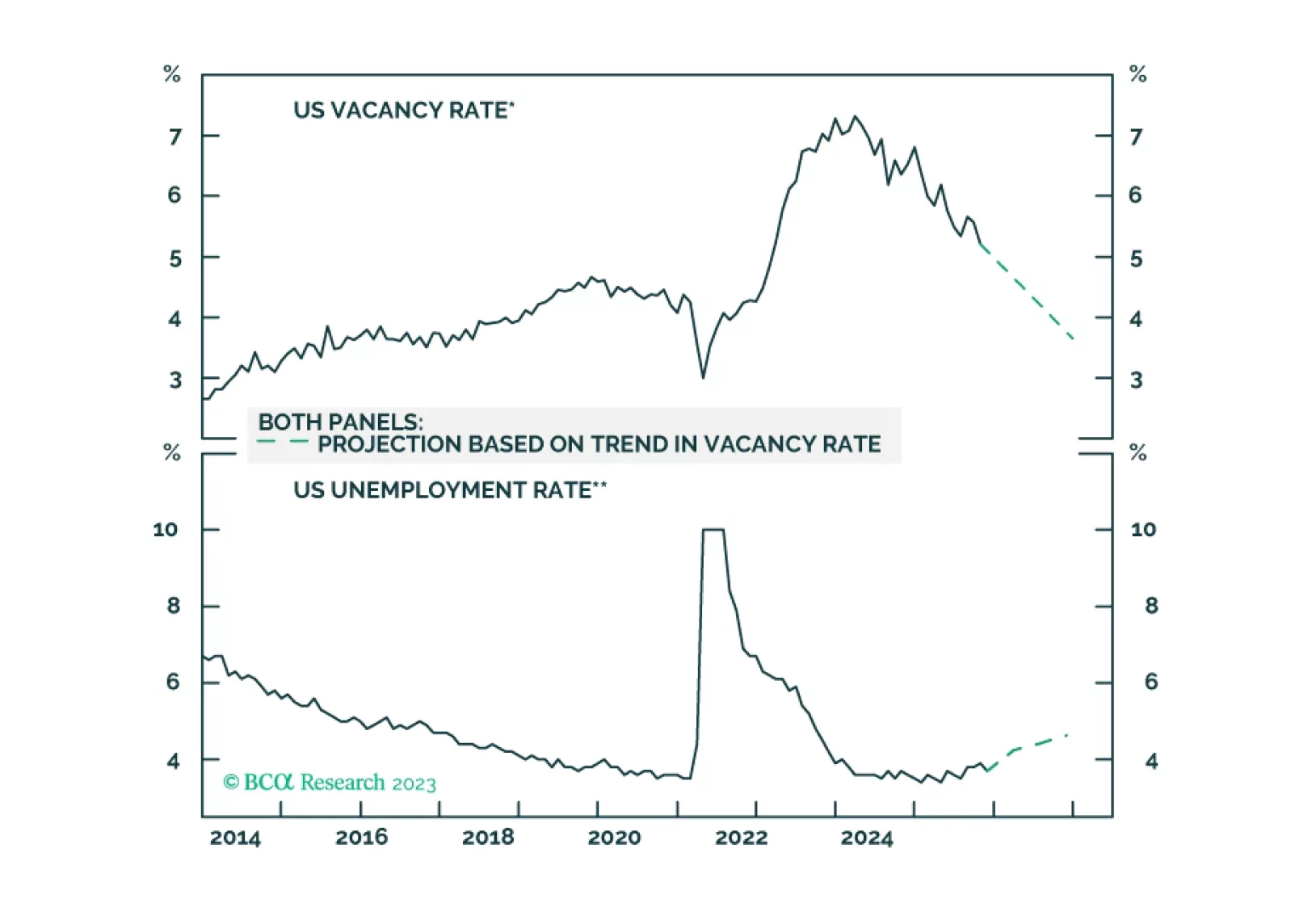

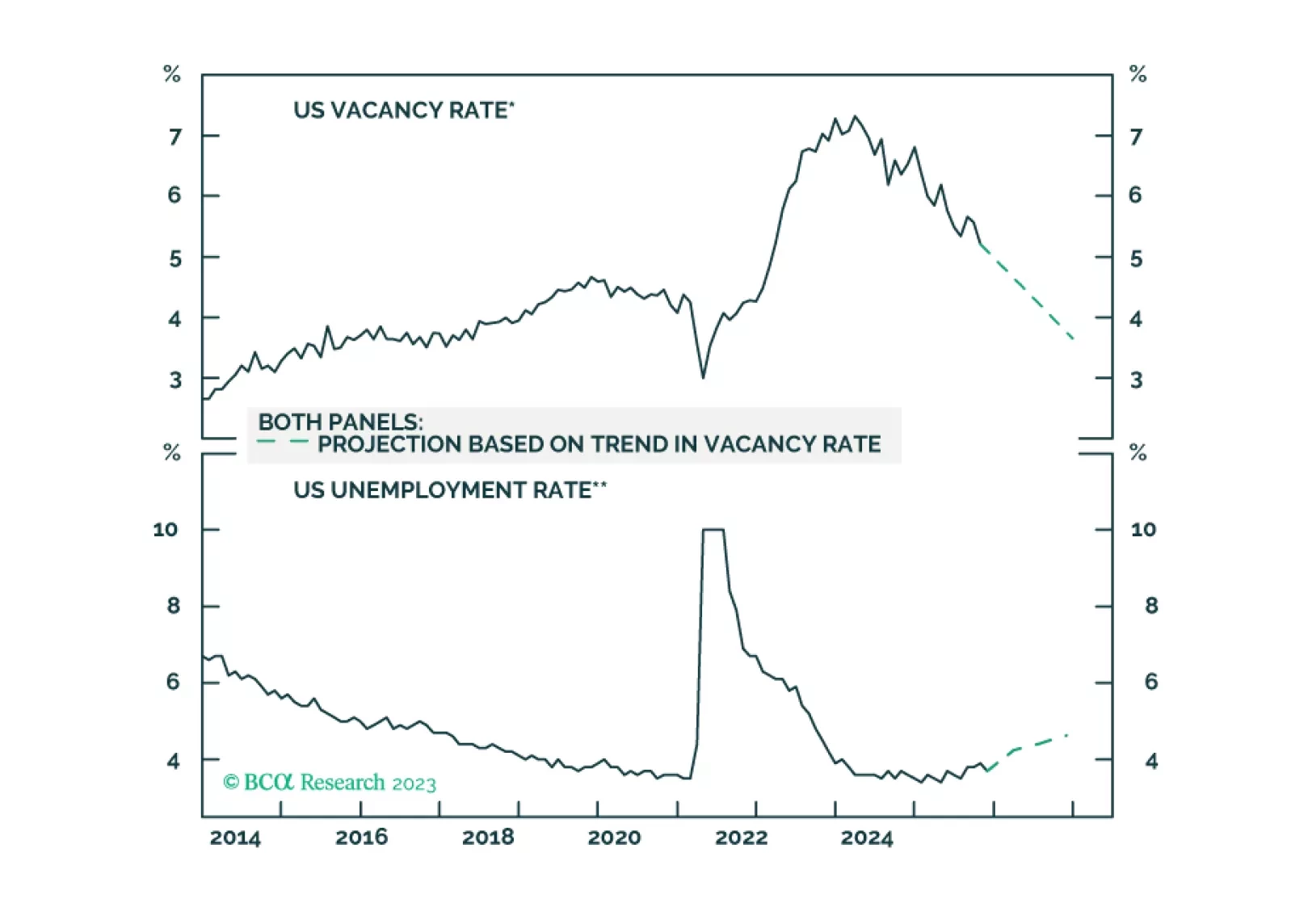

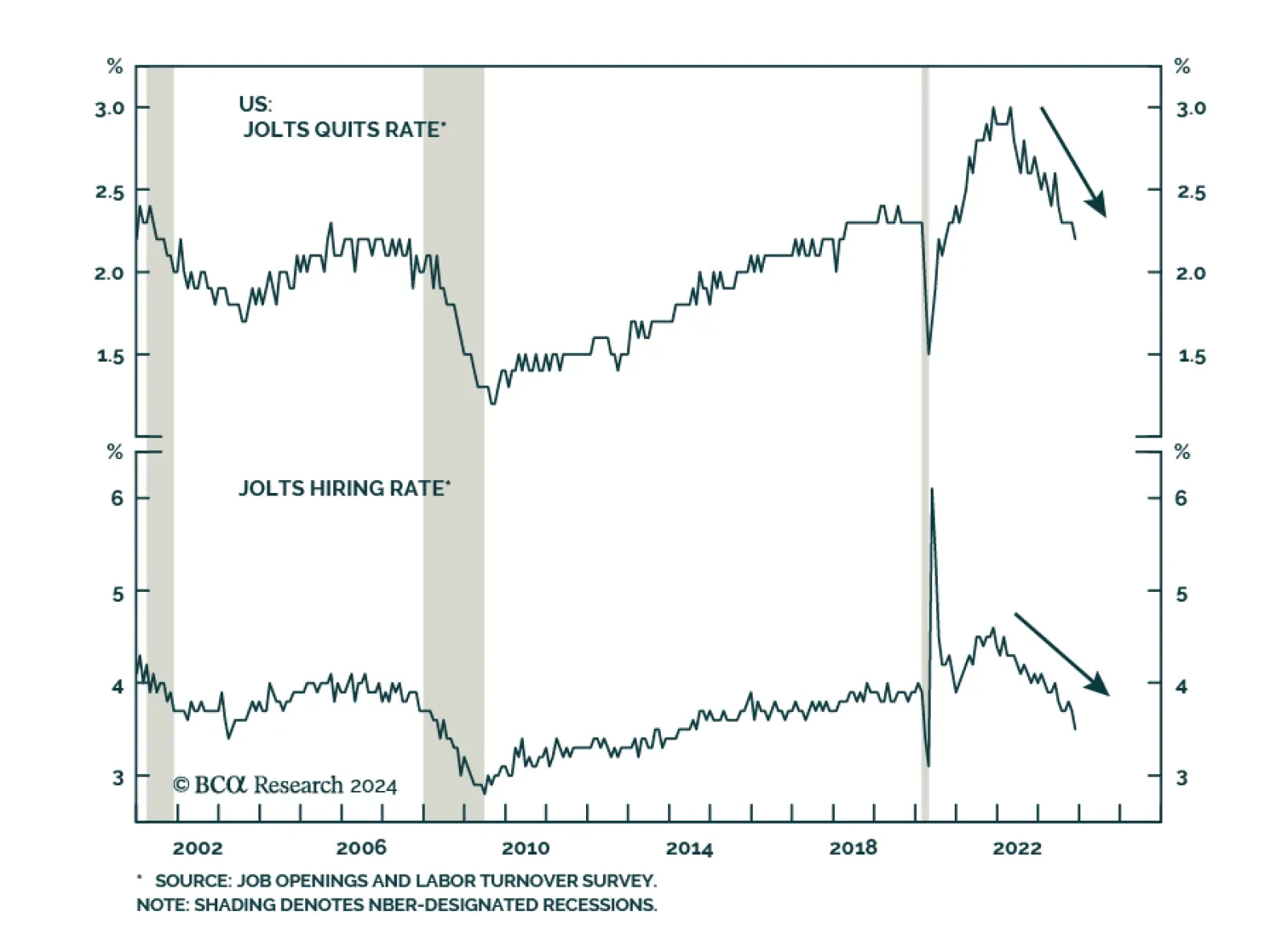

Results of the November JOLTS survey indicate that the US labor market is softening. The number of job openings slowed from 8.85 million to 8.79 million – the lowest since March 2021 and slightly below expectations of 8.…

