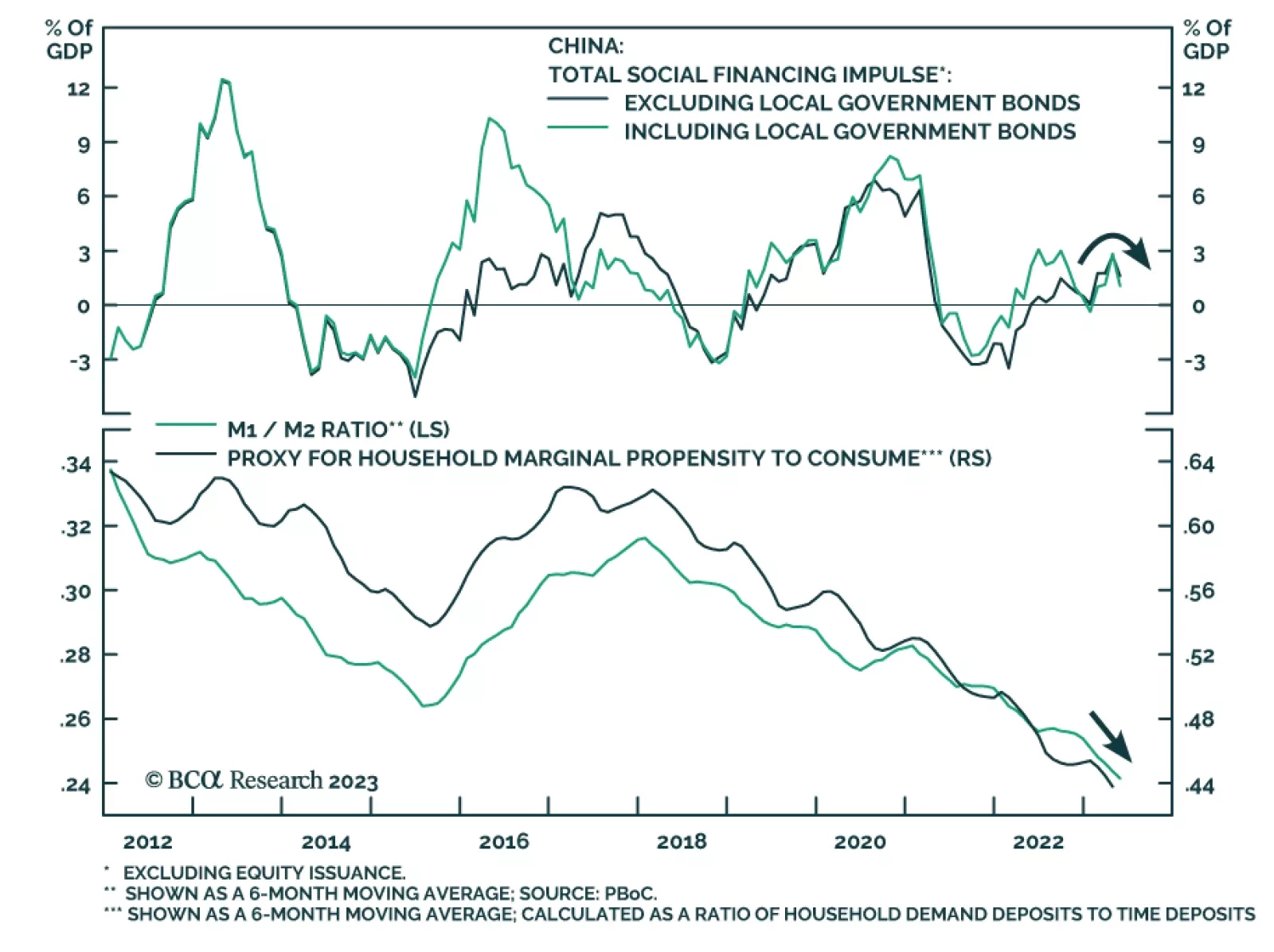

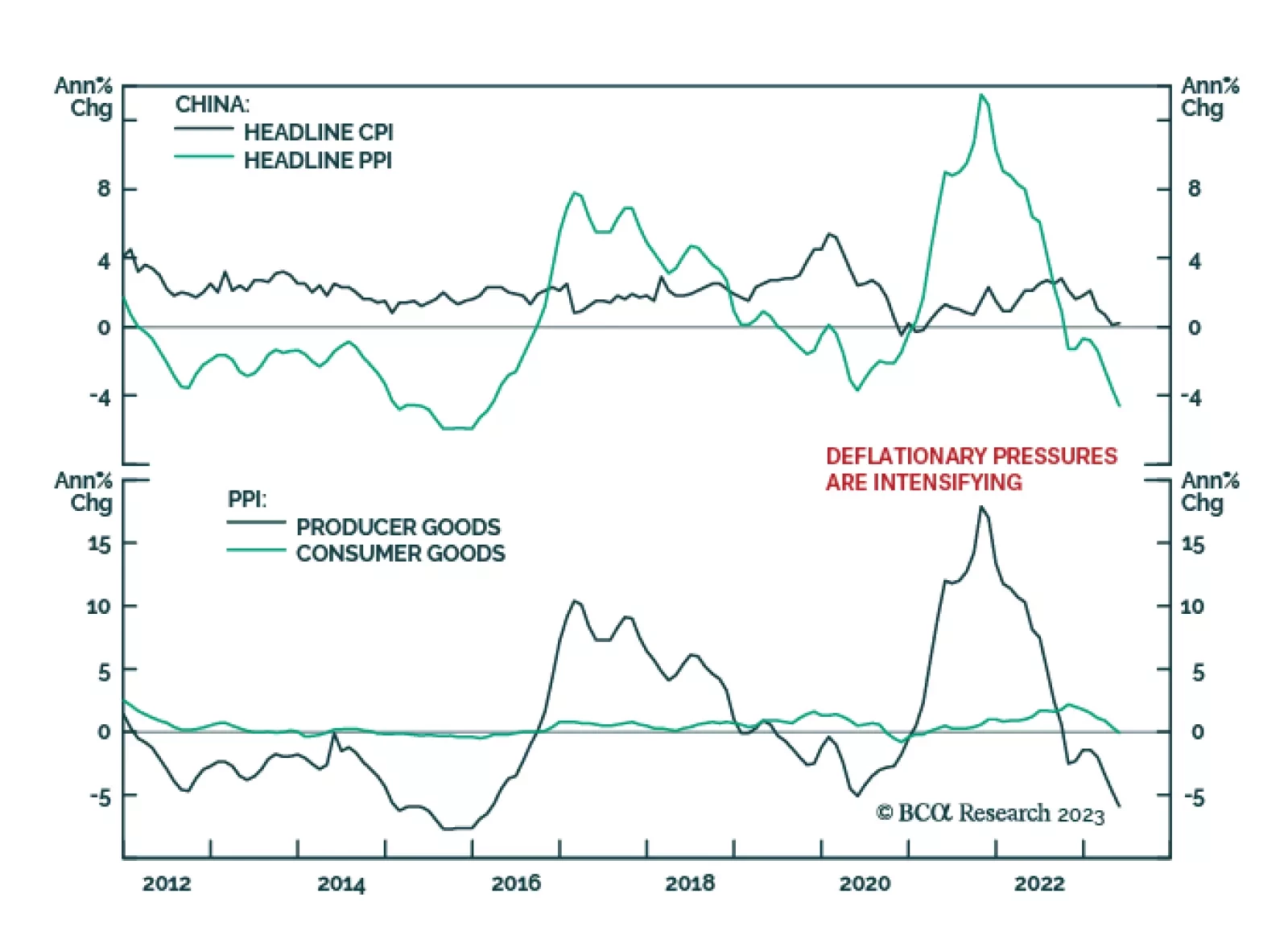

China is facing a risk of deflation. Marginal interest rate cuts and targeted stimulus will be insufficient to boost China’s growth given the current deflationary mindset and the danger is that the economy may be entering a liquidity…

