MacroQuant downgraded equities from overweight to neutral on a 1-to-3 month horizon. The model maintains a negative view on stocks over a 12-month horizon.

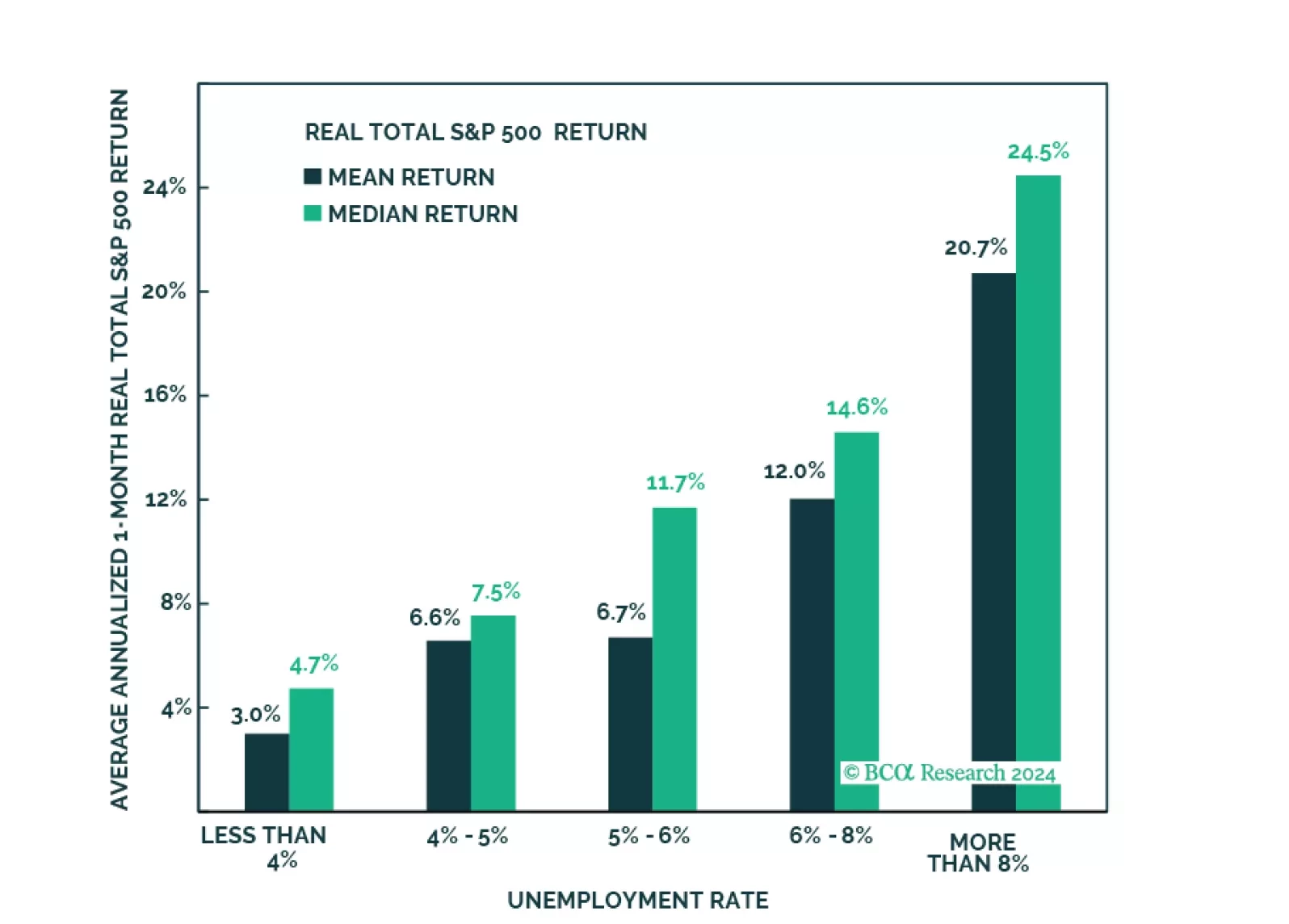

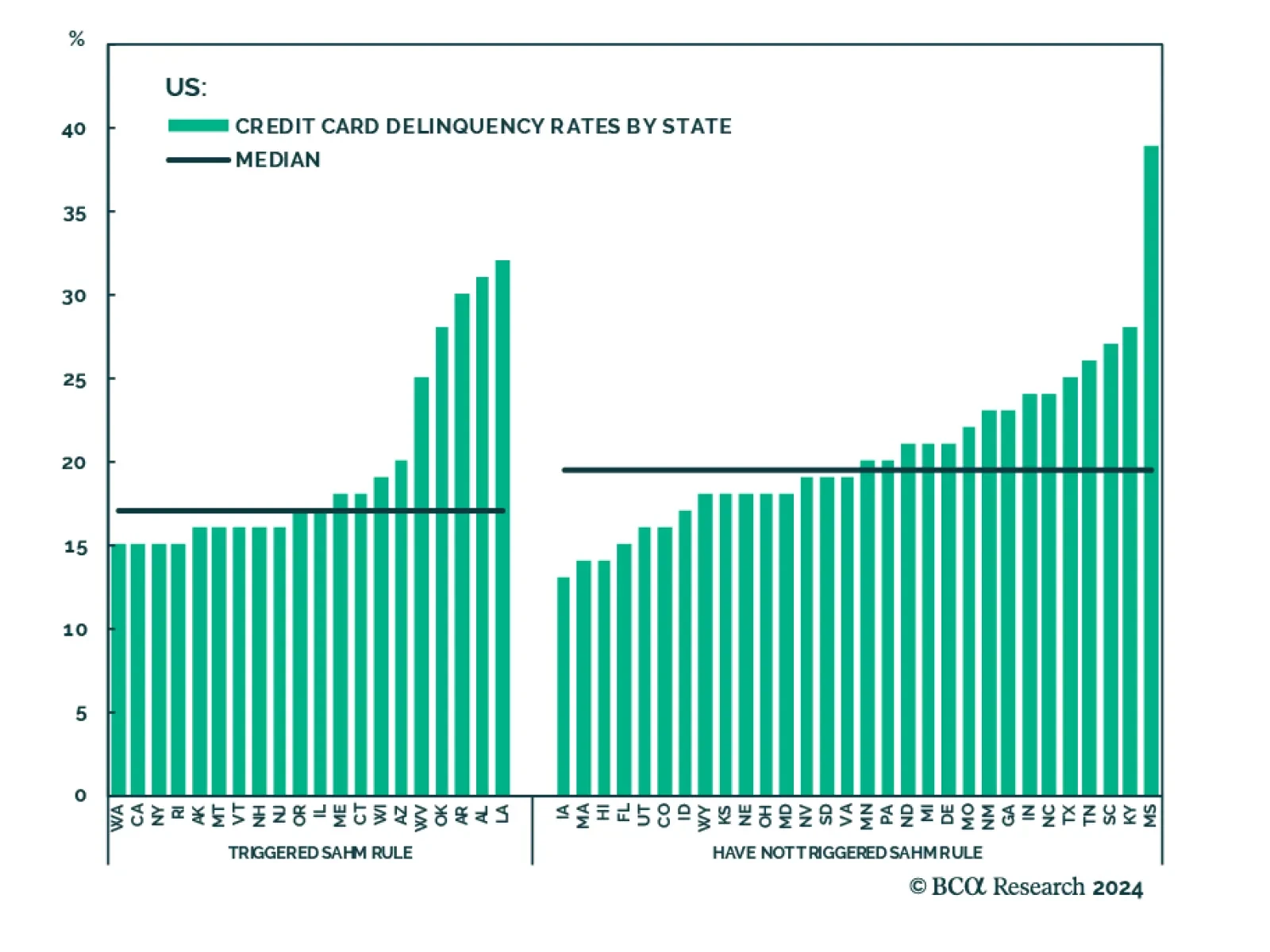

At 3.9% in February, the unemployment rate remains quite low in the US, corroborating the signal from GDP that current economic conditions are fine. Similarly, the Sahm Rule – which currently stands at 0.3 pp – has…

