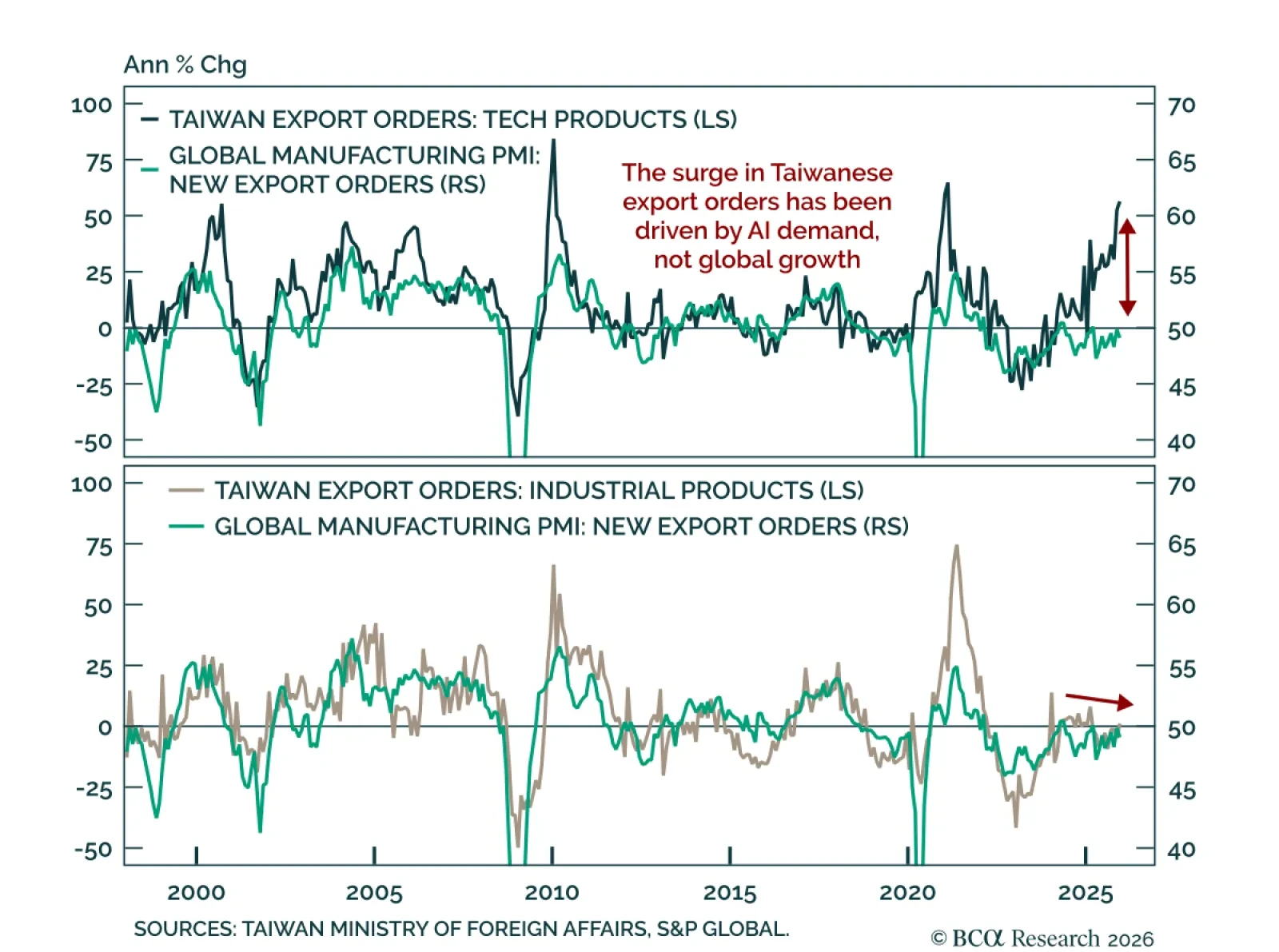

Strong Taiwanese export orders reflect AI demand rather than a pickup in global growth momentum. Taiwanese export orders reached a record high in December, rising 43.8% y/y and accelerating from 39.5% the prior month. The increase…

