Jay Powell didn’t say much at this afternoon’s FOMC press conference, and monetary policy will continue to take a back seat to fiscal for the next few months.

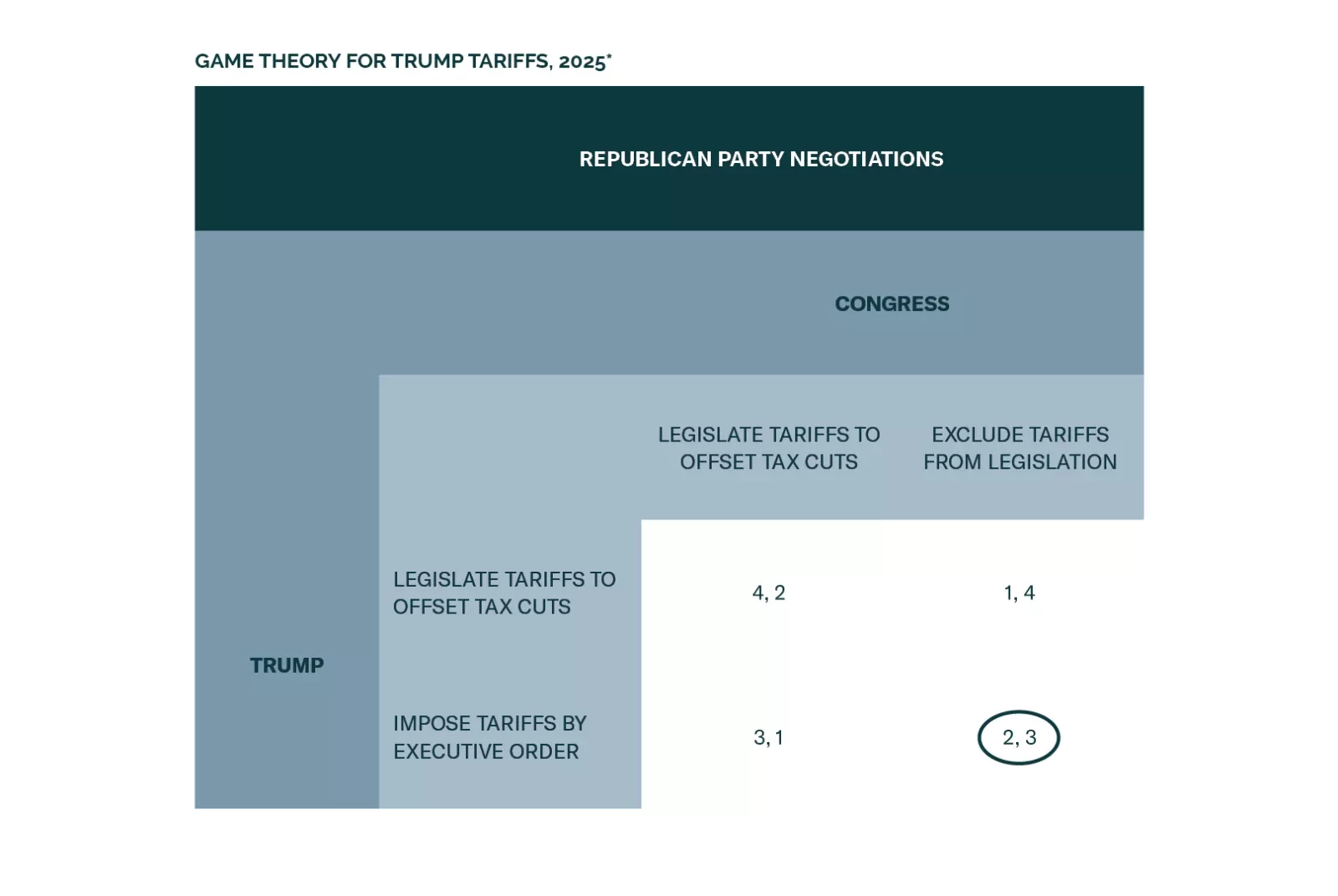

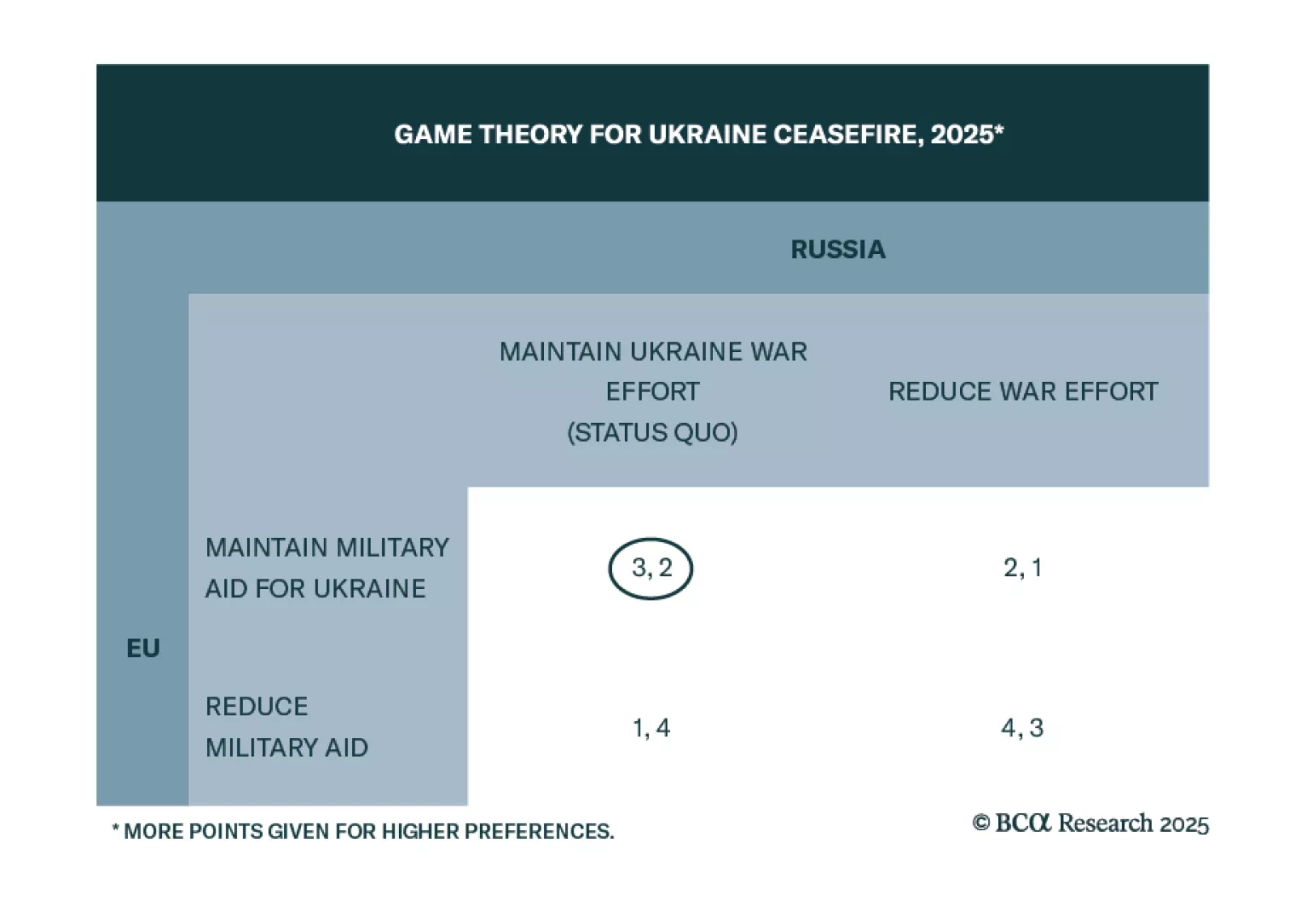

Our Geopolitical Strategy team modeled several of the Trump administration’s most disruptive policies in a simple game theory framework. The Trump administration’s policies have created a complex web of trade and foreign…

