Fiscal

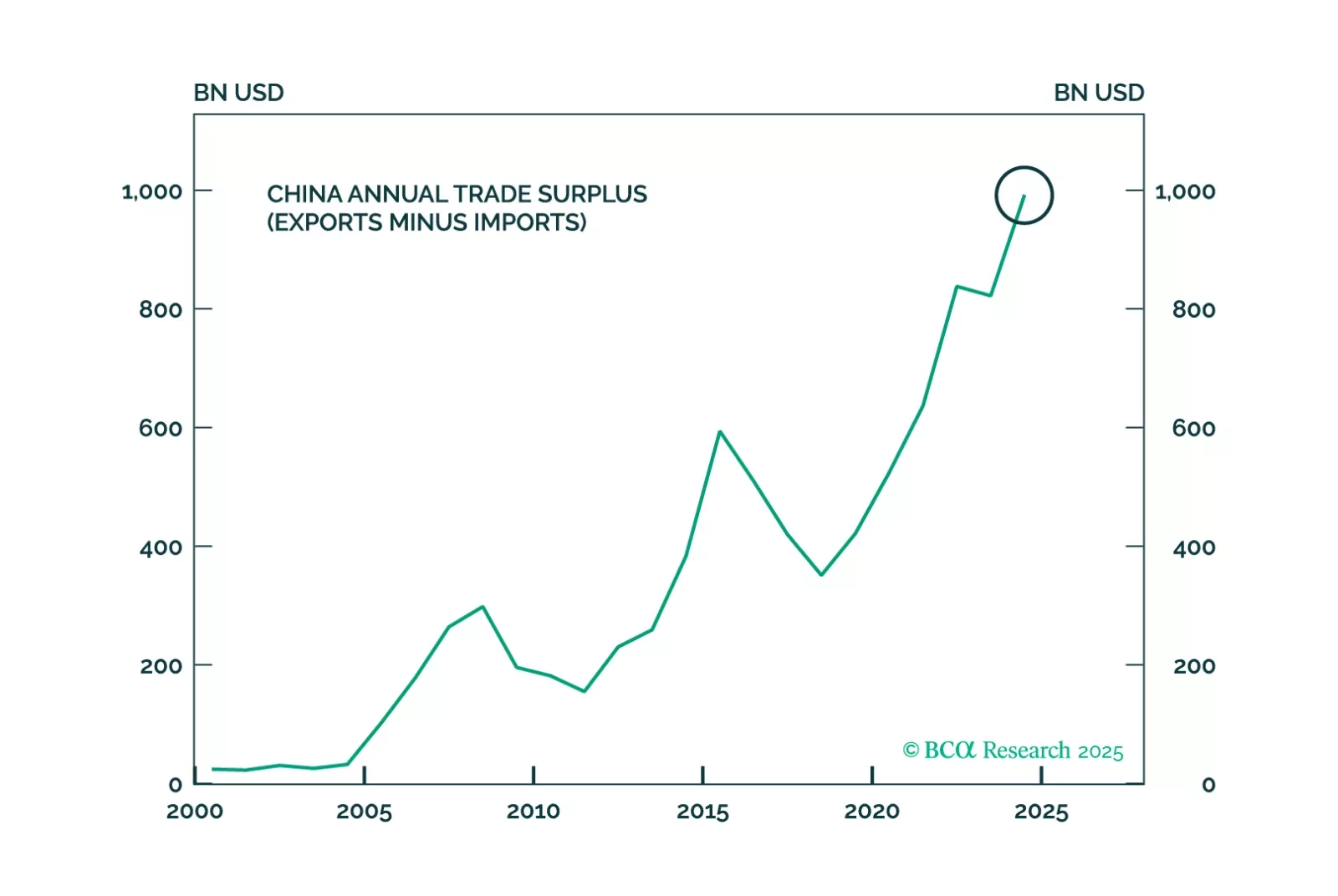

China barely hit its growth target in 2024 by shifting back to its old model of exports, racking up a record trade surplus with the world – right as Donald Trump walks back into the White House. Tariffs will elicit larger fiscal stimulus even as China rolls out innovations such as DeepSeek to meet its 2025 industrial goals, creating a volatile mix this year.

