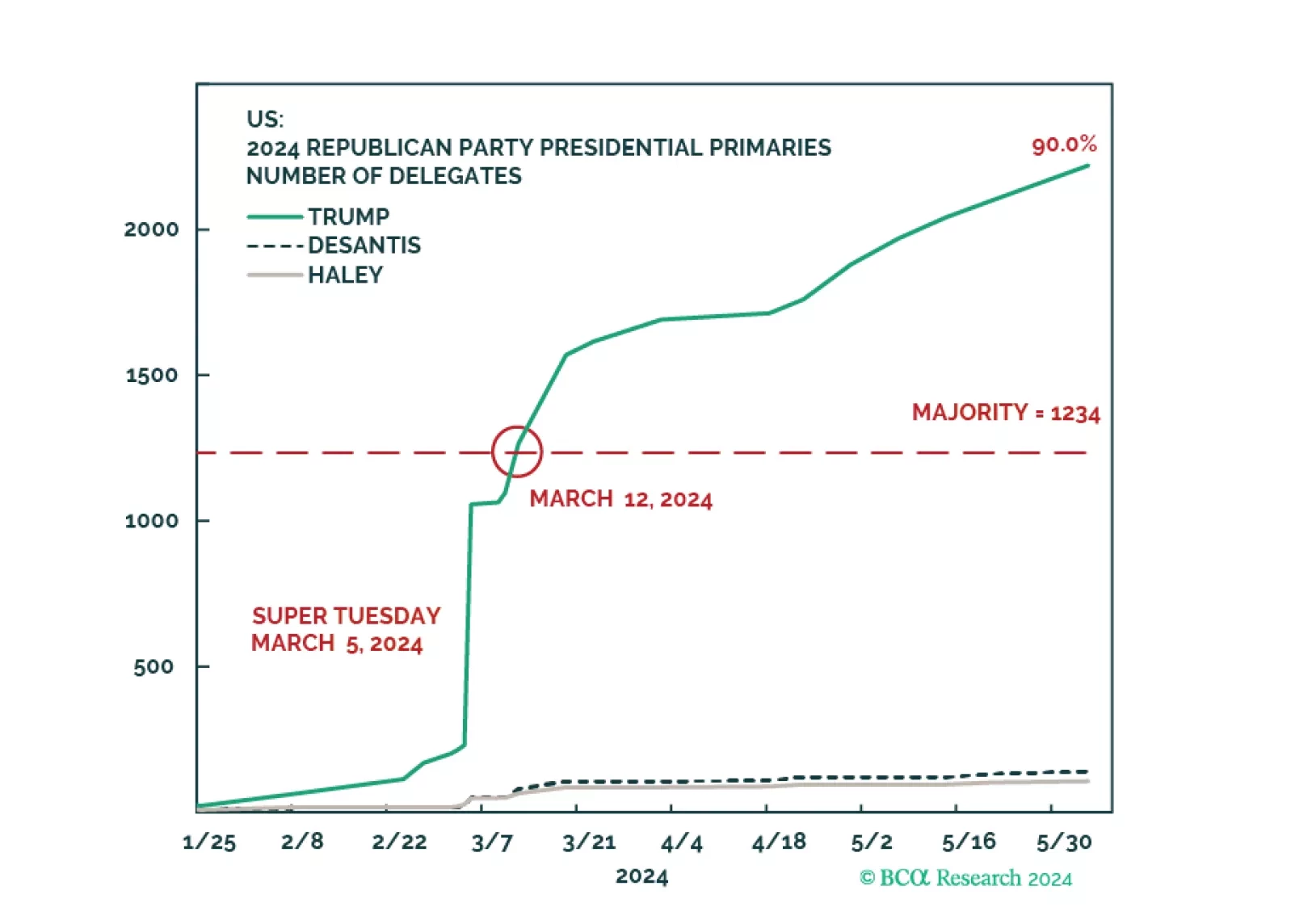

The market will eventually be forced to react to rising odds of a sharp US national policy reversal. Investors should overweight government bonds and defensive equity sectors.