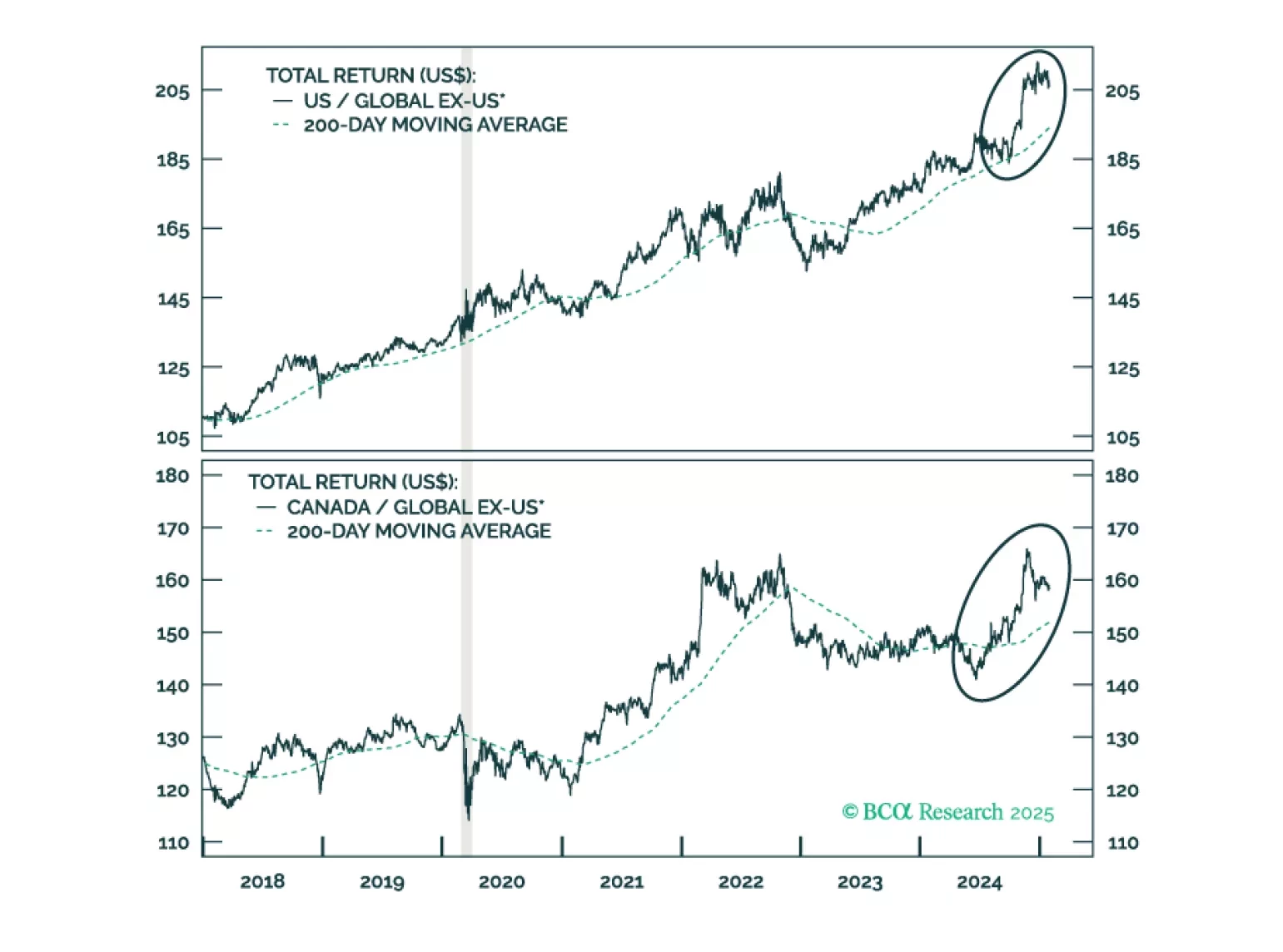

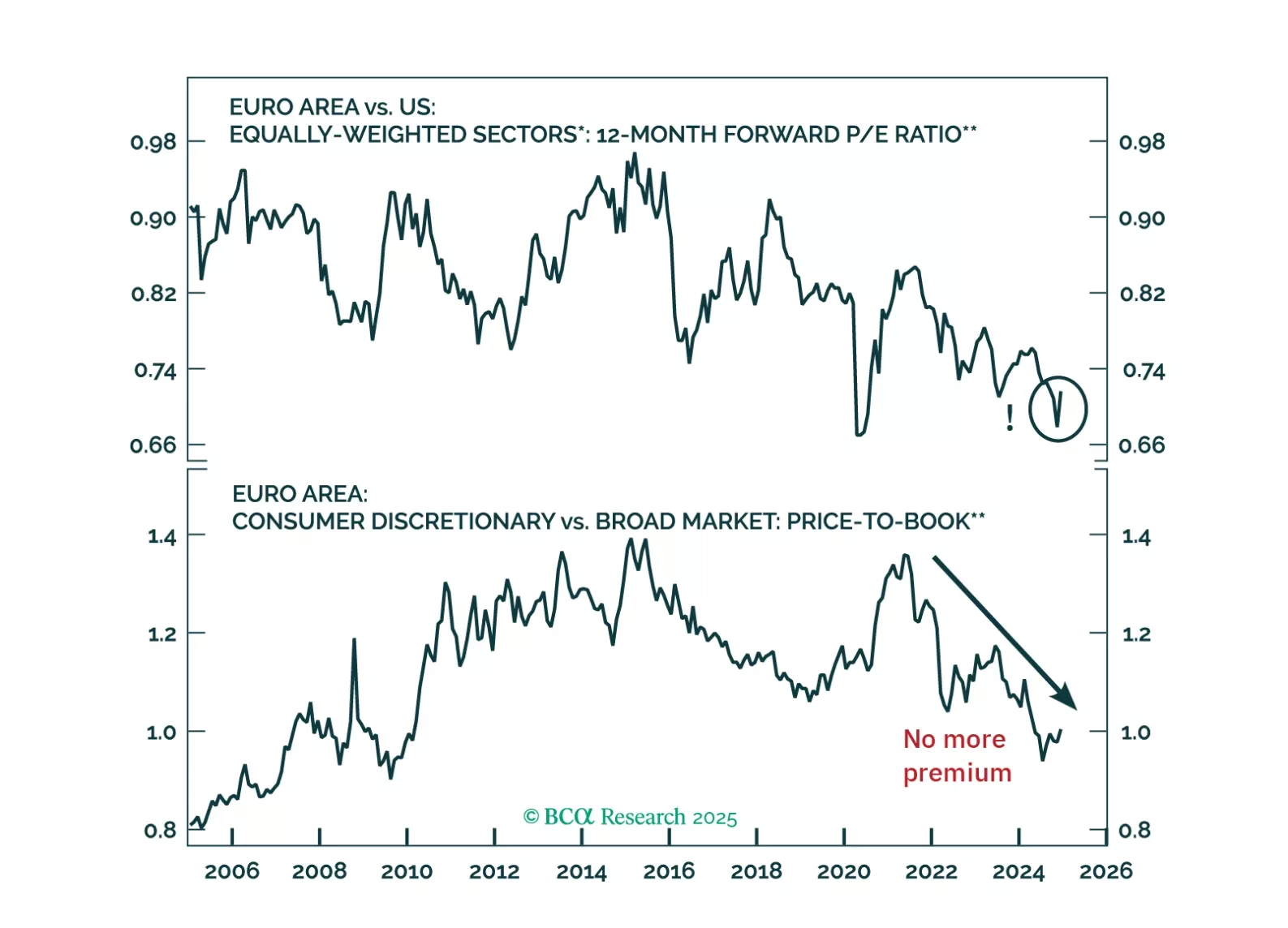

Global risk assets are engulfed in a wave of euphoria, which is pulling Europe higher along the way. However, risks still abound. How should investors adjust their allocation to Europe under these highly uncertain conditions?

