Every year we highlight five low-odds scenarios that would have a major impact on global financial markets if they happened. This year we contemplate a total reversal of Chinese policy, a US-Iran nuclear deal, a breakdown of NATO, US…

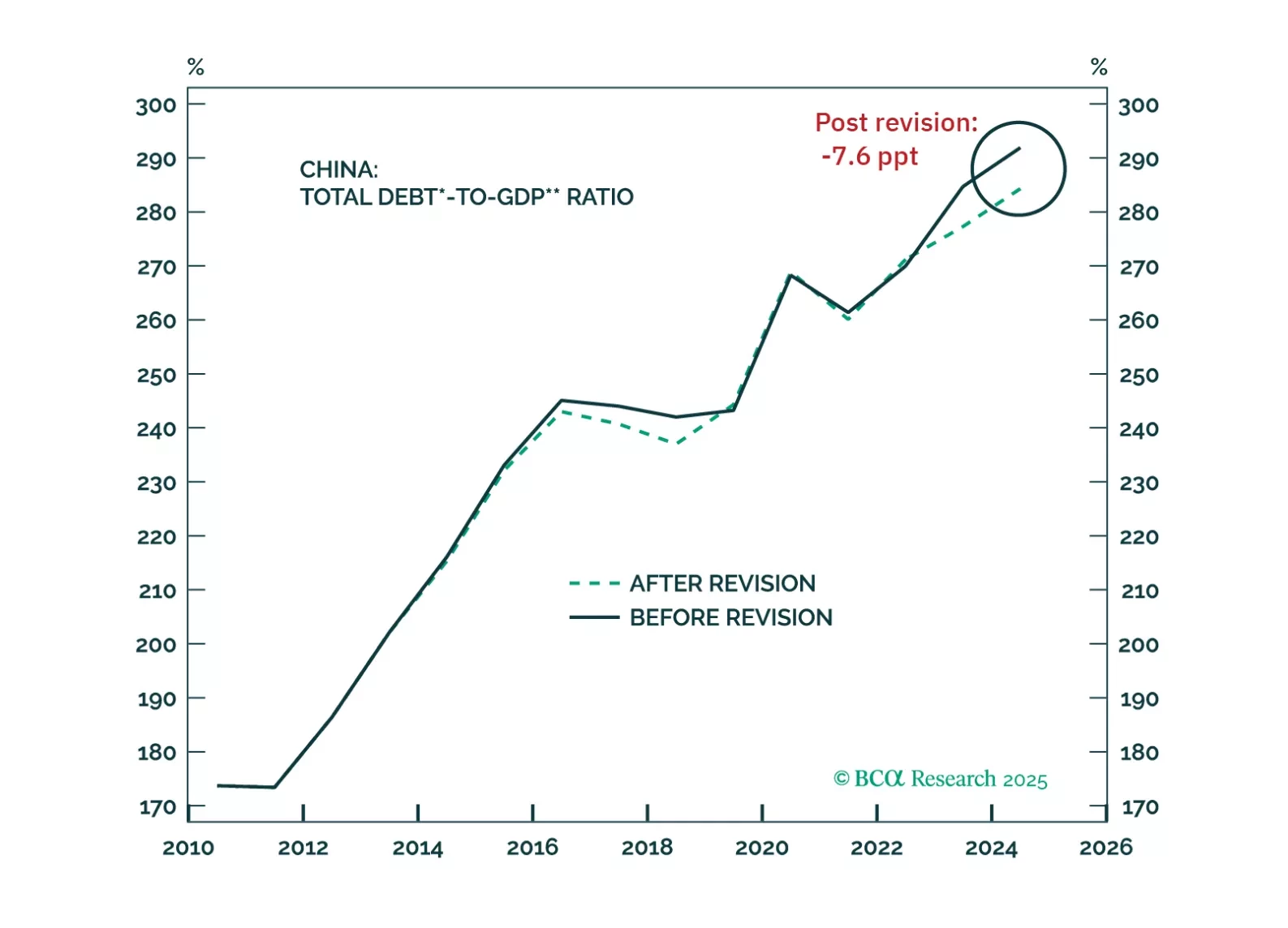

In this week’s report, we present our key takeaways from China's two notable adjustments recently implemented: an upward revision to its 2023 GDP and the reduction of the USD weighting in the RMB Exchange Rate Index.