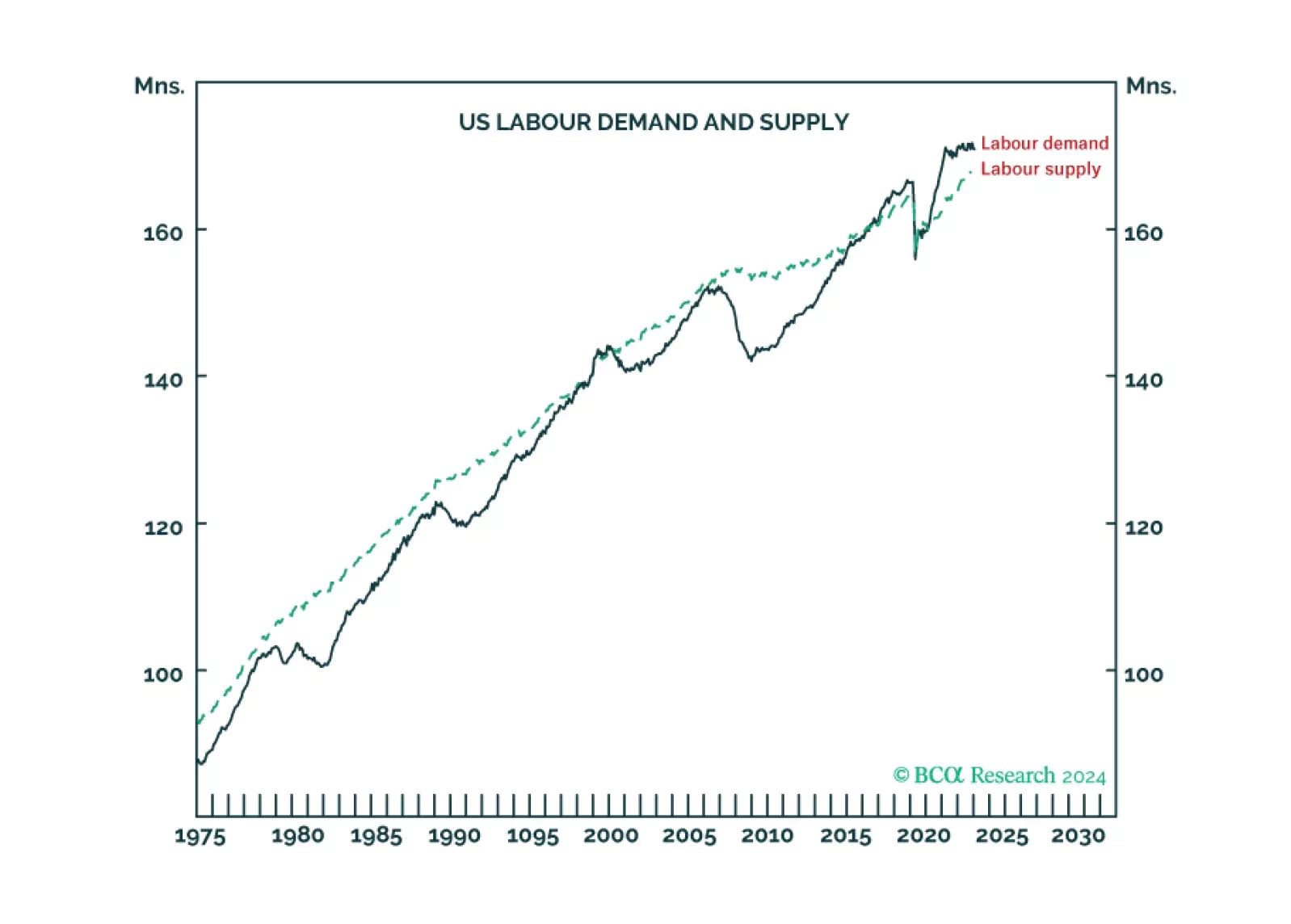

For the first time in at least fifty years, US labour supply is running well below labour demand, meaning the US economy is ‘inverted’. We discuss how and why the economy inverted, and what it means for recession, inflation, and…