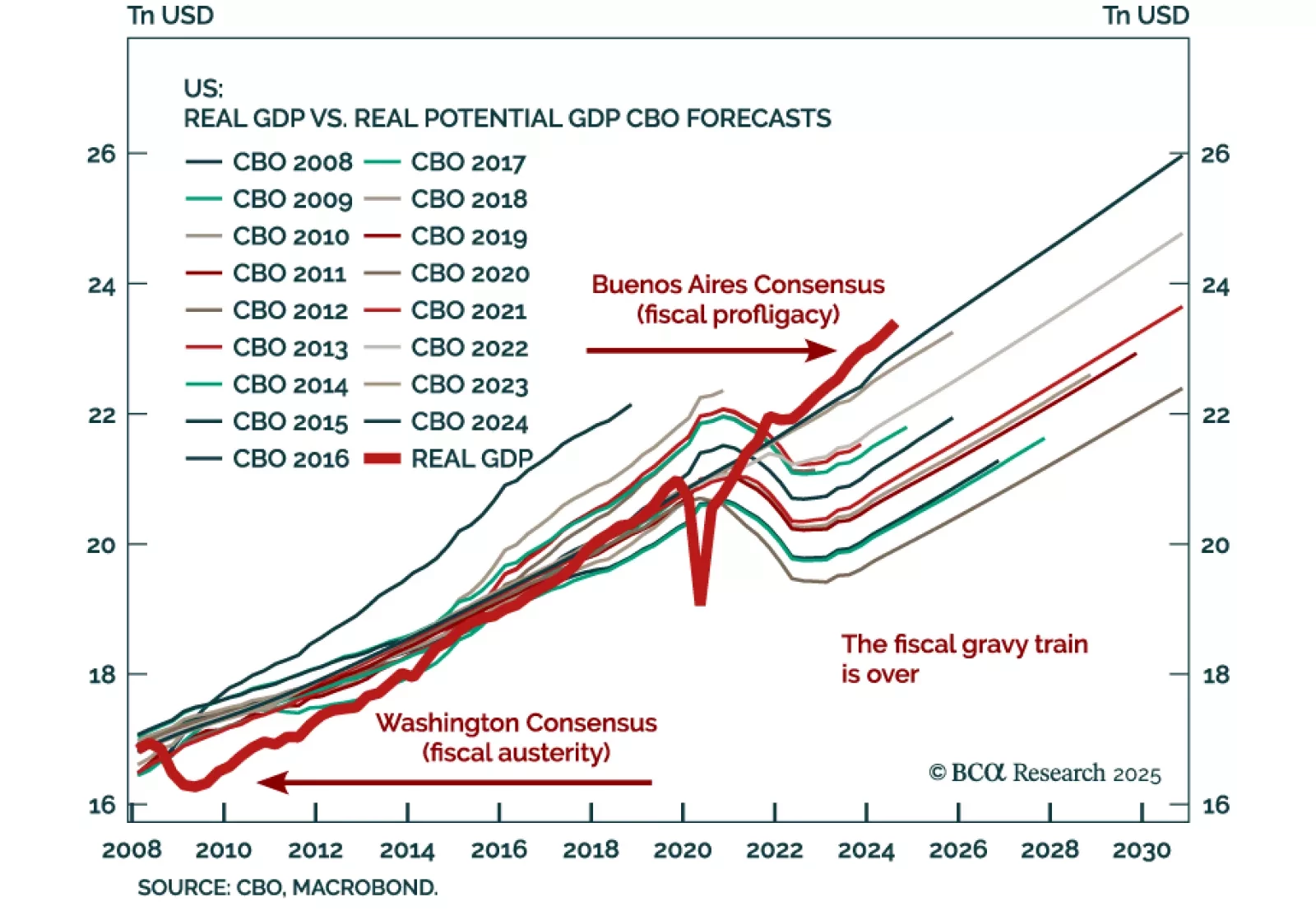

Our Chart Of The Week comes from Marko Papic, Chief Strategist of our GeoMacro Strategy service. Marko has argued that the most important macro story over the past decade has been the transition from the Washington Consensus,…

