Policymakers will likely continue to stimulate domestic demand via targeted measures and piecemeal stimulus. Yet, the economy will disappoint unless Beijing provides “irrigation-style” stimulus. The latter is not our base case…

Policymakers will likely continue to stimulate domestic demand via targeted measures and piecemeal stimulus. Yet, the economy will disappoint unless Beijing provides “irrigation-style” stimulus. The latter is not our base case…

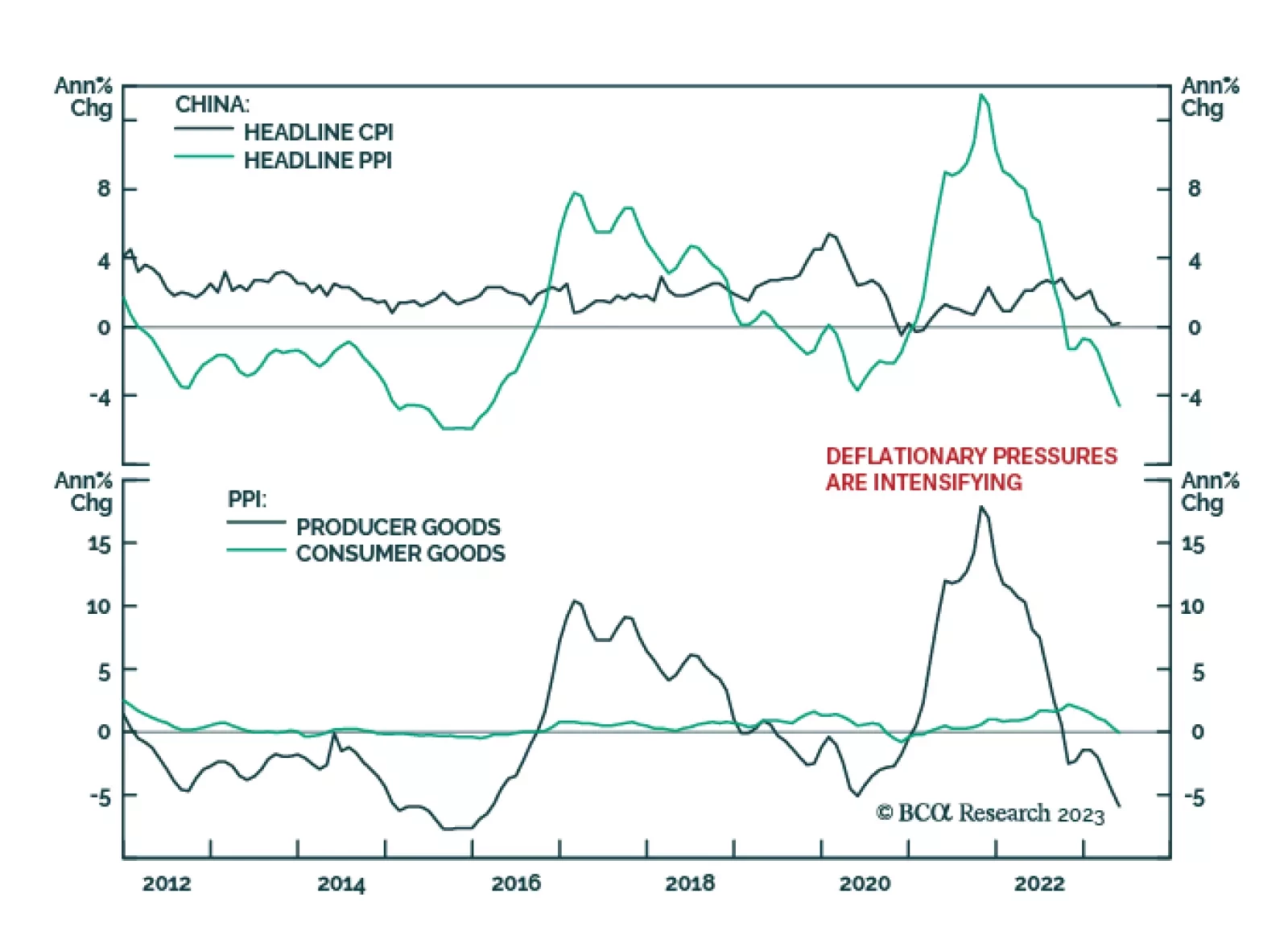

Chinese producer prices sent a disappointing signal about the domestic economy on Friday. The pace of decline in producer prices accelerated from -3.6% in April to -4.6% in May – worse than expectations of a -4.3% drop. The…

Symptoms of a liquidity trap for Chinese households are appearing. Our proprietary indicators for the marginal propensity to spend among households and enterprises continue falling. There has been a paradigm shift in Beijing’s…

The ECB continues to focus on lagging indicators and risks once again to cause a policy error that unduly hurts European growth. What does it mean for investors?

Have global equity markets reached a riot point? Is the Fed going on hold a sufficient condition for stocks to stage a cyclical rally? If not, what would be needed to produce such a rally? Does the Fed’s recent balance sheet…

Great Power Rivalry is taking another leg up as Russia and China further align their geopolitical interests. Investors should stay long USD-CNY, favor defensives over cyclicals, and markets like North America and DM Europe that have…

In Section I, we note that while recent inflation developments point to some supply-side and pandemic-related disinflation, they also point to potentially stickier inflation over the coming several months. The inflation, monetary…