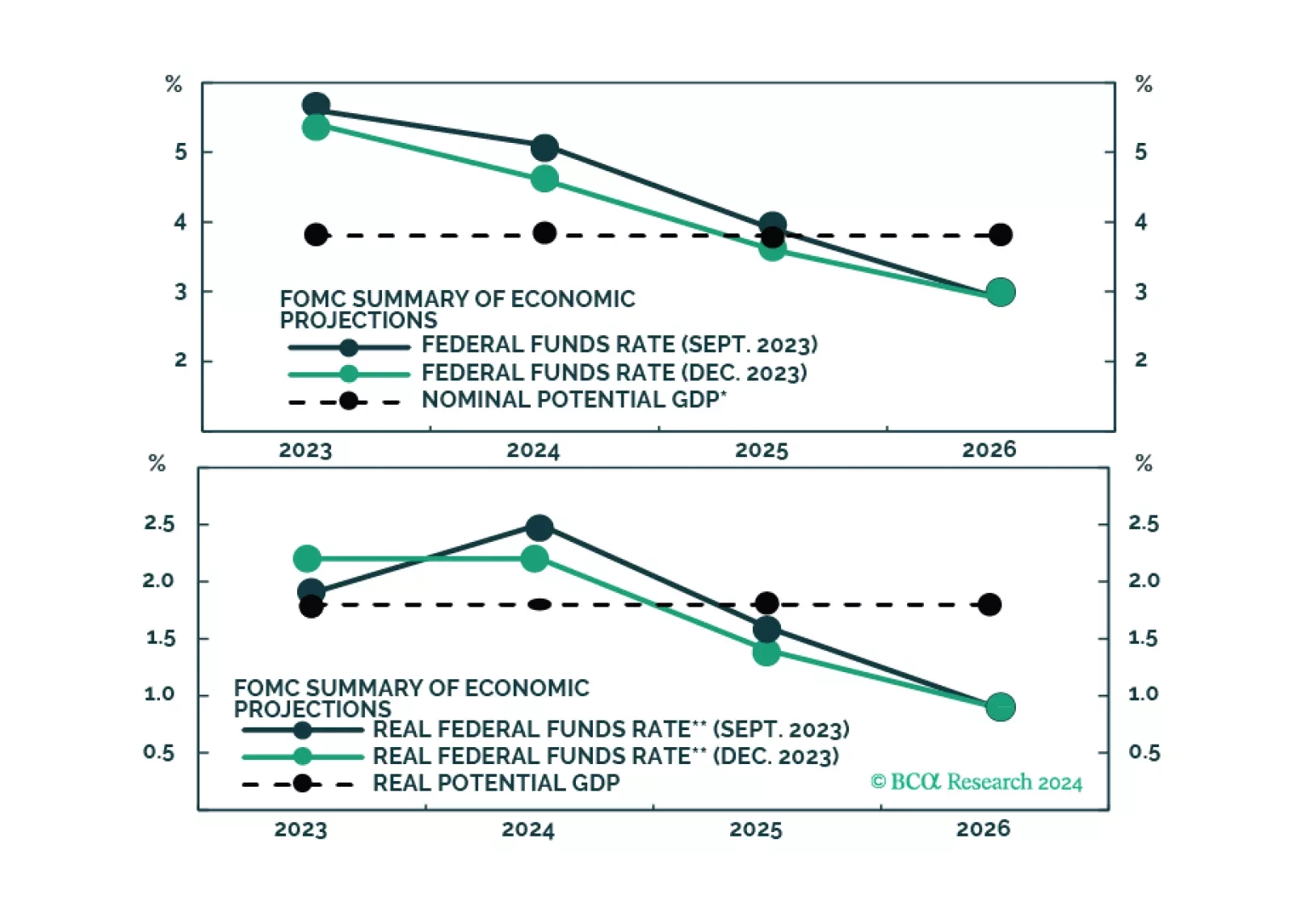

The market is excited by the idea that the Fed will cut rates early this year, even without a recession. But is that likely, with inflation still set to be around 2.8% mid-year?

