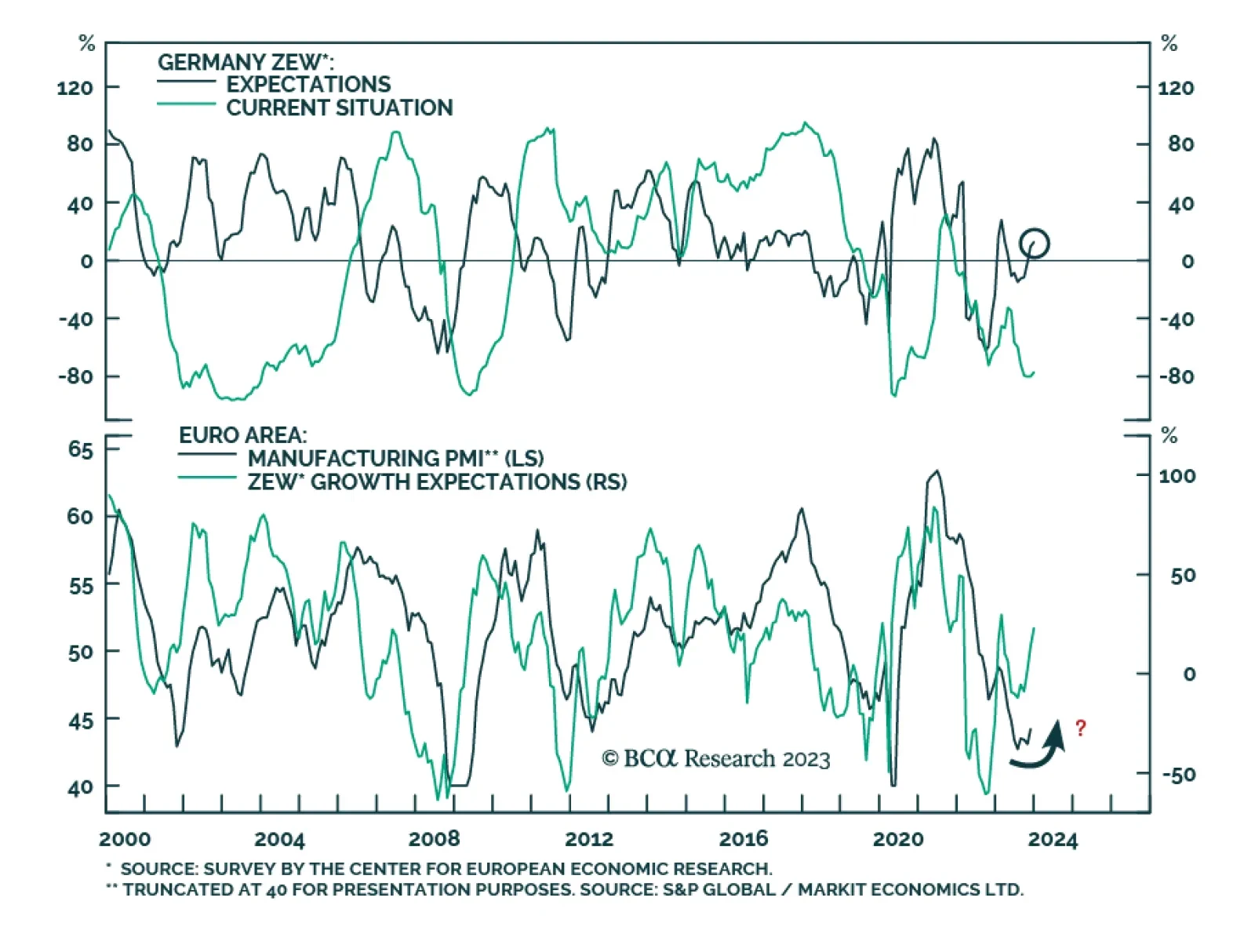

The continued improvement in German investor morale captured by the ZEW survey corroborates other indicators pointing to near-term support for Eurozone stocks. Economic sentiment jumped three points to a 9-month high of 12.8 in…

