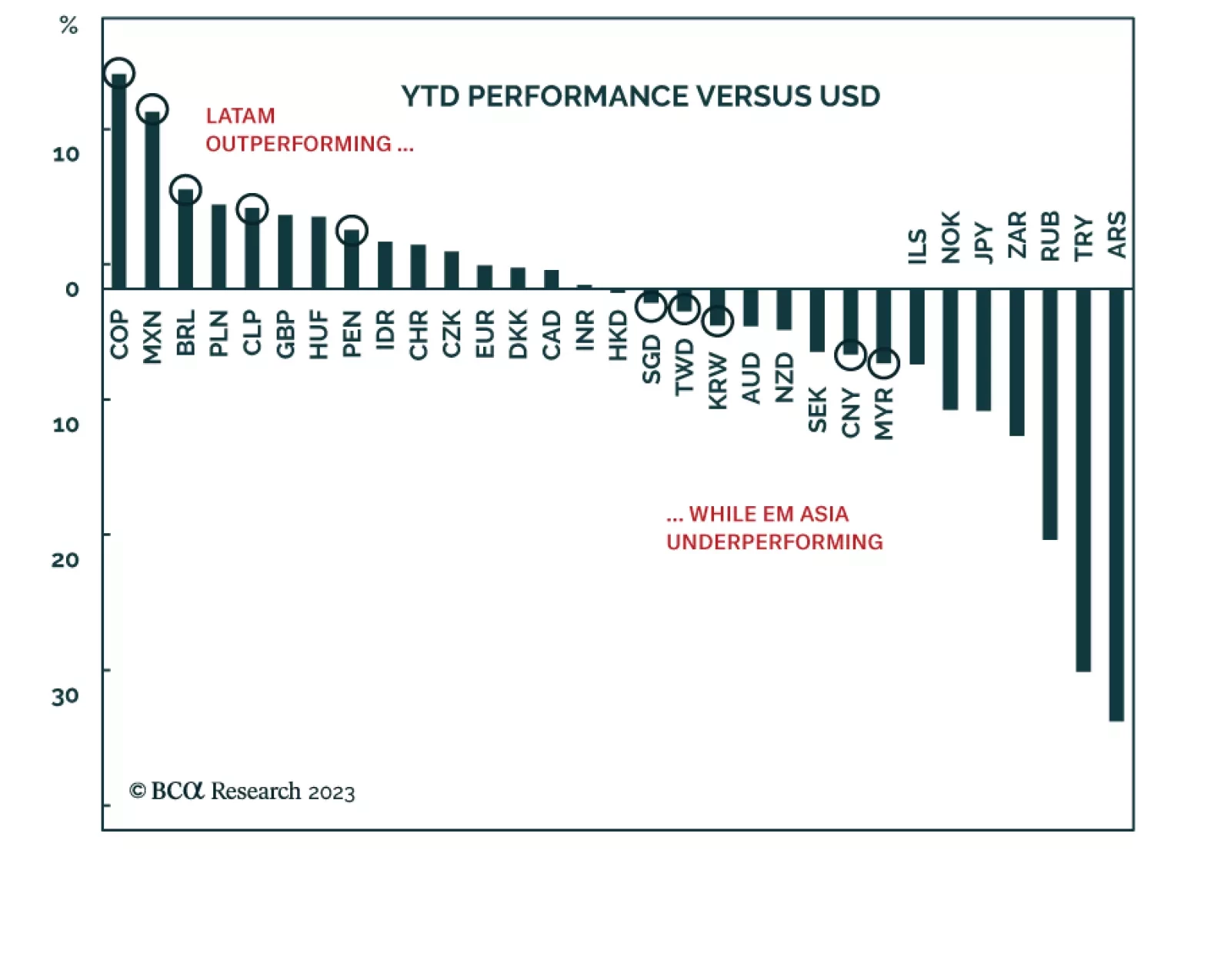

Latin American currencies are among the best performers in the FX space this year. The Colombian peso, Mexican peso, and Brazilian real occupy the top three spots among the major EM and DM currencies, up by 16%, 13%, and 7% vis-…

Peruvian financial markets will outperform their EM peers given the country’s clear macroeconomic and political visibility. Low and plummeting inflation, a decelerating economy and a lack of economic excesses will allow the central…

