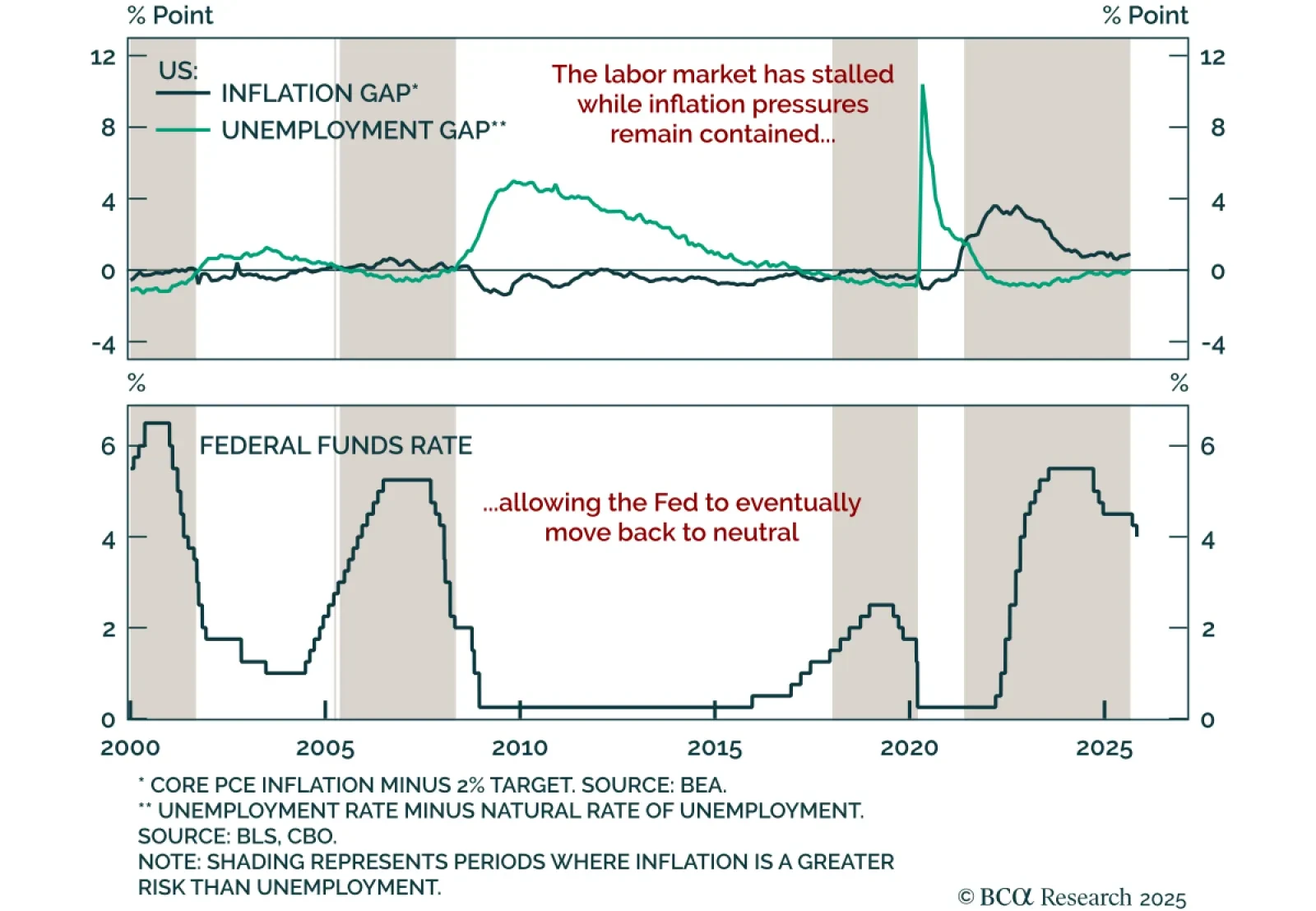

The Fed cut rates by 25 bps to 3.75%–4.00% and announced QT will end December 1, signaling modest easing but no December cut commitment. The decision matched expectations, with dovish (Gov. Miran, for a 50 bps cut) and hawkish (Pres…