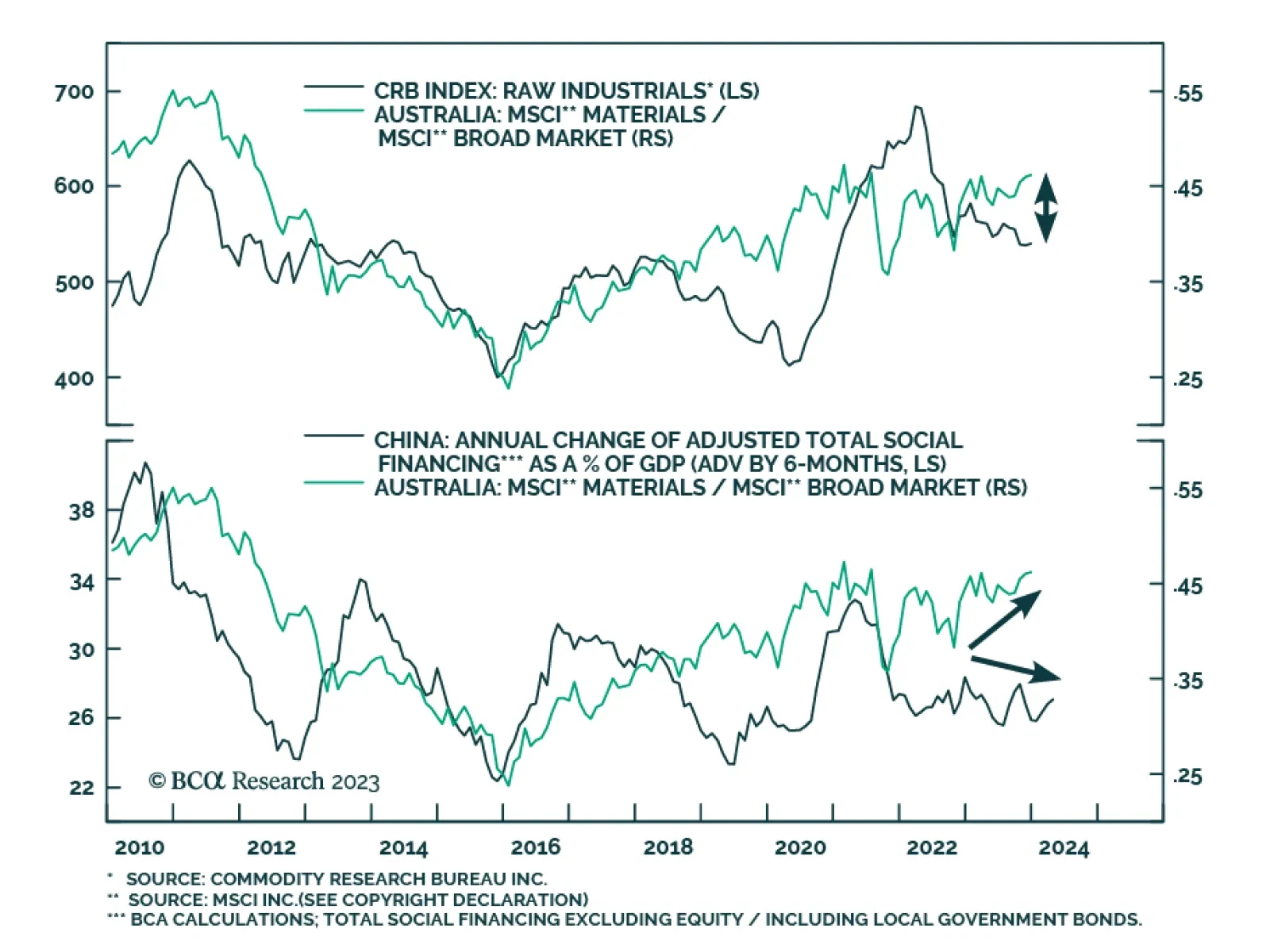

Australian materials stocks have been outperforming the country’s broad index since mid-August, undoing the sector’s relative losses of the prior months, and bringing the year-to-date gain to 7.7% in absolute terms…