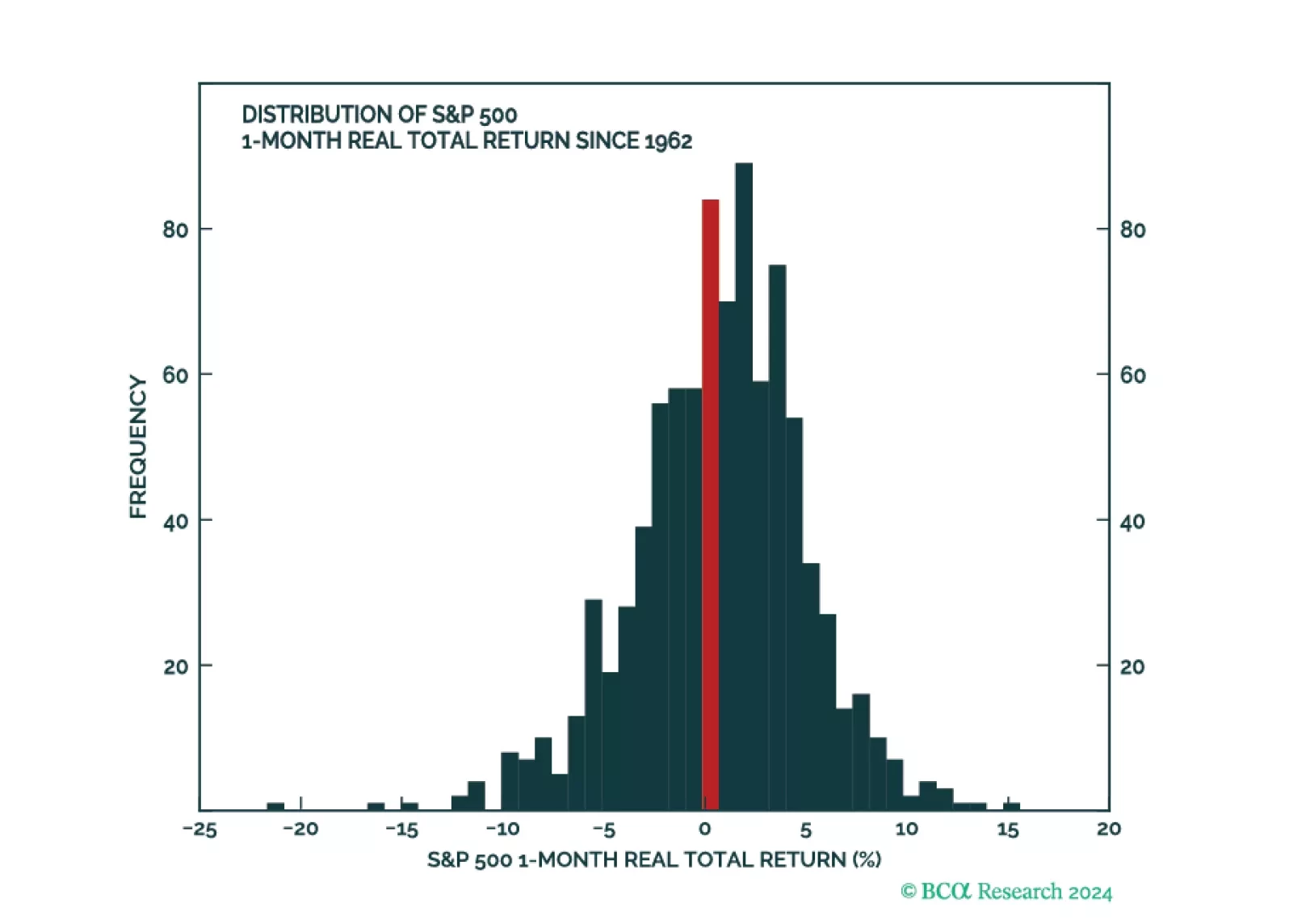

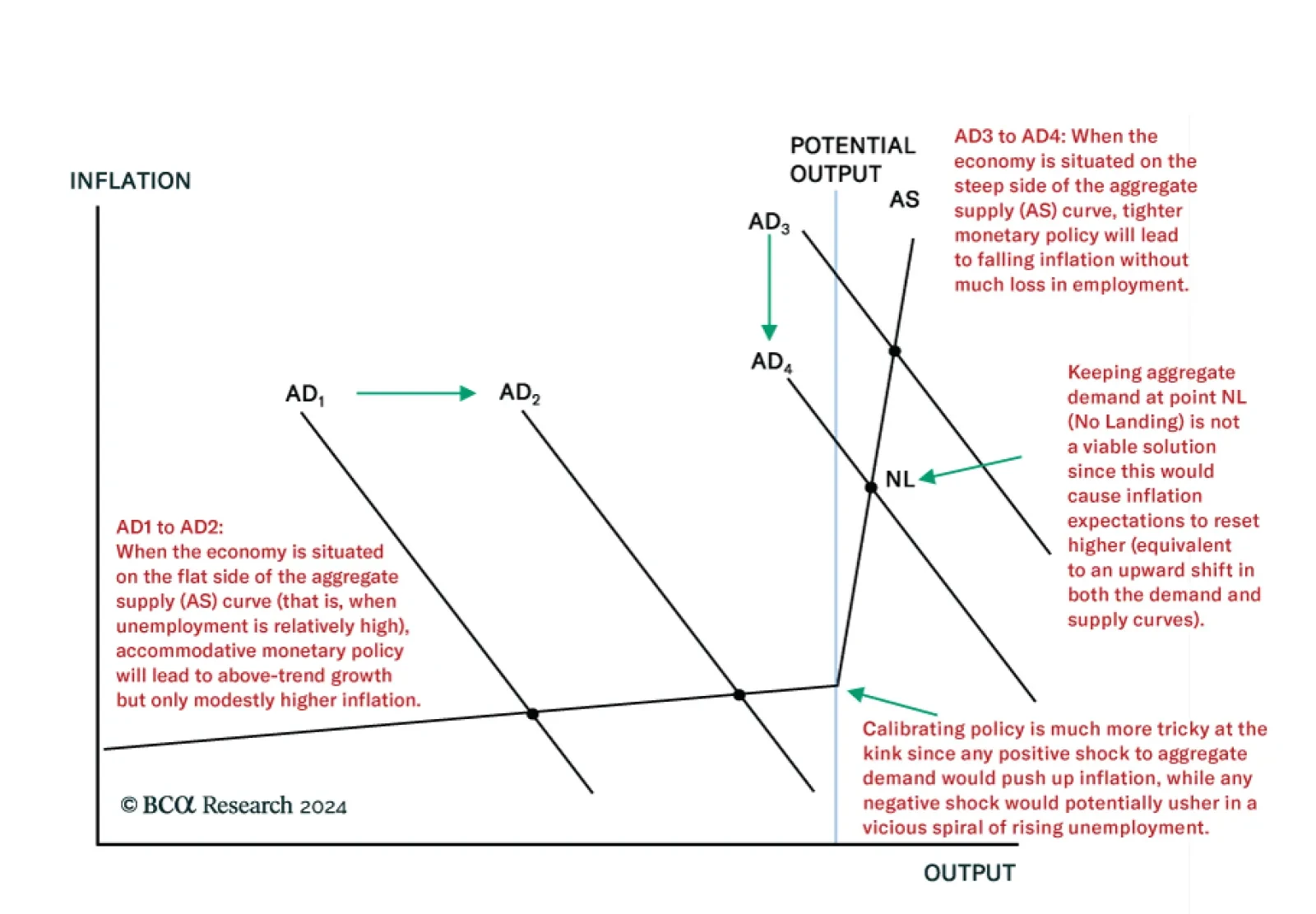

According to BCA Research’s Global Investment Strategy service, the wave of inflation that the US experienced over the past three years cannot be safely repeated. The unemployment rate is a highly mean-reverting series:…