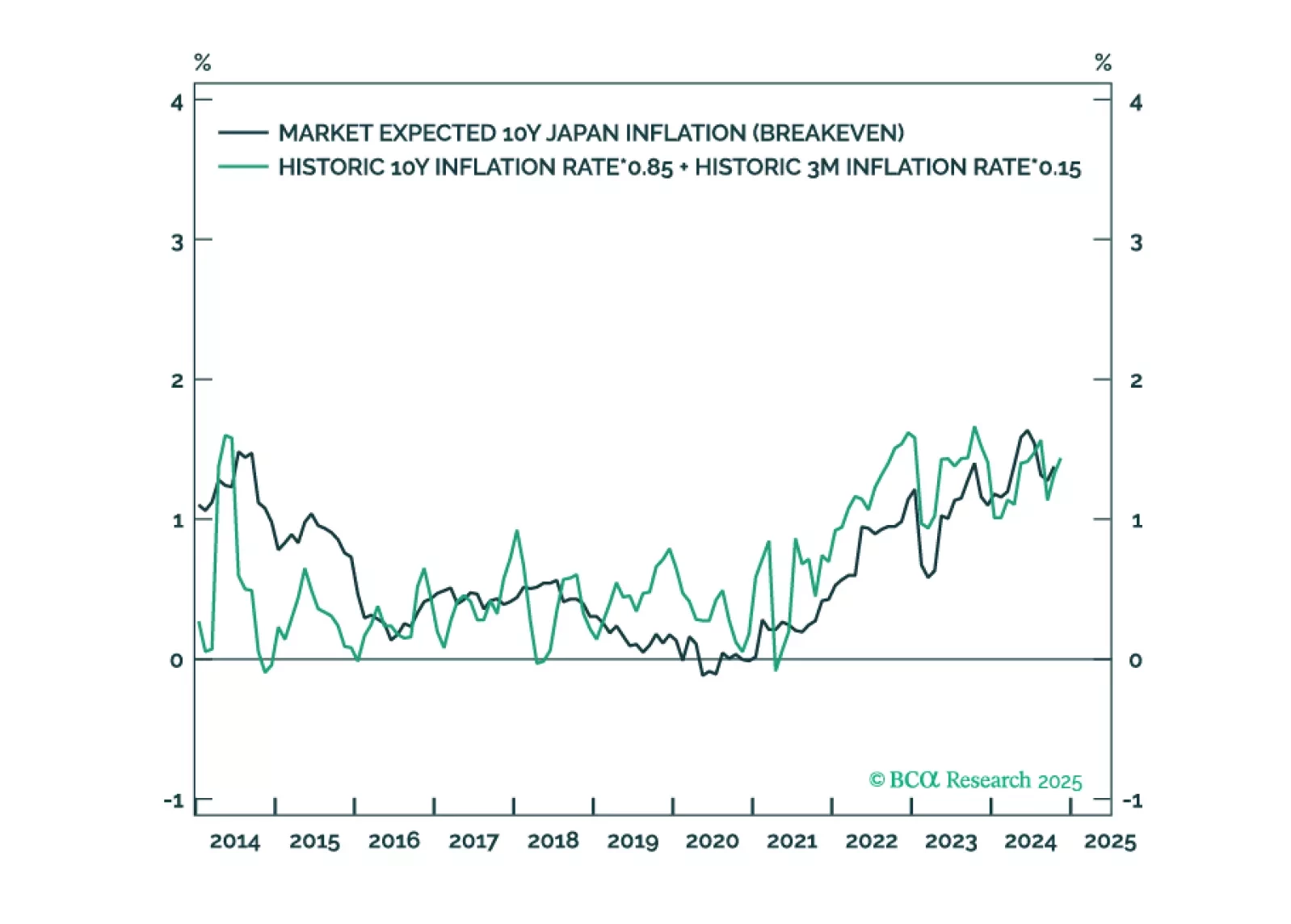

In most developed economies, rising inflation expectations will lift them further above the 2 percent target, limiting the scope for further interest rate cuts. But in Japan, rising inflation expectations will lift them up to the BoJ…