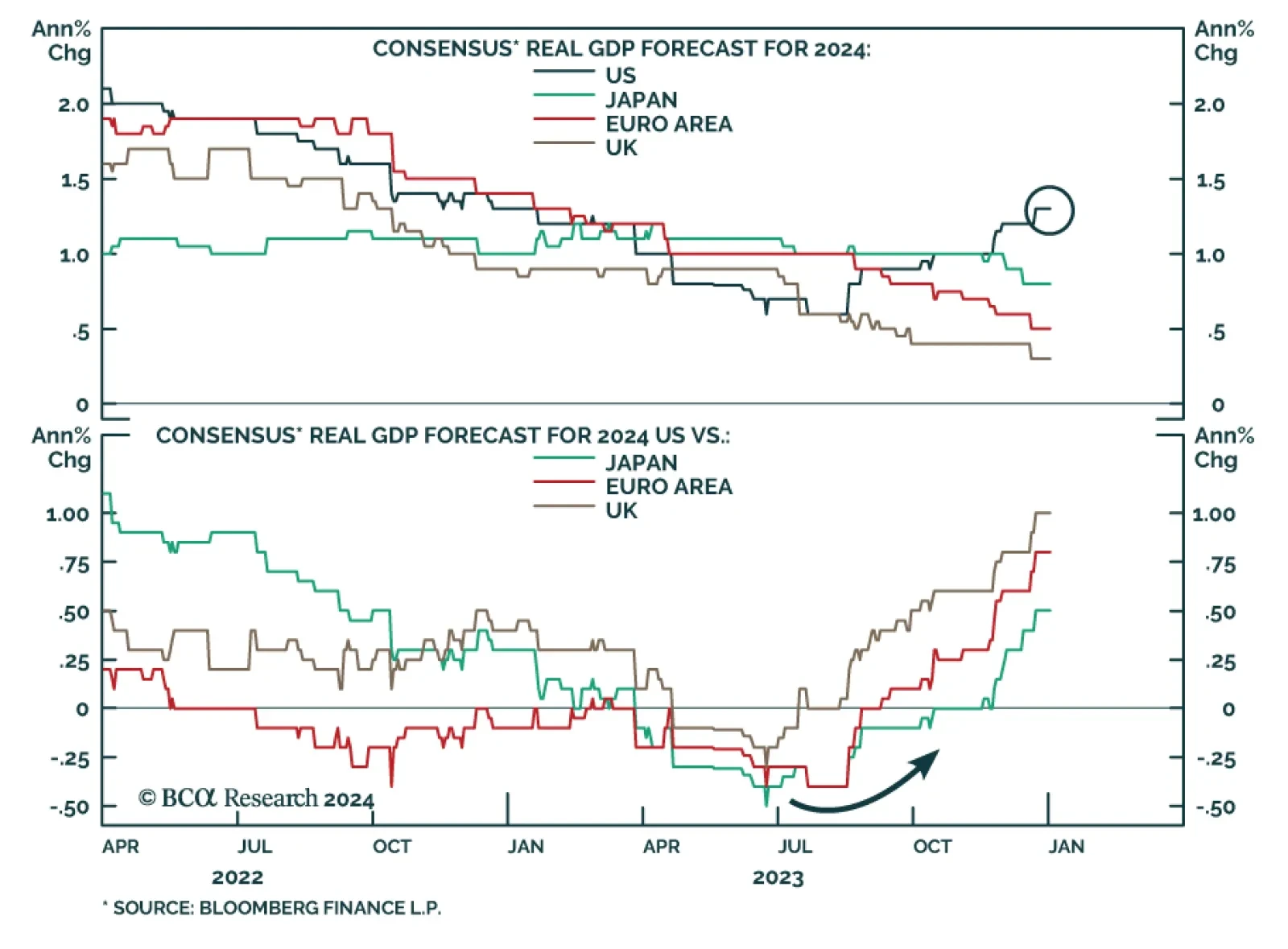

Economists have been consistently revising up their 2024 US GDP forecasts over the past 4 months. The consensus now anticipates US growth to clock in at 1.3% this year. According to the latest estimate from the Atlanta Fed’…