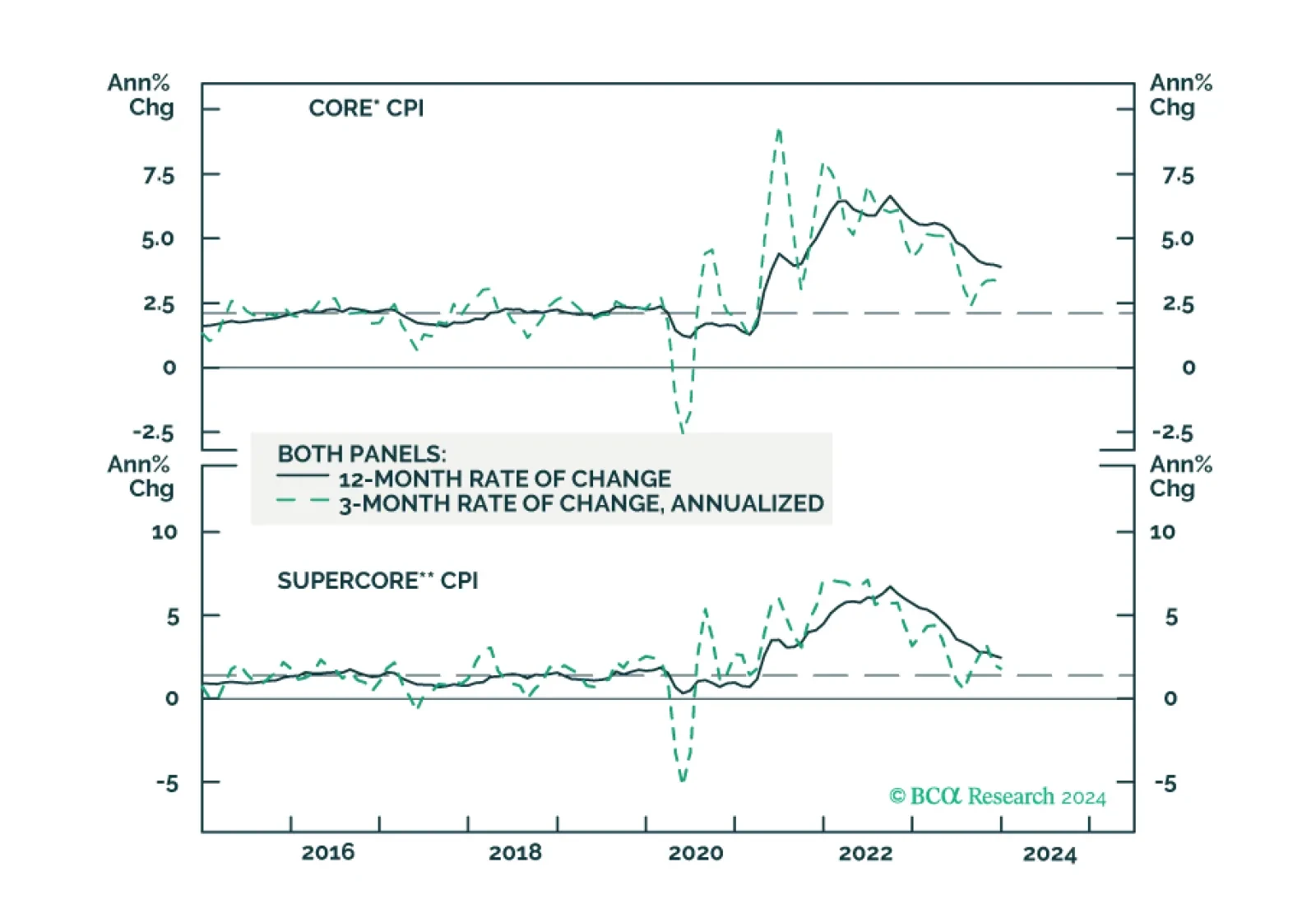

We update our inflation forecast following this morning’s CPI report.