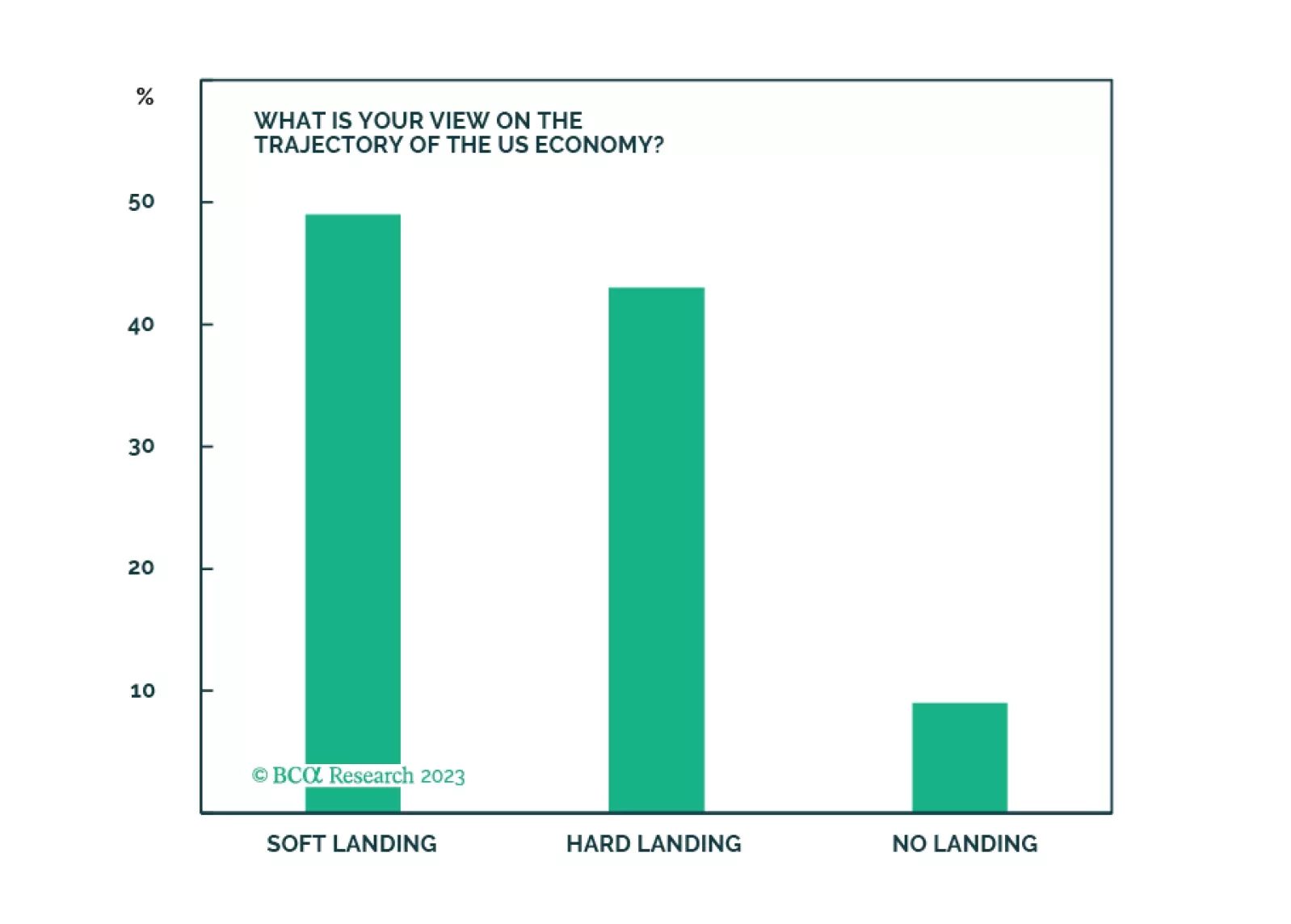

The Santa Claus rally is a repricing of the "soft landing" scenario as a likely economic outcome. Yet, many investors remain cautious, and harbor significant cash balances. Next year, repricing of various scenarios will continue, and…