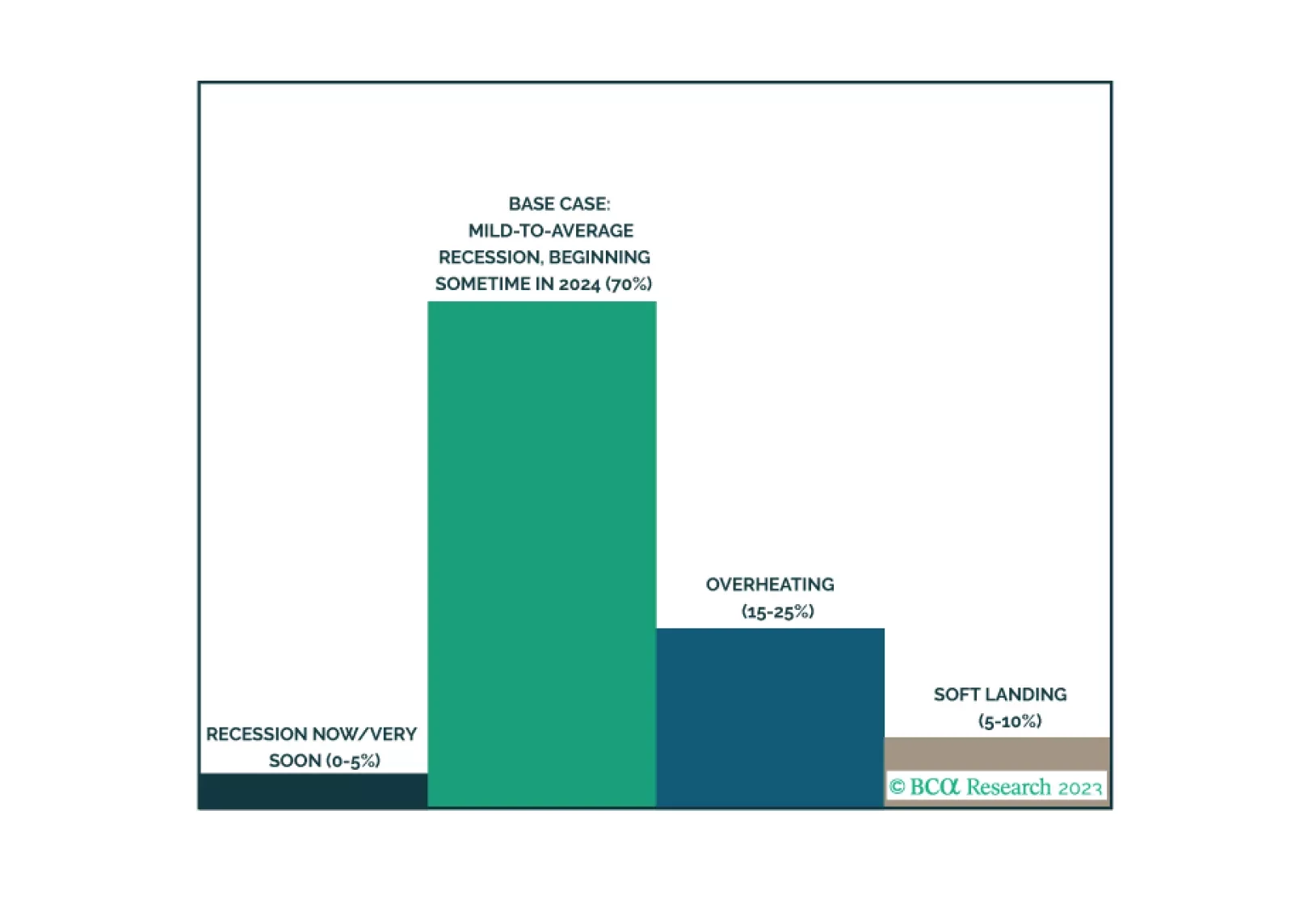

Our last publication of 2023 is an illustrated guide to our view that the economy will enter a recession around midyear. We expect equities will underperform Treasuries and cash over much of 2024, but we are waiting to turn…