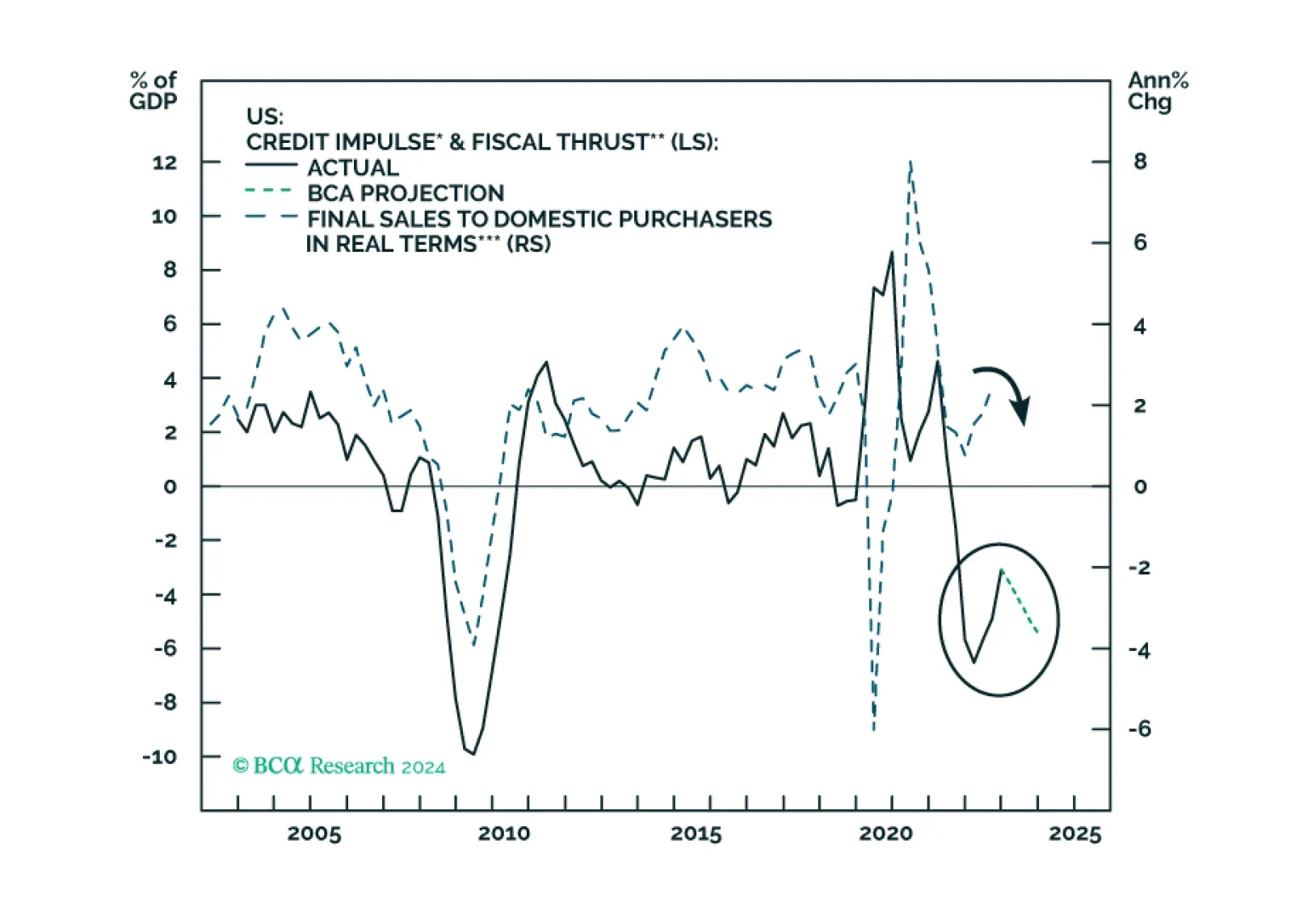

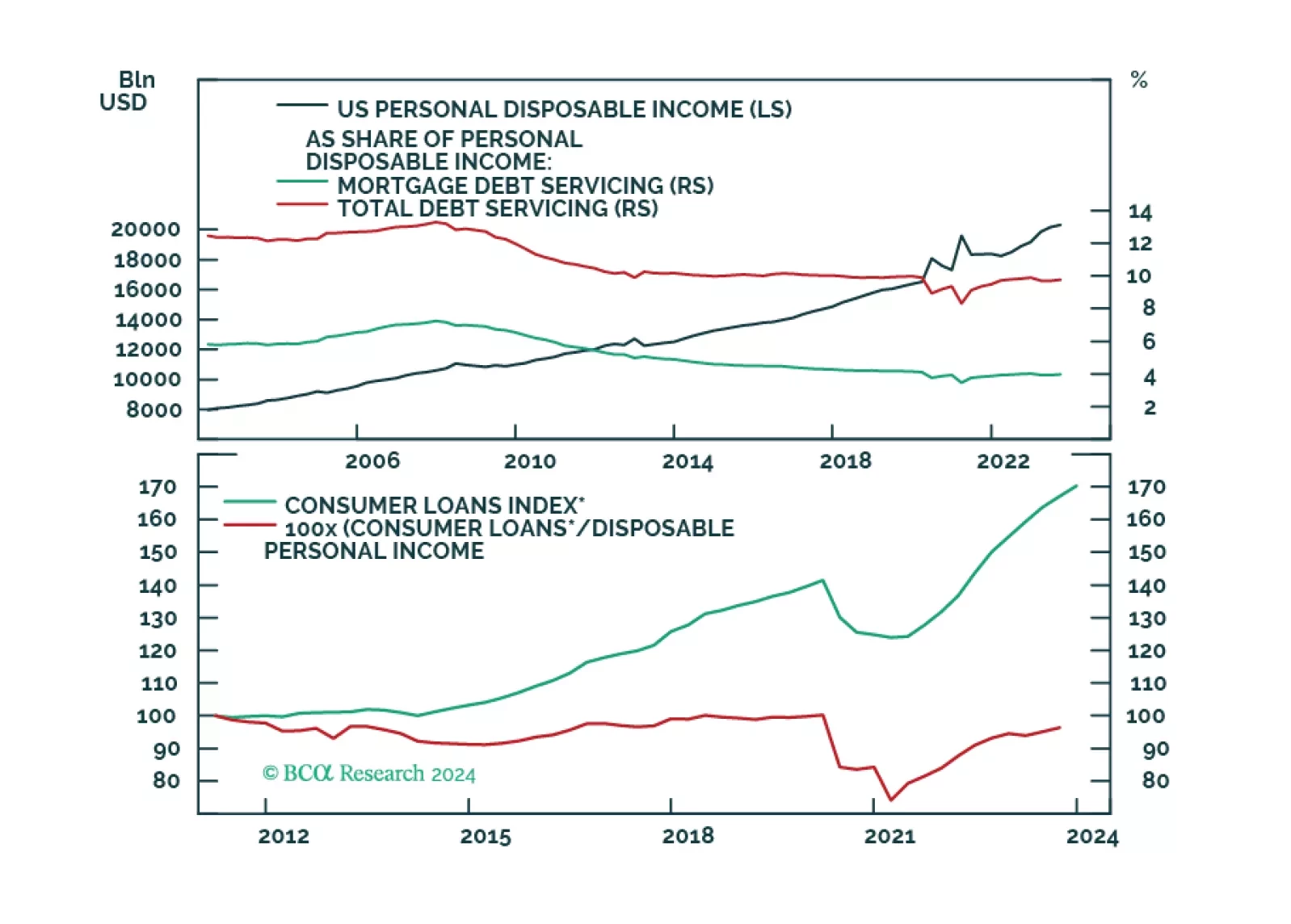

The combined US credit impulse and fiscal thrust indicator will likely relapse in 2024, heralding growth weakness. Stalling US sales volume and falling inflation, combined with sticky labor costs, will herald a non-trivial profit…