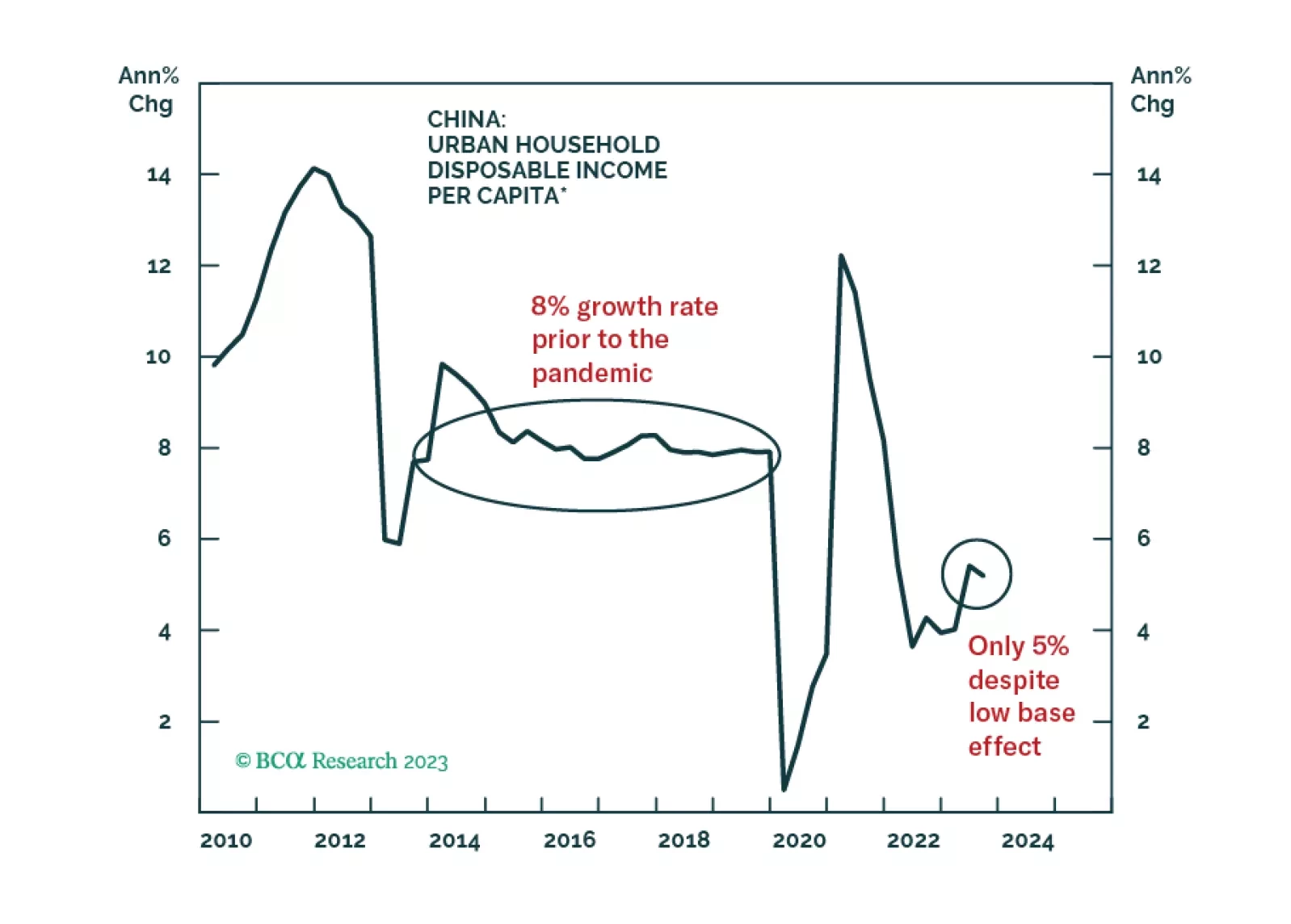

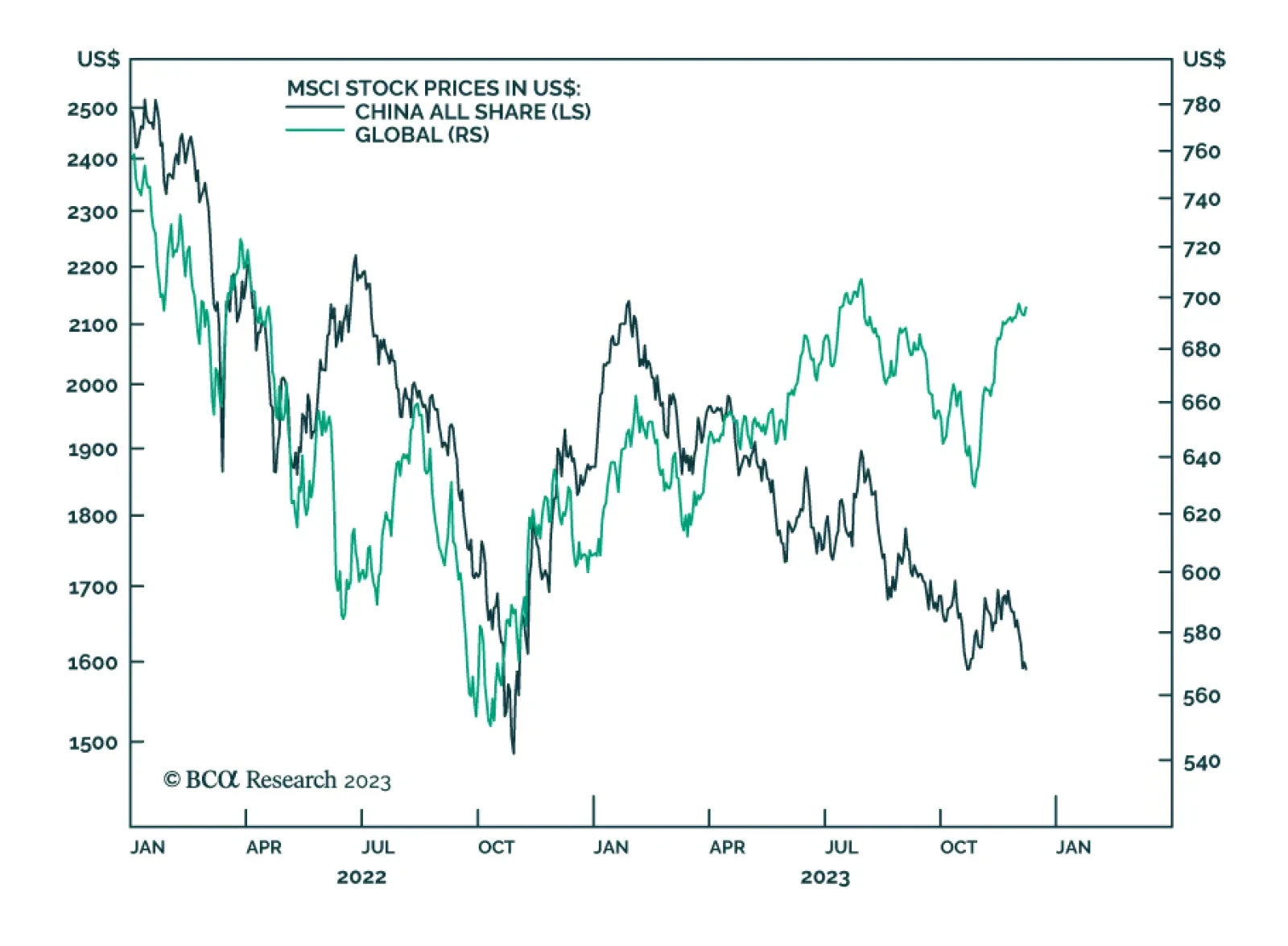

The global investment community has become well aware of many problems facing the Chinese economy including real estate excesses, policymakers’ reluctance to stimulate, as well as elevated debt levels among local…