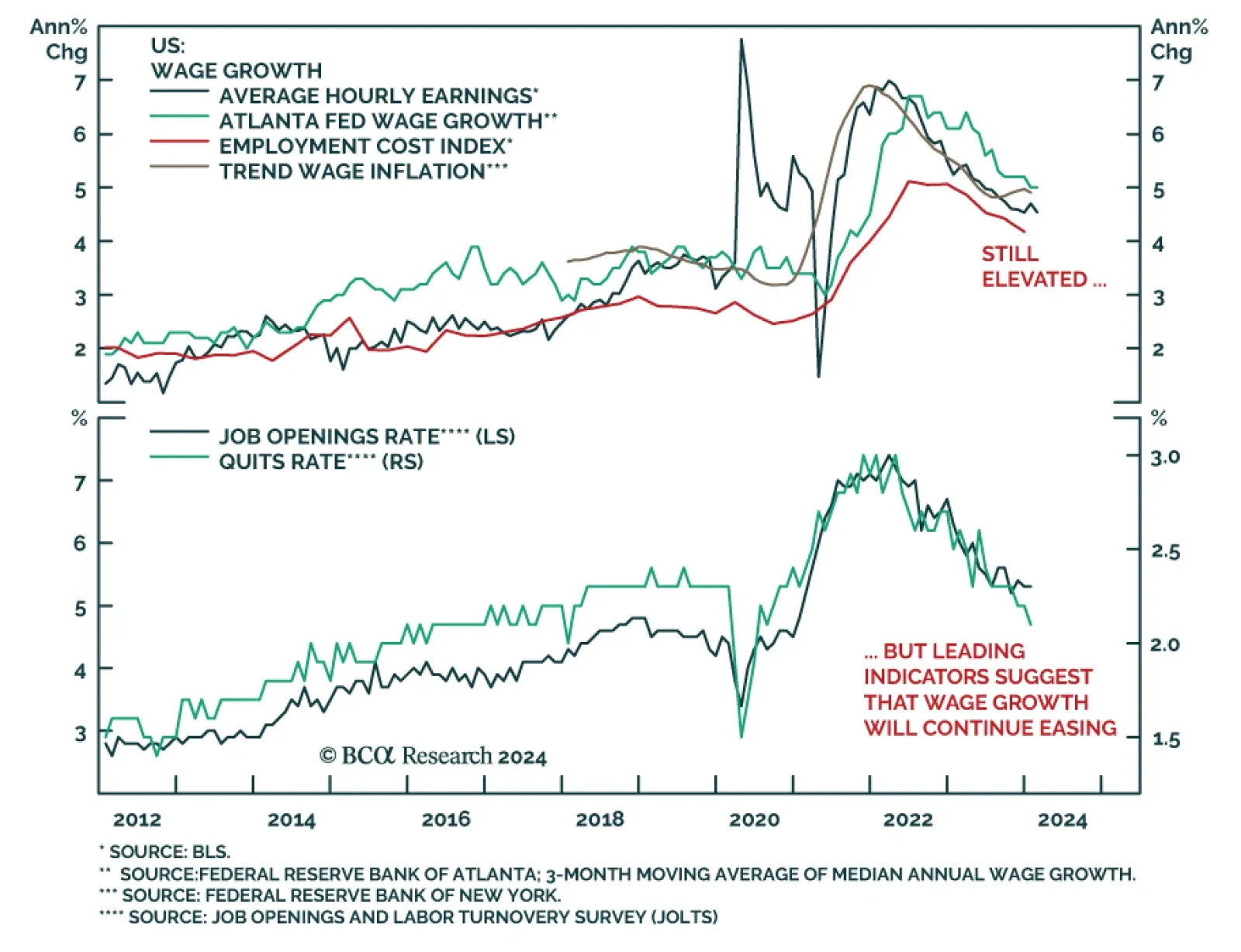

In Fed chair Jay Powell’s opening remarks at last week’s press conference, he noted that wage growth has been moderating and that FOMC participants expect a continued rebalancing of the labor market to help ease price…