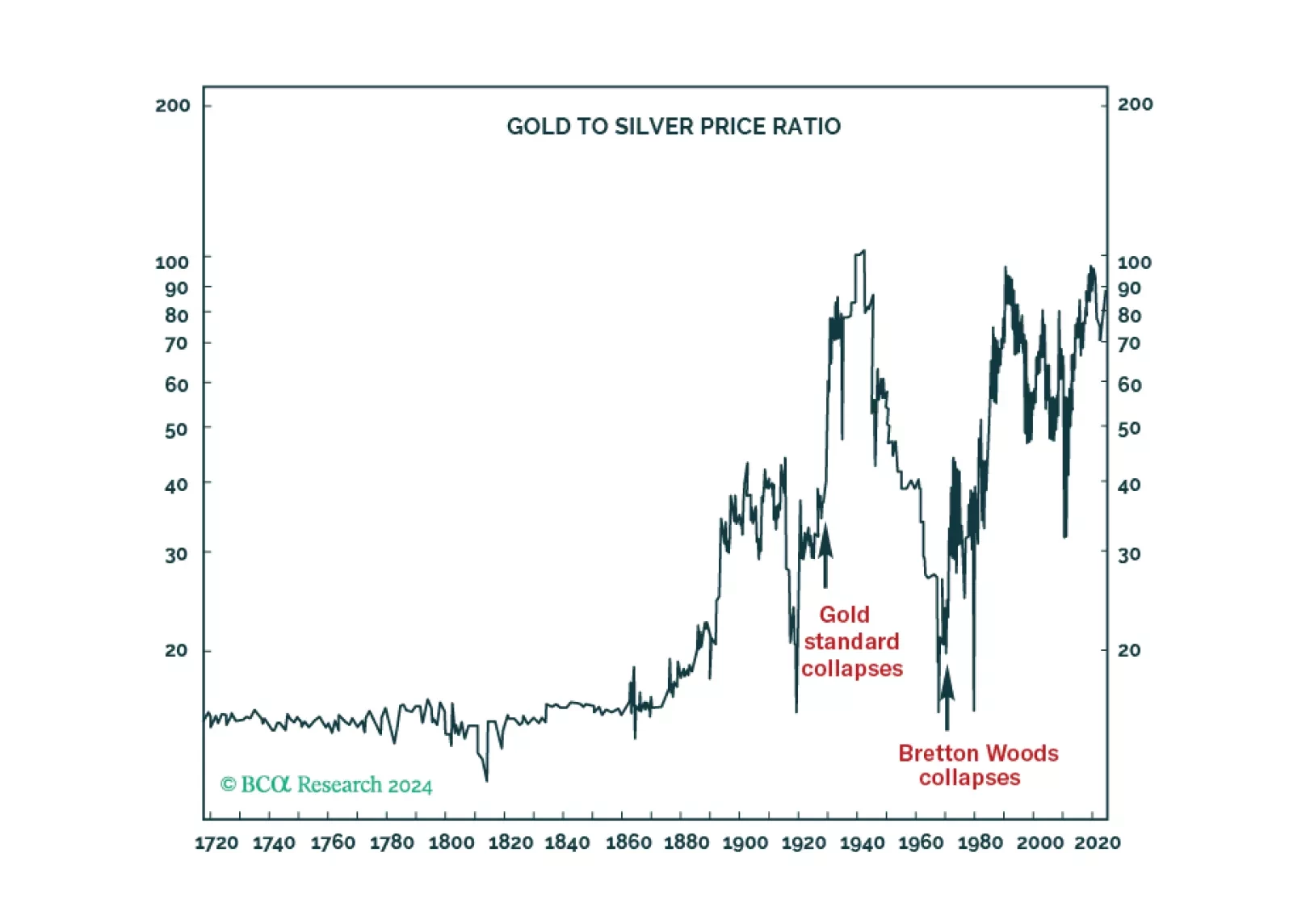

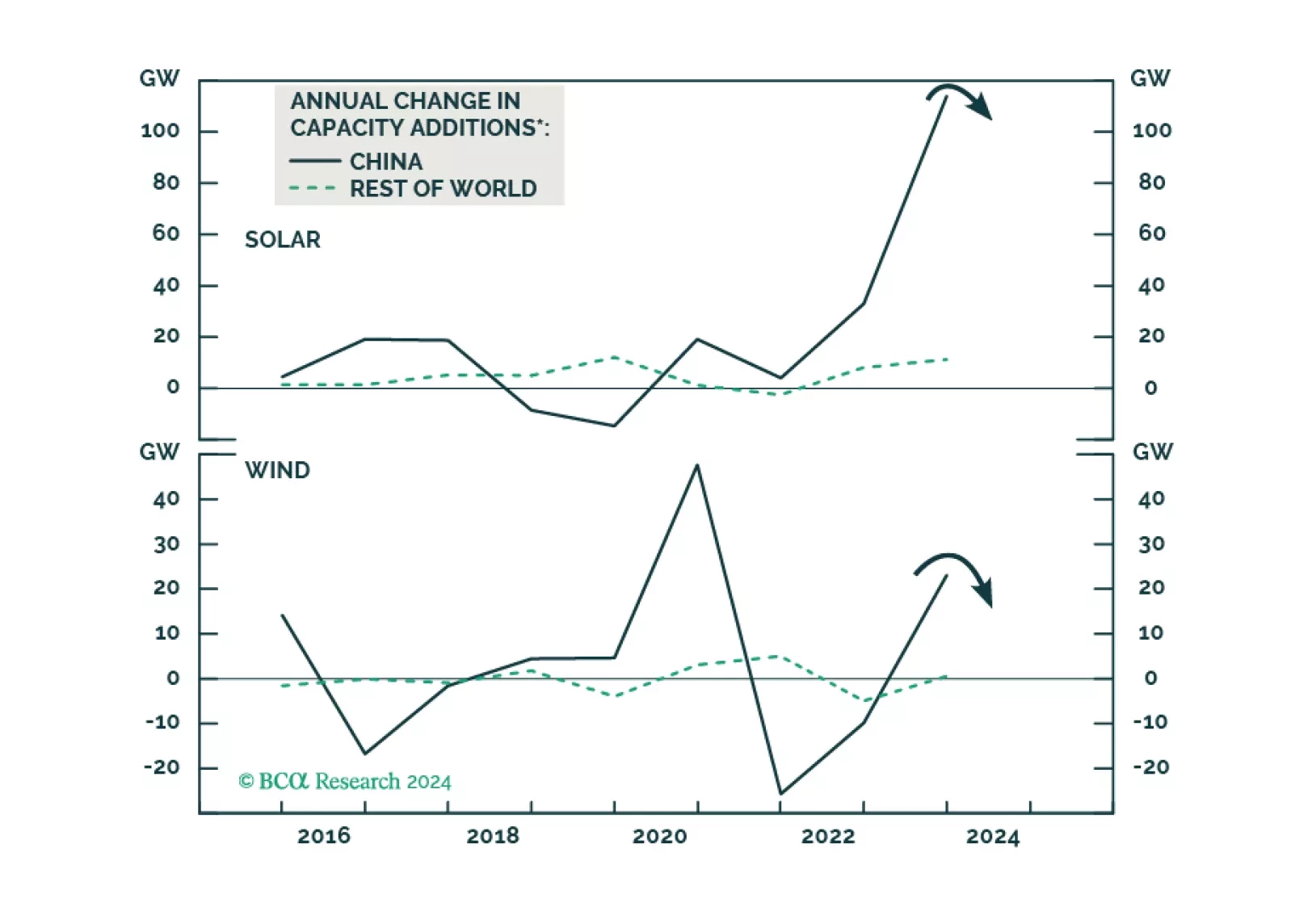

Increasing gray-zone confrontations and another round of tariff and non-tariff barriers to trade are not being reflected in commodity prices. This is keeping inflationary pressures emanating from the real economy subdued. That said,…