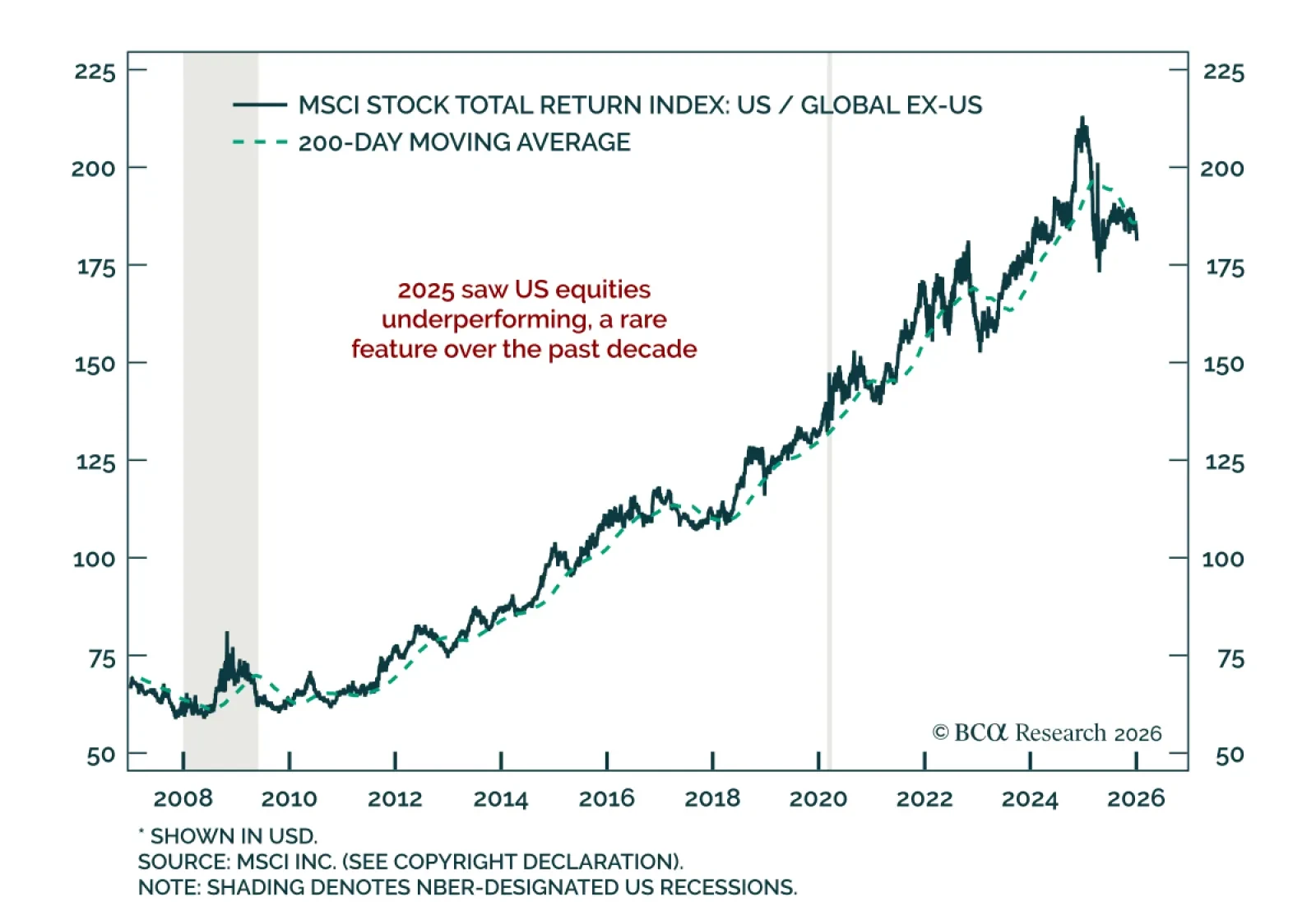

Favor Value over Quality and non-US equities as leadership broadens and late-cycle rotations gather pace. Global equities rose 21% in 2025, but leadership shifted meaningfully. The US finished in the bottom third of regional returns…

