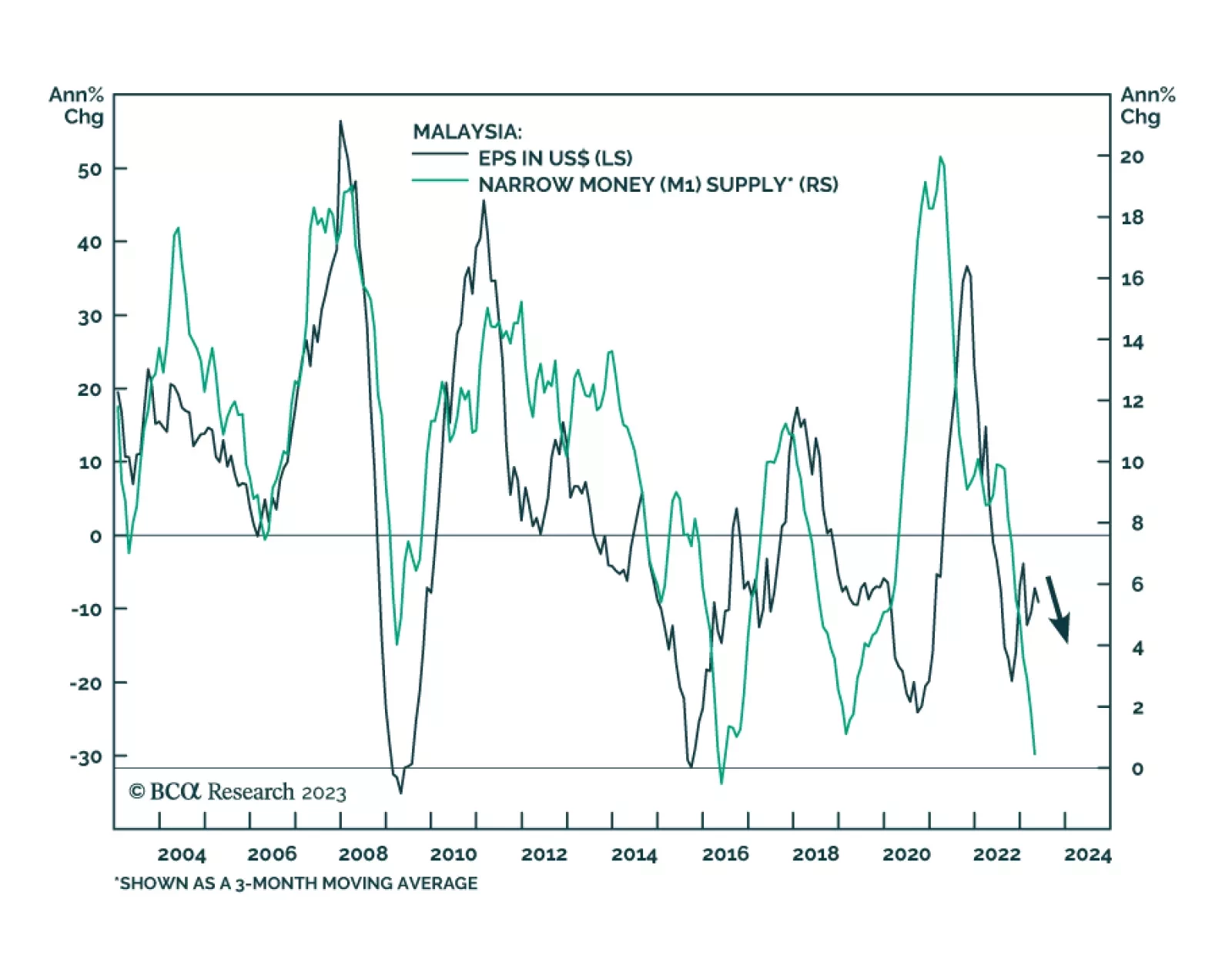

In a recent report, our Emerging Markets Strategy team posited that the bear market in Malaysian stocks will be prolonged. Disinflationary forces have taken hold of the Malaysian economy: money supply has plunged, bond yields…

Momentum, high cash balances, FOMO, and expectations of soft landing drive the market higher. This rally may continue for a while, but macroeconomic headwinds are intensifying and will eventually derail the rally. It is too early to…

Assuming yesterday’s policy rate hike is a sign that Turkey is finally veering towards orthodox economic policies; should investors rush in?