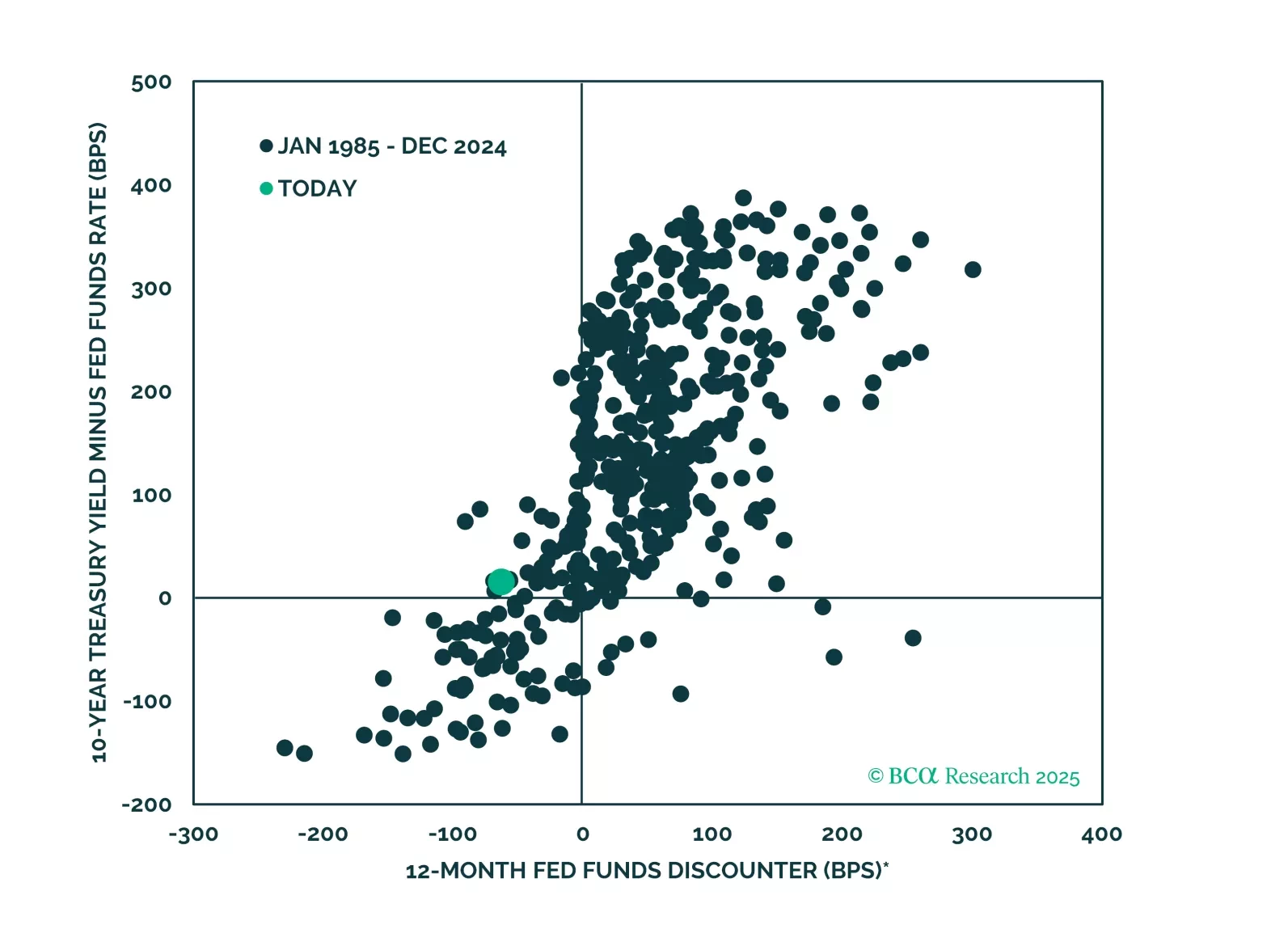

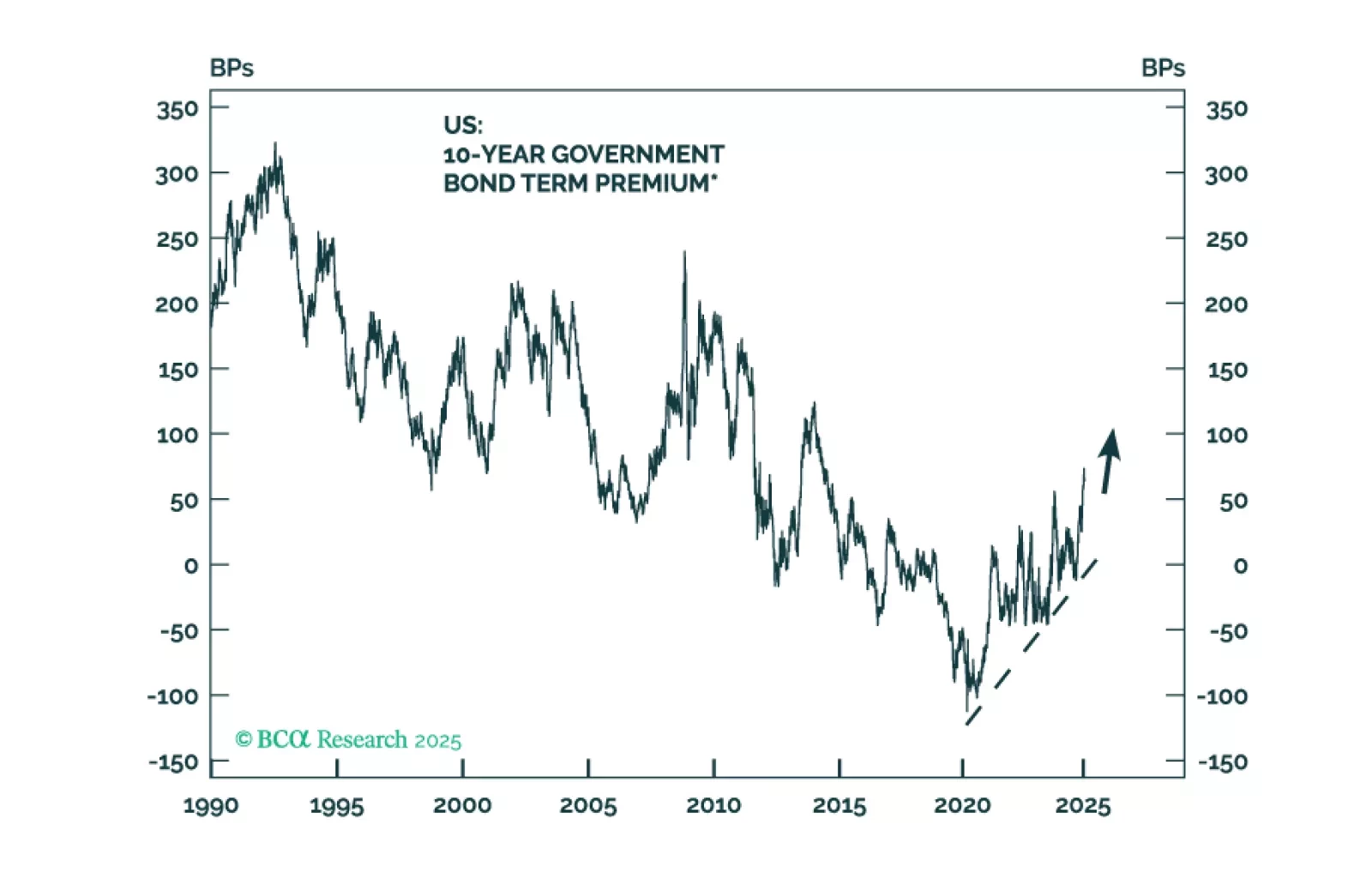

We examine Treasury market valuation and look for indicators that could help us time the next peak in yields. We also update the forecasts from our Treasury yield model.