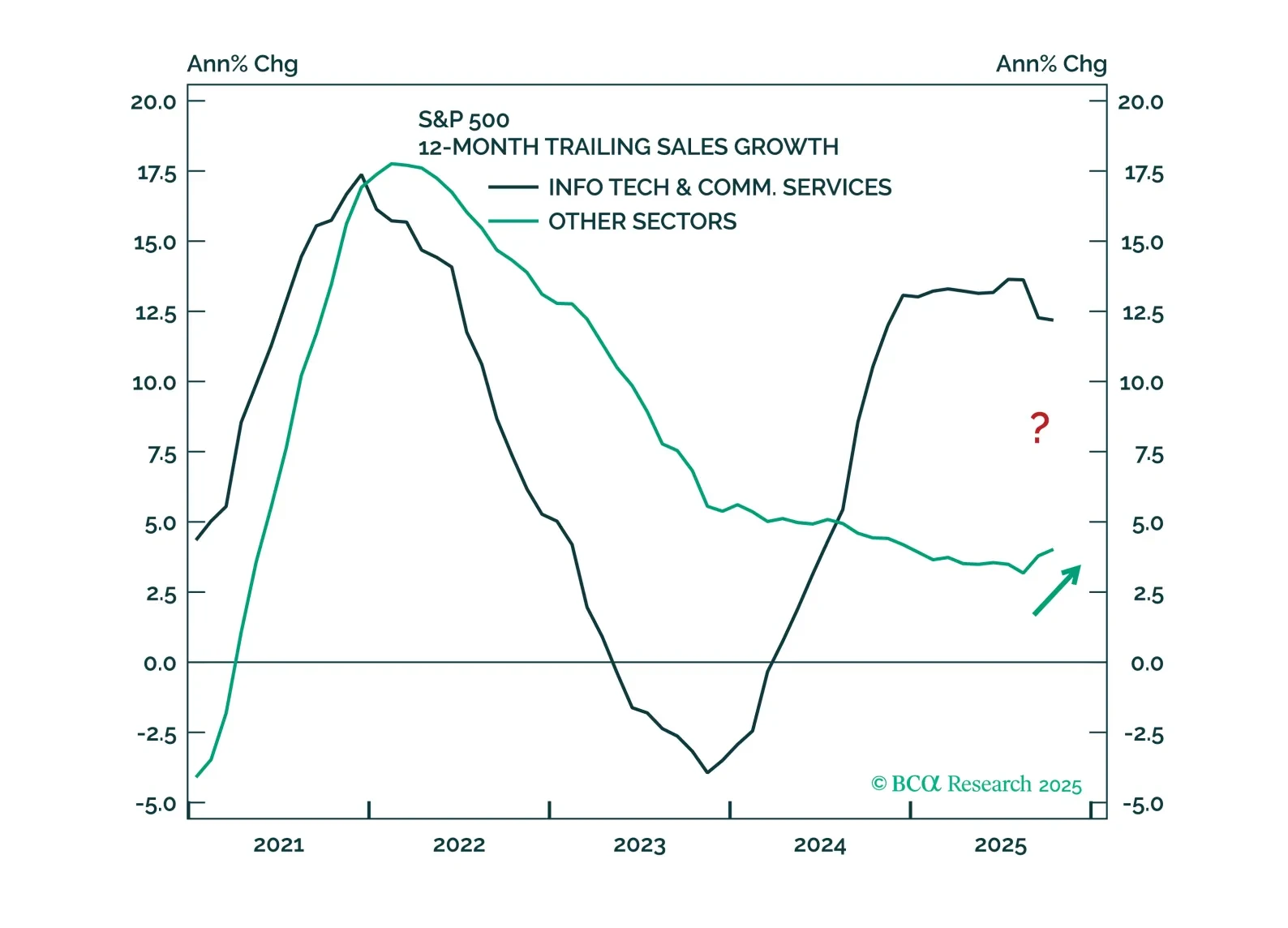

The K-shaped economy will likely reverse in 2026, with the cyclical parts of the economy doing better. Upgrade Financials and Materials from neutral to overweight. Downgrade Communication Services and Utilities from overweight to…