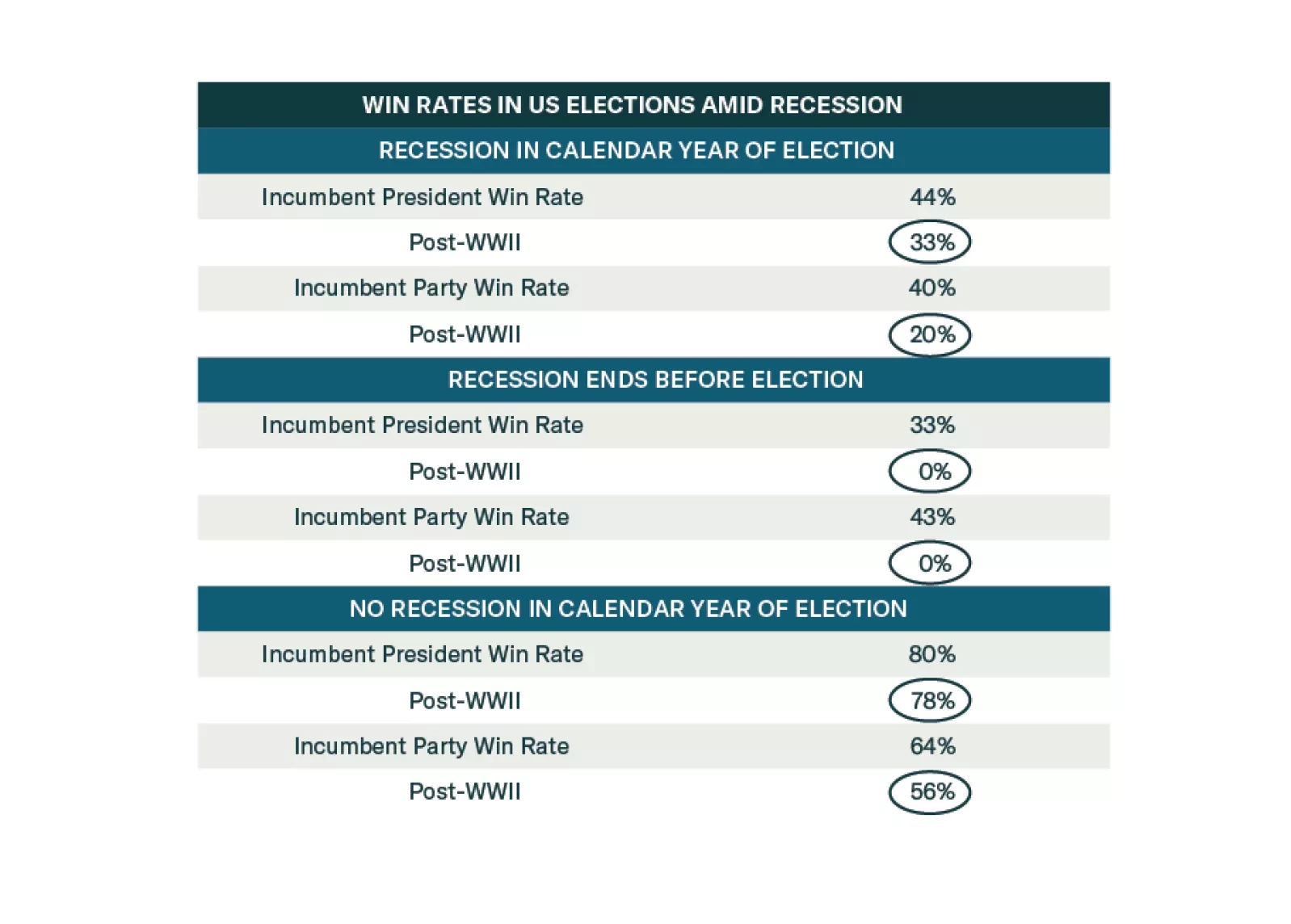

Democrats are favored to win the election until recession materializes. But recession risks are high. Investors should adopt a defensive and conservative strategy in 2024 amid extreme US policy uncertainty.