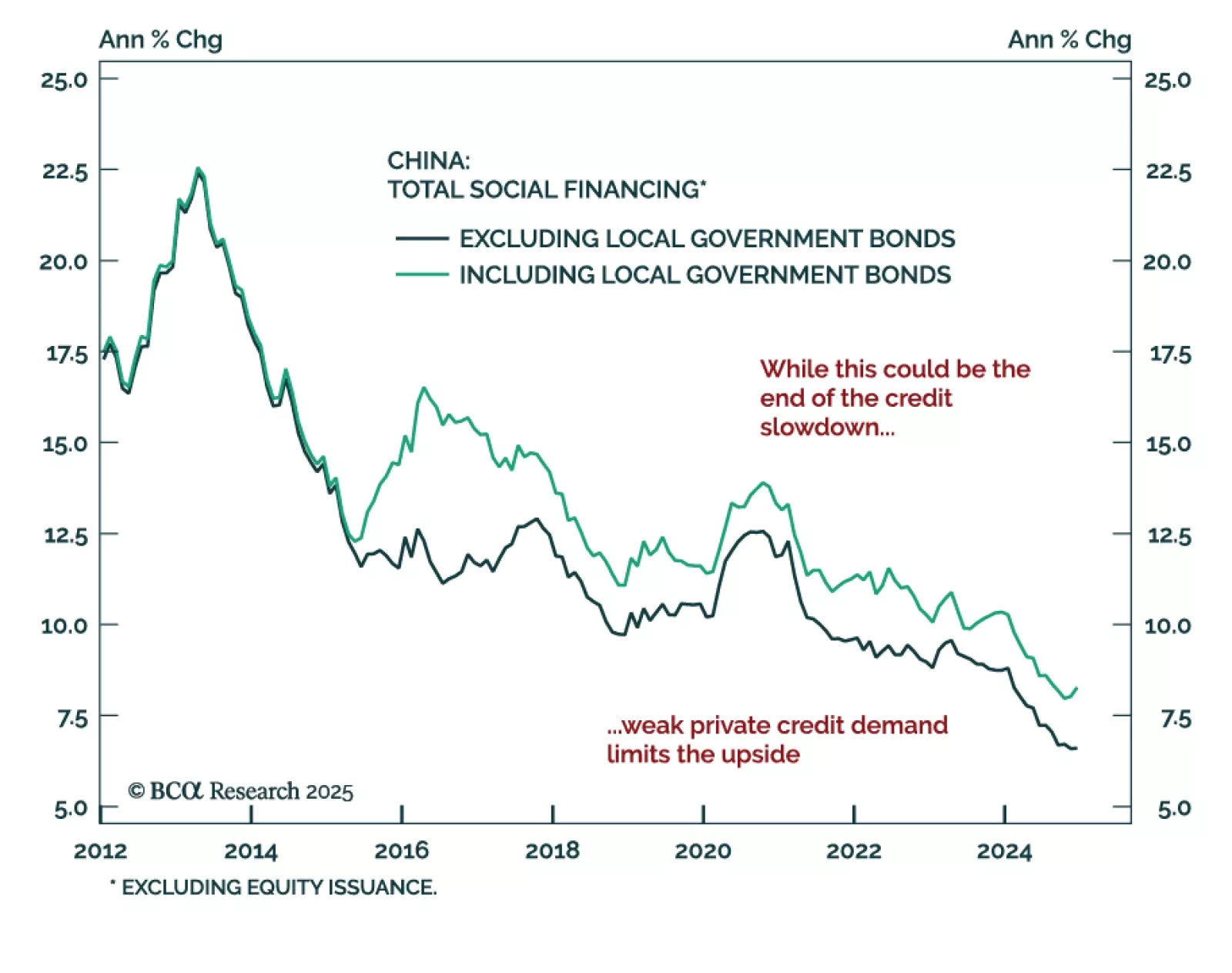

China’s monetary and credit data was relatively strong. New yuan loans increased more than expected, as did aggregate financing. M2 met estimates at 7.3% y/y. As was the case for trade in December, seasonality plays a big role…