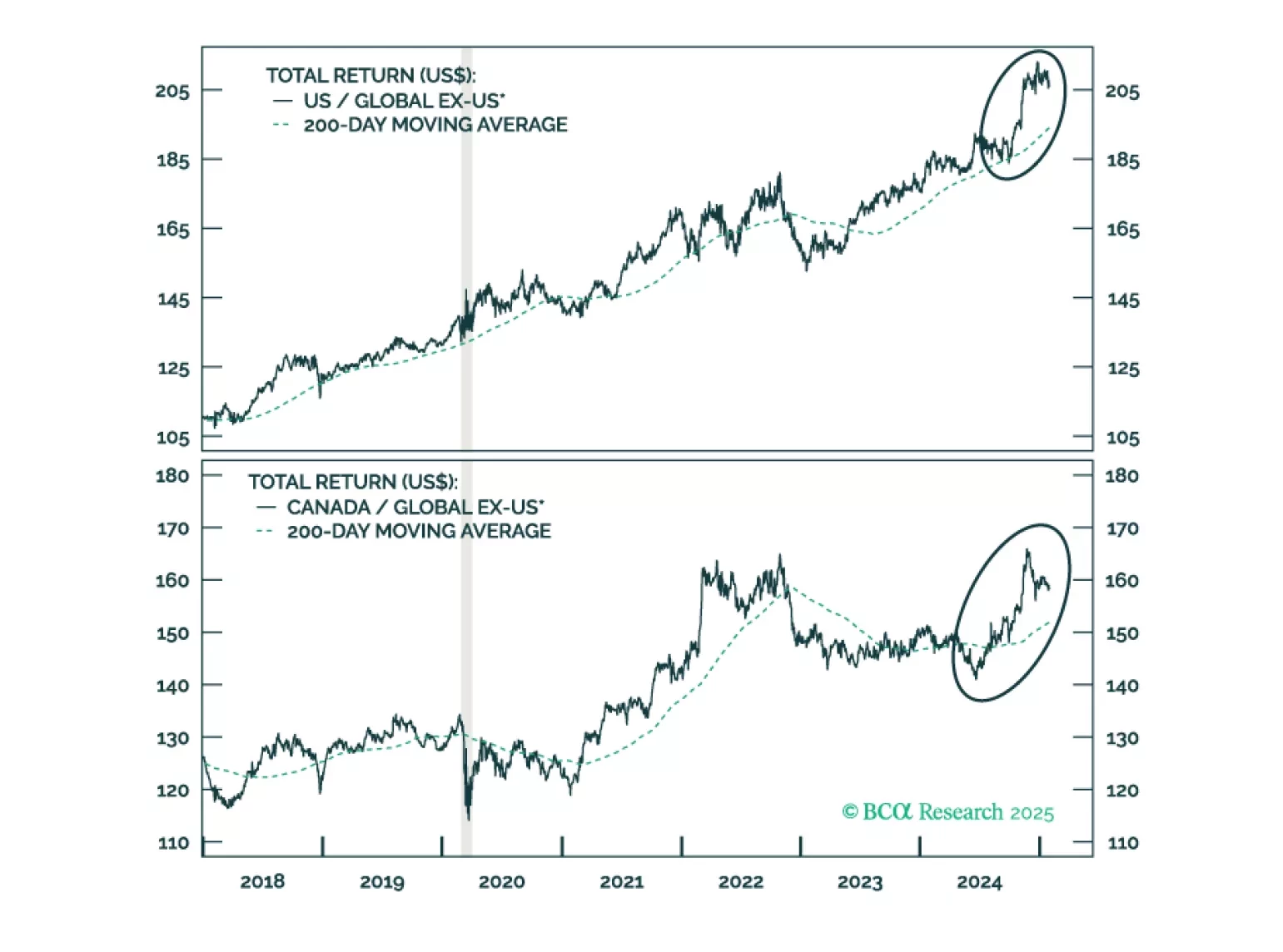

Jonathan provides an update on Canada following strong performance from Canadian stocks last year. On a tactical basis, underweight Canada versus global ex-US on the expectation of tariffs targeting Canada and Mexico. Following a sell off, or if a trade war is avoided, investors should place Canadian stocks on upgrade watch with the goal of moving to a modest overweight versus global ex-US.