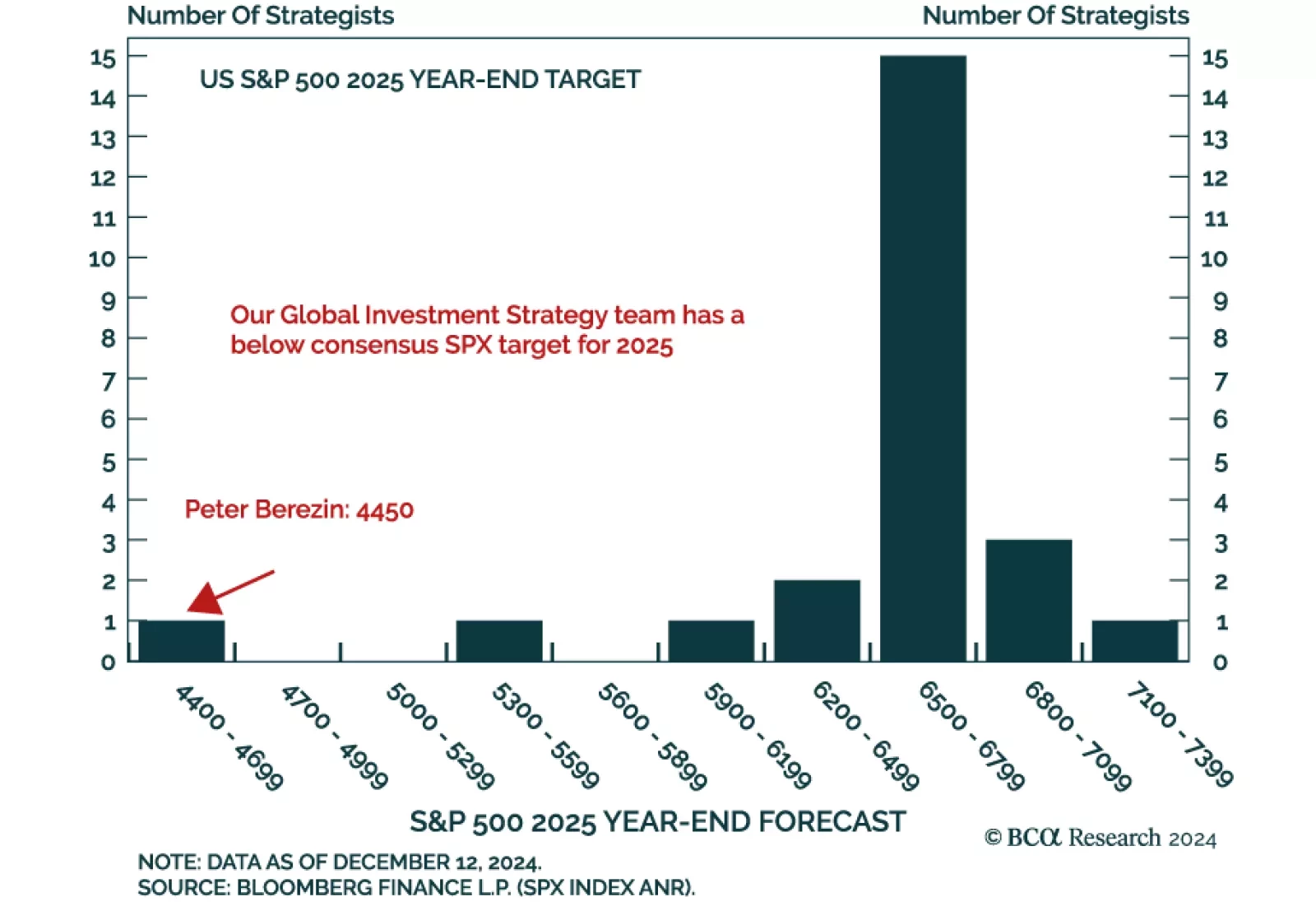

Our Global Investment Strategy team released their 2025 outlook, adopting the unique perspective of time-travelers reporting from January 2, 2026. They foresee a challenging 2025, with the global economy slowing sharply and…