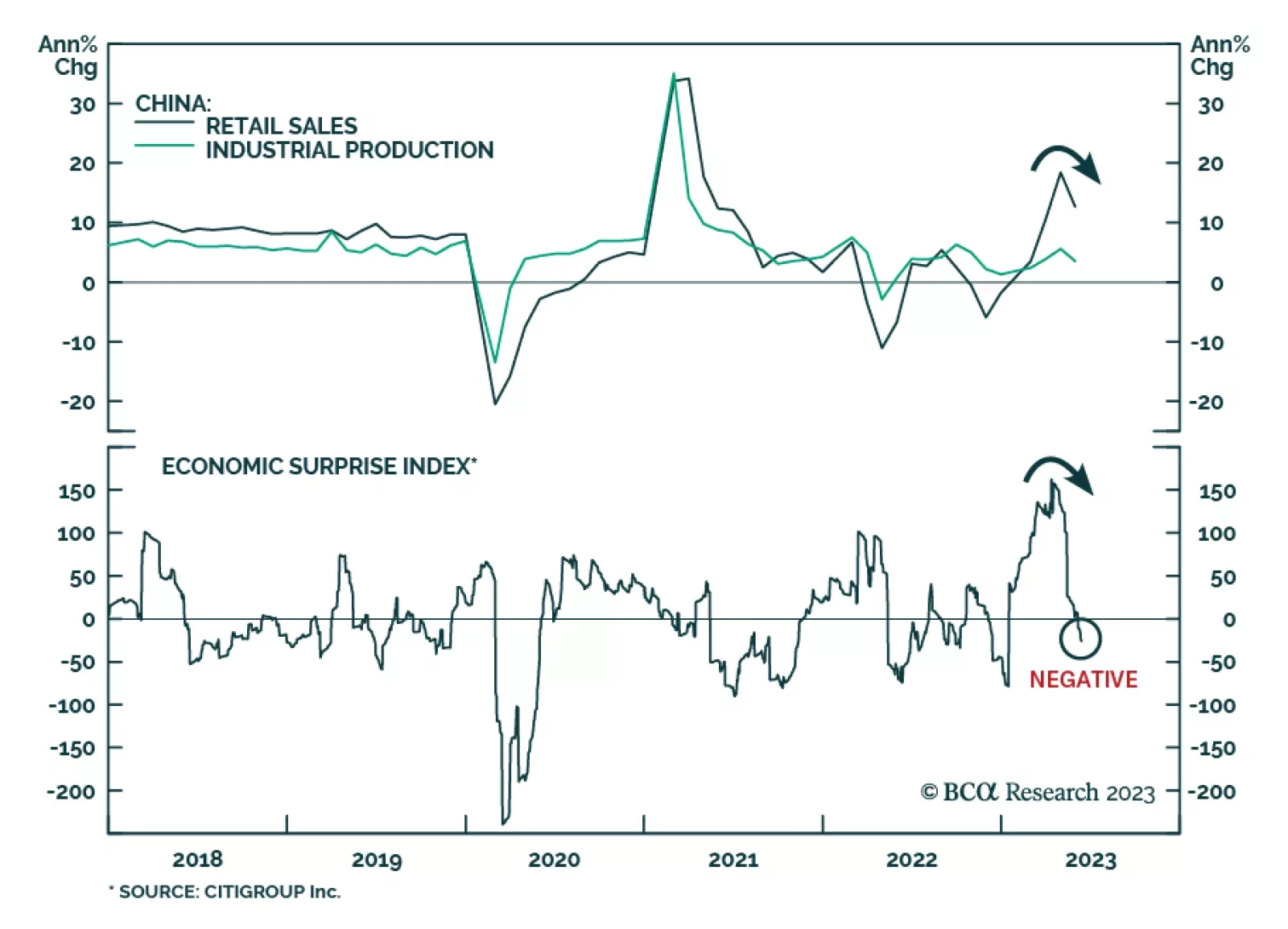

China’s economic data releases for May fell below consensus estimates. The 7.2% y/y contraction in property investment in the first five months of the year was worse than the expected 6.7% decline. The deceleration in…