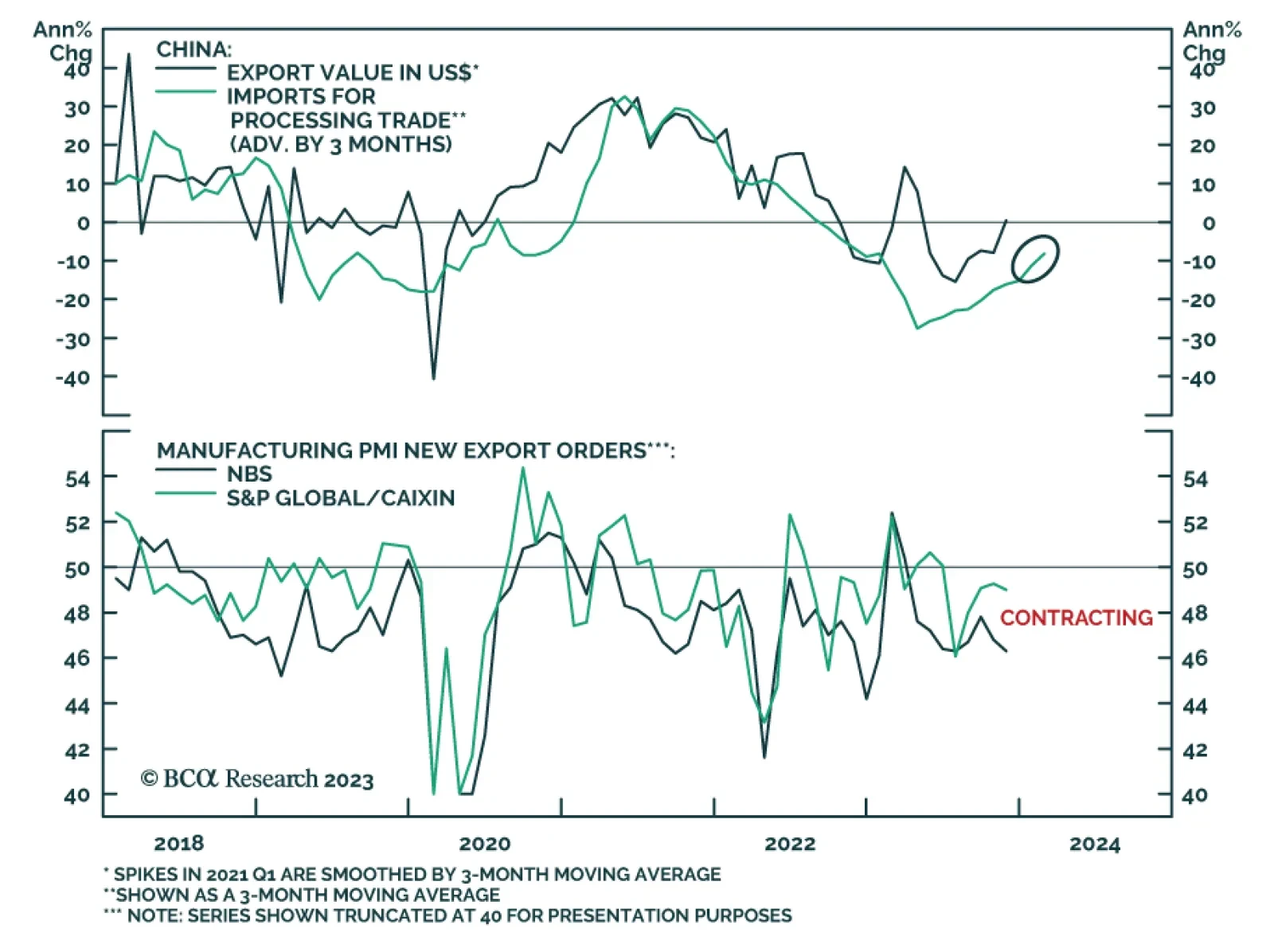

On the surface, Chinese export data delivered a positive surprise on Thursday, painting a favorable picture of the global manufacturing cycle. Exports unexpectedly grew on a year-over-year basis in November for the first time…