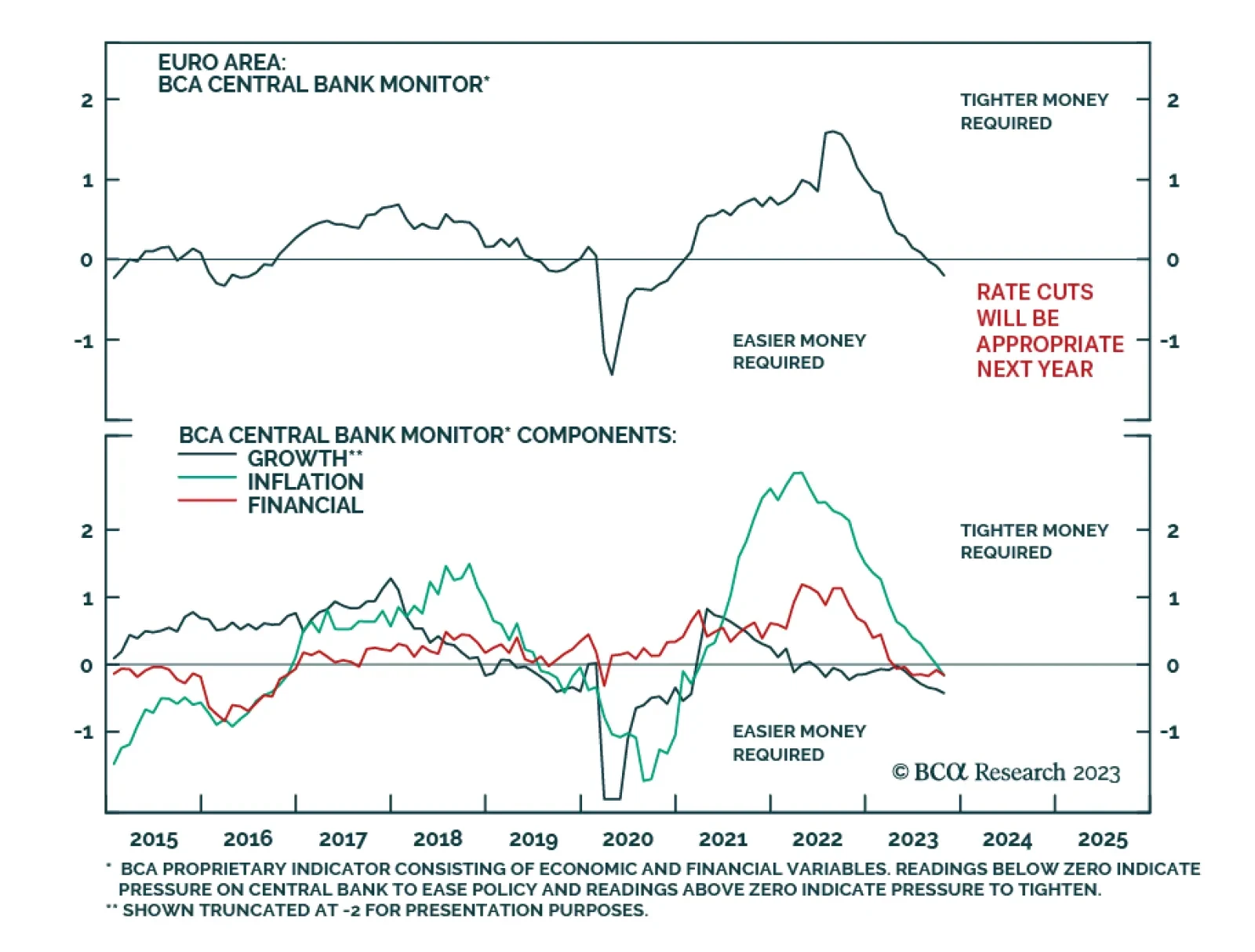

As expected, the ECB kept its policy rate unchanged on Thursday. In the updated macroeconomic projections, the central bank revised down its inflation and growth forecasts for next year. It now expects inflation to ease to 2.7…