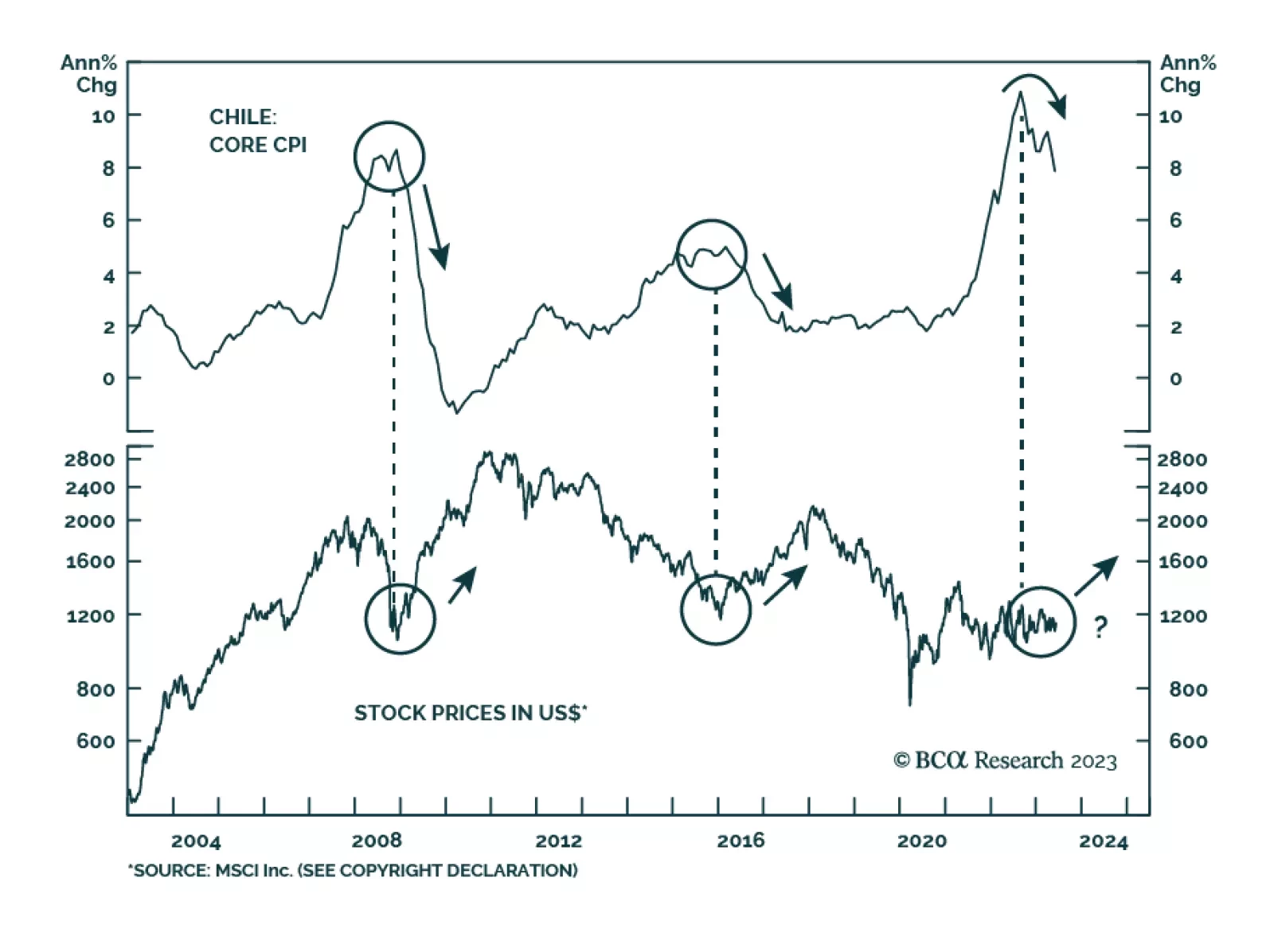

The Chilean economy is entering a recession. After two years of tightening fiscal and monetary policies, real economic growth is beginning to contract and inflation is tumbling. Our Emerging Markets strategists expect the…

China’s money and credit update for May continues a string of disappointing Chinese data releases. The CNY 1.56 trillion increase in total social financing fell below expectations of a CNY 1.90 trillion rise. Similarly, the…

In response to the first-ever federal indictment of a former President, investors should focus on the state of the economy and not on Trump’s legal trouble. They should also use the current market rally to stock up on protection, as…