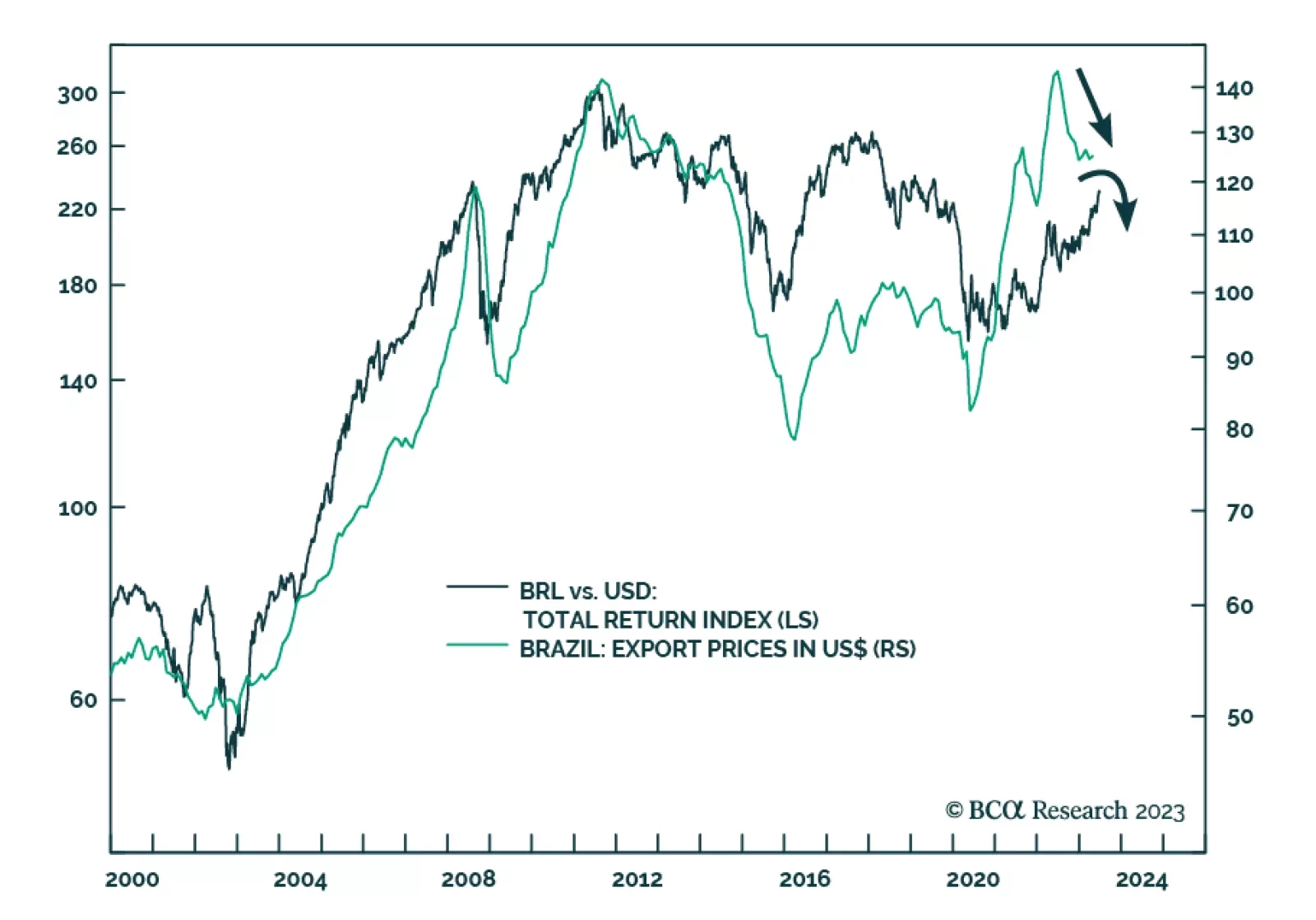

Since the Brazilian Central Bank (BCB) released its latest monetary policy minutes on June 27th, the Brazilian real has depreciated for three days in a row. Will the BRL resume its strengthening trajectory, or is the currency set…