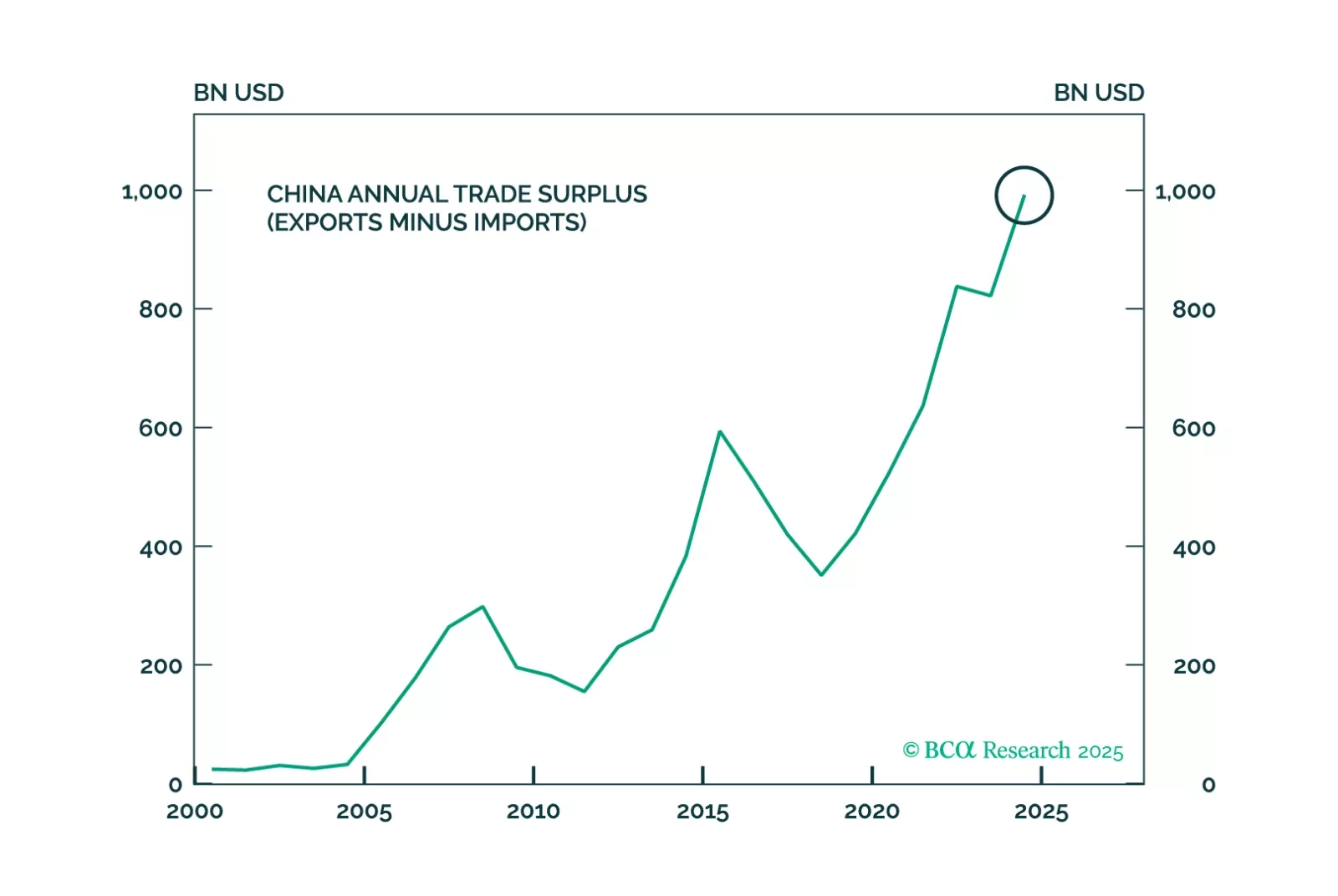

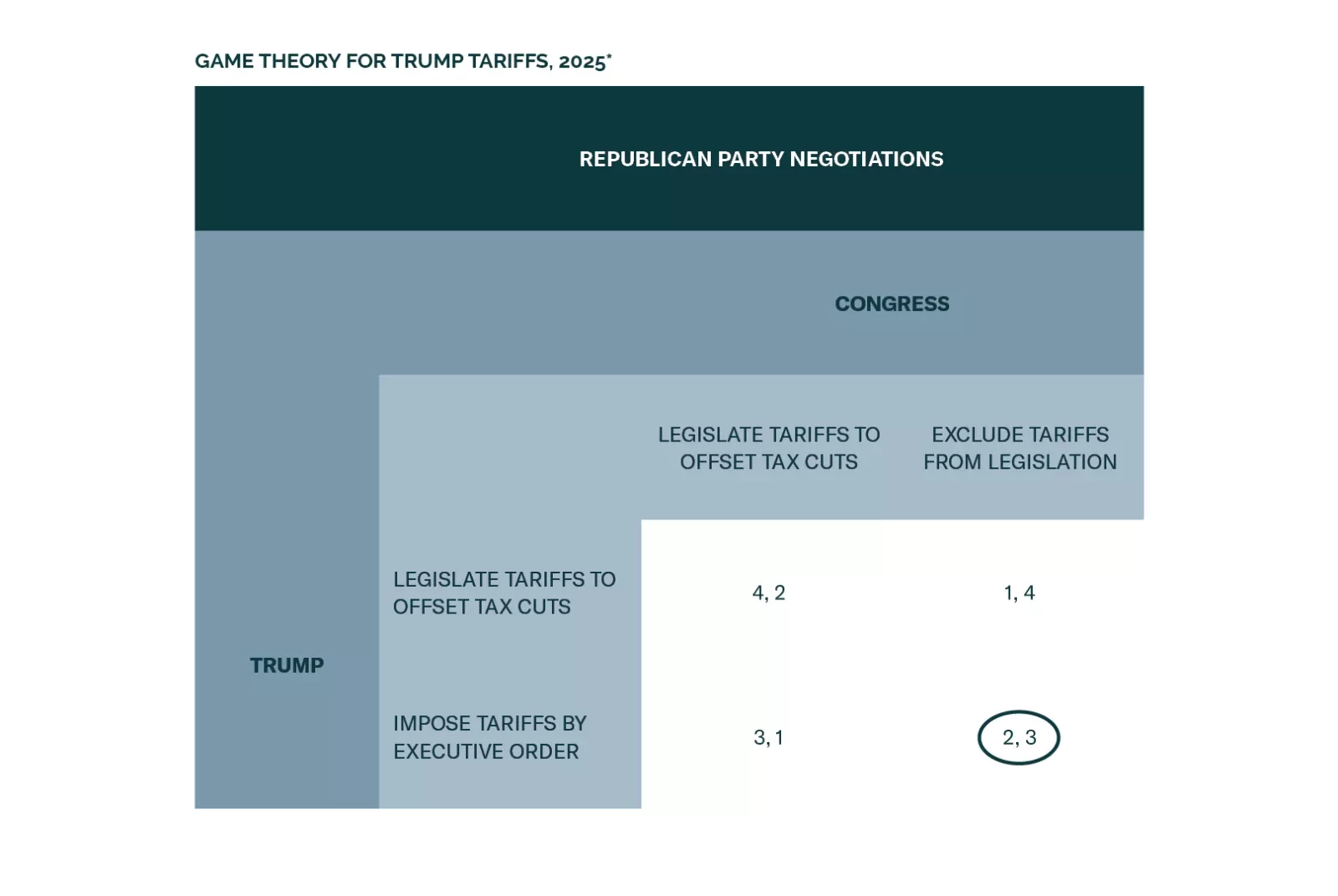

Congress will pass tax cuts by end of 2025 producing a fiscal thrust of about 0.9% of GDP in 2026. Trump will count on that stimulus as a basis for slapping tariffs on leading trade partners.China will retaliate against Trump…