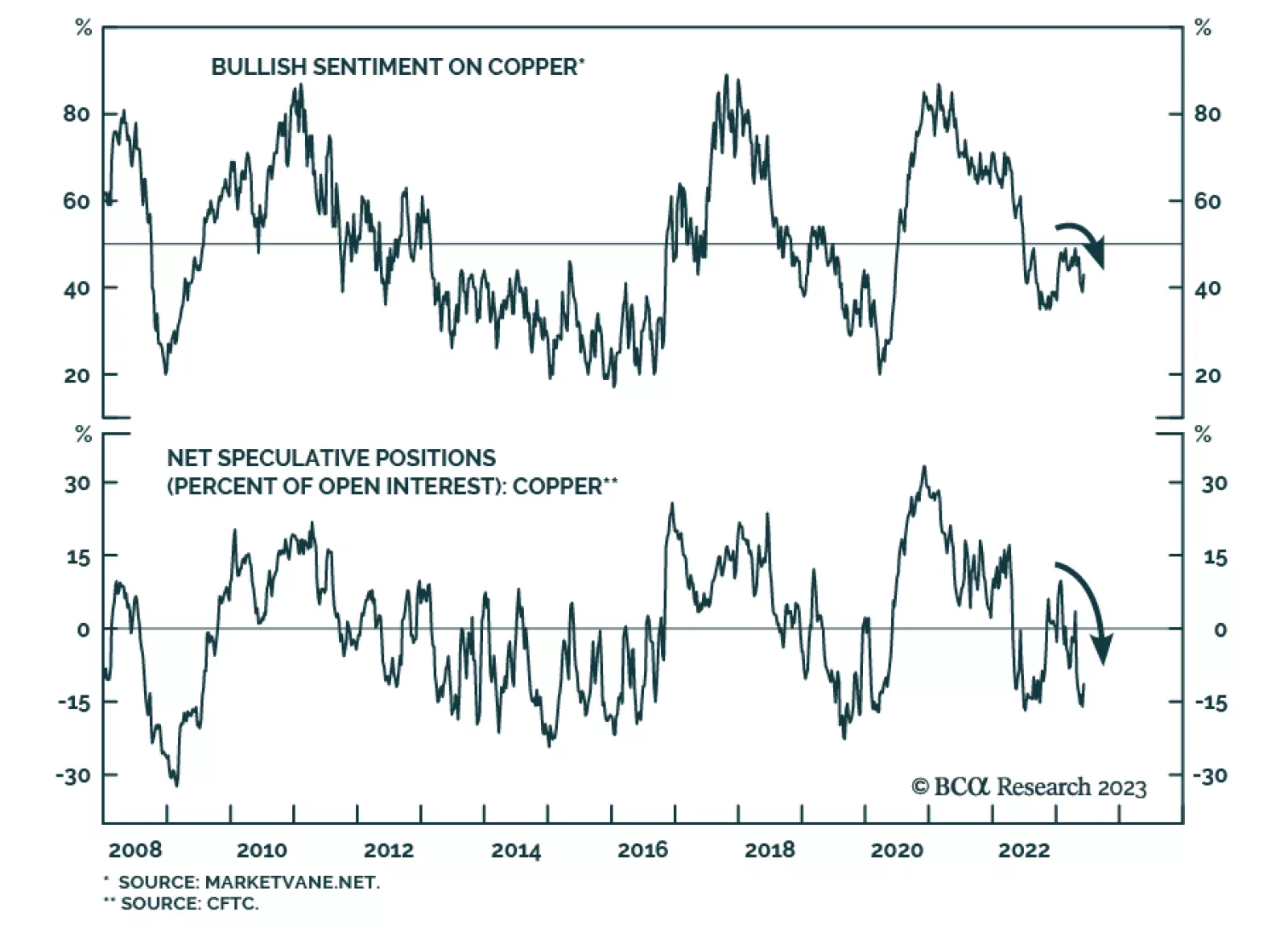

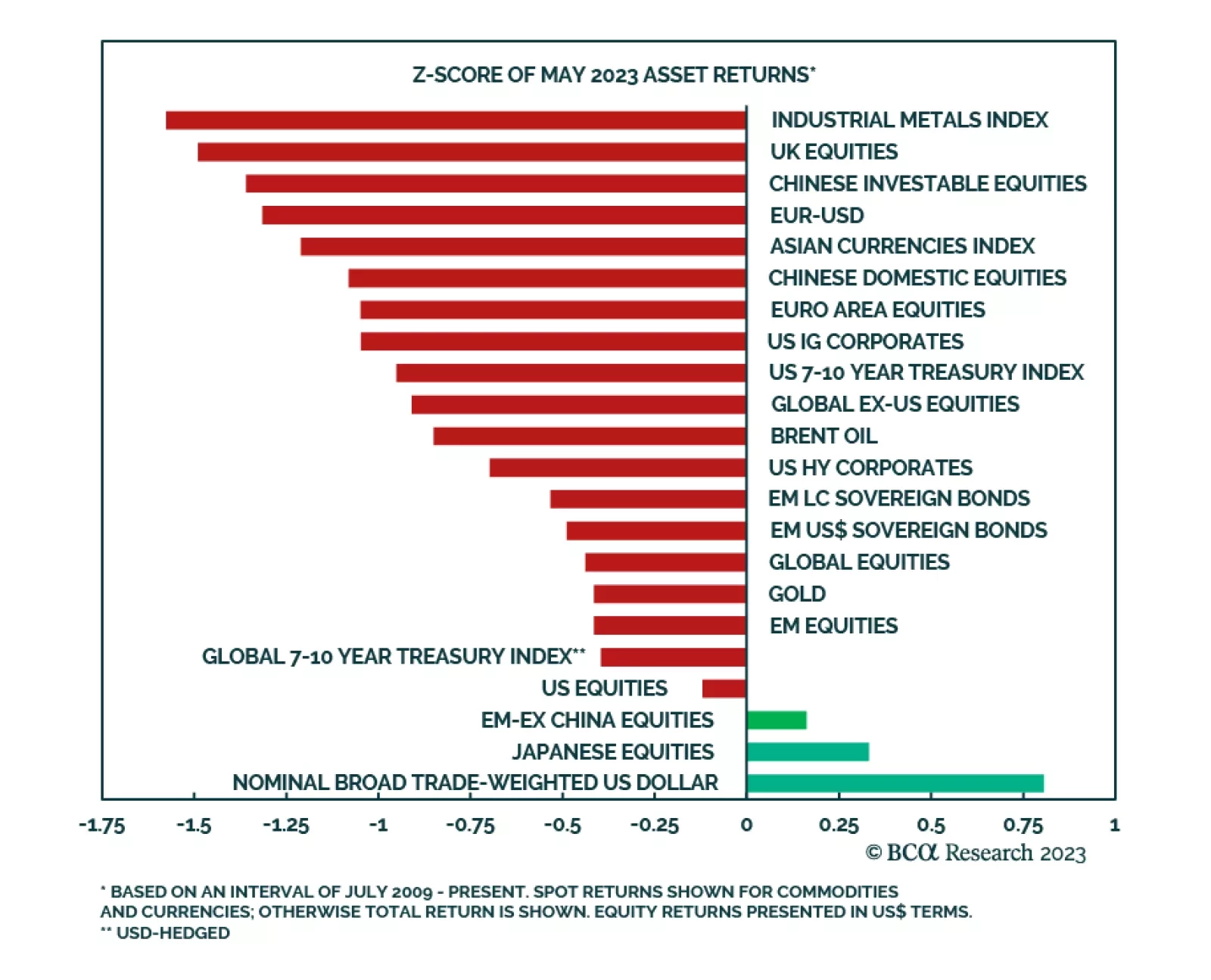

In our May In Review Insight, we highlighted that last month, industrial metals generated the largest abnormal losses among the major global financial assets we track. This continues a downtrend that started at the beginning of…

Chinese producer prices sent a disappointing signal about the domestic economy on Friday. The pace of decline in producer prices accelerated from -3.6% in April to -4.6% in May – worse than expectations of a -4.3% drop. The…