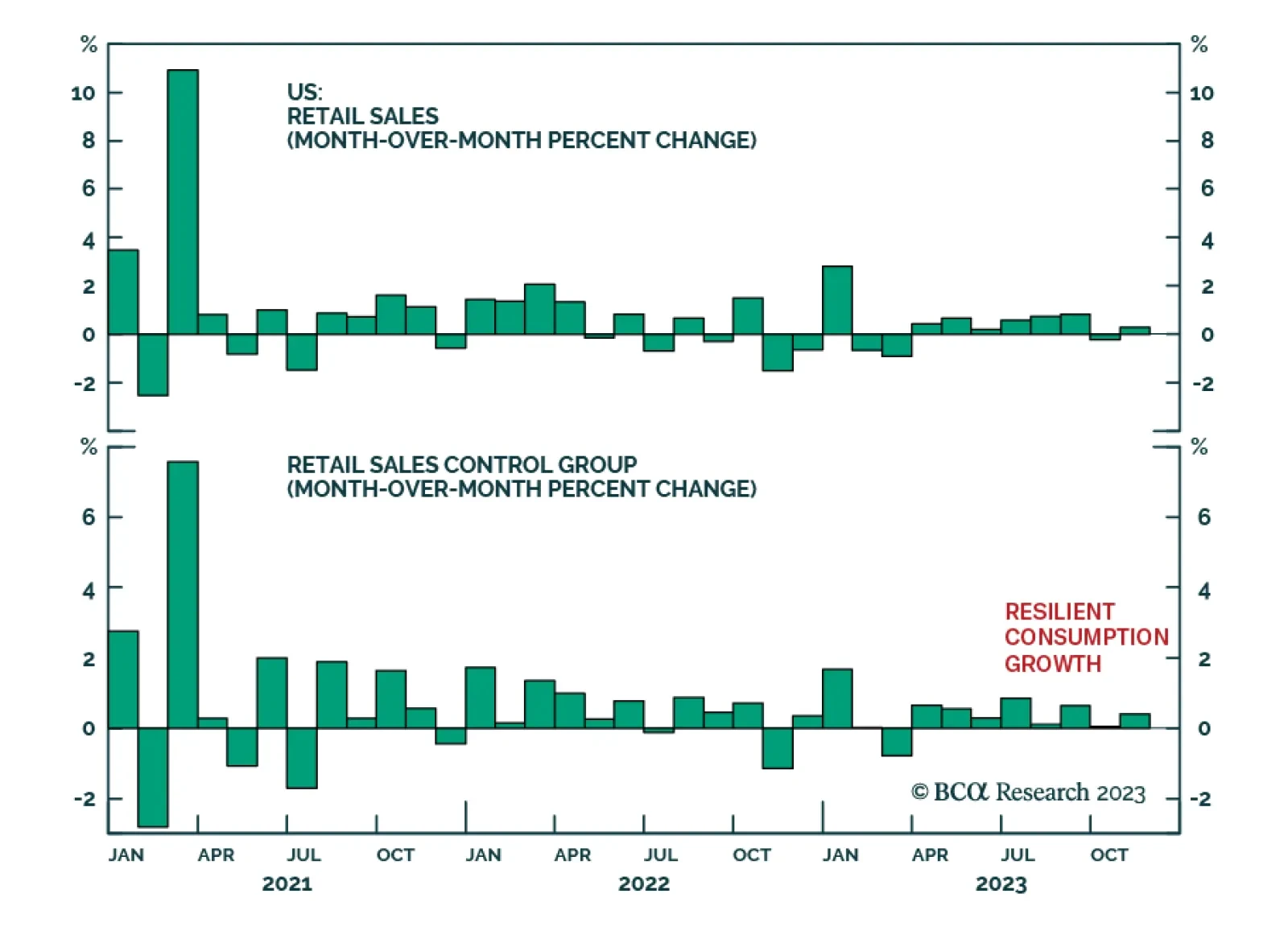

The November US retail sales release for November delivered a positive signal about consumer spending. Overall retail sales unexpectedly increased by 0.3% m/m, surprising expectations of a 0.1% m/m decline. The details of the…