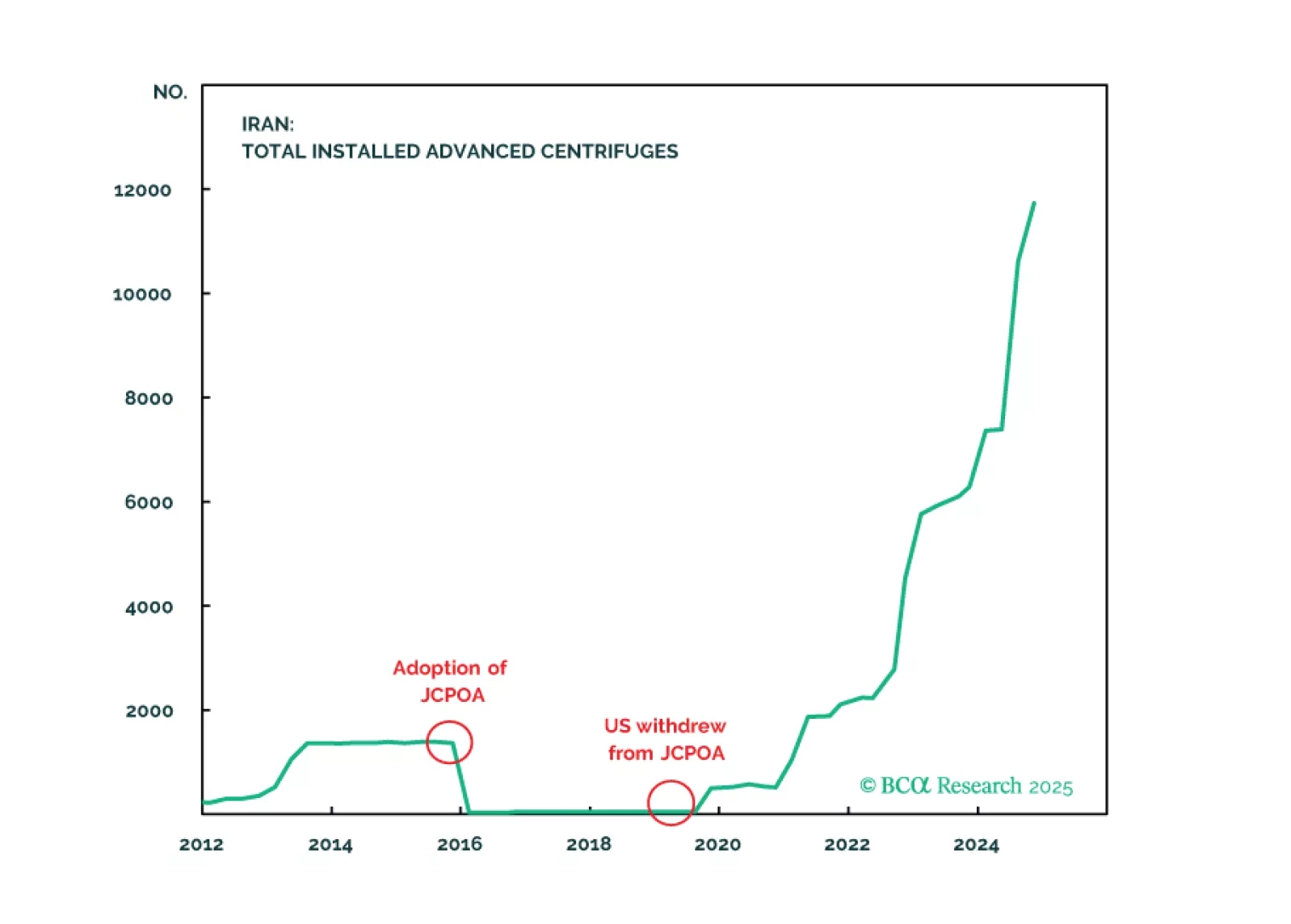

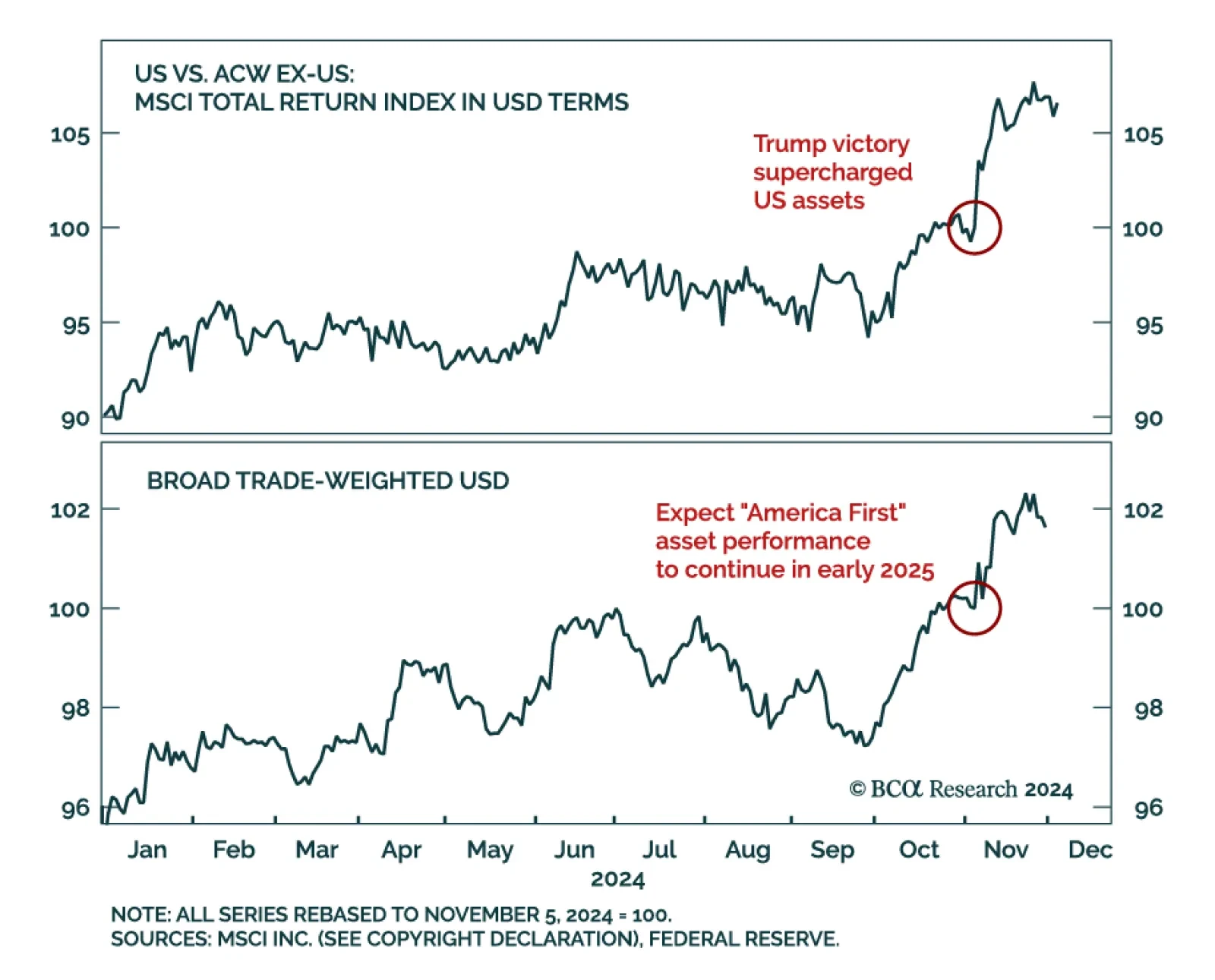

Our GeoMacro Strategy service published their 2025 outlook, and they see three peaks shaping the year: Peak fiscal, peak-deglobalization, and peak geopolitical risk. In 2024, our colleagues’ bullish economic outlook…

The November ISM Services PMI missed expectations, declining to 52.1 from 56 in October. All subcomponents declined, with new orders falling from 57.4 to 53.7. Employment also weakened but remains in expansion, while price…