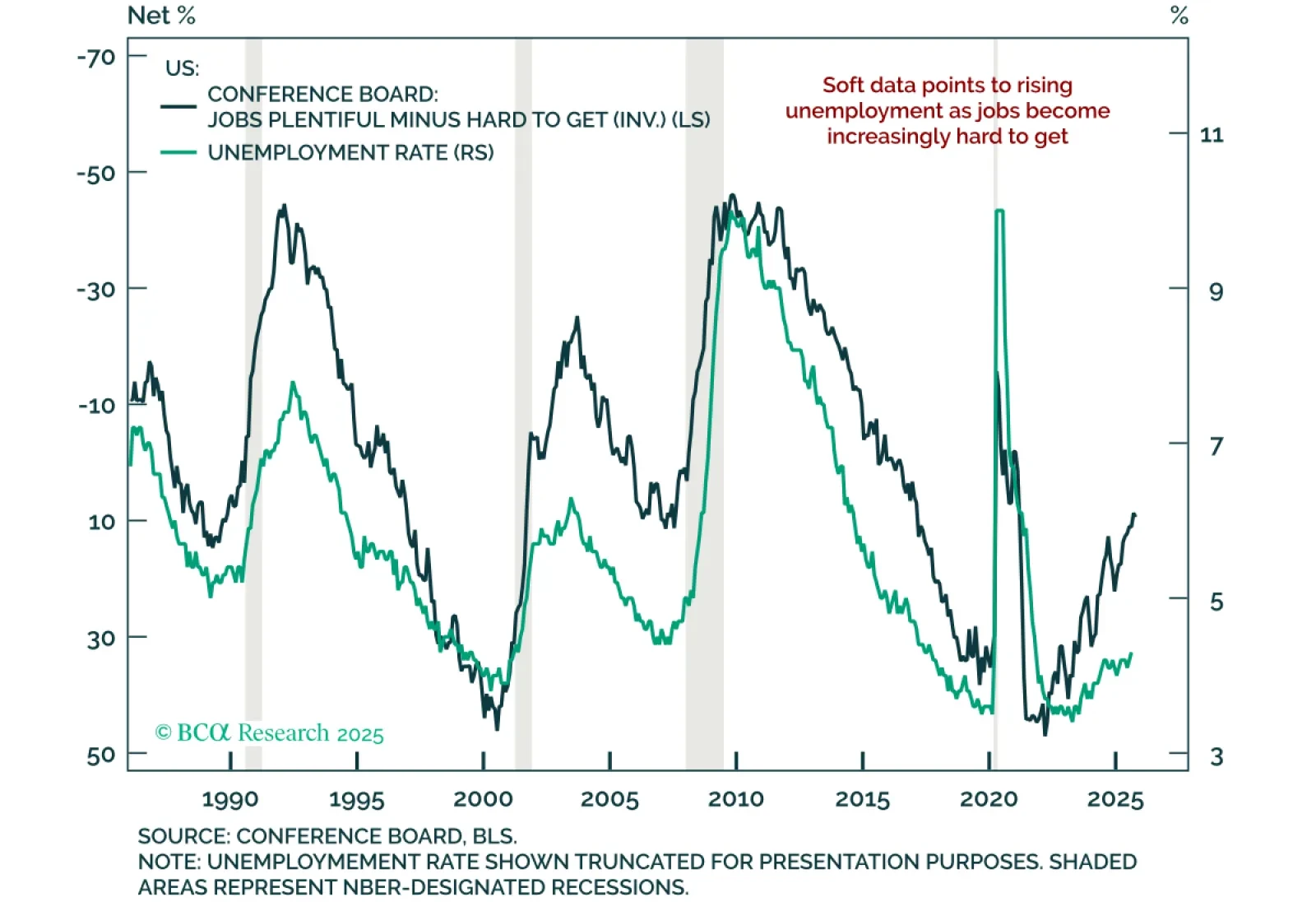

The October Conference Board Consumer Confidence survey beat estimates but fell slightly, showing stable current conditions and softer expectations. The headline declined to 94.6 from an upwardly revised 95.6. Consumers’ assessment…