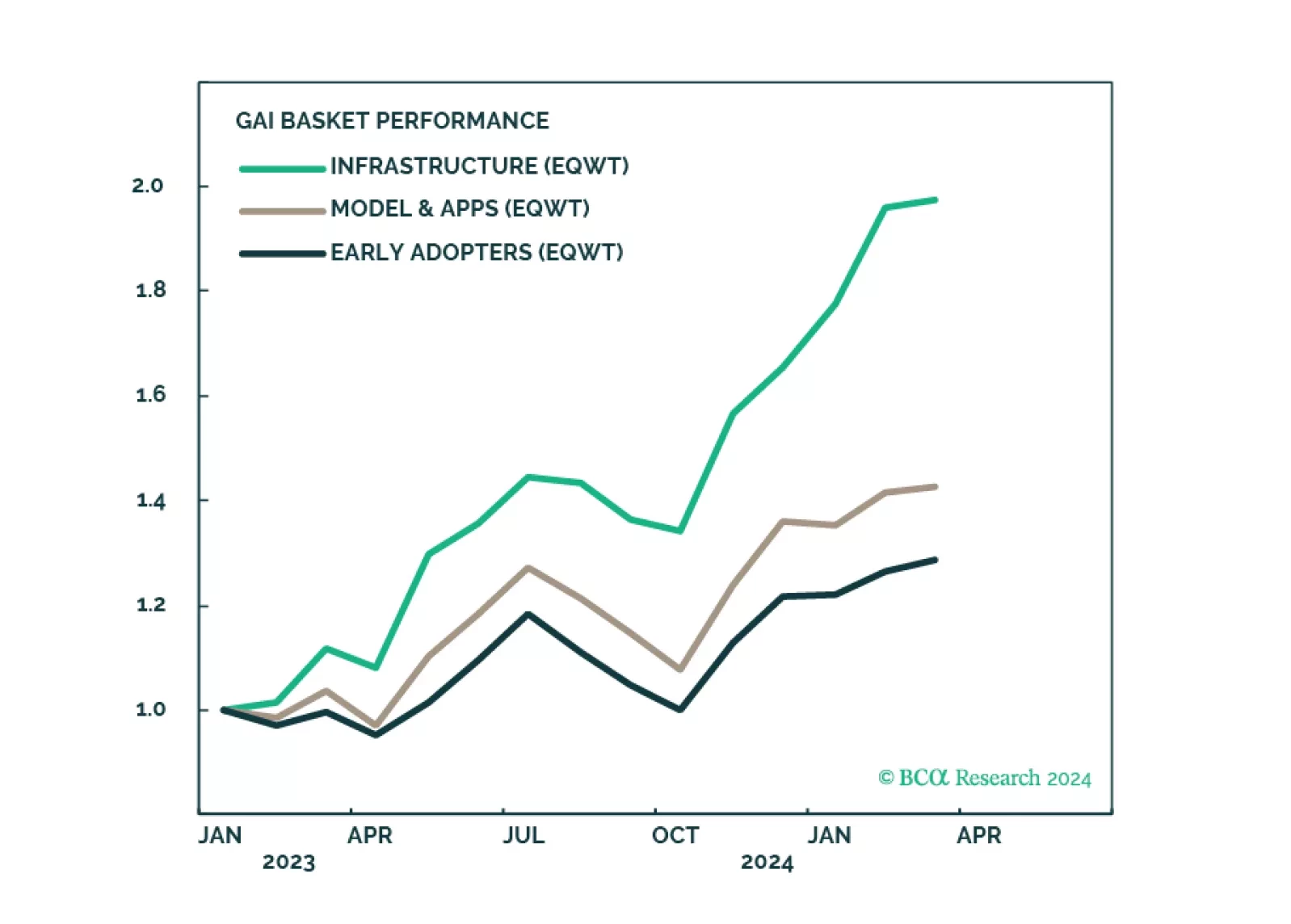

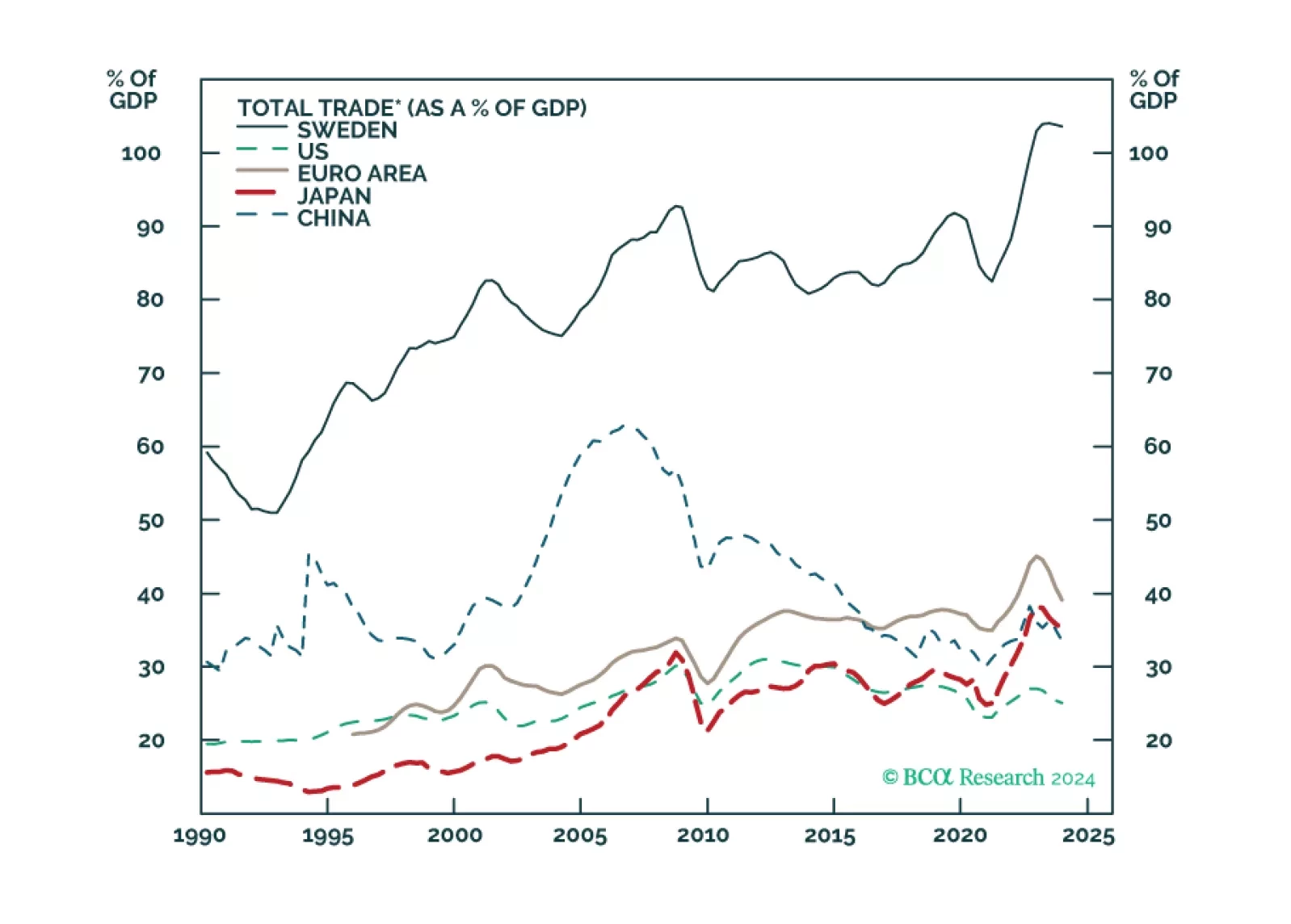

In this Strategy Outlook we examine why, contrary to popular perception, the odds of a global recession over the next 12 months are rising not falling.