Jay Powell didn’t say much at this afternoon’s FOMC press conference, and monetary policy will continue to take a back seat to fiscal for the next few months.

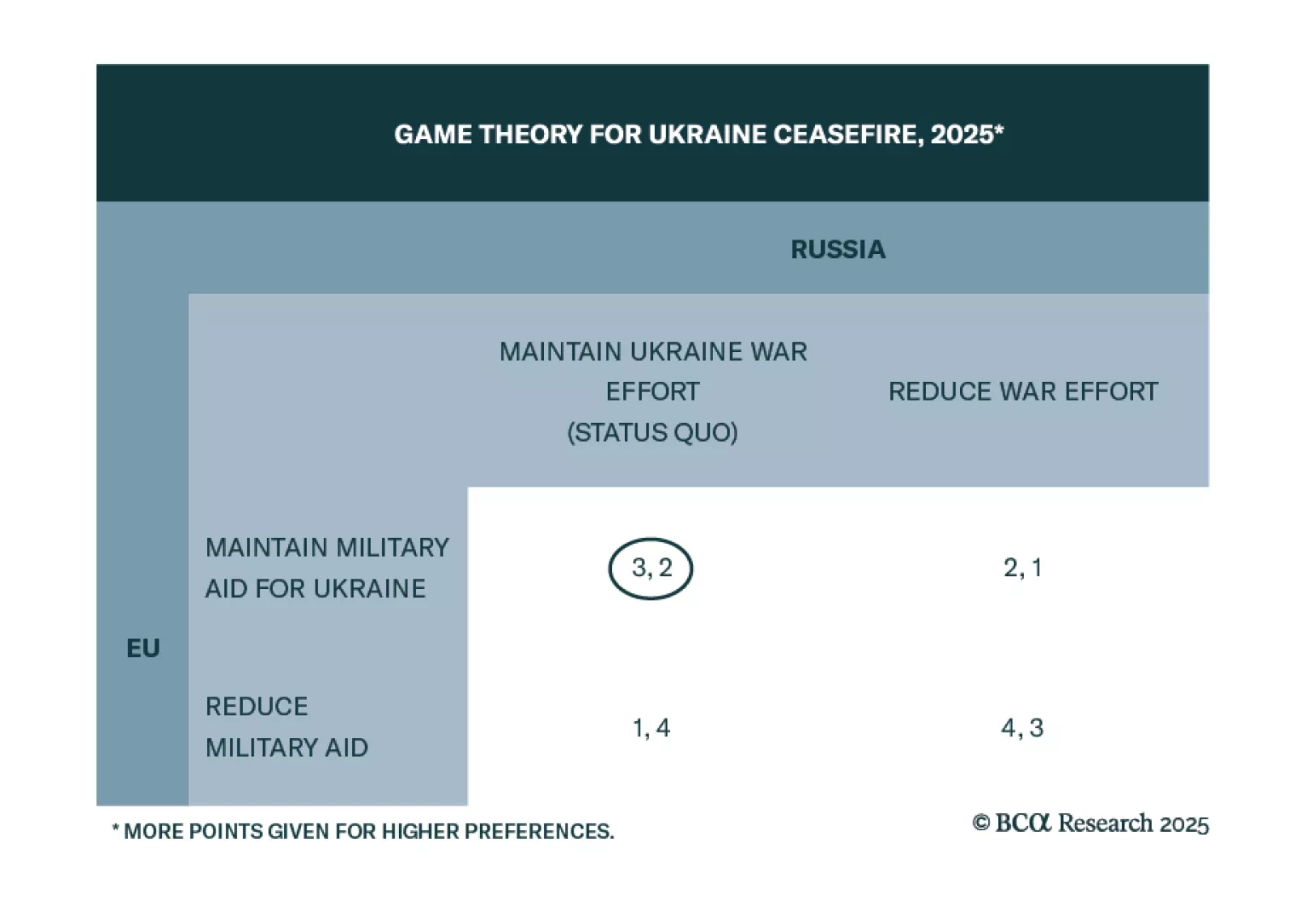

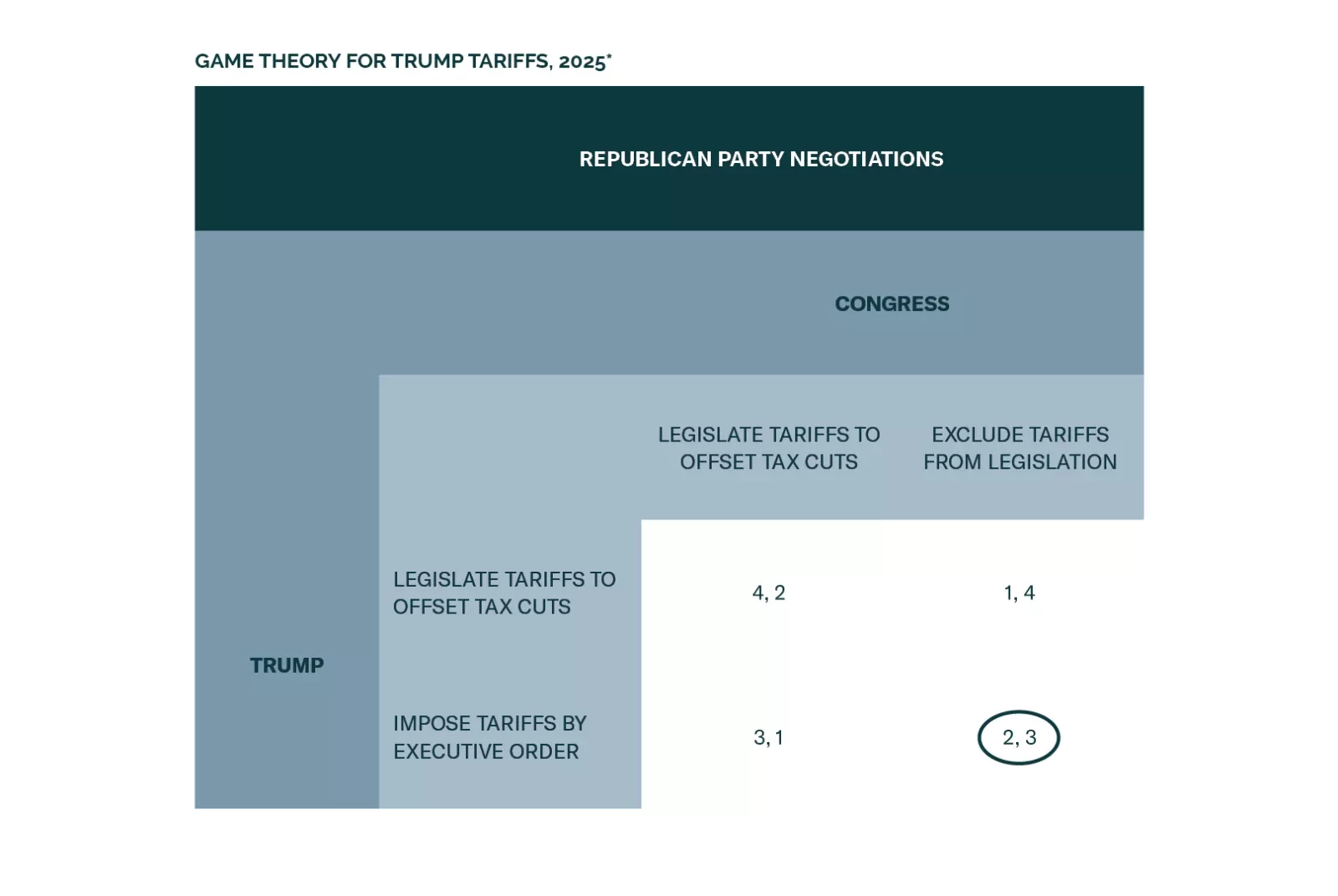

Simple games allow us to model several of the Trump administration’s most disruptive policies in 2025. We find that markets face an increase in volatility as Congress expands the budget, Trump implements tariffs on the world, China retaliates, and Taiwan tensions persist. A ceasefire in Ukraine is a marginally positive outcome for Europe, although it is not a long-term peace treaty.