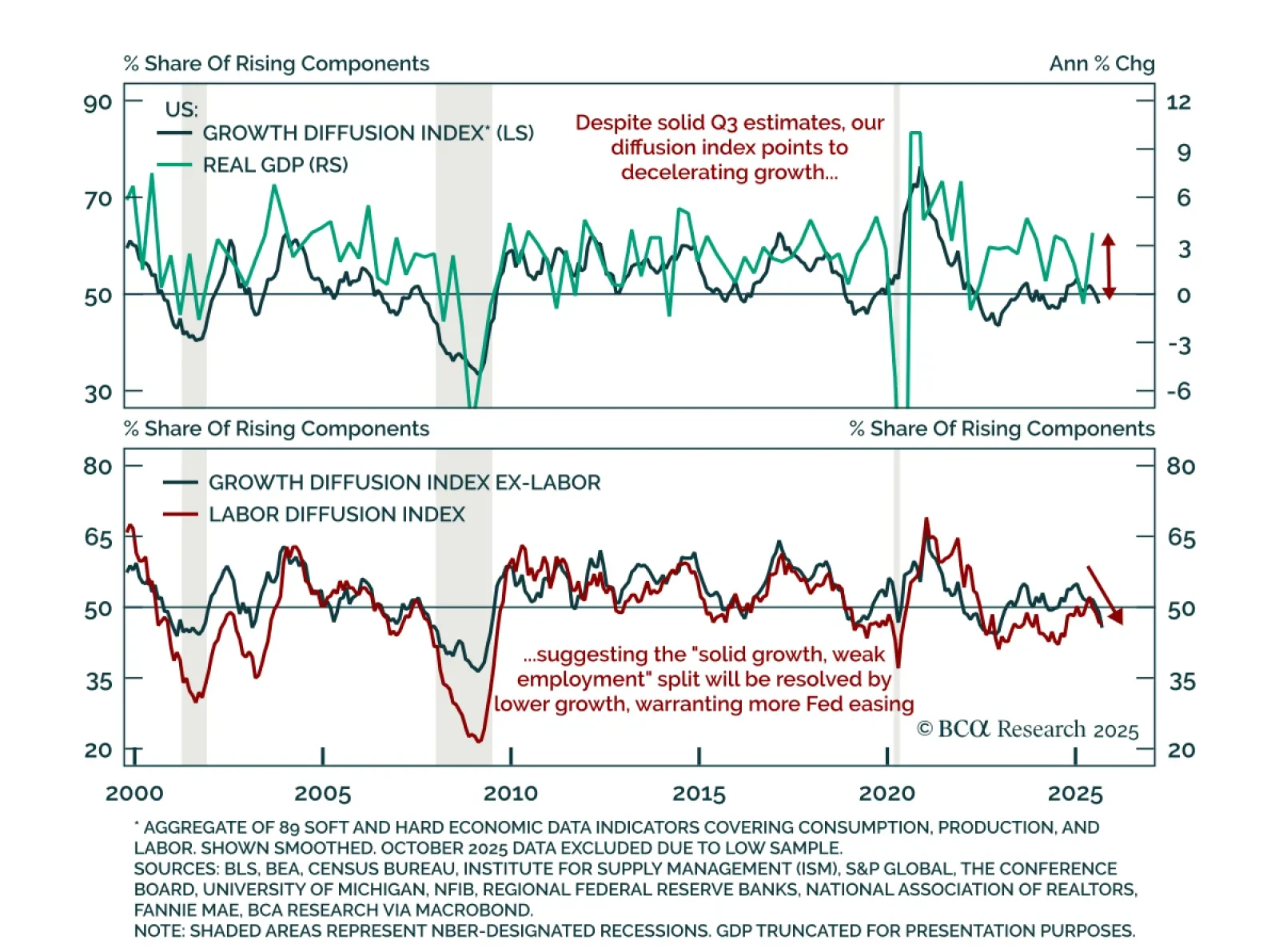

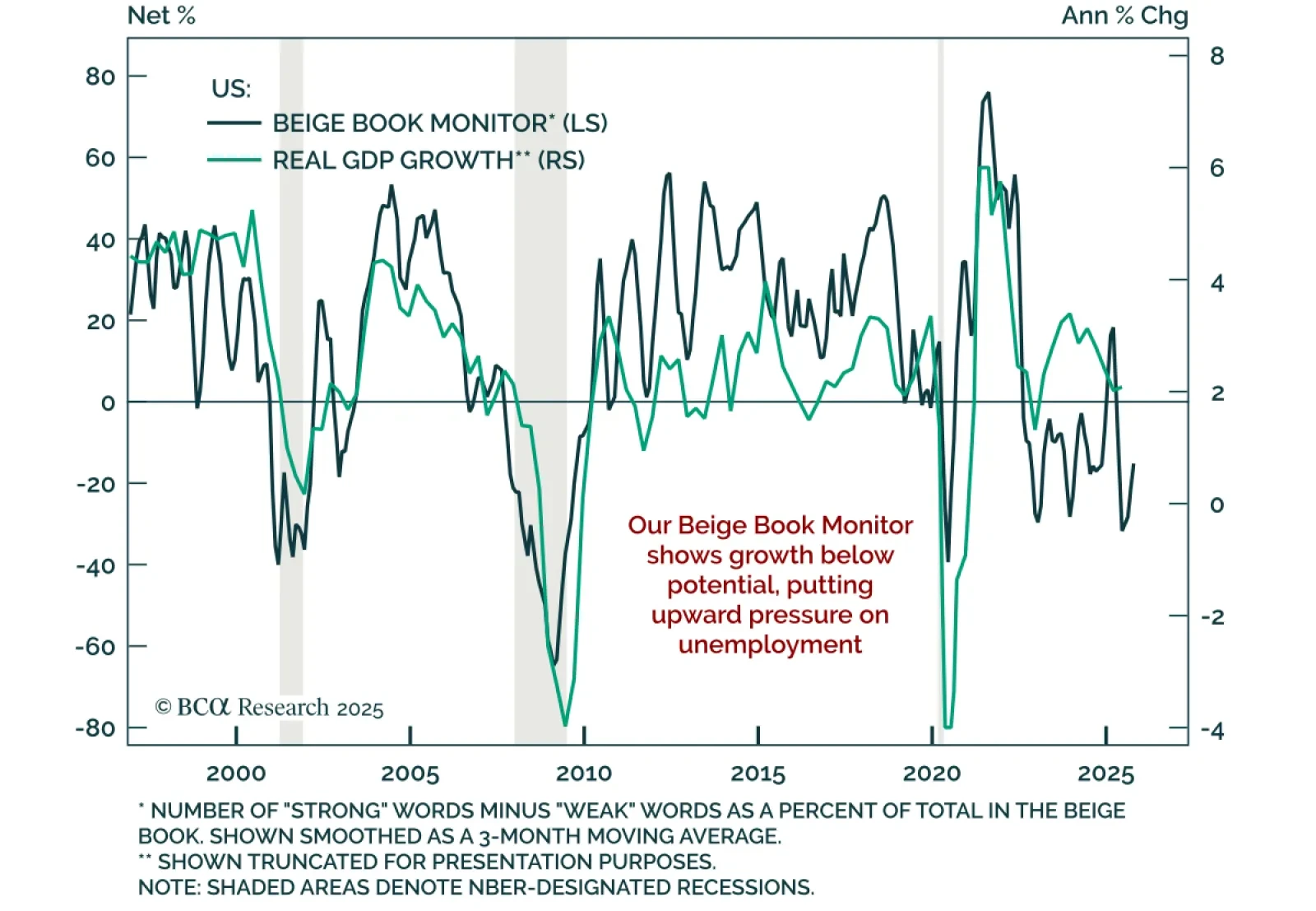

We expect the divergence between resilient growth and weakening employment to be resolved by lower growth estimates, supporting long duration and steepeners. Economic activity and employment usually move together in a circular…