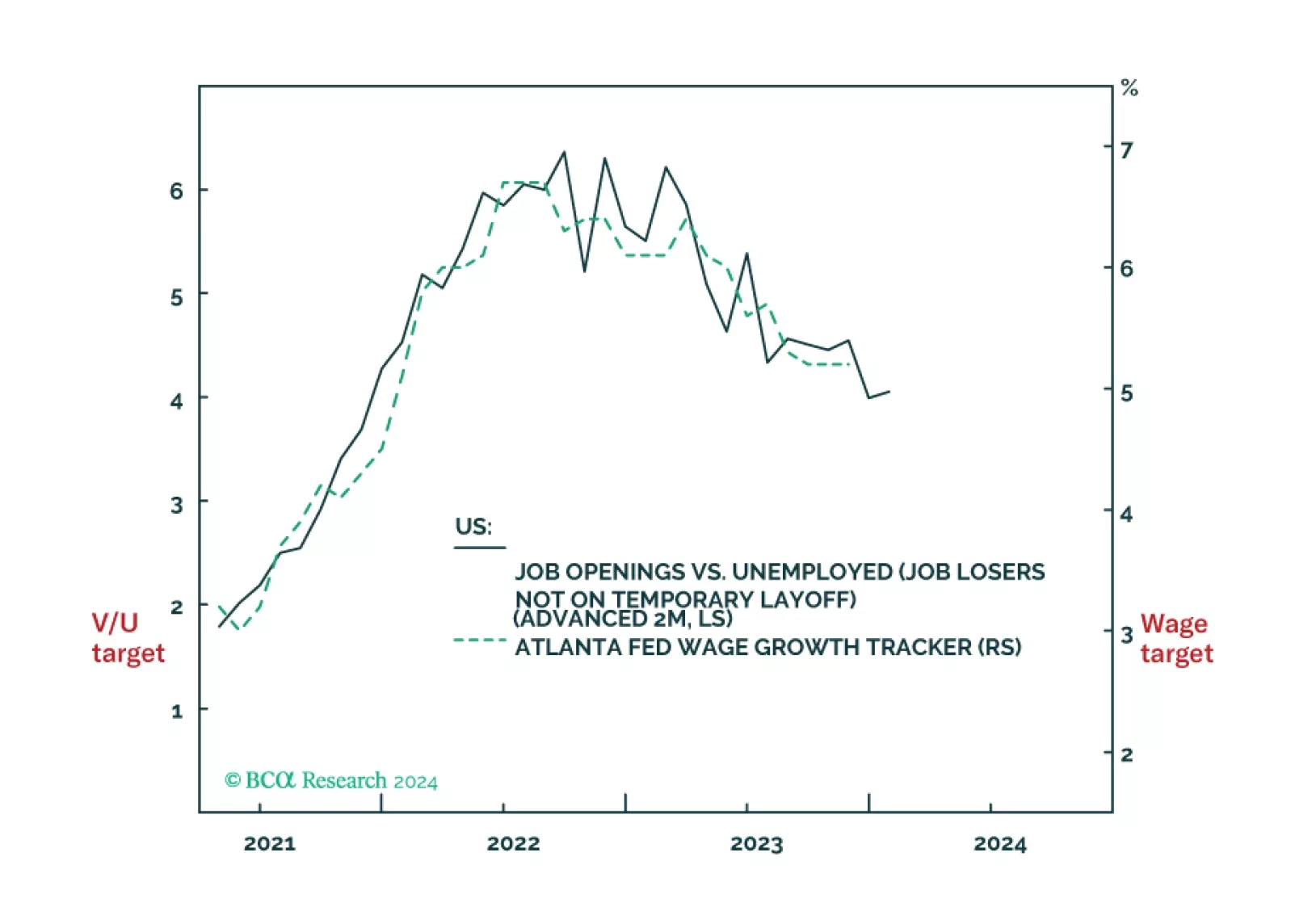

The Fed faces a dilemma. Cut rates early to avoid a recession, but at the risk of not slaying wage inflation. Or, not cut rates early to ensure that wage inflation is slayed, but at the risk of a downturn. Faced with such a dilemma,…

