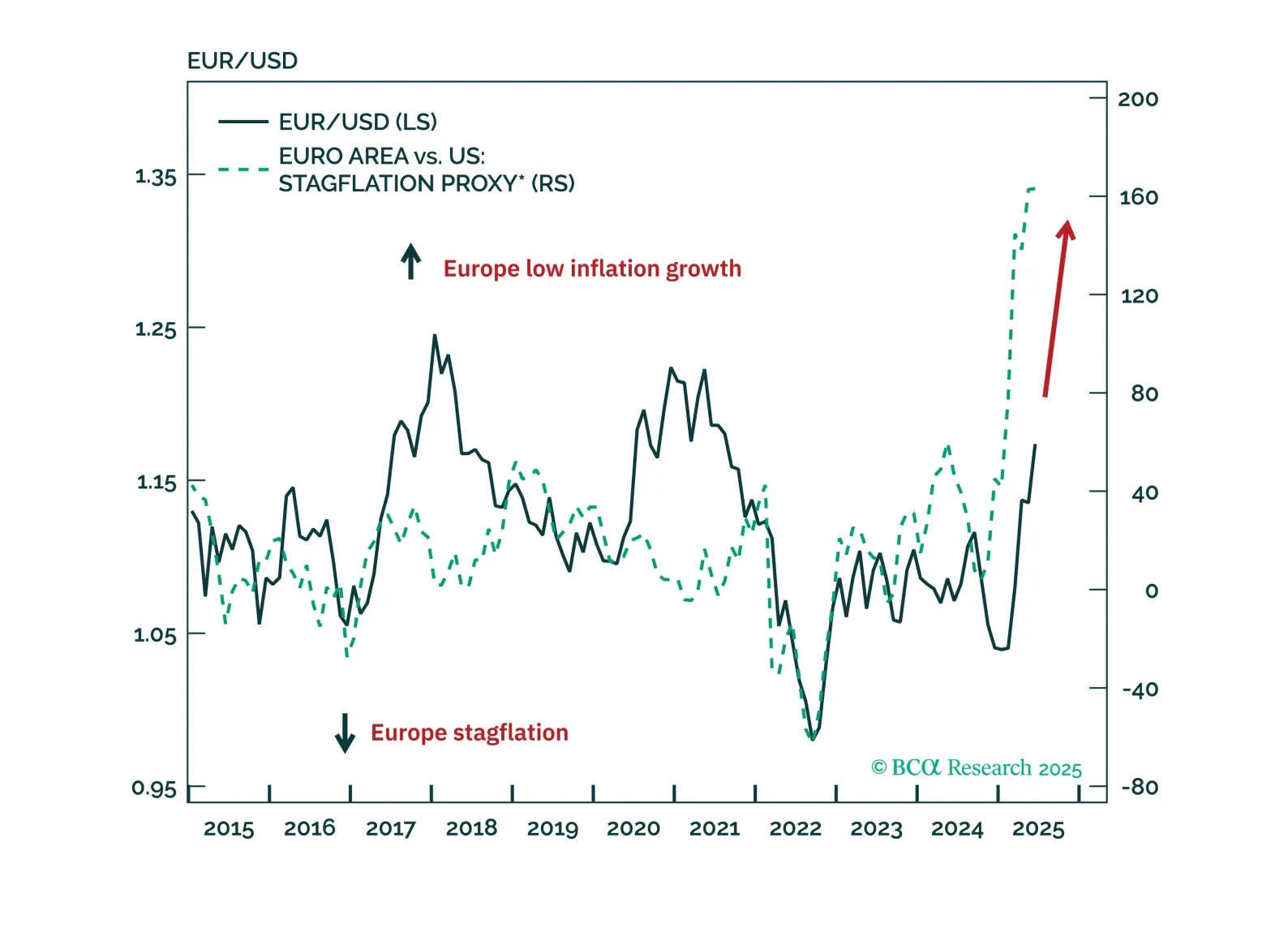

Our DM ex-US strategists see EUR/USD in a multi-year bull market and recommend selling EUR/JPY at 172.5. The euro’s 2025 rally has been driven first by improving Eurozone growth expectations, then by mounting concerns over the US…

EUR/USD is in a multi-year bull market. A short-term pause is likely, but the longer-term trend remains higher toward 1.25, and eventually 1.40.