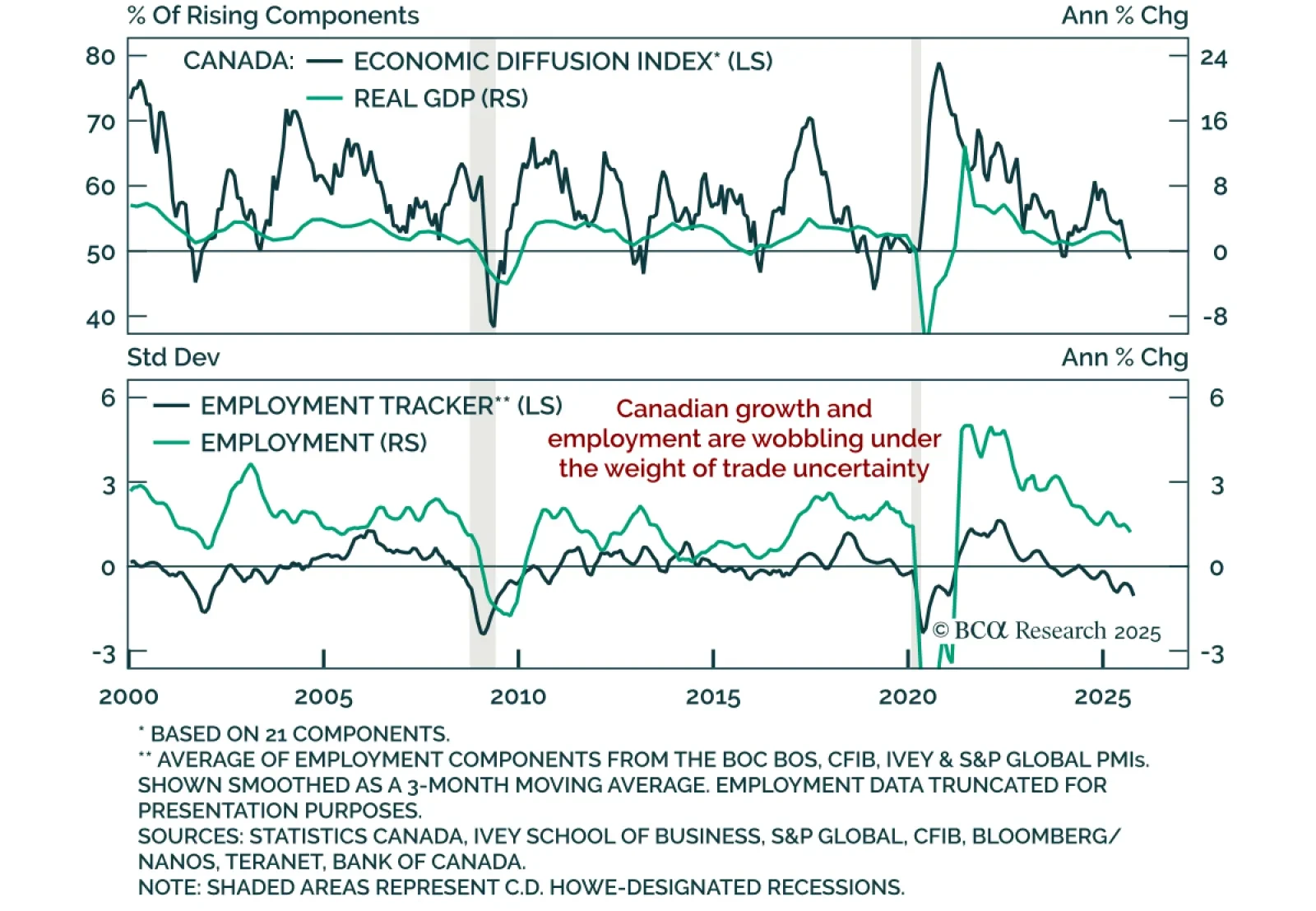

Recent Canadian data confirm slowing growth, reinforcing support for government bonds and steepeners. The October CFIB Business Barometer fell to 46.3 from 50.2, indicating contraction and underscoring the risk posed by small…