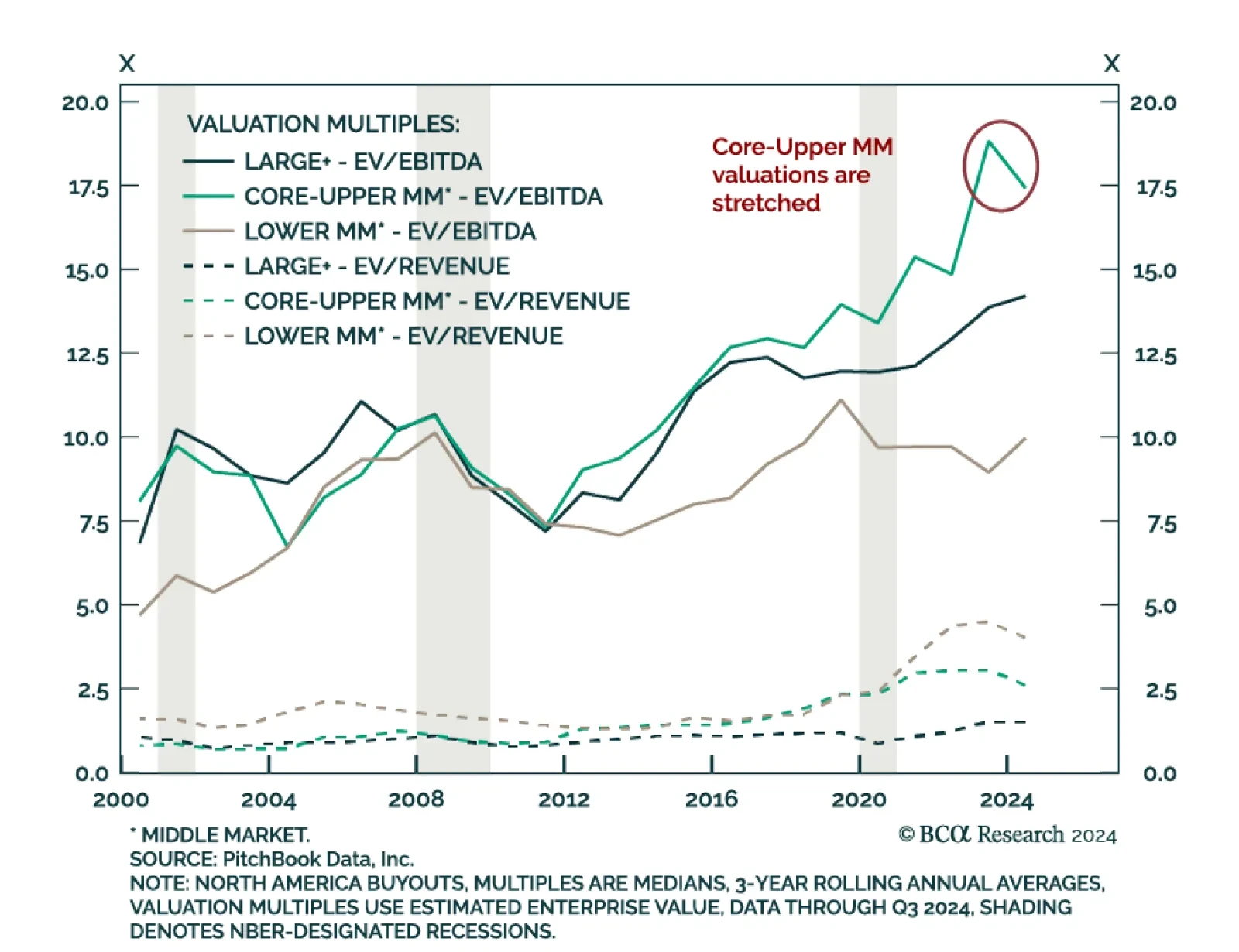

Our Private Markets & Alternatives strategists have delved into the North American Buyouts market, concluding that the investment playbook needs rewriting. The performance of Middle Market Buyouts has been exceptional,…