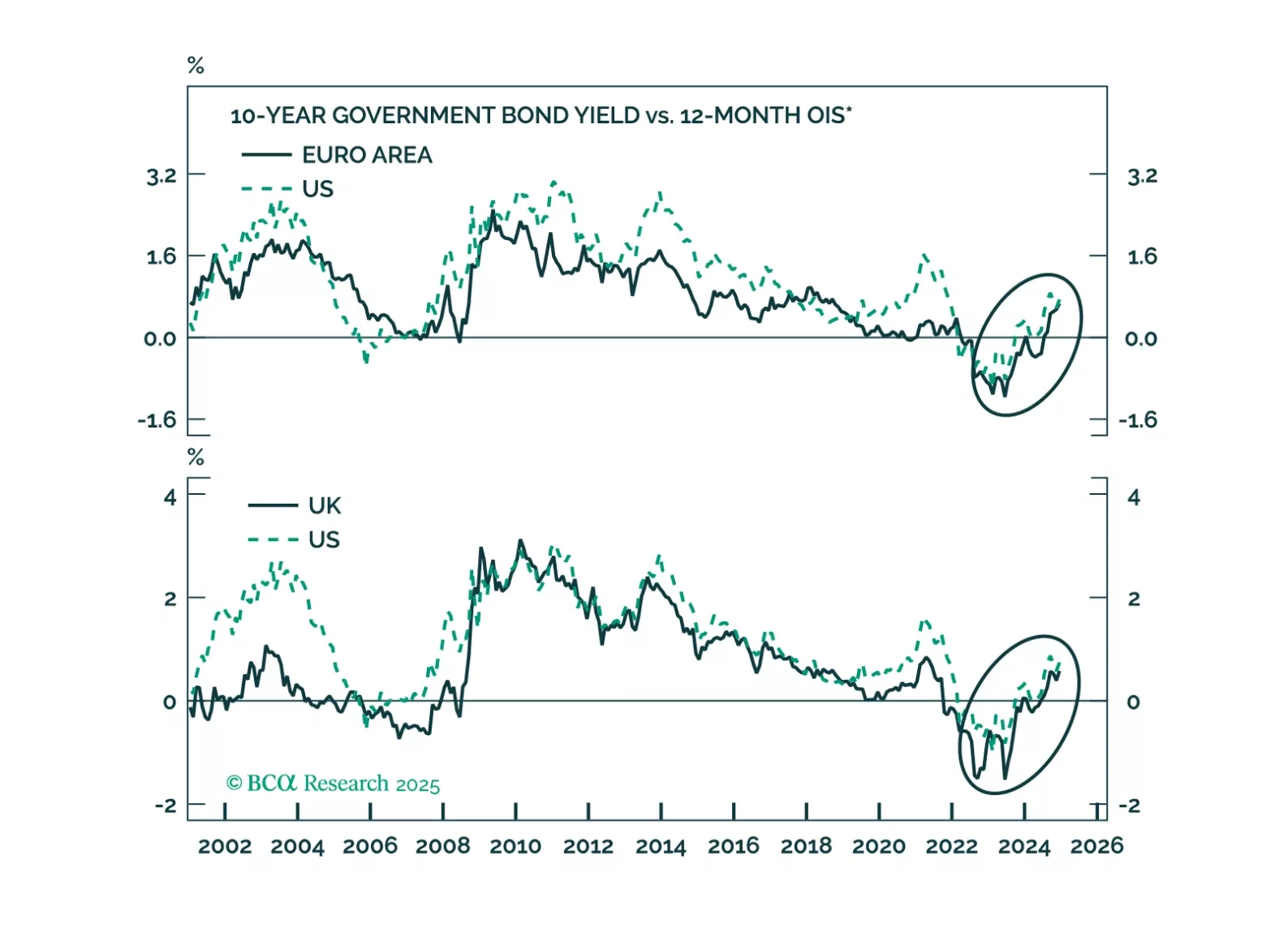

UK and German bonds are victims of the global bond market riots. Will European yields continue to move higher and will the euro and the pound find a floor anytime soon?