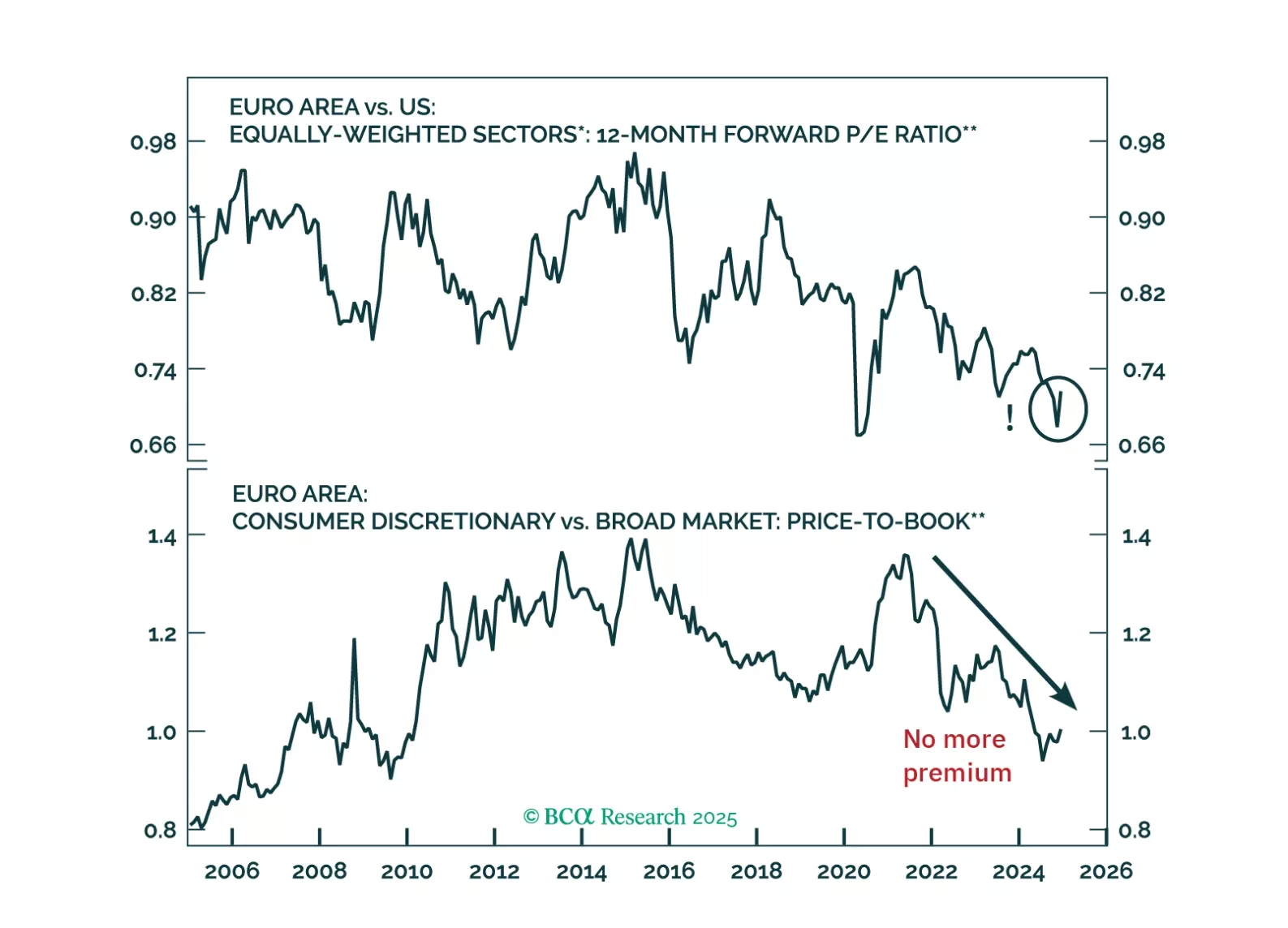

Global risk assets are engulfed in a wave of euphoria, which is pulling Europe higher along the way. However, risks still abound. How should investors adjust their allocation to Europe under these highly uncertain conditions?