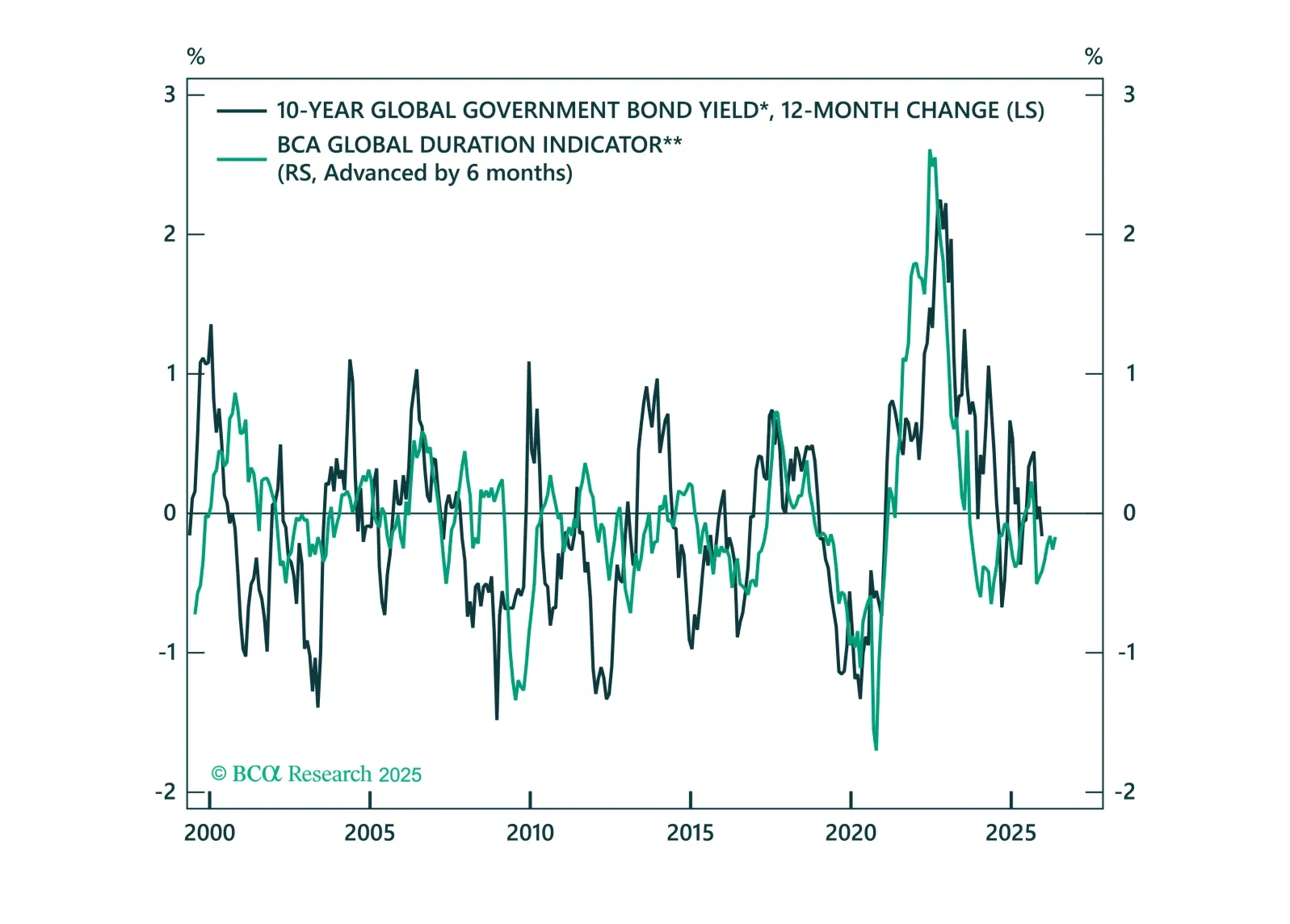

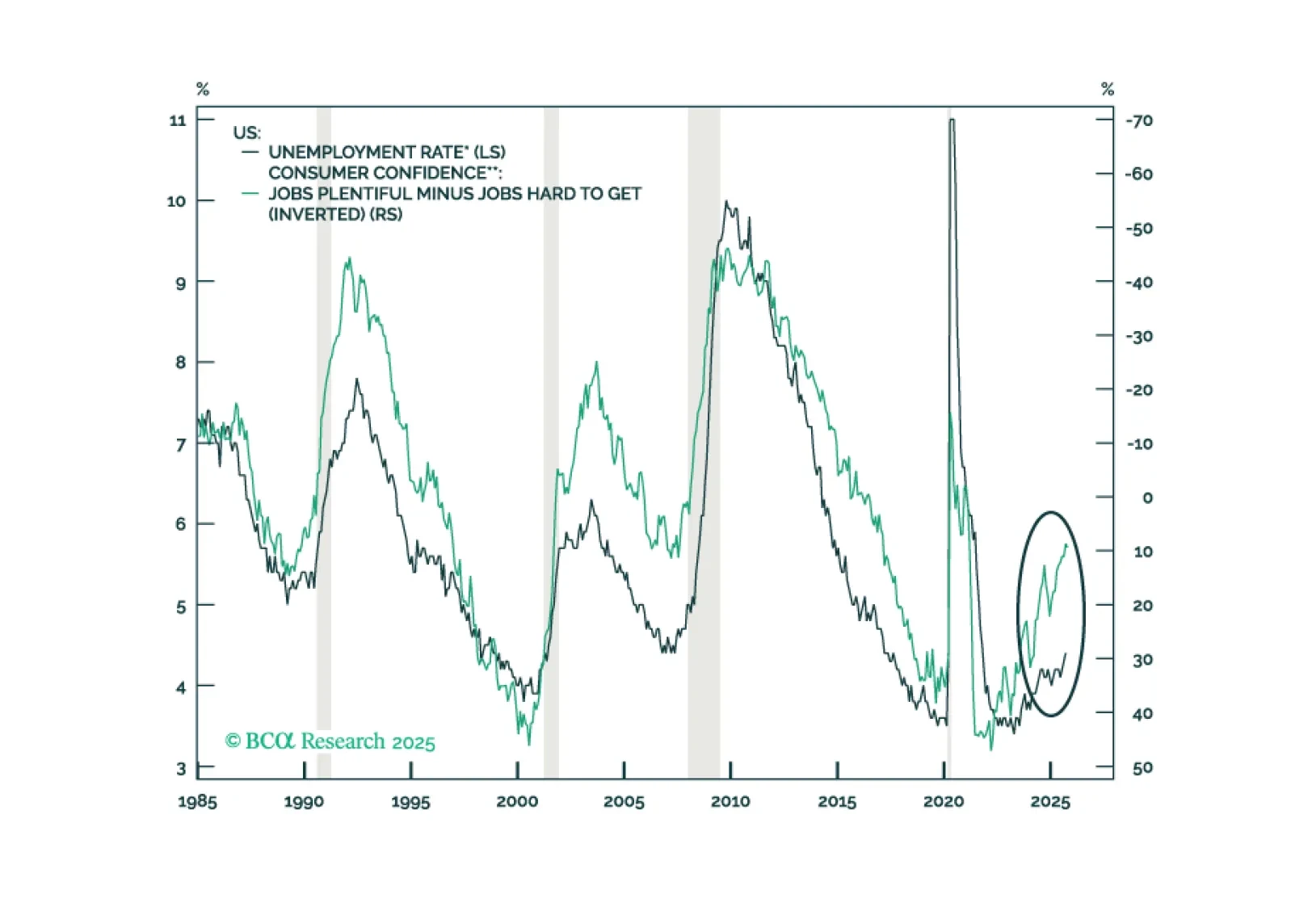

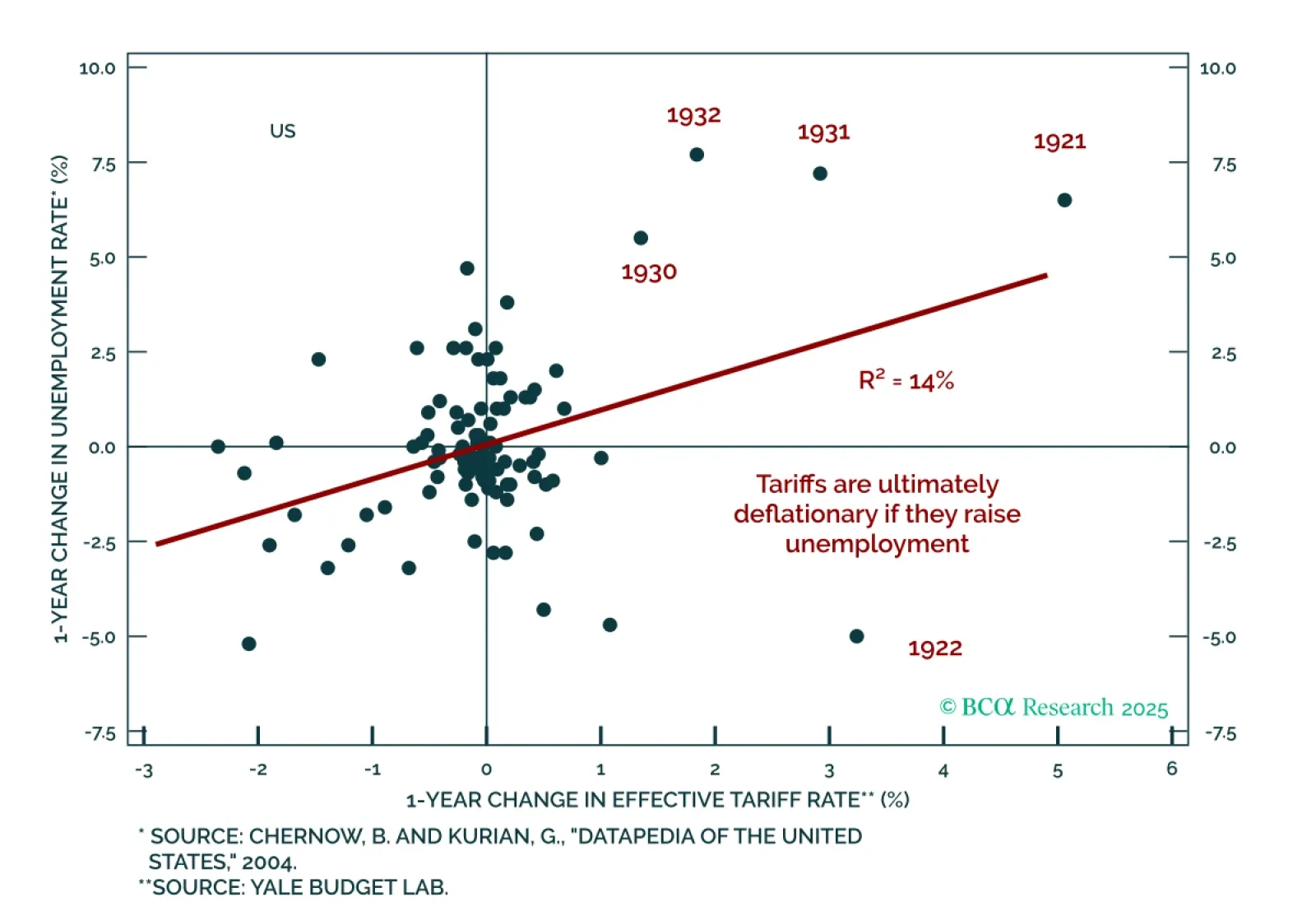

BCA’s 2026 outlook calls for a neutral stance on equities in multi-asset portfolios, with a bias toward downgrades as US labor market softness persists. The coming year will clarify whether falling labor demand pushes the US into…

Today, we are sending you the BCA annual outlook for 2026. The report is an edited transcript of our recent conversation with Mr. X and his daughter Ms. X, who are long-time BCA clients. Our discussion featured BCA’s economic and…