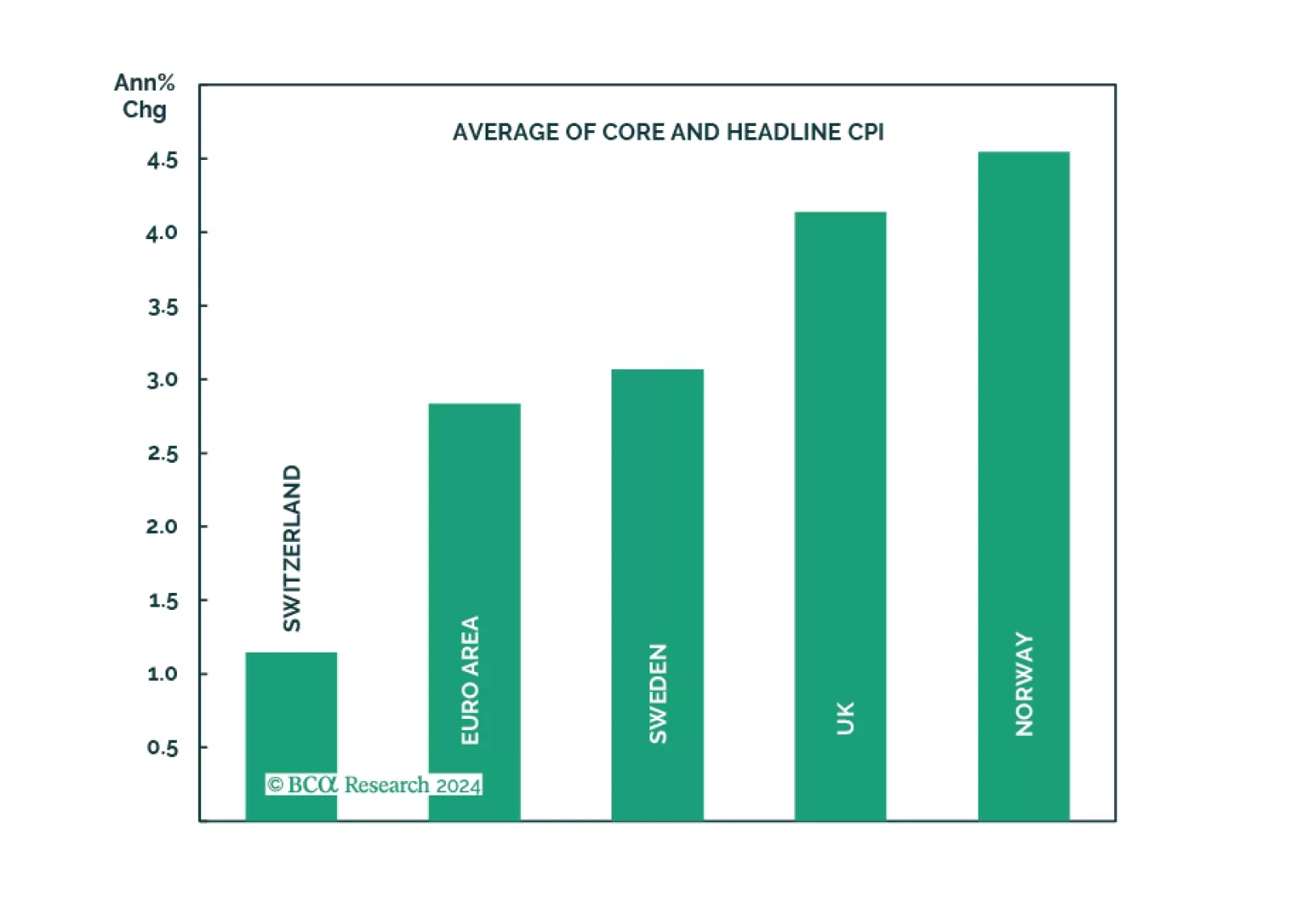

Does the recent surprise rate cut by the Swiss National Bank augur other dovish surprises among major central banks in Europe?

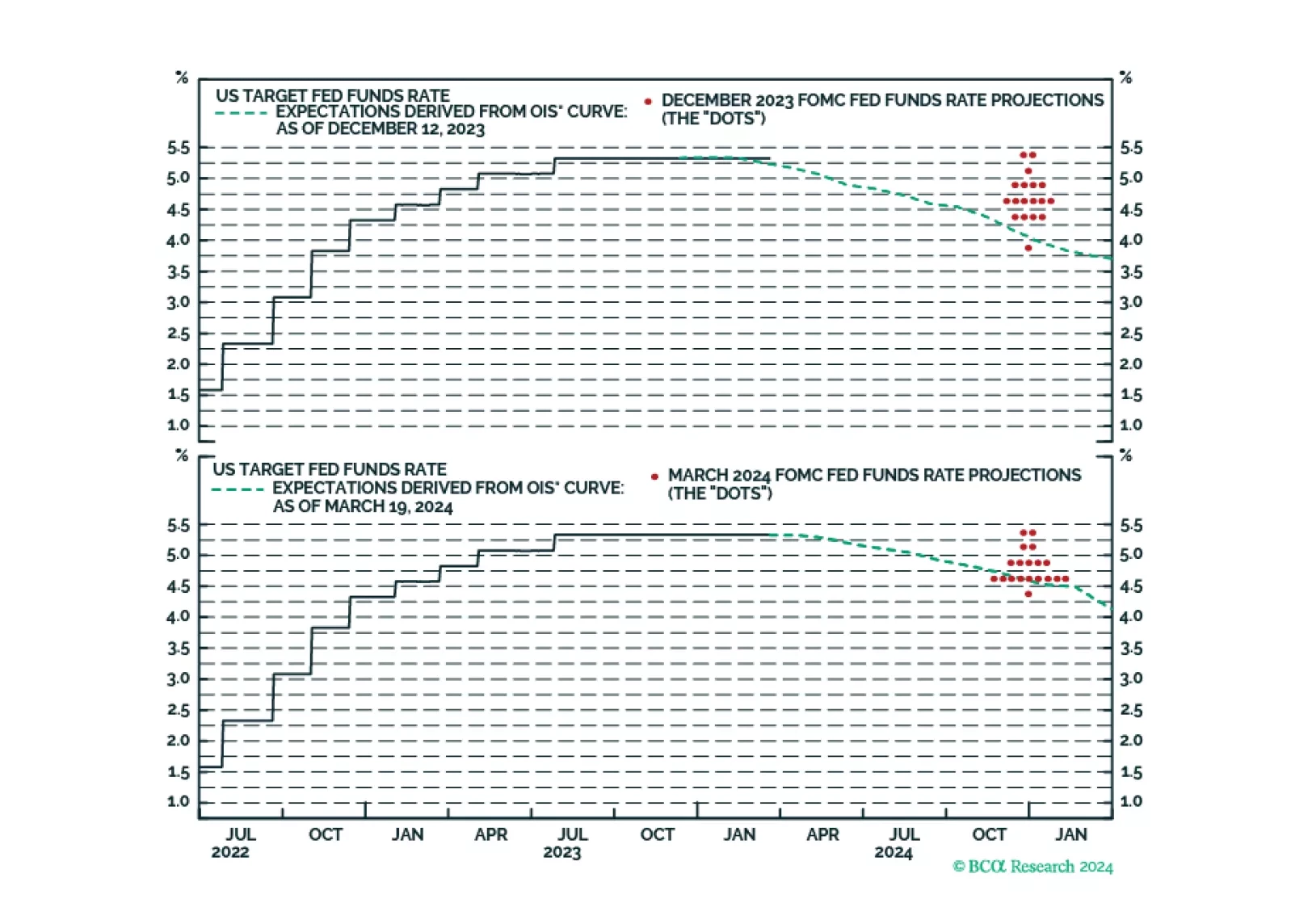

Our takeaways from this afternoon’s FOMC meeting.