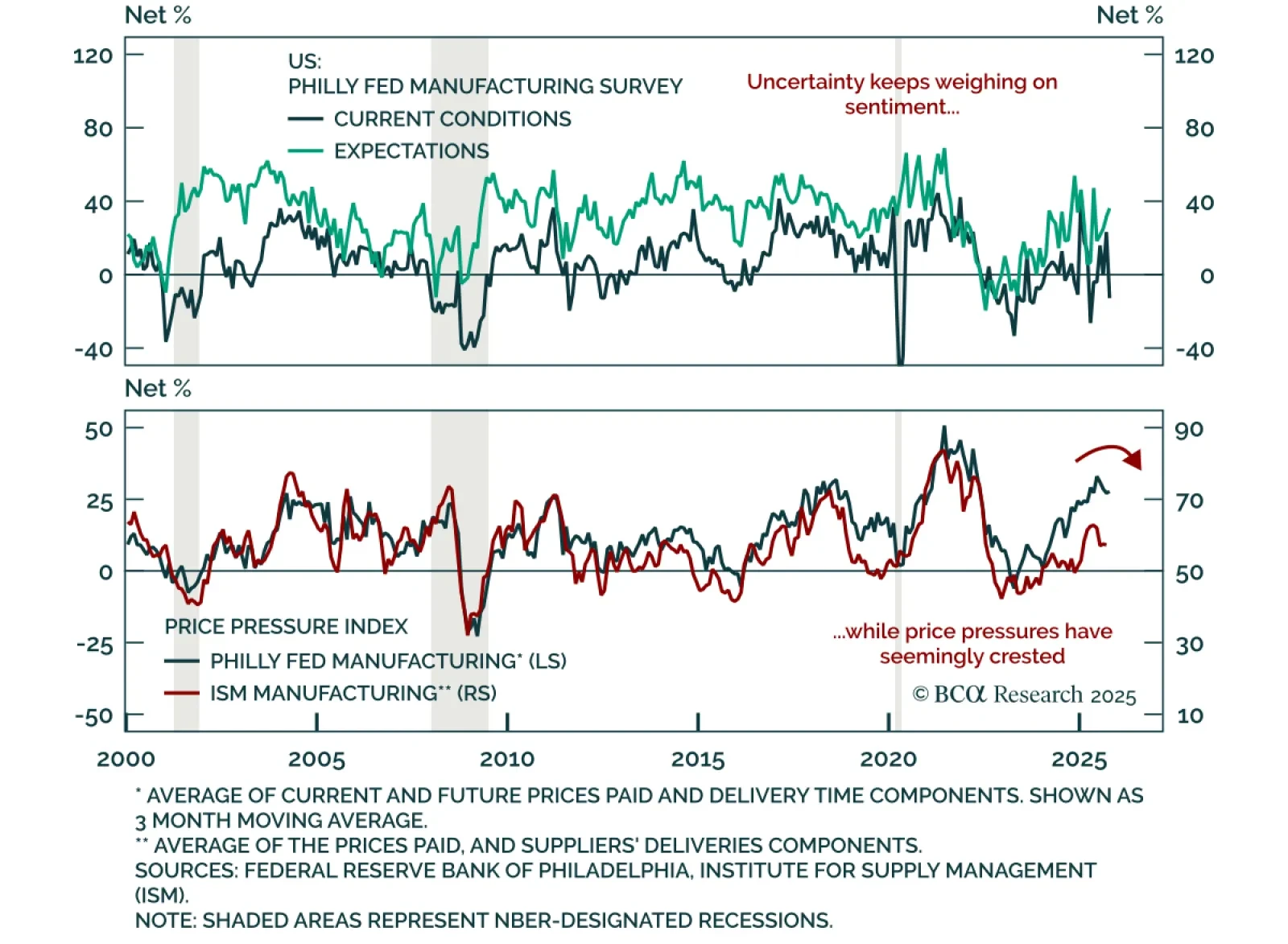

The October Philadelphia Fed manufacturing survey was mixed, showing weak headline data but steadier underlying components. The headline index fell to -12.8 from 23.2, the lowest level since April 2025. Underlying details were not as…

The October Fed Beige Book points to slowing growth as uncertainty continues to weigh on activity. Fed contacts reported consumer spending recently decreased, though auto sales were supported by EV purchases ahead of the expiration…