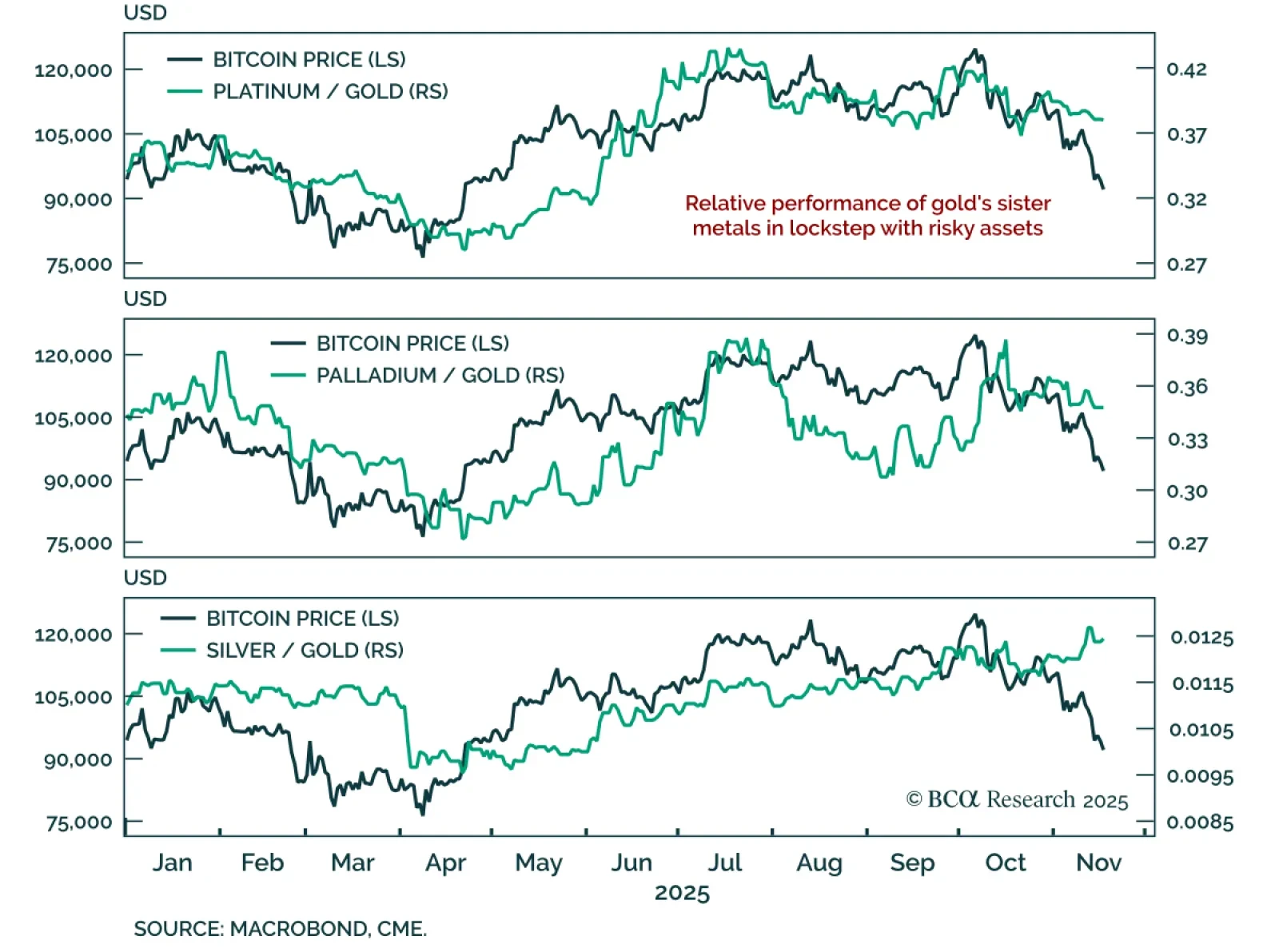

Platinum and palladium’s explosive year-to-date surges have stalled over the past month; their short-term outlook depends on broader risk sentiment. The two metals are down 10% and 13% respectively from their October 16 peaks. …

