energy transition will become more disorderly, if oil-and-gas capex growth continues to outpace that of critical minerals. We remain long exposure to the equities of oil and gas producers via the XOP ETF; the COMT ETF to…

China’s reopening faltered and now it is applying moderate stimulus. OPEC 2.0’s production discipline is getting results, with oil prices climbing. The Fed will not be able to deliver dovish surprises in Q4 2023. Investors should…

The geopolitical backdrop remains negative despite some marginally less negative news. China’s stimulus is not yet large or fast enough to prevent a market riot. Two of our preferred equity regions, ASEAN and Europe, are struggling…

European natural gas prices have recently been trending higher with the Dutch TTF gaining 66% since late July. The proximate cause of the rally is supply concerns. The risk of strikes at Australian LNG plants are a threat to the…

Positive economic surprises have delayed the onset of recession in the United States. But tighter monetary and fiscal policy, slowing global growth, and a looming rebound in policy uncertainty and geopolitical risk suggest that…

The attempted coup in Russia produced subdued short-covering rallies in oil, gas, and grains markets, as markets over time have observed that coups, rarely result in loss of production and exports. Markets await Putin’s next move.…