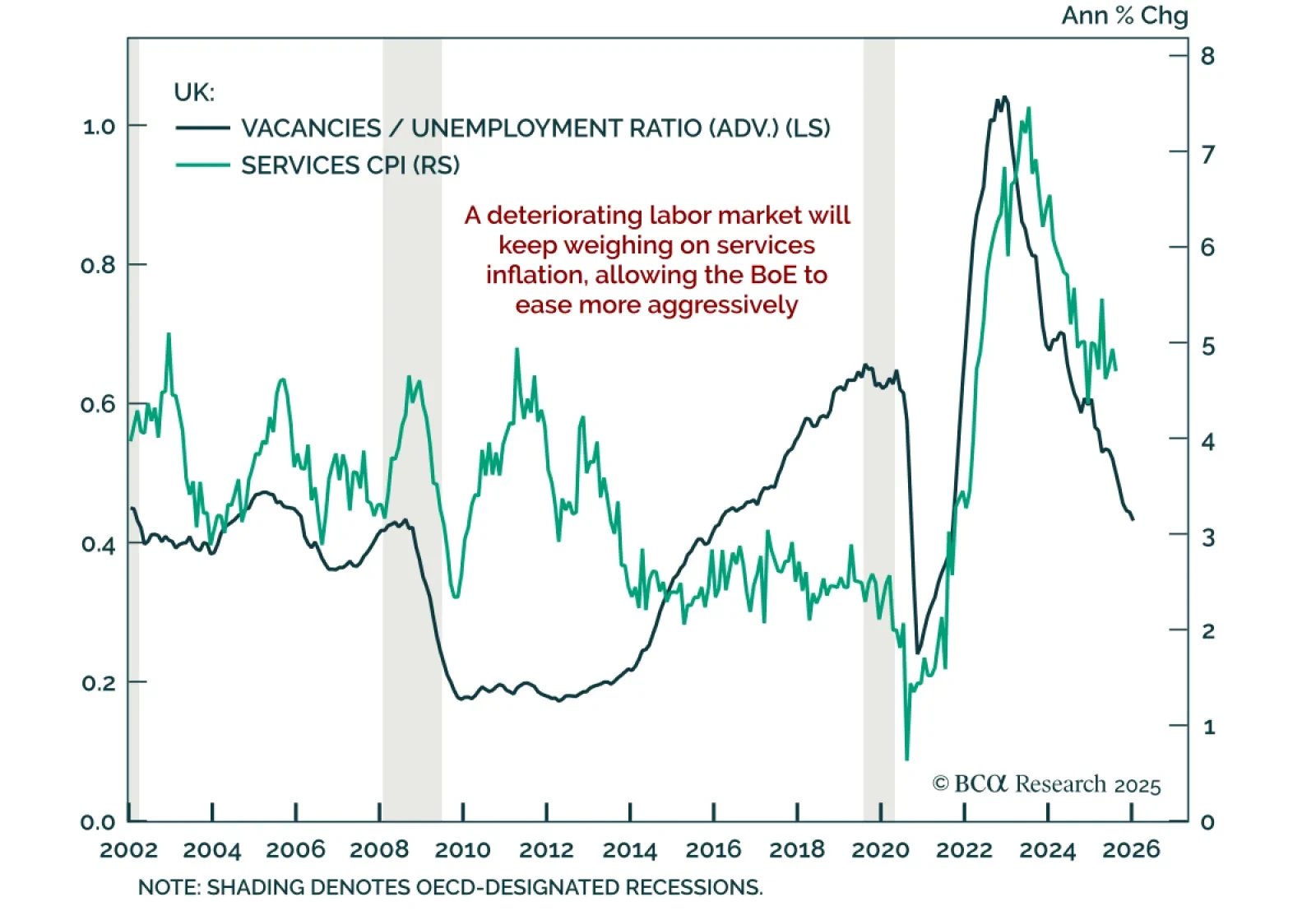

UK labor data weakened in August and September, reinforcing downside inflation risks and supporting overweight Gilts with 2s10s steepeners. Payrolls fell by 10k in September, while job vacancies continued to slide to cyclical lows as…