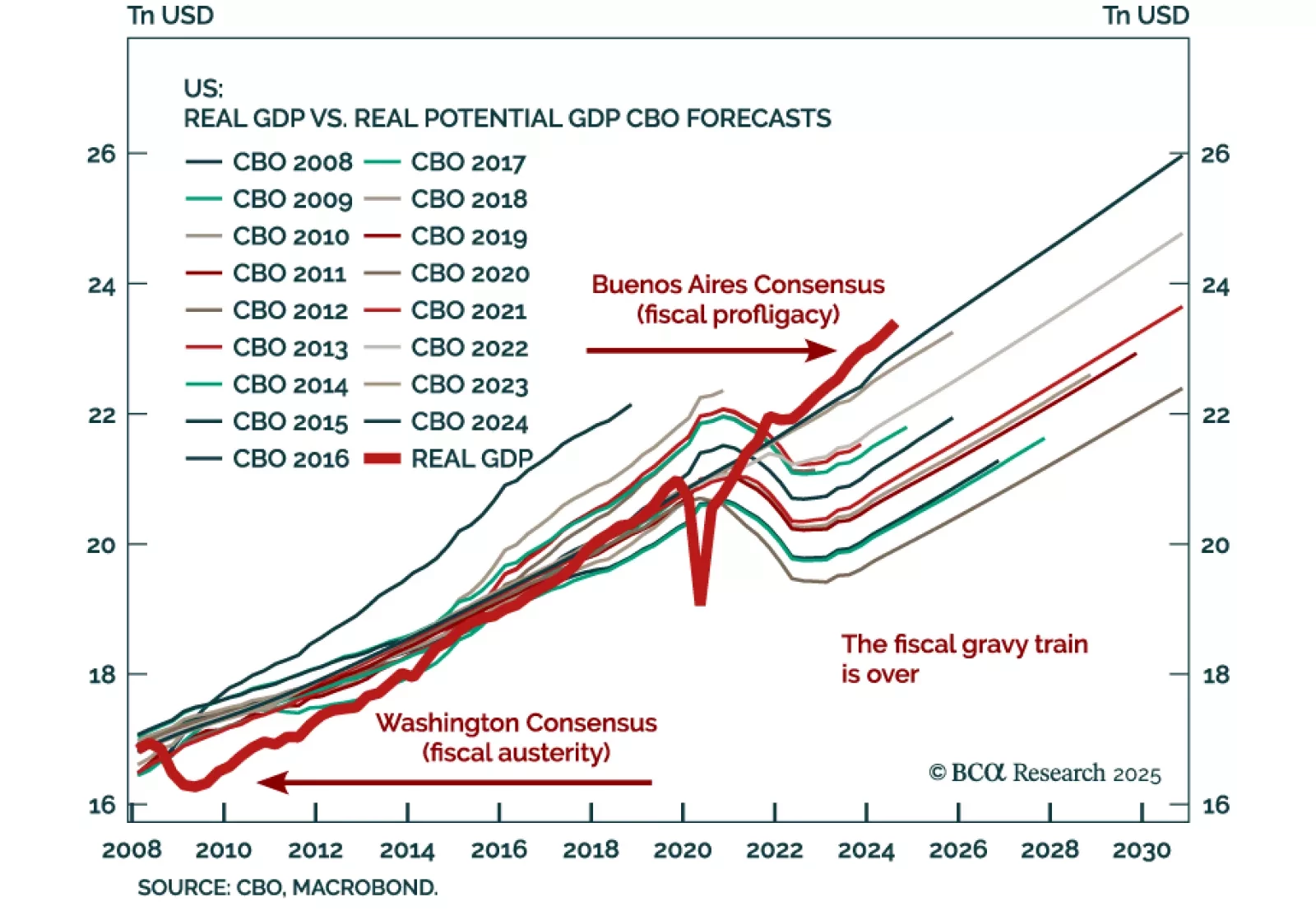

There is no better way to gauge the macro policies of the new US administration than being privy to President Donald Trump’s discussions with the new Treasury Secretary, Scott Bessent. While we do not have inside information, we have put the pieces of the puzzle together to help clients see the big picture. This report presents our take on a hypothetical conversation between President Trump and Scott Bessent that led to the latter’s appointment as Treasury secretary.