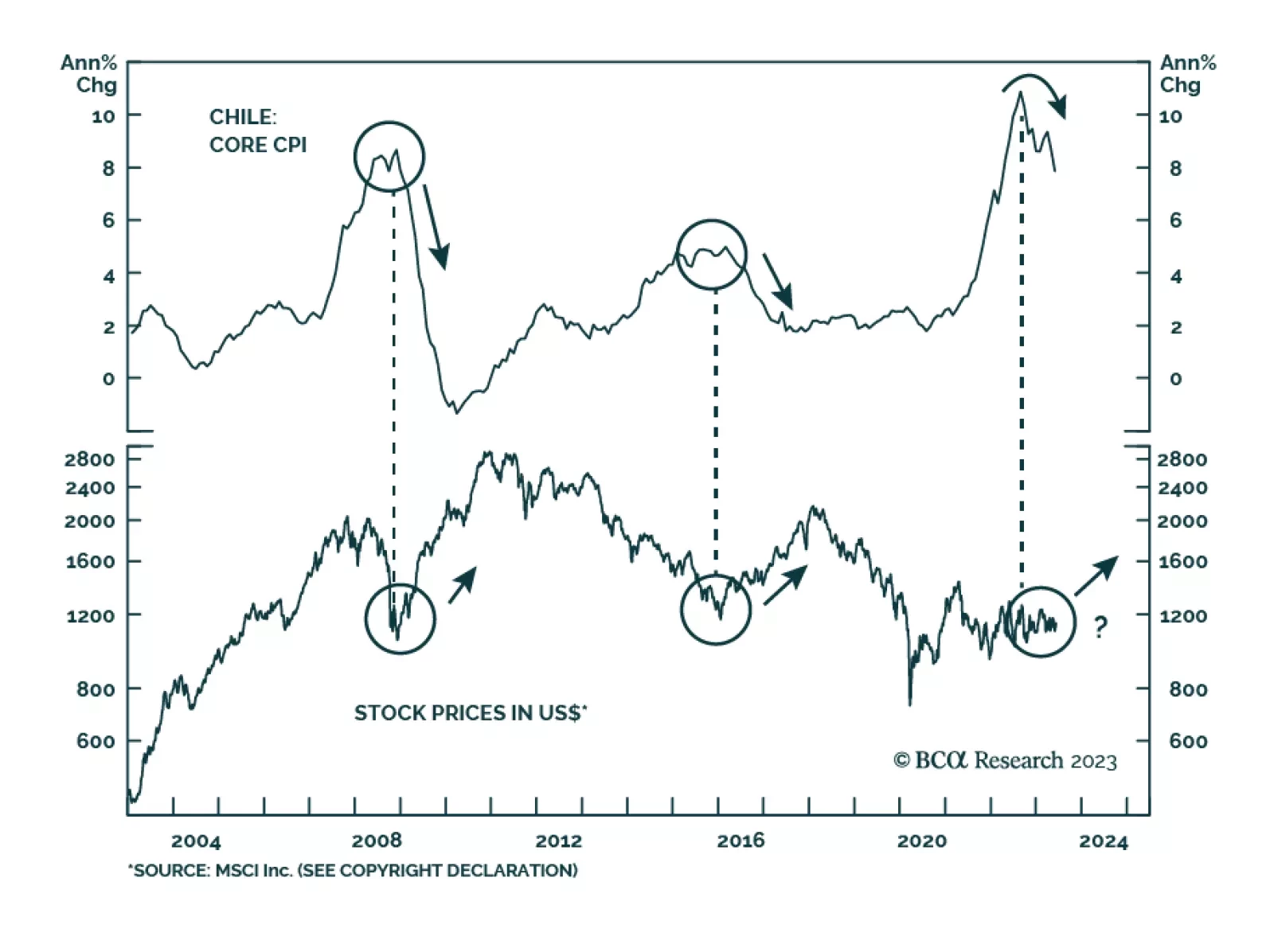

The Chilean economy is entering a recession. After two years of tightening fiscal and monetary policies, real economic growth is beginning to contract and inflation is tumbling. Our Emerging Markets strategists expect the…

Chile’s equity market is set to sustainably outperform its EM peers on the back of political and macroeconomic tailwinds. The new moderate constitution and pragmatic government will boost market sentiment. A continued economic…

In this short weekly report, we review some of our favorite FX trades.