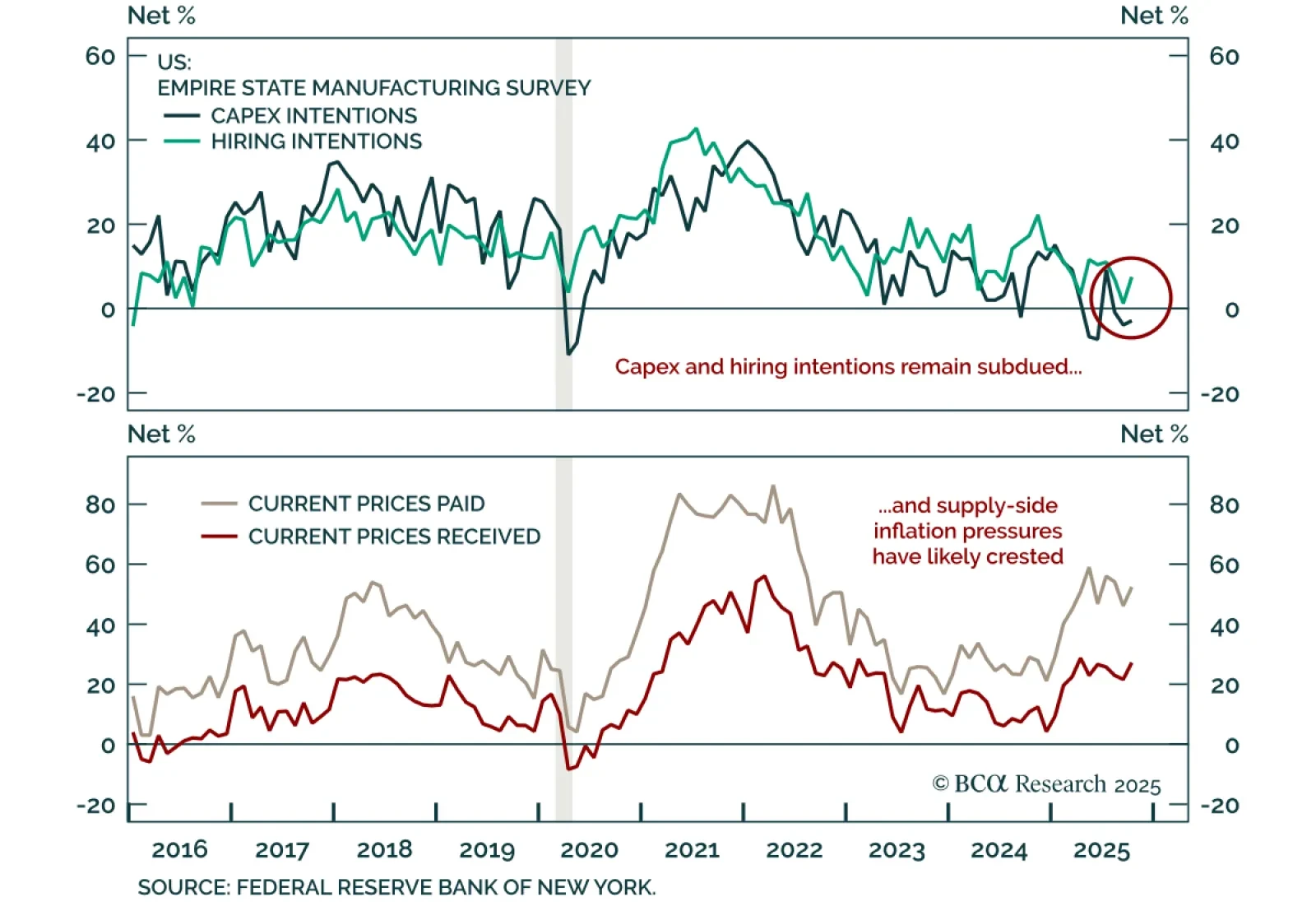

The October Empire Manufacturing survey beat estimates, but weak investment and hiring intentions temper its positive signal. The index rose to 10.7 from -8.7, indicating modest activity growth. New orders ticked up, and shipments…