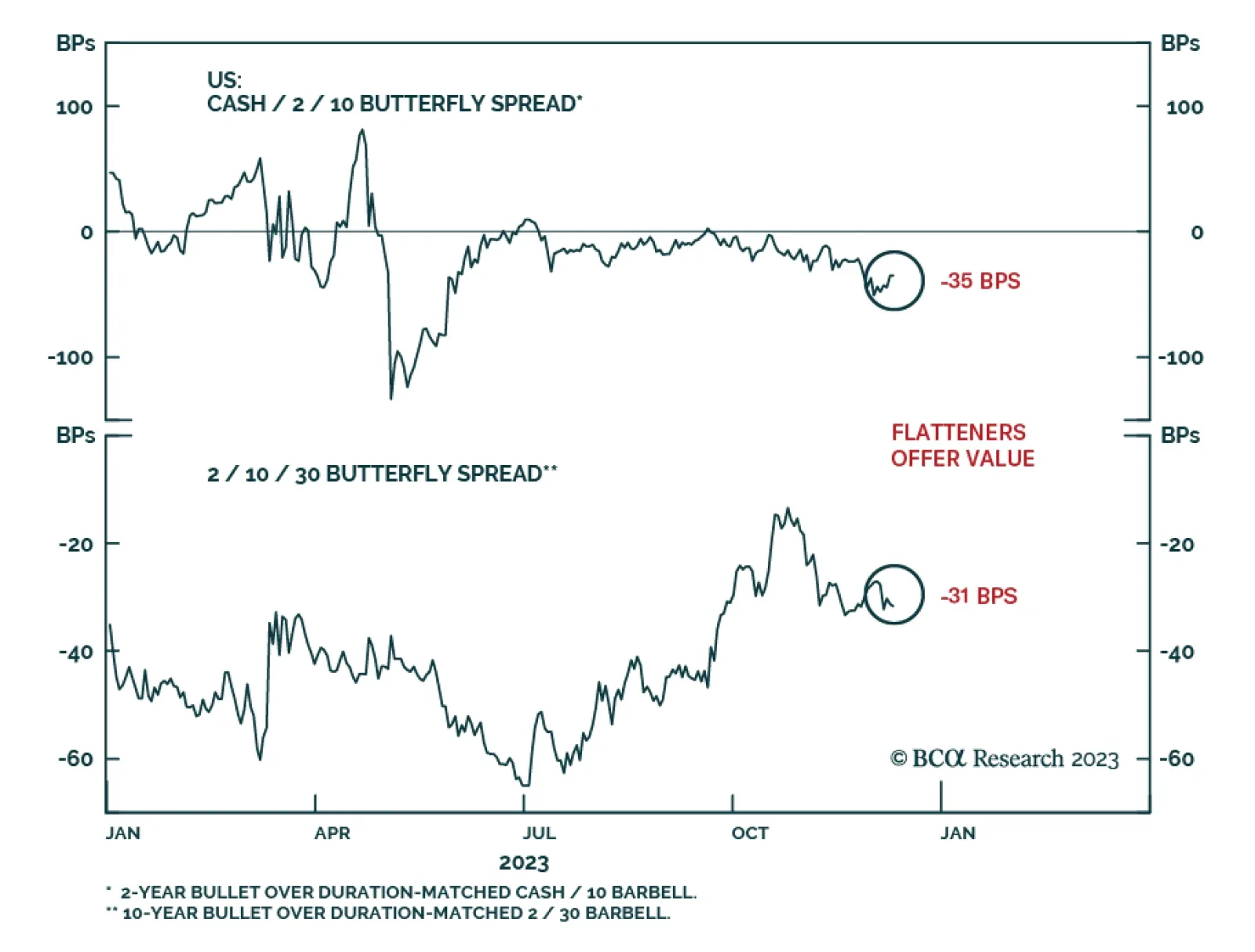

According to BCA Research’s US Bond Strategy service, Treasury curve steepeners will pay off handsomely once the next recession hits. However, curve flatteners (aka barbelled Treasury portfolios) offer better value for the…