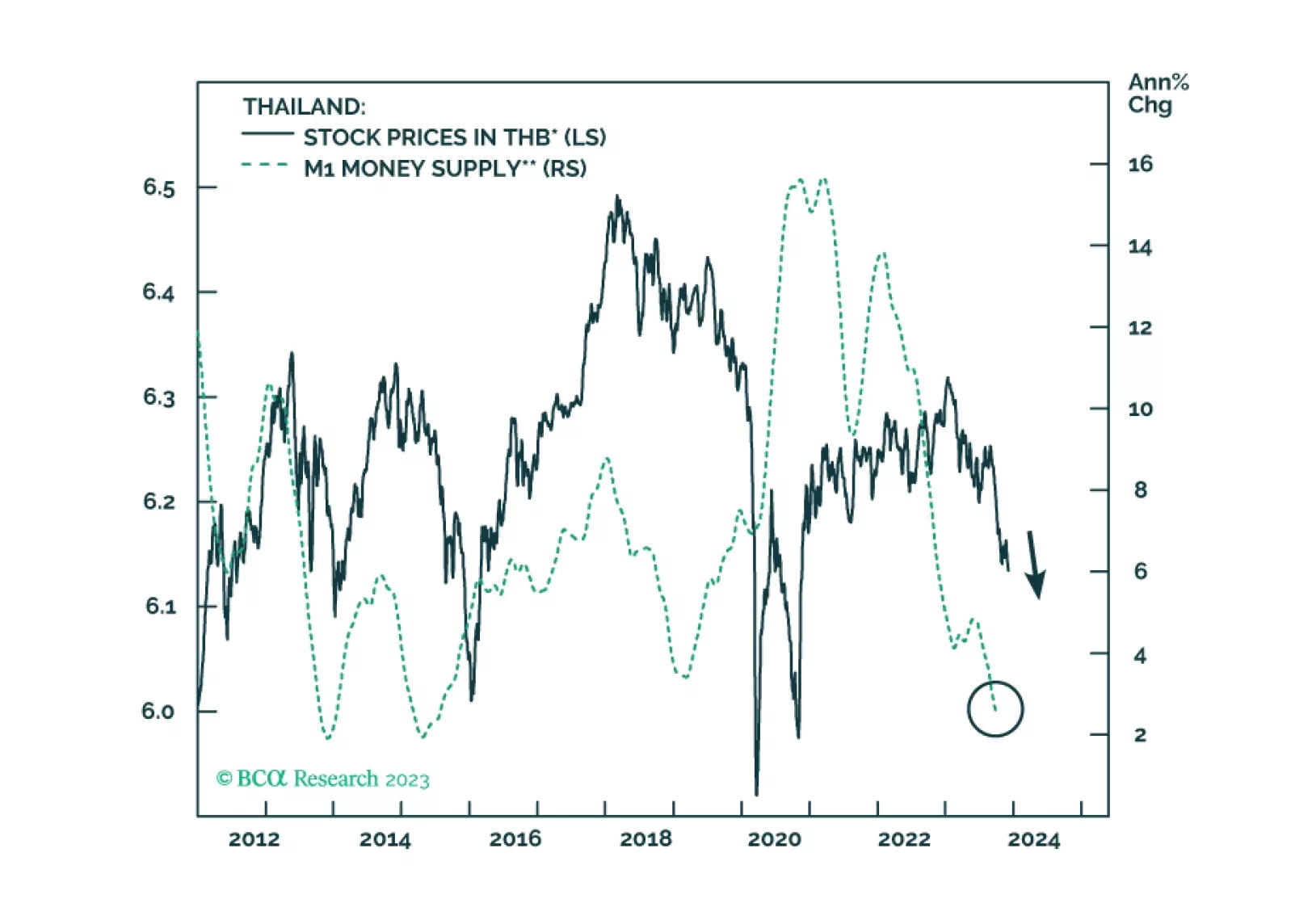

Meager credit growth and shrinking real wages will keep Thai inflation very low in the coming months. The currency will get support from an improving current account surplus. Fixed-income investors should upgrade Thailand from…