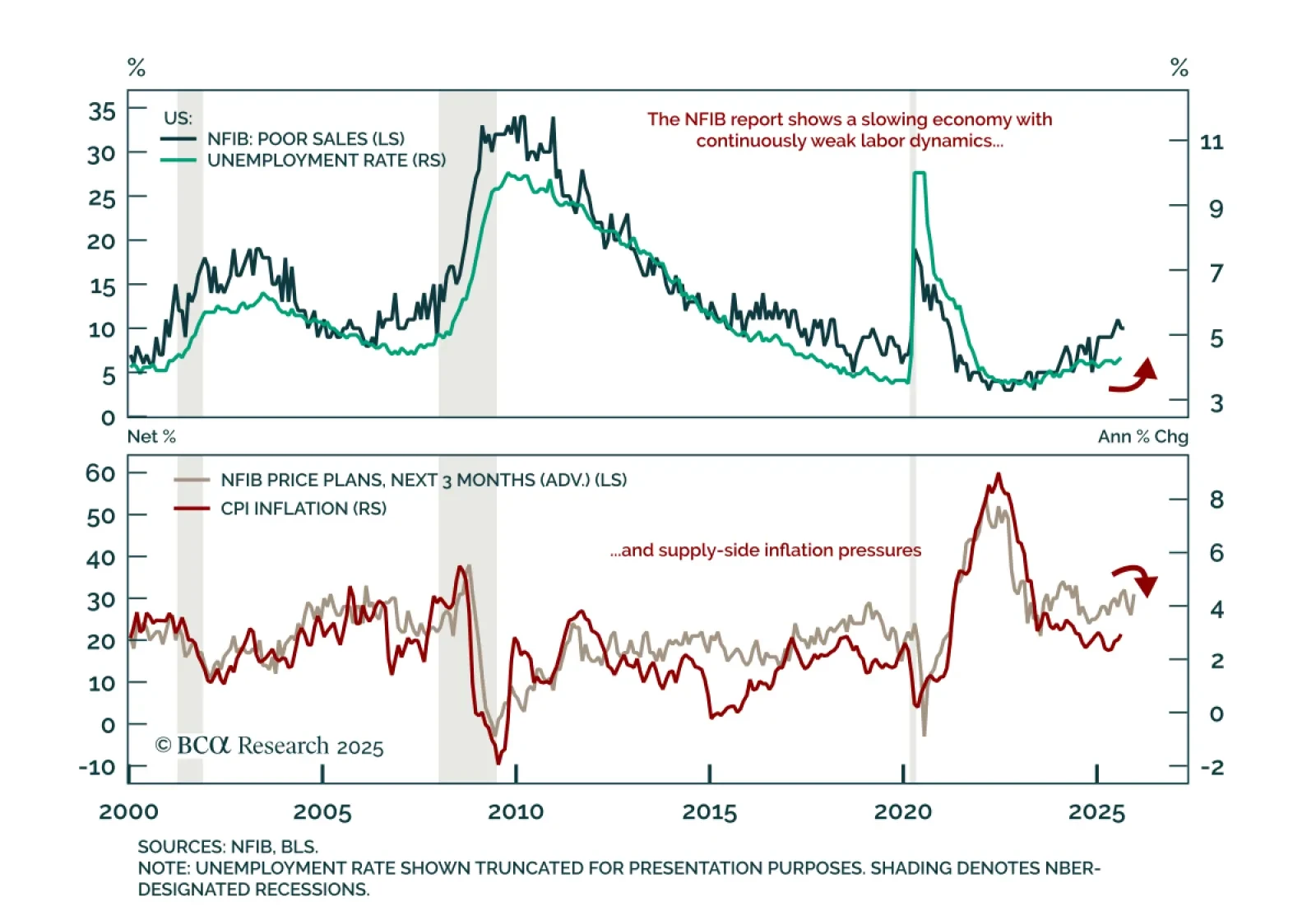

The September NFIB Small Business Optimism Index missed estimates, falling to 98.8 from 100.8. The decrease was driven by expectations, as fewer small businesses expect the economy to improve or real sales to rise. Firms also…

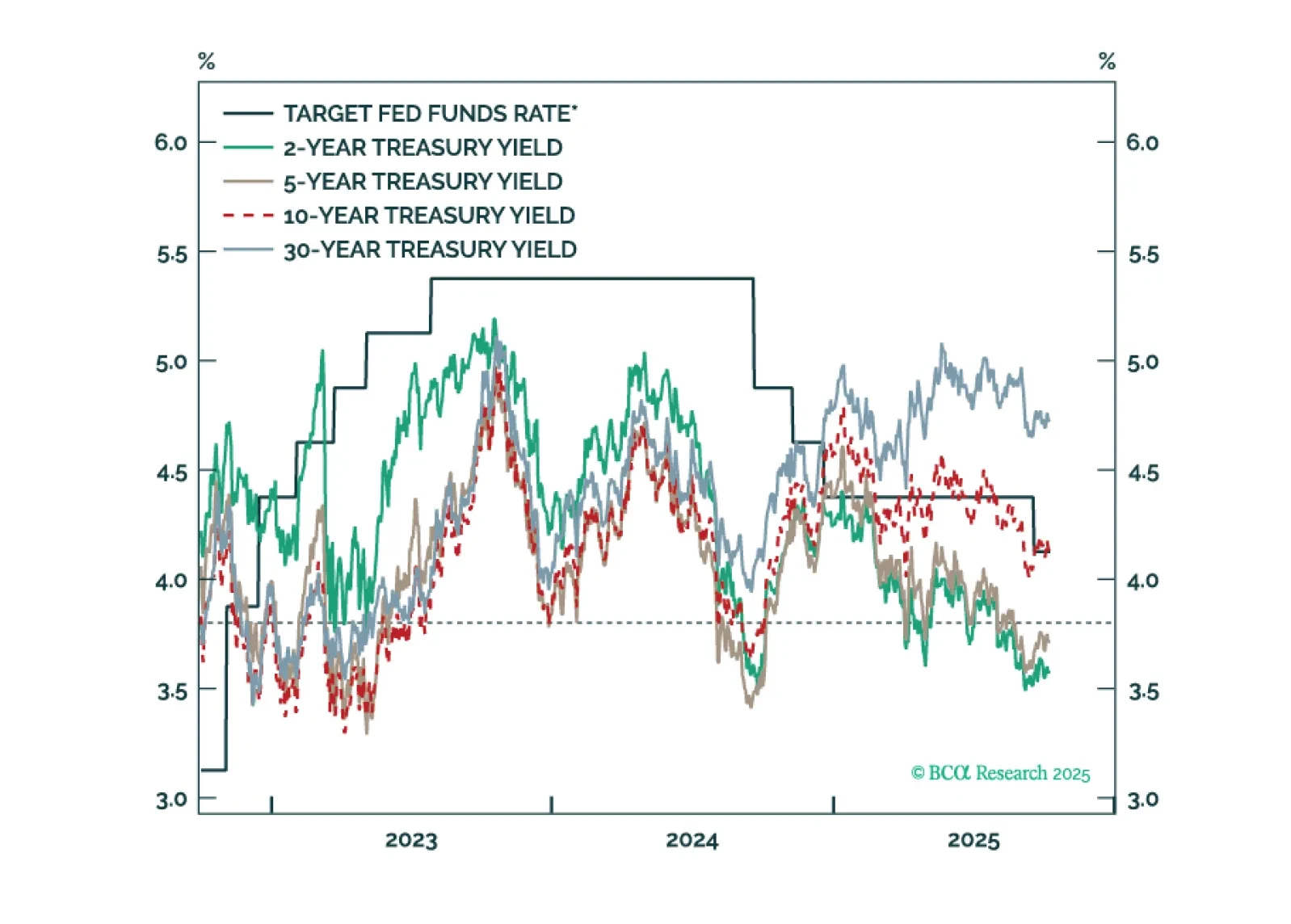

Treasury yields are generally following the pattern of past interest rate cycles, but with a larger term premium keeping the curve steeper than usual.