We will abandon our recession call if US economic data show clear signs of stabilization over the summer months. For now, that has not happened. Maintain a modest underweight to stocks but look to get more defensive if MacroQuant’s…

Acute geopolitical risks, like a massive oil shock, may be abating. But structural geopolitical risk remains high and could upset a blithe market. Cyclical economic risks are underrated as the US slows down and China continues to…

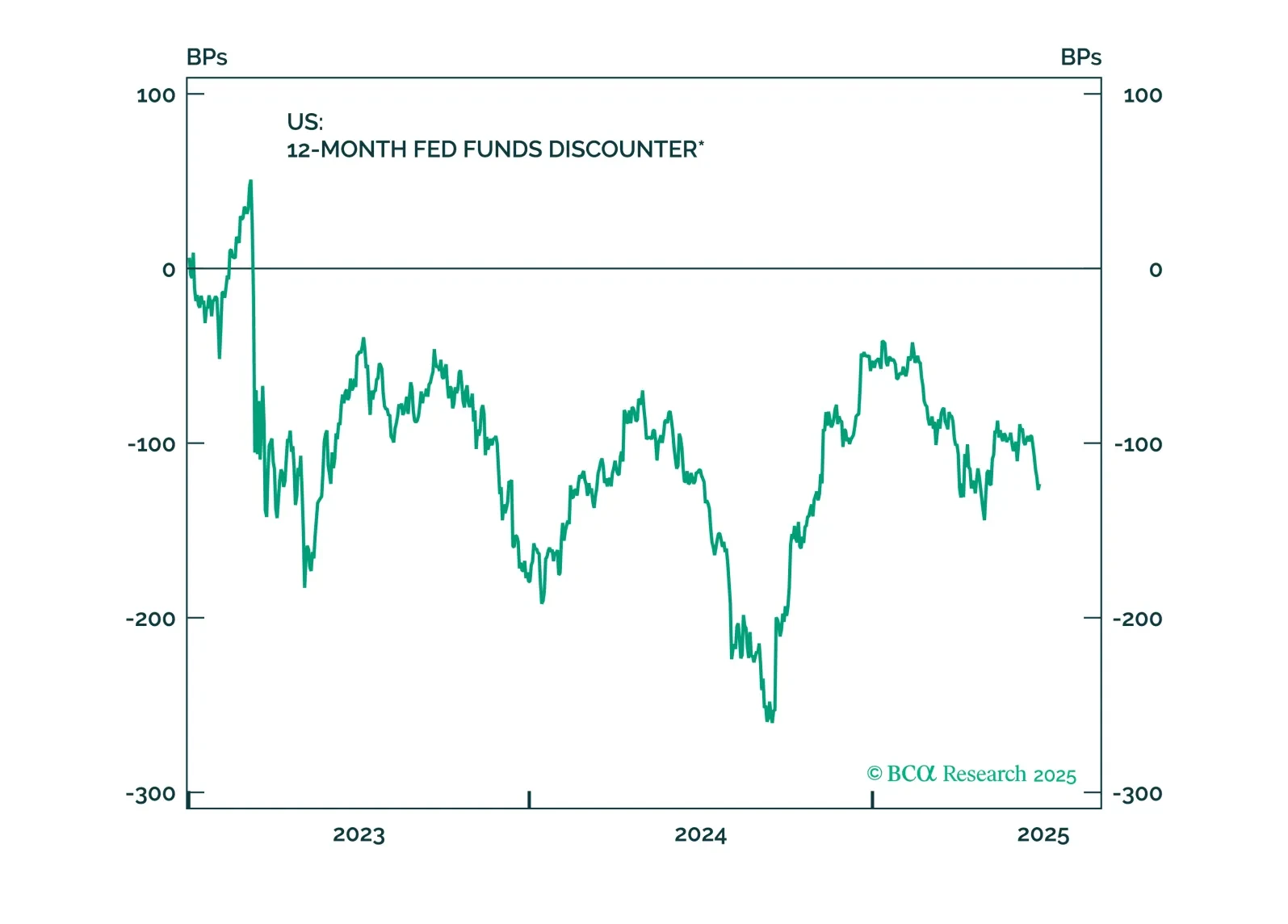

Monetary policy is about to become a powerful tailwind to the already bullish brew that includes Trump’s repeated step-downs from a global trade war, irrelevant geopolitical risks in the Middle East, and a fiscal policy that is no…

Investors should modestly underweight equities in their portfolios and look to turn more aggressively defensive once the whites of the recession’s eyes are visible. We think that will happen within the next few months.

