The statement from last week’s Central Economic Work Conference indicates that Chinese authorities are still not considering large-scale stimulus in 2024. Odds are that a full-fledged business cycle recovery in 2024 is unlikely.…

Today, we are sending you the BCA annual outlook for 2024. The report is an edited transcript of our recent conversation with Mr. X and his daughter, Ms. X, who are long-time BCA clients with whom we discuss the economic and…

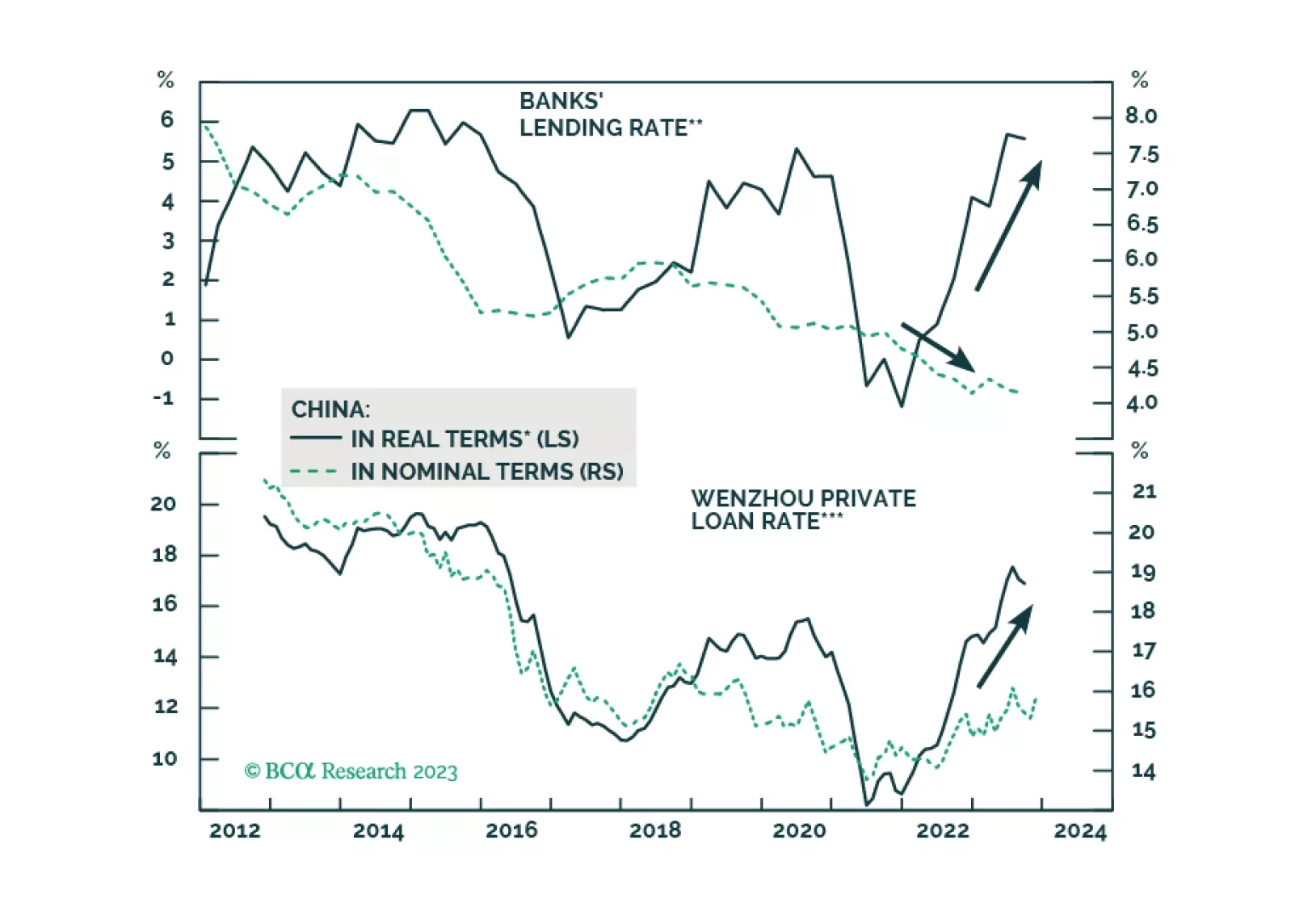

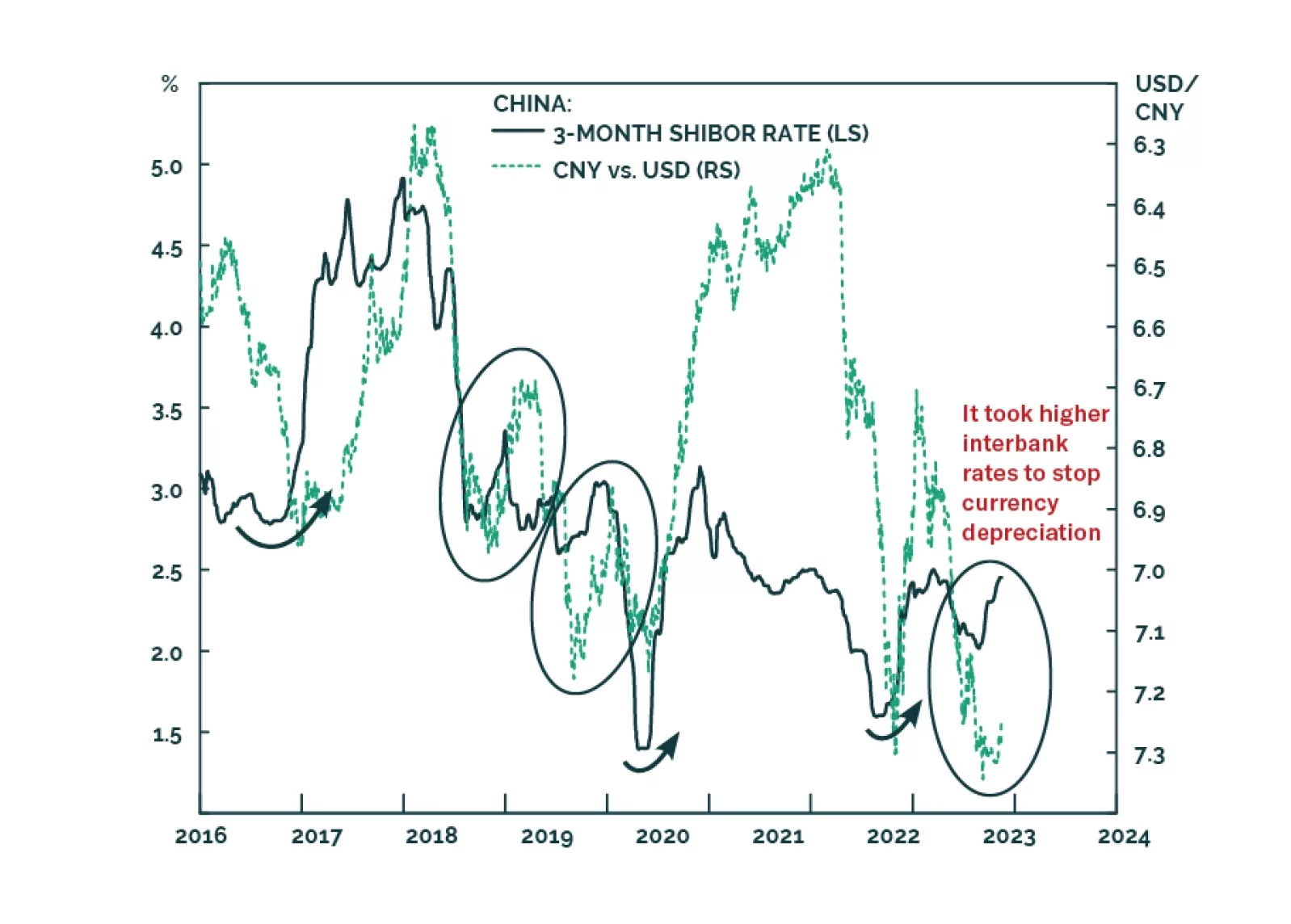

Many commentators have attributed the latest increase in Chinese interest rates to an improving economy, the large issuance of government bonds, the tax payments season, and other technical factors. Yet, these explanations are…