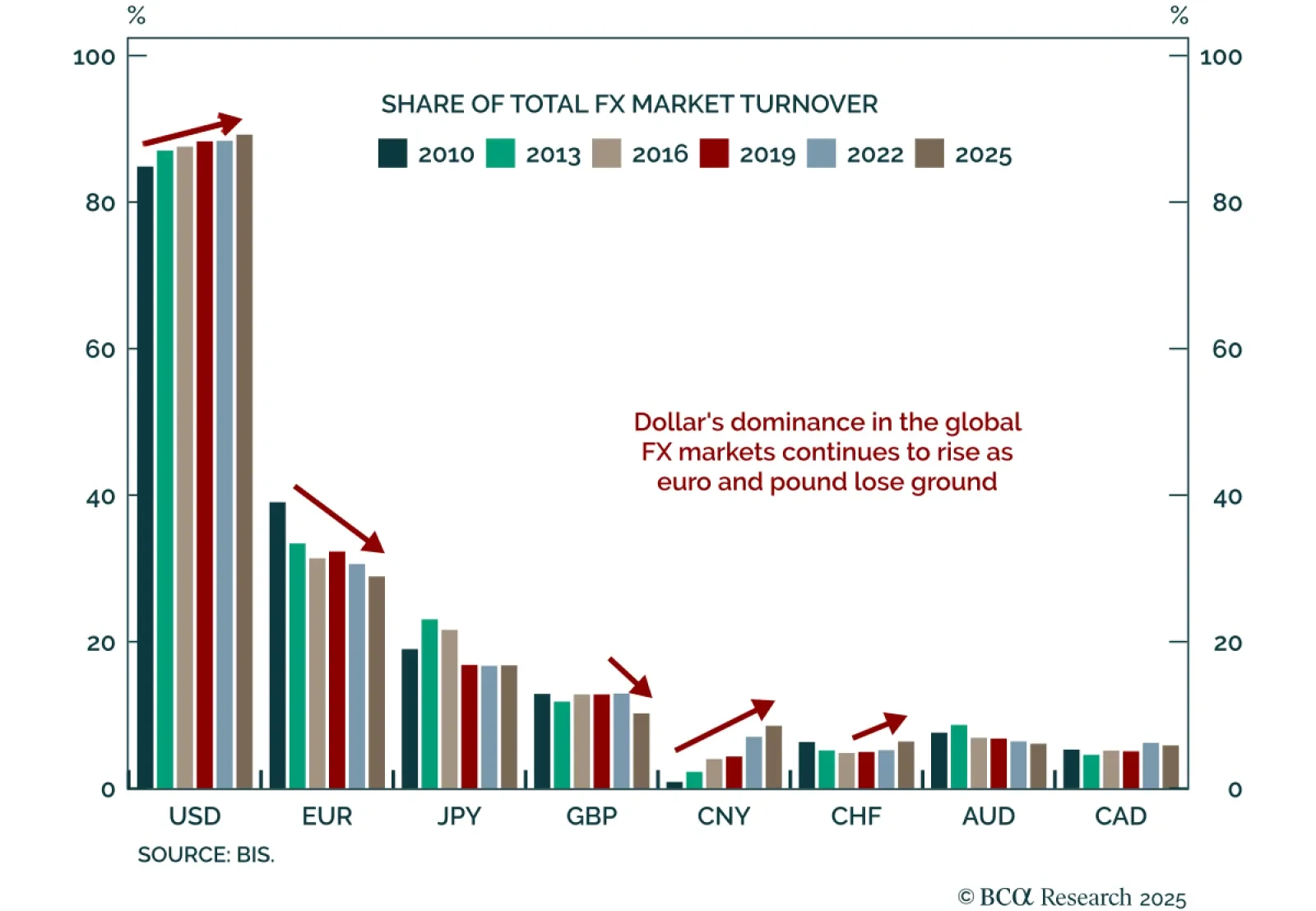

The latest BIS Triennial Central Bank Survey reaffirms the US dollar’s dominance in global FX markets, highlighting the structural challenges of truly moving away from the USD-centric financial system. The survey conducted in…