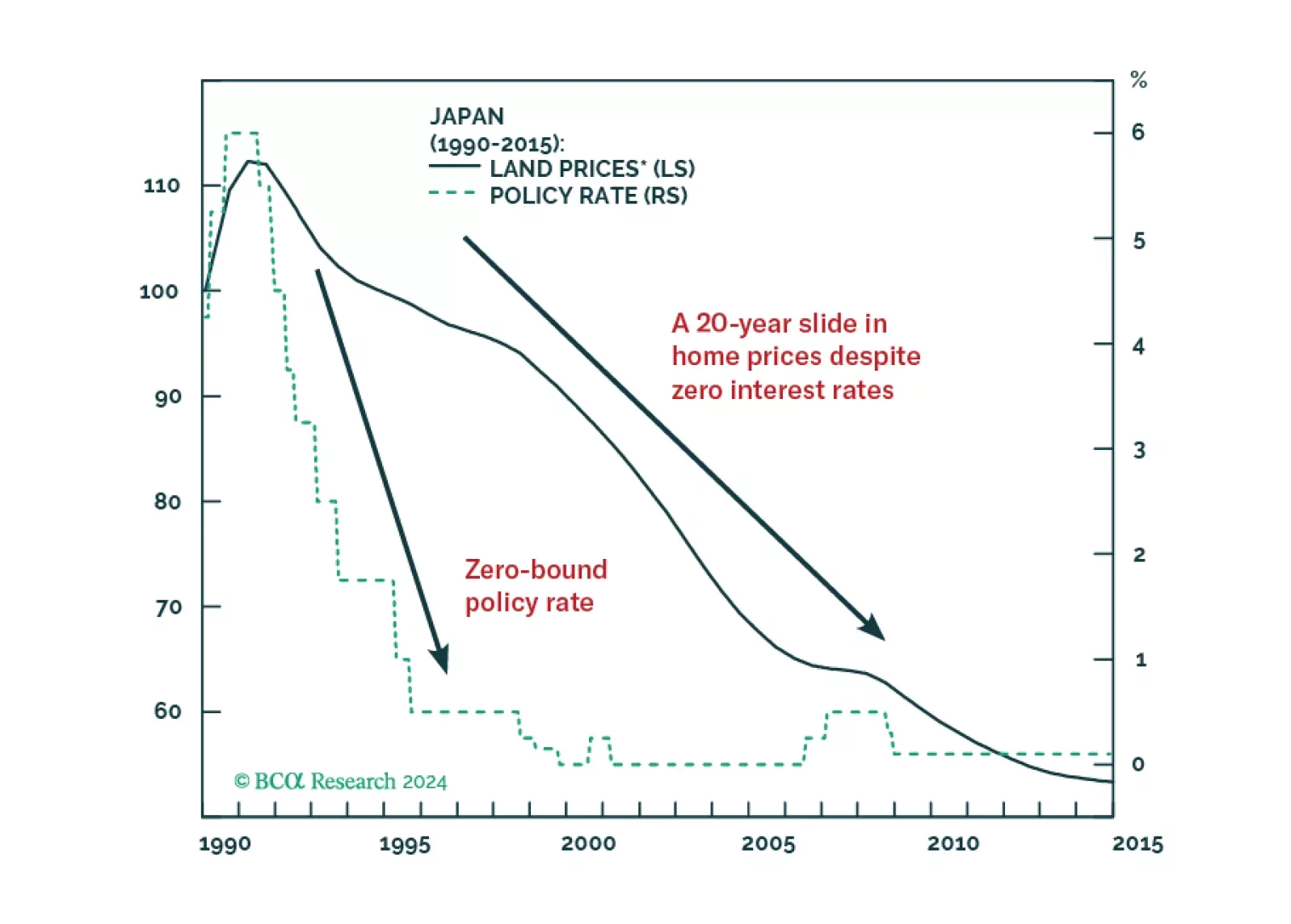

A low multiplier effect of stimulus will reduce the magnitude of the rebound in China's business activities in 2024. The housing market downturn will likely persist, and the ongoing household deleveraging also poses a significant…