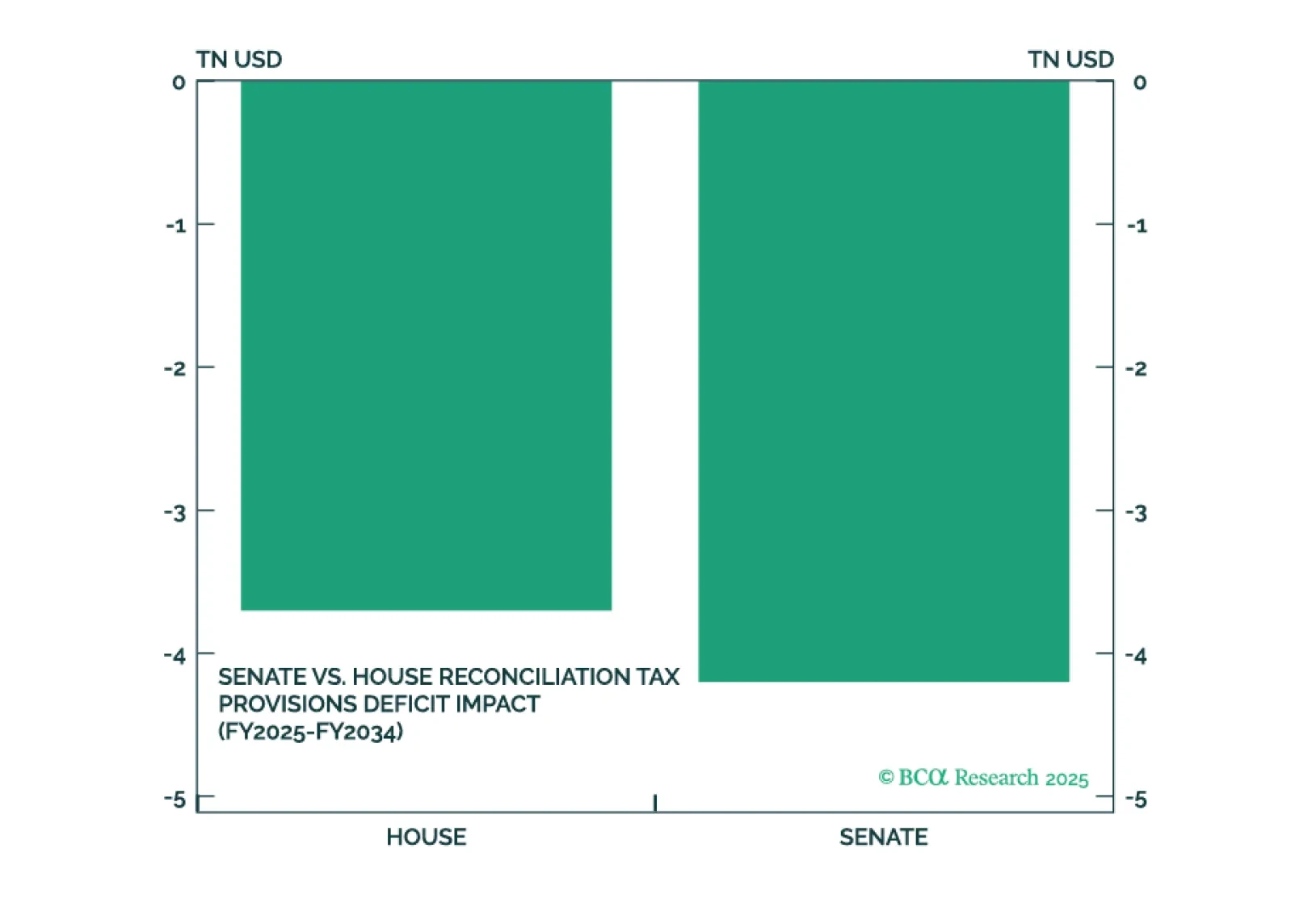

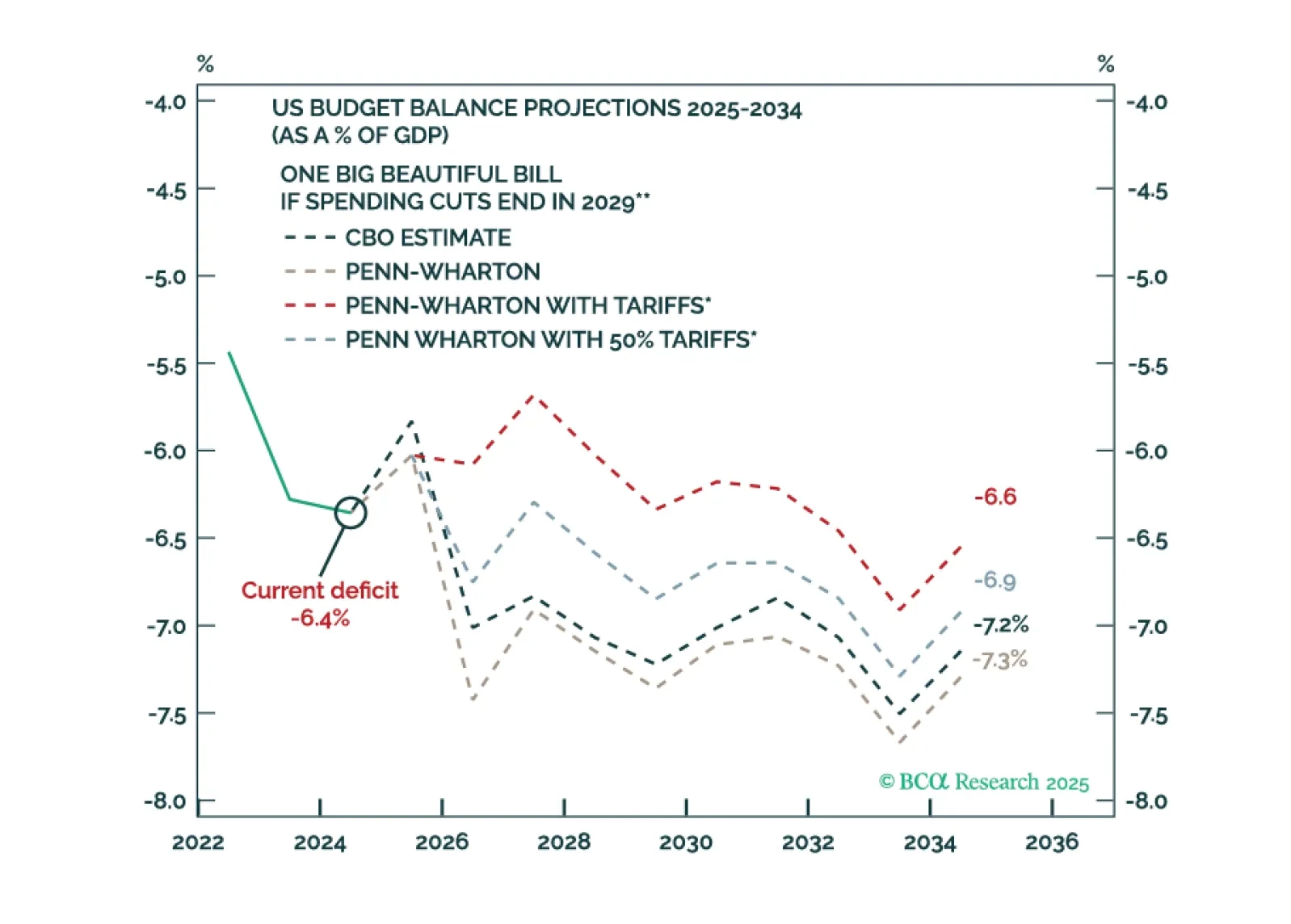

President Trump’s big beautiful bill will pass but faces near-term hurdles and will not tighten the government’s belt. It will combine with renewed tariff implementation to generate near-term risk for both the bond and stock market.…

Bond market volatility will spike again in the near term. The Fed is committed to an easing cycle yet the Trump administration’s signature fiscal policy action will stimulate the economy. Tariffs are supposed to keep the budget…