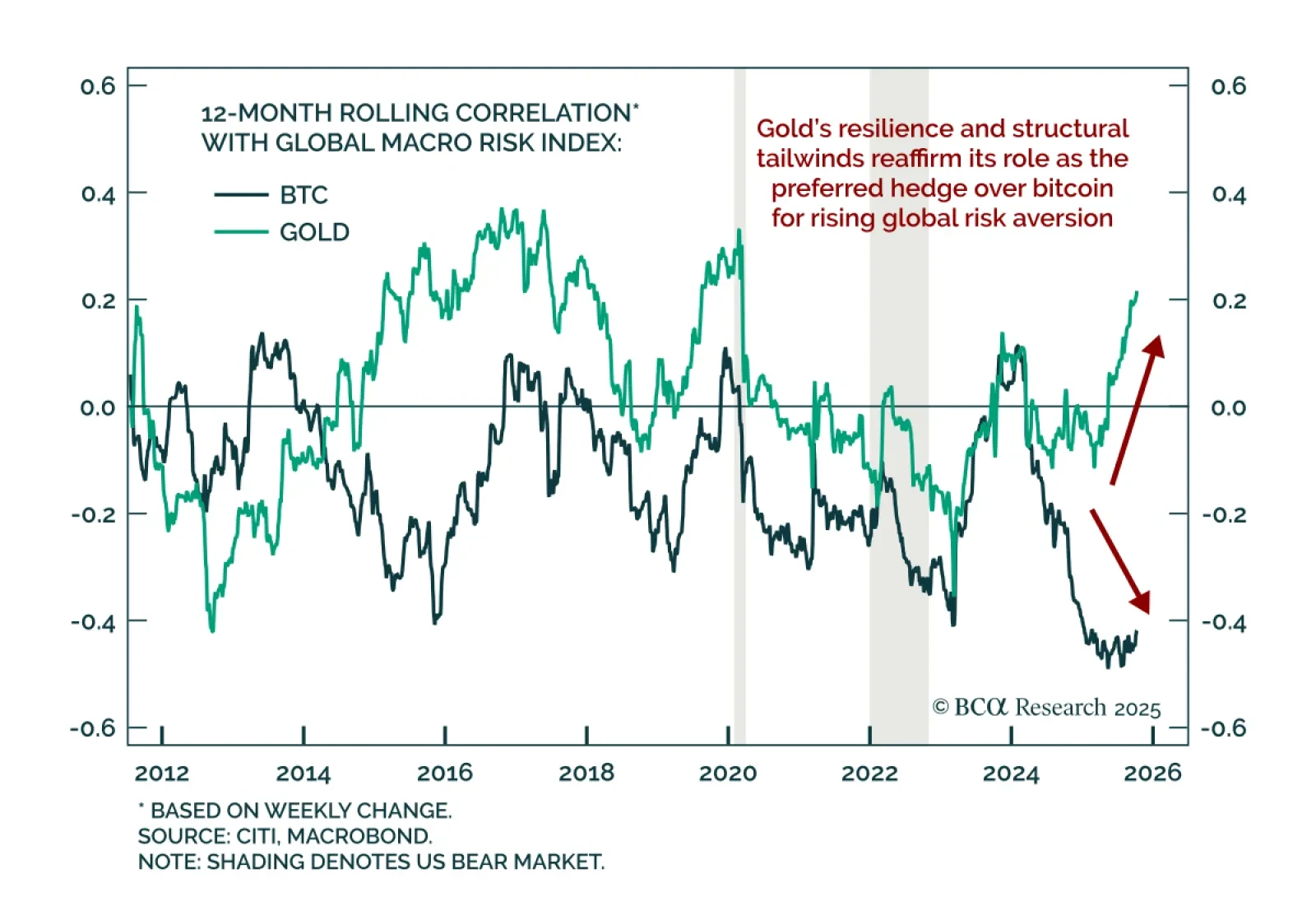

Gold remains a superior hedge asset to bitcoin during global risk-off periods. Both assets have rallied strongly this year, reaching new all-time highs as beneficiaries of the dubbed “debasement trade,” reflecting investor…