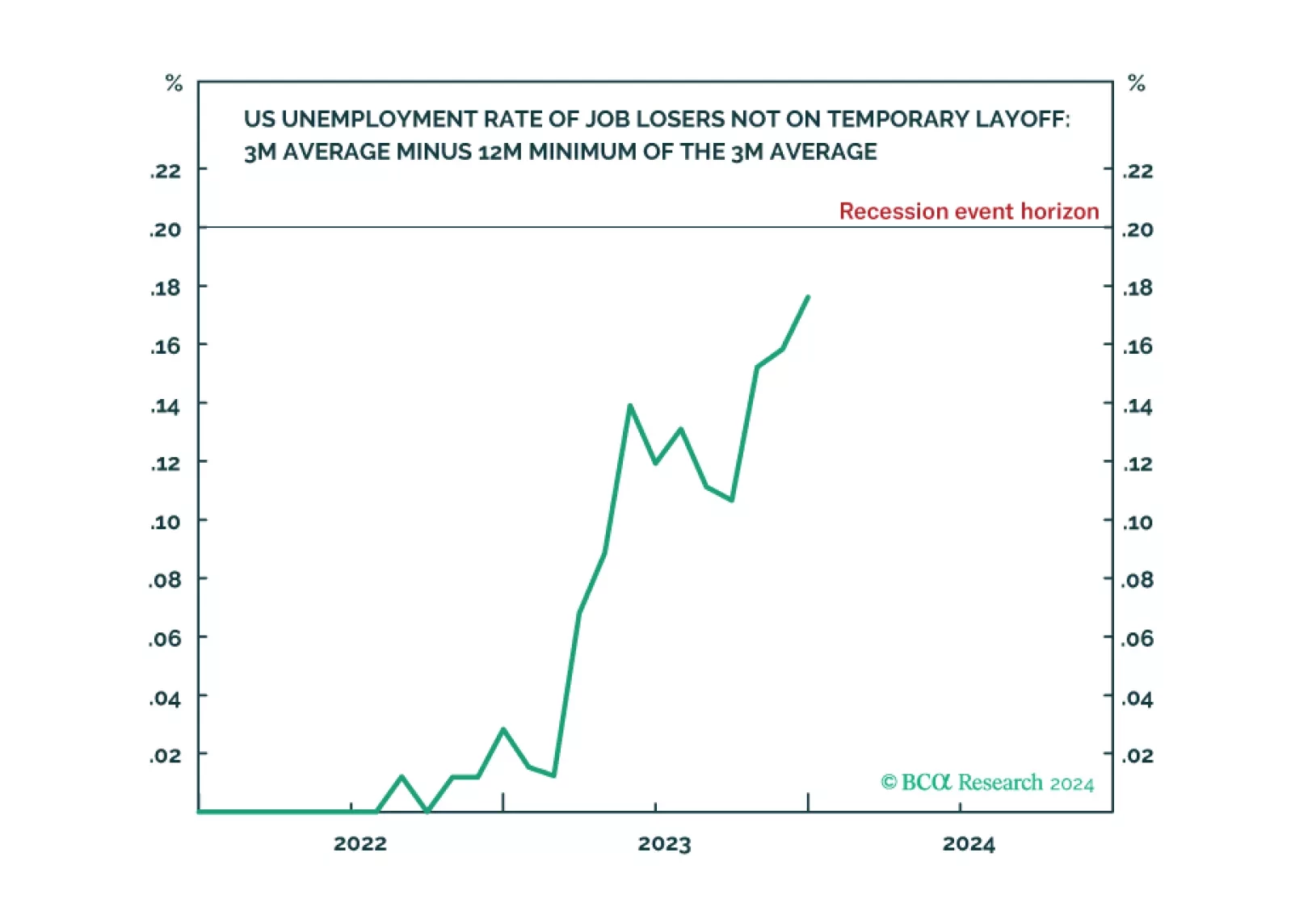

Following today’s US jobs data release, the Joshi rule real-time US recession indicator inched up to 0.18 and is now just a whisker from its recession event-horizon of 0.20.