Global financial markets relapsed in May. After a relatively strong start to Q2, most of the major financial assets we track generated below average returns last month. A shift in investor expectations for the path of the Fed…

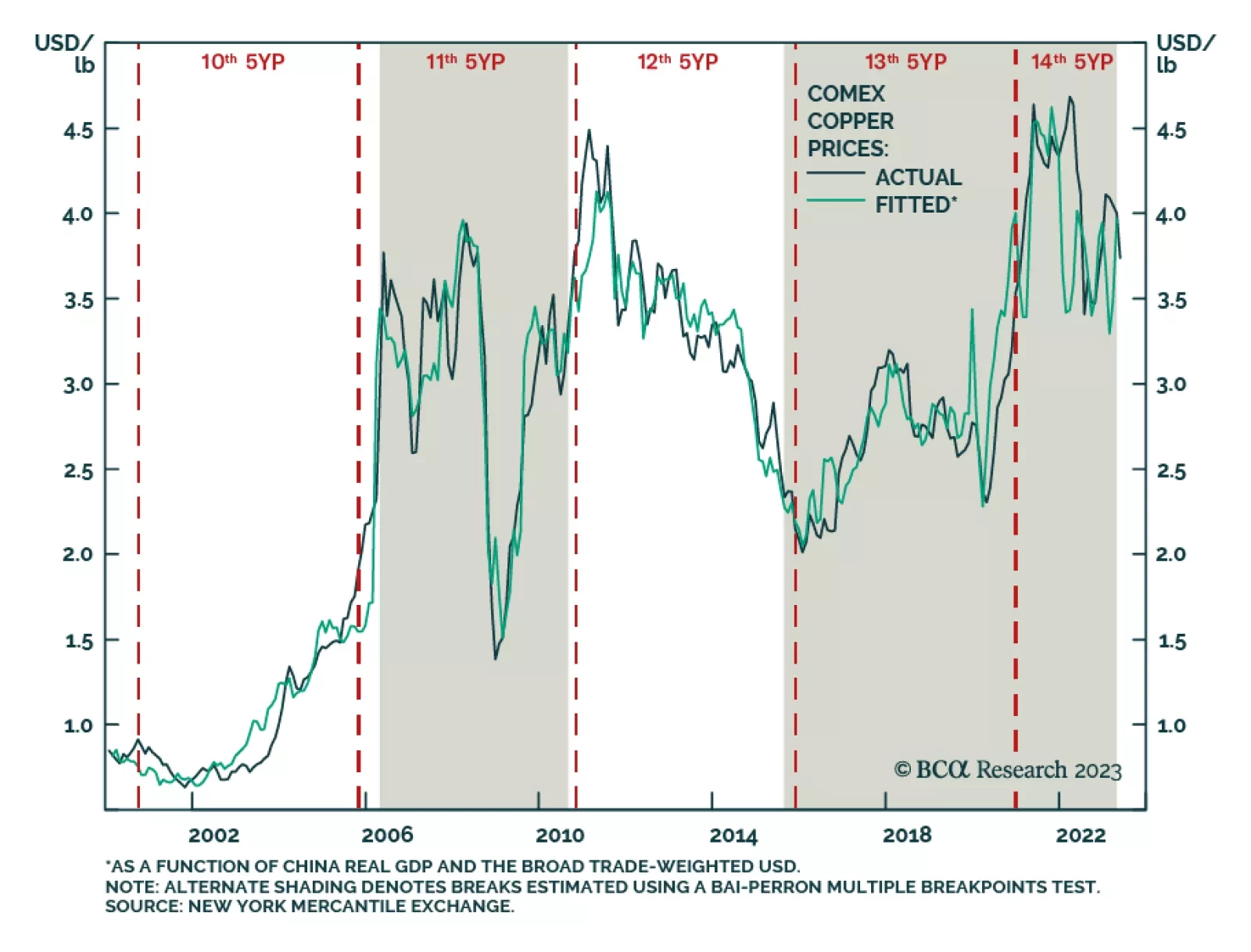

Our colleagues in BCA's Commodity & Energy Strategy (CES) service expect the Chinese Communist Party (CCP) to announce a new round of policy stimulus to re-boot the economy, in an effort to escape a prolonged liquidity…