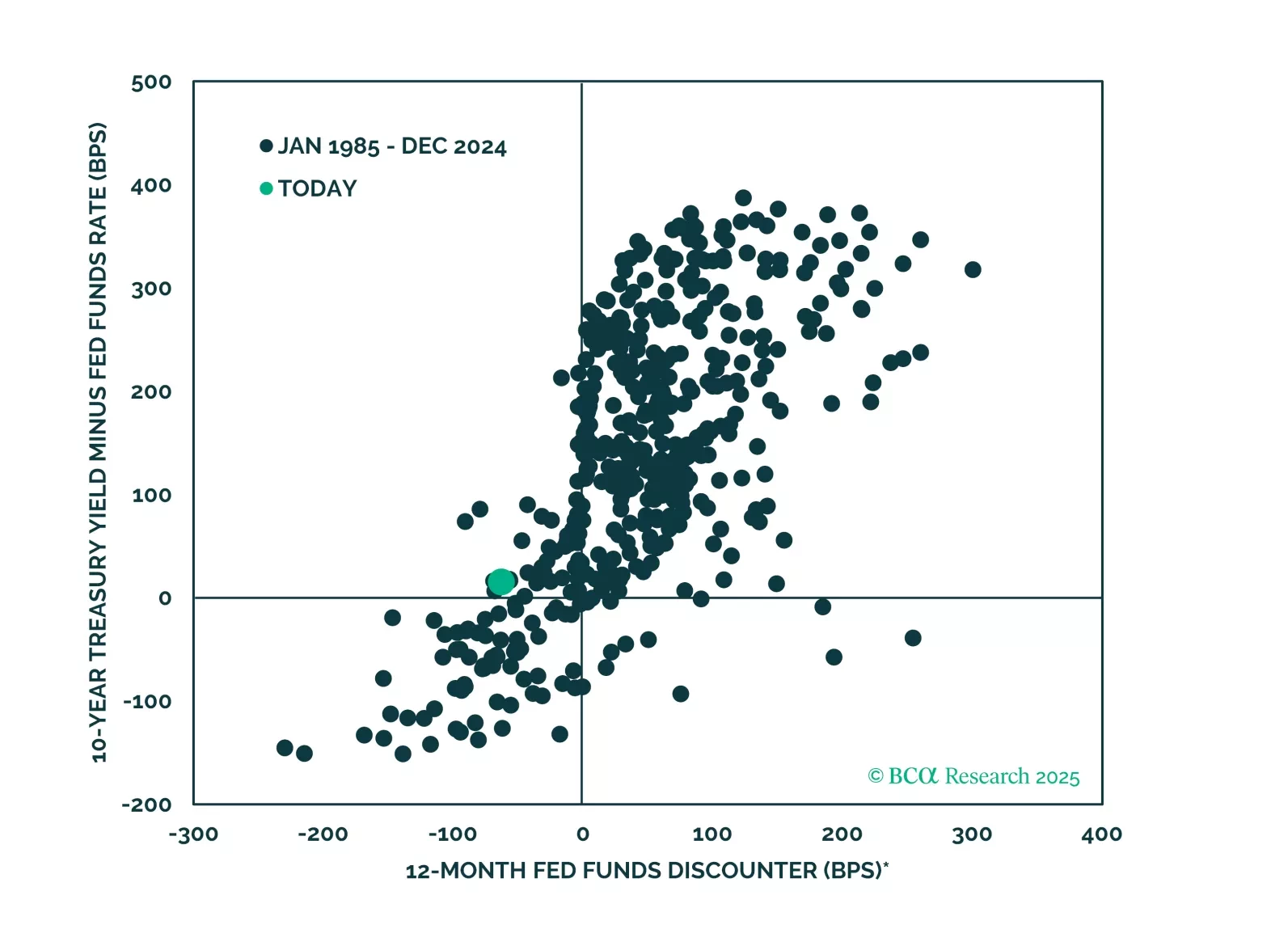

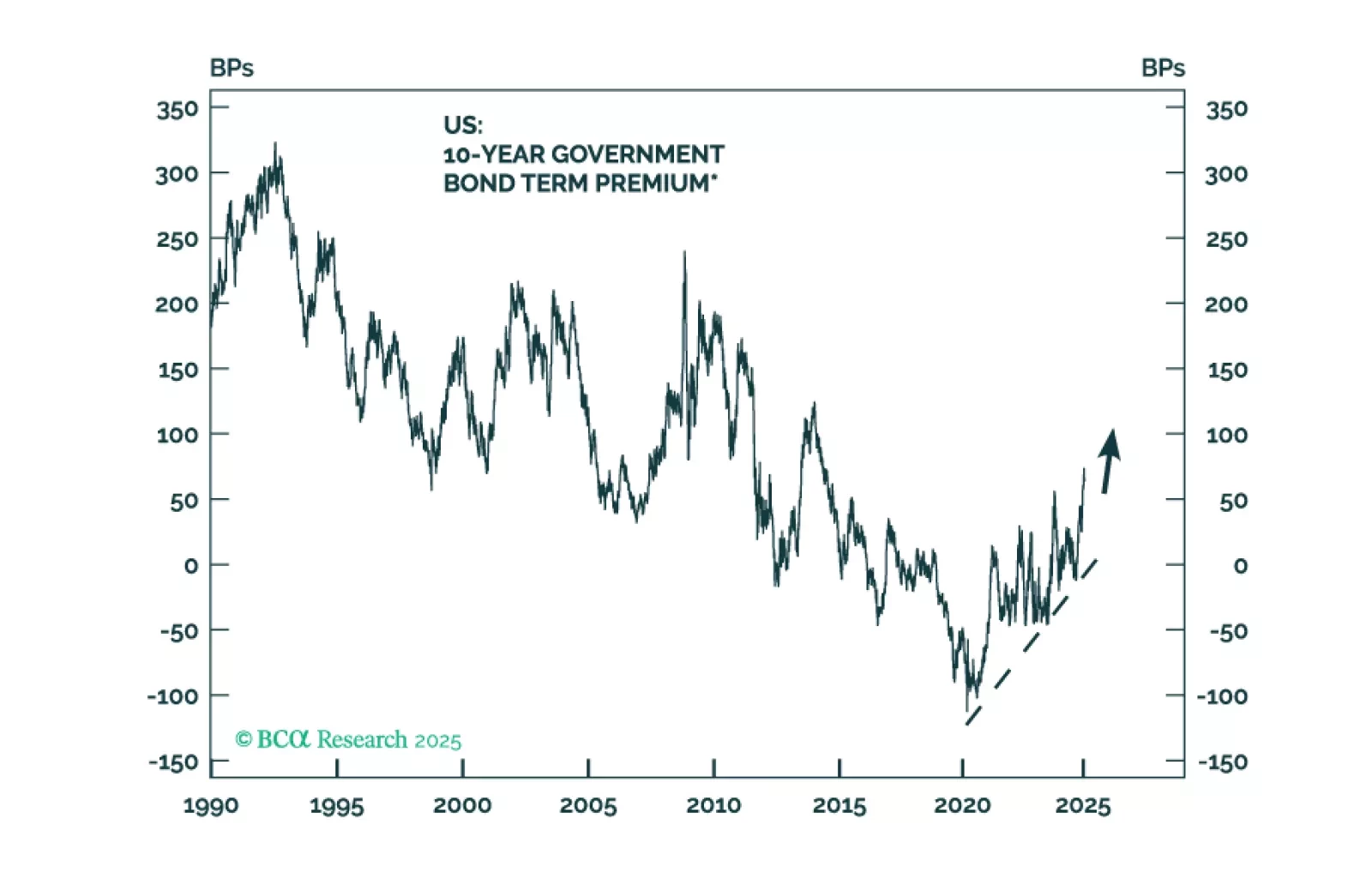

We examine Treasury market valuation and look for indicators that could help us time the next peak in yields. We also update the forecasts from our Treasury yield model.