The new fiscal framework will fail to prevent the rise of the public debt-to-GDP ratio as it relies on overly optimistic revenue growth. A rising public debt-to-GDP ratio will lead to a widening fiscal risk premium in Brazilian…

Colombian assets are inexpensive, but they are cheap for a reason. The economy is entering a growth recession while inflation will remain sticky and above target. Further, President Gustavo Petro’s policies will lead to lower…

The Chilean economy is entering a recession. Inflation will drop rapidly and the central bank will cut rates meaningfully in H2 2023. We continue to recommend a structural overweight across Chilean risk assets on the basis of falling…

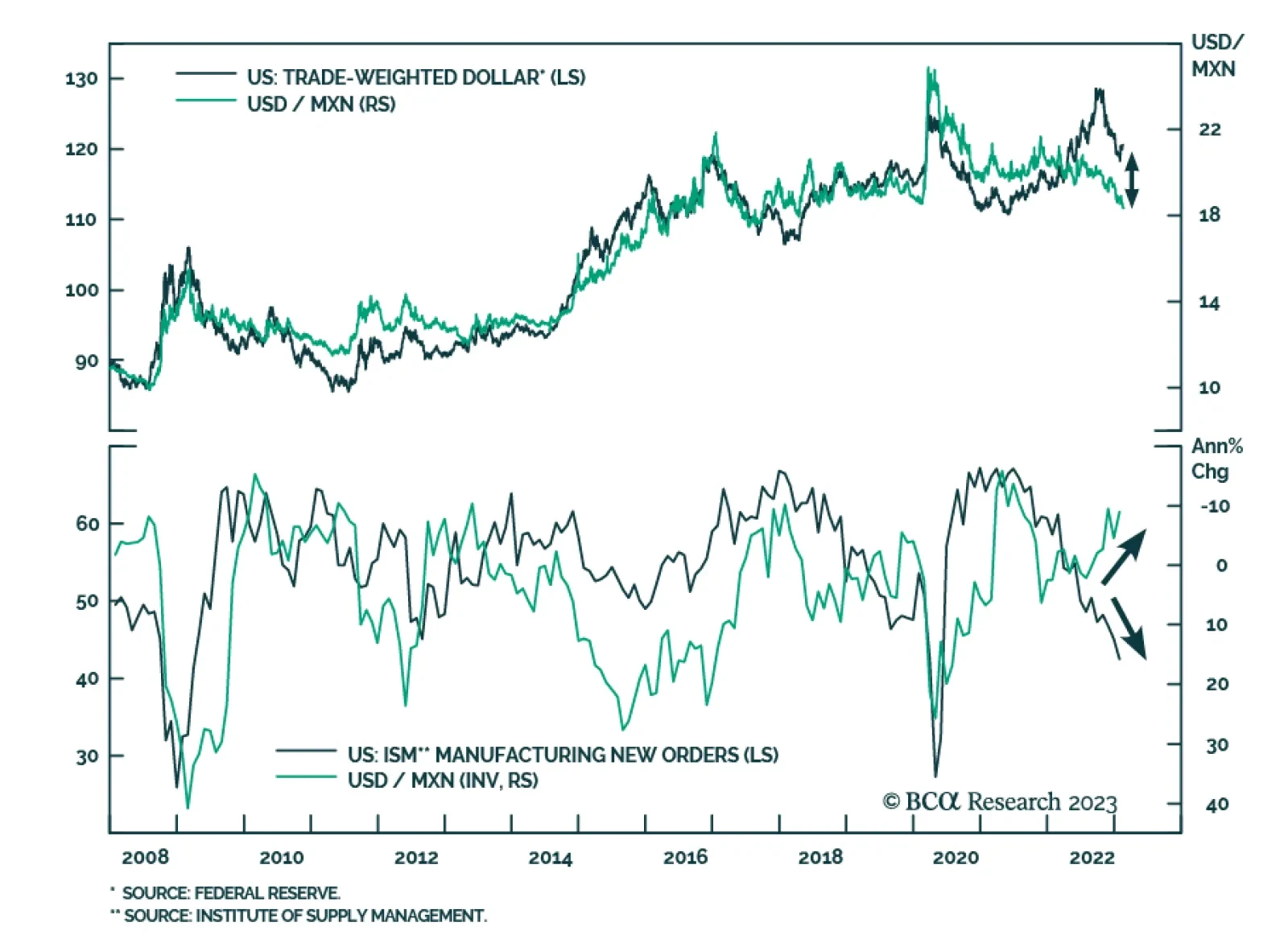

The Mexican peso is the only major currency that has appreciated against the US dollar since the greenback’s February 2 bottom. Notably, USD/MXN has lost 1% over this period, despite the broad trade weighted dollar’s…