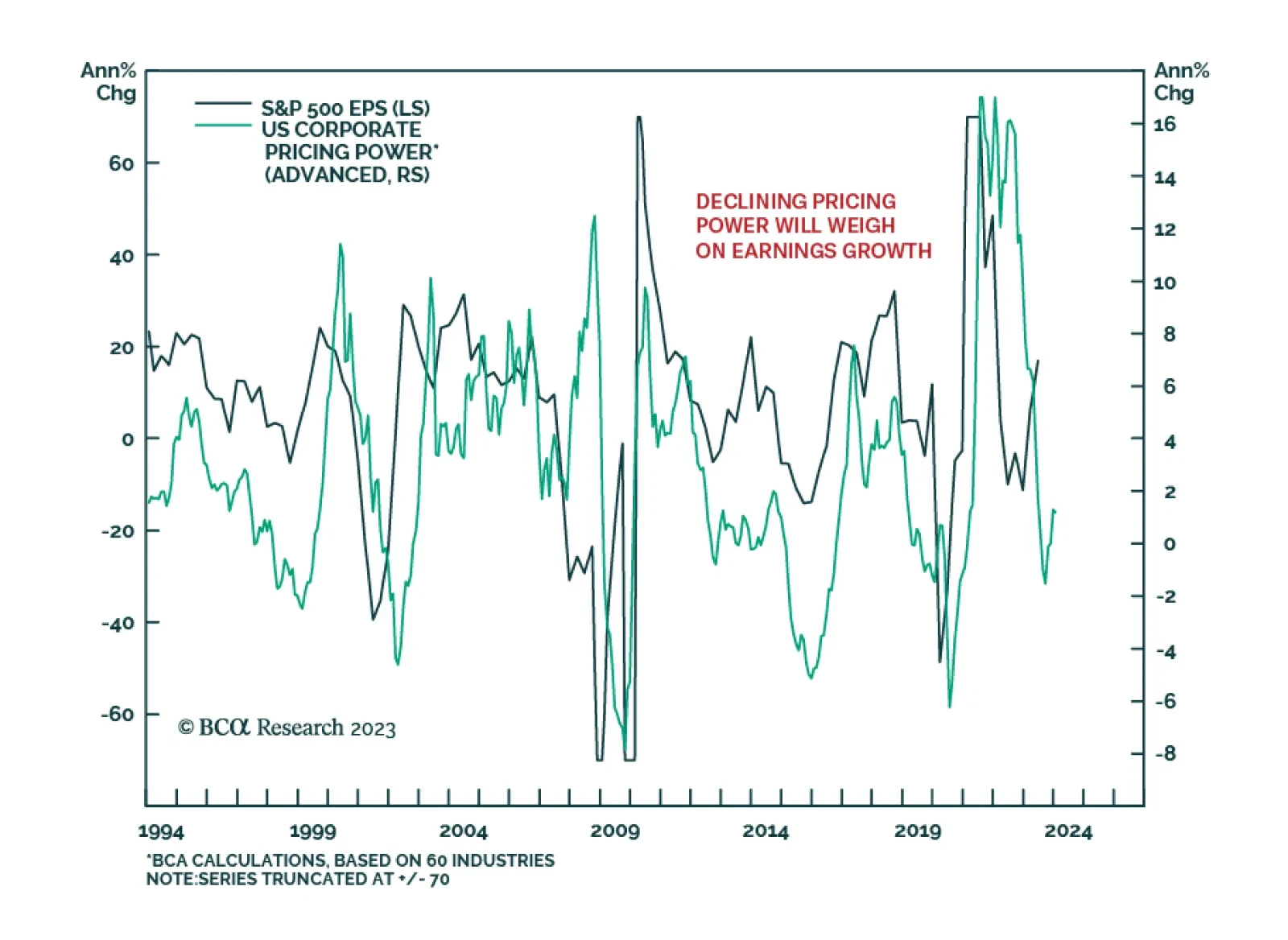

According to BCA Research’s US Equity Strategy service, earnings growth estimates for 2024 appear overly optimistic. Just like economists and strategists, sell-side analysts are optimistic about the US economy. They have…