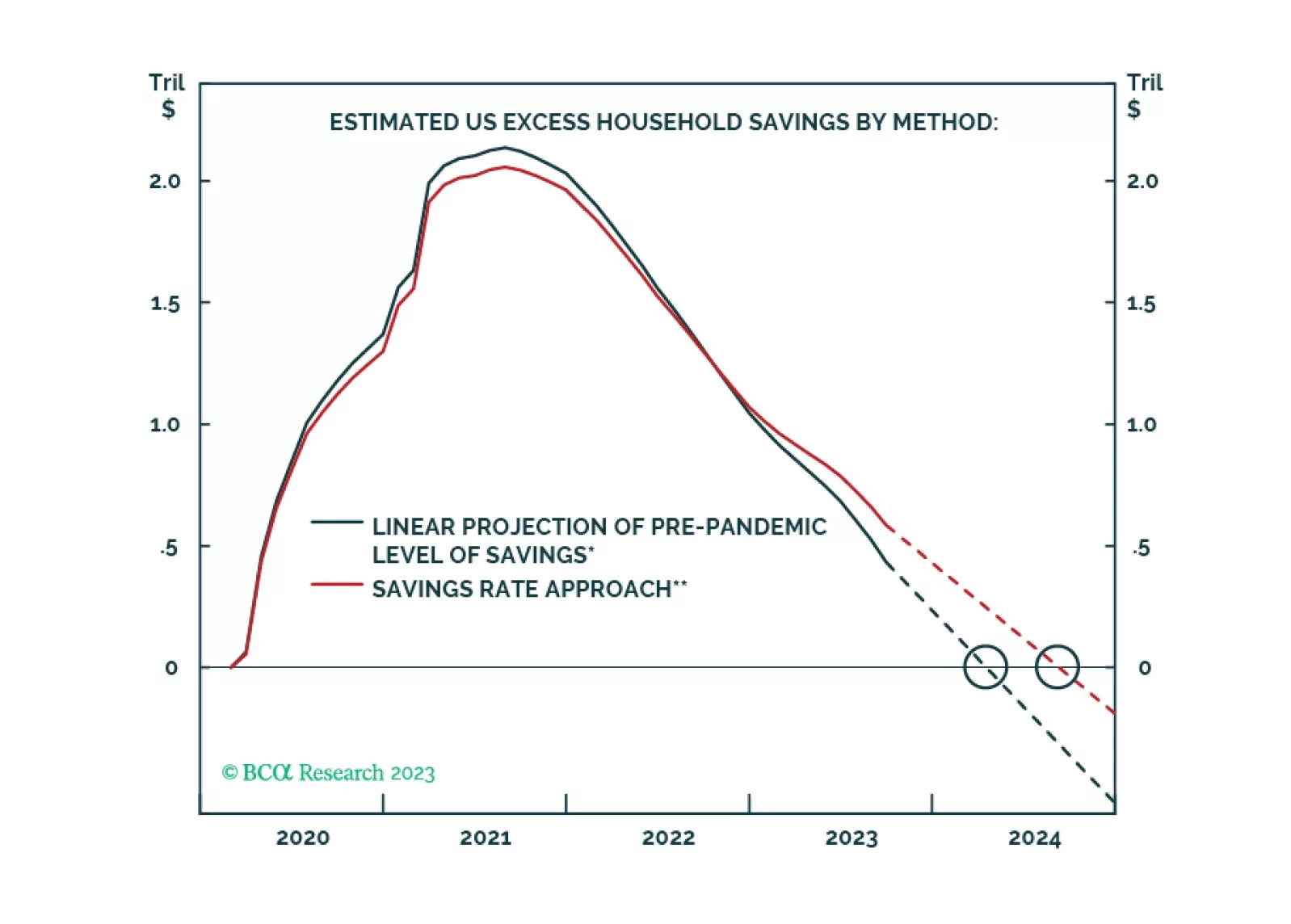

We unveil the ‘Joshi rule’ real-time recession indicator as a much better version of the Federal Reserve’s own ‘Sahm rule’. And we identify what would trigger these recession indicators in this week’s and future US jobs reports. Plus…

Most diagnoses of China’s liquidity trap miss the point that policies arising from these theories were developed for market-based economies with governments accountable to their electorates, not autocracies pursuing autarky. As the…

We continue to expect China to deploy stronger fiscal and monetary stimulus to avoid prolonged deflation brought about by a liquidity trap and sub-zero growth. All the same, a lower-growth risk has been added to our ensemble forecast…

Assuming yesterday’s policy rate hike is a sign that Turkey is finally veering towards orthodox economic policies; should investors rush in?

China is facing a risk of deflation. Marginal interest rate cuts and targeted stimulus will be insufficient to boost China’s growth given the current deflationary mindset and the danger is that the economy may be entering a liquidity…