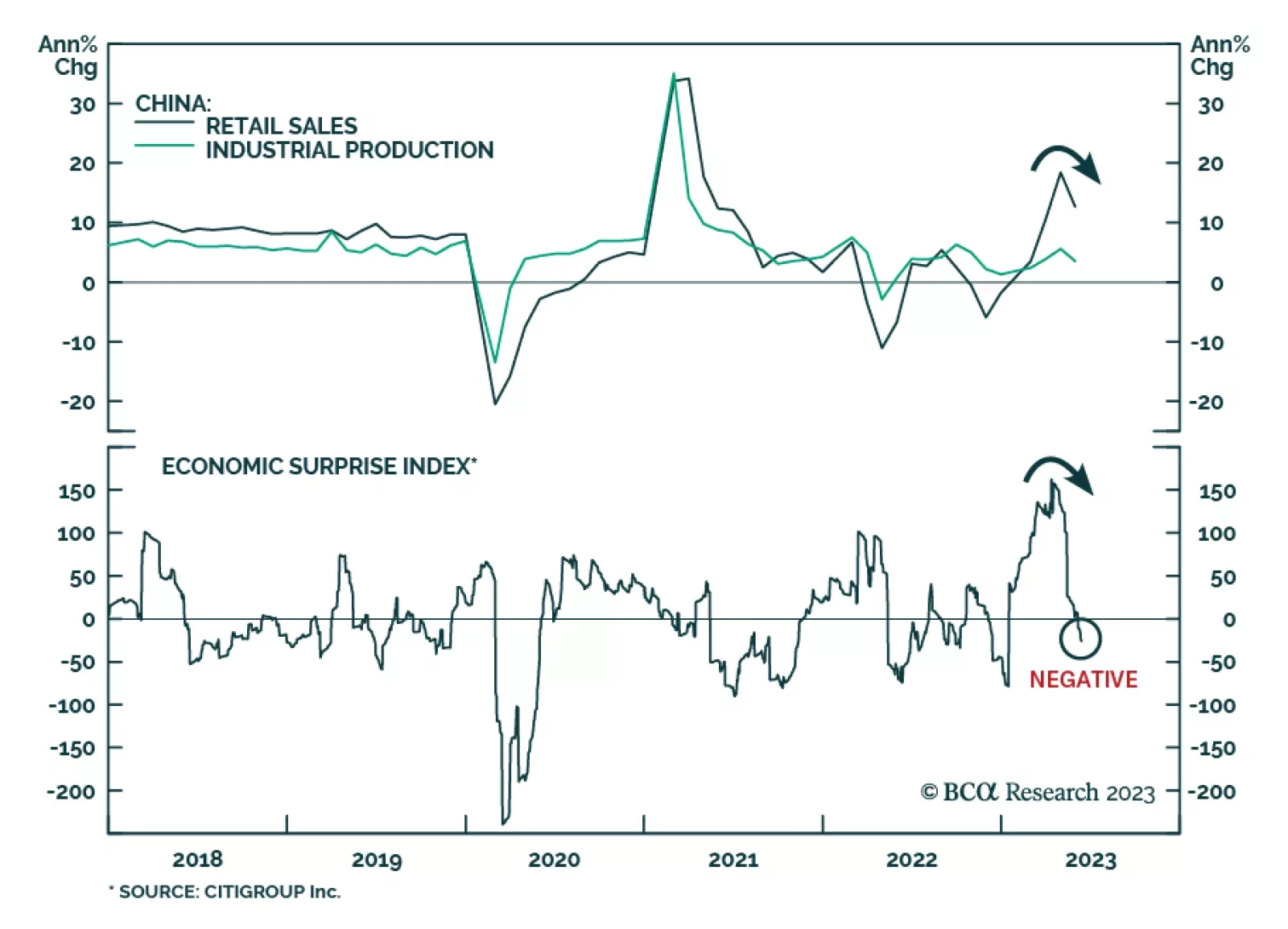

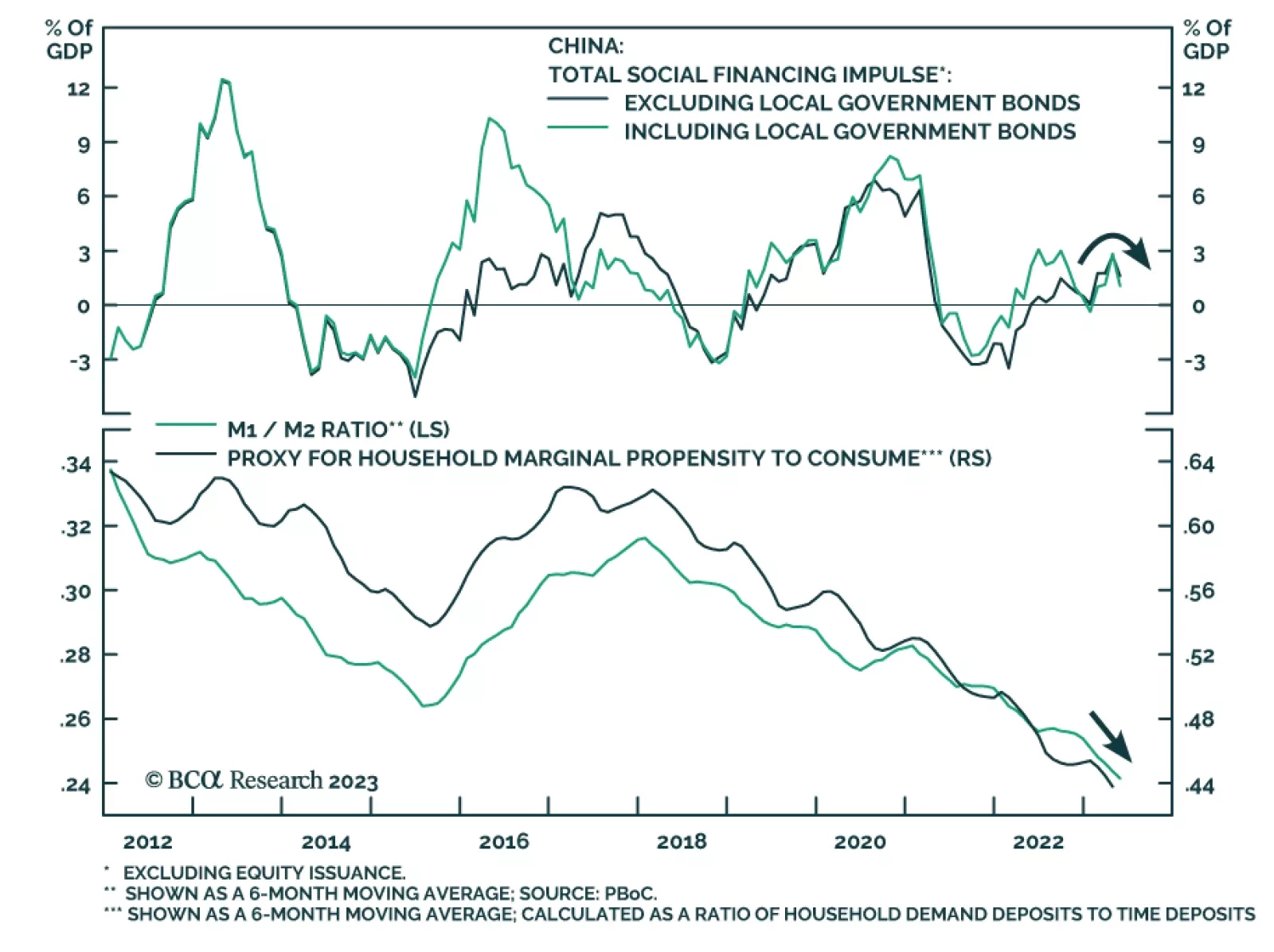

China is facing a risk of deflation. Marginal interest rate cuts and targeted stimulus will be insufficient to boost China’s growth given the current deflationary mindset and the danger is that the economy may be entering a liquidity…

China’s economic data releases for May fell below consensus estimates. The 7.2% y/y contraction in property investment in the first five months of the year was worse than the expected 6.7% decline. The deceleration in…

The normalization of oil storage markets in the Northern Hemisphere; strong demand, aided by China stimulus this year; and continued production discipline supports our view Brent prices likely have bottomed, and will move higher from…

China’s money and credit update for May continues a string of disappointing Chinese data releases. The CNY 1.56 trillion increase in total social financing fell below expectations of a CNY 1.90 trillion rise. Similarly, the…

The CCP is poised to roll out a re-boot of China’s economy that will focus on its comparative advantage in the processing of base metals – particularly copper – and the export of metals-intensive products like EVs. The re-boot will…

We expect the CCP to pivot toward more fiscal stimulus – and less credit stimulus – this year, which will put a bid under energy and metals prices. On the back of this view, at tonight’s close we are getting long 4Q23 Brent futures…